Dell-Oro Group

Highlights of Dell’Oro’s 5-year RAN forecast

Market conditions remain challenging for the broader RAN market. Following the 40% to 50% ramp between 2017 and 2021, the RAN market has been declining since then. These trends are expected to prevail throughout the forecast period. However, the pace of the decline should moderate somewhat after 2024.

“It is not a surprise that there is rain after sunshine,” said Stefan Pongratz, Vice President for RAN market research at Dell’Oro Group. “In addition to MBB-based coverage-related challenges, this disconnect between mobile data traffic growth and the capacity boost provided by the mid-band, taken together with continued monetization uncertainty, is clearly weighing on the market,” Pongratz added.

- Worldwide RAN revenues are projected to decline at a 2 percent CAGR over the next five years, as continued 5G investments will be offset by rapidly declining LTE revenues.

- The Asia Pacific region is expected to lead the decline, while easier comparisons following steep contractions in 2023 will improve the growth prospects in the North American region. Even with some recovery, North American RAN revenues are expected to remain significantly lower relative to the peak in 2022.

- 5G-Advanced positions remain unchanged. The technology will play an essential role in the broader 5G journey. However, 5G-Advanced is not expected to fuel another major capex cycle. Instead, operators will gradually transition their spending from 5G towards 5G-Advanced within their confined capex budgets.

- RAN segments that are expected to grow over the next five years include 5G NR, FWA, mmWave, Open RAN, vRAN, private wireless, and small cells.

Commentary:

Worldwide RAN revenues are projected to decline at a 2% CAGR between 2023 and 2028, as rapidly declining LTE revenues will offset continued 5G investments. This is predicated on the assumption that the MBB portion of the RAN market will continue to trend downward, and the upside from new growth opportunities is not enough to change the trajectory.

The mix between existing and new use cases has not changed. We still forecast private/enterprise RAN to grow at a 20%+ CAGR while public RAN investments decline. At the same time, because of the lower starting point, it will take some for private RAN to move the broader RAN needle.

As the investment focus gradually shifts from coverage to capacity, one of the most significant forecast risks is slowing mobile data traffic growth. Given current network utilization levels, there are serious concerns about the timing of capacity upgrades. The network utilization metric will play a much more significant role as we move further into the capacity phase.

Generally, the less advanced 5G regions are expected to perform better than the mature 5G markets. As a result, markets with lower 5G POP coverage, including Middle East & Africa, Caribbean and Latin America, and APAC Excluding China/India should perform better.

Easier comparisons following steep contractions in 2023 will improve the North American region’s growth prospects. Even with some recovery, North American RAN revenues are expected to remain significantly below peak levels in 2022.

5G-Advanced will play an essential role in the broader 5G journey. However, 3GPP Releases 18-20 are not expected to fuel another major capex cycle. Instead, operators will gradually transition their spending from 5G towards 5G-Advanced within their confined capex budgets. Also, ITU-R WP5D has not started any work related to a 5G-Advanced recommendation(s).

More importantly, some RAN segments will stand out even as the broader RAN market shrinks. RAN segments expected to grow over the next five years include 5G NR, Non-MM 5G NR, FWA, mmWave, Open RAN, vRAN, private wireless, and small cells.

References:

Analysts: Telco CAPEX crash looks to continue: mobile core network, RAN, and optical all expected to decline

Dell’Oro: 2023 global telecom equipment revenues declined 5% YoY; Huawei increases its #1 position

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Dell’Oro: RAN market declines at very fast pace while Mobile Core Network returns to growth in Q2-2023

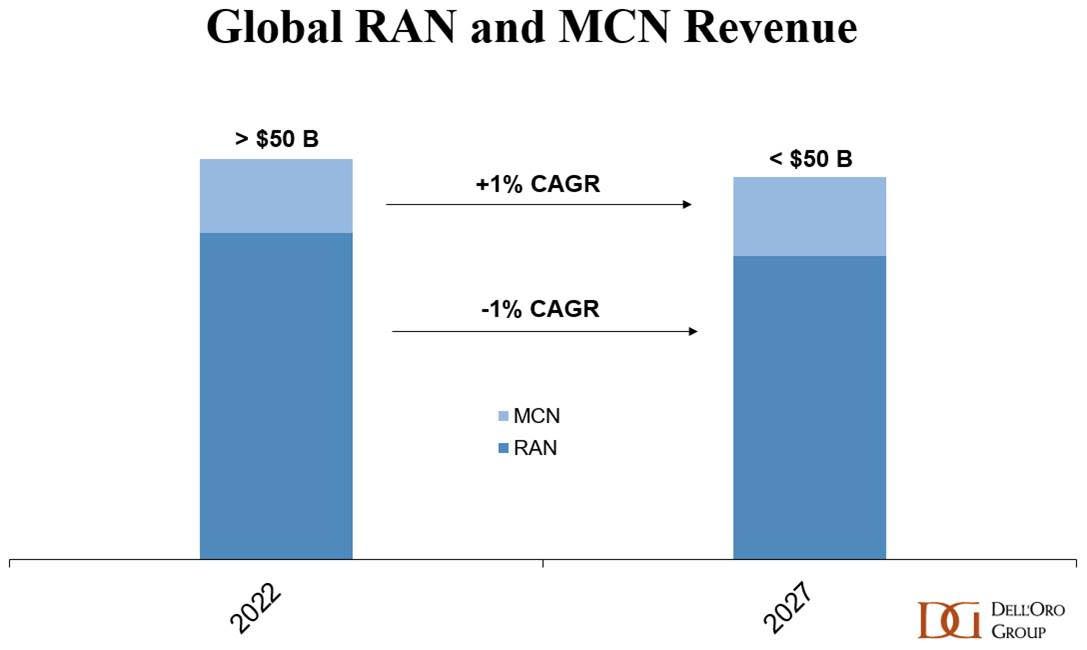

Dell’Oro: RAN Market to Decline 1% CAGR; Mobile Core Network growth reduced to 1% CAGR

Global 5G Market Snapshot; Dell’Oro and GSA Updates on 5G SA networks and devices

ITU-R: IMT-2030 (6G) Backgrounder and Envisioned Capabilities

Dell’Oro: RAN revenues declined sharply in 2023 and will remain challenging in 2024; top 8 RAN vendors own the market

According to a new report by Dell’Oro Group, the Radio Access Network (RAN) market is now in a downward trajectory. That’s no surprise to readers of the IEEE Techblog, as we forecasted the “5G train wreck” many years ago and continued the drumbeat due to the scarcity of 5G SA core networks, without which there are NO 5G features/functions. Also that URLLC performance requirements were not met by either the 3GPP Release 16 Enhancements for URLLC in the RAN spec or the ITU M.2150 recommendation which is the official standard for 5G NR.

Following the >40 percent ascent between 2017 and 2021, RAN revenues stabilized in 2022, and are on target to decline sharply in 2023. Market conditions are expected to remain challenging in 2024 as the Indian RAN market pulls back, though the pace of the global decline this year and for the remainder of the forecast period should be more moderate.

“The big picture has not changed. MBB-based investments are now slowing and the upside with new growth areas including FWA and private wireless is still too small to change the trajectory,” said Stefan Pongratz, Vice President at Dell’Oro Group. “Also weighing on the MBB market is the fact that the upper mid-band capacity boost is rather significant relative to current data traffic growth rates in some markets, which could impact the timing for capacity upgrades,” continued Pongratz.

Additional highlights from the Mobile RAN 5-Year January 2024 Forecast Report:

- Worldwide RAN revenues are projected to decline at a 1 percent CAGR over the next five years.

- The Asia Pacific region is expected to lead the decline, while easier comparisons following steep contractions in 2023 will improve the growth prospects in the North America region.

- 5G-Advanced is expected to play an important role in the broader 5G journey, however, it is not expected to fuel another major capex growth cycle.

- RAN segments that are expected to grow over the next five years include: 5G NR, FWA, mmWave, Massive MIMO, Open RAN, private wireless, small cells, and Virtualized RAN.

Dell’Oro said in November said it was optimistic about the long-term growth prospects of the RAN space, but simultaneously noted that after a peak in 2021, RAN revenues will track downwards until the second half of the current decade; overall it predicted a 1% compound annual growth rate between 2020 and 2030. That forecast will now have to be revised DOWN significantly as 6G- the next big RAN mover- won’t be standardized till 2031 at the earliest.

RAN remains a concentrated market, with the top 8 RAN suppliers accounting for more than 98% of the 1Q23-3Q23 RAN market. New technologies, architectures, and segments can in some cases present opportunities for vendors with smaller footprints. Still, the track record for new entrants is far from perfect.

Dell’Oro Group’s Mobile RAN 5-Year Forecast Report offers a complete overview of the RAN market by region – North America, Europe, Middle East & Africa, Asia Pacific, China, and Caribbean & Latin America, with tables covering manufacturers’ revenue and unit shipments for 5GNR, 5G NR Sub 7 GHz, 5G NR mmW and LTE pico, micro, and macro base stations. The report also covers Open RAN, Virtualized RAN, small cells, and Massive MIMO. To purchase this report, please contact us by email at [email protected].

References:

RAN Decline to Extend Beyond 2023, According to Dell’Oro Group

https://techblog.comsoc.org/2024/01/18/where-have-you-gone-5g-midband-spectrum-fwa-decline-in-capex-and-ran-revenue-in-2024/

Dell’Oro: RAN market declines at very fast pace while Mobile Core Network returns to growth in Q2-2023

Dell’Oro: OpenRAN revenue forecast revised down through 2027

Dell’Oro: U.S. suppliers ~20% of global telecom equipment market; struggling in RAN business

Dell’Oro: Private 5G ecosystem is evolving; vRAN gaining momentum; skepticism increasing

https://www.sdxcentral.com/articles/contributed/what-to-expect-from-ran-in-2024/2024/01/

Dell’Oro: RAN Market to Decline 1% CAGR; Mobile Core Network growth reduced to 1% CAGR

According to a newly published forecast report by Dell’Oro Group,the Radio Access Network (RAN) market is done expanding for now. Following the 40% to 50% ascent between 2017 and 2021, RAN revenues flattened out in 2022 and these trends extended to 1Q 2023.

“Even if it is early days in the broader 5G journey, the challenge now is the comparisons are becoming more challenging in the more mature 5G markets and the upside with the slower-to-adopt 5G regions is not enough to extend the growth streak,” said Stefan Pongratz, Vice President at Dell’Oro Group.

“Meanwhile, growth from new revenue streams including Fixed Wireless Access and enterprise LTE/5G is not ramping fast enough to change the trajectory. With 5G-Advanced not expected to trigger a new capex cycle, the question now is no longer whether RAN will grow. The question now is, rather, how much will the RAN market decline before 6G comes along?” Pongratz added.

Additional highlights from the Mobile RAN 5-Year July 2023 Forecast Report:

- Global RAN is projected to decline at a 1 percent CAGR over the next five years.

- The less advanced 5G regions are expected to perform better while the more developed 5G regions, such as North America and China, are projected to record steeper declines.

- LTE is still handling the majority of the mobile data traffic, but the focus when it comes to new RAN investments is clearly on 5G. Even with the more challenging comparisons, 5G is projected to grow another 20 percent to 30 percent by 2027, which will not be enough to offset steep declines in LTE.

- With mmWave comprising a low single-digit share of the RAN market and skepticism growing about the MBB business case, it is worth noting that our position has not changed. We still envision that the mmWave spectrum will play a pivotal role in the long-term capacity roadmap.

……………………………………………………………………………………………………………………….

Separately, Dell’Oro again lowered its forecasts for the Mobile Core Network market (which is now 5G SA core network), this time citing a slowdown in customer growth. It now predicts that the worldwide market for mobile core networks will expand at a CAGR of 1% over the next five years, having previously forecast a 2% CAGR as recently as January.

“We have reduced our forecast for the third consecutive time, primarily caused, this time, by an expected slowdown in subscriber growth,” said Dave Bolan, Research Director at Dell’Oro Group.

Dave said that Dell’Oro has reduced its expectations for the Multi-Access Edge Computing (MEC) market (which requires 5G SA core network). It now anticipates MEC will have a CAGR of 31%, noting that commercially-viable enterprise applications are taking much longer to come to fruition than many had hoped.

“Mobile Network Operators (MNOs) are concerned about inflation, a possible recession, and political conflicts. They are therefore being restrained in their capital expenditures, another factor weighing in on a more conservative forecast,” said Bolan. “As we continue refining our count of MNOs that have launched 5G Standalone (5G SA) eMMB networks, we note that only 4 MNOs have commercially deployed new 5G SA networks compared to six in the first half of 2022,” he added.

Additional highlights from the Mobile Core Network & Multi-Access Edge Computing 5-Year July 2023 Forecast Report:

- Year-over-year MCN revenue growth rates are projected to be flat in 2026 and turn negative in 2027.

- The North America and China regions are expected to have negative CAGRs, while Europe, Middle East, and Africa (EMEA), and Asia Pacific excluding China regions are expected to have the highest positive CAGRs.

Vodafone became one of those first-half 2023 launches, when it brought 5G Ultra to market in the UK in late June. In its latest Mobility Report, published around the same time, Ericsson noted that while around 240 telcos have launched commercial 5G services, only 35 of them have brought standalone 5G to market.

That should bode well for the mobile core market, and indeed it is faring better than the RAN space, in growth potential terms, at least.

Nonetheless, Dell’Oro predicts that year-on-year growth rates in mobile core network revenues will be flat by 2026 and turn negative the following year.

Dell’Oro Group’s Mobile RAN 5-Year Forecast Report offers a complete overview of the RAN market by region – North America, Europe, Middle East & Africa, Asia Pacific, China, and Caribbean & Latin America, with tables covering manufacturers’ revenue and unit shipments for 5GNR, 5G NR Sub 6 GHz, 5G NR mmW and LTE pico, micro, and macro base stations. The report also covers Open RAN, Virtualized RAN, small cells, and Massive MIMO. To purchase this report, please contact us by email at [email protected].

Dell’Oro Group’s Mobile Core Network & Multi-Access Edge Computing 5-Year July Forecast Report offers a complete overview of the market for Wireless Packet Core including MEC for the User Plane Function, Policy, Subscriber Data Management, and IMS Core with historical data, where applicable, to the present. The report provides a comprehensive overview of market trends by network function implementation (Non-NFV and NFV), covering revenue, licenses, average selling price, and regional forecasts for various network functions. To learn more about this report, please contact us at [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, security, enterprise networks, and data center infrastructure markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com.

References:

RAN Market to Decline at a 1 Percent CAGR Through 2027, According to Dell’Oro Group

Slower Subscriber Growth to Cut Mobile Core Network Market Growth, According to Dell’Oro Group

Dell’Oro: Private 5G ecosystem is evolving; vRAN gaining momentum; skepticism increasing

Private 5G ecosystem is evolving:

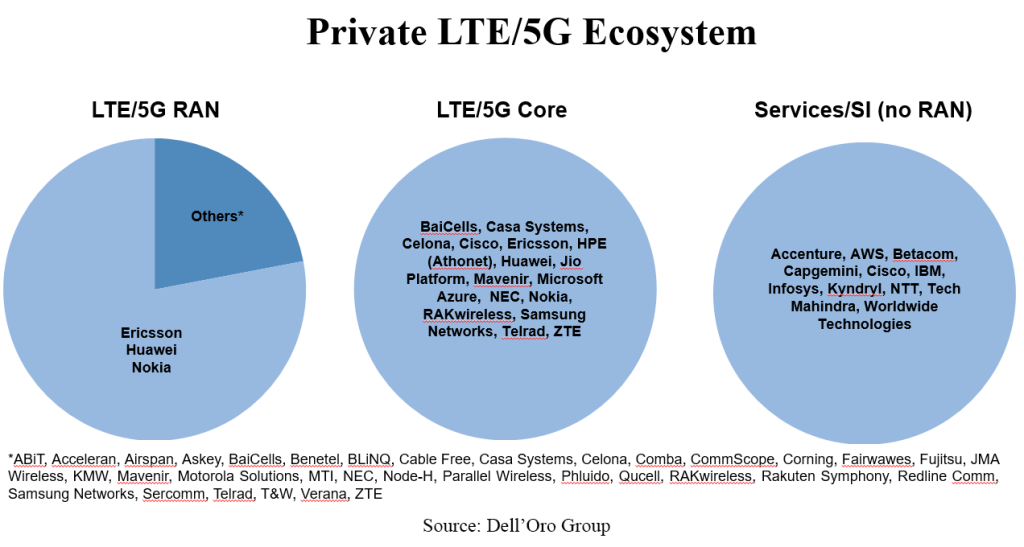

Private 5G is running behind schedule. Dell’Oro’s VP Stefan Pongratz adjusted the firm’s private wireless forecast downward to reflect the current state of the market. Still, the slow uptake is not dampening the enthusiasm for private wireless. If anything, the interest is growing and the ecosystem is evolving as suppliers with different backgrounds (RAN, core, Wi-Fi, hyperscaler, in-building, SI) are trying to solve the enterprise puzzle.

According to Dell’Oro’s data, the total private wireless small cell market outside of China exceeds $100 million. But Pongratz indicated that’s not very much. “Commercial private wireless revenues are still so small. We estimate private wireless small cells is still less than 1% of the overall public-plus-private RAN market in 2022.”

He did concede that the private wireless small cell market outside of China is growing at double digits. “It’s heading in the right direction,” said Pongratz. “A lot of suppliers see good things for 2023.”

According to Stefan, the top three private wireless vendors in the world are Nokia, Huawei and Ericsson. Celona has said that its goal is to overtake Nokia in private wireless. Celona CEO Rajeev Shah said that based on Nokia’s public earnings reports, the company seems to be garnering about 30-35 private wireless customers a quarter and has about 515 of these customers in total. Shah said these numbers aren’t huge, and the industry has a long way to go.

Below is a summary of the private RAN, core, and SI/services providers that Stefan is currently monitoring.

Pongratz said the private wireless market can also be segmented by macro versus small cell. He said private wireless has been around for quite some time — since 2G. But traditionally, it was used as a wide area network (WAN), using the 3GPP definition for non-public networks. Often these networks deployed macros for very large organizations such as utility companies.

“The shiny new object is really the local campus deployments; that’s really small cells,” said Pongratz. “There will be a component of the new shiny that is also WAN, like a car manufacturer that could use both macros and small cells.”

But regardless, whether the private wireless market is segmented by macro or small cell, Dell’Oro still finds the top three suppliers are Huawei, Ericsson and Nokia.

………………………………………………………………………………………………………………………………………………………………………..

Virtualized RAN is gaining momentum:

As we now know, vRAN started out slow but picked up some speed in 2022 in conjunction with the progress in the US. The challenge from a forecasting perspective is that the visibility beyond the greenfields and the early brownfield adopters is limited, primarily because purpose-built RAN still delivers the best performance and TCO. As a result, there is some skepticism across the industry about the broader vRAN growth prospects.

During MWC, Steffan learned four things: 1) Near-term vRAN visibility is improving – operators in South Korea, Japan, US, and Europe are planning to deploy vRAN in the next year or two. 2) vRAN performance is firming up. According to Qualcomm, Vodafone (and Qualcomm) believes the energy efficiency and performance gap between the traditional and new Open vRAN players is shrinking (Vodafone publicly also praised Mavenir’s OpenBeam Massive MIMO AAU). Samsung also confirmed (again) that Verizon is not giving up any performance with Samsung’s vRAN relative to its purpose-built RAN. 3) vRAN ecosystem is expanding. In addition to existing vRAN suppliers such as Samsung, Ericsson, Mavenir, Rakuten Symphony, and Nokia announcing improvements to their existing vRAN/Cloud RAN portfolios, more RAN players are jumping on the vRAN train (both NEC and Fujitsu are expecting vRAN revs to ramp in 2023). And perhaps more interestingly, a large non-RAN telecom vendor informed us they plan to enter the vRAN market over the next year. 4) The RAN players are also moving beyond their home turf. During the show, Nokia announced it is entering the RAN accelerator card segment with its Nokia Cloud RAN SmartNIC (this is part of Nokia’s broader anyRAN strategy).

Skepticism is on the rise

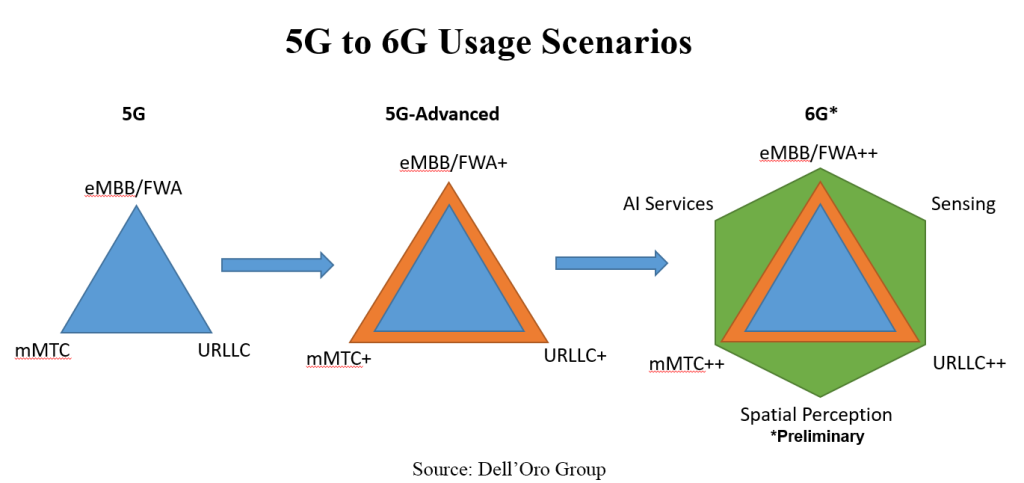

Not surprisingly, disconnects between vision and reality are common when new technologies are introduced. Even if this is expected, we are sensing more frustration across the board this time around, in part because RAN growth is slowing and 5G still has mostly only delivered on one out of the three usage scenarios outlined in the original 5G use case triangle. With 5G-Advanced/5.5G and 6G starting to absorb more oxygen, people are asking if mMTC+/mMTC++ and URLLC+/URLLC++ are really needed given the status of basic mMTC and URLLC. Taking into consideration the vastly different technology life cycles for humans and machines, there are more questions now about this logic of assuming they are the same and will move in tandem. If it is indeed preferred to under-promise and over-deliver, there might be some room to calibrate the expectations with 5G-Advanced/5.5G and 6G.

References:

Dell’Oro: XGS, 25G, and Early 50G PON Rollouts to Fuel Broadband Spending

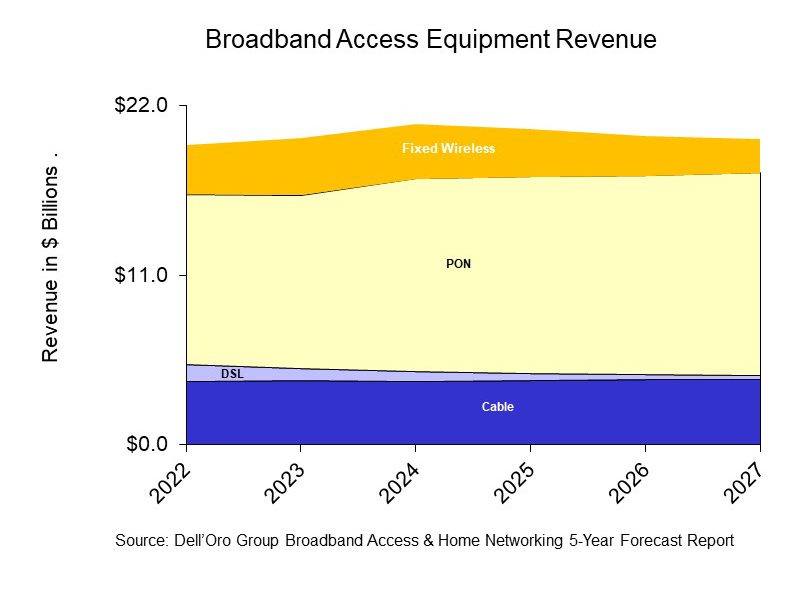

A newly published report by Dell’Oro Group predicts that sales of PON (Passive Optical Network) equipment for fiber-to-the-home deployments, cable broadband access equipment, and fixed wireless CPE will all increase from 2022 to 2027, as service providers continue to expand their fiber and DOCSIS 4.0 networks, while expanding the types of services they deliver to residential subscribers.

“Service providers around the world continue to transition their broadband networks to fiber and retire their existing copper and DSL networks,” said Jeff Heynen, Vice President at Dell’Oro Group. “With markets expected to become more competitive, broadband providers will have to continue spending in order to differentiate their services not only by increasing advertised speeds, but also improving latency and expanding managed Wi-Fi services,” added Heynen.

Additional highlights from the Broadband Access & Home Networking 5-Year January 2023 Forecast Report:

- PON equipment revenue is expected to grow from $11.0 B in 2022 to $13.2 B in 2027, driven largely by XGS-PON deployments in North America, EMEA, and CALA.

- Revenue for Cable Distributed Access Equipment (Virtual CCAP, Remote PHY Devices, Remote MACPHY Devices, and Remote OLTs [1.]) is expected to reach $1.5 B by 2027, as operators ramp their DOCSIS 4.0 and fiber deployments.

- Revenue for Fixed Wireless CPE [2.] is expected to reach $2.2 B by 2027, led by shipments of 5G sub-6GHz and 5G Millimeter Wave units.

Note 1. Remote OLTs (Optical Line Terminals) can be deployed in distributed access nodes to support targeted deployments of FTTP. Comcast is already doing that for its next-gen HFC network. But others, such as Charter Communications, are also ramping up their respective efforts and pursuing similar deployment models.

“You’re now talking about a whole new architecture with remote OLTs, virtual CMTSs and remote PHY. It will take longer to operationalize. It’s a slower burn than it used to be in the past,” Heynan said. He expects cable access network spending to continue climbing past 2027 as other cablecos join the mix.

Note 2. Heynen expects FWA CPE spending to stay steady through 2024, but notes that some providers might run into capacity issues that curtail growth and will also be faced with fiercer competition from fiber and newly upgraded HFC networks. “That puts a ceiling on how much growth can happen for fixed wireless,” he said. While T-Mobile and Verizon are now driving FWA growth in the U.S., we wonder how the future will shake out for the WISP (wireless ISP) sector, which is also seeing steady growth at the moment. As WISPs (Wireless Internet Service Providers) seek out government subsidy opportunities, some may need to consider licensed spectrum or transition to fiber across their footprint.

The Dell’Oro Group Broadband Access & Home Networking 5-Year Forecast Report provides a complete overview of the Broadband Access market with tables covering manufacturers’ revenue, average selling prices, and port/unit shipments for PON, Cable, Fixed Wireless, and DSL equipment. Covered equipment includes Converged Cable Access Platforms (CCAP), Distributed Access Architectures (DAA), DSL Access Multiplexers (DSLAMs), PON Optical Line Terminals (OLTs), Customer Premises Equipment ([CPE] for Cable, DSL, PON, Fixed Wireless), along with Residential WLAN Equipment, including Wi-Fi 6E and Wi-Fi 7 Gateways and Routers. For more information about the report, please contact [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, security, enterprise networks, data center infrastructure markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com.

References:

Broadband network spending set to climb as cable gets its groove back | Light Reading

Dell’Oro: FWA revenues on track to advance 35% in 2022 led by North America

Dell’Oro: PONs boost Broadband Access; Total Telecom & Enterprise Network Equipment Markets

Dell’Oro: PON ONT spending +15% Year over Year

Dell’Oro: 5G Fixed Wireless Access (FWA) deployments to be driven by lower cost CPE

Passive Optical Network (PON) technologies moving to 10G and 25G

Dell’Oro Worldwide Wireless LAN market at new high in 2Q-2022; IDC reports 20.4% annual growth for enterprise segment

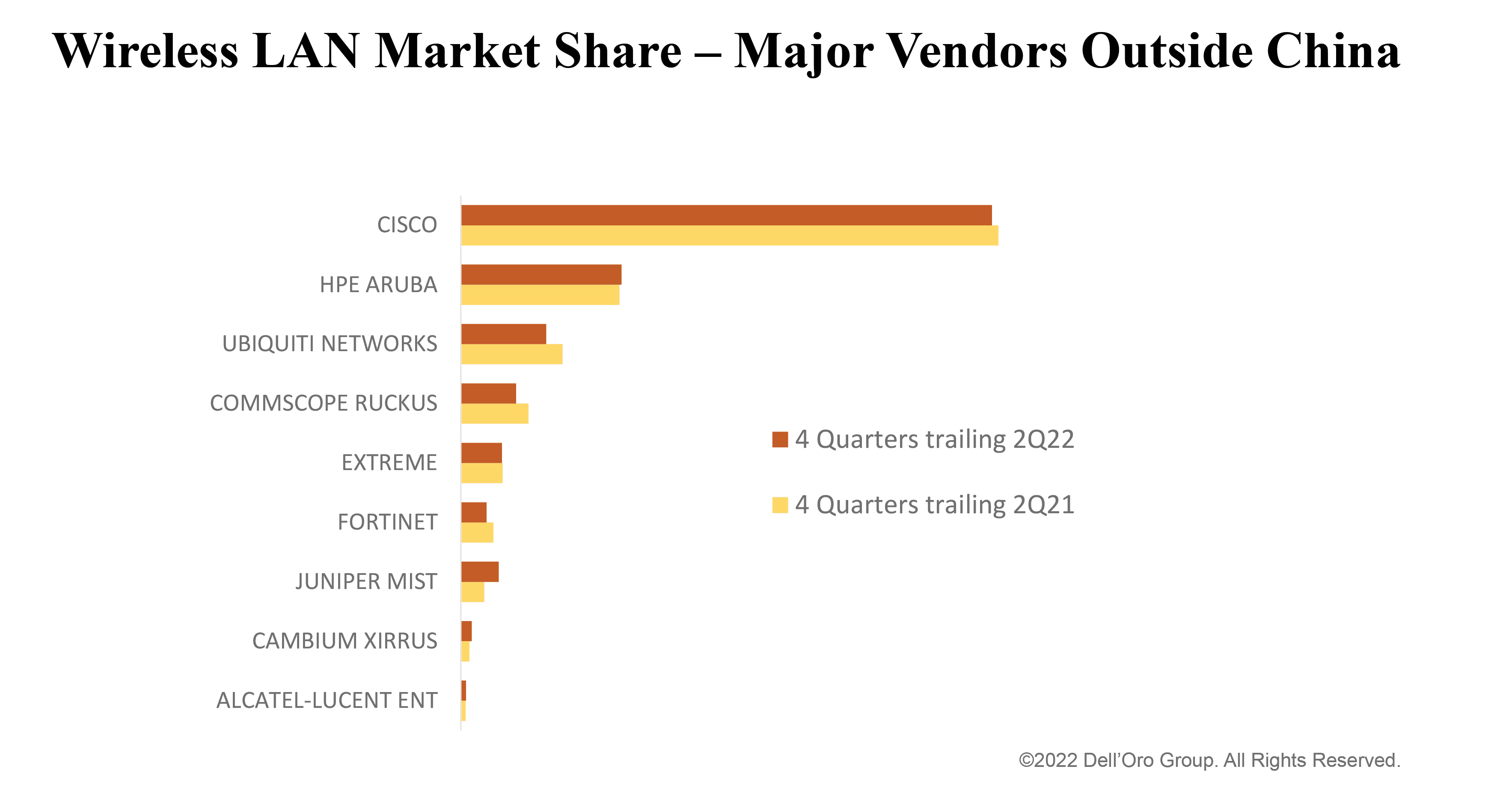

1. According to Dell’Oro Group’s Wireless LAN Quarterly Report, the Wireless LAN market reached a new high in the second quarter, eclipsing $2 Billion, with HPE Aruba and Juniper Mist overcoming supply constraints to contribute over two thirds of the shipment growth outside China. Enterprises saw a 10 percent increase in average prices compared to last year, boosting manufacturers’ revenues and helping to defray additional costs.

“HPE and Juniper really pulled rabbits out of their hats this quarter ̶ Aruba and Mist represent the majority of the growth in units shipped outside China,” says Siân Morgan, Wireless LAN Research Director at Dell’Oro Group. “It’s like a game of whack-a-mole for the manufacturers. They’ll get their hands on one particular access point component and then another shortage will pop up. We’re expecting shipments to be lumpy through the next few quarters.”

Cisco has promised shipments ‘en masse’ for enterprises, and all of the manufacturers are busy finding creative solutions: redesigning products, using brokerage firms, or bypassing component distributors.

“Wireless LAN solutions have also become more expensive for enterprises. It’s very rare to see such a long stretch of quarters with year-over-year price increases. It’s a combination of higher-end products being available, including the new Wi-Fi 6E technology, as well as a general move by the manufacturers to cover their escalating costs. Looking ahead we have to ask ourselves how long the market will bear these higher prices,” added Morgan.

Additional highlights from the 2Q 2022 Wireless LAN Quarterly Report:

- The Wireless LAN market saw two distinct phenomena driving the growth: one in China, and another one in the markets outside China.

- In light of the China lockdowns, the Wireless LAN market in China showed surprising strength with both Huawei and H3C pulling in strong quarters.

- Wi-Fi 6E shipments accelerated this quarter, as another half dozen vendors started shipping products supporting the new 6 GHz band. However, now in its fourth quarter of product availability, Wi-Fi 6E is lagging the adoption rate of the prior two generations of Wi-Fi.

- Revenue from public cloud-managed APs has outpaced the market. The cloud-managed AP business is still dominated by Cisco – although this quarter, Juniper grabbed an outsized market share in cloud-managed Wireless LAN.

Sian wrote in an email to this author, “It is difficult to judge changes in market share based on one or two quarters, given that supply constraints are making shipment volumes choppy. To understand how the market is unfolding it is useful to look at market share based on trailing four-quarter averages, which are shown in the chart below.

Dell’Oro note earlier this year that supply chain issues increased vendor backlogs by up to 15-times normal levels. “Many enterprises have planned network upgrades and the popular connection is Wi-Fi. The trouble is getting it. Several manufacturers announced that components from second and third-tier suppliers became the bottleneck in 1Q22,” said Tam Dell’Oro, Founder, CEO and Wireless LAN Analyst. “Supply constraints have resulted in highly volatile quarterly performance vendor-to-vendor depending on whether or not they have all the components. For example, sales may be up 20 percent in one quarter and down 20 percent the next. Another item, which could potentially cause delays, that we are keeping our eye on are the contract negotiations between the west coast dockworkers union and the Maritime Association,” added Dell’Oro.

The Dell’Oro Group Wireless LAN Quarterly Report offers complete, in-depth coverage of the Enterprise Outdoor and Indoor markets, Wireless LAN Controllers with tables containing manufacturers’ revenue, average selling prices, and unit shipments by the following wireless standards: 802.11ax (Wi-Fi 6 and 6E [6 GHz]), 802.11ac (Wi-Fi 5) Wave 1 vs. Wave 2, and historic IEEE 802.11 standards. The Enterprise market is portrayed by Public Cloud vs. Premises and Private Cloud deployments, as well as by ten Vertical markets and by Customer Size. To purchase these reports, please contact us by email at [email protected].

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

2. IDC reports that the enterprise segment of the worldwide wireless local area network (WLAN) market continued its strong growth in the second quarter of 2022 (2Q22), increasing 20.4% year over year to $2.1 billion. That’s according to the IDC report: “Worldwide Quarterly Wireless LAN Tracker.”

The 20.4% annualized growth builds on the enterprise WLAN market growing 17.1% year over year in the first quarter of 2022. In the first half of 2022, the enterprise WLAN market has grown 18.4% compared to the first half of 2021. Growth in the enterprise WLAN market continues to be driven by the latest Wi-Fi standard, known as Wi-Fi 6 or 802.11ax. Wi-Fi 6 access points (AP) made up 76.5% of the revenues in the Dependent AP segment and accounted for 62.7% of unit shipments within the segment. Wi-Fi 5 products, also known as 802.11ac, made up the remaining balance of Dependent AP sales.

The consumer segment of the WLAN market declined 3.5% year over year in 2Q22, with the quarter’s unit shipments remaining relatively flat at 0.6% growth compared to the first quarter of 2022. Adoption of Wi-Fi 6 continues in the consumer segment of the WLAN market too: In 2Q22, Wi-Fi 6 made up 33.5% of the market’s revenues.

“The enterprise WLAN market continues to grow at a rapid clip, emphasizing the importance of wireless technology in the network and digital transformation goals of organizations across the globe,” said Brandon Butler, research manager, Enterprise Networks at IDC. “The enterprise WLAN market is not immune to challenges however, with the supply chain disruptions and component shortages being notable examples. But strong demand for wireless refreshes to Wi-Fi 6 – and increasingly to Wi-Fi 6E – is buoying the market and leading to strong growth rates.”

The enterprise WLAN market had mixed results across the globe. In the United States, the market increased 15.7% annually, while in Latin America the market grew 47.7% from a year earlier. In Canada the market declined 1.6%. In Western Europe, the market increased 45.4%, but in Central and Eastern Europe, the market declined 20.6%. Within Central and Eastern Europe, Russia’s market declined 73.2% as the Russia-Ukraine war rages on. In the Middle East & Africa, the market rose 23.2%. In the Asia/Pacific region, excluding Japan and China, the market rose 26.5%, while in the People’s Republic of China the market increased 8.7% year over year. In Japan the market rose 6.2%.

Vendor highlights (note that Juniper Mist is NOT mentioned by IDC as a leading wireless LAN vendor):

- Cisco’s enterprise WLAN revenues increased 19.3% year over year in 2Q22 to $792.0 million, giving the company market share of 37.7%, compared to market share of 41.5% in the previous quarter, 1Q22.

- HPE-Aruba revenues rose 48.6% year over year in 2Q22, giving the company market share of 14.9%, down from 16.5% in the first quarter.

- Ubiquiti enterprise WLAN revenues increased 10.5% year over year in 2Q22, giving the company 7.9% market share in the quarter, up from 7.1% in 1Q22.

- Huawei enterprise WLAN revenues rose 20.0% year over year in 2Q22, giving the company 8.5% market share, up from 4.6% market share in the previous quarter.

- H3C revenues increased 16.4% year over year in 2Q22, giving the company market share of 4.6%, up from 4.3% in 1Q22.

The IDC Worldwide Quarterly Wireless LAN Tracker provides total market size and vendor share data in an easy-to-use Excel Pivot Table format. The geographic coverage includes nine major regions (USA, Canada, Latin America, People’s Republic of China, Asia/Pacific (excluding Japan & China), Japan, Western Europe, Central and Eastern Europe, and Middle East and Africa) and 60 countries. The WLAN market is further segmented by product class, product type, product, standard, and location. Measurement for the WLAN market is provided in vendor revenue, value, and unit shipments.

About IDC Trackers:

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly Excel deliverables and on-line query tools.

References:

HPE Aruba and Juniper Mist Navigate Component Shortages to Gain Share, According to Dell’Oro Group

https://www.idc.com/getdoc.jsp?containerId=prUS49663322

https://www.idc.com/getdoc.jsp?containerId=IDC_P23464

Dell’Oro: Telecom Capex Growth to Slow in calendar years 2022-2024

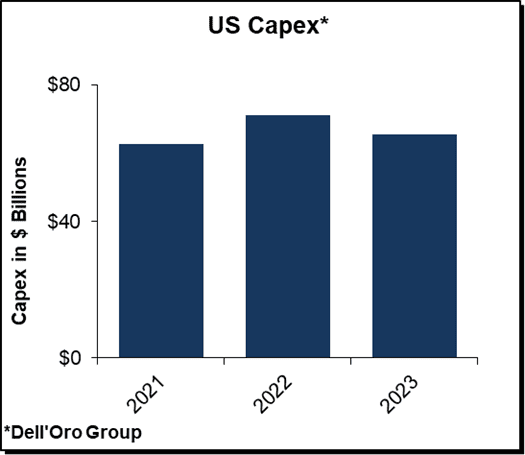

Dell’Oro Group forecasts that telco capex growth will taper off in 2023 and 2024 after increasing 9% year-over-year in nominal USD terms and on track to advance 3% in 2022.

The market research firm states that the top fifty carriers in the world collectively generated combined annual revenue and investments of well over $1.4 T this past year. They estimate that these carriers account for roughly 80% of worldwide capex and revenue.

Dell’Oro’s Telecom Capex bi-annual reports (previously called Carrier Economics bi-annual reports) track the revenue and capital expenditure (capex) trends for these fifty-plus carriers.

“Telco investments, in general, have shown remarkable resilience to external factors including Covid-19 containment measures, supply chain disruptions, and economic uncertainties,” said Stefan Pongratz, Vice President and analyst with the Dell’Oro Group. “Surging wireless investments in the US taken together with non-mobile capex expansions in China will keep the momentum going in 2022,” continued Pongratz.

Stefan believes carrier revenue and capex trends can to some degree explain telecom equipment manufacturer revenue trends. The highly granular information provided in this report will enable carriers, system and component vendors, equity researchers, and regulatory bodies to assess growth opportunities and to observe performance practices in the telecom sector.

Additional highlights from the March 2022 3-year Telecom Capex forecast report:

- Global capex growth is expected to moderate from 9 percent in 2021 to 3 percent in 2022, before tapering off in 2023 and 2024.

- The coupling between carrier investments and manufacturing infrastructure revenues is expected to prevail over the short-term—capex and telecom equipment are on track to advance 3 percent and 4 percent in 2022, respectively.

- Short-term output acceleration is expected to be relatively broad-based, with investments growing in China and the US. At the same time, challenging comparisons in the US are expected to drag down the overall capex in the outer part of the forecast.

- Following a strong showing in 2021, capex growth prospects across Europe will be more muted in 2022.

Editor’s Note:

MTN Consulting estimates a nearly $325B annualized global capex in 2021, or nearly double the webscale total of $175B. The ratio of capex to revenues, or capital intensity, reached 17.2% in 2021, the highest level since 2015.

Excluding China/HK-based companies (which haven’t finished reporting), the top 10 biggest telco capex spenders in 2021 were AT&T, DT, Verizon, NTT, Comcast, Vodafone, Orange, Charter, America Movil, and Telefonica. The biggest capex gains in 2021 were seen at America Movil (+$2.54B versus 2020 total), Telecom Italia (+$2.49B), Verizon (+$2.09B), AT&T (+$1.93B), Deutsche Telekom (+$1.74B), BT (+$1.63B), and Rakuten ($1.47B). The DT jump is inflated slightly by its Sprint acquisition, which closed in April 2020.

MTN’s latest official global capex forecast is for $328B in 2022, a bit higher than 2021. “We are maintaining this target for now, but there is a high level of uncertainty and considerable downside risk.” No forecast beyond 2022 was provided.

The Dell’Oro Group Telecom Capex Report provides in-depth coverage of more than 50 telecom operators highlighting carrier revenue, capital expenditure, and capital intensity trends. The report provides actual and 3-year forecast details by carrier, by region by country (United States, Canada, China, India, Japan, and South Korea), and by technology (wireless/wireline). To purchase this report, please contact by email at [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications and enterprise networks infrastructure, network security and data center IT markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, please contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com.

China is already showing signs of slowing its 5G investment – China Telecom plans to reduce 5G investment by nearly 11% to 34 billion yuan (US$5.34 billion) this year, reported Light Reading’s Robert Clark in March. China Mobile has budgeted 110 billion yuan (US$17.3 billion) for spending on 5G networks in 2022, a 3.5% decline.

In the US, Dish Network is among service providers upping their 5G investments this year. Dish spent $1 billion on 5G-related capex in 2021 and plans to spend $2.5 billion in 2022 , reported Light Reading’s Jeff Baumgartner in February.

On the other hand, IDC doesn’t expect telecom capex to drop until 2024:

“COVID-19 has shown no long-term negative effects on telecommunications capex. IDC expects 2021 capex will grow versus 2020 and show no decline until at least 2024. If anything, COVID-19 has led to communications service providers increasing their network investments to sustain increase demand for connectivity and the speeds associated with it.” said Daryl Schoolar, IDC research director, Worldwide Telecommunications Insights.

References:

Worldwide Telecom Capex Growth to Taper Off in 2023, According to Dell’Oro Group

https://www.lightreading.com/5g/telco-capex-could-level-out-in-2023-delloro-reports/d/d-id/776610?

MTN Consulting: : 4Q2021 review of Telco & Webscale Network Operators Capex

https://www.idc.com/getdoc.jsp?containerId=US48465621

Dell’Oro: Cable Broadband Access Equipment Revenue to Decline from $13B in 2019 to $11B in 2024

According to a newly published report by Dell’Oro Group, sales of cable broadband access equipment will decrease with a meager 2 percent CAGR from 2019 to 2024. The virtualization of network infrastructure, which is already playing out in the cable market, will extend to other equipment areas, thereby reducing traditional hardware revenue.

The cable broadband category includes both network infrastructure and consumer premises equipment.

That expected decline will be driven by multiple factors, including a saturating broadband services market in regions such as North America and Europe. Another key factor is the lack of a near-term need for many cable operators to move ahead with big access network upgrades following their recent migrations to DOCSIS 3.1, a technology that gives cablecos the ability to deliver 1-Gig services, Jeff Heynen, senior research director at Dell’Oro Group, said.

“For the North American cable operators, there isn’t a competitive incentive for them to really force upgrades at this point,” Heynen said. “Virtualization, coupled with subscriber saturation in some mature markets will result in gradually declining revenue for broadband access equipment globally,”Heynen added .

Additional highlights from the Broadband Access 5-Year Forecast Report:

- Virtual CMTS/CCAP revenue will grow from $90 Million in 2019 to $418 Million worldwide in 2024, as cable operators move to these platforms to expand broadband capacity.

- Mesh-capable routers and broadband CPE units will reach 30 Million units in 2020.

Although AT&T is pushing FTTP and having some success in upgrading some of its existing customers, that has not had much of an impact on major US cable operators such as Comcast and Charter Communication, which added 424,000 and 313,000 broadband subs, respectively, in Q4 2019.

“There has to be a driver for them to spend, and I really don’t see it,” Heynen said.

The cable industry is fast at work on DOCSIS 4.0, a next-gen specification that will support multi-gigabit speeds alongside lower latency capabilities and a higher level of network security. An even longer-term target being pursued is “10G,” a cable industry initiative that’s aiming for 10-Gig symmetrical speeds on multiple types of access networks, including hybrid fiber/coax (HFC), FTTP and even wireless.

Speaking on the company’s Q4 earnings 2019 call last week, Tom Rutledge, Charter’s chairman and CEO, made it clear that these are longer-term initiatives that include features and capabilities that can be added on an incremental basis. “There’s no immediate need to deploy a new upgrade to the marketplace today,” Rutledge said. Charter wrapped up its D3.1 network upgrade in late 2018.

That scenario also gives operators time to push ahead with related projects, including migrations to distributed access architectures and network virtualization.

Even as the move to D4.0 is still out on cable’s horizon, virtualization efforts are expected to ramp up in the next few years. Dell’Oro expects virtual cable modem termination system (CMTS) and converged cable access platform (CCAP) revenues to climb from just $90 million in 2019 to $418 million worldwide in 2024. Heynen said the 2019 total represents about 12% of the total for the CMTS/CCAP core market.

Comcast, along with some small and midsize operators in the US and Western Europe, has begun to deploy virtualized access networks. Harmonic, a lead partner for Comcast’s virtual CMTS rollout, is set to announce Q4 2019 results later today and is expected to offer an update on its vCCAP business.

The bigger broadband picture

And cable isn’t the only market feeling some pain. Dell’Oro projects that revenues for the broader access equipment market, including DSL and PON technologies, will decline from $13 billion in 2019, to $11 billion in 2024.

A big culprit there is the ongoing decline of DSL spending, Heynen said. Another contributor to the decline in hardware revenues will come as the PON market starts to virtualize the OLT (optical line terminal), he added.

Dell’Oro’s forecast currently does not include opportunities around fixed wireless. Fixed wireless will have a role in the broadband market, but “I’m still reluctant that fixed wireless will be as big as others predicted it to be,” Heynen said.

References:

Dell’Oro: Broadband access revenue declines 2% y/y in Q1-2019

In a new report published Monday June 10th, Dell-Oro Group said that global revenue for broadband access equipment declined 2 percent Y/Y in 1Q 2019, reaching $2.9 Billion. Increased shipments of XG-PON1, XGS-PON, NG-PON2 OLT ports, and DOCSIS 3.1, CPE offset CCAP (Converged Cable Access Platform) spending declined for the second straight quarter.

“The 10 Gbps FTTH deployments continue to build momentum,” said Jeff Heynen, Research Director, Broadband Access and Home Networking. “The next-gen fiber increases nearly offset the weakness in cable CCAP spending, as cable operators push off new capacity purchases while they determine how to move forward with distributed access architectures,” Heynen added.

Following are additional highlights from the 1Q 2019 Broadband Access Quarterly Report:

- Total cable access concentrator revenue decreased 38 percent Y/Y to $275 M, driven by a strong slowdown in CCAP channel purchases in North America and EMEA.

- Total DSL port shipments decreased 21 percent Y/Y, with ADSL ports down 71 percent and VDSL ports down 20 percent.

- Total PON OLT port shipments increased 7 percent Y/Y, with XGS-PON ports up 337 percent.

- Total SOHO WLAN units increased 13 percent Y/Y, driven by the driven by 19% Y/Y growth in broadband CPE with WLAN and 125% Y/Y growth in mesh router units.

According to Dell’Oro Group’s Q1 2019 Broadband Access Quarterly Report, total cable access concentrator revenue was down 38% year over year to $275 million, driven by the slowdown in CCAP channel purchases in North America and EMEA.

Reference:

http://www.delloro.com/news/broadband-access-equipment-revenue-dipped-2-9-b-1q-2019

Dell’Oro PRESS RELEASES:

SHIPMENT OF 25 GBPS PORTS REACHED A NEW HEIGHT IN 1Q 2019 DESPITE SERVER MARKET SLOWDOWN, ACCORDING TO DELL’ORO GROUP

Rest of the Ethernet Controller and Adapter Market Remains Challenged

REDWOOD CITY, Calif. – June 11, 2019 – In a newly published report by Dell’Oro Group, the trusted source for information about the telecommunications and networking industries, shipments of 25 Gbps Ethernet controller and adapter ports reached a new height … Continued

1Q 2019 ENTERPRISE WLAN MARKET LIFTED BY STRONG SURGE IN NORTH AMERICA FOR THREE CONSECUTIVE QUARTERS, ACCORDING TO DELL’ORO GROUP

Cisco and HPE Aruba Scored Most Significant Revenue Gains

REDWOOD CITY, Calif. – June 11, 2019 – According to a recently published report by Dell’Oro Group, the trusted source for market information about the telecommunications, networks, and data center IT industries, the 1Q 2019 Enterprise Wireless LAN (WLAN) market … Continued

SERVER MARKET REVENUE GREW AT THE SLOWEST PACE IN EIGHT QUARTERS IN 1Q 2019, ACCORDING TO DELL’ORO GROUP

Cloud Capex Forecasted to Revert to Stronger Growth by Late 2019

REDWOOD CITY, Calif. – June 10, 2019 – According to a recently published report from Dell’Oro Group, the trusted source for market information about the telecommunications, networks, and data center IT industries, the worldwide Server market grew at the slowest … Continued