AI wave stimulates big tech spending and strong profits, but for how long?

Big tech companies have made it clear over the last week that they have no intention of slowing down their stunning levels of spending on artificial intelligence (AI), even though investors are getting worried that a big payoff is further down the line than most believe.

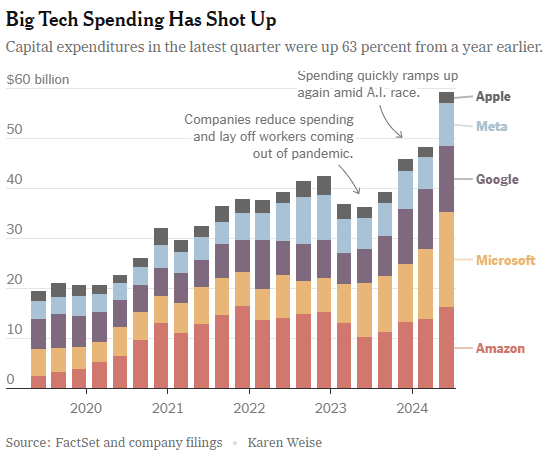

In the last quarter, Apple, Amazon, Meta, Microsoft and Google’s parent company Alphabet spent a combined $59 billion on capital expenses, 63% more than a year earlier and 161 percent more than four years ago. A large part of that was funneled into building data centers and packing them with new computer systems to build artificial intelligence. Only Apple has not dramatically increased spending, because it does not build the most advanced AI systems and is not a cloud service provider like the others.

At the beginning of this year, Meta said it would spend more than $30 billion in 2024 on new tech infrastructure. In April, he raised that to $35 billion. On Wednesday, he increased it to at least $37 billion. CEO Mark Zuckerberg said Meta would spend even more next year. He said he’d rather build too fast “rather than too late,” and allow his competitors to get a big lead in the A.I. race. Meta gives away the advanced A.I. systems it develops, but Mr. Zuckerberg still said it was worth it. “Part of what’s important about A.I. is that it can be used to improve all of our products in almost every way,” he said.

………………………………………………………………………………………………………………………………………………………..

This new wave of Generative A.I. is incredibly expensive. The systems work with vast amounts of data and require sophisticated computer chips and new data centers to develop the technology and serve it to customers. The companies are seeing some sales from their A.I. work, but it is barely moving the needle financially.

In recent months, several high-profile tech industry watchers, including Goldman Sachs’s head of equity research and a partner at the venture firm Sequoia Capital, have questioned when or if A.I. will ever produce enough benefit to bring in the sales needed to cover its staggering costs. It is not clear that AI will come close to having the same impact as the internet or mobile phones, Goldman’s Jim Covello wrote in a June report.

“What $1 trillion problem will AI solve?” he wrote. “Replacing low wage jobs with tremendously costly technology is basically the polar opposite of the prior technology transitions I’ve witnessed in my 30 years of closely following the tech industry.” “The reality right now is that while we’re investing a significant amount in the AI.space and in infrastructure, we would like to have more capacity than we already have today,” said Andy Jassy, Amazon’s chief executive. “I mean, we have a lot of demand right now.”

That means buying land, building data centers and all the computers, chips and gear that go into them. Amazon executives put a positive spin on all that spending. “We use that to drive revenue and free cash flow for the next decade and beyond,” said Brian Olsavsky, the company’s finance chief.

There are plenty of signs the boom will persist. In mid-July, Taiwan Semiconductor Manufacturing Company, which makes most of the in-demand chips designed by Nvidia (the ONLY tech company that is now making money from AI – much more below) that are used in AI systems, said those chips would be in scarce supply until the end of 2025.

Mr. Zuckerberg said AI’s potential is super exciting. “It’s why there are all the jokes about how all the tech C.E.O.s get on these earnings calls and just talk about A.I. the whole time.”

……………………………………………………………………………………………………………………

Big tech profits and revenue continue to grow, but will massive spending produce a good ROI?

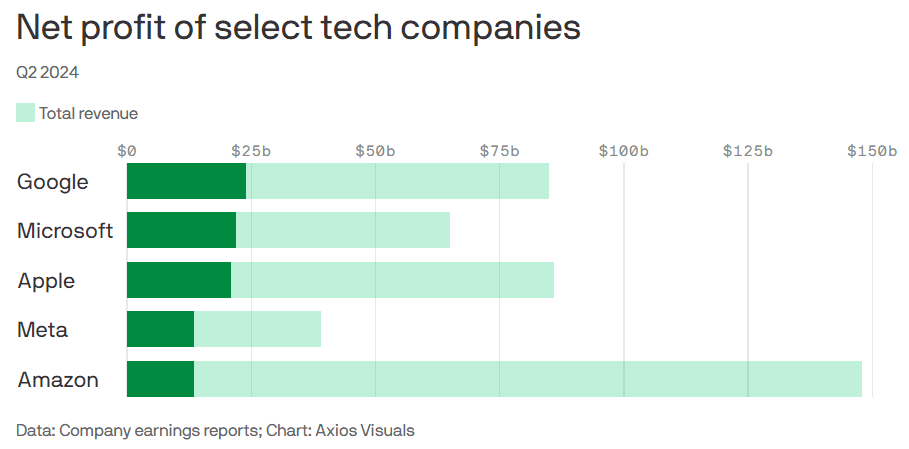

Last week’s Q2-2024 results:

- Google parent Alphabet reported $24 billion net profit on $85 billion revenue.

- Microsoft reported $22 billion net profit on $65 billion revenue.

- Meta reported $13.5 billion net profit on $39 billion revenue.

- Apple reported $21 billion net profit on $86 billion revenue.

- Amazon reported $13.5 billion net profit on $148 billion revenue.

This chart sums it all up:

………………………………………………………………………………………………………………………………………………………..

References:

https://www.nytimes.com/2024/08/02/technology/tech-companies-ai-spending.html

https://www.axios.com/2024/08/02/google-microsoft-meta-ai-earnings

https://www.nvidia.com/en-us/data-center/grace-hopper-superchip/

AI Frenzy Backgrounder; Review of AI Products and Services from Nvidia, Microsoft, Amazon, Google and Meta; Conclusions

3 thoughts on “AI wave stimulates big tech spending and strong profits, but for how long?”

Comments are closed.

Good article, Alan. Tesla should be included in the conversation about AI, given its relatively large investment in AI for various efforts, the most notable being their autonomous driving efforts.

“Capital expenditures on AI infrastructure in the quarter amounted to $600 million,” according to CNBC.

Tesla’s 14.8% margins aren’t in the same range as their tech cousins referenced above, but one has to think that the AI infrastructure they are installing will benefit multiple businesses in the Elon Musk ecosystem (NeuralLink, Boring Company, X, Tesla’s insurance product), SpaceX, Starlink) over the long-term.

https://www.cnbc.com/2024/07/23/teslas-margin-getting-hammered-by-discounts-and-hefty-ai-spending.html

Thanks for your comment Ken. I purposely EXCLUDED Tesla because it is NOT a cloud services provider (CSP) which are by far the big spenders on AI. At it’s 2024 Directions conference, IDC said that enterprise clients should use CSPs for their AI related projects. Tesla’s AI initiatives are all for internal consumption rather than for external customers.

Big Tech companies are engaged in an artificial-intelligence arms race, each building data centers at a blistering rate. All together, the four giants spent $95 billion on capex in the second quarter, and much more than that is in the pipeline.

The companies have been giving annual capex guidance. Microsoft, whose fiscal year ended this quarter, declined to issue a fiscal 2026 projection, but put out a big number—over $30 billion—for the current quarter’s investments. That would see expenses rise by 50% on the year, but Chief Financial Officer Amy Hood cautioned that the growth rate would moderate through the fiscal year.

By contrast, Meta isn’t slowing down. After raising its 2025 capex guidance last quarter and inching it up this past week, Chief Financial Officer Susan Li said on the earnings call that the company “expects to ramp our investments significantly in 2026.” This is exceptional because Meta is the only one from this group that doesn’t operate a cloud to rent out these AI servers; it’s all for its own use.

Amazon is also proceeding full steam ahead. It used almost every penny of its second-quarter operational cash flows for $31 billion of capex, and guided to around $60 billion for the second half, putting it on pace for a stunning $115 billion for the year. Amazon leads the pack here, but unlike the other AI contenders, its number is inflated by large retail investments for warehouses, vehicles, and robots.

Alphabet isn’t slowing down either, raising its 2025 capex guidance considerably. And though Apple spends much less—$3.5 billion in the quarter—that’s still 61% higher than last year.

https://www.barrons.com/articles/takeaways-big-tech-earnings-ai-68402f1a?mod=hp_WIND_A_3_2