Dell’Oro: RAN market still declining with Huawei, Ericsson, Nokia, ZTE and Samsung top vendors

RAN market conditions continued to remained challenging in the second quarter despite some faint signs of improvements. Dell’Oro estimates that the overall 2G–5G Radio Access Network (RAN) market—including baseband plus radio hardware and software, excluding services—declined at a double-digit rate for a fourth consecutive quarter in 2Q24. The results in the second quarter were mostly an extension of what we have seen over the past year, characterized by cautious capex spending and challenging comparisons.

“Even if the RAN market is still down at a double-digit rate in the first half, the second quarter offered some glimmer of hope that the nadir of this cycle with double-digit declines might now be in the past for the time being,” said Stefan Pongratz, Vice President and analyst at the Dell’Oro Group. “This does not change the fact that the RAN market is expected to decline at a 2 percent CAGR over the next five years. But the pace of the decline should moderate somewhat going forward,” continued Pongratz.

Additional highlights from the 2Q 2024 RAN report:

- Total RAN revenues were mostly in line with expectations.

- Strong growth in North America and stable trends in China were not enough to offset steep declines in the Asia Pacific region, partly driven by sharp drops in India.

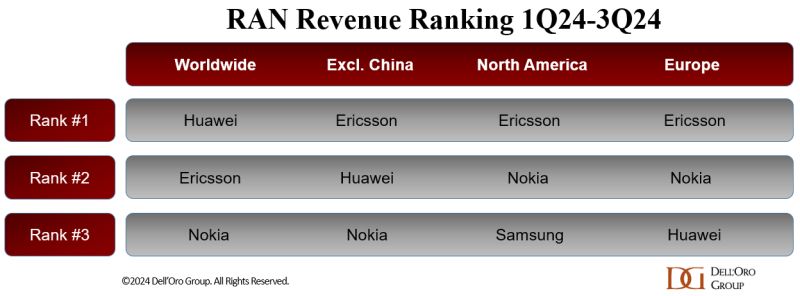

- Vendor rankings are mostly unchanged. The top 5 RAN suppliers based on worldwide revenues are Huawei, Ericsson, Nokia, ZTE, and Samsung.

- Relative to 2023, Huawei’s 1H 2024 revenue share is up, ZTE is stable, and Nokia/Ericsson are together down 3 to 4 percentage points.

- Short-term RAN projections are mostly unchanged since the 5-year forecast update. Global RAN is expected to decline 8 percent to 12 percent outside of China.

On the bright side, the overall results were fairly aligned with expectations, and more regions are now growing. Our initial analysis shows that three out of the six tracked regions advanced on a year-over-year basis in the quarter, up from just one region in the first quarter (North America, MEA, and CALA increased while Europe, China, and Asia Pacific Excl. China declined).

Strong growth in North America and stable trends in China were not enough to offset steep declines in the Asia Pacific region, partly driven by sharp drops in India.

The supplier landscape is mostly unchanged with Huawei, Ericsson, Nokia, ZTE Corporation, and Samsung Networks still leading the way, while many of the non-top 5 suppliers are declining.

Relative to 2023, Huawei’s 1H 2024 revenue share is up, ZTE is stable, and Nokia/Ericsson are together down 3 to 4 percentage points.

Short-term RAN projections have remained mostly unchanged since the 5-year forecast update. Global RAN is expected to decline 8% to 12% outside of China. This implies a stronger-than-typical 2024 second half, comprising more than 53% of full-year revenues.

References:

RAN Market Still Down with Some Glimmer of Hope, According to Dell’Oro Group

Analysts: Telco CAPEX crash looks to continue: mobile core network, RAN, and optical all expected to decline

Where Have You Gone 5G? Midband spectrum, FWA, 2024 decline in CAPEX and RAN revenue

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Dell’Oro: RAN market declines at very fast pace while Mobile Core Network returns to growth in Q2-2023

Dell’Oro: RAN Market to Decline 1% CAGR; Mobile Core Network growth reduced to 1% CAGR

One thought on “Dell’Oro: RAN market still declining with Huawei, Ericsson, Nokia, ZTE and Samsung top vendors”

Comments are closed.

Data from Omdia, a Light Reading sister company, gave Huawei, Ericsson and Nokia, the three largest suppliers, a whopping 75.1% of the entire global market in 2023, an increase of 0.2 percentage points on the 2022 figure. ZTE and Samsung, the fourth- and fifth-biggest players, respectively, claimed another 20%.

https://www.lightreading.com/5g/after-losing-nokia-crisis-hit-intel-seeks-network-assets-buyer