Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

A new report from the Dell’Oro Group reveals that the global Radio Access Network (RAN) market concluded the year with another difficult quarter, resulting in a global decrease of nearly $4 billion in RAN revenues for the full year of 2023. However, despite these challenges, the results for the quarter exceeded expectations, partly due to robust 5G deployments in China.

“Following the intense rise between 2017 and 2021, it’s clear that the broader RAN market is now experiencing a setback, as two out of the six tracked regions are facing notable declines,” said Stefan Pongratz, Vice President for RAN market research at the Dell’Oro Group. “In addition to challenging conditions in North America and Europe, the narrowing gap between advanced and less advanced operators (e.g. India) in this first 5G wave, compared to previous technology cycles, initially had a positive impact but is now constraining global 5G and broader RAN growth prospects,” Pongratz added.

Additional highlights from the 4Q 2023 RAN report:

- Overall concentration in the RAN market showed signs of improvement in 2021 and 2022, but this progress slowed down in 2023.

- While full-year RAN rankings remained mostly unchanged for major suppliers, revenue shares within the RAN market showed more variability, with Huawei and ZTE enhancing their global revenue shares. Similarly, Huawei and Nokia saw improvements in their revenue shares outside of China.

- The top 5 RAN suppliers based on worldwide revenues are Huawei, Ericsson, Nokia, ZTE, and Samsung.

- Regional projections are mostly unchanged, with market conditions expected to remain tough in 2024 due to difficult comparisons in India. Nevertheless, the base-case scenario anticipates a more moderate pace of decline this year.

…………………………………………………………………………………………………………………………

Source: Dell’Oro Group

…………………………………………………………………………………………………………………………

Separately, Rémy Pascal of Omdia says that global RAN revenues (including both hardware and software) declined by 11% last year to just over $40 billion. The worst performing region by far was North America, which almost halved, but this should be viewed in the context of a relatively strong 2022.

India and China were been the best performing countries for new RAN deployments. This partly explains why Huawei continues to be the top RAN vendor despite attempts by the U.S. and its allies to prevent that, but as the Omdia table below shows, the Chinese vendor is still doing well in many other regions too. We’re told this table looked pretty much the same last year.

Top RAN vendors by region, full year 2023:

|

North America |

Asia & Oceania |

Europe, Middle East and Africa |

Latin America & the Caribbean |

|

Ericsson |

Huawei |

Ericsson |

Huawei |

|

Nokia |

ZTE |

Nokia |

Ericsson |

|

Samsung |

Ericsson |

Huawei |

Nokia |

Source: Omdia

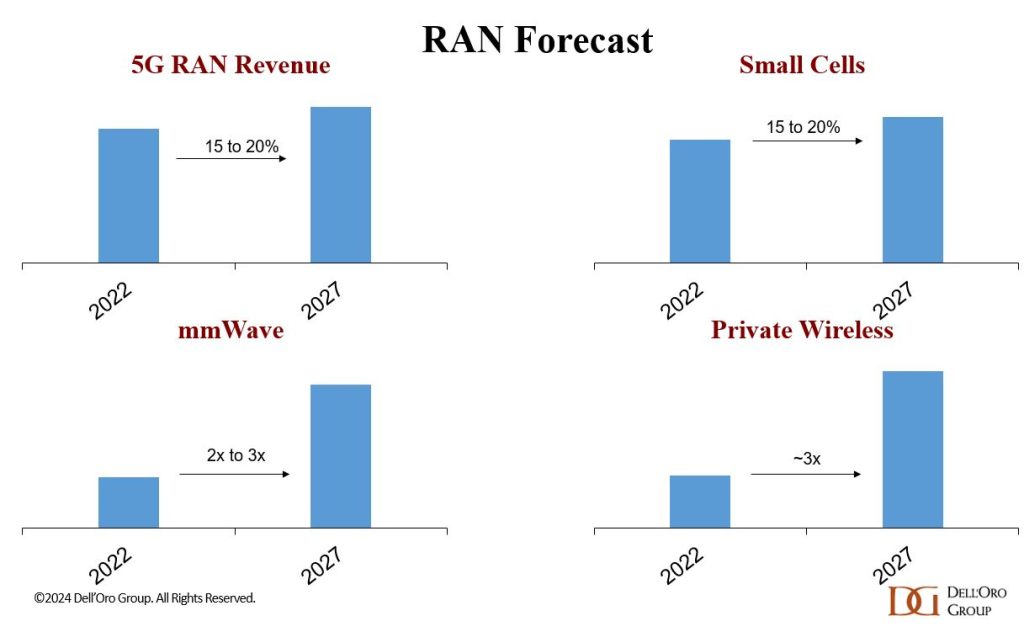

Omdia expects the RAN market size to decrease by around 5% compared to 2023. That’s an improvement on the 11% 2022-23 decline but still not good news for the RAN industry.

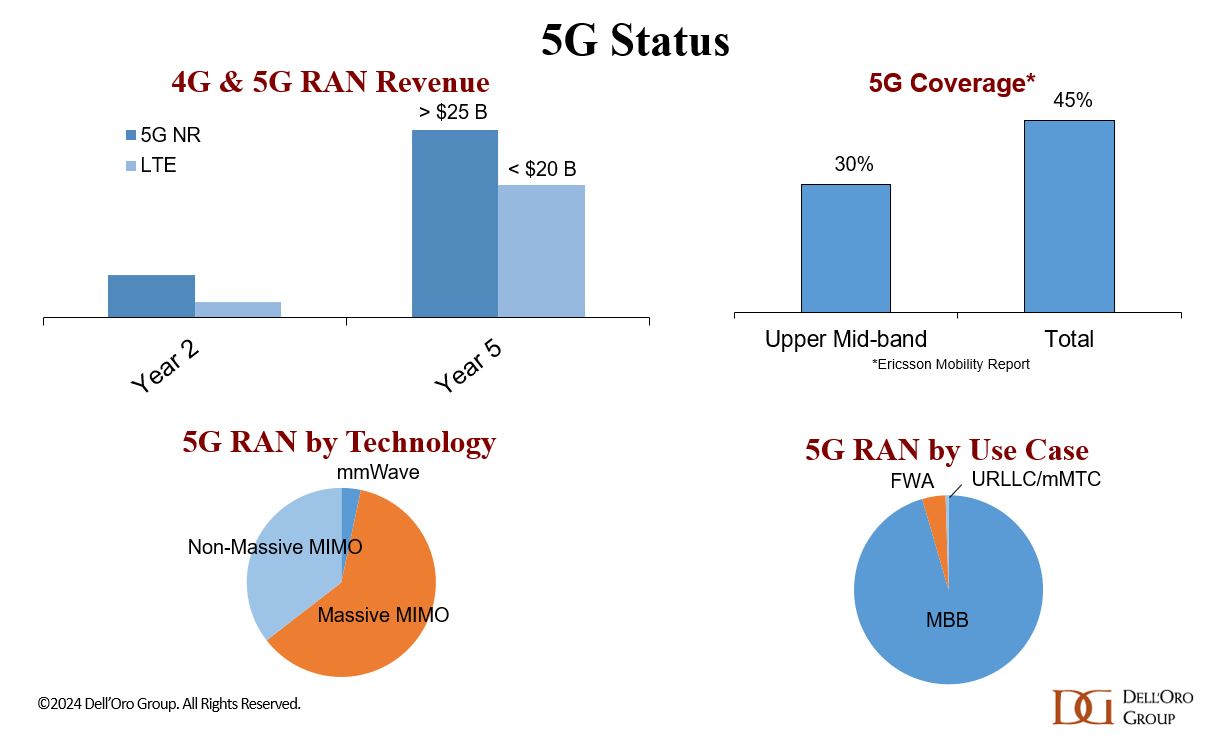

For all the talk of Open RAN, it clearly has yet to inspire significant capex from operators. The same goes for private 5G or programmable networks. Less than halfway through the presumed 5G cycle, spending has stalled and it’s not at all clear what will restart it.

Dell’Oro Group’s RAN Quarterly Report offers a complete overview of the RAN industry, with tables covering manufacturers’ and market revenue for multiple RAN segments including 5G NR Sub-7 GHz, 5G NR mmWave, LTE, macro base stations and radios, small cells, Massive MIMO, Open RAN, and vRAN. The report also tracks the RAN market by region and includes a four-quarter outlook. To purchase this report, please contact us by email at [email protected].

References:

RAN Market Shows Faint Signals of Life in 4Q 2023, According to Dell’Oro Group

https://www.telecoms.com/wireless-networking/global-ran-market-declined-by-11-in-2023

Dell’Oro: RAN market declines at very fast pace while Mobile Core Network returns to growth in Q2-2023

Dell’Oro: RAN Market to Decline 1% CAGR; Mobile Core Network growth reduced to 1% CAGR

https://www.silverliningsinfo.com/5g/ericsson-nokia-and-state-global-ran-2024

LightCounting: Open RAN/vRAN market is pausing and regrouping

4 thoughts on “Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024”

Comments are closed.

Iain Morris, Light Reading:

This global RAN market dominated by Ericsson, Huawei and Nokia looks increasingly dysfunctional, too. Deemed a security threat by western governments, China’s Huawei can no longer sell 5G products in the UK and other European countries, and it has long been seen as a public enemy by US authorities. In a tit for tat, China has squeezed Ericsson and Nokia to the fringes. And outside China, Nokia looks in desperate shape.

Big US contracts have instead gone to Ericsson and South Korea’s Samsung, a RAN challenger, and other customers have not picked up the slack. What was a lightning-fast rollout of 5G in India last year has now shifted down several gears. While sales at Ericsson have also dwindled, Nokia’s fell dramatically for the recent first quarter. Having recorded an operating profit for 12 consecutive quarters, its mobile networks business group this year slumped to its first-ever loss.

It’s unsettling for telcos such as Vodafone UK, which have had few other choices. “What is the state of Nokia? Not great, from what I read. It’s worrying,” said Andrea Dona, the operator’s chief network officer. “So we need to inject diversity in the network. We need another option. Samsung could be it.”

The South Korean vendor has come to figure prominently in Vodafone UK’s network strategy. Under government orders, Vodafone is stripping out Huawei equipment and software installed at 2,500 RAN sites, a job it must finish by the end of 2027. Using a system called open RAN, it has been replacing those with a mix of vendors. But Samsung is the key. It is not only down to supply many of the radio units (RUs) but also the sole provider of RAN software.

After spending about two years on technology trials at a “golden cluster” of around 20 sites in Devon, a county in southwest England, Vodafone kicked off its commercial deployment last August. Vodafone is not sharing current site numbers, but Dona insists it has now gone significantly beyond that original golden cluster. It has also ticked off some important milestones.

The most recent was the critical pairing of Samsung’s software with RUs supplied by Japan’s NEC. The original goal of open RAN was to find an alternative to CPRI, a fronthaul interface that has required operators to buy software and RUs from the same vendor’s system. With an open fronthaul interface, they would supposedly be able to combine software from one vendor with RUs from another. Yet this remains tricky.

The big problem is an advanced 5G technology called massive MIMO, which crams dozens of transmitters and receivers into antenna units. “Open interfaces does not equal multivendor,” said Ericsson in a guide to massive MIMO published in February. It notes four “fundamental challenges.”

First, new interfaces do not minimize the cost and effort of systems integration, the work a vendor would normally do before bringing a fully integrated product to market. Different vendors also need to coordinate on software releases to maintain interoperability, said Ericsson. Support for technology features is dictated by a “minimum common denominator,” it added, “resulting in performance limitations.” Finally, in the event of problems, identifying the vendor at fault, and therefore responsible for providing a fix, can be difficult.

Much of this seems to echo comments made by Tommi Uitto, the head of Nokia’s mobile business, at Mobile World Congress (MWC). Massive MIMO relies on complex algorithms in both the RU and distributed unit (DU), a server box hosting RAN software, and these need to match, he told Light Reading.

“If I have to connect my DU to someone else’s massive MIMO RU, he will have to make changes to his software, I will have to make changes to my software, or both will,” he said. Falling back on simpler algorithms could make integration easier, but these could also reduce throughput by up to 80%, according to Uitto.

In February, nevertheless, Vodafone showed off its first open RAN site where a massive MIMO NEC radio, featuring 64 transmitters and receivers, was linked to a Samsung DU. “You need to choose your partners and be very specific to your partners about the role they have and the rules of engagement,” said Dona, when asked how it was accomplished.

He insists, too, that performance is not worse than Vodafone would get from a single-vendor product. “There are difficulties to overcome, obviously, but I am not going to compromise, and we’ve worked very hard to ensure parity on the KPIs [key performance indicators],” he said. “I am not going to introduce something that doesn’t perform to at least the same level, if not better.”

Unlike several years ago, when Nokia was hurt by 5G product problems, its current malaise largely reflects the market downturn. Outside China and the US, Nokia’s RAN market share has recently grown, according to independent analysts. It has won plaudits from other commentators on open RAN. AT&T’s decision to replace Nokia across one third of sites with Ericsson, already the supplier to the other two thirds, seems mainly about having a single technology platform and the efficiencies this could bring.

Nevertheless, Nokia’s technology approach does not align with Vodafone UK’s. The open RAN the telco is building will also be entirely virtualized, using technologies that derive from the IT world. This means running the Samsung software on Intel chips in Dell servers and relying on Wind River as the cloud platform. Nokia is unopposed to much of this, but it prefers to keep its Layer 1 software – a resource-hungry part of the RAN – on custom silicon from Marvell Technology. Smart network interface cards (SmartNICs) hosting these Marvell chips can slot directly into servers.

Nokia does not, accordingly, have Layer 1 code that works with Intel’s chips. It has recently taken issue with the marketing of these as “general purpose” central processing units (CPUs), arguing that new Intel generations like Granite Rapids-D feature plenty of customization and embed that in a server. “It’s not a general-purpose processor,” said Uitto at MWC. “And if you build servers with only those CPUs, it would be ridiculous because you’d have all this overhead of hardware acceleration in the product cost and power consumption.”

The Finnish vendor’s earlier criticisms focused on the shortcomings of using general-purpose silicon for Layer 1 functions. Even Ericsson, which uses Intel chips in its virtual RAN products, says custom silicon will remain ahead for some key performance measures. In comments emailed to Light Reading earlier this year, Michael Begley, the head of Ericsson’s RAN compute product line, said that “purpose-built hardware will continue to be the most energy-efficient and compact hardware for radio site deployments going forward.”

But Dona says Vodafone has not seen any drawbacks. “We wouldn’t have gone to mass deployment if we hadn’t met the minimum criteria, but it took a while,” he said, noting that it has been nearly three years since Vodafone UK first announced its open RAN partners.

Vodafone has now taken what Dona calls the same “blueprint” into parts of Romania, where it also needs to replace Huawei under government orders (there is a huge amount of Huawei across Vodafone’s European footprint). And there is a strong hint from Dona that this Samsung-based template will play an even bigger role in future. Margherita Della Valle, Vodafone’s CEO, confirmed on a recent earnings call that suppliers have been invited to pitch for future work across Vodafone’s entire European and African footprint of about 170,000 sites.

The danger for Nokia could be the perception it is in financial trouble and that the market needs alternatives. This gave impetus to the open RAN movement several years ago, when operators were unimpressed by Nokia’s initial 5G products. If decision makers at other telcos share Dona’s view about the “state” of Nokia, and are convinced they must introduce new suppliers, Nokia’s condition may only worsen.

But if it were perilously weakened, operators would simply be substituting one vendor for another, not boosting choice. The consolidation that happened years ago showed that a global RAN market supporting low-cost mobile usage at scale was not big enough for more than a handful of vendors. Last year, it shrank 11%, according to Omdia (a Light Reading sister company).

Omdia forecasts another decline this year of between 4% and 6%. Nokia’s mobile business, meanwhile, has just suffered a first-quarter operating loss of €42 million (US$45 million), after sales dropped 39% year-over-year, to less than €1.6 billion ($1.7 billion). It worryingly suggests there is not enough pie to keep even a few vendors well nourished.

https://www.lightreading.com/open-ran/nokia-plight-shows-need-for-samsung

Research from Omdia, a Light Reading sister company, reads like a horror novel for anyone in the radio access network (RAN) products business. Sales for the first three months of 2024 fell more than 20%, compared with the year-earlier quarter. Omdia has revised down its outlook after the worse-than-expected start to the year. Previously it had been looking at a 4% to 6% drop. Sales will fall 7% to 9%, according to its latest figures.

Dell’Oro says the RAN market a “disaster” in a recent update. The results in the first quarter were exceptionally weak, underpinned by poor results across most suppliers. Preliminary findings suggest that the overall 2G-5G RAN market—including baseband plus radio hardware and software, excluding services—declined 15 to 30 percent in 1Q 2024, resulting in a third consecutive quarter of double-digit contractions.

“The velocity of the deceleration is now simply unprecedented,” said Stefan Pongratz, an analyst at Dell’Oro, in a LinkedIn post about his company’s research. His preliminary estimates point to a year-over-year decline in RAN spending of up to 30% – and no less than 15% – for the first quarter. This range makes it the steepest drop that Dell’Oro has observed since 2000, the year of the dotcom crash.

https://www.linkedin.com/feed/update/urn:li:activity:7197000012113862658/

Recent data from Omdia, a Light Reading sister company, shows that Ericsson’s share of the global RAN market fell from 25.7% in 2022 to 24.3% last year, with Huawei’s share unchanged at 31.3%. Finland’s Nokia gained 1.7 percentage points to capture 19.5% of the market.

https://www.lightreading.com/5g/ericsson-expects-losses-to-aggressive-huawei-as-sales-fall

Data from Omdia, a Light Reading sister company, gave Huawei, Ericsson and Nokia, the three largest suppliers, a whopping 75.1% of the entire global market in 2023, an increase of 0.2 percentage points on the 2022 figure. ZTE and Samsung, the fourth- and fifth-biggest players, respectively, claimed another 20%.

https://www.lightreading.com/5g/after-losing-nokia-crisis-hit-intel-seeks-network-assets-buyer