Ericsson reports ~flat 2Q-2025 results; sees potential for 5G SA and AI to drive growth

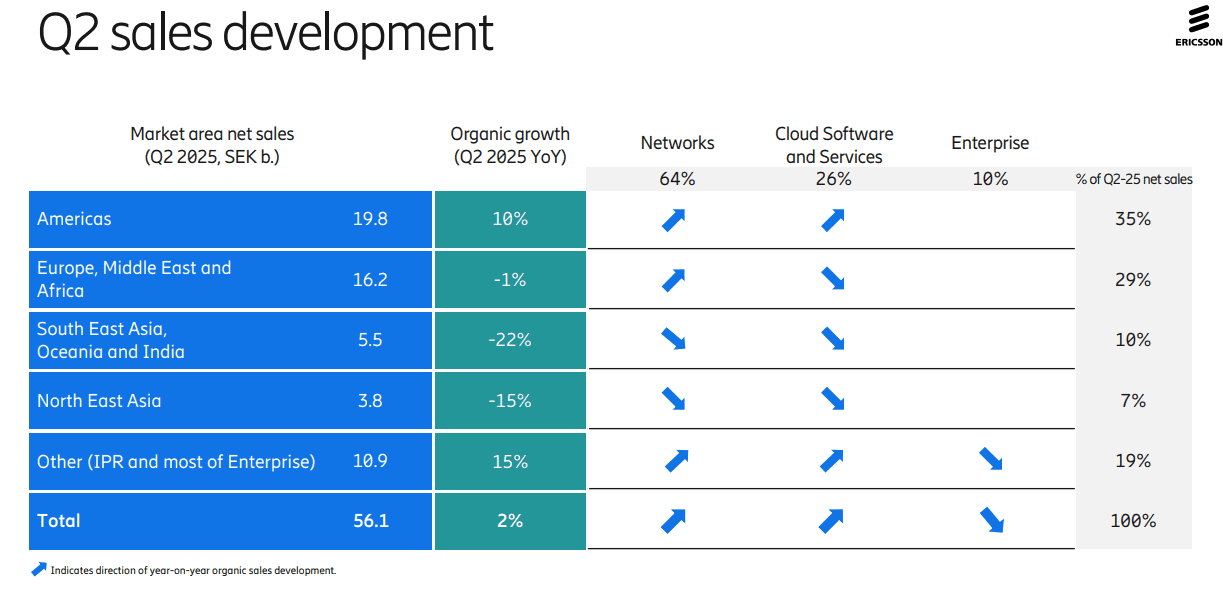

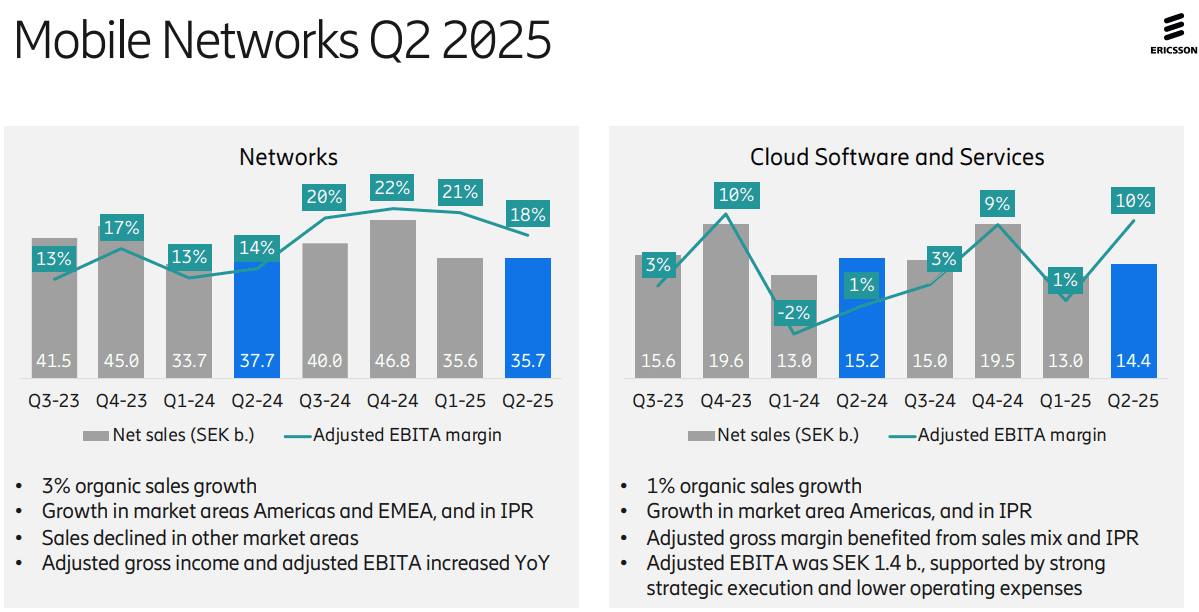

Ericsson’s second-quarter results were not impressive, with YoY organic sales growth of +2% for the company and +3% for its network division (its largest). Its $14 billion AT&T OpenRAN deal, announced in December of 2023, helped lift Swedish vendor’s share of the global RAN market by +1.4 percentage points in 2024 to 25.7%, according to new research from analyst company Omdia (owned by Informa). As a result of its AT&T contract, the U.S. accounted for a stunning 44% of Ericsson’s second-quarter sales while the North American market resulted in a 10% YoY increase in organic revenues to SEK19.8bn ($2.05bn). Sales dropped in all other regions of the world! The charts below depict that very well:

Ericsson’s attention is now shifting to a few core markets that Ekholm has identified as strategic priorities, among them the U.S., India, Japan and the UK. All, unsurprisingly, already make up Ericsson’s top five countries by sales, although their contribution minus the US came to just 15% of turnover for the recent second quarter. “We are already very strong in North America, but we can do more in India and Japan,” said Ekholm. “We see those as critically important for the long-term success.”

Opportunities: As telco investment in RAN equipment has declined by 12.5% (or $5 billion) last year, the Swedish equipment vendor has had few other obvious growth opportunities. Ericsson’s Enterprise division, which is supposed to be the long-term provider of sales growth for Ericsson, is still very small – its second-quarter revenues stood at just SEK5.5bn ($570m) and even once currency exchange changes are taken into account, its sales shrank by 6% YoY.

On Tuesday’s earnings call, Ericsson CEO Börje Ekholm said that the RAN equipment sector, while stable currently, isn’t offering any prospects of exciting near-term growth. For longer-term growth the industry needs “new monetization opportunities” and those could come from the ongoing modest growth in 5G-enabled fixed wireless access (FWA) deployments, from 5G standalone (SA) deployments that enable mobile network operators to offer “differentiated solutions” and from network APIs (that ultra hyped market is not generating meaningful revenues for anyone yet).

Cost Cutting Continues: Ericsson also has continued to be aggressive about cost reduction, eliminating thousands of jobs since it completed its Vonage takeover. “Over the last year, we have reduced our total number of employees by about 6% or 6,000,” said Ekholm on his routine call with analysts about financial results. “We also see and expect big benefits from the use of AI and that is one reason why we expect restructuring costs to remain elevated during the year.”

Use of AI: Ericsson sees AI as an opportunity to enable network automation and new industry revenue opportunities. The company is now using AI as an aid in network design – a move that could have negative ramifications for staff involved in research and development. Ericsson is already using AI for coding and “other parts of internal operations to drive efficiency… We see some benefits now. And it’s going to impact how the network is operated – think of fully autonomous, intent-based networks that will require AI as a fundamental component. That’s one of the reasons why we invested in an AI factory,” noted the CEO, referencing the consortium-based investment in a Swedish AI Factory that was announced in late May. At the time, Ericsson noted that it planned to “leverage its data science expertise to develop and deploy state-of-the-art AI models – improving performance and efficiency and enhancing customer experience.

Ericsson is also building AI capability into the products sold to customers. “I usually use the example of link adaptation,” said Per Narvinger, the head of Ericsson’s mobile networks business group, on a call with Light Reading, referring to what he says is probably one of the most optimized algorithms in telecom. “That’s how much you get out of the spectrum, and when we have rewritten link adaptation, and used AI functionality on an AI model, we see we can get a gain of 10%.”

Ericsson hopes that AI will boost consumer and business demand for 5G connectivity. New form factors such as smart glasses and AR headsets will need lower-latency connections with improved support for the uplink, it has repeatedly argued. But analysts are skeptical, while Ericsson thinks Europe is ill equipped for more advanced 5G services.

“We’re still very early in AI, in [understanding] how applications are going to start running, but I think it’s going to be a key driver of our business going forward, both on traffic, on the way we operate networks, and the way we run Ericsson,” Ekholm said.

Europe Disappoints: In much of Europe, Ericsson and Nokia have been frustrated by some government and telco unwillingness to adopt the European Union’s “5G toolbox” recommendations and evict Chinese vendors. “I think what we have seen in terms of implementation is quite varied, to be honest,” said Narvinger. Rather than banning Huawei outright, Germany’s government has introduced legislation that allows operators to use most of its RAN products if they find a substitute for part of Huawei’s management system by 2029. Opponents have criticized that move, arguing it does not address the security threat posed by Huawei’s RAN software. Nevertheless, Ericsson clearly eyes an opportunity to serve European demand for military communications, an area where the use of Chinese vendors would be unthinkable.

“It is realistic to say that a large part of the increased defense spending in Europe will most likely be allocated to connectivity because that is a critical part of a modern defense force,” said Ekholm. “I think this is a very good opportunity for western vendors because it would be far-fetched to think they will go with high-risk vendors.” Ericsson is also targeting related demand for mission-critical services needed by first responders.

5G SA and Mobile Core Networks: Ekholm noted that 5G SA deployments are still few and far between – only a quarter of mobile operators have any kind of 5G SA deployment in place right now, with the most notable being in the US, India and China. “Two things need to happen,” for greater 5G SA uptake, stated the CEO.

- “One is mid-band [spectrum] coverage… there’s still very low build out coverage in, for example, Europe, where it’s probably less than half the population covered… Europe is clearly behind on that“ compared with the U.S., China and India.

- “The second is that [network operators] need to upgrade their mobile core [platforms]... Those two things will have to happen to take full advantage of the capabilities of the [5G] network,” noted Ekholm, who said the arrival of new devices, such as AI glasses, that require ultra low latency connections and “very high uplink performance” is starting to drive interest. “We’re also seeing a lot of network slicing opportunities,” he added, to deliver dedicated network resources to, for example, police forces, sports and entertainment stadiums “to guarantee uplink streams… consumers are willing to pay for these things. So I’m rather encouraged by the service innovation that’s starting to happen on 5G SA and… that’s going to drive the need for more radio coverage [for] mid-band and for core [systems].”

Ericsson’s Summary -Looking Ahead:

- Continue to strengthen competitive position

- Strong customer engagement for differentiated connectivity

- New use cases to monetize network investments taking shape

- Expect RAN market to remain broadly stable

- Structurally improving the business through rigorous cost management

- Continue to invest in technology leadership

………………………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.telecomtv.com/content/5g/ericsson-ceo-waxes-lyrical-on-potential-of-5g-sa-ai-53441/

https://www.lightreading.com/5g/ericsson-targets-big-huawei-free-places-ai-and-nato-as-profits-soar

Ericsson revamps its OSS/BSS with AI using Amazon Bedrock as a foundation

Below are some of the items Dell’Oro Group will be looking for in Ericsson’s mid-year update.

Market momentum:

After two consecutive years of steep declines that wiped out nearly $9 B of RAN equipment revenues globally, RAN market conditions improved in 1Q25. We attributed the improved conditions to a favorable regional mix and lighter comps. Since it is unclear how much of the progress was from front-loading ahead of new tariffs, it will be key to understand how this impacts the second quarter growth rates in the North America region.

And since APAC outside of China fell sharply in 2024, the full-year stabilization expectation is, to some degree, hinging on the nadir being in the past in both India and Japan.

Mobile data traffic:

While the correlation between mobile data traffic growth and 5G RAN capex is weak in the coverage phase, the coupling tends to be stronger in the capacity phase. And this time around, data traffic growth rates could also impact the timing of 6G. Per Ericsson’s latest Mobility Report, mobile data traffic is expected to grow 15% to 20% annually over the next five years. Consequently, we are looking for any signs that could ultimately change the flattish long-term RAN growth outlook (positive data traffic indicators, stronger focus on network differentiation, improved enterprise/FWA momentum…).

Market share:

It’ll take a bit longer to get the full 2Q picture. Ericsson previously said its goal is to grow its RAN market share outside China by about one percentage point per year, reflecting confidence in its portfolio and win momentum (Capital Markets Day 2022). After a dip in 2023, we estimate its RAN revenue share is on the rise again. Hopefully, the upcoming report will give us a better sense of its RAN progress outside of China.

https://www.linkedin.com/feed/update/urn:li:activity:7350692887027666945/

From Heavy Reading:

5G standalone (SA) deployments are becoming more widespread, but identifying the services potential for 5G SA remains a challenge. While 5G SA provides the opportunity to access new or better 5G services, such as RedCap and network slicing, service providers continue to grapple with how best to package 5G SA services and communicate the value of 5G SA to consumers and enterprise customers.

Gabriel Brown of Heavy Reading likens the difference between 5G non-standalone and 5G SA to driving a 20-year-old car in good condition to a newer model vehicle. Or, using a five-year-old iPhone versus the iPhone 16. In both cases, the older model will do the job required but there’s a stark difference in the features of the latest model.

“You’re not going to notice a few milliseconds of difference on your phone but I think incrementally we’re going to see basically better service,” says Brown.

The big Chinese (state owned) network operators and T-Mobile have been running 5G SA at scale for years, he adds. In addition, Reliance Jio in India is running a huge 5G SA network and has ten network slice types available in commercial operations, and EE in the UK has reached 50% population coverage for 5G SA. There’s plenty of evidence that 5G SA deployments at scale are doable so that supports a forecast of broader adoption, Brown.

In Heavy Reading’s 2025 5G SA Core Operator Survey, 35% of respondents said 5G SA is already generally available nationwide in their company’s wide area network, and 20% said it would be generally available by the end of the year.

During the podcast, Brown also explains the difference between 5G SA and 5G Advanced.

https://www.lightreading.com/5g/5g-standalone-deployments-are-scaling-now-comes-the-hard-part