Omdia on resurgence of Huawei: #1 RAN vendor in 3 out of 5 regions; RAN market has bottomed

Market research firm Omdia (owned by Informa) says Huawei remains the number one RAN vendor in three out of five large geographical regions. Far from being fatally weakened by U.S. government sanctions, Huawei today looks as big and strong as ever. Its sales last year were the second highest in its history and only 4% less than it made in 2020, before those sanctions took effect. In three out of the five global regions studied by Omdia – Asia and Oceania, the Middle East and Africa, and Latin America and the Caribbean – Huawei was the leading RAN vendor. While third in Europe, it was absent from the top three only in North America where it is banned.

Spain’s Telefónica remains a big Huawei customer in Brazil and Germany, despite telling Krach in 2020 that it would soon have “clean networks” in those markets. Deutsche Telekom and Vodafone, two other European telco giants, are also still heavy users of Huawei. Ericsson and Nokia have noted Europe’s inability to kick out Huawei while alerting investors to “aggressive” competition from Chinese vendors in some regions.

“A few years ago, we were all talking about high-risk vendors in Europe and I think, as it looks right now, that is not an opportunity,” said Börje Ekholm, Ericsson’s CEO, on a call with analysts last month. The substitution of the Nordic vendors for Huawei has not gone as far as they would have hoped. Ekholm warned analysts one year ago about “sharply increased competition from Chinese vendors in Europe and Latin America” and said there was a risk of losing contracts. “I am sure we’ll lose some, but we do it because it is right for the overall gross margin in the company. Don’t expect us to be the most aggressive in the market.”

There are few signs of European telcos replacing one of the Nordic vendors with Huawei, or of big market share losses by Ericsson and Nokia to Chinese rivals. Nokia’s RAN market share outside China did not materially change between the first and second quarters, says Remy Pascal, a principal analyst with Omdia (quarterly figures are not disclosed but Nokia held 17.6% of the RAN market including China last year). Huawei appears to have overtaken it because of gains at the expense of other vendors and a larger revenue contribution from Huawei-friendly emerging markets in the second quarter. Seasonality and the timing of revenue recognition were also factors, says Pascal.

Huawei is still highly regarded by chief technology officers for the quality of its products. It was a pioneer in the development of 5G equipment for time division duplex (TDD) technology, where uplink and downlink communications occupy the same frequency channel, and in massive MIMO, an antenna-rich system for boosting signal strength. It beat Ericsson and Nokia to the commercialization of power amplifiers based on gallium nitride, an efficient alternative to silicon, according to Earl Lum, the founder of EJL Wireless Research.

Sanctions have not held back Huawei’s technology as much as analysts had expected. While the company was cut off from the foundries capable of manufacturing the most advanced silicon, it managed to obtain good-enough 7-nanometer chips in China for its latest smartphones, spurring its resurgence in that market. Network products remain less dependent on access to cutting-edge chips, and sales in that sector do not appear to have suffered outside markets that have imposed restrictions.

Alternatives to Huawei’s dominance have not materialized in a RAN sector that was already short of options. Besides evicting Huawei from telco networks, U.S. authorities hoped “Open RAN” would give rise to American developers of RAN products. That has failed badly.

- Mavenir, arguably the best Open RAN hope the U.S. had, became emblematic of the Open RAN market gloom after it recently withdrew from the market for radio units as part of a debt restructuring. The company has sold its Open RAN software to DISH Network and Vodafone, it has not achieved the market penetration it initially targeted. Mavenir has faced significant financial challenges that led to a restructuring in 2025, significant layoffs and a major shift in strategy away from developing its own hardware.

- Parallel Wireless makes Open RAN software and also provides Open RAN software-defined radios (SDRs) as part of its hardware ecosystem, focusing on disaggregating the radio access network stack to allow operators flexibility and reduced total cost of ownership. Their offerings include a hardware-agnostic 5G Standalone (SA) software stack and the Open RAN Aggregator software, which manages and converges multi-vendor RAN interfaces toward the core network.

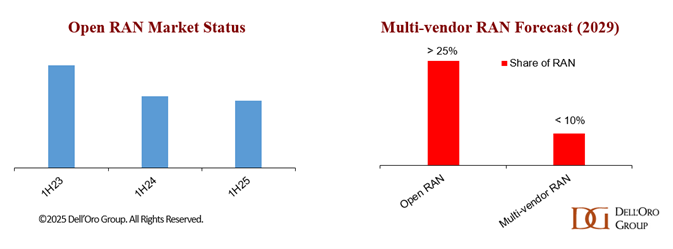

Stefan Pongratz of Dell’Oro Group forecasts annual revenues from multi-vendor RAN deployments – where telcos combine vendors instead of buying from a single big supplier – will have reached an upper limit of $3 billion by 2029, giving multi-vendor RAN less than 10% of the total RAN market by that date. He says five of six tracked regions are now classed as “highly concentrated,” with an Herfindahl-Hirschman Index (HHI) score of more than 2,500. “This suggests that the supplier diversity element of the open RAN vision is fading,” Stefan added.

Preliminary data from Dell’Oro indicate that Open RAN revenues grew year-over-year (Y/Y) in 2Q25 and were nearly flat Y/Y in the first half, supported by easier comparisons, stronger capex tied to existing Open RAN deployments, and increased activity among early majority adopters.

Open RAN used to mean alternatives to Ericsson and Nokia. Today, it looks synonymous with the top 5 RAN vendors (Huawei, Ericsson, Nokia, ZTE, and Samsung). In such an environment of extreme market concentration and failed U.S. sanctions, the appeal of Huawei’s RAN technology is still very much intact.

……………………………………………………………………………………………………………………………………………………………………….

Omdia’s historical data shows that RAN sales fell by $5 billion, to $40 billion, in 2023, and by the same amount again last year. In 2025, it is guiding for low single-digit percentage growth outside China, implying the RAN market has bottomed out. This stabilization suggests the market may be transitioning into a phase of flat-to-modest growth, though risks such as operator capex constraints and uneven regional demand remain. However, concentration of RAN vendors

…………………………………………………………………………………………………………………………………………………………………………

References:

https://www.lightreading.com/5g/huawei-overtakes-nokia-outside-china-as-open-ran-stabilizes-

Omdia: Huawei increases global RAN market share due to China hegemony

Malaysia’s U Mobile signs MoU’s with Huawei and ZTE for 5G network rollout

Dell’Oro Group: RAN Market Grows Outside of China in 2Q 2025

Dell’Oro: AI RAN to account for 1/3 of RAN market by 2029; AI RAN Alliance membership increases but few telcos have joined

Network equipment vendors increase R&D; shift focus as 0% RAN market growth forecast for next 5 years!

vRAN market disappoints – just like OpenRAN and mobile 5G

Mobile Experts: Open RAN market drops 83% in 2024 as legacy carriers prefer single vendor solutions

Huawei launches CloudMatrix 384 AI System to rival Nvidia’s most advanced AI system

U.S. export controls on Nvidia H20 AI chips enables Huawei’s 910C GPU to be favored by AI tech giants in China

For the full year 2024, Dell’Oro Group estimated that Huawei held approximately 31% of the overall telecom equipment revenue market (including wireless and wireline/fiber).

While maintaining its top position in China, Huawei has also shown strength outside its home market. In 2024, Dell’Oro Group suggests Huawei surpassed Nokia to become the number-one RAN supplier outside of China

Data from Omdia (owned by Informa) states that spending on RAN equipment dropped from $45 billion in 2022 to $35 billion in 2024. Excluding China, Omdia forecasts a low-single-digit percentage increase in revenues last year. But nobody anticipates a major recovery.

From the start of 2023and September 2025, Ericsson cut more than 15,600 full-time jobs, roughly 15% of the international total.

Ericsson has drawn attention to its investment in application-specific integrated circuits (ASICs) as a reason for the growth in R&D spending. But it increasingly champions cloud RAN, which substitutes Intel’s general-purpose processors (GPPs) for those ASICs in baseband equipment (although not in radios). As the capability of those GPPs improves, investors may wonder why Ericsson is still pumping money into custom baseband silicon. Maintaining two software tracks – one for purpose-built and the other for cloud RAN – itself looks duplicative.

Nokia’s global workforce shrank by almost 27%, nearly 27,500 jobs, between 2018 and the end of 2024, when its annual report showed that 75,600 employees remained. The figure may have grown with last year’s takeover of Infinera, which employed about 3,000 people before the acquisition. Yet in November, CEO Justin Hotard said another 5,000 Nokia jobs would be cut to finalize the restructuring plan initiated under previous management.

https://www.lightreading.com/5g/ericsson-and-nokia-cuts-reflect-the-grisly-state-of-5g