China’s telecom industry rapid growth in 2025 eludes Nokia and Ericsson as sales collapse

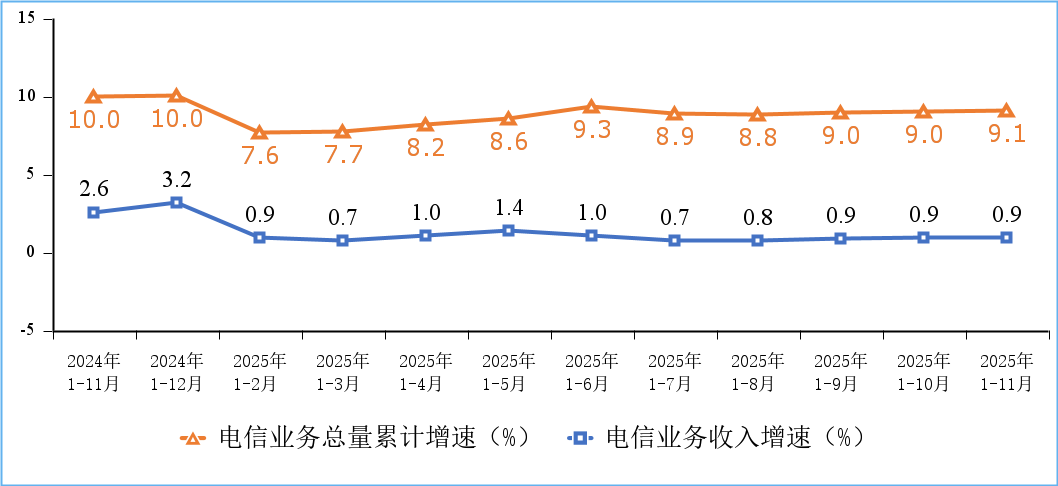

According to a Chinese government update, “Telecommunications business volume and revenue grew steadily, mobile internet access traffic maintained rapid growth, and the construction of network infrastructure such as 5G, gigabit optical networks, and the Internet of Things was further promoted.”

Figure 1. Cumulative growth rate of telecommunications service revenue and total telecommunications service volume

There were 4.83 million 5G base stations in service in China at the end of November 2025, an increase of 579,000 since late 2024 and 37.4% of the total number of mobile base stations in China. In one year, China claims to have added more 5G base stations than Europe has installed since the 5G technology was first put into service.

The total number of mobile phone users of the top four Chinese telcos (China Mobile, China Telecom, China Unicom, China Broadcasting Network) reached 1.828 billion, a net increase of 38.54 million from the end of last year. Among them, 5G mobile phone users reached 1.193 billion, a net increase of 179 million from the end of last year, accounting for 65.3% of all mobile phone users.

Meanwhile, the total number of fixed broadband internet access users of the three state owned telecom operators (China Mobile, China Telecom and China Unicom) reached 697 million, a net increase of 27.12 million from the end of last year. Among them, fixed broadband internet access users with access speeds of 100Mbps and above reached 664 million, accounting for 95.2% of the total users; fixed broadband internet access users with access speeds of 1000Mbps and above reached 239 million, a net increase of 32.52 million from the end of last year, accounting for 34.3% of the total users, an increase of 3.4 percentage points from the end of last year.

The construction of gigabit fiber optic broadband networks continues to advance. As of the end of November, the number of broadband internet access ports nationwide reached 1.25 billion, a net increase of 48.11 million compared to the end of last year. Among them, fiber optic access (FTTH/O) ports reached 1.21 billion, a net increase of 49.42 million compared to the end of last year, accounting for 96.8% of all broadband internet access ports. As of the end of November, the number of 10G PON ports with gigabit network service capabilities reached 31.34 million, a net increase of 3.133 million compared to the end of last year.

The penetration rate of gigabit and 5G users continued to increase across all regions. As of the end of November, the penetration rates of fixed broadband access users with speeds of 1000Mbps and above in the eastern, central, western, and northeastern regions were 34.6%, 33.8%, 35.8%, and 28.5%, respectively, representing increases of 3.4, 2.6, 4.1, and 4.9 percentage points compared to the end of last year; the penetration rates of 5G mobile phone users were 64.9%, 65.9%, 65.1%, and 65.9%, respectively, representing increases of 8.2, 8.7, 8.8, and 9.6 percentage points compared to the end of last year.

…………………………………………………………………………………………………………………………………………………………………

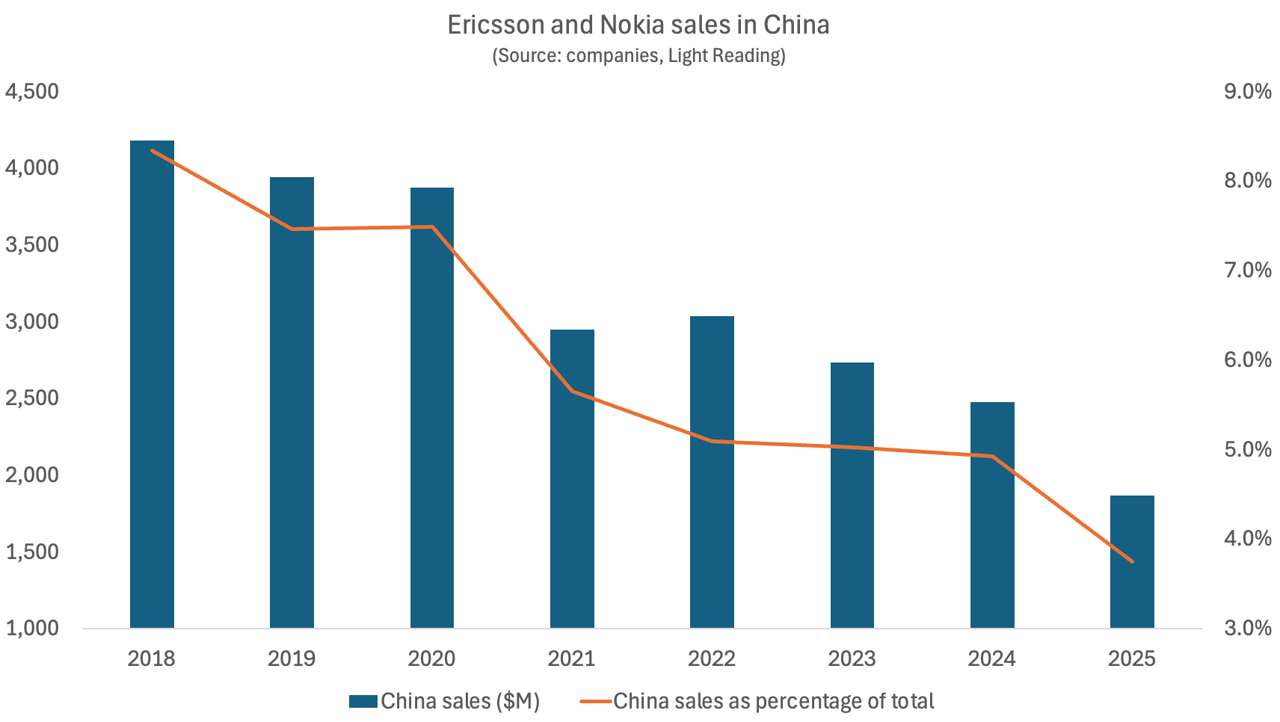

Separately, Light Reading reports that Ericsson and Nokia sales of networking equipment to China have collapsed.

Ericsson recently published earnings release for the final quarter of 2025 puts China revenues at just 3% of total sales last year. This would equate to revenues of 7.1 billion Swedish kronor (US$798 million). Based on a rounding range of 2.5% to 3.4%, it works out to be between SEK5.92 billion ($665 million) and SEK8.05 billion ($905 million) – down sharply compared with the SEK10.2 billion ($1.15 billion) Ericsson made in 2024, according to that year’s Ericsson annual report.

Nokia does not break out details of revenues from mainland China, instead lumping them together with the sales it generates in neighboring Hong Kong and Taiwan. But this “Greater China” business is in decline. Total annual revenues – which include Nokia’s sales of fixed, Internet Protocol and optical network products, as well as 5G – slumped from almost €2.2 billion ($2.6 billion) in 2019 to around €1.5 billion ($1.8 billion) in 2020, before creeping back up to nearly €1.6 billion ($1.9 billion) by 2022. Two years later, they had fallen to about €1.1 billion ($1.3 billion).

Bar Chart Credit: Light Reading

Nokia has recently indicated the complete disappearance of its China business. “Western suppliers, which is only us and Ericsson, have 3% market share now in China and it’s been coming down, and we are going to be excluded from China for national security reasons,” said Tommi Uitto, the former president of Nokia’s mobile networks business group, at a September press conference in Finland also attended by Justin Hotard, Nokia’s CEO. It implies China’s government is now treating the Nordic vendors in the same way Europe and the U.S. are banning Huawei and ZTE networking equipment.

Nokia revealed in its latest earnings update that Greater China revenues for 2025 had fallen by another 19%, to €913 million ($1.08 billion) – just 42% of what Nokia earned in the region seven years earlier. In the last few years, moreover, Nokia has cut more jobs in Greater China than in any other single region. While figures are not yet available for 2025, the Greater China headcount numbered 8,700 employees in 2024, down from 15,700 in 2019.

Ericsson has significantly reduced its China operations following greatly reduced 5G market share. In September 2021, the company consolidated three operator-specific customer units into a unified structure, impacting several hundred sales and delivery roles within its ~10,000-person local workforce. This followed the divestment of a Nanjing-based R&D center (approx. 650 employees), aligning with strategic pivots away from legacy 2G-4G technologies. The company’s total workforce in Northeast Asia plummeted from about 14,000 in mid-2021 to roughly 9,500 at the end of last year, according to Ericsson’s financial statements.

Exclusion from China would leave Ericsson and Nokia on the outside of the world’s most promising 6G market in 2030. That would intensify concern about a bifurcation of 6G into Western and Chinese variants of IMT 20230 RIT/SRIT standard and the 3GPP specified 6G core network.

References:

https://www.miit.gov.cn/gxsj/tjfx/txy/art/2025/art_7514154ec01c42ecbcb76057464652e4.html

https://www.lightreading.com/5g/ericsson-and-nokia-see-their-sales-in-china-fall-off-a-cliff

China’s open source AI models to capture a larger share of 2026 global AI market

Goldman Sachs: Big 3 China telecom operators are the biggest beneficiaries of China’s AI boom via DeepSeek models; China Mobile’s ‘AI+NETWORK’ strategy

China Telecom’s 2025 priorities: cloud based AI smartphones (?), 5G new calling (GSMA), and satellite-to-phone services

China ITU filing to put ~200K satellites in low earth orbit while FCC authorizes 7.5K additional Starlink LEO satellites

China gaining on U.S. in AI technology arms race- silicon, models and research