“Fiber is Foundational” as AT&T achieves 37% subscriber penetration rate across its fiber footprint

During its annual Analyst & Investor day virtual presentations today, AT&T said that Fiber is Foundational for the company’s growth. It is the critical asset in making AT&T the most pervasive and scaled broadband network provider. According to the company, that fiber foundation includes: Multi-gig capable speeds, Symmetric and low latency connectivity, Sustainable, and Enabling critical technologies.

“To us, fiber is foundational to our entire network. Wherever fiber goes, wireless follows,” Jeff McElfresh, CEO of AT&T Communications, said. McElfresh is confident that AT&T has the heft and deals in place to execute on the plan in the face of supply chain constraints and increasing demand and costs for labor.

“We are a very large fiber overbuilder,” he said. “We’ve got scale and we’ve done it before. That scale translates to things like supply chain agreements that are long in tenure and have really good protections for both us and our suppliers.”

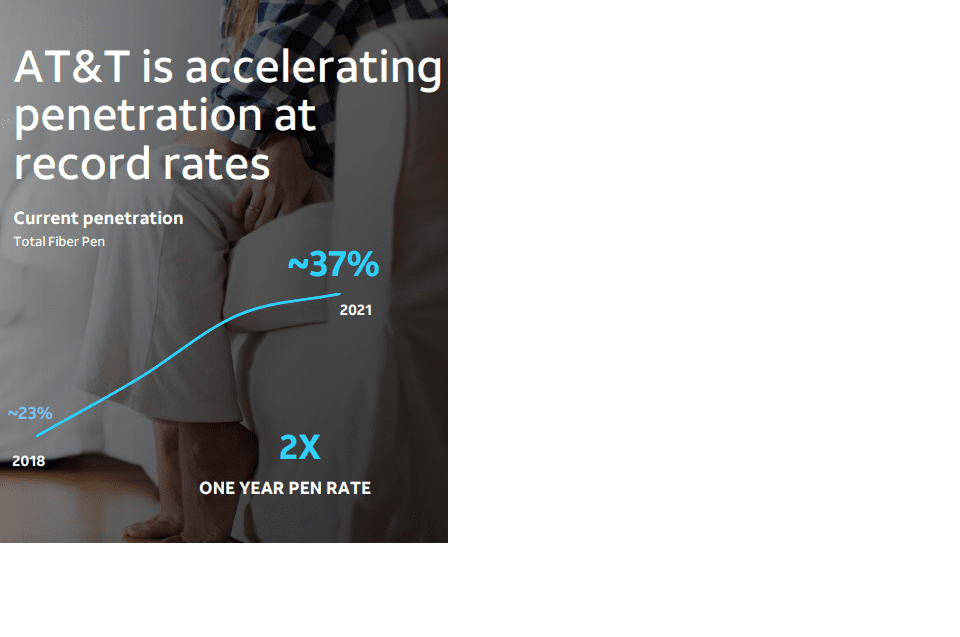

Furthermore, AT&T experienced 37% service penetrations across its entire fiber footprint, including new-build areas, last year.

In markets such as New Orleans, Miami and Louisville, where AT&T is now building FTTP rapidly, penetrations are “well north of 30% after only 12 months of fiber deployment,” Jenifer Robertson, AT&T’s EVP and GM, mobility, said during AT&T’s annual analyst and investor day.

About two-thirds of AT&T’s fiber adds are new to AT&T, Robertson added. With a nod toward service bundling, AT&T is also seeing a 50% boost in wireless market share in its fiber footprint.

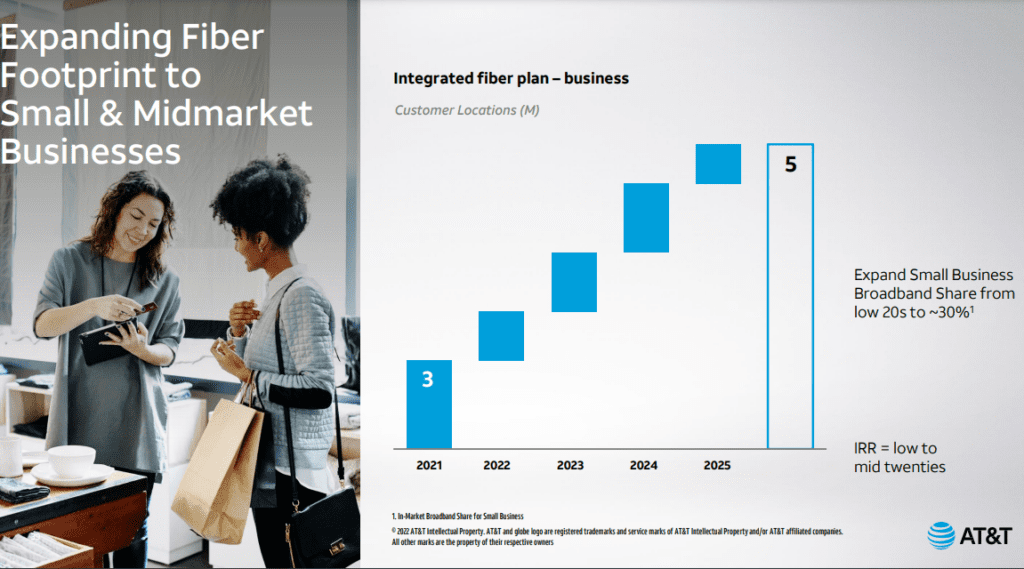

AT&T is targeting small and medium businesses with its FTTP deployments. That’s depicted in this graphic:

AT&T built about 2.6 million new fiber locations in 2021. The company reiterated a plan to build out a footprint of 30 million-plus locations (25 million residential, 4 million small businesses and 1 million enterprise locations) by 2025. It will build in the range of 3.5 million to 4 million locations per year in the coming years to hit that mark. AT&T also expects to spend $3 billion to $4 billion per year to fulfill its fiber buildout mission.

In tandem with the aggressive fiber buildout, AT&T expects broadband revenue to grow by 6% or more in 2022, and in the mid-to-high single-digit range in 2023. Total annual capital expenses are poised to hit $24 billion in 2022 and 2023, up from $20.1 billion in 2021.

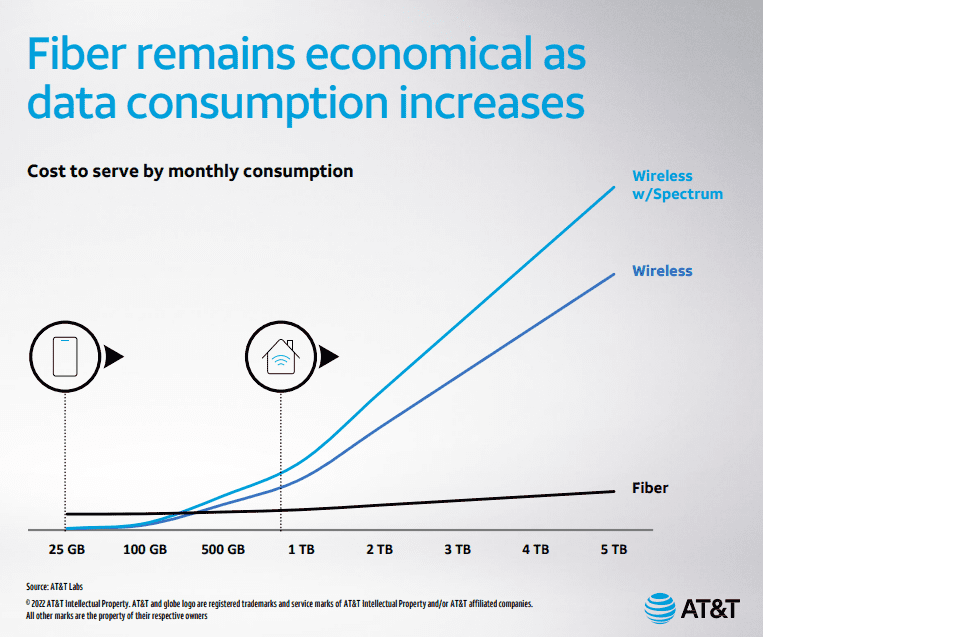

McElfresh outlined the data growth the company expects in coming years that will take advantage of fiber-level speeds. While consumer data consumption has reached the neighborhood of 0.9 terabytes (TB) today, the company expects that to climb to 4.6 TB by 2025. AT&T expects to see big gains in its small- and medium-sized (SMB) and enterprise segments. It also anticipated that the average number of devices connected to the home network will triple, to about 40, by 2025.

“We’re not attempting to serve terabytes of monthly consumption over wireless,” McElfresh said, implying such high data consumption would be via fiber.

Commenting on future networking trends, AT&T CEO John Stankey said:

We conservatively project a 5x data increase on our network over 5 years. A couple of examples. The evolution of social interaction, gaming and experiential alternate realities will consume huge amounts of real-time, low latency 2-way data.

Dramatically improving collaboration tools will enable more effective distributed work environments that will take traffic off of corporate lands and onto robust distributed WANs. Improved health care outcomes and lower cost to address an aging population will rely on access, telemetry and observation to address the challenge of rising cost curves and the list goes on. Some worry and ask, will we get paid for this new rule? History has shown us that sound policy will, in fact, provide returns and solutions.

In the lab, software and hardware will mature rapidly and efficiently. As has been the case since the advent of compute, distributed networking will be running to keep pace. We exit the pandemic with a credible real-world testimony to the value of reliable and pervasive connectivity.

In order to meet the bandwidth and latency needs of broadband applications “nothing is going to top fiber,” he added, noting that AT&T is making a “longer term bet” with its fiber buildout plan.

Separately, U.S. fiber investment forecast from RVA LLC calls for service providers to spend $125 billion over the next five years, exceeding the total amount that has been invested in fiber since providers first began deploying it.

………………………………………………………………………………………………………….

References:

https://video.ibm.com/recorded/131492715

AT&T CEO John Stankey: 30M or more locations could be passed by AT&T fiber

Fiber Investment Forecast to Surpass $125 Billion Over Next Five Years

2 thoughts on ““Fiber is Foundational” as AT&T achieves 37% subscriber penetration rate across its fiber footprint”

Comments are closed.

IBD Comment:

AT&T projected 6% growth in earnings before interest, taxes, depreciation and amortization, known as EBITDA, for T stock in 2023. That would be up from estimated 3% EBITDA growth the company sees for the current 2022 fiscal year, which ends in December.

AT&T predicted adjusted EBITDA in a range of $43.5 billion to $44.5 billion in 2023, up from a range of $41 billion to $42 billion in 2022.

As expected, AT&T outlined plans to invest in 5G wireless networks and fiber-optic broadband connections to homes. In 2022, AT&T expects capital spending to rise about 19% to $24 billion. It projected the same amount of capital spending in 2023.

T stock closed unchanged at 23.19 on the stock market today. Further, the company reiterated much of its previous revenue and earnings forecasts for 2022 and 2023. T shares have declined nearly 6% in 2022.

AT&T stock fell in February after it announced plans to spin off WarnerMedia to shareholders as a precursor to its merger with Discovery. As a result of the deal, the annual dividend of T stock will fall by about 46% to $1.11 per share. The new media company will become Warner Brothers Discovery and trade under the ticker symbol WBD. AT&T shareholders will own 71% of the new media company.

https://www.investors.com/news/technology/t-stock-rises-on-updated-forecast-amid-warnermedia-discovery-deal/

FT-Europe needs a more robust optical fibre supply chain, says Corning chief:

The head of the world’s biggest producer of fibre optic cable said the EU needs a “much more resilient and self-sufficient” supply chain to tackle a tight market as the rollout of 5G and rapid growth in data centres drives soaring demand for the crucial material.

“You don’t really have a robust supply chain here in Europe,” said Wendell Weeks, chief executive of Corning, in an interview with the Financial Times.

“The global supply chain is not what we thought it was and manufacturers like us need to take on the responsibility of producing closer to our customers.”

On Thursday, the US-based company opened one of the biggest fibre plants in the world in Poland, which aims to meet 30 per cent of demand in Europe over the coming year.

Optical fibre is made of glass as thin as a human hair. Once produced, the fibre is often sent to cable manufacturers who wrap it in a plastic coating and protective tubing for use in telecoms networks.

European cable manufacturers currently import more than half of their fibre from Asia and North America.

Demand for the material has surged over the past three years driven by the rollout of 5G infrastructure, which requires around 100 times more fibre than existing networks. Meanwhile, tech companies such as Amazon, Google and Microsoft have pumped billions into expanding their data centre estates, including laying huge international fibre networks under the ocean.

Europe and North America still lag behind Asia in terms of the scale of fibre rollout. Only a third of households in Europe currently have a fibre connection, compared with more than 90 per cent in China.

“It’s not so much that the price is a significant issue for our customers. The issue primarily is supply,” Weeks said.

Please use the sharing tools found via the share button at the top or side of articles. Copying articles to share with others is a breach of FT.com T&Cs and Copyright Policy. Email [email protected] to buy additional rights. Subscribers may share up to 10 or 20 articles per month using the gift article service. More information can be found at https://www.ft.com/tour.

https://www.ft.com/content/33197e36-b2c9-4c96-8dc7-60446f7abd6c

However, an executive at Prysmian Group, currently Europe’s largest fibre producer, contested the view that there was a significant shortage in the continent, arguing there was only a temporary tightness in the market caused in large part by higher input costs.

“The fibre supply chain is tight but I don’t see any shortage,” said Philippe Vanhille, executive vice-president of telecoms at the Italian group.

Vanhille added that Europe was viewed as a “paradise for business”, with the UK, Germany and Italy currently seen as particularly attractive markets to sell to because they had lagged behind European peers in updating their network infrastructure and were now massively accelerating their fibre rollout.

The price of fibre has decreased precipitously over the past decade. However, it has increased again in Europe this year, driven in part by shortages of some crucial components, including helium, octamethyl and silicon metals.

According to industry data provider Cru Group, prices in Europe have risen to €6.5 per fibre/km from record lows of €3 in January 2021. “Prices in Europe continue to be supported by tight availability and elevated production costs,” they wrote in a note.

Fibre accounts for between 5 and 20 per cent of the cost of building a terrestrial network.

https://www.ft.com/content/33197e36-b2c9-4c96-8dc7-60446f7abd6c