Dell’Oro: Analysis of the Nokia-NVIDIA-partnership on AI RAN

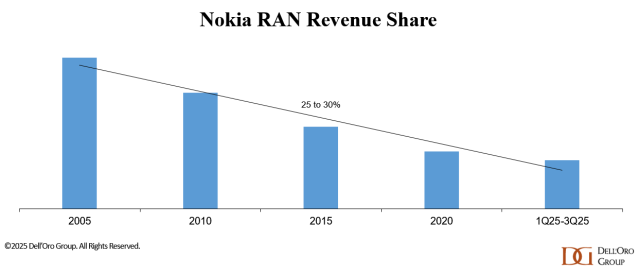

According to Dell’Oro VP Stefan Pongratz, Nokia has outlined a clear plan to arrest its declining RAN revenue share (see chart below), with NVIDIA now a central pillar of that strategy. The partnership is designed to deliver AI RAN [1.] while meeting wireless network operators’ near-term constraints and concerns on performance, power, and TCO (Total Cost of Ownership). IEEE Techblog has noted in many past blog posts that telcos have huge doubts about AI RAN which implies they won’t buy into that new RAN architecture.

This is especially relevant considering the monumental failure of multi-vendor Open RAN which was promoted as a game changer, but has dismally failed to attain that vision.

Note 1. AI RAN is a mobile RAN architecture where AI and machine learning are embedded into the RAN software and underlying compute platform to optimize how the network is planned, configured, and operated. It is being pushed by NVIDIA to get its GPUs into 5G, 5G Advanced and 6G base stations and other wireless network equipment in the RAN.

……………………………………………………………………………………………………………………………………………………..

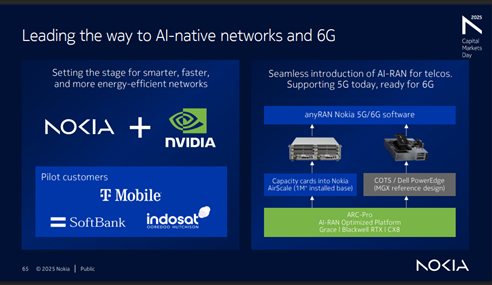

Nokia aims to use collaboration with NVIDIA (which invested $1B in the Finland based company) to stabilize its RAN market share in the near term and create a platform for long-term growth in AI-native 5G-Advanced and 6G networks. The timing—following a dense cadence of disclosures at NVIDIA’s GPU Technology Conference and Nokia’s Capital Markets Day—makes this an ideal time to reassess the scope of the joint announcements, the RAN implications, and Nokia’s broader competitive posture in an increasingly concentrated market.

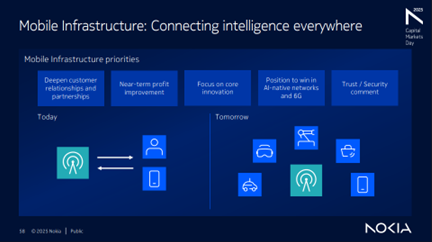

Both companies share a belief that telecom networks will evolve from best-effort connectivity into a distributed compute fabric underpinning autonomous machines, self-driving vehicles, humanoids, and industrial digital twins. From that perspective, the RAN becomes an “AI grid” that executes and orchestrates AI workloads at the edge, enabling massive numbers of latency-sensitive, bandwidth-intensive AI use cases.

Unlike prior attempts to penetrate the RAN market with its GPUs, NVIDIA is now taking a more pragmatic approach, explicitly targeting parity with incumbent, purpose-built RAN equipment based on performance, power, and TCO rather than leading with speculative multi-tenant or new-revenue narratives. Nokia, acutely aware of wireless telco risk tolerance, is positioning the solution so that the ROI must be justifiable on a pure RAN basis, with additional AI and edge-compute upside treated as optional rather than foundational.

A quick recap of NVIDIA’s entry into RAN: Based on the announcement and subsequent discussions, our understanding is that NVIDIA will invest $1 B in Nokia and that NVIDIA-powered AI-RAN products will be incorporated into Nokia’s RAN portfolio starting in 2027 (with trials beginning in 2026). While RAN compute—which represents less than half of the $30B+ RAN market—is immaterial relative to NVIDIA’s $4+ T market cap, the potential upside becomes more meaningful when viewed in the context of NVIDIA’s broader telecom ambitions and its $165 B in trailing-twelve-month revenue.

With a deployed base of more than 1 million BTS, Nokia is prioritizing three migration vectors to GPU/AI-RAN, in order of expected impact:

-

Purpose-built D-RAN [2.], by inserting a new card into existing AirScale slots.

-

D-RAN vRAN [3.], using COTS servers at the cell site.

-

Cloud RAN [4.] or vRAN, using centralized COTS infrastructure.

This approach aligns with wireless network operators’ desire to sweat existing AirScale assets while minimizing operational disruption.

Note 2. Purpose-built D-RAN is a distributed RAN architecture where the baseband processing runs on dedicated, vendor-specific hardware at or very close to the cell site, rather than on generic COTS servers. It is “purpose-built” because the silicon, boards, and software stack are tightly integrated and optimized for RAN performance, power efficiency, and footprint, not general-purpose compute.

Note 3. vRAN or virtual RAN is a technology that virtualizes the functions of a cellular network’s radio access network, moving them from dedicated hardware to software running on general-purpose servers. This approach makes mobile networks more flexible, scalable, and cost-efficient by replacing proprietary hardware with software on common-off-the-shelf (COTS) hardware.

Note 4. Cloud RAN (C-RAN) is a centralized cellular network architecture that uses cloud computing to virtualize and process radio access network (RAN) functions. This architecture centralizes baseband units in a “BBU hotel,” allowing for more flexible and scalable network management, efficient resource allocation, and improved network performance. It allows operators to pool resources, adjust capacity based on demand, and support new services, which is a key enabler for 5G networks.

………………………………………………………………………………………………………………………………………………

In this model, the Distributed Unit, and often the higher-layer functions, are physically collocated with the radio unit at the site, making each site a largely self-contained RAN node. This contrasts with Cloud RAN or vRAN, where baseband functions are centralized or virtualized on shared cloud infrastructure, and with cloud/AI-RAN approaches that rely on GPUs or other general-purpose accelerators instead of custom RAN hardware.

The macro-RAN market (baseband plus radio) is roughly a $30 billion annual opportunity, with on the order of 1–2 million macro sites shipped per year. In that context, operators have limited appetite to pay more than $10,000 for a GPU per sector, even if software-led benefits accumulate over time, which is why NVIDIA is signaling GPU pricing in line with ARC-Compact, but at roughly double the capacity and Nokia is targeting 48–50% gross margins in Mobile Infrastructure by 2028, slightly above the current run-rate.

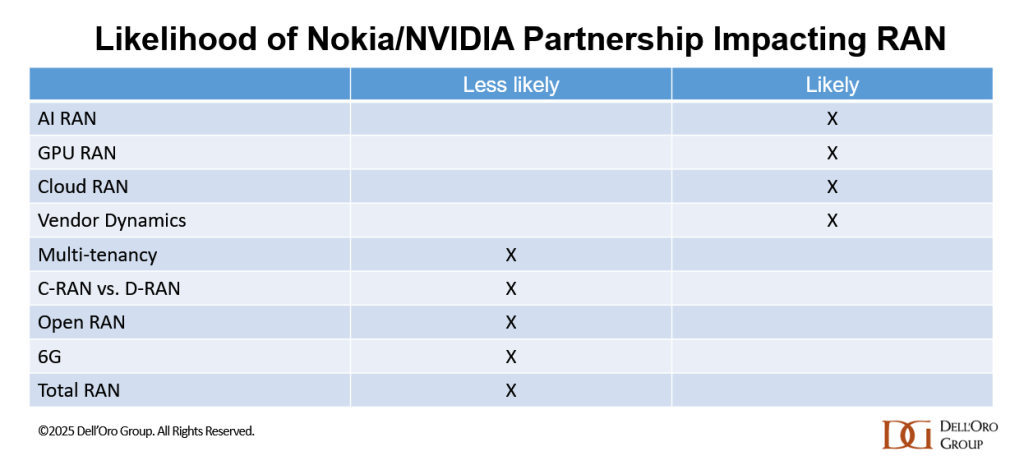

If the TCO and performance-per-watt gap versus custom silicon continues to narrow, the partnership could materially influence AI-RAN and Cloud-RAN trajectories while also supporting Nokia’s margin expansion goals. AI-RAN was already expected to scale to roughly one-third of the RAN market by 2029; Nokia’s decision to lean harder into GPUs amplifies this structural shift without fundamentally changing the long-term 6G direction.

In the near term, GPU-enabled D-RAN using empty AirScale slots is expected to dominate deployments, reflecting operators’ preference for incremental, site-level upgrades. At the same time, the Nokia-NVIDIA partnership is not expected to meaningfully alter the overall Cloud RAN vs. D-RAN mix, Open RAN adoption (slow or non-existent) , or the trajectory of multi-tenant RAN, which remain more dependent on network operator architecture and commercial decisions than on a single vendor–silicon alignment.

Nokia plans to remain disciplined and focus on areas where it can differentiate and unlock value—particularly through software/faster innovation cycles via its recently announced partnership with NVIDIA. The company sees meaningful opportunities to capture incremental share in North America, Europe, India, and select APAC markets. And it is already off to a solid start— we estimate that Nokia’s 1Q25–3Q25 RAN revenue share outside North America improved slightly relative to 2024. Following this stabilization phase, Nokia is betting that its investments will pay off and that it will be well-positioned to lead with AI-native networks and 6G.

Nokia’s objective is clear: stabilize RAN in the short term, then grow by leading in AI-native networks and 6G over the longer horizon. Success now hinges on Nokia’s ability to operationalize the GPU-based RAN roadmap at scale and on NVIDIA’s ability to deliver carrier-grade economics and performance—turning the AI-RAN narrative into production-grade, repeatable deployments.

Nokia sees meaningful opportunities to capture incremental RAN market share in North America, Europe, India, and select APAC markets. And it is already off to a solid start— we estimate that Nokia’s 1Q25–3Q25 RAN revenue share outside North America improved slightly relative to 2024. Following this stabilization phase, Nokia is betting that its investments will pay off and that it will be well-positioned to lead with AI-native networks and 6G.

References:

Many telcos remain dubious about the need for GPUs. Yago Tenorio, the chief technology officer of Verizon, will have spoken for a few when he recently said that Intel’s Granite Rapids was powerful enough for 6G. Ericsson and Samsung have not yet deviated from their CPU-heavy, virtual RAN approach. Tweaking today’s code to work on AMD or Arm looks much easier than producing new software for Nvidia’s compute unified device architecture (CUDA) platform. Certainty about what the immediate future holds for NEX makes Granite Rapids less treacherous waters to enter.

https://www.lightreading.com/5g/intel-networks-u-turn-is-a-relief-for-ericsson-and-samsung

Nokia warns AI is “too big” for Europe’s networks, backing that claim with a survey of “business leaders across industries and telecommunication providers” it commissioned. Just over half of surveyed businesses report poor network performance, while 81% of respondents from communication service providers said customers are asking for AI services their networks can’t deliver. The vendor – which likely wouldn’t mind a big wave of network spending – is calling for policy changes, better collaboration between business and telecom, and defending European sovereignty.

https://onestore.nokia.com/asset/215237

It’s fascinating to see Nokia and NVIDIA team up for AI RAN development. The focus on optimizing network planning and operation through AI integration could be a game-changer. Do you think this collaboration will address the industry’s skepticism about AI RAN adoption?

You asked, “Do you think this collaboration will address the industry’s skepticism about AI RAN adoption?”

Answer: Definitely NOT!

-Vodafone: Executives, including Francisco Martín Pignatelli, the head of open RAN activities, are skeptical about needing GPUs for AI in the RAN, emphasizing that the business case and economics must materialize first. They believe many AI-for-RAN functions can likely run on advanced CPU platforms, such as Intel’s Granite Rapids chips.

-Verizon: Yago Tenorio, the former CTO, has been publicly quoted voicing considerable skepticism about the high cost of NVIDIA GPUs for AI-RAN.

-Orange: Atoosa Hatefi, Director of Innovation in Radio and Environment at Orange, has noted that the company is “still waiting to see whether there is a concrete use-case that could bring benefits to operators” before fully committing to AI-RAN.

-Bell Canada: In field trials using Cohere Technology’s software to boost spectral efficiency, Bell Canada utilized standard Dell servers without GPUs, suggesting a non-GPU path for implementing some AI capabilities in the RAN.

And of course, non of the China state owned telecoms support AI RAN.

The primary concern among these operators often revolves around the total cost of ownership (TCO) and whether the additional benefits of GPU-based AI justify the significant expense and potential energy consumption at mobile sites or edge data centers.

Nokia, the world’s third-biggest RAN vendor, appears to be struggling. After setbacks in the more profitable US market, it reported an operating loss of €64 million ($75 million) on sales of €5.3 billion ($6.2 billion) at its mobile networks business group for the first nine months of 2025. Between 2023 and the end of 2024, Nokia cut more than 9,000 jobs to protect company profits and it aims to cut another 5,000 before it is finished with an earlier restructuring plan. It finished 2024 with a workforce of 75,600 employees, down sharply from the 103,000 it employed six years earlier.

https://www.lightreading.com/5g/telecom-is-suffering-a-big-exodus-of-vendors

1. Nokia’s supporters might reject the assertion it has gone all-in with Nvidia. Marvell Technology is still its main silicon partner for Layer 1, the computationally demanding part of the baseband. Nor did its objective sound that different from Ericsson’s when it announced the Nvidia deal. “We built a hardware abstraction layer so that whether you are on Marvell, whether you are on any of the x86 servers or whether you are on GPUs, the abstraction takes away from that complexity, and the software is still the same,” Pallavi Mahajan, Nokia’s chief technology officer, told Light Reading at the time.

Justin Hotard, Nokia’s CEO, has also characterized his Nvidia deal as “the shift from proprietary to general-purpose hardware.” Marvell itself appears concerned about the return on investment of developing custom RAN silicon for specific vendors.

2. Ericsson remains firmly committed to its proprietary silicon. “That’s an easy investment case for us,” said Per Narvinger, the head of Ericsson’s mobile networks business group, ruling out any imminent pivot away from this and toward x86. “So far, we have been able to offer a better TCO [total cost of ownership] with custom silicon … We don’t see that changing rapidly. We still see the case for having custom silicon.”

Many telcos sound unconvinced that using GPUs for RAN compute at mobile sites will be economical or necessary for AI-RAN. Narvinger, without ruling out GPUs, evidently shares those concerns and says Ericsson has been able to improve network performance through AI-native link adaptation, a RAN technology, without the need for Nvidia’s chips so far.

“I can do it on existing baseband, I can do it on an Intel x86,” he said. “Such an algorithm would not justify having a GPU all the way out by the tower. But maybe if you have thousands of them, it’s a different question.”

Amid so much uncertainty, he naturally wants to avoid making an expensive commitment of resources to multiple software tracks for different silicon platforms. “Almost every month, you get a new announcement or someone wanting to be in the inference business of hardware, and so there are going to be a lot of choices, and we don’t see that decision has to be made already today,” he said. “I think it’s fair to assume, if you take a longer perspective on this, that there will be winners. And whether that will be one big winner or a couple of tracks, I think time will tell.”

Conclusions:

-Nokia has taken a much bigger plunge into Nvidia’s GPUs at a relatively early stage.

-Ericsson aims to be as cautious as possible while ensuring it does not rule out any attractive silicon options that might emerge. With little sign of any major revival in the RAN market, neither approach is devoid of risk.

https://www.lightreading.com/5g/ericsson-resists-nokia-like-nvidia-pact-keeps-chip-options-open