Dell’Oro: Fixed Wireless Access revenues +10% in 2025 & will continue to grow 10% annually through 2029

Additional highlights from the Fixed Wireless Access Infrastructure and CPE Advanced Research Report:

- Total FWA subscriptions, which include residential, SMB, and large enterprises, are expected to grow steadily, surpassing 191 million by 2029.

- 5G Sub-6GHz and mmWave units will dominate the global residential CPE market.

The Dell’Oro Group Fixed Wireless Access Infrastructure and CPE Report includes 5-year market forecasts for FWA CPE (Residential and Enterprise) and RAN infrastructure, segmented by technology, including 802.11/Other, 4G LTE, CBRS, 5G sub-6GHz, 5G mmWave, and 60GHz technologies. The report also includes regional forecasts for FWA subscriptions, including for both residential and enterprise markets, with the enterprise subscriptions segmented by SMB and Large Enterprise. To purchase this report, please contact us by email at [email protected].

………………………………………………………………………………………………………………………………………………………………………

Independent Analysis via Perplexity.ai:

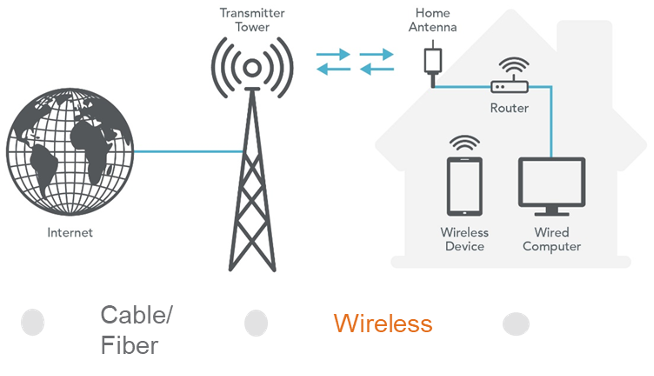

Fixed Wireless Access Schematic Diagrams

……………………………………………………………………………………………………………………………………………………………

Demand-side drivers:

-

Rising demand for high‑speed home and enterprise broadband, including video streaming, gaming, and cloud/SaaS, in areas poorly served by DSL or legacy cable.

-

Customer appetite for quick‑install, no‑truck‑roll broadband that can be activated using wireless CPE instead of waiting for fiber construction.

-

Growing need for reliable connectivity for remote work, distance learning, and SME digitization, especially in suburban and rural regions.

Supply-side / operator economics:

-

Ability to leverage existing 4G LTE macro grids and sub‑6 GHz spectrum, with incremental capex mainly in CPE and software rather than full new access builds.

-

Refarming of LTE spectrum and overlay of 5G NR on the same bands allows operators to run both mobile broadband and FWA on a common RAN/core.

-

Attractive ROI relative to fiber in low‑density areas, since one macro site at sub‑6 GHz can cover large rural or ex‑urban footprints.

Technology and spectrum factors (4G & sub‑6 GHz 5G):

-

4G LTE coverage ubiquity: years of investment mean LTE already reaches most urban, suburban, and many rural markets, making LTE‑FWA immediately deployable.

-

Sub‑6 GHz 5G propagation: better penetration through buildings and walls than higher bands, enabling more reliable indoor FWA without extensive outdoor CPE alignment.

-

Massive MIMO and beamforming on sub‑6 GHz bands increase sector capacity and improve non‑line‑of‑sight performance, which is critical for FWA quality at cell edge.

Competitive and regulatory drivers:

-

Mobile operators using FWA to attack cable and DSL bases; in several markets FWA contributes a high share of net broadband additions, pressuring incumbents on price and speed.

-

Government rural‑broadband programs and subsidies (e.g., U.S. RDOF‑type initiatives) encourage use of FWA as a cost‑effective tool to close the digital divide.

-

Regulatory allocation of additional mid‑band and sub‑6 GHz spectrum (e.g., 3–4 GHz bands) increases usable capacity and supports scaling FWA to millions of homes.

Market growth indicators:

-

FWA market value is growing at double‑digit CAGRs, with 4G still a large share today but 5G FWA projected to dominate new subscriptions by the late 2020s.

-

Sub‑6 GHz FWA gateways and CPE are a rapidly expanding device segment, driven by operator deployments targeting residential and SME broadband.

…………………………………………………………………………………………………………………………………………………………………….

References:

https://www.delloro.com/news/fwa-infrastructure-and-cpe-spending-will-remain-above-10-billion-annually-through-2029/

Fiber and Fixed Wireless Access are the fastest growing fixed broadband technologies in the OECD

Ookla: FWA Speed Test Results for big 3 U.S. Carriers & Wireless Connectivity Performance at Busy Airports

Point Topic: Global Broadband Subscribers in Q2 2025: 5G FWA, DSL, satellite and FTTP

Aviat Networks and Intracom Telecom partner to deliver 5G mmWave FWA in North America

T-Mobile’s growth trajectory increases: 5G FWA, Metronet acquisition and MVNO deals with Charter & Comcast

Dell’Oro: 4G and 5G FWA revenue grew 7% in 2024; MRFR: FWA worth $182.27B by 2032

Latest Ericsson Mobility Report talks up 5G SA networks and FWA

Highlights of Qualcomm 5G Fixed Wireless Access Platform Gen 3; FWA and Cisco converged mobile core network

Ericsson: Over 300 million Fixed Wireless Access (FWA) connections by 2028