Latest Ericsson Mobility Report talks up 5G SA networks and FWA

Ericsson’s November 2024 Mobility Report predicts that global 5G standalone (SA) connections will top 3.6 billion by 2030. That compares to 890 million at the end of 2023. Over that same period of time, 5G SA as a proportion of global mobile subscriptions is expected to increase from 10.5% to 38.4%, while average monthly smartphone data consumption will grow to 40 GB from 17.2 GB. By the end of the decade, 80% of total mobile data traffic will be carried by 5G networks.

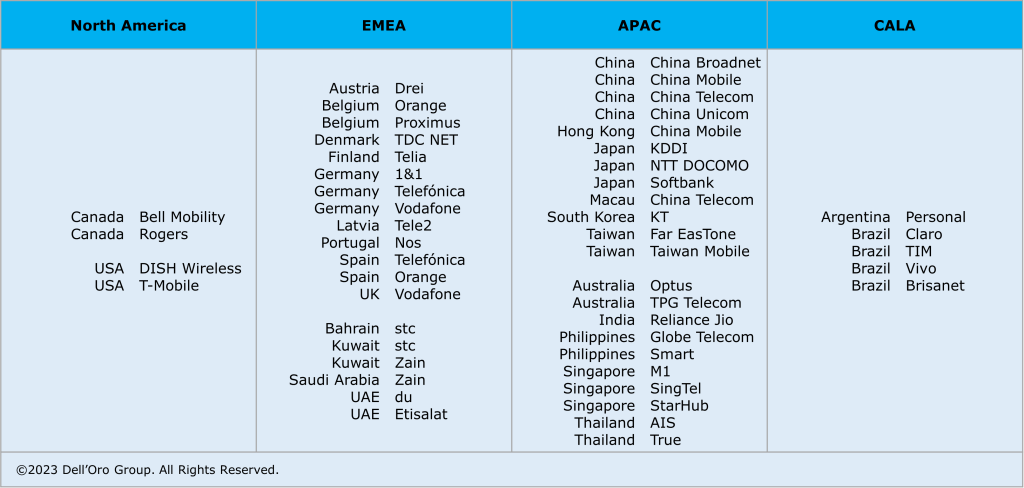

That rosy forecast is in sharp contrast to the extremely slow and disappointing pace of 5G SA deployments to date. In January, Dell’Oro counted only 12 new 5G SA deployments in 2023, compared to the 18 in 2022. “The biggest surprise for 2023 was the lack of 5G SA deployments by AT&T, Verizon, British Telecom EE, Deutsche Telekom, and other Mobile Network Operators (MNOs) around the globe. As we’ve stated for years, 5G SA is required to realize 5G features like security, network slicing, and MEC to name a few.”

Fifty 5G Standalone enhanced Mobile Broadband (eMBB) networks commercially deployed (2020 – 2023):

The report states, “Although 5G population coverage is growing worldwide, 5G mid-band is only deployed in around 30% of all sites globally outside of mainland China. Further densification is required to harness the full potential of 5G.” Among the report highlights:

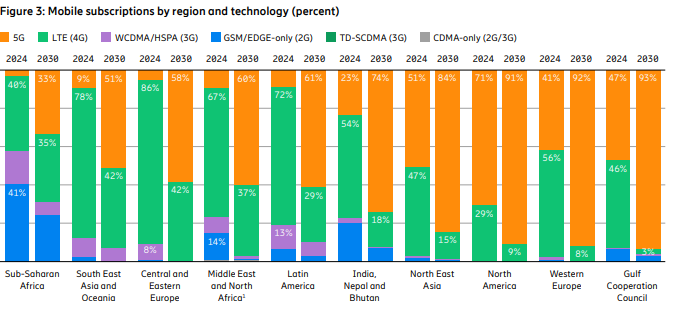

- Global 5G subscriptions will reach around 6.3 billion in 2030, equaling 67% of total mobile subscriptions.

- 5G subscriptions will overtake 4G subs in 2027.

- 5G is expected to carry 80% of total mobile data traffic by the end of 2030.

- 5G SA subscriptions are projected to reach around 3.6 billion in 2030.

Source: Ericsson Mobility Report -Nov 2024

“Service differentiation and performance-based opportunities are crucial as our industry evolves,” said Fredrik Jejdling, EVP and head of Ericsson’s networks division. “The shift towards high-performing programmable networks, enabled by openness and cloud, will empower service providers to offer and charge for services based on the value delivered, not merely data volume,” he added.

The Mobility Report provides two case studies in T-Mobile US and Finland’s Elisa – both of which have rolled out network slicing on their 5G SA networks and co-authored that section of the report:

- T-Mobile has been testing a high priority network slice to carry mission-critical data during special events.

- Elisa has configured a slice to support stable, high-capacity throughput for users of its premium fixed-wireless access (FWA) service, called Omakaista.

The Mobility Report doesn’t say if those two telcos are deriving any monetary benefit from network slicing, or more broadly from their 5G SA networks.

……………………………………………………………………………………………………………………………………………………………………………………………………………..

The Fixed Wireless Access (FWA) market has momentum:

- Ericsson predicts FWA connections will reach 159 million this year, up from 131 million in 2023.

- By 2030, connections are expected to hit 350 million, with 80% carried by 5G networks.

- In four out of six regions, 83% or more wireless telcos now offer FWA.

- The number of FWA service providers offering speed-based tariff plans – with downlink and uplink data parameters similar to cable or fiber offerings – has increased from 30% to 43% in the last year alone.

- An updated Ericsson study of retail packages offered by mobile service providers reveals that 79% have a FWA offering.

- There are 131 service providers offering FWA services over 5G, representing 54 percent of all FWA service providers.

- In the past 12 months, Europe has accounted for 73%of all new 5G FWA launches globally.

- Currently, 94% of service providers in the Gulf Cooperation Council region offer 5G FWA services.

- In the U.S. two service providers (T-Mobile US and Verizon) originally set a goal to achieve a combined 11–13 million 5G FWA connections by 2025. After reaching this target ahead of schedule, they have now revised their goal to 20–21 million connections by 2028.

- The market in India is rapidly accelerating, with 5G FWA connections reaching nearly 3 million in just over a year since launch. • An increasing number of service providers are launching FWA based on 5G standalone (SA).

References:

https://www.ericsson.com/en/reports-and-papers/mobility-report/reports/november-2024

https://www.ericsson.com/4ad0df/assets/local/reports-papers/mobility-report/documents/2024/ericsson-mobility-report-november-2024.pdf

“On the forecast side, we see continued mobile network traffic growth but at a slower rate,” said Fredrik Jejdling, the head of Ericsson’s networks business area, in the introduction to Ericson’s latest Mobility Report published this week. The sales patter is no longer about the volume of data and what telcos must do to cope. Instead, it highlights the value of new 5G network features.

All that is supported by a strategy built around what Ericsson calls the “programmable” network. Software that can be hosted on existing base station equipment can pinpoint the location of users more accurately than GPS, boost performance as and when needed, extend battery life for smartphone users or power down mobile sites – to name a handful of the features Ericsson advertised when it recently launched 5G Advanced, the latest flavor of the current mobile generation.

Wireless network operators will benefit only if programmability persuades subscribers – whether consumers or businesses – to spend more on network services. The problem is that adding speed, responsiveness and other capabilities to networks has not previously led to an increase in customer spending. In many cases, customers have spent less.

Ericsson’s track record in forecasting is not great. Its June mobility report featured a massive downward revision of historical data after the latest numbers from telcos and regulators were fed into the model. William Webb, an independent consultant and former executive at UK regulator Ofcom, noticed Ericsson had more surreptitiously cut the data forecast that supports the latest report, too. The exabyte total for Western Europe in 2029 is 10% lower than it was in June. Ericsson has also cut the growth rate for 2024 from 30% in the previous edition to 20% in the latest, flattening an awkward bump in the growth curve as if squashing an unsightly zit.

https://www.lightreading.com/5g/ericsson-rewrites-sales-pitch-in-face-of-slowing-traffic-growth

To the average consumer, “quality on demand” (via 5G network slicing which requires a 5G SA core network) could smack of priority boarding on a budget flight, or the coffee shops that charge extra for the privilege of sipping while seated. The industry has failed to boost revenues by providing high-speed, low-latency connections that are “always on” for a mass market. Instead, it is restricting access to short bursts for those prepared to pay a premium. Customers without technical knowhow probably expect the 5G service they were pitched to be higher quality than 4G. Suddenly they learn there is an even higher-quality service, available “on demand” to the more discerning customer.