DWDM Equipment Market

Quintessent: Supporting “newer AI workloads” with lasers and DWDM

Integrated-photonics companies have increasingly seized on the opportunities in advanced AI. Many are building high-speed optical interconnects for data centers, with the electrical–optical conversion as close as possible to the number-crunching GPU or application-specific integrated circuit (ASIC).

However, Goleta, CA based startup Quintessent, is focusing on solving what it says is a major bottleneck hindering commercial deployment of such high-speed optical interconnects for AI – the light source or laser, which is currently the “weakest link” in system reliability and scalability, according to co-founder and CEO, Alan Liu.

Quintessent’s answer lies in part in its laser technology, incorporating quantum dots (QDs)—the semiconductor nanocrystals celebrated in the 2023 Nobel Prize in Chemistry—and multiwavelength comb lasers. The firm believes that combination can boost bandwidth, improve efficiency and cut latency by enabling highly parallel dense wavelength-division multiplexed (DWDM) optical links for computing clusters and data centers. And in late March, the company announced that it had secured US$11.5 million in new seed funding to push its vision closer to commercialization.

Quintessent was co-founded in 2019 by Optica Fellow John Bowers of the University of California, Santa Barbara (UCSB), USA, who serves as the company’s board chairman, and Liu, formerly a student in Bowers’ lab. In a conversation with OPN in November 2023, Liu noted that his Ph.D. work in the lab, which spanned the years from 2011 to 2017, focused on what he called “one of the glaring holes in silicon photonics”: how to integrate the light source. His work specifically involved integration of QD lasers with silicon photonics, which subsequently became “one of the core technologies for Quintessent.”

Quintessent co-founders Alan Liu (left) and John Bowers. Image: Courtesy of A. Liu.

Even at that time, Liu had some stirrings in the direction of commercializing the technology. Ultimately, though, after earning his Ph.D. in 2017, he left Santa Barbara for a two-year stint at a consulting firm in the Washington, DC, area. There, he worked as a subject-matter expert in photonics on projects for the US Department of Defense’s advanced-research arm, DARPA, and the US Department of Energy’s counterpart, ARPA-E.

Still, the entrepreneurial itch never quite left Liu. Nor did his fascination with the promise of QD laser technology, as he saw subsequent work done in Bowers’ lab to further advance the performance of those lasers and demonstrate new functions with them, including multiwavelength comb sources.

In 2019, Liu says, he got a call from Bowers, who noted that he was seeing “a lot of interest” from industry in the technology the lab was developing, but that there was “no company to sell it.” When Bowers asked if he wanted to help start one up, Liu recalls, “it didn’t take me long to sign on and say yes.” In the course of the next few years, they built Quintessent’s core team, drawing on numerous other contacts both within and outside of Bowers’ UCSB lab, and pulled in a mix of government R&D and venture funding, including the $11.5 million seed round announced in March 2024. The business case for Quintessent, Liu says, rests largely on “some of the newer AI workloads that were coming into the fray” beginning in the late 2010s, and their immense appetite for computing resources and power.

“If you’re going to be optimizing for power efficiency and bandwidth and latency, the required architecture is one that’s wide and parallel,” he explains. And for optics, at some point, trying to achieve that level of parallelism by adding more and more spatial or fiber channels becomes unwieldy.

The alternative solution, Liu says, is a highly parallel DWDM architecture—using not lots of fibers but “lots of lambdas.” For the crushing workloads of advanced AI, DWDM is optimal, as it “allows you to both simultaneously optimize bandwidth and minimize power and latency,” without relying on digital signal processing or a potential rat’s nest of individual fiber interconnects to boost overall bandwidth.

One key for achieving that vision was “enabling a new kind of laser, and using that laser to enable new communication and transceiver architectures,” according to Liu. “That was a common gap I saw across the industry.” Particularly in the context of AI, Liu observes, a big argument for better lasers has to do with reliability.

Particularly in the context of AI, Liu observes, a big argument for better lasers—and especially for Quintessent’s concept of simplifying wavelength scaling using multiwavelength comb sources fabricated from InAs/GaAs QD material—has to do with reliability. “Optical solutions for AI are going to have to be at least an order of magnitude more reliable than what we see today in existing transceivers,” he maintains. “If you imagine a scenario where there’s 10 times more optics deployed, and your failure rates stay the same, then you’ve got 10 times more failures you’re asking the customer to deal with. That gets a little dicey.”

An atomic force microscopy (AFM) image of InAs/GaAs quantum dots. Image: Courtesy of A. Liu

Getting to better overall reliability will require much more reliable lasers, Liu believes, as lasers are “kind of the weakest link at the moment.” And he and the Quintessent team think that QD lasers offer a way forward, as they are “intrinsically more reliable than quantum well materials today.”

Tobias Egle, a materials scientist who works with M Ventures, one of the partners in the most recent Quintessent funding round, explained the difference further in a separate call with OPN. “These QD lasers are not as affected by material defects, dislocations and so on,” Egle says. “Simply put, a single dislocation through the facet or active region of a traditional laser can lead to complete failure. In contrast, when you have billions of QDs which are independent of one another, the presence of a single dislocation has a negligible impact on your overall performance.”

Quintessent experienced a milestone a year ago, when the company and Tower Semiconductor—the Israel-based global foundry firm with which Quintessent had partnered since 2021—announced that they had achieved what they called the world’s first heterogenous integration of GaAs quantum dot lasers in a commercial foundry silicon photonics process. The pair also unveiled a foundry silicon platform, PH18DB, targeted for the telecom and datacom optical transceiver market, and an accompanying process development kit (PDK).

Meanwhile, on the funding side, Quintessent announced an oversubscribed US$11.5 million seed round in March 2024, with an investment group led by Osage University Partners (OUP) and including, in addition to M Ventures, participation by previous Quintessent funders Sierra Ventures, Foothill Ventures and Entrada Ventures. In a press release accompanying the recent funding announcement, Liu said the new money would let the company “grow our team and accelerate the development of highly scalable and highly reliable optical interconnects that transcend the scaling limitations of incumbent solutions,” based on the firm’s core technology of QD-enabled multiwavelength comb lasers.

Operationally, Liu told OPN that—having “checked off all of the fundamental technology questions” regarding the laser technology’s feasibility—Quintessent is now focused on optimizing the laser design, which he calls “a key Lego block,” and of other pieces of the overall architecture to validate system-level functionality. Then, an important next step will be getting chips into customers’ hands for ground-truthing and feedback, and using that feedback to “drive forward the commercialization roadmap.”

“So samples, then low-volume pilots, then high-volume manufacturing—simple, right?” he laughs. Liu seems exhilarated by the challenge. “I’m one of those people that liked to play video games in the hard, hard mode,” he says. “If it’s too easy, you don’t get much enjoyment out of it.”

References:

https://www.optica-opn.org/Home/Industry/2024/April/Quintessent_Targets_Lasers_for_AI

Co-Packaged Optics to play an important role in data center switches

Ranovus Monolithic 100G Optical I/O Cores for Next-Generation Data Centers

Dell’Oro: DWDM equipment market to exceed $17 billion by 2026

Dell’Oro: DWDM equipment market to exceed $17 billion by 2026

Demand for optical transport DWDM equipment is forecast to exceed $17 billion by 2026, according to a new Dell’Oro Group report.

The $17 billion in revenue for dense wavelength-division multiplexing (DWDM) equipment represents the bulk of revenue for the total optical transport equipment market. Dell’Oro forecasts the total market to grow at a 3% compound annual growth rate (CAGR) to $18 billion by 2026 as a result of sales of DWDM systems delivering wavelength speeds over 200 Gbit/s.

“Although there is a ton of market turbulence, we do not see demand for DWDM equipment letting up,” said Jimmy Yu, Vice President at Dell’Oro Group. “In fact, the biggest issue is that demand seems to be growing faster than supply. Hence, even if a mild recession were to occur, we think the worst case scenario is that demand will align with supply sooner.

“Hence, we are projecting continuous growth for DWDM system revenues. The only difference over the next five years, compared to previous years, is that we are expecting more growth from DWDM Long Haul since IPoDWDM should lower the use of WDM Metro systems in data center interconnect,” added Yu.

Dell’Oro predicts that DWDM long-haul revenue will grow at a five-year CAGR of 5%. Over the same period, the research group forecasts that metro WDM revenue will grow at a CAGR of 3%.

Additional highlights from the Optical Transport 5-Year July 2022 Forecast Report:

- DWDM Long Haul revenue is forecasted to grow at a five-year compounded annual growth rate (CAGR) of 5 percent.

- WDM Metro revenue is forecasted to grow at a five-year CAGR of 3 percent.

- Capacity shipments each year are projected to grow at an average annual rate of 30+ percent.

- Spectral efficiency is expected to improve at an average annual rate of 9 percent.

Dell’Oro forecasts that DWDM long-haul system sales will grow faster than wavelength division multiplexing (WDM) metro system sales over this five-year period. While the DWDM market is experiencing quite a bit of “market turbulence,” demand is not expected to decrease, said Jimmy Yu, VP at Dell’Oro Group, in a statement.

Capacity shipments each year are projected to grow at an average annual rate of over 30%, according to Dell’Oro. The group also predicts that spectral efficiency will improve at an average annual rate of 9%.

Overall, the optical transport equipment market grew 2% year-over-year in Q1, largely from increased market growth in the Americas, according to another recent report by Dell’Oro. The war in Ukraine, COVID lockdowns, supply chain constraints and inflation all contributed to a decline in the optical transport equipment market in Europe, the Asia-Pacific and China.

…………………………………………………………………………………………………………………………………….

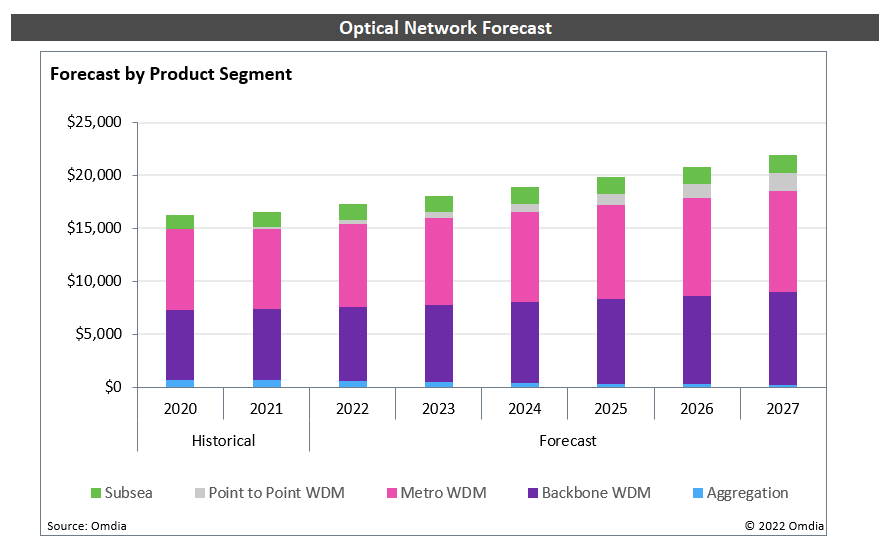

Researchers at Omdia are also bullish about growth in the optical network market, which they project will exceed $20 billion by 2027. Analysts at Omdia forecast that the metro WDM market will exceed $9 billion by 2026.

References:

Optical Transport DWDM Equipment Market to Surpass $17 Billion by 2026, According to Dell’Oro Group