Fiber vs Cable

New Street Research study: Cable broadband will continue its decline, but total broadband access subscribers will increase

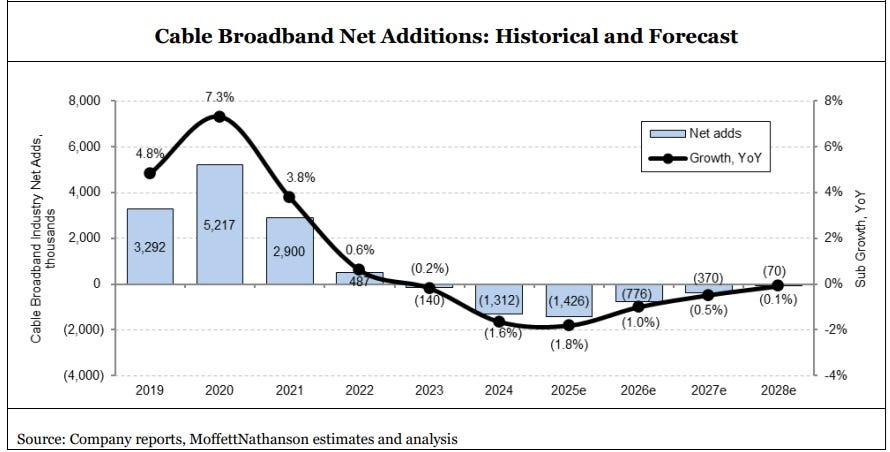

A recent New Street Research broadband trends study suggests that U.S. cablecos (previously called MSOs) aren’t likely to increase the net number of broadband internet subscribers during this decade, but their broadband losses are expected to decrease. The financial market research firm doesn’t anticipate cable broadband subscriber growth to be positive for at least another four to five years. Under New Street’s “base case,” cable broadband net adds will remain negative each year until 2030. Cable broadband is facing fierce competition on the high end from fiber to the premises (e.g. AT&T, Frontier/Verizon) and on the lower end from 5G FWA (e.g. T-MobileUS, Verizon).

Cable “is the new copper,” New Street Research analysts David Barden and Vikash Harlalka wrote, implying declining subscribers for xDSL based broadband will also happen to cablecos. Obviously, cablecos won’t like that characterization given that their hybrid fiber/coax (HFC) networks are mostly comprised of fiber. However, declining subscriber trends is not a commentary about the cable industry’s underlying broadband access network technology.

“With industry growth remaining below pre-pandemic levels and FWA adds remaining strong, we don’t expect Cable to grow subscribers this decade. Cable needs industry growth to improve and FWA adds to slow down to return to growth,” New Street’s analysts write in their 140-page report (subscribers only).

New Street outlines potential scenarios for how cable’s share of the broadband market will look by 2030:

-

Best case scenario – cable has 42% of the market as 84% of the market is divvied up between cable and fiber, while FWA gets 16%.

-

Plausible scenario – cable retains 32% share of the broadband market, with 80% of it being shared with fiber, and FWA capturing 20%.

-

Optimistic scenario – cable captures 50% of the broadband market, fueled by “superior marketing and cheaper mobile bundles,” compared to fiber (41%) and FWA (10%).

New Street expects cable’s “steady state terminal market share” to be just a bit higher than 40% across its footprint, down from 62% today.

The report also takes a look at how cable will fare in markets that overlap with fiber. New Street estimates that 75% of cable markets will have a fiber competitor in the years to come. When combining non-fiber and fiber markets, cable is expected to capture about 41% of the share in their footprints. That compares to fiber (34%), FWA (20%), DSL (2%) and satellite broadband (3%).

It only gets worse for cablecos, as their customer net promoter scores (NPS) [1.] are lower than their competitors (mostly telcos). Using data from Recon Analytics’ weekly survey of about 10,000 respondents, New Street’s study notes there’s a pronounced customer NPS gap for cable against its primary broadband rivals. Customer NPS scores from Comcast (2) and Charter (1) are just above water compared to Cox Communications (-1) and Optimum Communications (-8). Fiber providers are doing much better: AT&T Fiber (25), Verizon Fios (21), Frontier (17) and Lumen Fiber (1). FWA also holds a sizable customer NPS advantage: T-Mobile (31) and Verizon FWA (29).

Note 1. NPS is a customer loyalty metric that measures the likelihood of customers recommending a company to a friend or colleague, using a scale of \(0\)-\(10\). The score is calculated by subtracting the percentage of “detractors” (those who score \(0\)-\(6\)) from the percentage of “promoters” (those who score \(9\)-\(10\)), with “passives” (those who score \(7\)-\(8\)) not being factored into the final score. NPS is a single, easy-to-understand number that ranges from \(-100\) to \(+100\) and is used to gauge customer satisfaction and predict business growth. Customers are asked, “On a scale of \(0\)-\(10\), how likely are you to recommend [company] to a friend or colleague?”

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

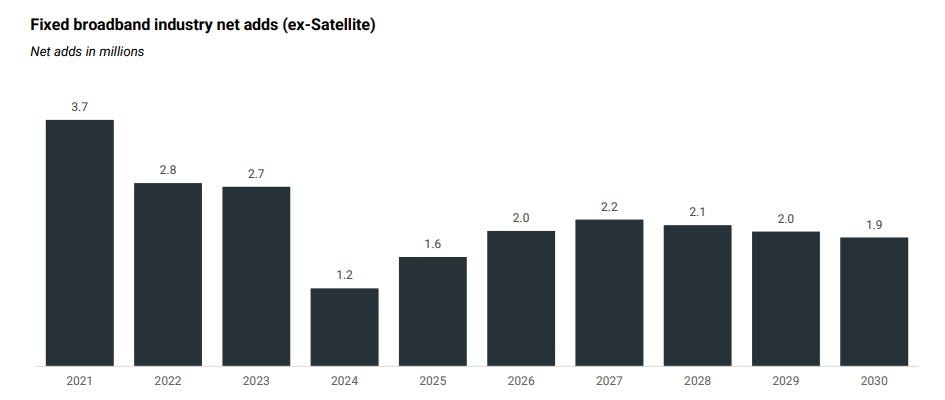

Considering all types of broadband access, New Street expects total net U.S. broadband net adds of 1.6 million, up from the 1.2 million from an earlier estimate. Fueled by fiber and FWA, net broadband subscriber adds are expected to continue above that level through 2030.

That growth will continue even as the market becomes increasingly saturated. New Street forecasts 139 million Internet households in 2030, up from 133 million at the end of 2025. Broadband penetration is expected to reach 93% by 2030, up from 87.7% at the end of 2025.

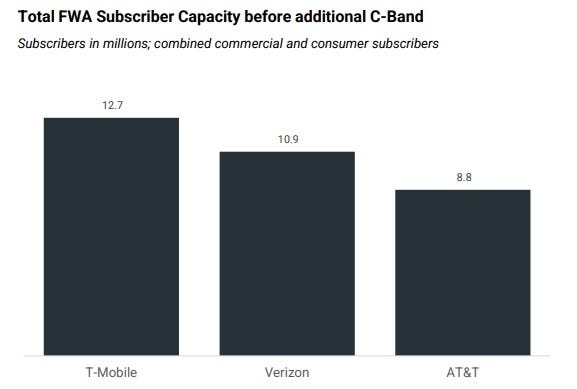

New Street expects U.S. network service providers to have 32 million to 36 million FWA subscribers in the coming years. However, the forecast expects a slight slowdown in FWA sub adds in 2026, coming in just below the range of 3.7 million to 3.8 million seen over the past three years. Next year, New Street expects FWA subscriber adds of 3.6 million (1.7 million for T-Mobile, 1 million for Verizon and 900,000 for AT&T). The analysts estimate that the carriers currently have enough capacity to support about 32 million FWA subs, estimating that carriers have already consumed about 55% of total capacity with new subs. That estimate does not include potential capacity coming from the upcoming auction of upper C-Band spectrum. That auction could provide capacity for another 4 million or so additional FWA subs, New Street said.

- Intense Competition: Cable operators are losing subscribers to FTTH, which offers faster speeds and higher reliability, and FWA services, which often appeal to customers seeking lower-priced or easily installed options.

- Market Saturation and Demographics: The broadband market is becoming increasingly saturated, and a slowdown in new household formation and people moving is curbing a key driver of new broadband connections.

- End of Government Subsidies: The expiration of government programs like the Affordable Connectivity Program (ACP) is impacting subscriber numbers, with major cable operators losing customers who relied on the subsidy.

- Network Upgrades: Cable companies are investing in network upgrades, such as DOCSIS 4.0, to improve speeds and performance, but it is not yet clear if these upgrades will significantly boost subscriber numbers.

Other Analyst Opinions:

- MoffettNathanson sees flattish cable broadband subscriber growth for the next couple of years, with a small gain in 2028. The firm projects subscriber losses in legacy markets will be eventually offset by gains from rural expansions and edge-out builds. “The conclusion for the two [Comcast and Charter] is about the same: even a near worst-case scenario yields roughly flat subscribership over the next five years or so,” Moffett wrote. “That’s a far cry from the doomsday scenarios we typically hear for the bear case.”

- In February 2025, Wolfe Research estimated that total industry net broadband additions for 2025 would be under 2 million, with cable providers bearing much of the slowdown.

- Grand View Research forecasts the global broadband services market (all connection types) to reach ~ US$ 875 billion by 2030, growing ~ 9.8% per year from 2025. In North America, broadband services revenue is expected to grow at ~ 8.3% CAGR from 2025 to 2030.

- Mordor Intelligence forecasts that the global market for hybrid-fiber coaxial (HFC — the backbone for many cable networks) will grow a 7.6% CAGR from $14.96 billion in 2025 to ~ $21.58 billion in 2030.

- An Ericsson analysis noted a projected decline of around 150 million DSL and cable connections globally between 2024 and 2030, with most growth coming from fiber, FWA, and satellite.

References:

https://www.lightreading.com/cable-technology/ouch-broadband-study-casts-cable-as-the-new-copper-

https://www.lightreading.com/cable-technology/cable-broadband-faces-a-flat-future-not-doomsday

https://telcomagazine.com/top10/top-10-global-fxxt-companies-in-telecoms

U.S. fiber rollouts now pass ~52% of homes and businesses but are still far behind HFC

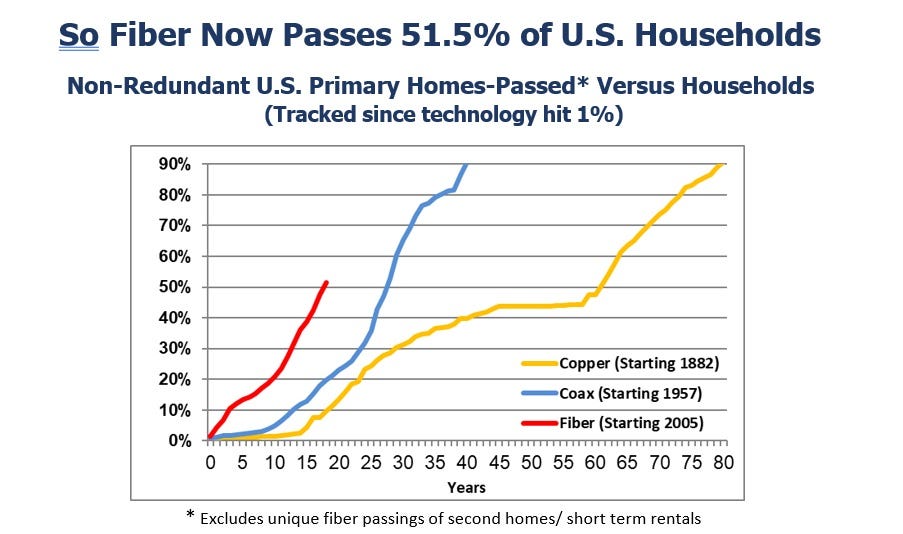

Fiber optic network deployments have reached a milestone as they now pass more than 50% of U.S. households, according to recent report from the Fiber Broadband Association (FBA) [1.] and RVA Market Research and Consulting. Fiber broadband deployment set a new historical record in 2023, passing nine million new homes at a growth rate of 13% year-over-year. The 2023 North America Fiber Provider Survey, sponsored by the FBA, concluded that 77.9 million U.S. homes were passed with fiber, with nearly 52% of all the nation’s unique homes and businesses passed.

Note 1. The FBA is an all-fiber trade association that provides resources, education, and advocacy for companies, organizations, and communities that want to deploy fiber networks. The FBA’s goal is to raise awareness and provide education about the fiber deployment process, safe worksites, and effective fiber installs.

Image Credit: The Fiber Broadband Association (FBA)

………………………………………………………………………………………………………………………………………………………………………………………….

The last $10 billion U.S. Treasury American Rescue Plan (ARP) funding for infrastructure projects such as broadband networks is being distributed this year. The $42.5 billion in NTIA BEAD funding available over the next few years will significantly contribute to enabling and upgrading communities across America with the high-speed, low-latency broadband necessary for participation in today’s 21st-century society. We are seeing a steady stream of NTIA approvals and expect the first states to make BEAD awards in the second half of 2024.

Here’s how the growth of fiber has risen in recent years compared to coax cable (or hybrid fiber/coax, HFC) and the long history of copper.

“Thanks to this latest surge, fiber lines now pass nearly 78 million U.S. homes, up 13% from a year ago,” Alan Breznick, Heavy Reading analyst and the cable/video practice leader at Light Reading, explained in recorded opening remarks here at Light Reading’s 17th’s annual Cable Next-Gen event. Almost 69 million of those locations are “unique” fiber homes, meaning that about 9 million are passed by more than one fiber provider, Breznick added.

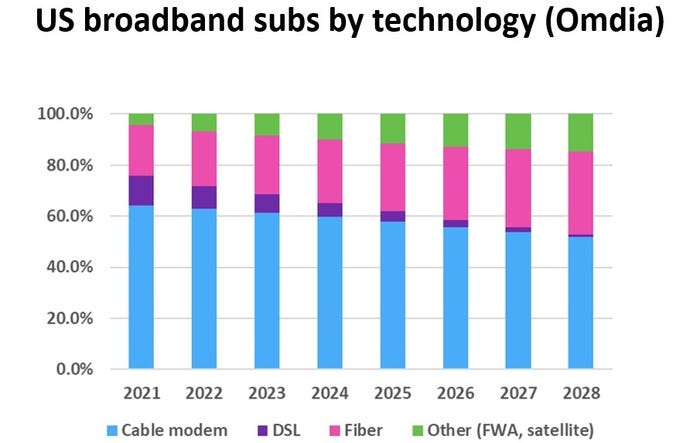

The share of broadband technology is also evolving. While HFC remains the primary way of delivering broadband, fiber-to-the-premises (FTTP) and fixed wireless access (FWA) will continue to make their presence felt in the coming years. Omdia (owned by Informa) expects cable’s share of that mix to drop over the next four years, hitting about 55% by 2028, while fiber’s share is expected to rise to 30% by that time, Breznick explained.

For the cable industry, fiber and FWA are not solely about competition. Many operators are also using FTTP extensively in greenfield deployments and subsidized rural buildouts. They are deploying it on a targeted basis via a new generation of nodes that can support multiple access technologies, including HFC and wireless.

CableLabs has put fiber-to-the-premises on the front burner via a pair of new working groups. A recent survey from Omdia shows that more than one-third of cable operators have already deployed passive optical networking (PON) in some form. That number will “undoubtedly keep rising” thanks to initiatives such as the Broadband Equity Access and Deployment (BEAD) program, Breznick said. Omdia expects spending on next-gen cable technologies to tick up in 2024 and 2025 and then reach a relatively steady annual state through 2029.

Meanwhile, operators such as Mediacom Communications have tapped into FWA to extend the reach of broadband in rural areas. Combined, they demonstrate some of the reasons why the industry has been shedding the “cable” label via rebranding efforts and name changes in recent years.

Cable’s broadband challenge is to grow broadband subscribers as it faces more broadband competition combined with historically low churn and a slow housing move market. “If it feels like an uphill battle for cable, maybe that’s because it is. But that doesn’t mean it has to be a losing battle,” Breznick said. “That’s because the cable industry still has plenty of tricks left up its sleeve.”

Those tricks include the use of next-generation DOCSIS 3.1 (sometimes called DOCSIS 3.1+ or extended DOCSIS 3.1) that can bump up speeds as high as 8 Gbit/s by opening up new orthogonal frequency division multiplexing (OFDM) channels. Some operators, including Comcast, Charter Communications, Rogers Communications, Cox Communications and Cable One, have begun to deploy DOCSIS 4.0 or have put it squarely on their network upgrade roadmaps.

And though cable operators’ network spending is expected to be down in the first half of 2024, vendors are optimistic that the spigots will start to open up again in the second half of the year as operators pick up the pace.

References:

https://www.lightreading.com/fttx/us-fiber-rollouts-reach-tipping-point-but-are-still-far-behind-hfc

Fiber Connect 2023: Telcos vs Cablecos; fiber symmetric speeds vs. DOCSIS 4.0?

Dell’Oro: Broadband access equipment sales to increase in 2025 led by XGS-PON deployments

Nokia’s launches symmetrical 25G PON modem

Fiber Connect 2023: Telcos vs Cablecos; fiber symmetric speeds vs. DOCSIS 4.0?

Derek Kelly, Lumos’ VP of market development, went as far as to say that “fiber is always the answer,” and suggested cable alternatives will not stand the test of time. Kelly claimed that as $42.5 billion is set to roll out through the Broadband, Equity, Access, and Deployment (BEAD) program, relying on investments in fiber will provide stability over the next 15 years.

“I think we’ve all seen DSL and fixed wireless projects get funded over the last couple of years. And then what happens? Those areas ultimately become blocked from future funding until the definitions change. And then they become available for another grant. And we see public dollars going on top of previous public dollars.” Kelly said. He noted Lumos defines “unserved being no cable, underserved means they’re stuck with cable. And then there’s everyone else that has life-changing fiber. So we don’t care about speeds at this point.”

While acknowledging the need for funding in areas without even cable access, he noted another large-scale program after the BEAD initiative is unlikely. “Cable modems aren’t going to keep up with these definitions forever. Their lobbyists aren’t going to be able to convince people forever just make sure that they just barely can meet the definition of unserved,” he said. “We have communities that don’t have access to fiber. The FCC and NTIA may consider them as served today. And I agree the funding should go to areas that don’t even have cable yet, but the time is coming, where cable is going to be what’s unserved or underserved.”

Fiber execs mostly targeted cable’s “Achilles heel,” which is its lacking symmetric speed capabilities (upstream and downstream).

AT&T Fiber’s EVP Chris Sambar told a large keynote audience, “Don’t ask cable about symmetrical speeds, they don’t even know what that means.” In an earlier blog post, he wrote, “Fiber is superior technology for things like uploading large files and increased bandwidth. It delivers an amazing experience, with multi-gig speeds and equally fast up- and downlinks. It’s also critical for powering technologies like 5G (backhaul) and edge computing (fiber access for ultra low latency). And with a far superior upgradeable capacity to handle soaring demand for high-quality bandwidth well into the future.”

However, Jay Lee, CTO of ATX Networks said that cable operators are “right in the throes” of upgrading their networks to get to full DOCSIS 3.1, and that high-split type of architecture will allow them to achieve competitive speeds in the upstream. “Their downstream is probably two gigabits per second now and there’s a line of sight to be more than that,” he said. “Is it 10 Gig PON? No. But it’s still in that gig threshold that I think is as important from a consumer standpoint,” he added.

The next plan phase for cable is to move up to DOCSIS 4.0, which starts to get toward multi-gigabit upstream and five-plus in the downstream, sometimes upwards of 10 in the downstream. Lee noted that plenty of cable companies are doing “lots” of their own fiber buildouts. “Some of the statements made on cable were like ‘they can’t do anything about it’ and certainly they can. DOCSIS 3.1 high-split is just the start.”

Jeff Heynen, VP at Dell’Oro Group echoed Lee’s comments, noting that current DOCSIS 3.1 mid-split can deliver 2 Gbps downstream and up to 200 Mbps upstream, which is what Comcast is offering today. Charter and Cox’s high-split offerings can go even further, delivering 2 Gbps downstream and up to 1 Gbps upstream.

A recent interoperability test conducted by Cable Labs showed that DOCSIS 4.0 modems paired with CCAP and vCMTS platforms in high-split configurations could deliver up to 8.6 Gbps downstream and 1.5 Gbps upstream. Cable operators have claimed DOCSIS 4.0 modems should become available later this year, with volumes in 2024. Those downstream speeds would give cable “very comparable service tiers to most fiber providers,” Heynen said. “And this is before the outside plant is upgraded to DOCSIS 4.0, which will be capable of delivering up to 10 Gbps down and 6 Gbps up.” However, other analysts have hinted that DOCSIS 4.0 rollouts will take longer than cable companies are saying.

References:

https://www.fiercetelecom.com/broadband/cable-fiber-rivalry-separating-fact-fiction

https://www.business.att.com/learn/articles/docsis-vs-fiber-why-knowing-the-difference-matters.html

https://about.att.com/innovationblog/2022/sambar-fiber-expansion.html