Global 5G market/deployments

NEC exits 4G/5G base station market underscoring Japan’s weak mobile infrastructure ecosystem

Japanese telecom vendor NEC has decided to cease development of 4G and 5G radio access base stations, effectively exiting a segment now overwhelmingly controlled by only five vendors (Huawei, Ericsson, Nokia, ZTE and Samsung). Huawei, Ericsson, and Nokia collectively hold ~80% of the worldwide 4G/5G base station market, while NEC and Fujitsu together hold under 1.5% global market share. That leaves Japan’s network equipment vendors structurally disadvantaged on both scale and pricing power. The move underscores structural weaknesses in Japan’s mobile infrastructure ecosystem, particularly its inability to reach scale in a highly globalized, capex‑intensive market.

Fujitsu spun off its communications-related business, including base stations, into a new subsidiary this July. Kyocera, which had planned to enter the 5G base station market in 2027, has also abandoned development of 5G base stations. NTT DoComo, Japan’s largest mobile network operator by subscriber count and market share, previously prioritized procurement from such Japanese companies such as NEC and Fujitsu but changed tack in 2024 and stepped up purchases from Ericsson, Nokia and other foreign companies.

A wireless base station on the roof of a building in Tokyo. (Photo obtained by Nikkei)

……………………………………………………………………………………………………………………………………………………………………

Key points:

-

NEC will halt new development of 4G and 5G base stations for smartphones and other endpoint devices, while stepping back from a market where its share had already fallen to a marginal level.

-

The decision is widely viewed as a market‑driven outcome, reflecting persistent losses in a business that never achieved the scale or cost structure required to compete with leading global RAN vendors.

-

Contemporary mobile infrastructure is a globalized and capital‑intensive industry, where survival hinges on high volumes to amortize R&D, silicon, software, manufacturing, and go‑to‑market costs across multiple product generations.

-

NEC will continue R&D for 6G and “Beyond 5G” systems, aligning with Japan’s national Beyond 5G Promotion Strategy, which targets commercialization of next‑generation services around 2030.

-

The company is concentrating research talent in areas such as open and virtualized RAN (v-RAN, Near‑RT RIC, AI-driven network optimization, and integrated terrestrial–non‑terrestrial networks, which are all positioned as building blocks for 6G.

-

However, Japan’s relatively shallow 5G deployment and weak installed base constrain its ability to test dense high‑frequency networks, a prerequisite for 6G architectures that will rely on ultra‑short‑range spectrum and far denser site grids.

-

Japan’s research and IP position in 6G remains modest, with domestic players accounting for roughly 10 percent of global 6G‑related patent filings in recent surveys, trailing several major competitors.

-

Limitations in technology reserves and standards participation raise questions about whether policy roadmaps alone can close the gap without corresponding gains in commercial scale and deployment experience.

-

Japan, along with Australia, Canada, the UK, and the US, has formed the Global Coalition on Telecommunications (GCOT), which is focusing on AI, security, and next‑generation standards, and is widely interpreted as a vehicle to counter China’s growing influence in telecom infrastructure.

-

Attempts to architect future high‑speed networks primarily around geopolitical blocs risk fragmenting markets, inflating development and compliance costs, and undermining interoperability—factors that historically have worked against technically superior but commercially isolated platforms in 4G and 5G.

-

Japan lacks a sufficiently large, unified domestic mobile market to independently sustain globally competitive RAN vendors and generate the economies of scale seen in China, Europe, or the US‑centric ecosystem.

-

Political alignment and industrial policy can provide funding and coordination, but they cannot substitute for large‑scale commercial demand, broad ecosystem participation, and sustained competitiveness across cost, performance, and time‑to‑market

References:

https://www.globaltimes.cn/page/202512/1351697.shtml

Japan to support telecom infrastructure in South Pacific using Open RAN technology

Japan telecoms are launching satellite-to-phone services

SNS Telecom & IT: Private 5G Market Nears Mainstream With $5 Billion Surge

Telecom sessions at Nvidia’s 2025 AI developers GTC: March 17–21 in San Jose, CA

SK Telecom, DOCOMO, NTT and Nokia develop 6G AI-native air interface

Nikkei Asia: Huawei demands royalties from Japanese companies

StrandConsult: 2022 Year in Review & 2023 Outlook for Telecom Industry

Selected Comments by John Strand, CEO of StrandConsult:

Spectrum:

While we can fault the Chinese government for its authoritarian ways, it deserves credit for allocating the right radio spectrum frequencies to its best technological use in the case of 5G. Simply put, if you want to deploy 5G, you need mid-band spectrum in the 2.6-6 GHz range, the frequencies which maximize data transmission across distance. This is nothing more than basic physics and technocratic management, but US policymakers are failing on this front.

As of this writing the US Congress still has not reauthorized the auction authority of the Federal Communications Commission (FCC). To align the incentives and economics to best serve Americans, the FCC should have perpetual auction authority. Today the FCC only received a 3-month extension, which expire in March 2023!.

It’s hard to contemplate a modern nation being so irresponsible. We are talking about the ability of the US government to raise hundreds of billions of dollars being put on ice because the Defense Department can’t modernize. Simply put, the US military lost its spectrum edge by waging wars with non-peers for two decades. Instead of upgrading to the most spectrally-efficient tools on the appropriate frequency, the Pentagon is entrenched with bloated legacy systems on the mid-band beachfront with 12 times the spectrum that’s available for 5G.

It is remarkable that the US has achieved such incredible wireless success to date with the limited access to frequencies. But to compete with China in the future, the US will need a more aggressive approach to making mid-band spectrum available for exclusive licensed use. China has not been so foolish to squander its spectrum resources. It just unveiled a high-power, low-frequency P-band (216-450 MHz) satellite-hunting radar, reported to detect and track low-orbiting satellites and functions around the clock in all weather conditions. Observers dubbed it the “Anti-Starlink” system.

Broadband fair cost recovery:

As countries look at their populations and those who suffer a lack of digital equity, particularly people of color, low-income, and the elderly, they will see that the traditional concept of universal service should come to an end. Taxing broadband subscriptions for the sake of raising money for infrastructure does not scale when it comes to closing the digital divide for the poor.

Making the cost of broadband higher for end users undermines its affordability for the digital poor and disenfranchised. Countries will increasingly look at Big Tech to foot the bill for the unrecovered costs they impose on networks. Closing the digital divide globally and getting some 3 billion people online for the first time are also the goals of the International Telecommunications, now led by a woman for the first time in its history.

South Korea, the world’s #1 broadband nation, has long recognized that content providers have a financial responsibility to ensure the quality and delivery of their data and has had operated a cost recovery regime since 2016. South Korea enjoys the highest adoption of FTTH (86%) and 5G (47%) in part because end users are not forced to bear the full burden of the cost of broadband.

Indeed, Google’s gambit to undermine the policy effort of good faith negotiation for cost recovery backfired. It is a bad look for a company which is the single largest source of traffic in South Korea hijacking the democratic process.

Google Korea launched a series of Google ads against a Korean Assembly bill and enjoined South Korean YouTubers to join. Asia-Pacific Vice President for YouTube Gautam Anand warned that the bill would “penalize the companies that provide the content, and the creators who share a living with them.” Some 265,000 YouTubers signed the petition.

However Google’s lobbying practices came under fire in one Assembly hearing which revealed that South Korea’s leading internet advocacy non-profit OpenNet, which was founded with Google as the sole sponsor, received some $10 million to espouse favorable policy. Lawmakers questioned the relationship for what appeared to be lobbying efforts outside the organization’s remit and an official financial disclosure from the organization that noted a far lower figure than the actual gift from Google.

Big Tech may grumble about not getting to free access to networks, but they are enjoying record profits in the country. Google Korea reported its 2021 sales grew almost a third over the prior year to 292.3 billion won with 88 percent operating profit.

Netflix, another person non grata that enjoys record profits in South Korea, declares that it has “no obligation to pay for or to negotiate for the use of” another’s network. Strand Consult has detailed the Scrooge-worthy saga of Netflix’s litigation against a local broadband provider in Netflix v. SK Broadband. The David and Goliath Battle for Broadband Fair Cost Recovery in South Korea.

In the US, there is bipartisan Congressional support for the FCC to investigate the feasibility of a fair cost recovery regime. With Congress having failed to rein in Big Tech on the antitrust front, fair cost recovery remains one of the few rational, evidence-based methods to address Big Tech’s abuse of market power, namely its perversion of public policy to achieve its corporate goals and the free use of public and private resources.

Economists will have a field day exploring the cost recovery business models: market-based pay as you go (PAYG), ad taxes, usage fees, USF surcharges and so on. While there is no one size fits all for every country, there is an increasingly recognition that broadband policy must evolve. The prevailing models of broadband access where enshrined when email was the killer app of the internet more than 30 years ago. No one knew that video entertainment would become the key use case and account for 80% of the internet’s traffic. It’s time to update policy to reflect reality.

In 2023, Strand Consult will launch an update to its earlier report Middle Mile Economics: How streaming video entertainment undermines the business model for broadband. The new report describes an investigation of 50 broadband providers in 24 US states. It finds that middle mile costs are growing 2-3 times faster than household broadband revenues, that traffic from Big Tech consumes as much as 90 percent of network capacity, and that few, if any, broadband providers have been able to monetize the increase in video streaming entertainment traffic in their network.

Metaverse: Second Life 2.0?

Meta (formerly Facebook) calls its Metaverse, “the future of digital connection…moving beyond 2D screens and into immersive experiences in the metaverse, helping create the next evolution of social technology.” It’s all very exciting, the dream (or nightmare) of science-fiction turned into a commercialized reality of being ever closer to people you don’t know in a digital world. The big question is whether it will become a reality or whether it will be a replay of Second Life, which flopped big time.

To test whether the Metaverse will succeed, try innovation expert Clay Christiansen’s milkshake test. The milkshake test attempts to gauge whether a new product or service can become a reliable, affordable substitute. For example, some order a milkshake for breakfast at the fast-food drive though because it is as filling as breakfast (We are not weighing in on the nutrition here!). The milkshake question whether the firm—Meta–can produce a quasi-food beverage (or experience) such that it gets enough users with the right monetization.

For Strand Consult the more interesting questions are whether Meta will pay for the radio spectrum and infrastructure which the asserted “successor” to the mobile network will require. Meta announced a $19.2B investment in the new online world for 2023. That’s about half of the capex that the world’s mobile operators spend on RAN in a good year.

Few of the people gushing about the marvels of the Metaverse have stopped to think what it would cost, along with the other proposed online “verses”. If you are concerned about online streaming video entertainment consuming as much as 90 percent of internet bandwidth today, how will it be for broadband providers to recover costs when even more data to be pumped into networks? How will such a broadband subscription be price in today’s framework? Is it such that users are asking for every Meta bell and whistle, or do they just want some of the experience? There will need to be some policy innovation and business model upgrade before the Metaverse is real.

Emergence of the Titanium Economy: Over the top vs. Net Centric?

Strand Consult is excited about 5G and the mobile industry’s continuous improvement of its networks. 5G for home broadband, also known as Fixed Wireless Access (FWA), is a game changer and can substitute for wireline broadband in many cases. While the tower is connected to a larger network with wires and/or radio links, no wires are required to the customer’s premises, only a wireless receiving device. FWA is soon expected to account for 10 percent of all US broadband connections.

What’s beyond home broadband is the bigger question for 5G. Many want to see 5G transform industry and bring a new era of advanced healthcare, transportation, and manufacturing. Indeed some leading manufacturers already integrate 5G into their production like John Deere, Bosch, ASML and some carmakers. Even more exciting is the manufacturing renaissance afoot in USA led by small and mid-cap companies earning returns that rival the online tech/software sector. They are not widely known or discussed, but there are some 4000 of them, driving about $200b in revenue. Their startup costs are relatively low, and they take advantage of 5G, and 5G enabled AI, robotics, automation, and cloud computing. Strand Consult’s suggested holiday reading on this topic is The Titanium Economy: How Industrial Technology Can Create a Better, Faster, Stronger America by Nick Santhanam, Gaurav Batra, and Asutosh Padhi.

Strand Consult is keenly interested in the 5G value chain, where monetization will occur, and who will win. The big question is whether operators are positioned to capture the value in applications or services, or whether over the top (OTT) third parties be the winners. If 4G is any guide, the content and application providers took the prize.

Network monetization has long dogged the mobile telecom industry. In 2009, GSMA launched a suplement to premium SMS, a reboot of SMS payment introduced in 1999. However, few or non innovations succeed. Strand Consult’s report OneAPI – Next Generation Value Added Services in the Mobile Industry described many of the challenges to launch this kind of mobile network business models.

Simply put, the long-term trend for consumer monetization by mobile operators goes in a negative direction. It may be a boon for consumers that broadband prices have stayed constant (if not fallen) during this cost-of-living crisis, in the long term it does not scale for mobile operators to continually upgrade networks with better technology if they earn declining returns. This can be improved on the policy front with consolidation, lowering costs so operators can get a better case for investment. Strand Consult suggests that countries should move from 4 to 3 mobile network operator markets, as Strand Consult details in its report Understanding 4 to 3 mobile mergers.

Another needed policy reform is to modernize net neutrality. Strand Consult predicts that policymakers will pick this up in 2023.

Net neutrality:

Following the lead of United Kingdom’s Ofcom which proposes to modernize its rules, Strand Consult predicts that European and Latin American telecom regulators will issue a call for evidence on the performance of net neutrality regulation. Invariably they will find that the policy is failing consumers, innovators, and investors. These countries want to move forward with 5G smart networks, but they have policy designed to maintain a dumb pipe. This can’t be resolved, even with the proffered “5G slicing” techniques.

More important, consumers are denied their freedom of choice by being forced to value all data uniformly and equally when their preferences show that they place different values on different data. Policymakers will see that they are trading away billions of dollars in network investment for the sake of a “look good, feel good policy” which does not serve consumers, startups, or investors. Simply put, no leading 5G nation has hard net neutrality rules, and yet they protect consumers and the ecosystem with competition law and transparency rules. Strand Consult will launch a report on this topic in early 2023. Check out our library of reports and research notes covering this issue for the last decade.

Mobile operators will mature their ESG practices

Green energy consumption is a big deal in broadband. Many mobile telecom operators have formalized in Environmental, Social and Governance (ESG) goals into key performance indicators. Yet the corporate maximization of ESG by some companies has led to “greenwashing”, deceptive marketing to create the illusion of goodness and to hide malpractice perpetuated by ESG practices and regulation.

Politicians, regulators, and business leaders often claim to be focused on sustainability. Yet, few fully appreciate the difference between being truly sustainable and just “less bad”. The traditional ESG metrics of CO2 emissions, energy consumption, etc. are used as proxies for sustainability progress, but often performance is merely incrementally improved and then celebrated as sustainability. This is not sustainable – it is just “less bad” performance, as the negative impact is still there.

As such, the Future-Fit Business Benchmark has emerged for clear, actionable guidance to perform without negatively impacting people, society and the planet. European solar power producer Better Energy uses Future Fit in its provision of Purchasing Power Agreements for certified green energy to mobile telecom operators and content/application companies, and its performance model is likely to be adopted even more widely.

Another key learning is that operating parallel infrastructures with small cells is not sustainable. The business case for small cell is in network sharing. Mobile operators in United Kingdom just announced trials of a shared small cell network which hosts all 4 mobile operators.

Conclusions:

Strand Consult’s Christmas wish is that the war in Ukraine will end in 2023. We have a simple choice in this world: democratic capitalist systems with promote human freedom, rights and flourishing OR totalitarian systems which demand control over public and private life and prohibit opposition. Mobile networks telecom networks improve quality of life for their users. In 2023 Strand Consult will continue its work in policy transparency to ensure that mobile telecom networks have sustainability, security, and integrity.

This past year In 2022 Strand Consult published many research notes and reports, and featured half a dozen industry experts on our guest blog. Strand Consult’s analysis was quoted in some 1000 news stories globally. Our work took us to all the continents but Antarctica. Our readership continues to grow. For the last 22 years, Strand Consult has made predictions for the coming year. You can check our archive to see whether we were right.

Sincerely, John Strand, CEO

GSA: 200 global operators offer 5G services; only 20 (Dell’Oro says 13) have deployed 5G SA core network

200 global network operators in 78 countries are offering 5G mobile and/or fixed wireless services at the end of 2021, according to the GSA. 487 operators in 145 countries are investing in 5G, including trials and spectrum license acquisitions, up from 412 operators at the end of 2020.

Notably, only 187 of the operators offering 5G services provide 5G mobile services, in 72 countries. The others are delivering 5G fixed-wireless access (even though it’s not an IMT 2020 use case). In total, 83 operators in 45 countries/territories have launched 3GPP-compliant 5G fixed-wireless access services.

Only 99 operators in 50 countries are investing already in 5G standalone (SA) core network, which includes those planning/testing and launched 5G SA networks).

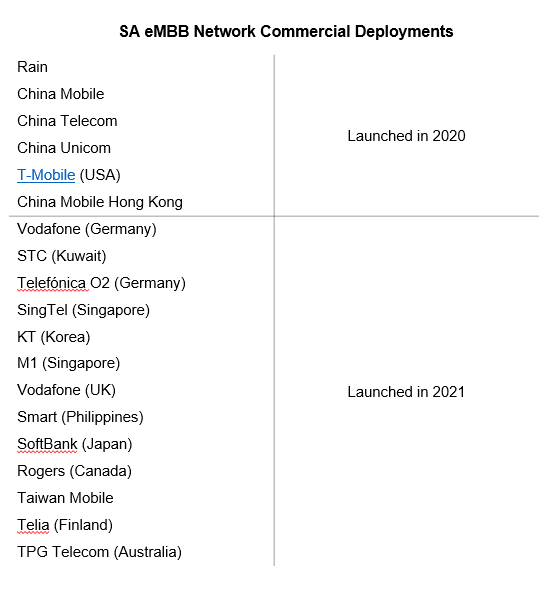

GSA has catalogued just 20 operators in 16 countries with 5G standalone deployed/launched in public networks.

13 January 2022 update from Dave Bolan of Dell’Oro Group:

We count 13 CSPs that commercially deployed 5G SA networks for enhanced Mobile Broadband (eMBB) in 2021, and they were nowhere close to the aggressiveness in breadth and depth of the buildouts that we saw by the Chinese Service Providers in 2020, or for that matter in 2021. We thought all three CSPs in Korea would have launched by now, but so far only KT has launched.

And we expected AT&T and Verizon in the U.S., and the CSPs in Switzerland to have launched 5G SA in 2021. In spite of these disappointments, the projected growth rate for 2021 is 61% Y/Y for 2021 and lowering to 18% Y/Y for 2022 due to the expected decline in growth rate by the Chinese CSPs.

The 5G device market is growing much more quickly. The GSA counted 1,257 announced devices at year-end, up nearly 125 percent from 2020. Around half (614) are 5G phones, up more than 120 percent from 278 at the end of 2020.

In total, 857 of the devices are commercially available, up more than 155% from the 335 on the market at the end of 2020. GSA has identified 614 announced 5G phones, up more than 120% from 278 at the end of 2020.

References:

https://gsacom.com/technology/5g/

GSA: 5G Market Snapshot – 5G networks, 5G devices, 5G SA status

Mobile Core Network (MCN) growth to slow due to slow roll-out of 5G SA networks