Industrial IoT

IDC IoT investment forecast: 10.4% CAG over 2023-2027

Worldwide spending on the Internet of Things (IoT) is forecast to grow 10.6% this year to a value of $805.7 billion, according to the latest forecast from IDC. Investments in the IoT ecosystem are expected to surpass $1 trillion in 2026 with a compound annual growth rate (CAGR) of 10.4% over the 2023-2027 forecast period.

“The last few years have shown that connecting with a digital infrastructure is no longer a luxury, but a necessity,” said Carlos M. González, research manager for the Internet of Things at IDC. “For organizations to excel in data-driven operations, investing in IoT projects is essential. Connecting devices to data networks to gather insight, expand operations, and increase performance are the hallmarks of executing an IoT ecosystem.”

Discrete and Process Manufacturing are the industries that will see the largest investment in IoT solutions in 2023 and throughout the forecast period, accounting for more than one third of all IoT spending worldwide. Professional Services, Utilities, and Retail are the next largest industries in terms of overall IoT spending with roughly 25% of the worldwide total. State/Local Government and Telecommunications will deliver the fastest spending growth over the five-year forecast with CAGRs of 12.0% and 11.7% respectively.

IoT investment is a key building block to supporting an increasingly digital and distributed organizational footprint. Most of these investments are seeking solutions that can help organizations achieve a specific business goal or customer challenge, such as cost savings or supply chain efficiency. As such, use cases are the focus of most IoT investment plans.

The two IoT use cases that will receive the most investment in 2023 are both closely tied to the manufacturing industries: Manufacturing Operations ($73.0 billion) and Production Asset Management ($68.2 billion). The next largest use cases – Inventory Intelligence ($37.6 billion), Smart Grid (Electricity) ($36.9 billion), and Supply Chain Resilience ($31.6 billion) – will benefit from strong investments from the Retail and Utilities industries. The use cases that will experience the fastest spending growth represent the diverse application of IoT technologies – Electric Vehicle Charging (30.9% CAGR), Next Generation Loss Prevention (14.5% CAGR), Agriculture Field Monitoring (13.9% CAGR), and Connected Vending and Lockers (13.8% CAGR).

“Updates to the IoT use case taxonomy in this release of the IoT Spending Guide reflect the evolving Digital Transformation investment objectives of enterprises. Thematically, greater investment in goods production and supply chains resulting from the COVID-19 pandemic and global reactions that caused massive business and societal disruptions are evident in the new use cases. These production and supply chain related use cases can be seen in the Discrete Manufacturing, Process Manufacturing, Retail, and Transportation industries,” said Marcus Torchia, research vice president with IDC’s Data & Analytics Group. “Meanwhile, digital business investments are ramping up in other industries such as the Resource Industries. For example, IoT is helping to improve upstream supply chain processes in Agriculture, such as growing, harvesting, and delivering higher quality produce to market.”

This release of the IoT Spending Guide also includes a Video Analytics overlay forecast that is intended to provide high-level insight into a broadly adopted use case (i.e., found in most or all enterprise industries). Video analytics refers to the use of artificial intelligence (AI) and other advanced algorithms to recognize, detect and analyze live or stored video feeds in a variety of uses, including business analytics, security surveillance, and other rapidly evolving adaptations of this technology. These uses are found in numerous settings (e.g., business analytics in manufacturing and retail, in government for crowd management and traffic congestion management, and broadly for security surveillance). Video analytics requires IP networked capable cameras to support the advanced software whether embedded in hardware or provided by third party vendors.

IDC expects spending on Video Analytics solutions across all industries to be more than $23.5 billion this year. Future releases of the IoT Spending Guide will include additional broadly adopted use cases, such as smart buildings.

From a technology perspective, IoT services will be the largest area of spending in 2023 and through the end of the forecast, accounting for nearly 40% of all IoT spending worldwide. Hardware spending is the second largest technology category, dominated by module/sensor purchases. Software will be the fastest growing technology category with a five-year CAGR of 11.0% and a focus on application and analytics software purchases.

Western Europe, the United States, and China will account for more than half of all IoT spending throughout the forecast. Although Western Europe and the United States currently have similar levels of spending, Western Europe will expand its lead with an 11.0% CAGR over the 2023-2027 forecast, compared to an 8.0% CAGR for the United States. China’s IoT spending is forecast to surpass the United States by the end of the forecast due to its 13.2% CAGR.

The Worldwide Internet of Things Spending Guide (V1 2023) forecasts IoT spending for 18 technology categories and 70 named use cases (87 including sub-use cases) across 19 industries in nine regions and 53 countries. The spending guide also includes an IoT connectivity forecast for cellular, Low-Power Wide Area Networks, and other connectivity (e.g. wired, satellite). This provides tech buyers and providers with a tool to understand how the plethora of IoT use cases call for multiple connectivity types, driven by different expectations in terms of latency, bandwidth, and data frequency.

……………………………………………………………………………………………………………………………………………………………

Separately, Rational Stats says the global IoT platforms market was estimated at a market value of $15.3 billion in 2022 and is expected to grow at a significant CAGR of over 15.2% over the forecast period of 2023-2028.

The main drivers of this expansion are the increased availability of inexpensive sensors and the rising need for connected devices across a range of sectors, including manufacturing, healthcare, and retail. IoT platforms must be scalable to handle the rising number of connected devices and the growing volume of generated data.

References:

https://www.idc.com/getdoc.jsp?containerId=prUS50936423#

https://www.idc.com/getdoc.jsp?containerId=US49578922

https://www.openpr.com/news/3094459/global-iot-platforms-market-analysis-and-forecast-2023-2028

IoT Sensor Standards Are Absolutely Essential for Security

By Logan Kugler (edited by Alan J Weissberger)

Companies making and using IoT sensors can have a high degree of confidence their technology uses the best security features and practices if they adhere to established, credible security standards. There are plenty of security standards that IoT devices can—or should—follow. Some are related to how IoT devices use networks and transmit data. Some are related to the underlying technologies IoT devices rely upon (such as Wi-Fi). Others offer comprehensive guidance on how to create and use IoT devices in a secure way.

One well-known IoT standard is ISO/IEC 30141 which “provides a standardized IoT Reference Architecture using a common vocabulary, reusable designs, and industry best practices.” Another IoT standard, TS 103645 from ETSI aims to create a security baseline for Web-connected devices, including guidelines for password usage, software updates, and user data standards for consumer IoT devices.

In another example, the U.S. National Institute of Standards and Technology (NIST) has created a list of six prescribed security characteristics that manufacturers should incorporate into IoT devices. The list includes security features such as device identification, device configuration features, data protection features, logical access to interfaces, adequate software and firmware updates, and adequate cybersecurity event logging.

There are dozens of organizations that publish helpful standards to guide IoT manufacturers and device customers on how to design, manufacture, and use IoT sensors and sensor-enabled devices in the safest way possible. However, the diversity of organizations and standards also presents problems.

Some standards organizations may aim to publish universal standards across different IoT technologies, while others may only publish standards for certain countries or devices and technologies. While these organizations are usually highly credible and undergo rigorous processes to ensure their standards are comprehensive, many such standards are not legally binding. However, there is no single, well accepted standard for IoT security. The existing standards are not always designed for the unique risks IoT technologies face, says Izzat Alsmadi, a computer science professor at Texas A&M University in San Antonio, who does work on IoT security. Existing standards may not adequately apply to significant numbers of IoT sensors, he explained, and some IoT devices and networks use proprietary technology that does not follow more widely accepted or used industry standards.

“Today’s IoT standards are relevant, but not enough and in some cases not up to date or not up to security challenges,” says Alsmadi. That’s because some of today’s existing security mechanisms were initially designed for desktop computers and are difficult to implement on resource-constrained IoT devices, he says. There also is the problem of compliance. Standards are often voluntary—and many companies do not adhere to them due to business pressures.

“Currently, the IoT segment sacrifices security due to resource allocation and price,” says Marion Marincat, founder and CEO of Mumbli, an IoT company. It is often faster and cheaper to limit security options in order to get to market, he says. As such, the standards for IoT mainly end up being adopted by the companies with deep-enough pockets and wide-enough competitive moats to afford to implement better security in their devices.

“Although there are a lot of methods to design low-cost devices with security in mind, business decisions usually push back the implementation for these solutions in order to speed up the route to market or reduce the price of devices even further,” says Marincat.

The issues with IoT sensor standards have larger implications for the overall security of the Internet of Things.

“The Internet of Things is very vulnerable in comparison with other categories of information systems,” says Alsmadi, because so many IoT applications are publicly visible and can be remotely controlled.

These vulnerabilities become even more pronounced as the adoption of IoT grows, especially as the industrial Internet of Things becomes a growing attack vector.

“The biggest change in operational technology systems over the past decade is that they have recently become more vulnerable to attacks from the outside as they are moving away from isolated, air-gapped environments and embracing more automation and digitally connected devices and systems,” says Fortinet’s Nelson.

Industrial IoT devices often run on hardware with little or no management interface and often are not able to be upgraded in the field. Physically, IoT devices in industrial use-cases frequently are installed in hard-to-reach or publicly inaccessible places (such as on top of a building). As such, they must be able to operate unattended for long periods and be resistant to physical tampering, he says.

“An attack on industrial IoT, especially on a device or system used to monitor critical operations and processes, can have a very significant impact on not only the business itself but also on the environment, even on the health and safety of staff and the public at large,” Nelson says.

Marincat advocates rolling out minimum standards to broad categories of IoT devices, but acknowledges many manufacturers will still see complying with such standards as a luxury in a competitive marketplace.

However, even with smarter standards approaches, making security updates to combined IoT software/hardware can be slower and more complicated than bug fixes and security updates for software alone. One possible fix is having companies adopt smarter risk-mitigation policies in how they use IoT devices, says Nelson. Companies should consider employing a zero-trust access (ZTA) model that verifies users and devices before every application session. “Zero-trust access confirms that users and devices meet the organization’s policy to access that application and dramatically improves the organization’s overall risk posture,” he says.

Nelson also recommends companies use micro-segmentation in their networks. This approach segments and isolates attack surfaces into specific zones. Data flows are then controlled into these zones. The result is companies can limit attacks to a small subset of the business, minimizing the chance bad actors move laterally through networks into other core business functions.

Even basic risk mitigation techniques can help. Other popular risk mitigation techniques employed by businesses include encrypting internet connections, using alternate networks in addition to primary ones, and investing in higher-quality (and more costly) devices from companies that have, in turn, invested in stronger IoT security. Despite all this, however, the vast majority of organizations can still expect at least one cybersecurity attack attempt in a given year. Research from Fortinet found only 6% of organizations experienced no cybersecurity intrusions in 2022.

Putting better cybersecurity measures in place still requires proactive, voluntary compliance from companies—compliance that has not always been forthcoming in the past. While the need for speed may win markets, it is not going away as a major obstacle to safer IoT devices and networks. That leaves experts skeptical about just how much of the problem can be solved by expanded standards—and how much is a result of human nature and incentives in the technology sector. “We tend to rush and enjoy advances in technology, then deal with security problems later on or when they become serious,” says Alsmadi.

References:

Communications of the ACM, June 2023, Vol. 66 No. 6, Pages 14-16

2022 State of Operational Technology and Cybersecurity Report, Fortinet, Jun. 21, 2022, https://bit.ly/3G6HTDO

IoT Standards and Protocols Explained, Behrtech, https://behrtech.com/blog/iot-standards-and-protocols-explained

Number of IoT connected devices worldwide 2019–2021, with forecasts to 2030, Statista, Nov. 22, 2022, https://www-statista-com.libproxy.scu.edu/statistics/1183457/iot-connected-devices-worldwide

CEA-Leti RF Chip Enables Ultralow-Power IoT Connectivity For Remote Devices Via Astrocast’s Nanosatellite Network

CEA, a technology-research organization, and Astrocast, a leading global satellite Internet of Things network operator, have announced their successful collaboration on a low-cost, bidirectional communication module that enables corporations to communicate with their remote assets in areas not covered by terrestrial networks.

The module’s L-band chip, based on a new architecture developed by CEA-Leti, is a key hardware component that enables Astrocast customers to cost-efficiently communicate with their assets in the field via its network. It was completed earlier this year in an expedited project between the research institute and Astrocast, and is embedded in Astrocast’s RF module, called Astronode S.

The chip’s architecture is split over the RF core and digital processing and control units. It is fully optimized to support Astrocast’s dedicated bidirectional ground-to-satellite protocol and provides an optimal trade-off between link budget and low-power and low-cost constraints. The chip also embeds all low-earth orbit (LEO), satellite-specific features such as satellite detection and robustness to Doppler shift.

The miniaturized, surface-mount module communicates with terrestrial devices via Astrocast’s constellation of LEO satellites. Using the L-band spectrum, the network primarily targets maritime, oil & gas, agriculture, land transport and environmental applications in which ubiquitous coverage is required.

“Terrestrial IoT networks cover only about 15 percent of the planet, which leaves vast remote and rural areas where our global satellite network provides coverage that is crucial for our target markets,” said Laurent Vieira de Mello, Astrocast’s COO. “Leveraging its expertise embedded in a preliminary version of the RF chip, CEA-Leti developed its chip and delivered the final prototype to meet our requirements and time-to-market goals. They managed the chip technology transfer to our industrialization, qualification and production partner.”

The project’s critical time-to-market window was managed through a flexible collaboration model covering both prototype and industrialization phases.

“An accelerated time-to-market goal drove this project from the outset,” said Michel Durr, business development manager at CEA-Leti. “We pioneered this RF technology in 2019, and our team customized it for Astrocast up to production in only three years.”

CEA-Leti’s industrial tester used for characterization was key to accelerating from prototype to production, which enabled prototype characterization in parallel on the tester and in the lab, Durr explained.

“This process provided a short-loop debug capability with all skills available at CEA-Leti, and enabled us to deliver fully validated inputs to Astrocast’s industrialization partner for an easier industrial test-program development,” he said.

The low-energy, compact, surface-mount Astronode S module for highly integrated, battery-powered IoT systems offers a total cost of ownership up to three times lower than traditional satellite IoT alternatives.

References:

Hiber in deal with Shell for remote IoT monitoring of wells via HiberHilo

Dutch satellite asset tracking start-up Hiber has signed an agreement with Royal Dutch Shell to provide worldwide well monitoring systems. The global framework agreement will allow all Shell entities and subsidiaries to use the HiberHilo product worldwide for Industrial IoT applications.

HiberHilo, launched in October 2020, is an end-to-end IoT system that makes adds data and security to monitoring. Based on satellite technology, the system will enable oil and gas companies to measure real-time well temperature and pressure at disconnected wells in remote and offshore locations. HiberHilo is already installed in Shell operations in the North Sea. Shell is considering using HiberHilo for various operations in Africa, the Middle East and Southeast Asia.

“After testing HiberHilo, the opportunity was clear,” said Ian Taylor, Global Principal Technical Expert for well integrity at Shell. Operations in South-east Asia, the Middle East, and Africa are considering HiberHilo.

“HiberHilo is a simple solution to help oil and gas companies improve safety, optimize operations, and reduce their environmental footprint,” said Coen Jansen, Hiber’s Chief Strategy Officer. “We’re thrilled to be working with Shell toward a technologically cleaner future. Hiber’s mission is connecting everything everywhere to deliver productivity and sustainability in global industrial IoT,” he added.

Shell plans to use HiberHilo to reduce travel to and from wells in remote locations. The system will also let the company to gain more data on their well performance and better monitor well integrity issues, improving the safety of remote and offshore oil and gas wells.

Image Credit: Hiber Global

Hiber, founded in 2016 in the Netherlands, designs, builds and operates end to end solutions for the Internet of Things, focused on industrial uses such as well integrity or heavy equipment monitoring. The company is working on a network of 50 satellites aimed at making the ‘Internet of Things’ available all over the world. Its Hiberband network is described on their webpage as follows:

Hiberband is the world’s first LPGAN (Low Power Global Area Network) and it changes everything. It’s low cost thanks to using tiny nano satellites at a low orbit of just 600km above Earth. Unlike traditional satellite and cellular operators who launch gigantic, super expensive satellites at 60x higher with much higher costs.

Low orbit also means low power with modem batteries lasting 5-10 years. Just one of many factors that make experimenting with Hiberband-enabled devices a developer’s dream. We’ve even secured priority on our own dedicated frequency. Which is why everyone at Hiber believes Hiberband is the future of IoT connectivity.

Hiber acquired a new space permit in July 2020. On 29 February, the company launched a second-generation satellite into orbit through a SpaceX launch. A second Soyuz rocket launch followed in March. At the end of March, Hiber received an investment of 26 million EUROs to further expand its IoT satellite network. The funding came from the European Innovation Council Fund (EIC Fund), the EU’s innovation agency, which has a €278 million Innovation Fund. The EIC co-invested with an innovation credit provided by the Dutch government and existing shareholders. Other investors include Finch Capital, Netherlands Enterprise Agency and Hartenlust Group. Hiber’s satellite constellation tracks and monitors machines and devices in harder-to-reach places.

References:

https://hiber.global/press/hiberhilo-shell-deal/

https://www.telecompaper.com/news/hiber-signs-iiot-agreement-with-shell–1397276

Hiber signs deal with Shell for remote IoT well monitoring system

Shell hands major IoT contracts for oil well and refinery monitoring to Dutch startups

IoT satellite network startup Hiber secures €26M in funding round led by EU’s innovation agency

https://hiber.global/press/hiberhilo-wts-venture/

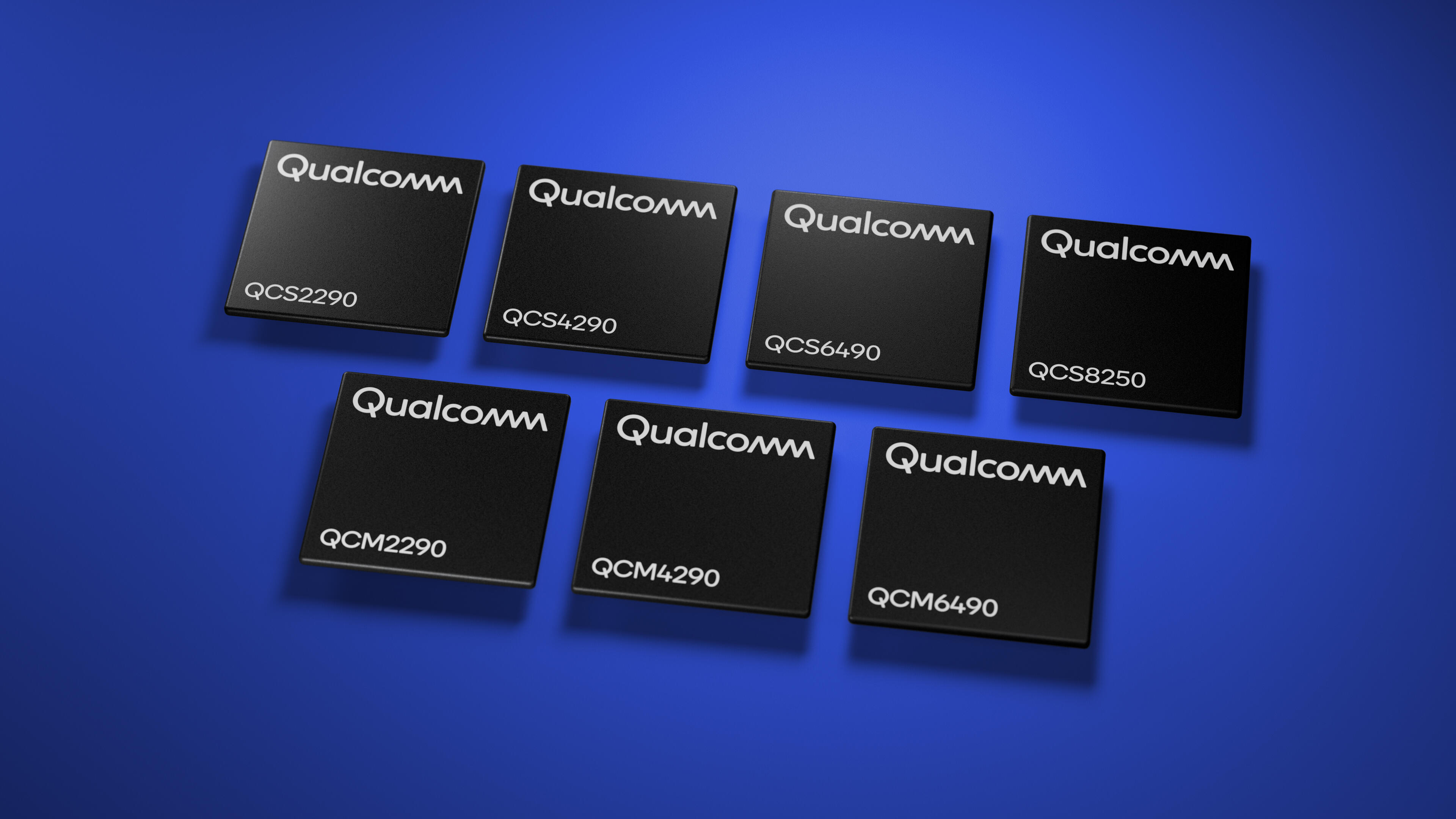

Qualcomm introduces 7 new chips to power IoT installations

Qualcomm has released a new range of cellular connectivity modules for IoT devices. The seven new products range from entry-level to premium tier to expand access to a variety of industrial and commercial applications, including transportation and logistics, warehousing, video collaboration, smart cameras, retail and healthcare.

Qualcomm’s senior director of product management Nagaraju Naik said that the new chips are a comprehensive offering from entry-level to high-end products that meet the needs of a broad range of IoT solutions. Naik said that the high-end chips in particular will support video collaboration with support for high-resolution cameras and image signal processing for electronic pan, tilt and zoom actions.

“Within the Internet of Things ecosystem, there are a variety of segments going through digital transformation, whether its retail or warehouse management or the shipping industry. Collaboration is yet another significant segment. These products that we’re introducing are going to enable a lot of those applications,” Naik said.

“Smart cart is actually bringing the point-of-sale experience or the checkout experience into the cart. So, you have cameras that can detect what (merchandise) is being picked by the consumer, and then right on the cart you have point-of-sale ability. Companies need highly capable cameras and AI compute capability and connectivity to provide these services,” Naik added.

The chips can support a variety of activities, according to the company, including:

- Integrated connectivity

- Sensor fusion

- Person identification and detection

- Object detection

- Edge interaction

- Activity analysis

- Personalization

Naik said the chips also can support modern warehouse management from inventory management to package delivery to driver safety and productivity. In a warehouse environment, the entry-level chip can power the handheld device for managing inventory while the high-end chip can run the robot that pulls items. “All of these scenarios can be supported with the family of products we are introducing today,” Naik said.

Qualcomm also has promised extended life hardware and software options for a minimum of eight years for the new products. All of the new chips are available now except the QCM 6490.

The Qualcomm QCS8250 is the premium-tier offering, optimized to enable maximum performance at the greatest power efficiency possible for intensive AI at the edge. It comes with support for Wi-Fi 6 and 5G, with the Qualcomm Kryo 585 CPU architecture, latest Qualcomm AI Engine and an image signal processor to support up to 7 concurrent cameras with 4K resolution at 120 frames per second. The new Neural Processing Unit supports AI and machine learning for products such as smart cameras, video collaboration, AI hubs, connected healthcare and smart retail.

The next tier is the Qualcomm QCS6490 and QCM6490, also with global 5G connectivity and Wi-Fi 6E, and available from the second half of this year. These come with the Kryo 670 CPU architecture targeting industrial and commercial IoT applications such as transportation, warehousing, connected healthcare, logistics management and POS kiosks. The models can support triple ISPs and advanced edge-AI based on the 6th generation Qualcomm AI Engine.

The Qualcomm QCS4290 and QCM4290 are aimed at mid-tier devices, running the Kryo 260 CPU and 3rd generation Qualcomm AI Engine. This platform supports LTE Cat13 and is ready for upgrade to Wi-Fi 6.

For the entry-level market, the company has the Qualcomm QCS2290 and QCM2290 with LTE connectivity and memory support for low power consumption. Equipped with the Cortex A53 CPU architecture, this cost-effective solution is aimed at retail point-of-sale, industrial handheld, tracking and camera applications.

Customers supporting the new modules include Arrow Electronics, Zebra, Amtran, EInfoChips, Honeywell, Fibocom, Lanotronix and Quectel.

References:

Gartner: 5G IoT endpoints to triple between 2020 and 2021; Surveillance cameras to be largest market over next 3 years

Executive Summary:

After 3GPP release 16 has been completed and included in IMT 2020 RIT/SRIT, 5G networks will offer ultra-reliable, ultra-low-latency and high-bandwidth capabilities. That will open up new enterprise market opportunities for communications service providers/wireless network operators. Therefore, understanding the future market is key to an effective strategy. Gartner Inc. says that IoT use cases like surveillance cameras and connected cars will offer the biggest markets for 5G IoT.

| Segment | 2020

Volume |

2020

Market Share (%) |

2023

Volume |

2023

Market Share (%) |

| Connected cars — embedded (consumer and commercial) |

393 |

11 |

19,087 |

39 |

|

Outdoor surveillance cameras |

2,482 |

70 |

15,762 |

32 |

|

Fleet telematics devices |

135 |

4 |

5,146 |

11 |

|

In-vehicle toll devices |

50 |

1 |

1,552 |

3 |

|

Emergency services |

61 |

2 |

1,181 |

2 |

|

Others |

400 |

11 |

5,863 |

12 |

|

Total |

3,522 |

100 |

48,590 |

100 |

Due to rounding, figures may not add up precisely to the totals shown

Source: Gartner (October 2019)

Connected Cars Will Offer the Biggest Opportunity for 5G IoT in the Long Term:

In 2023, the automotive industry will become the largest market opportunity for 5G IoT solutions. It will represent 53% of the overall 5G IoT endpoint opportunity in that year.

Within the automotive sector, embedded connected-car modules are the major use case for 5G. Embedded endpoints in connected cars for commercial and consumer markets will represent an installed base of 19.1 million units out of a total of 25.9 million 5G endpoints in the automotive sector in 2023.

“The addressable market for embedded 5G connections in connected cars is growing faster than the overall growth in the 5G IoT sector,” said Ms. Baghdassarian. “Commercial and consumer connected-car embedded 5G endpoints will represent 11% of all 5G endpoints installed in 2020, and this figure will reach 39% by the end of 2023.”

In addition, the share of 5G-connected cars actively connected to a 5G service will grow from 15% in 2020 to 74% in 2023. This figure will reach 94% in 2028, when 5G technology will be used for Cellular V2X communications that enable messages to be sent and received within vehicles and between vehicles, infrastructure, pedestrians, cyclists and more. Ultimately, connected cars actively connected to a 5G service will help keep traffic moving and improve road safety.

“As the automotive industry will be the largest sector for IoT endpoints and 5G IoT use cases in the long term, we recommend that CSPs that want to be relevant in the 5G IoT market put this industry at the forefront of their investments. They should do this in terms of personnel who understand the sector and of partnerships that will move the market forward,” said Ms. Baghdassarian.

Other Analyst and Industry Opinions:

“The industrial IoT market is among the most fractured especially amongst the verticals like healthcare and automotive,” said Lee Doyle, principal analyst with Doyle Research. “Large companies such a Cisco, HP and IBM have been challenged to address it because it is so fractured. It’s not at all clear any one of them has the overall network architecture to handle it all.” Vendors need to show users on a case-by-case, application-by-application basis what works, Doyle said.

…………………………………………………………………………………………………………………………………………………………………………………………………………

“With 5G, you can put more video cameras up in a big facility to monitor where folks are going and what they’re doing. Then bring analytics into the picture to increase efficiency. Speed really matters when you’re adding that many cameras,” said Samsung Networks’ VP of Networks Strategy & Marketing Alok Shah.

Shah believes the most “magical” element of 5G for enterprise users is decreased latency (so does this author, but it won’t happen till 3GPP Release 16 is finalized). “Bringing latency down substantially allows the user to perform from a remote perspective much more. Robotics in factories can be manipulated without being there in person,” he elaborated.

In addition, with 5G, the number of IoT sensors that can be implemented can skyrocket. “It can go up to a million sensors around a facility, which is huge,” Shah stated. “It’s a combo of these different things. You don’t get all of this at once because different devices have different requirements, but network slicing will help with this,” Shah added.

……………………………………………………………………………………………………………………………………………………………………

Ericsson’s new 5G business potential report considers a set of “5G-enabled B2B use case clusters” as drivers of industrial 5G revenues. Among these use case clusters, it said “enhanced video services” represents the largest opportunity for telecoms providers in terms of value across industrial sectors, worth up to 17 per cent or $118 billion of the total value by 2030.

Ericsson said enterprise 5G services will drive up to $700 billion of new revenues in the period. However, the total market, of 5G services for industry will be worth more than twice that, it said. The $700 billion operators can go for corresponds to 47 per cent of the total 5G business-to-business (B2B) market to be served by ICT players. Network operators must extend their reach “beyond connectivity” and consider newer roles for their services and expertise within the B2B value chain, and “what use case clusters to address.” Operators must act urgently, Ericsson warned, if they are to capture new value from industrial transformation services, as revenues for existing airtime services will remain stagnant through to 2030.

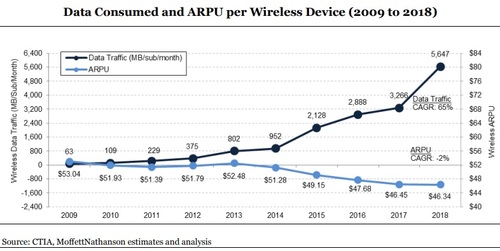

The chart below superbly illustrates the dire dilemma of network operators- traffic increasing exponentially, revenues (measured by ARPU) decreasing!

Jan Karlsson, senior vice president and head of B2B digital services at Ericsson, said: “The journey to grow the 5G business starts now by building momentum and identifying 5G-enabled B2B opportunities.”

Ericsson looked at the following industrial sectors for its report: manufacturing, automotive, energy and utilities, public safety, healthcare, media and entertainment, public transport, financial services, retail, and agriculture.

Other use cases in the report, besides enhanced video, include real-time automation, connected vehicles, and augmented/virtual reality. The company said use case examples building up these ‘clusters’ include live streaming of events, real-time monitoring of distributed energy, and autonomous cars.

–>Please refer to my comment in box below this article for more on the Ericsson report.

……………………………………………………………………………………………………………………………………………………………………

“Clearly there is no single access technology out there that solves all the problems and challenges of networking especially in the industrial arena where customers have one of every type of communications device imaginable, but 5G and Wi-Fi 6 will deliver a whole bunch of new use cases and address many multi-access requirement challenges,” said Liz Centoni, senior vice president and general manager of Cisco’s Internet of Things Business Unit, in an interview with Network World.

“Many industrial IoT use cases mandate wide mobility, low latency, and mission-critical reliability, such as mobile-robot control in production automation and autonomous vehicles in open-pit mining. These use cases rely on wireless access at 50ms to 1ms latency and service reliability from 5 nines to 6 nines,” Centoni wrote in a recent blog about 5G.

“4G/LTE has attempted to address these use cases but has often failed due to unsatisfactory performance. 5G’s combination of ultra-reliable and low-latency connection will extend industrial IoT to unconquered spaces,” Centoni.

Cisco’s Scott Harrell, senior vice president and general manager of enterprise networking told Network World the company expects to see a lot of 5G being used in branches as a faster backup and bandwidth alternative to current 4G or LTE links. Keeping an enterprise’s branch and campus locations all connected to each other and the internet has traditionally fallen to wired technologies like T1/E1 and xDSL, Harrell said. Today, 4G is often used to quickly bring up sites or as a back-up link, but it’s seldom used as a primary link, due to bandwidth limitations and cost, Harrell said.

https://www.networkworld.com/article/3446457/cisco-pushes-5g-to-hasten-industrial-iot.html

https://blogs.cisco.com/news/how-5g-will-accelerate-industrial-iot

https://www.ericsson.com/assets/local/5g/the-5g-for-business-a-2030-compass-report-2019.pdf