IT infrastructure spending

Gartner: Gen AI nearing trough of disillusionment; GSMA survey of network operator use of AI

Global IT spending is expected to total $5.61 trillion in 2025, an increase of 9.8% from 2024, according to the latest forecast by Gartner, Inc.

“While budgets for CIOs are increasing, a significant portion will merely offset price increases within their recurrent spending,” said John-David Lovelock, Distinguished VP Analyst at Gartner. “This means that, in 2025, nominal spending versus real IT spending will be skewed, with price hikes absorbing some or all of budget growth. All major categories are reflecting higher-than-expected prices, prompting CIOs to defer and scale back their true budget expectations.”

GenAI will Influence IT Spending, but IT Spending Won’t Be on GenAI Itself:

Segments including data center systems, devices and software will see double-digit growth in 2025, largely due to generative AI (GenAI) hardware upgrades (see Table 1). However, these upgraded segments will not differentiate themselves in terms of functionality yet, even with new hardware.

Table 1. Worldwide IT Spending Forecast (Millions of U.S. Dollars)

2024 Spending |

2024 Growth (%) |

2025 Spending |

2025 Growth (%) |

|

| Data Center Systems | 329,132 | 39.4 | 405,505 | 23.2 |

| Devices | 734,162 | 6.0 | 810,234 | 10.4 |

| Software | 1,091,569 | 12.0 | 1,246,842 | 14.2 |

| IT Services | 1,588,121 | 5.6 | 1,731,467 | 9.0 |

| Communications Services |

1,371,787 |

2.3 | 1,423,746 | 3.8 |

| Overall IT | 5,114,771 | 7.7 | 5,617,795 | 9.8 |

Source: Gartner (January 2025)

“GenAI is sliding toward the trough of disillusionment which reflects CIOs declining expectations for GenAI, but not their spending on this technology,” said Lovelock. “For instance, the new AI ready PCs do not yet have ‘must have’ applications that utilize the hardware. While both consumers and enterprises will purchase AI-enabled PC, tablets and mobile phones, those purchases will not be overly influenced by the GenAI functionality.”

Spending on AI-optimized servers easily doubles spending on traditional servers in 2025, reaching $202 billion dollars.

“IT services companies and hyperscalers account for over 70% of spending in 2025,” said Lovelock. “By 2028, hyperscalers will operate $1 trillion dollars’ worth of AI optimized servers, but not within their traditional business model or IaaS Market. Hyperscalers are pivoting to be part of the oligopoly AI model market.”

Gartner’s IT spending forecast methodology relies heavily on rigorous analysis of the sales by over a thousand vendors across the entire range of IT products and services. Gartner uses primary research techniques, complemented by secondary research sources, to build a comprehensive database of market size data on which to base its forecast.

More information on the forecast can be found in the complimentary Gartner webinar “IT Spending Forecast, 4Q24 Update: GenAI’s Impact on a $7 Trillion IT Market.”

………………………………………………………………………………………………………….

Gartner’s 2025 forecast for IT spending is consistent with the market research firm’s predictions from late last year that the move to AI is driving a surge in spending on data center infrastructure and IT services in Europe. IT spending across the continent will come in at US$1.28 trillion in 2025 they said. Presumably it takes a little longer to gather up the data necessary for predictions across the whole world.

……………………………………………………………………………………………………

Separately, Citi analysts expect 2025 growth to be largely driven by continued AI spending as data center capital expenditure for the biggest cloud service providers is forecasted to increase by 40% this year.

……………………………………………………………………………………………………

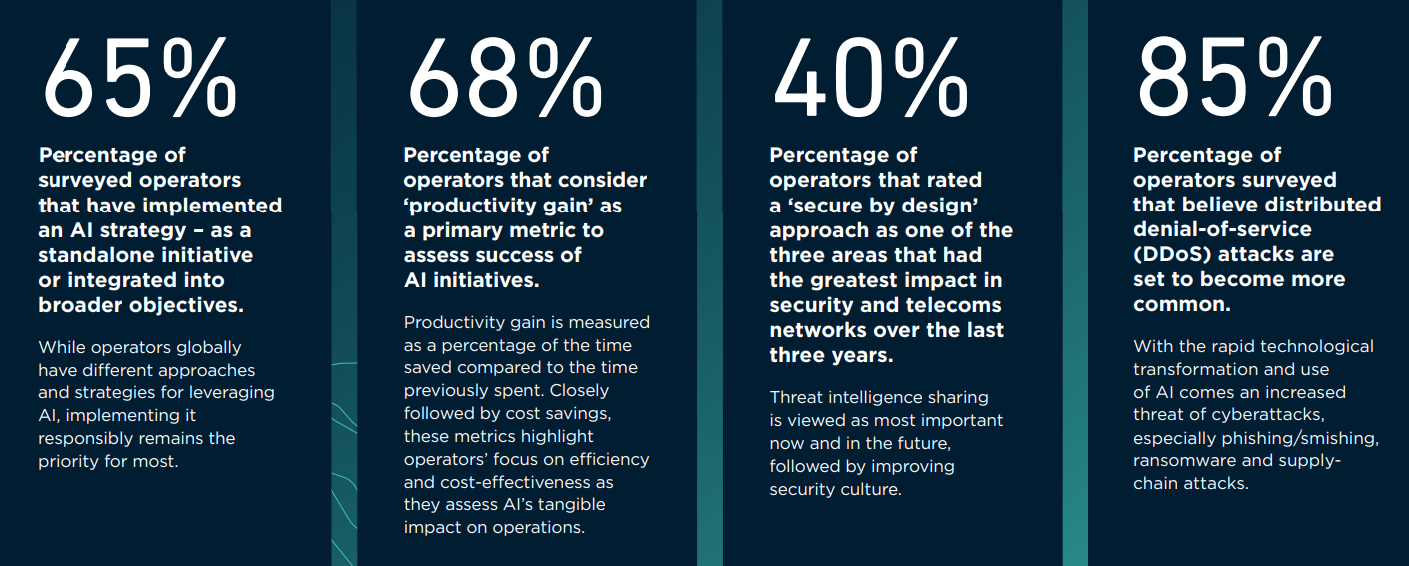

In a recent survey of network operators, GSMA found that telcos are allocating more resources to in-house and out-of-house AIs capabilities and projects, but only a subset are spending more than 15% of their digital budgets on AI. Nearly half of operators are dedicating 5% to 15% of their digital budgets towards AI, covering a range of categories, including data systems, large language models and infrastructure upgrades, the GSMA survey found. That AI money is also being allocated toward AI teams, tools and partnerships, said GSMA. The association, which primarily represents mobile operators, has been asked for more details about the size, scope and methodology of its latest study.

AI Status at Network Operators:

References:

Will billions of dollars big tech is spending on Gen AI data centers produce a decent ROI?

Canalys & Gartner: AI investments drive growth in cloud infrastructure spending

AI Echo Chamber: “Upstream AI” companies huge spending fuels profit growth for “Downstream AI” firms

AI wave stimulates big tech spending and strong profits, but for how long?

Telco spending on RAN infrastructure continues to decline as does mobile traffic growth

Synergy Research: Growth in Hyperscale and Enterprise IT Infrastructure Spending; Telcos Remain in the Doldrums

Hyperscale cloud companies are spending more and more money on Capex IT infrastructure compared with the largest telecommunication companies as overall IT infrastructure spending in 2022 reached $700 billion. In 2022, hyperscale operators spent roughly $200 billion on Capex IT infrastructure such as network switches and data center hardware and software, representing a 9 percent increase annually and led by Amazon, Google and Microsoft, according to new data from IT market research firm Synergy Research Group.

Comparatively, telecom spending on IT infrastructure by companies like Verizon, AT&T and China Mobile dropped 4 percent in 2022 to approximately $290 billion, Synergy Research Group reported.

Hyperscale operator share of total spending has continued to rise steadily over the last few years, as continued growth in cloud and other digital services drive ever-higher spending levels. Telco spending remains heavily crimped by lack of meaningful growth in their revenue streams. Enterprise spending has also bounced back in the last two years after a soft spell in 2019 and 2020. The main drivers in the enterprise have been the continued long-term growth of hosted and cloud collaboration solutions, increased spending on network security, and a post-pandemic bounce back for both enterprise data centers and switches. In some segments, higher ASPs have also contributed, as cost increases due to supply chain issues are passed on to the customers of tech vendors.

Telcos remain locked in a low-to-no-growth world and their Capex reflects that. For hyperscale operators, the boom in cloud services and continued growth in other digital services is driving ongoing growth in spending. Telecom companies’ share of Capex IT infrastructure spending was 42 percent in 2022, down from 58 percent share in 2016. The largest telco spenders on technology infrastructure last year were China Mobile, Deutsche Telekom, Verizon, AT&T, NTT and China Telecom.

In 2022, hyperscale operators accounted for 29 percent share of the total Capex infrastructure spending market, up significantly from 13 percent share in 2016. Some of the biggest spenders in 2022 were Amazon, Apple, Google, Microsoft and Alibaba.

Overall spending by both fixed and mobile telco operators has been relatively flat over the past eight years, with annual spending levels for infrastructure hovering around $290 billion each year. Synergy market data covers total capital expenditure for telco and hyperscale operators mostly around networking and data center hardware and software.

The final market segment covered in Synergy’s new data is enterprise spending on IT infrastructure, which grew 9 percent year over year in 2022 to roughly $210 billion. The enterprise spend accounted for 29 percent of the total Capex infrastructure market in 2022.

“Enterprise spending has also bounced back a bit in the last two years after a soft spell in 2019 and 2020,” said Dinsdale. ince 2016, enterprise IT spending has grown by an average of over 6 percent annually. Synergy said to make the market data numbers more comparable, enterprise spending covers data center hardware and software, networking and collaboration tools. It excludes enterprise spending on communication and IT services, devices and business software.

“There has also been something of a post-pandemic bounce back for both enterprise data centers and switches, the former being helped by higher costs due to supply chain issues that are being passed on in the form of higher ASPs [average selling price],” said Dinsdale. “For equipment and software vendors, the good news is that overall IT infrastructure spending will continue to grow steadily over the next five years,” he added.

…………………………………………………………………………………………………………………………………………………………………………………………………..

About Synergy Research Group:

Synergy provides quarterly market tracking and segmentation data on IT and Cloud related markets, including vendor revenues by segment and by region. Market shares and forecasts are provided via Synergy’s uniquely designed online database SIA ™, which enables easy access to complex data sets. Synergy’s Competitive Matrix ™ and CustomView ™ take this research capability one step further, enabling our clients to receive on-going quantitative market research that matches their internal, executive view of the market segments they compete in.

Synergy Research Group helps marketing and strategic decision makers around the world via its syndicated market research programs and custom consulting projects. For nearly two decades, Synergy has been a trusted source for quantitative research and market intelligence.

To speak to an analyst or to find out how to receive a copy of a Synergy report, please contact [email protected] or 775-852-3330 extension 101.

…………………………………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.crn.com/news/cloud/cloud-provider-spend-on-it-capex-climbs-as-telecom-falls

Synergy Research: public cloud service and infrastructure market hit $126B in 1Q-2022

Synergy Research: Microsoft and Amazon (AWS) Dominate IT Vendor Revenue & Growth; Popularity of Multi-cloud in 2021

Synergy Research: Hyperscale Operator Capex at New Record in Q3-2020

Synergy Research: Strong demand for Colocation with Equinix, Digital Realty and NTT top providers