Multi-access Edge Computing (MEC)

DZS Inc: 2023 Telecom Trends & Applications Changing the Broadband Industry

by Geoff Burke, DZS Inc. (a global provider of access networking infrastructure, service assurance and consumer experience software solutions). Edited by Alan J Weissberger

There are a handful of significant trends that will emerge over the next several months as service providers navigate their transformation and seek to find their Competitive EDGE. This post will focus on the increasing shift to multi-gigabit services, the growing importance of the network edge and how service providers are being transformed into “experience providers..

- Multi-Gigabit Broadband Services are Becoming the New Standard – The shift to gigabit services was both widespread and well suited for Gigabit Passive Optical Networking (GPON) However, new advanced applications will require symmetrical multi-gigabit speeds. The proliferation of multiple devices using these bandwidth-hungry apps is pushing service providers to begin to think 10 gig services and beyond for both business and residential services. The emergence of the metaverse, with Ultra High Definition (UHD) Augmented Reality/Virtual Reality/Extended Reality (AR/VR/XR) and gaming applications will continue push these boundaries.

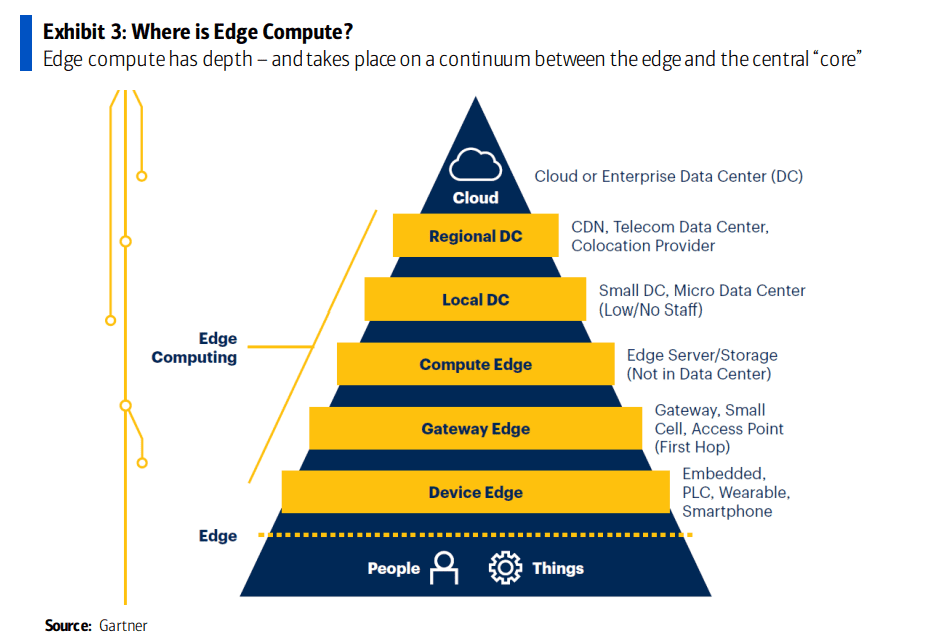

- The Network Edge Continues to Rise as a Strategic Location – The rise of 10 Gigabit Symmetrical (XGS)-PON and multi-gigabit services that support the above mentioned applications and more is creating new challenges in the network – especially as these apps require symmetrical bandwidth. Service providers realize that they must push equipment as close to the subscriber as possible to optimize traffic management, but also to minimize latency, which is becoming increasingly important in the world of the metaverse and AR/VR/XR apps. Additionally, leveraging intelligence at the edge moves it closer to where data is actually created and consumed and where the subscriber experience is defined giving service providers increased agility in monitoring, managing and optimizing performance.

- Service Providers are Rapidly Transforming into Experience Providers – As the network becomes increasingly software defined and intelligent equipment is deployed closer to the edge, the ability for carriers to both gather meaningful information that can reflect and provide actionable insights into user experience grows dramatically. As a result, the concept of a true “experience provider” is emerging where subscriber problems can be anticipated and proactively addressed, and user needs can be addressed remotely and immediately in an extraordinarily personalized manner. This transformation is proving to have profound impacts on carrier performance, with dramatically reduced churn, faster responsiveness, better performance, and higher Average Revenue Per User (ARPU).

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

DZS Inc says these Applications are Changing the Broadband Industry:

- Connected Home: WiFi everywhere

- Connected Business: Passive Optical LAN

- MDUs: delivering multi-gigabit services

- Multi-gigabit services: they are becoming a major source of differentiation for service providers

References:

https://dzsi.com/resources/blog/the-broadband-trends-that-will-define-2023-part-1/

Has Edge Computing Lived Up to Its Potential? Barriers to Deployment

Despite years of touting and hype, edge computing (aka Multi-access Edge Computing or MEC) has not yet provided the payoff promised by its many cheerleaders. Here are a few rosy forecasts and company endorsements:

In an October 27th report, Markets and Markets forecast the Edge Computing Market size is to grow from $44.7 billion in 2022 to $101.3 billion by 2027, which is a Compound Annual Growth Rate (CAGR) of 17.8% over those five years.

IDC defines edge computing as the technology-related actions that are performed outside of the centralized datacenter, where edge is the intermediary between the connected endpoints and the core IT environment.

“Edge computing continues to gain momentum as digital-first organizations seek to innovate outside of the datacenter,” said Dave McCarthy, research vice president, Cloud and Edge Infrastructure Services at IDC. “The diverse needs of edge deployments have created a tremendous market opportunity for technology suppliers as they bring new solutions to market, increasingly through partnerships and alliances.”

IDC has identified more than 150 use cases for edge computing across various industries and domains. The two edge use cases that will see the largest investments in 2022 – content delivery networks and virtual network functions – are both foundational to service providers’ edge services offerings. Combined, these two use cases will generate nearly $26 billion in spending this year (2022). In total, service providers will invest more than $38 billion in enabling edge offerings this year. The market research firm believes spending on edge compute could reach $274 billion globally by 2025 – though that figure would be inclusive of a wide range of products and services.

HPE CEO Antonio Neri recently told Yahoo Finance that edge computing is “the next big opportunity for us because we live in a much more distributed enterprise than ever before.”

DigitalBridge CEO Marc Ganzi said his company continues to see growth in demand for edge computing capabilities, with site leasing rates up 10% to 12% in the company’s most recent quarter. “So this notion of having highly interconnected data centers on the edge is where you want to be,” he said, according to a Seeking Alpha transcript.

Equinix CEO Charles Meyers said his company recently signed a “major design win” to provide edge computing services to an unnamed pediatric treatment and research operation across a number of major US cities. Equinix is one of the world’s largest data center operators, and has recently begun touting its edge computing operations.

……………………………………………………………………………………………………………………………………………………………..

In 2019, Verizon CEO Hans Vestberg said his company would generate “meaningful” revenues from edge computing within a year. But it still hasn’t happened yet!

BofA Global Research wrote in an October 25th report to clients, “Verizon, the largest US wireless provider and the second largest wireline provider, has invested more resources in this [edge computing] topic than any other carrier over the last seven years, yet still cannot articulate how it can make material money in this space over an investable timeframe. Verizon is in year 2 of its beta test of ‘edge compute’ applications and has no material revenue to point to nor any conviction in where real demand may emerge.”

“Gartner believes that communications and manufacturing will be the main drivers of the edge market, given they are infrastructure-intensive segments. We highlight existing use cases, like content delivery in communications, or

‘device control’ in manufacturing, as driving edge compute proliferation. However, as noted above, the market is still undefined and these are only two possible outcomes of many.”

Raymond James wrote in an August research note, “Regarding the edge, carriers and infrastructure companies are still trying to define, size and time the opportunity. But as data demand (and specifically demand for low-latency applications) grows, it seems inevitable that compute power will continue to move toward the customer.”

……………………………………………………………………………………………………………………………………………

BofA Global Research – Challenges with Edge Compute:

The distributed nature of edge compute can pose several risks to enterprises. The number of nodes needed between stores, factories, automobiles, homes, etc. can vary wildly. Different geographies may have different environmental issues, regulatory requirements, and network access. Furthermore, the distributed scale in edge compute puts a greater burden on ensuring that edge compute nodes are secured and that the enterprise is protected. Real-time decision making on the edge device requires a platform to be able to anonymize data used in analytics, and secure data in transit and information stored on the edge device. As more devices are added to the network, each one becomes a potential vulnerability target and as data entry points expand across a corporate network, so do opportunities for intrusion.

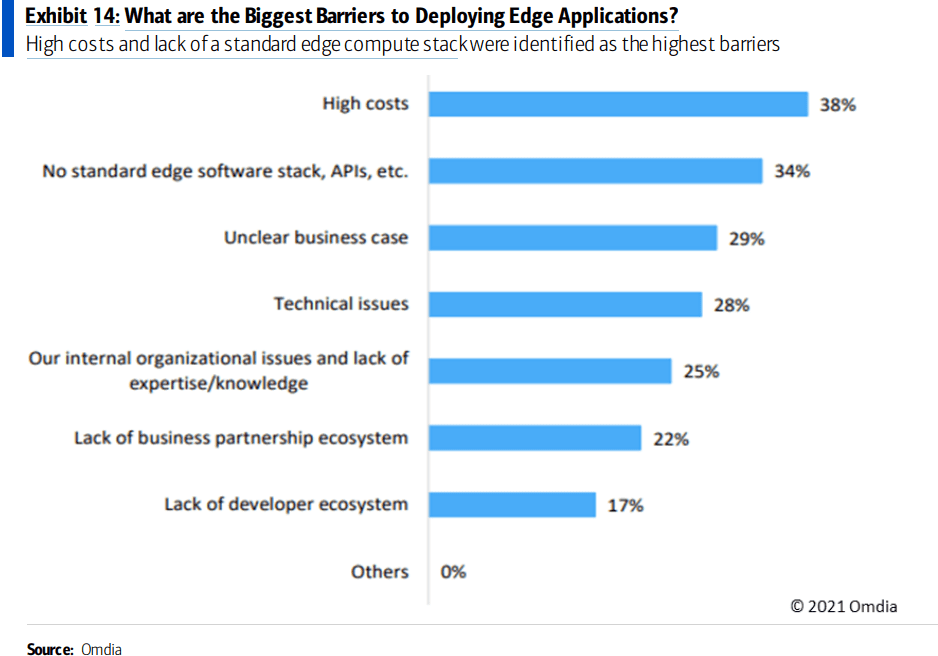

On the other hand, the risk is somewhat double-sided as some security risk is mitigated by keeping the data distributed so that a data breach only impacts a fraction of the data or applications. Other barriers to deploying edge applications include high costs as a result of its distributed nature, as well as a lack of a standard edge compute stack and APIs.

Another challenge to edge compute is the issue of extensibility. Edge computing nodes have historically been very purpose-specific and use-case dependent to environments and workloads in order to meet specific requirements and keep costs down. However, workloads will continuously change and new ones will emerge, and existing edge compute nodes may not adequately cover additional use cases. Edge computing platforms need to be both special-purpose and extensible. While enterprises typically start their edge compute journey on a use-case basis, we expect that as the market matures, edge compute will increasingly be purchased on a vertical and horizontal basis to keep up with expanding use cases.

References:

The Amorphous “Edge” as in Edge Computing or Edge Networking?

Edge computing refuses to mature | Light Reading

Multi-access Edge Computing (MEC) Market, Applications and ETSI MEC Standard-Part I

ETSI MEC Standard Explained – Part II

Lumen Technologies expands Edge Computing Solutions into Europe