SD-WAN

Dell to offer SD-WAN service based on VMware Velocloud platform

Dell Technologies announced it has started offering a co-branded SD-WAN service with its affiliate VMware, based on the latter’s VeloCloud platform. Previewed at Dell Technologies World in May, the new service is now globally available and supported.

This Dell EMC SD-WAN Solution combines VMware SD-WAN by VeloCloud with modern appliances in multiple configuration options. The service is backed by Dell EMC support, supply chains, and services.

“Dell EMC and VMware are rebuilding the network for the cloud era – with everything open, automated and software-defined,” said Tom Burns, senior vice president & general manager, Dell EMC Networking & Solutions. “New SD-WAN solutions powered by VMware and network fabric management delivered by SmartFabric Director raise the stakes when it comes to network virtualization and security in today’s highly-distributed software-defined enterprise. We’re just getting started on our combined innovation.”

Collaboration between Dell EMC and VMware to:

- Re-define the network for the cloud era with tighter integration and combined development efforts

- Modernize network operations and reduce WAN costs with new Dell EMC SD-WAN Solution – one-stop solution combining VMware SD-WAN by VeloCloud, Dell EMC managed infrastructure

- Simplify data center fabric deployment, operations through enhanced visibility across virtual and physical networks with new Dell EMC SmartFabric Director

Customers have a choice of public, private or hybrid cloud network for enterprise-grade connection to cloud and enterprise applications; branch office enterprise appliances and optional data center appliances; software-defined control and automation; and virtual services delivery. Software subscription options can be upgraded to accommodate changing business requirements for features, duration and bandwidth.

The Dell EMC SD-WAN Solution has three key components:

- SD-WAN Edge powered by VMware – networking specific, purpose-built appliances designed for high efficiency and reliability

- SD-WAN Orchestrator – cloud-based management and orchestration software services from VMware, managed by Dell EMC

- SD-WAN Gateways – a global network of more secure, application-focused access gateways from VMware to handle WAN traffic

At VMworld, Dell EMC and VMware also announced SmartFabric Director, for software-defined networking that enables the physical switch underlay infrastructure to keep pace with the changing demands of virtualized and software-defined networks. Dell EMC SmartFabric Director enables data center operators to build, operate and monitor an open network underlay fabric based on Dell EMC PowerSwitch Series switches.

The Dell EMC SmartFabric Director is a network orchestration solution jointly developed with VMware that enables organizations to synchronize the deployment of a physical switch fabric with the virtual network and gain comprehensive visibility at both the physical and virtual network layers. Organizations can then potentially configure the network fabric in significantly less time than traditional methods. When integrating the SmartFabric Director with VMware vCenter or NSX/NSX-T, organizations can achieve end-to-end visibility of the physical network and all supported virtual overlays. To help organizations continuously monitor fabric health, SmartFabric employs telemetry to collect switch operational data and display metrics graphically at both the network fabric and switch levels. SmartFabric Director extends the two related companies’ shared vision of a software-defined data center by simplifying the definition, creation and deployment of data center fabrics with intent-based auto-provisioning and enhanced visibility and management between virtual and physical network environments.

Key features include:

- VMware vSphere and VMware NSX-T Data Center Integration – Tight integration with VMware vCenter and NSX-T enables the physical underlay/fabric to be correctly provisioned for the smooth functioning of application workloads in a VMware software-defined data center

- Leaf/Spine Fabric Automation – SmartFabric Director uses a declarative model that allows the user to express intent with a set of three well-defined fabric types. Fabric discovery is an ongoing process and ensures that the wiring is consistent with the user-defined intent and removes guesswork for rapid auto-provisioning

- Fabric Visibility – SmartFabric Director supports highly scalable and flexible streaming telemetry to gather key operational data and statistics from the fabric switches. Comprehensive, highly-intuitive visualization of the time-series data and other information greatly simplifies day-to-day fabric operations

- Fabric Lifecycle Management – Upgrading switch images is a critical operation in a data center. SmartFabric Director automates the download, install and verification process and ensures that switches are upgraded with the correct images

Dell said that this new service is important for organizations that are using the network virtualization version of SDN [1.] and need to help make sure their physical underlay networks are finely tuned for their overlay network environment. A lack of visibility between the two layers can lead to provisioning and configuration errors, hampering network performance. The new product will be available worldwide in September.

Note 1. The classical version of SDN, with a centralized controller and packet forwarding engines replacing hop by hop IP routers never really gained critical market mass, despite claims by Guru Parulkar, PhD, that everything else was “SDN WASHING.”

Supporting Quotes:

“Our customers today expect us to deliver the best and most advanced network solutions to solve their business needs,” said QOS Networks CEO, Frank Cittadino. “As a trusted partner to Dell EMC, we’re excited to do that with an SD-WAN solution that marries cost effective hardware with a dedicated orchestrator and VMware gateway. We combine that with our 5-Tool monitoring and management platform.”

“ESG was impressed with how the Dell EMC SmartFabric Director can help organizations to gain comprehensive visibility into the physical and virtual layers of their core networks and ensure that they are synchronized,” said Bob Laliberte, senior analyst, ESG Research. “We see how the SmartFabric Director can significantly ease the time-consuming process of creating and deploying a network fabric, while simultaneously verifying it will operate as intended.”

“VMware and Dell EMC are driving public cloud simplicity and utility across the entire network,” said Tom Gillis, senior vice president and general manager, networking and security business unit, VMware. “With this new SD-WAN solution, Dell EMC customers will be able to leverage the industry’s only hyperscale architecture for SD-WAN deployed at thousands of customers and more than 150,000 locations globally. Our joint engineering on SmartFabric Director will offer customers a tightly-integrated solution for physical to virtual networking visibility, further simplifying network operations and troubleshooting.”

Additional Resources:

- Dell EMC Networking

- ESG Research Lab: SmartFabric Director First Look report: Read how it can help build simple, efficient and open fabrics for VMware virtual network deployments

- ESG Research Lab video: Watch Bob Laliberte from ESG discuss the reasons why customers will want to use SmartFabric Director

- Dell Technologies video: A quick conversation about SD-WAN solutions with networking leaders Tom Burns (Dell EMC) & Tom Gillis (VMware)

Reference:

MEF SD-WAN Service Standard Now Publicly Available; ITU-T SD-WAN Work a Dead End?

After incorporating extensive feedback from service providers and technology vendor members, MEF is now moving the draft SD-WAN Service Attributes and Services standard (MEF 70) through the last phase of MEF membership and Board approval. The document is available for download here.

“MEF’s team of SD-WAN experts has worked overtime to develop a robust and timely industry standard following multiple rounds of in-depth peer review,” said Pascal Menezes, CTO, MEF. “We will officially publish MEF’s SD-WAN service standard by mid-July 2019, but we are making the final draft publicly available now because broad industry alignment on common terminology will be healthy for market growth.”

MEF’s SD-WAN service definition standard describes requirements for an application-aware, over-the-top WAN connectivity service that uses policies to determine how application flows are directed over multiple underlay networks irrespective of the underlay technologies or service providers who deliver them.

SD-WAN service relies on two or more network connections, directing traffic over one connection or the other based on pre-defined parameters, traffic levels and other variables. For example, a company might use an MPLS VPN and a direct internet connection, with mission-critical traffic routed over the MPLS connection, while less critical traffic travels over the internet connection.

MEF defines the SD-WAN UNI, or User to Network Interface, as the point of demarcation between the service provider network and the enterprise network, determining where each party’s functionality and responsibility ends. SD-WAN Edge defines the services available on the customer premises, which could be available through on-premises equipment or in the cloud. And the Underlying Connectivity Service, or UCS, is the underlay wide-area network, typically MPLS, LTE, cable broadband — likely in combination — and possibly from multiple vendors. Additionally, MEF defines the Tunnel Virtual Connection (TVC) as overlay tunnels that are built over the UCS, which provide interconnects between locations.

In summary, the MEF SD-WAN service standard introduces four relevant SD-WAN terms:

- SD-WAN UNI (user-network interface)

- SD-WAN Edge, where SD-WAN functionality is achieved, which could be a physical or virtual appliance such as a virtual network function in the cloud

- Underlay connectivity service (UCS), which is the wide area network service such as MPLS or IP

- Tunnel virtual connection (TVC), the connection created over the underlay network

SD-WAN Service Constructs:

Standardization will enable a wide range of ecosystem stakeholders to use the same terminology when buying, selling, assessing, deploying, and delivering SD-WAN services. The SD-WAN service definition is a foundational step for accelerating sales, market adoption, and certification of MEF 3.0 SD-WAN services orchestrated across a global ecosystem of service provider networks.

Next Steps for SD-WAN Service Standardization:

MEF already has begun work on the next phase of SD-WAN standardization (MEF 70.1), which covers more complex service attributes related to application business importance and prioritization, underlay network characteristics, and connectivity to private/public cloud services consistent with market priorities for SD-WAN services. MEF also is progressing standards work focused on LSO (Lifecycle Service Orchestration) APIs, application security, and intent-based networking for SD-WAN services.

Pilot MEF 3.0 SD-WAN Service Certification:

MEF remains on track to launch its pilot MEF 3.0 SD-WAN Service Certification program in 2019. This certification will test a set of service attributes and their behaviors defined in the SD-WAN standard and described in detail in the upcoming MEF 3.0 SD-WAN Service certification Blueprint. Service and technology companies interested in participating in the pilot should contact [email protected]

……………………………………………………………………………………………………………………

Read more at:

………………………………………………………………………………………………………………………………………………………………………………………..

ITU-T SD-WAN work item:

ITU-T has a SD-WAN work item under study, but as far as I can tell, there is no output yet. The project is named Signalling Requirement for SD-WAN service.

| Summary: | SD-WAN is an ecosystem of hardware (including customer-premises equipment, such as edge devices), software (including controllers), and services that enables enterprise-grade WAN performance, reliability, and security in a variety of ways. This Recommendation specifies signalling requirements for SD-WAN service. The signalling is to support the dynamically set up and manage the enterprise WAN connections. |

The three contacts for this work all are from China Mobile. Following are highlights from an unapproved draft spec:

Introduction:

[ITU-T Editor’s note in September 2018] It is needed to provide the difference between two types of SD-WAN, one is provided by enterprise itself, the other one is provided by the carrier. This Recommendation address the latter. Contributions are invited.

- The SD-WAN services could be provided by two types of providers. One type is the enterprise and the other is carrier. This Recommendation addresses the latter. The main differences between the two types are shown as below:Network performance monitoring and statistic collection: The enterprise launched service is only able to monitor the performance parameters of its own end-to-end path. While the carrier launched service is capable of monitoring not only the enterprise specific path but also the performance of the whole network. The over view of the network is more helpful for carrier to plan the end-to-end paths for thousands of enterprise as a whole.

- Service provision: when the path need to be switched over, the enterprises only has the authority to configure the CPE. If they need to change the path in core network, they have to ask the carrier to do so. In contrast, the service which is launched by carrier can be quickly changed by saving the communication time between enterprise and carrier.

ITU-T References:

The following ITU-T Recommendations and other references contain provisions which, through reference in this text, constitute provisions of this Recommendation. At the time of publication, the editions indicated were valid. All Recommendations and other references are subject to revision; users of this Recommendation are therefore encouraged to investigate the possibility of applying the most recent edition of the Recommendations and other references listed below. A list of the currently valid ITU-T Recommendations is regularly published.

The reference to a document within this Recommendation does not give it, as a stand-alone document, the status of a Recommendation.

[ITU-T Q.3300] Recommendation ITU-T Q.3300 (2014), Framework of software-defined networking;

[ITU-T Y.3011] Recommendation ITU-T Y.3011 (2012), Framework of network virtualization for future network.

AJW Comment: It doesn’t appear that this work item has made much progress recently.

……………………………………………………………………………………………………………………………………………………………………………………….

VSG: 2018 U.S. Carrier Managed SD-WAN LEADERBOARD

Vertical Systems Group defines a managed SD-WAN service as a carrier-grade network offering for enterprise and business customers, which is managed by a network operator, and delivered over a software-defined network (SDN) service architecture that has separate control (overlay) and data (underlay) planes.

SD-WAN is one of three managed VPN segments that Vertical Systems tracks, along with MPLS and site-to-site VPNs. The top-five carrier managed SD-WAN companies are also leading providers of dedicated IP VPN services, which included landline and satellite connectivity.

VSG Research Highlights:

SD-WAN is one of the three Managed VPN segments that Vertical tracks, along with MPLS and Site-to-Site VPNs. Service migration analysis shows that the majority of Carrier Managed SD-WAN service installations to date are hybrid configurations that include partial conversions of existing Site-to-Site and MPLS networks.

- The top five Carrier Managed SD-WAN companies are also the leading providers of Dedicated IP VPN services, including landline and satellite connectivity.

- A number of SDN-based technologies are utilized to deliver Carrier Managed SD-WAN services. The fourteen LEADERBOARD and Challenge Tier providers use products from the following companies (in alphabetical order): Cisco/Viptela, Silver Peak, Versa, and VMware/VeloCloud, or employ their own internally developed technologies. Several SD-WAN service providers offer multiple solutions.

The 14 leaderboard and challenge tier providers used SD-WAN technologies from Cisco/Viptela, Silver Peak, Versa Networks and VMware/VeloCoud or deploy their own internally developed technologies. Several SD-WAN service providers, such as AT&T, Verizon and CenturyLink, have multiple SD-WAN offerings.

https://www.verticalsystems.com/2019/05/21/2018-sd-wan-us-leaderboard/

SP Telecom deploys VeloCloud/VMware’s SD-WAN technology in Singapore

SP Telecom has launched Singapore’s first software-defined wide area network (SD-WAN). It’s based on VMware NSX SD-WAN by VeloCloud which VMware acquired last year. This will provide businesses with a low latency wide-area network that is automated and infrastructure-independent, to deliver robust and more secure networking services. Coupled with SP Telecom’s network management and consultancy services, this collaboration will expand SP Telecom offerings to meet growing customer demand to more securely run, manage, and connect any application from cloud to device.

The new SD-WAN services will provide businesses with the ability to automate and prioritize business-critical traffic to travel over faster, more secure connections, as well as set backup options for downed traffic links. This optimization of high traffic volume that enables near real-time access to rapidly changing data, is a key benefit crucial for mission-critical industries such as telecommunications, financial services, and the media and entertainment verticals.

In a multi-cloud era, where businesses operate in an increasingly complex environment, VMware NSX SD-WAN combined with SP Telecom’s diverse and utility-base data network provides simplicity, enabling greater flexibility to:

- support virtualized services from the cloud, connecting branch offices and mobile users to any type of data centers such as enterprise, cloud, or software-as-a-service;

- enable bandwidth expansion economically;

- provide optimal connectivity and access to the cloud and on-premises;

- accelerate new site deployments through zero-touch automated deployment.

SP Telecom’s data network is truly diverse, with network paths running along the Singapore power grid, enabling network resiliency for business-critical functions. Furthermore, this data network is enhanced with superior latency performance for more efficient processes. This reduces the risk of outage that could occur due to power or active equipment failure. Part of its network consultancy services, SP Telecom analyses and optimizes the network to deliver cost savings and efficiency. The connectivity and consultancy services, bundled with the new SD-WAN offering, will enable businesses to innovate fast and more securely by delivering robust performance for cloud applications, all through zero-touch deployment, the automation of network infrastructure implementation. Velocloud says their SD-WAN reduces the branch office footprint with a single click with seamless insertion and chaining of virtualized services on premise and in the cloud.

SP Telecom has more than 1M km of fiber connecting more than 100 sub-stations (data centers and commercial buildings) in Singapore as per this graphic:

Figure above courtesy of SP Telecom

……………………………………………………………………………………………………………………………………………………………………………………

“Smart and discerning businesses are competing to offer differentiated end-user experiences, and with advanced connectivity, they can go-to-market quickly and roll out new innovations to meet the changing demands of customers,” said Titus Yong, Chief Executive Officer of SP Telecom. “This is precisely why we are enhancing our portfolio with VMware’s NSX SD-WAN on VeloCloud, a game-changer that will provide our enterprise customers with the best-in-class network infrastructure that they need to sharpen their competitive edge and win in a digital era.”

NSX SD-WAN is touted by Velocloud as the industry-leading SD-WAN solution. One that enables customers to deliver better cloud and application performance with full visibility, metrics, control, and automation of all devices and user endpoints, and lower overall costs. VMware NSX SD-WAN provides an extensible platform for enterprises and telcos to integrate both on-premise and cloud services under the same consistent business policy framework. It’s said to eliminate data center backhaul penalties with a cloud-ready network to provide an optimized direct path to public and private enterprise clouds.

“We are shifting from a model of data centers to centers of data at the network’s edge. This new networking approach, virtual cloud networking, is required to manage the hyper-distribution of applications and data,” said Sanjay K. Deshmukh, vice president and managing director, Southeast Asia and Korea, VMware. “By deploying VMware SD-WAN by VeloCloud as part of a Virtual Cloud Network, SP Telecom can provide enterprise customers with consistent, pervasive connectivity and intrinsic security for applications, data, and users from the data centers to the cloud and the branch. VMware SD-WAN will enable their customers to streamline the digital transformation journey by providing superior application performance with significantly reduced network complexity,” he added.

References:

SD-WAN Market to Grow in 2019 with Managed Services Leading the Charge

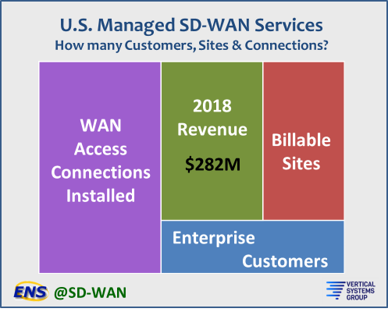

The managed SD-WAN services market is expected to generate more than $282 million in revenue in the U.S. by the close of 2018, according to researcher Vertical Systems Group. The figure is based on billable U.S. customer sites and WAN access connections installed and under management. Rick Malone, principal of Vertical Systems Group, said he expects a major boost in revenue next year with network operators fully ramped up to sell, deliver and support managed SD-WAN services.

A managed SD-WAN service is defined as a carrier-grade network offering for enterprise and business customers, which is managed by a network operator, and delivered over a software-defined network (SDN) service architecture that has separate control (overlay) and data (underlay) planes, according to MEF.

Service providers currently selling managed SD-WAN services in the U.S. include: Aryaka, AT&T, CenturyLink, Cogent, Comcast, Fusion Connect, GTT, Hughes, Masergy, MetTel, Sprint, Verizon, Windstream and Zayo by Vertical’s count. Other network operators both domestic and foreign are expected to enter the U.S. market, which will grow the segment’s size, Vertical said.

While the managed SD-WAN services market in the U.S. is small, it began to pick up steam in the last half of 2018, said Malone. “Carrier-grade managed SD-WAN services in the U.S. began to generate notable revenue in the second half of 2018,” he said.

One main reason the market’s revenue is small is because money is new to it. However, SD-WAN has proved to be more complex than customers previously believed. “Prior to this, most providers supported customers with pilot SD-WAN services that were not substantively monetized,” Malone said. “A key driver for managed services is the growing appreciation that migration to SD-WAN is considerably more complex than the promise of ‘easily deployed’ plug-and-play DIY solutions.”

“In 2019, we’ll continue to see SD-WAN as a key enabler for enterprise customers’ digital transformations. The integration between MPLS and internet, combined with the move to cloud, requires a different network and security design – particularly on a global scale. With SD-WAN, enterprises can address these requirements and introduce automation to make networks even more efficient. Future-proof solutions with simple interfaces, like Flexible SD-WAN from Orange, enable enterprises to use their networks dynamically to anticipate and respond to changes in their business environments while migrating applications to the cloud.” Rob Willcock, senior vice president, Americas, Orange Business Services.

In 2018, Cisco integrated its Viptela SD-WAN, which is bought in 2017 for $610 billion, more deeply across its enterprise routing platform. Also this year, VMware integrated VeloCloud’s SD-WAN technologies—which it bought last year for an undisclosed sum, into its product lines. Both acquisitions have turned out to be solid moves. Oracle is looking to duplicate Cisco and VMware’s successes next year after buying buying Talari Networks , also for an undisclosed sum, this year.

While some of the current SD-WAN vendors will fall by the wayside next year, others will be bought by companies that serve the enterprise and business sectors. Oracle, Cisco and VMWare?Dell bought such SD WAN start ups in 2018.

Another trend that will likely continue into 2019 is more firewall vendors entering the SD-WAN market. In 2018, Fortinet and WatchGuard Technologies moved from supplying security to SD-WAN vendors to offering their own flavors of it.

There will likely be more partnerships between SD WAN vendors and cloud providers, similar to the deal that Versa Networks did with Amazon Web Services (AWS) to offer SD-WAN to AWS partners. Citrix and Riverbed also announced availability of their SD-WAN offerings on Microsoft Azure cloud and AWS in 2018.

…………………………………………………………………………………………………………………………………………………………………………….

Vertical Systems has launched a new research service covering the carrier-based managed SD-WAN services market, focusing on service migration, network connectivity and market sizing. The research content it offers at this time spans managed SD-WAN purchase drivers, customers, WAN access connections, site configuration profiles, pricing and revenue.

At this point, SD-WAN research is a “moving target,” said Erin Dunne, Vertical’s research services director, in a video. “First of all the issue is definition. There’s no true definition out there. We pride ourselves on being able to lay out definitions that are from a market perspective — what service providers are selling and what enterprise, or business customers, are buying or what they want to buy.”

According to Vertical, managed SD-WAN services are a carrier-grade network offering for enterprise and business customers, managed by a network operator, and delivered over a software defined network service architecture that has separate control and data planes. Not included in this analysis are do-it-yourself SD-WAN solutions purchased directly from an SD-WAN technology supplier or a systems integrator.

STATFlash: Managed SD-WAN Services Market Tops $282 Million in the U.S.

Oracle to acquire SD-WAN vendor Talari Networks

In the ever arcane world of proprietary/non standardized SD-WANs, Oracle announced that it’s acquiring SD-WAN technology provider Talari Networks for an undisclosed sum. The transaction is expected to close before the end of this year.

Talari’s SD-WAN technology is expected to complement Oracle Communications’ Session Border Controller (SBC) and network management infrastructure. Talari’s Failsafe technology is said to enhance the benefits of SD-WAN by adding greater reliability and predictability while maintaining security for site-to-site and site-to-cloud connectivity and application access over any IP network.

San Jose, California-based Talari currently serves more than 500 enterprise customers in 40 different countries across a variety of industries, including public sector, financial services, insurance, retail and manufacturing—and it expects to do even bigger things under the Oracle tent.

Talari CEO Patrick Sweeney, who joined the company last year, said the impact to existing and new customers will be tremendous. “Our loyal customers can expect to see powerful new network functionality and capabilities at an accelerated pace,” he said in a blog post. “And the vast span of Oracle’s brand and reach will extend the Talari solution across the globe. Together, Oracle and Talari plan to accelerate digital transformation and cloud adoption by providing companies with complete enterprise network solutions that deliver reliable real-time communications and performance of mission-critical applications over any network.”

Analysts were not particularly surprised by the deal given the competition now underway in the SD-WAN space. Talari ranked No. 9 in IHS Markit’s rankings of SD-WAN vendors based on second-quarter revenues.

“The musical chairs in the SD-WAN game is accelerating, so it’s good that Talari found a partner,” said R. Scott Raynovich, founder and principal analyst at Futuriom. “Talari’s technology is optimized for data center connectivity, and its recent move to deliver a cloud solution for Office365 and NetSuite make it a natural complement to Oracle’s cloud infrastructure. Given that Oracle is a software company and not an enterprise networking vendor, the goal of this acquisition is likely to improve the performance of Oracle’s cloud software.”

There’s not a lot of synergy between Session Border Controllers and SD-WAN, but Lee Doyle, principal analyst at Doyle Research, told FierceTelecom that he can understand why Oracle would want to acquire a product it can monetize in a hot space like this. It also has a history of buying communications companies, Acme Packet and Tekelec, both ongoing businesses.

………………………………………………………………………………………………………………………………..

The Talari deal is one in a series of acquisitions Oracle has announced in recent weeks. Last month, the company announced plans to acquire data management and AI solutions provider DataFox. It also announced plans to acquire goBalto, a cloud platform developer in the life science industry.

Both Cisco and VMware have been working to blend more SD-WAN technology across their broader portfolios. Last year, VMware bought VeloCloud for an undisclosed sum while Cisco paid $610 million for Viptela.

SD-WAN vendors, connectivity providers, and application providers have begun to realize how much they need each other. Total SD-WAN revenue, which includes appliance and control management software, reached $221 million in the most recent second quarter, which was up 25% quarter-over-quarter and twice the amount recorded in the second quarter of last year, according to IHS-Markit.

“Recently, cloud service providers have come to realize the importance of high-quality network connectivity to ensure a happy end user,” said Cliff Grossner, senior research director at IHS Markit. “For Oracle, purchasing Talari is an important move to be able to bundle SD-WAN with cloud services, remaining competitive with other providers that have established relationships with SD-WAN vendors such as Citrix.”

Citrix is an example of an SD-WAN vendor that has relationships with connectivity providers. For example, in May, Citrix partnered with the managed cloud provider RapidScale, which is offering Citrix NetScaler SD-WAN as a standalone managed service over RapidScale’s backbone. And Citrix recently partnered with Teridion to combine SD-WAN with a routing optimization network.

Gartner apparently values SD-WAN vendors with a connectivity play because it placed Aryaka and Citrix in the “Challengers” quadrant of its Magic Quadrant for WAN Edge Infrastructure.

……………………………………………………………………………………………………………………………

Recently, Gartner published its first Magic Quadrant for WAN Edge Infrastructure and placed Talari in its “Niche Players” quadrant. The report, which profiles 20 vendors, placed VMware in the top position for completeness of vision, followed by Cisco and SilverPeak in its coveted “Leaders” quadrant.

The Gartner report stated, “Talari’s strength lies in its sophisticated link aggregation and remediation, which provide seamless failover for sensitive applications such as UCaaS/VoIP. Talari should be shortlisted for WAN edge opportunities for global mid-market enterprises, especially when link remediation and sophisticated traffic steering are required.”

…………………………………………………………………………………………………………………………………………..

References:

https://www.fiercetelecom.com/telecom/oracle-to-acquire-sd-wan-provider-talari-networks

https://www.zdnet.com/article/oracle-to-acquire-talari-network/

https://www.sdxcentral.com/articles/news/oracle-buys-sd-wan-vendor-talari-networks/2018/11/

Report: Cisco, VMware are cashing in on their SD-WAN deals

https://techblog.comsoc.org/category/sd-wan/

Sapio Research Survey: 20% have SD-WAN project, but 48% of those are proof of concept

In a survey of 200 senior IT and networking managers in the US and the UK, Sapio Research found 20% of respondents said they have a software-defined WAN project in progress, while 32% haven’t explored the technology and 27% may look at it in the future. About one-third of respondents said they wanted to reduce network costs and to better manage their network infrastructure. The research study found that 48% of those are running SD-WAN proof of concept at select sites or other limited deployments. That means only about 10% are transitioning fully to SD-WAN.

The survey was commissioned by Teneo and based on input from 200 senior IT and networking managers evenly split between the U.S. and U.K. The companies have worldwide operations and revenues between $127 million and $38 billion. The survey found that 32% have not yet explored the technology, though 27% may do so in the future.

When senior IT professionals were asked why they were considering SD-WAN, the most common reason was the increasing complexity of network infrastructure and performance tasks (cited by 36% of interviewees), closely followed by the need to cut network costs (34%) and the need for better management of network infrastructures (also 34%). Increasing pressure on both company resources and budgets as IT team look after more complex network infrastructures is driving companies to examine SD-WAN’s potential.

Exactly half of companies questioned say that deploying and managing networking infrastructure is time-consuming. Interviewees estimate that these upkeep tasks take up 36% of their overall IT budget. One third of the survey (33%) admit that they had used ‘as a Service’ models from external providers to keep on top of maintenance tasks.

Researchers also found that companies are blending connectivity options to get necessary bandwidth: nearly four in ten (38%) of interviewees want to add more MPLS, 22% want more Internet connectivity, and 20% want to add more Internet and MPLS combined. Under one in five (17%) said their needs were satisfied.

Half of the respondents pointed to the time-consuming nature of deploying and managing a network as their main driver. Overall, those interviewed said that upkeep consumes as much as 36% of their IT budgets. One-third said that they have used “as-a-service” platforms to keep pace. Varied offerings have emerged. “Due to the immaturity of the SD-WAN space each vendor has come to the market with a different strategy,” wrote Steve Evans, Teneo’s vice president of solutions engineering in response to emailed questions from FierceTelecom. “We are seeing this converge in some areas. However, there are still noticeable differences between the major players in the space. I would not say that the vendors do not know what to bring to market. I think it’s more that some vendors favor particular features over others.”

The SD-WANs enterprises deploy will look different from one another, according to the survey. Thirty-eight percent of respondents want to add MPLS, 22% want to add broadband and 20% want to add both. Seventeen percent are happy with their current connectivity.

It is perhaps surprising that companies want to add MPLS, since reducing costs is seen as a key driver of SD-WAN. “SD-WAN is not about removing MPLS, although there can be cost benefits,” Evans wrote. “With the reliability of Internet circuits or broadband improving, the usage of MPLS will still have a place until people are comfortable with running business critical applications over circuits with no SLAs.”

Evens did point to cost savings of using broadband where it makes sense. “We have seen SD-WAN being used to enable businesses to utilize all of the MPLS bandwidth they are paying for to improve service for critical applications and then augment this bandwidth with the cheaper options for less important traffic, thus removing the expensive backup circuits and gaining more bandwidth for less cost,” wrote Evans.

There still is a learning curve for both vendors and end users. “The challenge around understanding SD-WAN is that vendors are all talking features and that they all fit every situation,” Evans wrote. “They are not starting with what the customer is trying to achieve and then showing how their technology would fit the needs. There is also a misunderstanding on what is meant by certain features and in comparing how well one solution executes on a feature.”

Progress is being made, however. “More and more businesses already have a basic understanding of SD-WAN and are able to articulate their requirements, but some are still looking to get an understanding of the market and the technology,” according to Evans. “Both groups need help understanding exactly how their requirements map to the available SD-WAN technologies.”

Another element that is not yet clear is who companies prefer to work with. Thirty-nine percent of survey respondents want to partner with a global network vendor, 24% with a telecommunication partner and 24% with a management consultancy.

The survey found that 8% of respondents are considering specialist SD-WAN vendors, 3% are considering specialist integrators of SD-WAN and 3% will use multiple partners.

“Network managers are looking at SD-WAN strategies to run multiple networking environments in standardised ways – whether the underlying motivation is greater simplicity, cost efficiency or transforming critical applications’ performance across their company’s operations,” said Marc Sollars, CTO of Teneo.

“Many firms are clearly putting a toe in the water on SD-WAN, or doing a proof of concept, but it’s still very hard to say when this test phase will start to translate into enterprise-level implementations,” added Sollars. “In many ways, the broad range of choice that SD-WAN brings is what’s causing companies to hesitate over their decisions.”

References:

https://www.fiercetelecom.com/telecom/research-sd-wan-drivers-strategies-are-broad-and-deep

AT&T exec: SD-WAN is “killer app” after MEF says they will define SD-WAN service

AT&T exec: SD-WAN is “killer app” after MEF says they will define SD-WAN service

AT&T’s Josh Goodell at MEF 18 conference in LA: “SD-WAN is the killer app — we’re deploying 28,000 end points, it has really exploded.” Really? We’re from Missouri= show me

Meanwhile, the MEF has definesd an SD-WAN service and its various attributes. With strong support from service provider and technology provider members, MEF currently is on track to ratify and publicly release its MEF 3.0 SD-WAN Service Attributes and Service Definition standard in 1Q 2019. SD-WAN service standardization will enable a wide range of ecosystem stakeholders to use the same terminology when buying, selling, assessing, deploying, and delivering SD-WAN services. The SD-WAN service definition is a foundational step for accelerating sales, market adoption, and certification of MEF 3.0 SD-WAN services orchestrated across a global ecosystem of automated networks.

SD-WAN Service Standardization

SD-WAN service standardization is being conducted within the context of the MEF 3.0 Global Services Framework. It is part of a transformational initiative to standardize a complete family of dynamic Carrier Ethernet (CE), IP, Optical Transport, SD-WAN, security, and other virtualized services that will be orchestrated over programmable networks using LSO (Lifecycle Service Orchestration) APIs.

MEF’s SD-WAN service definition specification describes requirements for an application-aware, over-the-top WAN connectivity service that uses policies to determine how application flows are forwarded over multiple underlay networks irrespective of the underlying technologies.

“MEF’s groundbreaking work in standardizing an SD-WAN service addresses one of the biggest obstacles impacting SD-WAN service market growth,” said Nan Chen, President, MEF. “In a recent joint MEF and Vertical Systems Group survey of service providers worldwide, nearly 80% of respondents identified the lack of an industry-standard service definition as a significant challenge for service providers to offer or migrate to SD-WAN services. MEF’s SD-WAN service standardization will undoubtedly accelerate sales of SD-WAN products and services like MEF accomplished with Carrier Ethernet service standardization.”

Just as the industry has benefited from MEF standardization of CE services – which now exceed an estimated $50 billion in annual revenues globally – there are numerous potential benefits associated with a common SD-WAN service definition. These include, among other things:

- Reducing market confusion about service components, core capabilities, and related concepts, thus saving valuable time given the scarce availability of skilled personnel.

- Enabling service providers and technology providers to focus on providing a core set of common capabilities and then building on that core resulting in differentiated offerings.

- Facilitating inclusion of SD-WAN services in standardized LSO architectures, thereby advancing efforts to orchestrate MEF 3.0 SD-WAN services across multiple providers.

- Paving the way for creation and implementation of SD-WAN services certification, which will give users confidence that a service meets a fundamental set of requirements.

SD-WAN Implementation

MEF member companies are involved in multiple SD-WAN implementation-related initiatives that can be leveraged to provide feedback on standardization requirements and create software-oriented artifacts that can be used to accelerate efforts to orchestrate standardized SD-WAN services. These initiatives include the MEF 3.0 Multi-Vendor SD-WAN Implementation project, the MEF18 LSO Hackathon, and several SD-WAN Proof of Concept (PoC) demonstrations at MEF18.

The MEF18 LSO Hackathon is focused on developing and validating data models for SD-WAN services. This presents a unique opportunity for those involved in technical aspects of SD-WAN services and products to learn in a hands-on way about the latest SD-WAN service and LSO standardization work at MEF as well as the related API and YANG work at ONF and IETF.

Three MEF18 PoC demonstrations directly related to LSO-enabled orchestration of SD-WAN services include:

- Zero Touch Services with Secure SD-WAN

- Towards a Multi-Vendor Orchestrated SD-WAN – LSO-enabled Solution with Open Source Orchestrator and Container-based uCPEs

- Instantiation and Delivery of SD-WAN over a Virtualized and Orchestrated Wholesale Carrier Ethernet Access Service.

MEF 3.0 SD-WAN Service Certification

MEF currently plans to introduce a pilot version of certification for MEF 3.0 SD-WAN services in the first half of 2019. This certification will test a set of service attributes and their behaviors defined in the upcoming SD-WAN standard and described in detail in the MEF 3.0 SD-WAN Service Certification Blueprint.

…………………………………………………………………………………………..

References:

…………………………………………………………………………………

Cisco Virtual Networking Index report: Enterprise SD-WAN growth will increase five-fold by 2022:

IHS Markit: SD-WAN revenue was $221M in 2Q-2018; P&S Intelligence: CAGR of 54.1% during 2018-2023

IHS-Markit Analysis, by Cliff Grossner, PhD, IHS Markit Sr Research Director

SD-WAN (appliance + control and management software) revenue reached $221M in 2Q18, up 25% QoQ and 2x over 2Q17. VMware led the SD-WAN market with 18% share of 2Q18 revenue, Aryaka was in second place with 15% revenue share, and Cisco enters the top 3 with 12%, according to the DC Network Equipment market tracker early edition from IHS Markit.

“With SD-WAN deals becoming more competitive within the North American market, the race to expand into other regions is now well underway. VNF certifications with EMEA and Asia Pacific based service providers are now in full swing where SD-WAN vendors are in the final stages of VNF certifications with BT, Telefonica, Vodafone and China Mobile” said Cliff Grossner, senior research director and advisor for cloud and data center at IHS Markit, a world leader in critical information, analytics and solutions.

“Countries top of the agenda for hiring and office expansions for SD-WAN vendors are the United Kingdom, Germany, Singapore, Japan and China where SD-WAN vendors indicate there is heavy SaaS and IaaS traffic between multiple on- and off-premises DCs.” said Grossner.

More Data Center Network Market Highlights

· 2Q18 ADC revenue declined 2% from 1Q18 to $443M and declined 2% over 2Q17

· Virtual ADC appliances stood at 33% of 2Q18 ADC revenue

· F5 garnered 47% ADC market share in 2Q18 with revenue up 0.4% QoQ. Citrix had the #2 spot with 28% of revenue, and A10 (8%) rounded out the top 3 market share spots.

Data Center Network Equipment Report Synopsis

The IHS Markit Data Center Network Equipment market tracker is part of the Data Center Networks Intelligence Service and provides quarterly worldwide and regional market size, vendor market share, forecasts through 2021, analysis and trends for (1) data center Ethernet switches by category [purpose built, bare metal, blade and general purpose], port speed [1/10/25/40/50/100/200/400GE] and market segment [enterprise, telco and cloud service provider], (2) application delivery controllers by category [hardware-based appliance, virtual appliance], and (3) software-defined WAN (SD-WAN) [appliances and control and management software]. Vendors tracked include A10, ALE, Arista, Array Networks, Aryaka, Barracuda, Cisco, Citrix, CloudGenix, CradlePoint, Dell, F5, FatPipe, HPE, Huawei, Hughes, InfoVista, Juniper, KEMP, Nokia (Nuage), Radware, Riverbed, Silver Peak, Talari, TELoIP, VMware, ZTE and others.

……………………………………………………………………………………………………………………………………………………………………………..

In a different report, Prescient & Strategic (P & S) Intelligence says:

The global software defined wide area network (SD-WAN market) was valued at $676.9 million in 2017 and is forecast to witness a CAGR of 54.1% during 2018-2023 and will reach $9,691.0 million by 2023. The demand for cost effective WAN management solutions, increasing adoption of cloud technologies, need for simplified network architecture, end-to-end network security and visibility are driving the market globally.

The SD-WAN market is classified into solution and service. The solution category held a larger revenue share in the market accounting for nearly 78% in 2017. During the forecast period, the market for SD-WAN service is expected to witness higher growth, as the need for traffic management to optimize bandwidth and cost reduction by replacement of dedicated WAN network with broadband network without compromising on security, increases.

Based on appliances, the SD-WAN market is categorized into virtual, physical and hybrid appliances. Virtual appliance accounted for largest revenue share in the market in 2017. During the forecast period, it will continue to contribute largest revenue share owing to the fact that it reduces the cost incurred in installation and offers configuration and maintenance of complex stack of software virtually.

The Asia-Pacific (APAC) SD-WAN market is expected to witness a CAGR of 57.9% during the forecast period. Since the internet speed and internet quality have significantly improved in the region, IT departments are looking for cost effective, secure, performance related solutions to reduce their dependency on multi-protocol label switching (MPLS). Organizations in the IT and telecom industry in the region are focusing on agile, secure, and end-to-end visible WAN management solution, which will support the market growth in future.

Some of the key players operating in the market are Cisco Systems, Inc, Citrix Systems, Inc, Silver Peak Systems Inc, CloudGenix Inc, Ecessa Corporation, Viptela Inc, Riverbed Technology, Inc, Mushroom Networks, Inc, VeloCloud networks Inc, Glue Networks Inc, Elfiq Inc.

About P & S Intelligence

P & S Intelligence, a brand of P & S Market Research, is a provider of market research and consulting services catering to the market information needs of burgeoning industries across the world. Providing the plinth of market intelligence, P & S as an enterprising research and consulting company, believes in providing thorough landscape analyses on the ever-changing market scenario, to empower companies to make informed decisions and base their business strategies with astuteness.

IHS Markit: SD-WAN revenue = $162M in 1Q2018; MEF to Define SD-WAN Service

IHS Markit SD-WAN Revenue Report:

by Cliff Grossner, PhD, Senior Research Director and Advisor at IHS Markit

SD-WAN (appliance + control and management software) revenue reached $162M in 1Q18, up 12% QoQ and 2.3x over 1Q2017. VMware (after its VeloCloud acquisition) led the SD-WAN market with 19% share of 1Q2018 revenue, Aryaka was in second place with 18% revenue share, and Silver Peak rounded out the top 3 with 12%, according to the DC Network Equipment market tracker early edition from IHS Markit.

“SD-WAN is currently a maturing market, expected to reach $861M worldwide in 2018, as early adopters of SD-WAN are expanding existing deployments, having proved the SD-WAN business case. Adoption of SD-WAN is now ramping even in compliance-sensitive verticals such as healthcare and financial (the payment card industry),” said Cliff Grossner Ph.D., senior research director and advisor for cloud and data center at IHS Markit.

|

Worldwide SD-WAN revenue |

||||||

|

|

Revenue (US$M) |

% Change |

||||

|

|

|

|

1Q18 |

|||

|

VMware |

N/A |

$31.6 |

N/A |

|||

|

VeloCloud |

$26.8 |

N/A |

N/A |

|||

|

Aryaka |

$24.4 |

$29.1 |

19% |

|||

|

Silver Peak |

$17.6 |

$20.2 |

15% |

|||

|

Cisco |

$15.6 |

$19.5 |

25% |

|||

|

InfoVista |

$12.3 |

$9.6 |

-22% |

|||

|

Citrix |

$6.0 |

$7.1 |

18% |

|||

|

Talari |

$5.4 |

$5.9 |

9% |

|||

|

FatPipe |

$4.5 |

$4.3 |

-5% |

|||

|

Riverbed |

$2.5 |

$3.2 |

26% |

|||

|

CloudGenix |

$2.5 |

$2.5 |

0% |

|||

|

Huawei |

$3.3 |

$1.8 |

-45% |

|||

|

ZTE |

$0.7 |

$1.1 |

53% |

|||

|

Other |

$23.2 |

$26.2 |

13% |

|||

|

Total SD-WAN |

$145.0 |

$162.1 |

12% |

|||

|

Source: IHS Markit © 2018 IHS Markit |

||||||

“Many SD-WAN vendors have begun to incorporate analytics, utilizing rich telemetry data, into SD-WAN management platforms–enabling enterprises to monitor application traffic flow between multi-cloud environments,” said Grossner.

More Data Center Network Market Highlights

· F5 garnered 46% ADC market share in 1Q18 with revenue up 4% QoQ. Citrix had the #2 spot with 29% of revenue, and A10 (9%) rounded out the top 3 market share spots.

· 1Q18 ADC revenue declined 4% from 4Q17 to $453M and declined 4% over 1Q17

· Virtual ADC appliances stood at 31% of 1Q18 ADC revenue

Data Center Network Equipment Report Synopsis

The IHS Markit Data Center Network Equipment market tracker is part of the Data Center Networks Intelligence Service and provides quarterly worldwide and regional market size, vendor market share, forecasts through 2021, analysis and trends for (1) data center Ethernet switches by category [purpose built, bare metal, blade and general purpose], port speed [1/10/25/40/50/100/200/400GE] and market segment [enterprise, telco and cloud service provider], (2) application delivery controllers by category [hardware-based appliance, virtual appliance], and (3) software-defined WAN (SD-WAN) [appliances and control and management software]. Vendors tracked include A10, ALE, Arista, Array Networks, Aryaka, Barracuda, Cisco, Citrix, CloudGenix, CradlePoint, Dell, F5, FatPipe, HPE, Huawei, Hughes, InfoVista, Juniper, KEMP, Nokia (Nuage), Radware, Riverbed, Silver Peak, Talari, TELoIP, VMware, ZTE and others.

…………………………………………………………………………………………………………………………………………………

MEF to define SD-WAN service:

by Alan J Weissberger

The Metro Ethernet Forum is working on a common definition for SSD-WANs and is building out multivendor SD-WAN use cases.

- MEF is creating a SD-WAN service specification that will outline the required SD WAN components, such as application-centric quality of service and priority policy requirements.

- MEF’s Multi-Vendor SD-WAN Implementation project is one of the real-world results of the MEF 3.0 framework that was announced at MEF 17 in November. MEF 3.0 is a transformation framework for defining, delivering and certifying agile, assured and orchestrated network services across a global ecosystem of automated networks.

While SD-WAN has earned buzzword status across the telecoms industry, a lot of different offerings are available in the marketplace from a host of vendors. Currently, there are no clear definitions of what an SD-WAN service is.

MEF members are collaborating to develop an SD-WAN service specification that defines the service components, their attributes, and application-centric QoS, security, and business priority policy requirements to create SD-WAN services. This initiative is led by Riverbed and VeloCloud, now part of VMware, with major contributions from Fujitsu.

MEF is using the same blueprint that it successfully deployed when it defined Carrier Ethernet services 10 years ago—which led to the creation of an estimated $80 billion global market for Carrier Ethernet—to create the SD-WAN service definition specification.

“The significance of this work is that if you look at what MEF has done for the initial carrier Ethernet definition before that came out there were many, many different implantations,” said Ralph Santitoro, head of SDN/NFV/SD-WAN solutions for Fujitsu.

“You weren’t really sure what you were buying. The SD-WAN service market today is in exactly that same kind of state where you can go to different service providers and get an SD-WAN service but it’s apples to oranges to peaches and whatever, but it’s all different because there is no industry standard.

“The MEF is really the only organization in the industry that is actually putting a stake in the ground by defining what an SD-WAN service is.”

MEF hopes to have the specification finished ahead of its MEF 18 conference in October. When the specification is finished, MEF said it would pave the way for MEF 3.0 work on its Lifecycle Service Orchestration (LSO), MEF information models, policy-driven orchestration, intent, and other major projects that could be applied to SD-WAN services. All of those SD-WAN elements would then be integrated into the MEF 3.0 ecosystem to help service providers increase their automation efforts.

MEF’s Implementation Project features managed SD-WAN use cases that were driven by MEF’s membership that includes service providers. Because of mergers and acquisitions, service providers are faced with an increasing number of interoperability challenges where they need to support more than one SD-WAN solution.