SD-WAN

IHS Markit: Enterprises Evaluating SD-WAN; Ethernet Access Device Market up 8% YoY

Companies Evaluating SD-WAN As Enterprises Embrace the Cloud, IHS Markit Survey Says

LONDON (April 25, 2018) – IHS Markit (Nasdaq: INFO), a world leader in critical information, analytics and solutions, today released findings from its WAN Strategies North American enterprise survey, which reviews the evolving requirements for wide-area networks (WANs) of medium-to-large companies, including the adoption of software-defined WAN (SD-WAN). Nearly three-quarters (74 percent) of respondents conducted SD-WAN lab trials in 2017; by 2018, many will move into production trials and then to live production.

The latest annual survey of network managers from IHS Markit shows that investments in WANs continue unabated, driven by traffic growth, company expansion, adoption of the Internet of things (IoT), the need for greater control over the WAN, and the need to put WAN costs on a sustainable path. Security in particular is the number one network change by a wide margin, and the top reason to invest in new infrastructure, as companies must fend off the constant threat of cyber attacks.

“As companies shift a greater portion of their IT infrastructure into the cloud, and expand their physical presence to go after new markets or be closer to customers and partners, the need for reliable, secure and high-performance WAN and internet connectivity has never been greater,” saidMatthias Machowinski, senior research director for enterprise networks at IHS Markit. “However, companies don’t have unlimited budgets to fund growing WAN bandwidth consumption, which is why a majority are planning to deploy software-defined WAN in the next three years, to better control how their WANs are used.”

Following are some additional data points from the survey:

- Respondents expect their WAN bandwidth usage to grow over 20 percent annually — data center usage is the highest, while branch offices are experiencing the highest growth, at nearly 30 percent per year.

- Reflecting the significant demands placed on WANs, total WAN expenditures rose nearly 20 percent annually, to reach $300,000 per respondent in 2017.

- 71 percent of respondents will use off-premises cloud service providers by 2018, which will become the top application strategy in 2018.

………………………………………………………………………………………………………………

Ethernet access device market up 8 percent year over year in 2017

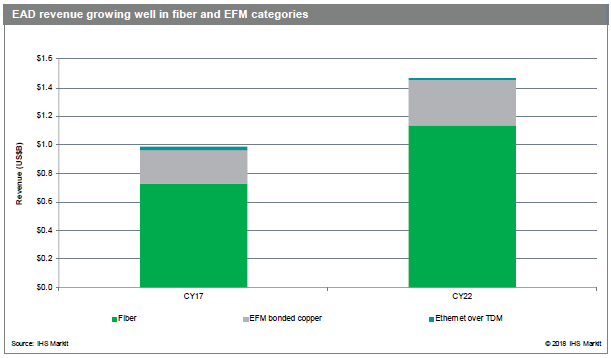

Worldwide Ethernet access device (EAD) revenue totaled $987 million in 2017, increasing 8 percent over 2016. The market is forecast to reach $1.47 billion in 2021, achieving a 2017–2022 compound annual growth rate (CAGR) of 8 percent.

“The EAD market is growing as a direct reflection of the continuous, steady demand from operators for mobile backhaul and wholesale services — and from business, broadband and building applications,” said Richard Webb, associate director, mobile backhaul and small cells research at IHS Markit.

“A new sub-segment is beginning to make an impact in the EAD market: the universal CPE, or ‘uCPE’ — a device that provides a ‘pico cloud’ of computing, storage and switching capable of executing virtualized functions,” Webb said. “Still, there will be an ongoing role for EADs even as virtual CPE takes off.”

Additional EAD market highlights

- Increasing demand for fiber-connected EADs will be the main driver of the market though at least 2022; in 2017, there was a 6 percent increase in the fiber segment

- Ciena was number one in EAD revenue market share for 2017, followed by ADVA, RAD, Actelis and MRV

- North America remained the largest market for EADs in 2017, with 50 percent of EAD revenue; Europe, the Middle East and Africa (EMEA) had 24 percent, Asia Pacific held 20 percent and the Caribbean and Latin America (CALA) had 6 percent

- For now and in the foreseeable future, North America maintains its lead through the early adoption of higher-capacity ports over fiber

Ethernet Access Devices Market Tracker

The biannual EAD report from IHS Markit tracks fiber and copper (EFM bonded and EoTDM bonded) Ethernet access devices by port speed, form factor and application. It also tracks uCPE. The report provides worldwide and regional market size, vendor market share, forecasts through 2022, analysis and trends.

FCM9003: Ethernet Access Device solution

Image courtesy of Metrodata in the U.K.

……………………………………………………………………………………………………….

About IHS Markit (www.ihsmarkit.com)

IHS Markit (Nasdaq: INFO) is a world leader in critical information, analytics and solutions for the major industries and markets that drive economies worldwide. The company delivers next-generation information, analytics and solutions to customers in business, finance and government, improving their operational efficiency and providing deep insights that lead to well-informed, confident decisions. IHS Markit has more than 50,000 business and government customers, including 80 percent of the Fortune Global 500 and the world’s leading financial institutions.

IHS-Markit: SD-WAN revenue reached $444M in 2017; Aryaka wins award

by Cliff Grossner, PhD, Senior Research Director and Advisor at IHS-Markit

|

Company

|

Revenue (US $M)

|

% Change

|

||||

|

|

3Q17

|

4Q17 |

4Q17

vs 3Q17 |

|||

|

VeloCloud

|

$26.0

|

$28.3

|

9%

|

|||

|

Aryaka

|

$21.3

|

$24.4

|

15%

|

|||

|

Silver Peak

|

$14.1

|

$17.6

|

25%

|

|||

|

Cisco

|

$3.1

|

$15.6

|

404%

|

|||

|

InfoVista

|

$9.6

|

$12.3

|

29%

|

|||

|

Citrix

|

$4.4

|

$6.0

|

38%

|

|||

|

Talari

|

$4.1

|

$5.4

|

31%

|

|||

|

FatPipe

|

$3.8

|

$4.5

|

21%

|

|||

|

Huawei

|

$2.8

|

$3.3

|

18%

|

|||

|

Riverbed

|

$1.7

|

$2.5

|

49%

|

|||

|

CloudGenix

|

$2.5

|

$2.5

|

0%

|

|||

|

ZTE

|

$0.6

|

$0.7

|

30%

|

|||

|

Viptela

|

$9.5

|

N/A

|

N/A

|

|||

|

Other

|

$18.9

|

$23.5

|

25%

|

|||

|

Total SD-WAN

|

$122.1

|

$146.7

|

20%

|

|||

|

© 2018 IHS Markit

|

||||||

Cliff will chair the OCP Market Impact Assessment session at OCP Summit in San Jose, CA and be at the Open Networking Driving Cloud Innovation panel session at ONS in Los Angeles, CA.

……………………………………………………………………………………………….

Related SD-WAN News:

chosen by Alan J Weissberger

- Aryaka wins 2018 SD-WAN Leadership Award

A March 1st press release noted that Technology Marketing Corp (TMC) has selected Aryaka for the 2018 SD-WAN Leadership Award, recognizing the company for its industry-leading SD-WAN technology. Aryaka’s global SD-WAN solution was honored for its technology leadership, market-driven innovation, growth, and outstanding business execution.

“Aryaka’s year-over-year momentum in the SD-WAN space continues to impress, with many vendors, resellers, and service providers fighting for their share of the market,” said Rich Tehrani, CEO of TMC. “Aryaka’s global SD-WAN solution delivers top performance for both on-premises and cloud-based SaaS applications anywhere in the world. In the past year, the Aryaka team has demonstrated extraordinary industry leadership, growth and customer success, which is why we selected the company for this year’s 2018 SD-WAN Leadership Award.”

“Aryaka is disrupting the enterprise connectivity space by combining a cloud-native private network, SD-WAN, WAN optimization, application acceleration techniques, connectivity to cloud platforms, and network visibility in a single solution that is delivered as-a-service,” said Gary Sevounts, Chief Marketing Officer at Aryaka. “Our goal is to continue to push the envelope and deliver a best-of-breed global SD-WAN solution that enables enterprises to seamlessly manage all of their global connectivity and application delivery needs.”

Deployed by 800 global enterprises, Aryaka is the leading global SD-WAN provider and has the fastest growing SD-WAN solution in the market today, delivering enhanced performance for cloud and on-premises applications worldwide. Aryaka’s global SD-WAN has quickly become the only viable MPLS replacement solution for global enterprises requiring alternatives to legacy WAN infrastructures for mission-critical application delivery.

…………………………………………………………………………………………………………………..

2. Windstream’s SD-WAN revenue tops 15% of sales, CEO says

Telecompetitor (3/1), FierceTelecom (3/1)

Cogent Communications CEO: MPLS VPNs to be replaced by VPLS & SD-WANs; Reasons to Deploy SD-WANs?

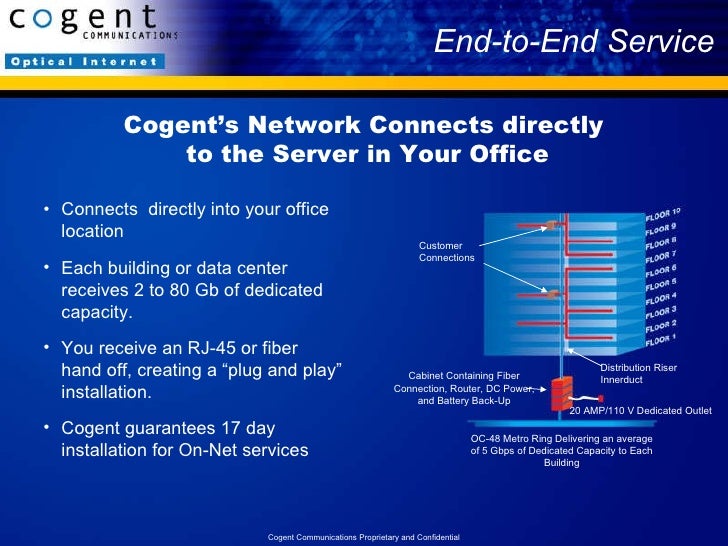

Dave Schaeffer, CEO of Cogent Communications, told investors during last week’s 2018 Citi Global TMT West Conference that there is a migration away from MPLS VPNs to Ethernet VPLS (Virtual Private LAN Service) [1] and SD-WANs.

“Cogent has focused on selling dedicated Internet access which is still the primary product (actually service) of our company. However, VPN services represent 17% of total revenues and 25% of corporate revenues. Most corporate customers supplement Internet access with a private network. The vast majority of those private networks are based on MPLS based services (e.g. MPLS VPNs), which are very difficult to install, manage, or modify. They’re also very expensive on a per transmitted bit basis.”

- VPLS, which is based on MPLS in the core network, has been a very successful offering for Cogent (see reference below). Shaeffer said that at the end of Q3-2017 an average of 12.5 customers out of 50 in a commercial building are using it (in addition to Internet access). VPLS has a huge advantage on a cost per bit basis over MPLS VPNs.

Note 1. Virtual Private LAN Service (VPLS) is a way to provide Ethernet-based multi-point to multi-point communication over IP or MPLS networks. It allows geographically dispersed sites to share an Ethernet broadcast domain by connecting sites through pseudo-wires.

- SD-WANs are very effective at low speeds. SD-WAN vendors are consolidating on IP SEC with 2**32 bit encryption (15% encryption overhead). At higher bandwidths (10M-100Mb/sec), the encryption tax has been 40% to 50% which resulted in a very low adoption of higher speed SD-WANs.

“As the equipment vendors have improved the efficiency of their processors, allowing encryption to occur in a multipath format through the processor instead of serially we’re seeing that efficiency go from like 40 or 50% to the high 80%. As that occurs, SD-WAN will become the dominant platform for location-to-location private networking and will replace MPLS,” Schaeffer added.

“The result for Cogent is an expansion in our addressable market. As we think about our corporate business in the U.S. and Canada, it is a $9 billion dedicated internet access market of which 10% of the market is on-net for Cogent and 90% is off-net.”

Schaeffer added that “out of the 90% off-net, roughly 40% of that total market is addressable through circuits we can buy from one of 90 off-net fiber providers.” However, approximately 1/2 of potential corporate customers don’t have fiber to their buildings.

“Fifty percent of corporate locations still don’t have fiber to them today and are therefore out of Cogent’s addressable market because we have made a conscious decision not to support fixed wireless, coax or twisted pair as a last mile connection due to low reliability, long provisioning times and low throughput,” Schaeffer said.

Since Cogent has decided not to use twisted pair, coax or fixed wireless for last mile access, there’s a large portion of the corporate market that it isn’t now able to address. But that might change with SD-WANs gaining popularity.

“What SD-WAN does is expands the market by allowing customers to bring their own bandwidth from locations that we are unwilling to purchase those sub optimal (non fiber based) tail circuits.”

Schaeffer said “the MPLS market is predicated on bandwidth costing 15 times as much per megabit as DIA (Dedicated Internet Access) bandwidth and that’s unsustainable. The U.S. MPLS addressable market, now worth $45 billion annually, will collapse to a $3 billion market (Schaeffer didn’t say when that would happen).” When that happens, Cogent believes their business will expand.

“We benefit two ways: our addressable market got a third bigger and we got a second reason for a customer to buy services from Cogent,” Schaeffer said. “That’s why we feel so confident about our corporate business continuing to perform even though our footprint expansion has continued to slow down.”

Author’s Note: It’s not clear how that will happen as Schaeffer didn’t say Cogent would offer SD-WANs.

Cogent’s network stretches over 199 markets throughout 41 countries in North America, Europe and Asia, with over 57,400 route miles of long-haul fiber and more than 31,070 miles of metropolitan fiber serving over 720 metropolitan rings.

Our end-to-end optical transport network consists of IP-over-WDM fiber links running up to 1200 Gbps intercity capacity and 320 Gbps on metropolitan rings, located in Cogent’s major markets throughout North America, Europe and Asia.

On the IP layer, Cogent’s Tier 1, IPv6 and MPLS enabled network has direct IP connectivity to more than 6,075 AS (Autonomous System) networks around the world with over 162.4 Tbps internetworking capacity.

Being a facilities-based carrier, Cogent takes advantage of full end-to-end control over its transport and routing technology to provide reliable and scalable service.

………………………………………………………………………………………………..

Separately, a survey from the SIP School asked this question:

What are the main reasons for you to deploy or investigate SD WAN solutions?

Answers from survey respondents:

- Better Use of Existing Links – 158

- Cost Savings – 148

- Improved WAN Performance – 114

- Failover – 95

- Security – 87

- Intelligent Routing – 83

- Analytics & Visibility – 50

…………………………………………………………………………………………………………….

References:

https://www.fiercetelecom.com/telecom/cogent-s-ceo-multi-location-sd-wan-services-will-replace-mpls

https://www.veracast.com/webcasts/citigroup/tmt2018/69111247817.cfm?0.0889053993034

Gartner Analysis & Predictions: Enterprise Network Infrastructure and Services

by : Bjarne Munch | To Chee Eng | Greg Young | Danellie Young | Vivek Bhalla | Andrew Lerner |Danilo Ciscato of Gartner Group

Overview:

This new Gartner Group report is on the key impacts of digital business, cloud and orchestration strategies. In particular, IT leaders must continue to focus on meeting enterprise needs for expanded WAN connectivity, application performance and improved network agility, without compromising performance.

Key Findings:

- As enterprises increasingly rely on the internet for WAN connectivity, they are challenged by the unpredictable nature of internet services.

- Enterprises seeking more agile WAN services continue to be blocked by network service providers’ terms and conditions.

- Enterprises seeking more agile network solutions continue to be hampered by manual processes and cultural resistance.

- Enterprise’s moving applications to public cloud services frequently struggle with application performance issues.

Recommendations:

IT leaders responsible for infrastructure agility should:

- Reduce the business impact of internet downtime by deploying redundant WAN connectivity such as hybrid WAN for business-critical activities.

- Improve WAN service agility by negotiating total contractual spend instead of monthly or annual spend.

- Improve agility of internal network solutions by introducing automation of all operations using a step-wise approach.

- Ensure the performance of cloud-based applications by using carriers’ cloud connect services instead of unpredictable internet services.

- Improve alignment between business objectives and network solutions by selectively deploying intent-based network solutions.

Strategic Planning Assumptions:

Within the next five years, there will be a major internet outage that impacts more than 100 million users for longer than 24 hours.

- By 2021, 25% of enterprise telecom contracts will evolve to allow for greater flexibility such as canceling services or introducing new services within the contract period, up from less than 5% today.

- By 2021, productized network automation (NA) tools will be utilized by 55% of organizations, up from less than 15% today.

- By YE20, more than 30% of organizations will connect to cloud providers using alternatives to the public internet, which is a major increase from 5% in 3Q17.

- By 2020, more than 1,000 large enterprises will use intent-based networking systems in production, up from less than 15 today.

Analysis:

Gartner Group has five predictions that represent fundamental changes that are emerging in key network domains, from internal networking to cloud services and WAN services.

two key aspects that the majority of Gartner clients struggle with:

- The increased interest in utilizing the internet for WAN connectivity continues to raise concerns about the performance of public internet services and performance of applications deployed in public cloud services. We discuss the risk that enterprises encounter due to the unpredictable nature of the internet, and we discuss how an enterprise can use MPLS to connect directly to public cloud services instead of using the internet.

- Enterprises continue to need new business solutions deployed faster, but remain hampered by the inability of network solutions and network services to respond fast enough and rectify performance issues fast enough. We discuss three options to improve network operations as well as network services.

Source: Gartner (December 2017)

Strategic Planning Assumptions

Strategic Planning Assumption: Within the next five years, there will be a major internet outage that impacts more than 100 million users for longer than 24 hours.

Analysis by: Andrew Lerner, Greg Young

Key Findings:

- We are increasingly seeing organizations use the internet as a WAN, and estimate that approximately 20% of Gartner clients in many geographic regions have at least some critical branch locations entirely connected via the internet.

- Most IT teams don’t have a detailed understanding of the multitude of applications and services that are being used on the public internet and/or their criticality. This is because of years of line of business (LOB)-centric buying and the proliferation of SaaS.

- While the internet is highly resilient, there are specific infrastructure and technology hot spots that, if compromised, could threaten the internet as a whole or large portions of it. This could be the result of natural disasters, man-made accidents or intentional acts.

- Natural disasters and man-made acts that could impact large portions of the internet include earthquakes, solar flares, electronic pulses, meteors, tsunamis, hurricanes, major cable cuts and network operator errors.

- Intentional acts include hacktivism, terrorism toward critical infrastructure, and/or coordinated distributed denial of service (DDoS) attacks, attacks against carrier- and ISP-specific components, and protocols (e.g., SS7).

While the probability of each of these events individually is small, the likelihood that at least some of them will occur over an extended period of time is actually surprisingly high. For example, even if there is only a 1% chance that any of the 11 examples identified above results in an outage within a year, there is a statistical likelihood of over 45% that at least one of them will occur over a five-year period. Further, to date, there have been indications that the internet is vulnerable to sizable outages:

- In 2008, millions of users and large portions of the Middle East and India were impacted by a cable cut. 1

- In 2016, a large DDOS attack resulted in many large e-commerce sites going down, including Twitter, Netflix, Reddit and CNN. 2

- In 2015, Telekom Malaysia created a routing problem that rendered much of the Level 3 network unavailable. 3

- It has been widely reported that 70% of all internet traffic goes thru Northern Virginia 4 and, while this might be an overstated, there’s no doubt that there are several major chokepoints in the internet infrastructure.

Market Implications:

At a minimum, an extended and widespread internet outage would cause dramatic revenue loss for enterprises, and could even create life-threating situations depending on what business the organizations is in. Initially, many organizations often brush this off by saying, “Well there’s not much we can do about it anyway” or “If there is a large internet outage due to a natural disaster, then personal safety is the priority and the enterprise connectivity is the least of our concerns.” However, there are very specific and actionable items that infrastructure and operations (I&O) leaders should take to mitigate the impact of a large outage.

Strategic Planning Assumption: By 2021, 25% of enterprise telecom contracts will evolve to allow for greater flexibility such as canceling services or introducing new services within the contract period, up from less than 5% today.

Analysis by: Danellie Young

Key Findings:

- Enterprise telecom contracts are typically fixed in both term duration and for the services required for procurement.

- Most larger revenue contracts ($1 million annually) require the enterprise to agree to minimum revenue commitments on an annual basis.

- Major WAN decisions are made by 31% to 47% of enterprises each year, including equipment refresh or carrier renegotiations (assuming the refresh cycle on routers is six years, and the average enterprise WAN service contract is three years).

- A large majority of enterprises are struggling with the cost, performance and flexibility of their traditional WAN contracts, further exacerbated by the proliferation of public cloud applications.

Market Implications:

Enterprise telecom contracts remain rigid and fixed, with specified services required to ensure compliance. Typically such contracts penalize customers when services are disconnected midterm. Enterprise telecom contracts are typically negotiated on 36-month cycles, based on either full-term or revenue commitments. Revenue commitments are set based on monthly spend, annual spend or total contract spending. Upon meeting the contract’s revenue commitment, the enterprise can then renegotiate or consider alternative services or providers since their financial obligation has been met. Terminating contracts early for convenience will typically levy penalties on the enterprise. These penalties range from 100% of the monthly recurring charges (MRCs) to a percentage of the MRCs to a declining portion through the remainder of the term (i.e., 100% in the first 12 months, 75% in months 13 to 24 and 50% through the end of the term).

Currently, contracts are split between term and revenue commit contracts, whereby most of the revenue commitments are made on an annualized basis. Alternatively, a small number (5%) are offered or negotiated with total contract values tied to them. Total contract revenue commitments enable the enterprise to meet the obligation earlier in their contract and provide the opportunity to negotiate new lower rates and a new contract, and to solicit competitive proposals before the full 36-month cycle terminates.

In addition to traditional voice and data services, many networking vendors now offer SD-WAN functionality products, while carriers and managed service providers (MSPs) are beginning to launch and roll out managed SD-WAN services as an alternative to managed routers. Contract flexibility will be needed to allow the enterprise the flexibility to migrate to new solutions, without financial risk or paying early termination fees on services. Thus, while we anticipate rapid adoption of SD-WAN and virtualized customer premises equipment (vCPE) solutions in the enterprise, SD-WAN by itself will not improve contractual conditions.

………………………………………………………………………………………………………………………………

Gartner Group: SD-WAN Survey Yields Surprises

by Danellie Young | Ted Corbett | Lisa Pierce

Introduction:

A Gartner-conducted software-defined (SD)-WAN survey has identified the key drivers for SD-WAN adoption and preferences for managed services from non-carrier providers. Despite its relative immaturity, the perceived benefits create incentives for IT leaders responsible for networking to leap into SD-WAN pilots now.

Editor’s Notes:

- Please refer to our report on IHS-Markit analysis of the SD-WAN market. Cisco and VMware are the top two vendors due to recent acquisitions of Viptela and Velocloud respectively. Cisco also bought Meraki which provides a SD-WAN solution as well as business WiFi networks.

- According survey data from Nemertes Research, enterprises are not discarding their MPLS networks as they deploy SD-WANs. “Fully 78% of organizations deploying SD-WAN have no plan to completely drop MPLS from their WAN,” Nemertes John Burke reports. “However, most intend to reduce and restrict their use of it (MPLS), if not immediately then over the next few years.”

- “Although it brings a lot of benefits to the table, SD-WAN still uses the public Internet to connect your sites,” points out Network World contributor Mike C. Smith. “And once your packets hit the public Internet, you will not be able to guarantee low levels of packet loss, latency and jitter: the killers of real-time applications.”

…………………………………………………………………………………………………………………………..

Key Findings of Gartner Survey:

- Enterprise clients cite increased network availability, reliability and reduced WAN costs resulting from less-expensive transport as the top benefits of software-defined WAN.

- Enterprise clients are concerned about the large number of SD-WAN vendors and anticipate market consolidation, making some early choices risky.

- A lack of familiarity with the technology, the instability of the vendors, and skepticism about performance and reliability are the most common concerns when deploying SD-WAN.

- Nearly two-thirds of the organizations we surveyed prefer buying managed SD-WAN, demonstrating a preference for presales and postsales support. A preference for type of managed service provider does not align with legacy carrier MSP adoption rates.

Recommendations:

To maximize new SD-WAN opportunities, infrastructure and operations leaders planning new networking architectures should:

- Include SD-WAN solutions on their shortlists if they’re aggressively migrating apps to the public cloud, building hybrid WANs, refreshing branch WAN equipment and/or renegotiating a managed network service contract.

- Include a diverse range of management solutions related to SD-WAN considerations; don’t just look at carrier offers to determine the best option available to meet enterprise requirements.

- Compare each vendor’s current features and roadmaps with enterprise requirements to develop a shortlist, and use pilots and customer references to confirm providers’ ability to deliver on the most desirable features and functionality.

- Focus pilots on specific, critical success factors and negotiate contract terms and conditions to support service configuration changes, fast site roll-out and granular application reporting.

- Negotiate flexible WAN or managed WAN services contract clauses to support evolution to SD-WAN when appropriate.

…………………………………………………………………………………….

Gartner has forecast SD-WAN to grow at a 59% compound annual growth rate (CAGR) through 2021 to become a $1.3 billion market (see Figure 1 and “Forecast: SD-WAN and Its Impact on Traditional Router and MPLS Services Revenue, Worldwide, 2016-2020”). Simultaneously, the overall branch office router market is forecast to decline at a −6.3% CAGR and the legacy router segment will suffer a −28.1% CAGR through 2020.

SD-WAN equipment and services dramatically simplify the complexity associated with the management and configuration of WANs. They provide branch-office connectivity in a simplified and cost-effective manner, compared with traditional routers. These solutions enable traffic to be distributed across multiple WAN connections in an efficient and dynamic fashion, based on performance and/or application-based policies.

The survey data highlights that most of the respondent organizations are in the early stages of their SD-WAN projects. To qualify, respondents must be involved in choosing, implementing and/or managing network services and equipment for their company’s sites, while their primary role in the organization is IT-focused or IT-business-focused. We intentionally searched for companies that plan to use or are using SD-WAN. Of those surveyed, 93% plan to use SD-WAN within two years or are piloting and deploying now, with approximately 73% in pilot or deployment mode. These results do not reflect actual market adoption rates, because Gartner estimates that between 1% and 5% of enterprises have deployed SD-WAN. Although the results differ numerically, the qualitative feedback is compelling.

Related to specific number of sites, the responses are shown in Figure below:

Respondents using SD-WAN; n = 21 (small sample size; results are indicative). Totals may not add up to 100%, due to rounding.

Source: Gartner Group (November 2017)

……………………………………………………………………………………………………………………………….

SD-WAN Concerns

Enterprises cite their lack of deep technology familiarity as a key barrier to using SD-WAN. In fact, of those who plan for SD-WAN, nearly 50% have concerns about their lack of technical familiarity, followed by concerns over the stability of vendors and concerns about performance and reliability.

Editor’s Note: Surprisingly, enterprises don’t seem to be concerned with the lack of SD-WAN standards which dictates a single vendor solution/lock-in.

…………………………………………………………………………………

With more than 30 SD WAN vendors in the market and consolidation accelerating, this doesn’t come as a surprise.

Other key findings include:

- Vendor stability is a major concern. Among the 51% of respondents who selected performance and reliability as key drivers (n = 44), nearly half (45%) had concerns about the stability of the vendors.

- Many among the 50% who see agility as a key driver (n = 36) expressed concern about their lack of familiarity with the technology.

- Among organizations with fewer than 1,000 employees (n = 53), the most common concern is lack of familiarity with the technology (51%). Organizations with 1,000 to 9,999 employees (n = 38) find the ROI of the investment to be most common challenge (50%).

- Among the EMEA respondents (n = 48), half were most concerned about the stability of the vendors, followed closely by concerns about proven performance and reliability.

To purchase the complete Gartner SD-WAN report go to:

https://www.gartner.com/doc/3829464/survey-analysis-early-findings-yield

………………………………………………………………………………………………………………

References:

https://www.sdxcentral.com/sd-wan/definitions/software-defined-sdn-wan/

https://blogs.gartner.com/andrew-lerner/2017/06/03/sd-wan-is-going-mainstream/

Technology Insight for Software-Defined WAN [SD-WAN]

http://sd-wan.cloudgenix.com/Q217GartnerTechInsightforSD-WANSearch_registration.html

http://blog.ntt-sdwan.com/post/102ekiu/sd-wan-momentum-five-trends-to-look-out-for-in-2018

Broadband Forum’s vBG network spec targeted at SD-WANs; led by ONUG

IHS-Markit: 15% Drop in Global Optical Network Equipment Sales; Cisco and VMware are SD-WAN market leaders

- Optical Network Equipment Market:

IHS-Markit reports that the optical network equipment market slumped 3% in the third quarter from the same period last year. Huawei was #1 in optical network sales, followed by Ciena, which ranked first in North America where Huawei isn’t permitted to sell its gear.

Highlights:

- In the third quarter of 2017 (Q3 2017), the global optical equipment market declined 15 percent quarter over quarter and 3 percent year over year as North America, Latin America and EMEA (Europe, the Middle East and Africa) experienced significant reductions in spending; the Asia Pacific region was up 2 percent on a year-over-year basis

- The metro wavelength-division multiplexing (WDM) segment was down slightly in Q3 2017 from the prior quarter but increased 3 percent from a year ago; long-haul WDM declined 9 percent year over year

- Huawei remained the worldwide optical equipment market leader in Q3 2017; Ciena was the number-two optical equipment vendor by revenue globally and maintained its number-one position in North America

IHS-Markit analysis:

The worldwide optical equipment market declined 15 percent sequentially and 3 percent year over year in Q3 2017 as soft growth in the Asia Pacific region was not sufficient to offset the declines in EMEA, North America and Latin America.

Recent performance in some corners of the optical components market has many in the industry looking to the market in China and questioning whether it can sustain the high investment levels seen over the past 18 months. While China was indeed down sharply sequentially as is typical for the quarter, it did manage to stay in growth territory on a year-over-year basis. Recent bid activity in China indicates that further significant investments in backbone and provincial networks are still ahead.

In Q3 2017, the WDM equipment segment declined 15 percent from the prior quarter and was down 2 percent from a year ago. The metro WDM segment fell slightly quarter over quarter, but increased 3 percent year over year, supporting our view that this will be the main growth vector for the market moving forward. The long-haul segment sank 23 percent quarter over quarter and was down 9 percent year over year. Subsea revenue also declined both sequentially and on a year-over-year basis in Q3 2017.

Huawei remained the optical equipment market leader in Q3 2017 despite a significant seasonal drop in revenue both sequentially and year over year. Tepid spending in Western Europe was responsible for a large part of Huawei’s overall decline in the quarter. Ciena moved back up to the number-two position worldwide for Q3 2017. The company continues to be the dominant optical equipment vendor in North America, and it also made notable progress outside its home market in Q3 2017 with strong year-over-year gains in EMEA, Latin America and Asia Pacific.

Analyst Quotes:

“The metro WDM segment fell slightly quarter over quarter, but increased 3% year over year, supporting our view that this will be the main growth vector for the market moving forward,” report author Heidi Adams said.

“Huawei remained the optical equipment market leader in Q3 2017 despite a significant seasonal drop in revenue both sequentially and year over year,” Adams said. “Tepid spending in Western Europe was responsible for a large part of Huawei’s overall decline in the quarter.”

Ciena “continues to be the dominant optical equipment vendor in North America, and it also made notable progress outside its home market in Q3 2017 with strong year-over-year gains in EMEA, Latin America and Asia Pacific,” Adams added.

Optical report synopsis:

The IHS Markit optical network hardware report tracks the global market for metro and long-haul WDM and Synchronous Optical Networking (SONET)/Synchronous Digital Hierarchy (SDH) equipment, Ethernet optical ports, SONET/SDH ports and WDM ports. The report provides market size, market share, forecasts through 2021, analysis and trends.

References:

https://technology.ihs.com/597065/optical-network-hardware-market-cools-off-in-q3-2017

…………………………………………………………………….

Related article:

Optical Networks Booming in India

…………………………………………………………………………………………………………………………………………………..

2. SD-WAN Market:

IHS Markit offered a much more bullish assessment for software-defined (SD) WAN vendors.

Consolidation and acquisitions are well underway in the software-defined wide area network (SD-WAN) market as vendors race to include SD-WAN technology in their offerings. Following Cisco’s acquisition of Viptela, VMware carried out its own acquisition of VeloCloud, the SD-WAN revenue leader in the first half of 2017, for an undisclosed amount.

“VMware and Cisco have acquired the two SD-WAN market share leaders, making the SD-WAN market a two-horse race for the number-one spot,” said Cliff Grossner, PhD and senior research director/advisor for cloud and data center markets at IHS Markit. “And we could see even more consolidation as vendors set out to add SD‑WAN to their capability sets, especially since the technology is key to supporting connectivity in the multi-clouds that enterprises are building.”

According to the IHS Markit Data Center and Enterprise SDN Hardware and Software Biannual Market Tracker, SD-WAN is currently a small market, totaling just $137 million worldwide in the first half of 2017 (H1 2017). However, global SD-WAN hardware and software revenue is forecast to reach $3.3 billion by 2021 as service providers partner with SD-WAN vendors to deploy overlay solutions — and as virtual network function (VNF)–based solutions become more closely integrated with carrier operations support systems (OSS) and business support systems (BSS).

“Currently, the majority of SD-WAN revenue is from appliances, with early deployments focused on rolling out devices at branch offices,” Grossner said. “Moving forward, we expect a larger portion of SD-WAN revenue to come from control and management software as users increasingly adopt application visibility and analytics services.”

More highlights from the IHS Markit data center and enterprise SDN report:

- Globally, data center and enterprise software-defined networking (SDN) revenue for in-use SDN-capable Ethernet switches, SDN controllers and SD-WAN increased 5.4 percent in H1 2017 from H2 2016, to $1.93 billion

- Based on in-use SDN revenue, Cisco was the number-one market share leader in the SDN market in H1 2017, followed by Arista, White Box, VMware and Hewlett Packard Enterprise

- Looking at the individual SDN categories in H1 2017, White Box was the front runner in bare metal switch revenue, VMware led the SDN controller market segment, Dell held 45 percent of branded bare metal switch revenue and Hewlett Packard Enterprise had the largest share of total SDN-capable (in-use and not-in-use) branded Ethernet switch ports

Reference:

Gartner’s Advice to use Multi-Vendor Network Architectures Contradicts Industry Trends, e.g. SD-WANs, NFV

Editor’s Note: Why Single Vendor Solutions Dominate New Networking Technologies

There are no accredited standards for exposed interfaces or APIs* in SD-WANs, NFV “virtual appliances,” Virtual Network Functions (VNFs), and access to various cloud networking platforms (each cloud service provider has their own connectivity options and APIs). Those so called “open networking” technologies are in reality closed, single vendor solutions. How could there be anything else if there are no standards for multi-vendor interoperability within a given network?

In other words, “open” is the new paradigm for “closed” with vendor lock-in a given.

* The exception is Open Flow API between Control and Data planes-from ONF.

Yet Gartner Group argues in a new white paper (available free to clients or to non clients for $195), that IT end users should always adopt multi-vendor network architectures. This author strongly agrees, but that’s not the trend in today’s networking industry, especially for the red hot “SD-WANs” where over two dozen vendors are proposing their unique solution in light of no standards for interoperability or really anything else for that matter within a single SD-WAN.

Yes, we know Metro Ethernet Forum (MEF) has started working on SD-WAN policy and security orchestration across multiple provider SD WAN implementations. They’ve also written a white paper “Understanding SD-WAN Managed Services,” which defines SD-WAN fundamental characteristics and service components. However, neither MEF or any other fora/standards body we know of is specifying functionality, interfaces for interoperability within a single SD-WAN.

…………………………………………………………………………………………………….

Here are a few excerpts from the Gartner white paper is titled:

Divide Your Network and Conquer the Best Price and Functionality

“IT leaders should never rely on a single vendor for the architecture and products of their network, as it can lead to vendor lock-in, higher acquisition costs and technical constraints that limit agility. They should segment their network into logical blocks and evaluate multiple vendors for each.”

Key Challenges:

-

Vendors tend to promote end-to-end network architectures that lock clients with their solutions because they are focused on their business goals, rather than enterprise requirements.

-

Enterprises that make strategic network investments by embracing vendors’ architectures without first mapping their requirements often end up with solutions that are overhyped, over-engineered and more expensive.

-

Enterprises that do not create and actively maintain a competitive environment can overpay by as much as 50% for the same equipment from the same vendor. Savings can be even greater when comparing to other vendors with a functionally equivalent solution.

Recommendations:

IT and Operations leaders focused on network planning should:

- Divide the network into foundational building blocks, defining how they interwork with each other, to enable multiple vendor options for each block.

- Remove proprietary components from the network, replacing them with industry standard elements as they are available, to facilitate new vendors to make competitive proposals.

- Get a technical solution that meets needs at the lowest market purchase price by competitively bidding on each building block.

- Ensure that operations can deal with multiple vendors by planning for network management solutions and processes that can cope with a multivendor environment.

Introduction

Network technologies have matured in the last 20 years and are a routine component of every IT infrastructure. No vendor can claim a unique “core competency” nor “best-of-breed” capabilities in every area of the network, so there is no reason to treat the network as a monolithic infrastructure entrusted to a single supplier. However, we regularly speak to clients that still give credit to the myth of the single-vendor network. They believe that having only one networking vendor provides the following advantages:

- There is no need to spend time designing a solution, as you simply get what leading vendors recommend.

-

Products from the same vendor are designed to work seamlessly together, with limited or no integration challenges.

-

The procurement process is simplified with only one vendor, and there’s no need to deal with time-consuming, vendor-neutral RFPs.

-

A higher volume of purchases with one vendor would result in a better discount.

-

You only have a single vendor to hold accountable in case you run into problems, and one that will respond quickly given the loyalty and volume of purchases.

However, these perceived advantages are largely a myth, as much as open networking and complete vendor freedom is a myth. The harsh reality that we frequently hear from clients that followed this single-vendor strategy includes:

- Holistic designs recommended by vendors are not necessarily the best. They are often over-engineered, include products that are not aligned with enterprise needs and are ultimately more expensive to buy and maintain.

- Diverse product lines from the same vendor share the brand, but they are rarely designed to work together from the start, since they often come from independent BUs or acquisitions, making them difficult to integrate.

- A higher volume of purchases does not automatically translate into better discounts. For most vendors, their best discounts are reserved for competitive situations and will generally offer savings of 15% to 50% when compared with the best-negotiated sole-source deals.

- Having to deal with just one vendor for technical issues is simpler, but does not necessarily translate in shorter time to repair and better overall network availability, which is the real goal.

Clients that pursue a multivendor strategy report that time spent on RFPs and evaluation of different vendors is not a waste, because it increases teams’ skills, motivates them to stay abreast of market innovations, prevents suboptimal decisions and pays off — technically and financially.

Divide the Network Into Foundational Building Blocks to Enable Multiple Vendor Options for Each Block

Network planners and architects must break the network infrastructure into smaller, manageable blocks to plan, design and deploy a “fit-for-purpose” infrastructure that addresses the defined usage scenarios and control costs (Figure 1 shows typical building blocks).

*Security is not addressed in this document. Note: There is no hierarchy associated with block positioning in this picture.

*Security is not addressed in this document. Note: There is no hierarchy associated with block positioning in this picture.

Source: Gartner (October 2017)

……………………………………………………………………………………….

The key objectives of this activity are to:

- Identify network blocks that have logical and well-defined boundaries.

- Document and standardize as much as possible the interfaces between the various building blocks, to allow choice and enable use of multiple vendors.

This building block approach is useful because not all network segments have the same properties. In some segments little differentiation exists among suppliers, and there is a high degree of substitution within a building block, so enterprises can seek operational and cost advantages. For example, wired LAN switching solutions for branch offices are largely commoditized, and the difference between vendors is hard to discern in the most common use cases.

In other cases, such as in the data center networking market, there is more differentiation among vendors, and the segmentation approach ensures that enterprise architectural decisions align with IT infrastructure strategies and business requirements.

There are no hard-and-fast industry rules on where the boundaries between blocks must be drawn. Each enterprise has to split network infrastructure in a way that makes sense for them. The most common approach is segmentation around functional areas, such as data center leaf and spine switches, WAN edge, WAN connectivity, LAN core and LAN access. Each segment could further be split. For example, LAN access includes wired and wireless, while WAN edge might include WAN optimization and network security services. Another complementary segmentation boundary can be the geographical place, as a large organization with subsidiaries in multiple locations could select different vendors on a regional or country basis for some blocks. Disaggregation is creating another possible segmentation, since hardware and software can be awarded to different vendors for some solutions like white-box Ethernet switching.

Defining building blocks also protects organizations from the “vendor creep” trap. As vendors acquire small companies and startups in adjacent markets, they often encourage enterprises to add these new products or capabilities to the “standardized” solution. If the enterprise defines its foundational requirements, it can easily determine whether the new functionality truly solves a business need, and whether any additional cost is warranted.

Remove Proprietary Components From the Network to Facilitate New Vendors to Make Competitive Proposals

Employment of proprietary protocols and features inside the network limits the ability to segment the network into discrete blocks and makes this activity more difficult.

Within building blocks, it is acceptable to use proprietary technologies, as long as enterprises compare vendors against their business requirements (to avoid over-engineering) and the solution provides a real and indispensable functional advantage. It is important to express the business functionality as a requirement and not to tie requirements to specific proprietary technologies.

Between building blocks, it is critical to avoid proprietary features and use standards, since proprietary protocols favor using certain vendors and disfavor others, leading to loss of purchasing power. Sometimes it’s necessary to employ a proprietary protocol, for example:

-

To obtain functionality that uniquely meets a critical business need. If so, then it’s critical that these protocols be reviewed regularly and are not automatically propagated into new buying criteria over the long term.

-

In the early stages of market development, before standards have caught up to innovation. However, once standards exist, or the technology has started to move down the commodity curve, it is imperative that network architects and planners migrate to standards-based solutions (as long as business requirements aren’t compromised). Examples of industry standards that replace previous proprietary solutions are Power over Ethernet Plus (PoE+) and Virtual Router Redundancy Protocol (VRRP) (see Note 1).

In these cases it is essential to document and motivate the exception, so that it can be periodically reviewed. Proprietary technologies should always be avoided in the interface between the network and other components of IT infrastructure (for example, proprietary trunking to connect servers to the data center network).

Get a Technical Solution That Meets Needs at the Lowest Market Purchase Price by Competitively Bidding on Each Building Block

Dividing the network provides a clear definition of what is really needed within each building block, which in turns enables a fit-for-purpose approach and a competitive bidding process.

–>The goal is not to bid on the best technical solution for each block, but on one that is good enough to meet requirements.

This enables real competition across vendors and provides maximum price leverage, since all value-adds to the common denominator can be evaluated separately and matched with the cost difference.

By introducing competition in this thoughtful manner, Gartner has seen clients typically achieve sustained savings of between 10% and 30% and of as much as 300% on specific components like optical transceivers.

Discern the Relationships Between Networking Vendors and Network Management Vendors

You may also find that networking vendors have some level of leverage with certain other vendors specialized in network management. Therefore, it is valuable to understand the arrangement of any partner agreement and whether this can be leveraged to your organization’s benefit.

………………………………………………………………

Editor’s Closing Comment:

The advice provided above by Gartner Group seems very reasonable and mitigates risk of using only a single vendor for a network or sub-network. If so, how can any network operator or enterprise networking customer justify the single vendor SD-WAN solutions that are proliferating today?

Readers are invited to comment in the box below the article (can be anonymous) or contact the author directly ([email protected]).

……………………………………………………………………………..

References:

https://www.firemon.com/resources/collateral/avoid-these-bottom-ten-networking-worst-practices/

https://www.gartner.com/doc/3783150/market-trends-csps-approach-sdwan

Broadband Forum’s vBG network spec targeted at SD-WANs; led by ONUG

The Broadband Forum has published TR-328, the Virtual Business Gateway, a network specification meant to facilitate the adoption of Software-Defined WAN (SD-WAN) technology. The Forum says that Virtual Business Gateway (vBG) (TR-328) “enables SD-WAN spearheaded by The Open Networking User Group (ONUG).”

–>We’ll try to unpack that quote later in this post, by examining SD-WAN projects in the ONUG.

“As operators look to transform their networks with greater use of software and virtualization, demand for solutions, such as the vBG and CloudCO, with these associated reference implementations and API’s is growing – the market is now ready for standards-based software deliverables for Open Broadband,” Robin Mersh, CEO of Broadband Forum, said in a press release.

The Forum said that “vBG accelerates the delivery of new-generation

standardized, carrier-class, interoperable business services such as enterprise class firewall and Wide Area Network optimization. SD-WAN, spearheaded by the Open Networking User Group (ONUG), is enabled by the vBG, which connects to other Broadband Forum initiatives such as CloudCO and the Network Enhanced Residential Gateway. The completion of the landmark specification

comes at the same time as the Forum begins work on two major software projects for Open Broadband and makes significant progress on its CloudCO project.”

The Broadband Forum said that the vBG system enables greater efficiency in service provider networks by virtualizing some of the functionality of a Business Gateway into a flexible hosting environment, which may be located at the customer premises, in the operator’s network, such as a CloudCO, or using a combination of the two approaches.

By using the vBG, a service provider could simplify customer-located and customer self-provisioning through a web portal, enabling it to enhance new service delivery times, shutting down unsuccessful services and up-selling value-added services. All of this can be done without the need to deploy specialized hardware devices to remote enterprise sites. Here are several illustrations of vBG in action:

Illustrations above courtesy of Broadband Forum

………………………………………………………………………………………………………

TR-328 Summary:

- TR-328 specifies the virtual Business Gateway (vBG) system architecture. The vBG system virtualizes some of the functionality of a Business Gateway into a flexible hosting environment which may be located at the customer premises, in the operator’s network, such as a CloudCO or using a combination of the two

- With the vBG system architecture, the functions provided traditionally by the BG are now distributed between a simplified on-site physical device called the pBG (physical Business Gateway) and a virtualized component – the virtual Business Gateway. The vBG hosting environment can benefit both from network equipment and recent network virtualization technology

- TR-328 describes the motivations to deploy the vBG System architecture, based on the use cases that it enables. In particular, it facilitates simplification of the customer located equipment, customer self-provision through a portal, rapid introduction of new services, decommissioning of unsuccessful ones, and upselling value-added services. All without the need to deploy specialized hardware devices to remote enterprise sites. Examples of value-added services include: enterprise class firewall and Wide Area Network optimization.

The vBG was published and the Open Broadband projects were launched during the Broadband Forum’s Q3 meeting, which took place in Helsinki Finland. The Open Broadband projects will be managed under the Broadband Forum’s “agile Open Broadband software” initiative, allowing for member and non-member participation to create a fast feedback loop between the specifications and the source code reference implementation that supports them. These new software projects are the first open source initiatives undertaken by the Broadband Forum.

…………………………………………………………………………………………….

| Related BB Forum specs | Title |

|---|---|

| TR-359 | A Framework for Virtualization |

| TR-345 | Broadband Network Gateway and Network Function Virtualization |

| TR-328 | Virtual Business Gateway |

| TR-317 | Network Enhanced Residential Gateway |

…………………………………………………………………………………………………….

Editor’s Note:

Up till now there have been no specifications for an internal SD-WAN or anything resembling an NNI to interconnect SD-WANs from different service providers. The new spec is not a standard as neither the Broadband Forum or Open Network User Group (ONUG) is an official standards organization – like ITU or IEEE.

………………………………………………………………………………………………

ONUG SD-WAN Activity:

As far as we can tell, the closest to a realizable SD-WAN specification is the ONUG’s Open SD-WAN Exchange (OSE) project. It’s said to be an open framework to enable inter-operability between SD-WANs and cloud providers.

ONUG says their OSE use cases address marketplace M&A, business partner connectivity, cloud/service provider network connectivity, technology transition, and vendor lock-in mitigation.

For more info on ONUG SD-WAN specification efforts, please see this presentation from ONUG’s Spring 2017 meeting. Related content:

……………………………………………………………………….

SD-WAN Market Update:

Last week, China Telecom Global announced global SD-WAN service with integrated security provided by Versa Networks (one of many SD-WAN software start-ups). Separately, Windstream said at a Goldman Sachs conference that the advent of SD-WAN and Office Suite will enable it to breathe much-needed life into its SMB ILEC and SMB CLEC units, which have seen revenue struggles in recent years.

IDC estimates that worldwide SD-WAN infrastructure and services revenues will see a compound annual growth rate (CAGR) of 69.6% and reach $8.05 billion in 2021. That forecast seems incredibly optimistic without agreed upon specs/standards for multi-vendor inter-operability and SD WAN inter network connectivity.

………………………………………………………………………………………

References:

https://www.broadband-forum.org/standards-and-software/major-projects/virtual-business-gateway

https://www.broadband-forum.org/news/download/pressreleeases/2017/PR11_BBF_Q3Helsinki_FINAL.pdf

http://www.fiercetelecom.com/telecom/broadband-forum-targets-sd-wan-trend-vbg-network-specification

https://www.onug.net/open-sd-wan-exchange-ose/

http://www.zdnet.com/article/china-telecom-announces-global-sd-wan-service/