Telco Ai

Fierce Network Research report examines telcos role in the AI economy and profiles early AI adopters

The telecommunications industry is at a critical crossroads. As AI reshapes global value chains, communications service providers (CSPs) must determine their strategic position: will they remain infrastructure enablers or evolve into full-scale participants in the AI economy?

A new Fierce Network Research report — “Risk, Reward and Revenue: Defining Telcos’ Role in the AI Economy” — examines this identity challenge — and how network operators are recalibrating for the next generation of network-driven intelligence. Based on a global survey of 500 technology decision-makers across 40 countries, the findings reveal a pronounced industry divide. A majority (57%) of operators see their core opportunity in infrastructure — networks, data centers, and secure connectivity — while 43% advocate for a more integrated position, aspiring to orchestrate AI ecosystems (19%) or participate fully in the AI value chain (24%).

Some of the industry’s early adopters are already showing what that future might look like.

- AT&T reports a twofold increase in cash flow for every dollar it invests in AI, emphasizing measurable outcomes over vague productivity gains. An AT&T executive said that success in the AI era depends on “Goldilocks governance” — a balance not too rigid to stifle innovation, and not too loose to compromise compliance and trust.

- Bell Canada is moving in a similar direction, targeting a doubling of enterprise AI revenue by 2028 and positioning its Ateko subsidiary and AI Fabric platform as the backbone of a “sovereign digital spine” for Canada.

- “We’re using AI to enhance our products and services and make them better,” Ed Fox, MetTel CTO. The company provides a private network to deliver integrated communications and IT services to U.S. businesses and government agencies, including voice, data, network, cloud, mobility, IoT and security solutions. MetTel also provides managed network services such as SD-WAN and secure access service edge (SASE).

- Rick Lievano, Microsoft CTO for the worldwide telecommunications industry, sees operators expanding their use of AI beyond efficiency. “Initially, the first place where telcos began to experiment with AI is around efficiency gains — how can I save money, and how can I do more with fewer people? That’s been the target of the first couple of waves of AI,” Lievano said. “However, their eyes light up when we talk with them about new revenue opportunities,” Lievano said.

The research highlights that telcos possess critical assets few other industries can match: globally distributed data center capacity, secure and resilient networks, and deep, long-standing relationships with enterprise and government customers. But the barriers are equally significant — from proving the business case for AI infrastructure to navigating a shortage of data science and AI talent. Legacy technology debt continues to drag, with one executive lamenting that 145 years of accumulated systems make modern data integration “extraordinarily complex.”

A new Fierce Network Research report reveals how communication service providers are navigating the AI economy amid uncertainty about their role and strategy. (Google Gemini)

The bottom line is clear: to remain relevant in the AI-driven economy, telcos must modernize both infrastructure and business models — transforming from connectivity providers into intelligent digital enablers. However, we’ve heard that cry for telco transformation from dumb pipes to intelligent and autonomous network and IT providers, but it has yet to be realized. Will this time be any different?

References:

https://www.fierce-network.com/cloud/dumb-pipes-or-ai-powerhouses-telcos-face-identity-crisis

Full REPORT: “Risk, Reward and Revenue: Defining telcos’ role in the AI economy.”

Private 5G networks move to include automation, autonomous systems, edge computing & AI operations

Palo Alto Networks and Google Cloud expand partnership with advanced AI infrastructure and cloud security

Generative AI could put telecom jobs in jeopardy; compelling AI in telecom use cases

Generative AI in telecom; ChatGPT as a manager? ChatGPT vs Google Search

Allied Market Research: Global AI in telecom market forecast to reach $38.8 by 2031 with CAGR of 41.4% (from 2022 to 2031)

Markets and Markets: Global AI in Networks market worth $10.9 billion in 2024; projected to reach $46.8 billion by 2029

Ericsson integrates Agentic AI into its NetCloud platform for self healing and autonomous 5G private networks

Ericsson CEO’s strong statements on 5G SA, WRC 27, and AI in networks

New Linux Foundation white paper: How to integrate AI applications with telecom networks using standardized CAMARA APIs and the Model Context Protocol (MCP)

Global telecom infrastructure market outlook after a dismal 2024

Despite the telecom industry’s hopes that 2025 will usher in a turnaround for the global network equipment market, there’s no hint of that happening considering how bad 2024 was.

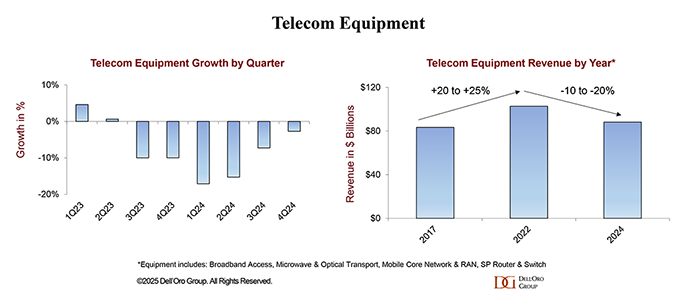

According to Dell’Oro Group, worldwide telecom equipment market revenues in 2024 dropped 11% year-over-year – marking “the steepest annual decline in more than 20 years.”

Dell’Oro VP Stefan Pongratz wrote:

“Preliminary findings suggest that worldwide telecom equipment revenues across the six telecom programs tracked at Dell’Oro Group—Broadband Access, Microwave & Optical Transport, Mobile Core Network (MCN), Radio Access Network (RAN), and SP Router & Switch—declined 11% year-over-year (YoY) in 2024, recording the steepest annual decline in more than 20 years (decline was >20% in 2002), propelling total equipment revenue to fall by 14% over the past two years. This remarkable output deceleration was broad-based across the telecom segments and driven by multiple factors, including excess inventory, challenging macro environment, and difficult 5G comparisons.

In 4Q24, stabilization was driven by growth in North America and EMEA, which nearly offset constrained demand in Asia Pacific (including China).

The full-year decline was uneven across the six telecom programs. Optical Transport, SP Routers, and RAN saw double-digit contractions, collectively shrinking by 14% in 2024. Microwave Transport and MCN experienced a more moderate combined decline in the low single digits, while Broadband Access revenues were fairly stable.

Similarly, regional developments were mixed in 2024. While the slowdown was felt across the five regions — North America, EMEA, Asia Pacific, China, and CALA — the deceleration was more pronounced in the broader Asia Pacific region, reflecting challenging conditions in China and Asia Pacific outside of China.

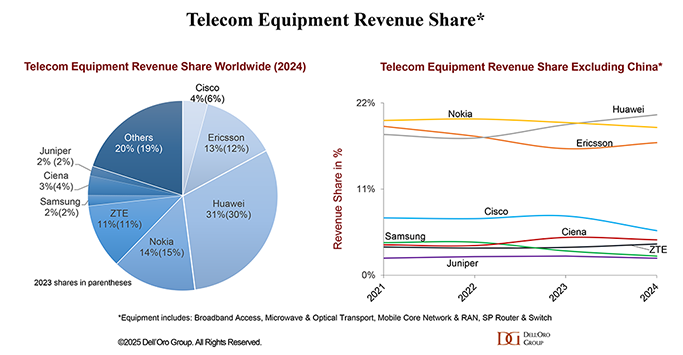

Supplier rankings were mostly unchanged globally, while revenue shares shifted slightly as both Huawei and Ericsson positions improved. Overall market concentration was stable with the 8 suppliers comprising around ~80% of the worldwide market in 2024.

Rankings changed outside of China. Initial estimates suggest Huawei passed Nokia to become the #1 supplier, followed by Nokia and Ericsson. Huawei’s revenue share outside of China was up 2 to 3 percentage points in 2024, relative to 2021, while Ericsson is down roughly two percentage points over the same period/region.

A glimmer of hope is that the Covid instigated inventory correction is over and the supply chain is starting to recover. For example, Ciena recently noted its problems with “inventory digestion” are mostly over. CEO Gary Smith said that customers are again investing in scaling their networks, specifically for the anticipated increase in cloud traffic and new AI workloads, including Managed Optical Fiber Networks opportunities with the cloud providers.

However, that might take time to play out. Vendors may have to take at least 6-12 months to retool their supply chains due to tariffs, AvidThink Principal Roy Chua has said. And given the “will-they, won’t-they” situation going on with the tariffs, their ultimate impact remains to be seen.

…………………………………………………………………………………………………………………………………..

It’s been six years since 5G networks have been commercially deployed. But aside from deploying fixed wireless access (FWA), telcos have struggled to “find large use cases that require 5G speeds and features,” Deloitte said in its latest telecom industry forecast.

“Not only were there seemingly few additional use cases driving 5G adoption and monetization in 2024, but there may not be many more for 2025 or even 2026 either.” The market research/accounting firm continued:

Our outlook focuses on three of those difficult choices, and we have a full chapter on each:

- In 2025, the most discussed source of growth for many industries is generative AI, and telcos are asking how they can share in that excitement. Telcos are using gen AI to reduce costs, become more efficient, and offer new services. Some are building new gen AI data centers to sell training and inference to others. A gen AI gold rush expected over the next five years. Spending estimates range from hundreds of billions to over a trillion dollars on the physical layer required for gen AI: chips, data centers, electricity. Close to another hundred billion US dollars will likely be spent on the software and services layer.

- At the same time, telcos are roughly at the midpoint between the launch of 5G and the expected launch of 6G, and they want to confirm that they can shape 6G to be more profitable than 5G has so far been.

- Finally, after years of divesting noncore assets, telcos are getting primed to deploy M&A strategies in pursuit of growth.

Globally, the telecommunications industry is expected to have revenues of about US$1.53 trillion in 2024, up about 3% over the prior year. Both in 2024 and out to 2028, growth is expected to be higher in Asia Pacific and Europe, Middle East, and Africa, with growth in the Americas being around 1% annually. All three regions are expected to surpass half a trillion dollars in revenue each by 2027. By market cap, the sector is about US$2.6 trillion globally (Figure 1, below).

Stefan summed up: “Market conditions are expected to stabilize in 2025 on an aggregated basis, though it will still be a challenging year. The analyst team is collectively forecasting global telecom equipment revenues across the six programs to stay flat.”

References:

https://www.fierce-network.com/broadband/global-telecom-infra-faced-ultimate-pitfall-2024

Telco spending on RAN infrastructure continues to decline as does mobile traffic growth

Dell’Oro: Global RAN Market to Drop 21% between 2021 and 2029

Dell’Oro: Global telecom CAPEX declined 10% YoY in 1st half of 2024

Dell’Oro: Private RAN revenue declines slightly, but still doing relatively better than public RAN and WLAN markets

Dell’Oro: RAN market still declining with Huawei, Ericsson, Nokia, ZTE and Samsung top vendors

Dell’Oro: 4G and 5G FWA revenue grew 7% in 2024; MRFR: FWA worth $182.27B by 2032

Highlights of Dell’Oro’s 5-year RAN forecast

Omdia: Telco AI investment starts to pick up and effect automation of network activities

According to Omdia (owned by Informa), service providers face intense pressure to transform their IT systems, operations, and processes. Telco AI investment is expected to ramp up in 2021, but there is not as much clarity as there should be around best practices and business outcomes.

Omdia’s research indicates that early 80% of service providers see the use of AI and analytics, when it comes to the automation of network activities, as an “important” or “very important” IT project for 2021. Nearly 60% of them are planning to increase investment in AI tools.

Top AI use cases are expected to include network fault prediction and prevention, automation of end-to-end life-cycle management, and the management of network slicing. AI will also support a variety of non-network use cases, including using AI to support new

business models such as contextual offer management as well as automating and personalizing customer engagement and delivering customer insights.

Let’s take automation as an example. As networks become more complex and services more difficult to manage (e.g. 5G core networks, edge computing and network slicing), Omdia emphasized that automation was becoming critical. Automation of service fulfillment and assurance and creating highly prized “closed loops” – where the need for human intervention is minimal – are usually seen as some of the main drivers for AI investment, as a way to improve operational efficiencies.

It is often said that it is crucial to consider the potential ROI (Return On Investment) before initiating an automation project. ROI is certainly a good starting point for sorting out “must have” from the “nice to have” automation project, whether looking at it from the perspective of five-year cost savings, annual operating cost, time to value, or some other indicator. However, measuring automation outcomes is more complex than it may at first seem. It is of course useful to directly compare operations costs before and after adoption of an AI-based solution, but it is not the full story. It is also important to consider the business outcomes that require prioritization. These can include improving the accuracy of a process, increasing consistency and predictability, including ensuring compliance with specific SLAs, delivering greater reliability, boosting productivity, or reducing turnaround times. The list is extensive, but to make a success of an automation project it is important not to lose sight of the end goal, and to identify those KPIs (Key Performance Indicators) which specifically support the business outcomes an organization is seeking to achieve.

An AI-driven automation also needs to be sustainable. It’s not just about having the capabilities in place to address incidents as they occur. A process automation also needs to continue to be relevant even when a network/IT element is upgraded, or a vendor swapped out.

Visibility is also essential, because to improve anything you need to be able to measure it. But how does a service provider know if they are automating more successfully than their peers? There are plenty of sources of AI-linked training and support, as well as best practice guidance and models provided by industry bodies like the TM Forum. But there is not as yet a commonly agreed methodology to assess automation in the telco space. Some vendors have internal measures, such as internal process automation indexes, but this is not the same as having an industry-wide measure.

“Cloud-native and distributed cloud architectures and the growing importance of the network edge are adding to the complexity. AI is increasingly needed because existing operations are too reactive and rely heavily on human operators to execute functions,” said Kris Szaniawski, Omdia’s practice leader of service provider transformation.

“In current stressful circumstances, service providers that provide a fragmented customer experience will be quickly punished,” warned Szaniawski, who noted that progress toward enabling omnichannel customer engagement “has not always been as advanced as it should be.”

The Omdia report concluded by by suggesting service providers should make “targeted use of AI to better orchestrate customer journeys, as well as invest in well integrated central data repositories and robust data management capabilities.”

………………………………………………………………………………………………………………………………………………………………………….

Separately, Liam Churchill writes that forward-thinking CSPs have focused their AI investments on four main areas:

- Network optimization

- Preventive maintenance

- Virtual Assistants

- Robotic process automation (RPA)

In these areas, AI has already begun to deliver tangible business results. AI applications in the telecommunications industry are increasingly helping CSPs manage, optimize and maintain not only infrastructure, but also customer support operations. Network optimization, predictive maintenance, virtual assistants and RPA are all examples of use cases where AI has impacted the telecom industry, delivering enhanced CX and added value for enterprises.

As Big Data tools and applications become more available and sophisticated, AI can be expected to continue to accelerate growth in this highly competitive space.

References:

https://omdia.tech.informa.com/products/service-provider-operations-it-intelligence-service

https://techsee.me/blog/artificial-intelligence-in-telecommunications-industry/