Telecom Infra Project

TIP launches Metaverse-Ready Networks Project Group

The Telecom Infra Project (TIP) has formed a new project group that, it says “addresses one of the central topics in today’s telecommunications industry, metaverse-ready networks… The TIP Metaverse-Ready Networks Project Group’s primary objective is to accelerate the development of solutions and architectures that improve network readiness to support metaverse experiences.”

Meta Platforms, Microsoft, T-Mobile US, Telefónica and Sparkle will be the initial co-chairs of the project group.

Alex Harmand, head of network platforms at Telefónica and co-chair of the new group, stated: “This new group will enable operators to address the exciting opportunities that the metaverse is creating in both the consumer and enterprise segments. Telefónica is looking forward to collaborating to define the network capabilities and associated APIs needed to enhance metaverse services. The TIP community is the perfect environment for this initiative as it will allow us to leverage multiple current project groups, such as OpenWIFI, OpenRAN, Open Optical and Packet Transport, to deliver end-to-end architectures and solutions that we will then test in Telefónica’s and other TIP Community Labs.”

Ron Marquardt, Vice President of Advanced Technologies & Innovation at T-Mobile said: “As one of the major upcoming revolutions in the telco industry, the metaverse has to be built through industry collaboration. We want to encourage other CSPs, technology makers and content creators to join us in this journey.”

Rashan Jibowu, Product Manager at Meta Platforms and Co-Chair of the MRN Project Group said: “The metaverse is the next chapter of the internet. In the early stages of its development, it’s critical that we work together as an industry to determine what it means for networks to be “metaverse-ready,” and what we need to do collectively to get there. We look forward to collaborating with the TIP community to lay this important groundwork and build toward our common goal of bringing the metaverse to life.”

Fabio Panunzi Capuano, Executive Vice President Business Development at Sparkle and Co-Chair of the MRN Project Group said: “The telecom industry will act as a key enabler for the metaverse by providing the performing network architectures and services that will support growing bandwidth requests and quality of experience generated by new business models. The Metaverse-Ready Networks Project Group, as one voice of the industry, has the challenging task to define new connectivity requirements supporting the end-to-end metaverse experience and Sparkle, with its assets and experience, is at the forefront in cooperating to shape the future.”

Ricardo Villarreal, Director of Product Management at Microsoft, Azure for Operators and Co-Chair of the MRN Project Group said: “The metaverse might be in a nascent state, but it is imperative to start building today the networks needed to realize the promise of a complete convergence of our physical and digital lives. Cross-industry collaboration is the only way to achieve this.”

The Project Group will be hosting its first open doors session at Fyuz in Madrid Oct 25-27th.

TIP Launches Metaverse-Ready Networks Project Group – Telecom Infra Project

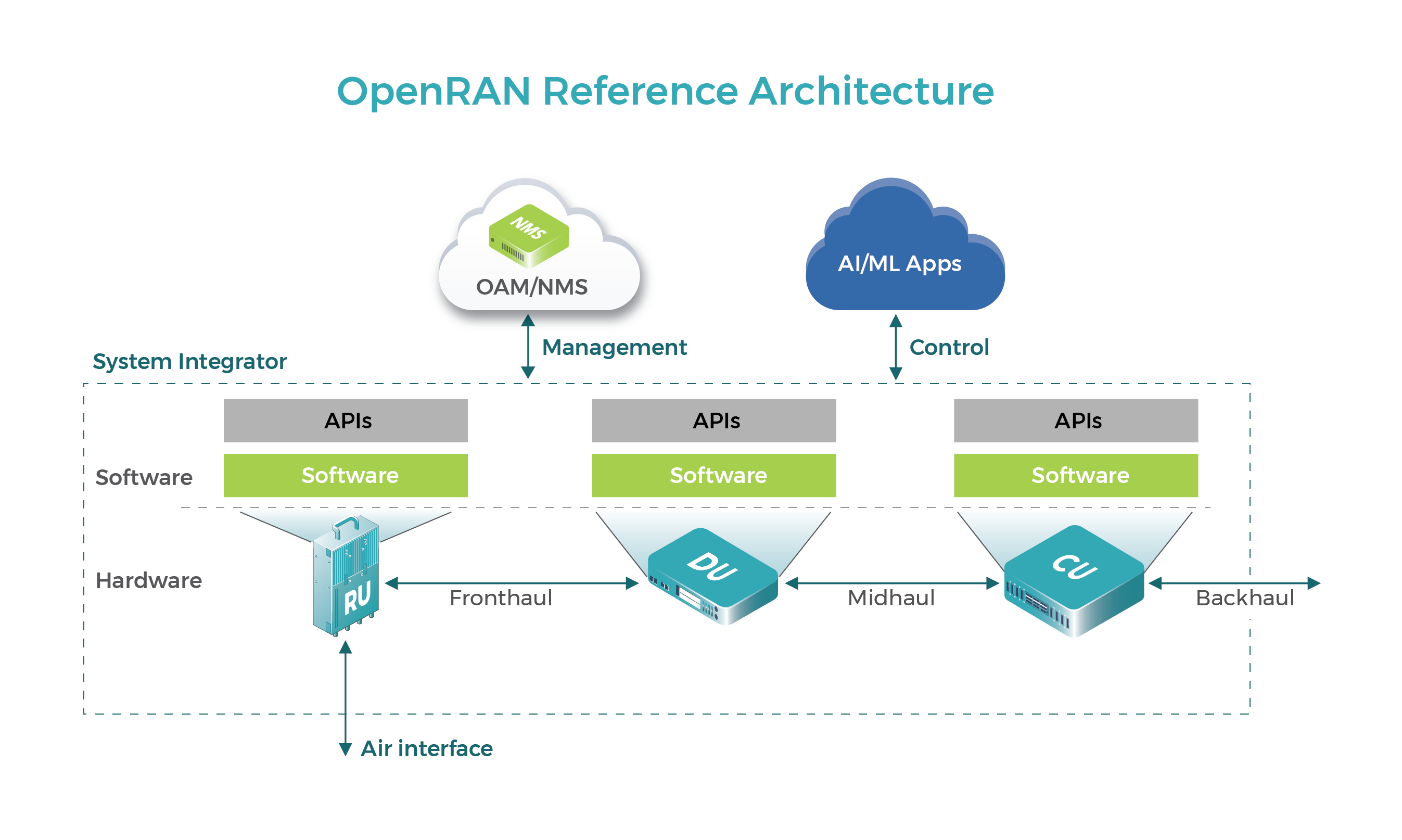

ABI Research: Open RAN radio units to exceed $47 billion by 2026

ABI Research expects the total CAPEX spent on Open RAN radio units (RUs) for public outdoor networks, including both macro and small cells will reach US$40.7 billion in 2026. Cumulative unit shipments will reach 9.9 million during the same year. Meanwhile, the total revenue of Open RAN radios for indoor enterprise networks will reach as much as US$6.7 billion in 2026, with cumulative unit shipments expected to reach 29.4 million. The Open Radio Access Network (Open RAN) market is rapidly expanding and is expected to exceed the traditional RAN market for the first time around 2027-2028.

“The Open RAN opportunity invites various stakeholders to bring their best in class technologies and hardware/software components to contribute to building a flexible, secure, agile, and multi-vendor interoperable network solution,” said Jiancao Hou, Senior Analyst at ABI Research. “In addition, trade wars and the global pandemic of COVID-19 have resulted in tremendous restrictions on the telecom supply chain and disrupt the evolution of new technologies. These effects will accelerate the development of Open RAN and open networks.”

Rakuten Mobile, a greenfield network operator in Japan, set a prime example to deploy this new approach. Moreover, many other operators are also quite active in the field, namely Dish Network in the U.S., Vodafone, Telefonica, Deutsche Telekom, Orange, and Turkcell in the EU and other geological regions. The Open RAN supply chain is also expanding with Altiostar, Mavenir, and Parallel Wireless leading the charge while new entrants are announced every week.

“ABI Research expects greenfield installations, as well as private enterprise networks and public consumer networks, in rural/uncovered areas to drive the deployment of Open RAN throughout the entire forecast period,” Hou points out. Open RAN can introduce many advantages to the enterprise market, including infrastructure reconfigurability, network sustainability, and deployment cost efficiency. On the other hand, these small and easily manageable network use cases will likely lower the entry barrier for Open RAN. Simultaneously they help network operators and their ecosystem partners clearly understand the approach and suppliers’ maturity level, therefore paving the way for a broader market. Besides, “ABI Research sees new entrants will lead the early deployment for Open RAN, but they will be increasingly challenged by tier-one vendors and system integrators for both public cellular implementations and enterprise deployment,” Hou concludes.

These findings are from ABI Research’s Open RAN market data report. This report is part of the company’s 5G & Mobile Network Infrastructure research service, which includes research, data, and analyst insights. Market Data spreadsheets are composed of in-depth data, market share analysis, and highly segmented, service-specific forecasts to provide detailed insight where opportunities lie.

Earlier this week, the Telecom Infra Project (TIP) saw fit to recap its recent achievements regarding OpenRAN; read more about them here.

Image Credit: Telecom Infra Project

…………………………………………………………………………………………………………………………………………………………………………………………

About ABI Research

ABI Research provides strategic guidance to visionaries, delivering actionable intelligence on the transformative technologies that are dramatically reshaping industries, economies, and workforces across the world. ABI Research’s global team of analysts publish groundbreaking studies often years ahead of other technology advisory firms, empowering our clients to stay ahead of their markets and their competitors.

References:

https://www.abiresearch.com/press/open-ran-radio-units-soar-more-us47-billion-2026/

O-RAN Alliance, Telecom Infra Project (TIP) & OCP Telco may open up telecom equipment market to new entrants

“There was more choice of network equipment suppliers 15 years ago than there is now and the industry is keen on expanding that vendor ecosystem,” Vodafone Group PLC’s Head of Network Strategy and Architecture, Santiago Tenorio, told Dow Jones Newswires.

For sure, the telecom industry would like to have more network equipment vendors to diversify supply chains, reducing risk and lowering costs. Network operators are pushing for change in the telecom-equipment market. Two international alliances of tech and telecom companies, universities and research centers are trying to develop networks that source gear from multiple vendors, which could attract new players to the market.

“Everybody wants it to happen,” said Janardan Menon, technology analyst at brokerage Liberum Capital. Mr. Menon expects progress to be slow but steady, and cautioned that it could take years before these open-architecture networks become a reality.

The O-RAN Alliance–which counts U.S. cell carriers Verizon Communications Inc., AT&T Inc. and Sprint Corp. as well as China Mobile Ltd. and Japan’s SoftBank Corp. among its members–is creating an ecosystem of new products that will support multi-vendor, interoperable radio-access networks. Meanwhile, the Telecom Infra Project, whose members include Facebook Inc. and Vodafone among others, is working on similar projects. Tech giants such as Intel Corp., Qualcomm Inc. and South Korea’s Samsung Electronics Co. are backing both groups.

Nokia is also a member of both the O-RAN Alliance and the Telecom Infra Project OpenRAN group. Ericsson has engaged with the O-RAN Alliance, which the Swedish company sees as aligning closer to its goals, but not with the Telecom Infra Project.

“Ericsson is actively contributing towards O-RAN specifications to make it a viable alternative in the future,” an Ericsson spokesperson said. Nokia and Huawei didn’t respond to requests for comment.

The O-RAN Alliance and the Telecom Infra Project (TIP) in February agreed to collaborate on 5G radio-access networks. They reached a liaison deal that allows for sharing information, referencing specifications and conducting joint testing.

Although some 4G projects using these open-architecture are already in operation, the technology isn’t yet ready to be deployed at scale. Facebook and Telefonica have launched a telecom-infrastructure company in Peru called Internet para Todos, which relies on so-called open radio-access network, or OpenRAN. Meanwhile, Vodafone is testing OpenRAN in rural parts of the U.K., following trials in South Africa and Turkey.

“OpenRAN is ready to be deployed commercially in pockets of the network, but not at scale throughout a market yet,” Mr. Tenorio said. “None of the smaller providers which OpenRAN is bringing into the market are ready yet to compete at scale with the likes of Nokia, Ericsson and Huawei,” he added.

The development of open-architecture networks began before Huawei’s blacklisting problems. The Telecom Infra Project was launched four years ago, and the O-RAN Alliance was formed in 2018 through the combination of two projects with shared goals.

There is no major U.S. manufacturer of cellular equipment currently, even though the U.S. is the biggest market in the industry for telecom equipment. The rise of open-architecture networks could create opportunities for smaller companies like Parallel Wireless, Mavenir or Altiostar, all of them based in the U.S., to have a say in the future of telecom networks.

It is unlikely that these new entrants take revenue from Huawei, Ericsson or Nokia in the next few years, said Liberum’s Mr. Menon. However, as the market begins to perceive that there are alternatives to the trio, their valuations could be hit, Mr. Menon said.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Telco is an important open hardware project within the Open Compute Project (OCP):

There is an industry desire to apply open hardware OCP model to the creation of open telecom optimized hardware. The OCP Telco Project enlists participants from telecom companies and carriers as well as sub systems, software, board and semiconductor suppliers who are seeking to use data center infrastructure to deliver IT services.

As technologists across industries participate in this community, OCP is creating and refining more designs, making it possible for more companies to transition from their old,existing proprietary solutions to Open Compute Project (OCP) solutions gear. and interoperable, multi-vendor supplier support.

The openEDGE Sub-Project is under the direction of the OCP Telco Project Group.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

References:

TIP OpenRAN and O-RAN Alliance liaison and collaboration for Open Radio Access Networks

https://telecominfraproject.com/

https://www.opencompute.org/projects/telco

https://techblog.comsoc.org/2020/02/12/nec-and-mavenir-collaborate-to-deliver-5g-open-vran-platform/

O-RAN Alliance, Telecom Infra Project (TIP) & OCP Telco may open up telecom equipment market to new entrants

“There was more choice of network equipment suppliers 15 years ago than there is now and the industry is keen on expanding that vendor ecosystem,” Vodafone Group PLC’s Head of Network Strategy and Architecture, Santiago Tenorio, told Dow Jones Newswires.

For sure, the telecom industry would like to have more network equipment vendors to diversify supply chains, reducing risk and lowering costs. Network operators are pushing for change in the telecom-equipment market. Two international alliances of tech and telecom companies, universities and research centers are trying to develop networks that source gear from multiple vendors, which could attract new players to the market.

“Everybody wants it to happen,” said Janardan Menon, technology analyst at brokerage Liberum Capital. Mr. Menon expects progress to be slow but steady, and cautioned that it could take years before these open-architecture networks become a reality.

The O-RAN Alliance–which counts U.S. cell carriers Verizon Communications Inc., AT&T Inc. and Sprint Corp. as well as China Mobile Ltd. and Japan’s SoftBank Corp. among its members–is creating an ecosystem of new products that will support multi-vendor, interoperable radio-access networks. Meanwhile, the Telecom Infra Project, whose members include Facebook Inc. and Vodafone among others, is working on similar projects. Tech giants such as Intel Corp., Qualcomm Inc. and South Korea’s Samsung Electronics Co. are backing both groups.

Nokia is also a member of both the O-RAN Alliance and the Telecom Infra Project OpenRAN group. Ericsson has engaged with the O-RAN Alliance, which the Swedish company sees as aligning closer to its goals, but not with the Telecom Infra Project.

“Ericsson is actively contributing towards O-RAN specifications to make it a viable alternative in the future,” an Ericsson spokesperson said. Nokia and Huawei didn’t respond to requests for comment.

The O-RAN Alliance and the Telecom Infra Project (TIP) in February agreed to collaborate on 5G radio-access networks. They reached a liaison deal that allows for sharing information, referencing specifications and conducting joint testing.

Although some 4G projects using these open-architecture are already in operation, the technology isn’t yet ready to be deployed at scale. Facebook and Telefonica have launched a telecom-infrastructure company in Peru called Internet para Todos, which relies on so-called open radio-access network, or OpenRAN. Meanwhile, Vodafone is testing OpenRAN in rural parts of the U.K., following trials in South Africa and Turkey.

“OpenRAN is ready to be deployed commercially in pockets of the network, but not at scale throughout a market yet,” Mr. Tenorio said. “None of the smaller providers which OpenRAN is bringing into the market are ready yet to compete at scale with the likes of Nokia, Ericsson and Huawei,” he added.

The development of open-architecture networks began before Huawei’s blacklisting problems. The Telecom Infra Project was launched four years ago, and the O-RAN Alliance was formed in 2018 through the combination of two projects with shared goals.

There is no major U.S. manufacturer of cellular equipment currently, even though the U.S. is the biggest market in the industry for telecom equipment. The rise of open-architecture networks could create opportunities for smaller companies like Parallel Wireless, Mavenir or Altiostar, all of them based in the U.S., to have a say in the future of telecom networks.

It is unlikely that these new entrants take revenue from Huawei, Ericsson or Nokia in the next few years, said Liberum’s Mr. Menon. However, as the market begins to perceive that there are alternatives to the trio, their valuations could be hit, Mr. Menon said.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Telco is an important open hardware project within the Open Compute Project (OCP):

There is an industry desire to apply open hardware OCP model to the creation of open telecom optimized hardware. The OCP Telco Project enlists participants from telecom companies and carriers as well as sub systems, software, board and semiconductor suppliers who are seeking to use data center infrastructure to deliver IT services.

As technologists across industries participate in this community, OCP is creating and refining more designs, making it possible for more companies to transition from their old,existing proprietary solutions to Open Compute Project (OCP) solutions gear. and interoperable, multi-vendor supplier support.

The openEDGE Sub-Project is under the direction of the OCP Telco Project Group.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

References:

TIP OpenRAN and O-RAN Alliance liaison and collaboration for Open Radio Access Networks

https://telecominfraproject.com/

https://www.opencompute.org/projects/telco

https://techblog.comsoc.org/2020/02/12/nec-and-mavenir-collaborate-to-deliver-5g-open-vran-platform/