ABI Research: Open RAN radio units to exceed $47 billion by 2026

ABI Research expects the total CAPEX spent on Open RAN radio units (RUs) for public outdoor networks, including both macro and small cells will reach US$40.7 billion in 2026. Cumulative unit shipments will reach 9.9 million during the same year. Meanwhile, the total revenue of Open RAN radios for indoor enterprise networks will reach as much as US$6.7 billion in 2026, with cumulative unit shipments expected to reach 29.4 million. The Open Radio Access Network (Open RAN) market is rapidly expanding and is expected to exceed the traditional RAN market for the first time around 2027-2028.

“The Open RAN opportunity invites various stakeholders to bring their best in class technologies and hardware/software components to contribute to building a flexible, secure, agile, and multi-vendor interoperable network solution,” said Jiancao Hou, Senior Analyst at ABI Research. “In addition, trade wars and the global pandemic of COVID-19 have resulted in tremendous restrictions on the telecom supply chain and disrupt the evolution of new technologies. These effects will accelerate the development of Open RAN and open networks.”

Rakuten Mobile, a greenfield network operator in Japan, set a prime example to deploy this new approach. Moreover, many other operators are also quite active in the field, namely Dish Network in the U.S., Vodafone, Telefonica, Deutsche Telekom, Orange, and Turkcell in the EU and other geological regions. The Open RAN supply chain is also expanding with Altiostar, Mavenir, and Parallel Wireless leading the charge while new entrants are announced every week.

“ABI Research expects greenfield installations, as well as private enterprise networks and public consumer networks, in rural/uncovered areas to drive the deployment of Open RAN throughout the entire forecast period,” Hou points out. Open RAN can introduce many advantages to the enterprise market, including infrastructure reconfigurability, network sustainability, and deployment cost efficiency. On the other hand, these small and easily manageable network use cases will likely lower the entry barrier for Open RAN. Simultaneously they help network operators and their ecosystem partners clearly understand the approach and suppliers’ maturity level, therefore paving the way for a broader market. Besides, “ABI Research sees new entrants will lead the early deployment for Open RAN, but they will be increasingly challenged by tier-one vendors and system integrators for both public cellular implementations and enterprise deployment,” Hou concludes.

These findings are from ABI Research’s Open RAN market data report. This report is part of the company’s 5G & Mobile Network Infrastructure research service, which includes research, data, and analyst insights. Market Data spreadsheets are composed of in-depth data, market share analysis, and highly segmented, service-specific forecasts to provide detailed insight where opportunities lie.

Earlier this week, the Telecom Infra Project (TIP) saw fit to recap its recent achievements regarding OpenRAN; read more about them here.

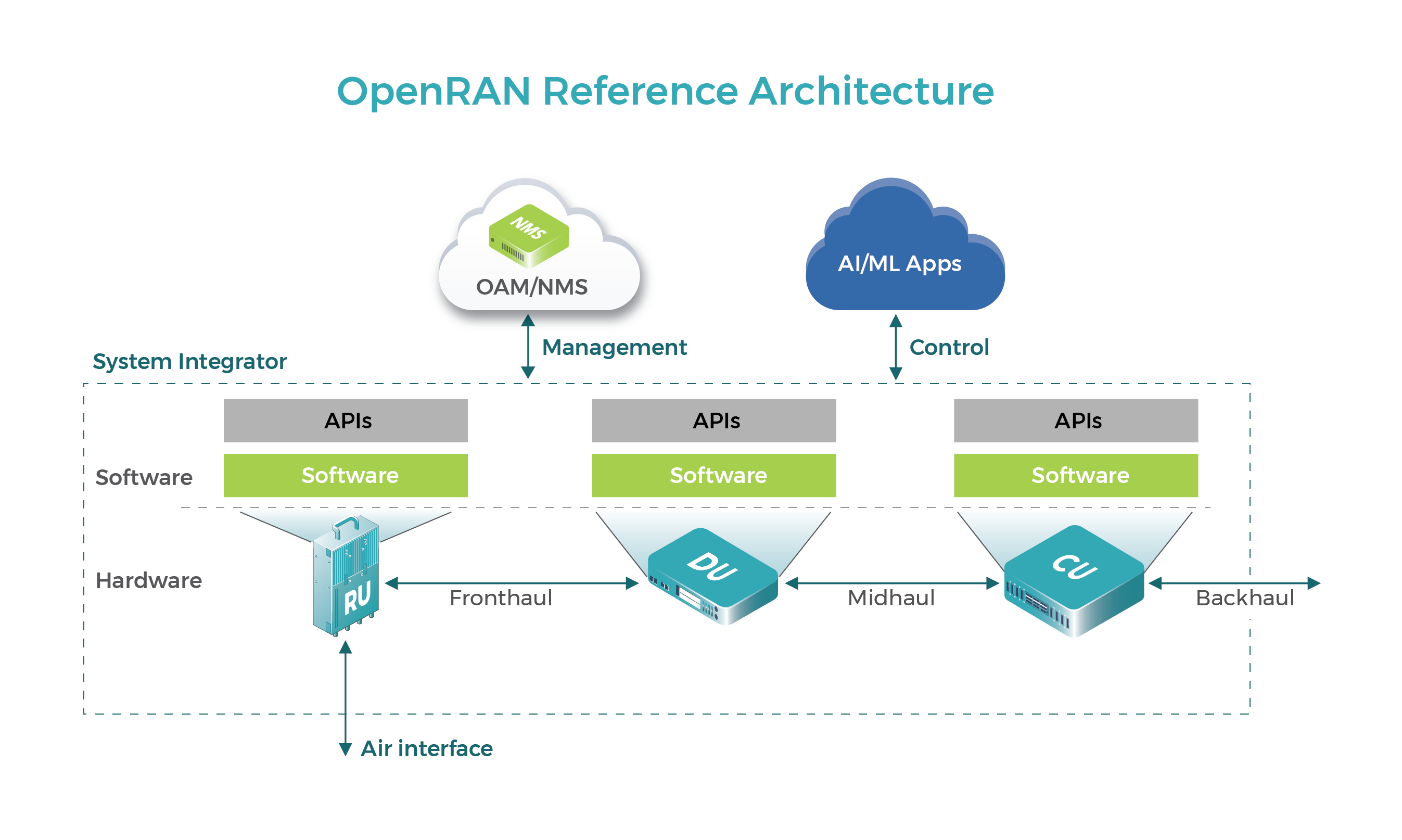

Image Credit: Telecom Infra Project

…………………………………………………………………………………………………………………………………………………………………………………………

About ABI Research

ABI Research provides strategic guidance to visionaries, delivering actionable intelligence on the transformative technologies that are dramatically reshaping industries, economies, and workforces across the world. ABI Research’s global team of analysts publish groundbreaking studies often years ahead of other technology advisory firms, empowering our clients to stay ahead of their markets and their competitors.

References:

https://www.abiresearch.com/press/open-ran-radio-units-soar-more-us47-billion-2026/

3 thoughts on “ABI Research: Open RAN radio units to exceed $47 billion by 2026”

Comments are closed.

Bharti Airtel, Vodafone Idea and Reliance Jio are increasingly looking to expand their telecom gear supplier options beyond traditional equipment vendors by using Open Radio Access Networks (OpenRAN) technology. The adoption of OpenRAN technology will help these telcos cut network-related costs and allow them to bring more customization as they upgrade their networks for 5G technology.

“They [OpenRAN vendors] can bring in efficiencies and actually help solve many problems, which may not be left to a single provider to solve. I think this is a good thing to happen,” Randeep Sekhon, Chief technology officer at Bharti Airtel, told ETTelecom.

Airtel, Sekhon said, has been a part of the ORAN alliance and Telecom Infra Project, and is actively involved in this space. Vodafone Idea has already done OpenRAN based commercial deployment TDD LTE and massive Mimo sites in various cities.

“We have been engaged in Open RAN for 3 years and we intend to further enhance the deployment into our network. We have worked with few vendors over the last 3 years to develop the next-gen radio solutions including OpenRAN,” Vishant Vora, chief technology officer at Vodafone Idea told ETTelecom.

Mukesh Ambani-led Jio is also fast-tracking its efforts in 5G and Open technologies by developing and working with a global initiative, called Open Test and Integration Centre (OTIC), to accelerate interoperable OpenRAN based deployments. Jio President Mathew Oommen is leading the OpenRAN related initiatives for the telco.

“To make sure that India participates in OpenRAN, the scale is critical, which Jio can offer. Jio is architecturally and technologically established for scale, which no other telco can provide. There have to be champions of technology. With Jio’s participation and another global operator participation, the potential for ORAN success is high,” a person familiar with Jio’s plan told ETTelecom.

Jio President Mathew Oommen said that that the telco is currently trialing Jio ORAN centric solutions. He added that Jio is using the OpenRAN technology to handle security-related issues.

“…cloud is the opportunity to bring the scale and also include the likes of Nokia and Ericsson of the world. It is important for us to accelerate the ecosystem and incentivize traditional vendors to get into open interface model to drive transformation…if we don’t do that there will be friction,” Oommen added.

OpenRAN as a concept enables hardware and software to be dis-aggregated, unlike conventional radio gears, allowing technology products from different suppliers to co-exist with the various software providers.

Analysts believe that OpenRAN technology wouldn’t eliminate traditional vendors from 4G and 5G space but would rather force them to shift their business model from hardware to software.

OpenRAN is compatible with 2G, 3G and 4G services, with 5G expected in the future, and allows more customization of the network architecture and capabilities creating opportunities for new business lines and improving customer experience, analysts added.

Airtel recently announced its small cell, which it developed with Taiwan-based Sercomm. “We completely sourced the hardware and the design was approved by all parties and lab-tested accordingly,” Sekhon said, adding that this technology opens the ecosystem for players that can help telcos tune hardware and add applications on top of it.

Vora also agreed and said that OpenRAN opens avenues for newer players to come into the market in all domains including hardware and software services.

Asked if OpenRAN will threaten the dominance of traditional network suppliers like Ericsson, Nokia, Huawei, Samsung and ZTE, Vora said that the introduction will create healthy competition amongst the new and traditional players to offer best-in-class products to telcos to deliver services and help in re-defining the value chain.

“We strongly believe that new OpenRAN entrants can be a significant force in the 4G+ & 5G space in the coming time,” Vora added.

Vora said that the OpenRAN phenomenon will drive innovation by helping in expanding the telecom gear suppliers’ ecosystem, allowing telecom operators to reach out directly to the manufacturers and achieve cost efficiencies.

“These suppliers can be introduced in the markets where Coverage and Capacity expansions are demanded…concepts like these are a precursor to 5G deployment, where these architectures are defined in the standards. Introducing such architecture strengthens our readiness for future technologies,” Vora said.

OpenRAN leverages Cloud Infrastructure and gels well with both telecom operators’ approach of expending the cloud services further into the networks, which help in leveraging the network infrastructure for more than one purpose.

Vodafone Idea has been engaged with various partners like Mavenir within the OpenRAN space to develop solutions catering to the traffic requirements of Indian networks. The telco’s OpenRAN partners include hardware suppliers for radios and servers; software suppliers, system integrators.

“This ecosystem is rapidly evolving and technology is enabling the evolution of new entrants into the market. We are engaged with all suppliers in defining the roadmaps and product specifications across all form factors – including macro, small cells and massive MIMO – which are relevant for the Indian market,” Vora said.

https://telecom.economictimes.indiatimes.com/news/jio-airtel-vodafone-idea-look-beyond-traditional-gear-vendors-to-cut-network-costs-heres-how/76689714

John Strand of Strand Consult: The reality check on OpenRAN

In 2020 OpenRAN was portrayed as a miracle “technology”. Many believe OpenRAN will increase innovation, reduce operators’ costs, and help rid Chinese equipment in telecommunications networks. Other OpenRAN boosters want more nations to become manufactures of telecommunications infrastructure.

2021 will bring a needed reality check. It will take years before OpenRAN can replace regular RAN on a 1:1 basis. Promised savings for operators will not be so great, and the purported openness of the solution will not necessarily deliver security, at least in the expectation of OpenRAN reducing reliance on Chinese vendors. China Mobile, China Unicom and China Telecom are among some 44 Chinese government technology companies in the O-RAN Alliance. Other members are ZTE and Inspur, which the US bans because of links to the Chinese military. While purporting to offer the way out from Huawei, O-RAN appears to substitute one Chinese government owned firm for another, like Lenovo. OpenRAN specifications may already violate cybersecurity rules in UK, Germany and France. Patent challenges are also likely as OpenRAN is 100% dependent on 3GPP and the patents of non-members of the O-RAN Alliance.

Strand Consult believes that industrial cooperation is important for technological development, investment, and innovation. Some of this cooperation is done in 3GPP, the O-RAN Alliance, and other organizations. Mobile operators should be free to choose the technological solutions that make sense for their business, provided the adherence to national security laws. OpenRAN should not be the justification for protectionism.

Nice post. I learned something new and challenging about ABI Research forecast for Open RAN radio units. However, I believe that forecast is way too optimistic!