Uncategorized

How 5G will Transform Smart Cities: Infrastructure, Public Events, Traffic

The infrastructure for 5G is still only beginning—with wider availability not expected until at least 2020—but cities like New York, Las Vegas, Sacramento, Calif., and Atlanta will soon get a chance to preview the promise of 5G this year when Verizon, T-Mobile and Sprint begin rolling out their faster networks in select areas. Using 5G, a city can sense “all sorts of variables across its many areas of interest, be it parking meters, traffic flow, where people are, security issues,” said Ron Marquardt, vp of technology at Sprint.

Mark Hung, an analyst at Gartner, pointed out that while 3G brought web browsing and data communication to the smartphone, 4G greatly enhanced it. And even though towers today can support hundreds or thousands of devices, 5G could help scale the Internet of Things from “hundreds and thousands to hundreds of thousands.”

Here are some of the ways 5G might transform cities over the next few years:

Infrastructure

Telecoms will increasingly weave their way into the infrastructure through 5G. By gathering data from buildings, 5G can help cities understand patterns in electricity usage, leading to lower power consumption across the grid. Those savings could vary greatly. According to a 2017 report by Accenture, smart technology and 5G in a small city with a population of around 30,000 could have a $10 million impact on the power grid and transportation systems. A slightly larger city of 118,000 could see $70 million. Meanwhile, a major metro area—say, Chicago—could see an economic impact of $5 billion.

Private-public partnerships are still in the early stages of being developed. For example, Nokia last month announced a partnership with the Port of Hamburg in Germany and Deutsche Telekom to monitor real-time data to measure water gates, environmental metrics or construction sites.

“I think last year the buzzword was fourth industrial revolution, but for me it still rings true,” Jane Rygaard, head of 5G marketing at Nokia, said about the endless possibilities of a 5G network.

As infrastructure becomes digitized through 5G, some agencies are already investing in understanding a 5G-infused infrastructure to help clients adapt to smarter cities. R/GA’s new venture studio with Macquarie Capital will include tackling how 5G will be tied to emerging technologies like AI and blockchain. R/GA chief technology officer Nick Coronges said the connectivity of 5G goes hand in hand with emerging technologies such as AI and blockchain.

Public events

Verizon, which will test 5G in nearly a dozen cities in 2018, is making its first broadband debut in Sacramento with a 5G wireless network later this year. As part of the rollout, Verizon is placing 5G in stadiums. Lani Ingram, Verizon’s vp for smart communities, sports and IoT platforms, said 5G could also be put to good use in airports, convention centers and other venues.

“The amount of usage of data during sporting events and concerts is only growing,” she said. “We see that every year during the Super Bowl, for example.”

Traffic

Many tout the need for 5G to power self-driving cars. For an autonomous vehicle to smoothly travel through a city, it will need to have low latency that allows it to continuously “see” its surroundings. 5G will allow for smart traffic lights, which connect with cars on the road to improve traffic flow. Carnegie Mellon University and Pittsburgh tested the use of smart traffic lights. The result? A 40 percent reduction in vehicle wait time, a 26 percent faster commute and a 21 percent decrease in vehicle emissions.

A 5G network will also make the roads safer. For example, as a car enters an intersection, a smart traffic light will notify it that a pedestrian has just hit the “walk” button, which will provide drivers more warning. Ambulances will be able to change traffic lights faster to accommodate their route and clear intersections.

“We see more and more of our customers linking smart city and safe city,” Rygaard said, adding that 5G isn’t just for consumers. It will improve their daily lives—whether that’s through safety, energy or countless other ways.

Reference:

Recap of Telecom Infra Project (TIP) Activity at MWC 2018

New Project and Working Groups:

Along with other TIP updates, three new groups were announced at MWC 2018: Disaggregated Cell Site Gateways, CrowdCell, and Power and Connectivity.

Disaggregated Cell Site Gateways

An Open Optical & Packet Transport sub-group led by Vodafone and Facebook. The sub-group is focused on the definition of a next generation cell site gateway device that operators can deploy at their cell sites. The group is working on technical requirements provided by Vodafone, other major operators, and hardware/software technology partners in an effort to produce a disaggregated device specification with a set of fully open APIs which can drive network cost efficiencies.

|

|

|

|

|

|

Cignal AI: Strong 4Q-2017 Optical Equipment Growth in Asia, EMEA led by Metro WDM Gear

Cignal AI’s quarterly optical hardware report was published last week and includes results for almost all vendors in 4Q2017. Global spending on optical network equipment surged due to larger than usual seasonal growth in China and EMEA combined with continued elevated spending in rest of APAC (RoAPAC) = APAC x Japan and China. However, North America and CALA regions each suffered a double digit decline. Here are Cignal AI’s YoY % change from 4Q2016 to 4Q2017:

Key takeaways for the 4th quarter of 2017:

- China – When compared to 4Q2016’s weak spending, 4Q2017’s Chinese spending was massive, with year-over-year revenue increasing 40 percent (see chart above) and reaching record quarterly levels. We expect further discussion with Chinese vendors to provide greater insight on what drove this surge.

- EMEA – Carriers maxed out capex at the end of the year and spent 21 percent more YoY. Beneficiaries of this spending were Huawei and Nokia, while Infinera also reported significant EMEA revenue from a large North American cloud/colo vendor. Vendors believe that 2018 will be better and they expect incumbent operators to spend more.

- Japan – Spending was up 13 percent YoY for the quarter. NEC and Fujitsu accounted for 80 percent of all optical equipment sold in the region in 2014, but by 2017 it has dropped to 65 percent, as vendors such as Huawei, Ciena, and Infinera made inroads in this market. Western vendors are encouraged, and now consider Japan an area of potential expansion.

- RoAPAC – Nokia and Ciena had record revenue in RoAPAC during 4Q2017. Ciena’s revenue exceeded $100 million in the region, while Nokia’s nearly matched that of Huawei. Spending in India remained high, though Cignal AI is monitoring for the impact of the upcoming merger between Jio and Reliance.

- North America – 4Q17 spending continued to slip on a YoY basis for the fifth consecutive quarter with all customer market segments spending at lower levels. Spending by cloud and colo operators has not returned to earlier levels. Multiple vendors also cited continued weakness at Level3/CenturyLink and AT&T, particularly on long-haul WDM equipment. We think AT&T’s spending will be depressed until the end of 2018 as the company prepares its new disaggregated hardware deployment strategy. Component vendors note that shipments used in metro WDM networks such as Verizon’s are trending up for next year.

“One of the biggest surprises in 2017 was massive spending growth in China. Despite slumping purchases from component manufacturers, Chinese optical vendors Huawei and ZTE reported record levels of revenue. A strong component sales rebound should be expected if this divergence was a result of excess inventory,” said Andrew Schmitt, lead analyst for Cignal AI.

Huawei, Nokia, Ciena, Cisco, and Infinera did very well in the EMEA region, according to the Cignal AI report. Huawei, ZTE, Nokia and Ciena all enjoyed a strong quarter overall, thanks in large part to the popularity of their Metro WDM systems and submarine line (undersea cable) terminal equipment (SLTE).

Additional highlights of results for the full year can be found in Cignal AI’s press release.

TABLE OF CONTENTS

…………………………………………………………………………………………………………………………………….

Separately, Research and Markets has published “Optical Networking Opportunities in 5G Wireless Networks: 2017-2026” report. According to a press release:

5G will create considerable new opportunities for the optical networking industry going forward in the 5G infrastructure; both backhaul and fronthaul. However, while optical links have been widely used in the mobile telephony industry for many years, revenue generation from optical networking in the 5G space will require carefully thought through strategies by the optical networking industry as a whole.

5G is poised to dramatically increase the use of fiber optics in some parts of the network, while actually reducing the use of fiber in others:

- There is a vision of 5G as a converged fiber-wireless network in which short-haul, but very high bandwidth wireless connections will support high data rates, but with fiber almost everywhere else. 5G as it is currently evolving seems more willing than previous generation to make fiber optic deployments a central part of the network and any general standards that emerge. This makes 5G potentially a huge opportunity for the fiber optics industry – including the makers of modules and components as well as the fiber/cable manufacturers themselves.

- The main beneficiary of the shift towards fiber in the 5G infrastructure will ultimately be NG-PON2. But for now this is really only being championed by one company; Verizon. XGS-PON will provide an interim solution, but the question is for how long?

- On the other hand, 5G, with its high data rates, seems to imply fiber could present a significant challenge to long-held assumptions about the need for fiber-to-the-premises. This suggests that some of the fiber optic opportunities that have been baked into the product/market strategies of many optical networking firms may turn out to be wrong. A faceoff between 5G and NG-PON as service platforms seem likely in the long run.

5G deployment is currently at an early stage. There is no formal standard yet for 5G and there are many different visions of what 5G will ultimately look like. In particular, fiber opportunities will be impacted by the implementation of new approaches using C-RAN architectures and next-generations interfaces that move beyond CPRI. Fiber opportunities in the 5G infrastructure will also depend on the shifting boundaries between fronthaul and backhaul. The votes are still out on what type of 5G network will ultimately evolve and this will impact the size and growth of the 5G network’s need for fiber optics market accordingly.

In this highly uncertain environment, this report is designed to provide guidance to the optical networking industry and where and how 5G backhaul and fronthaul will present new opportunities over the coming decade.

Included in this report are:

-

An assessment of how current visions of 5G networks vary in terms of their impact on optical network products and fiber optics demand. How will optical links help to support the necessary bandwidth and latency for 5G networks? And what will the concept of an integrated wireless/fiber network mean in practice?

-

An analysis of the type of optical networking products that 5G will require. In this analysis we cover modules (by MSA, data rate, etc.), components and the types of fiber that would be used in an integrated wireless/fiber network. The report is particularly focused on the role of PONs – especially XGS-PON and NG-PON2 – in providing 5G infrastructure. It also examines how interfaces between fiber and base stations/hubs will evolve in the 5G network

-

A granular market ten-year market forecast of fiber optics-related opportunities flowing from 5G deployment. The forecast is provided in both unit shipment and market value terms. It is also broken out by type of transceiver product, cable type, data rate, network segment, country/region, etc.

-

Discussions and assessments of how leading firms in the module and component space are preparing for 5G deployment and what this says about who the fiber optics-related winners and losers will be

-

A discussion of how the deployment of 5G networks as residential broadband platforms will impede the planned use of fiber in the access network. In particular, the report will take a look at how optical networking firms can readjust their marketing strategies to new product and customer types as the 5G revolution takes hold.

Media Contact:

Laura Wood, Senior Manager

[email protected]

IHS Operator Survey: Smart Central Offices in 85% of Service Provider Networks in 2018

By Michael Howard, executive director, research and analysis, carrier networks, IHS Markit, and Heidi Adams, senior research director, IP and optical networks, IHS Markit

Highlights:

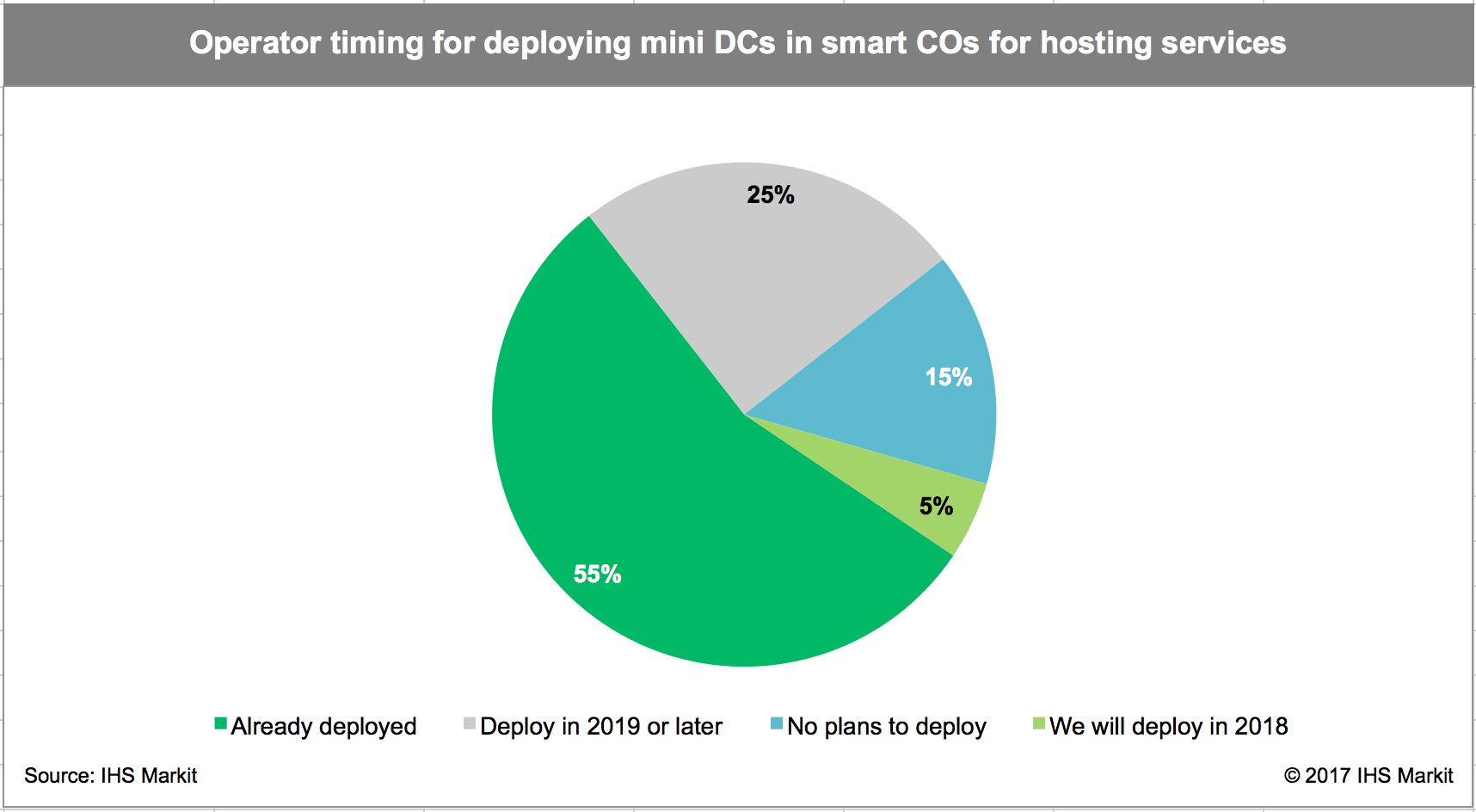

- In 2018, 85% of operator respondents to an IHS-Markit survey plan to create, or will have already deployed, smart central offices — that is, installing servers, storage and switching to create mini data centers in selected central offices. These mini data centers are used to offer cloud services, and as the network functions virtualization (NFV) infrastructure on which to run virtualized network functions (VNFs) such as vRouter, firewall, CG-NAT and IP/MPLS VPNs.

- More than half of operators (55%) surveyed plan to move each of 10 different router functions from physical edge routers to VNFs running on commercial servers in mini data centers in smart central offices, including customer edge (CE) router, route reflector (RR) and others.

- Seven out of 10 respondents plan to deploy central office rearchitected as a data center (CORD) in smart central offices.

- Operators expect 44% of their central offices will have mini data centers (or smart central offices) by 2023, and deploy CORD (Central Office Re-architected as a Data center) in half of those central offices.

IHS-Markit Analysis:

SDN and NFV are spurring fundamental changes in network architecture, network operations and how carriers are organized, which is illustrated by the purchasing decisions of operators worldwide. Nearly every operator around the world is undertaking major efforts.

More importantly, the move to SDN and NFV is changing the way operators make equipment purchase decisions, placing a greater focus on software. Although hardware will always be required, its functions will be refined, and software will drive services and operational agility.

A basic architectural change in motion is the deployment of new functions in large central offices that are closer to end customers. These also serve as locations for distributed broadband network gateways (BNGs), content delivery networks (CDNs), mini data centers and other new functions. Mini data centers (i.e., servers and storage) are used to deliver cloud services within a metropolitan area and house applications including augmented and virtual reality and gaming, to give users better response time as well as provide a place for NFV and VNFs, including vRouters, which run on servers. These central offices with mini data centers are known as “cloud central offices” or “smart central offices.”

Cloud services for business, and internet usage in general, have caused carrier network traffic patterns to change dramatically in and out of data centers. This is true not only for the hyperscale data centers of Google, Apple, Facebook, Amazon, Microsoft, Baidu, Alibaba and Tencent, but also for their smaller metro and regional megascale data centers, and large enterprises, as well as smaller data centers used by enterprises and government.

In a large metropolitan area, there might be 10 or more smart central offices aggregating traffic from smaller end offices. Based on our discussions with operators around the world, a common long-range plan is to identify 10 percent to 25 percent of central offices as smart central office locations — all candidates for CORD. The smart central office is the new location of the IP edge, which is creating a need for a new class of optical transport equipment and a new class of routers designed for data center interconnect (DCI) applications.

Routing, NFV and Packet-Optical Survey Synopsis

The 30-page 2017 IHS Markit routing, NFV and packet-optical strategies survey is based on interviews with router/CES purchase decision-makers at 20 global service providers that control a third of worldwide telecom capex and 27 percent of revenue. The survey covers hot and emerging topics in the carrier Ethernet, routing and switching space, with a focus on the IP edge. It looks at deployment plans, strategies and locations, router bypass, 100GE port mix, price per port and more.

…………………………………………………………………………………………………………………………………………

Notes & Clarifications:

- Smart central offices are simply central offices containing mini data centers that have servers, storage, and switching. Mini data centers can offer cloud services and typically include NFV infrastructure that supports virtualized network functions (VNFs) including vRouter, firewalls, carrier grade network address translation (CG-NAT), and IP/MPLS VPNs.

- IHS concluded that the reason more operators are leaning this direction is that deploying these functions in central offices brings them close to the end-user. This is part of the greater push by operators and service providers to focus on software to drive services, while refining hardware functions.

- If network operators re-architect their networks by distributing the core network, it would be closer to the end user. Virtualization allows operators to quickly deploy a core anywhere and to scale it at will. Edge computing could be deployed closer to the user without breaking the network topology. This is a major advantage that the telcos have over the cloud players – but they have not been able to capitalize on it. By pushing the core closer to the edge, and through virtualization of the network, operators could capitalize on this advantage.

- As operators push away from hardware into software, the smart central office is a new IP edge, and thus requires a class of routers for data center interconnect (DCI) applications and optical transport equipment.

Google Expands Cloud Network Infrastructure via 3 New Undersea Cables & 5 New Regions

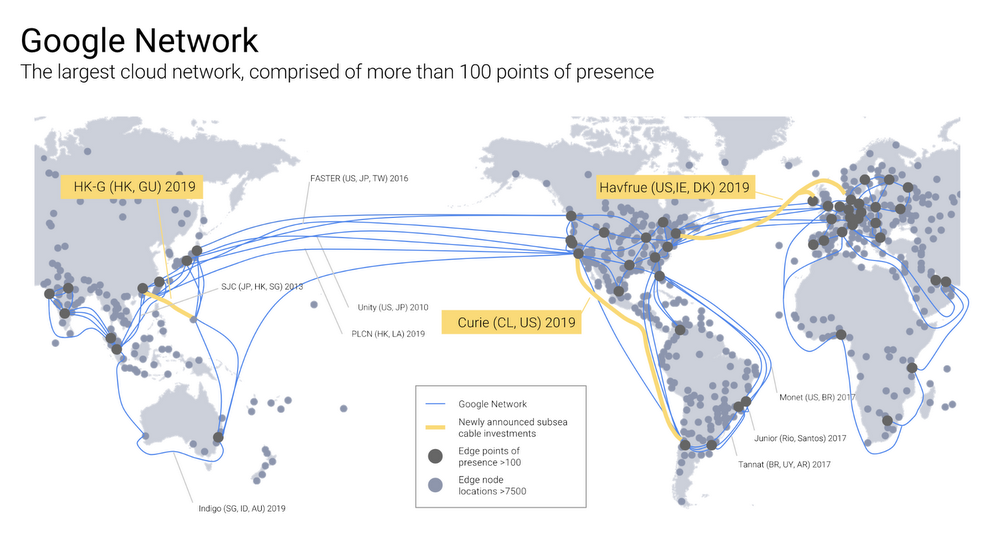

Google has plans to build three new undersea cables in 2019 to support its Google Cloud customers. The company plans to co-commission the Hong Kong-Guam (HK-G) cable system as part of a consortium. In a blog post by Ben Treynor Sloss, vice president of Google’s cloud platform, three undersea cables and five new regions were announced..

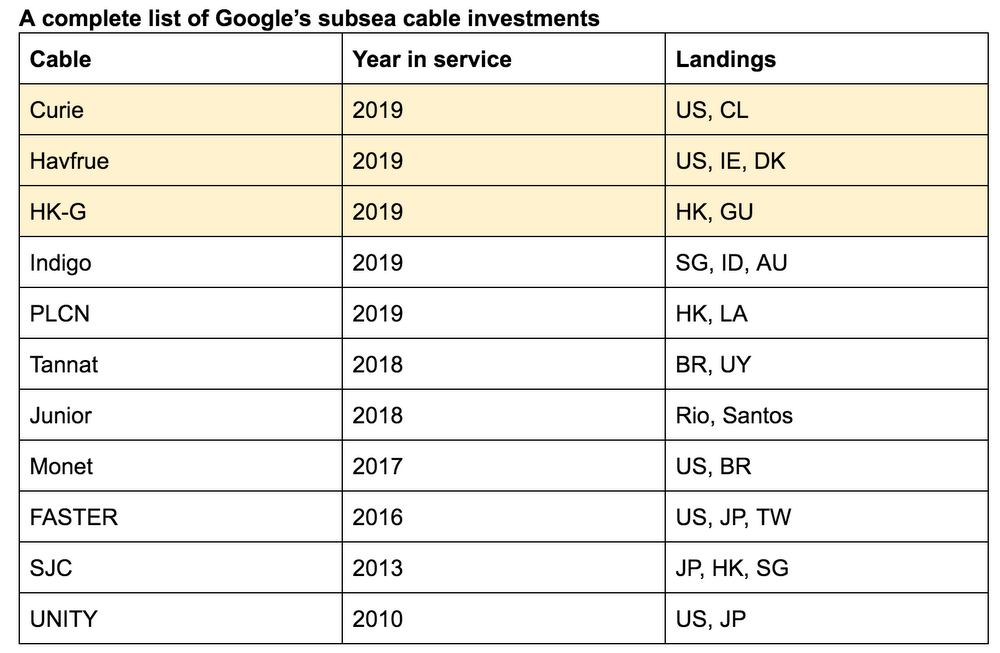

The HK-G will be an extension of the SEA-US cable system, and will have a design capacity of more than 48Tbps. It is being built by RTI-C and NEC. Google said that together with Indigo and other cable systems, HK-G will create multiple scalable, diverse paths to Australia. In addition, Google plans to commission Curie, a private cable connecting Chile to Los Angeles and Hvfrue, a consortium cable connecting the US to Denmark and Ireland as shown in the figure below.

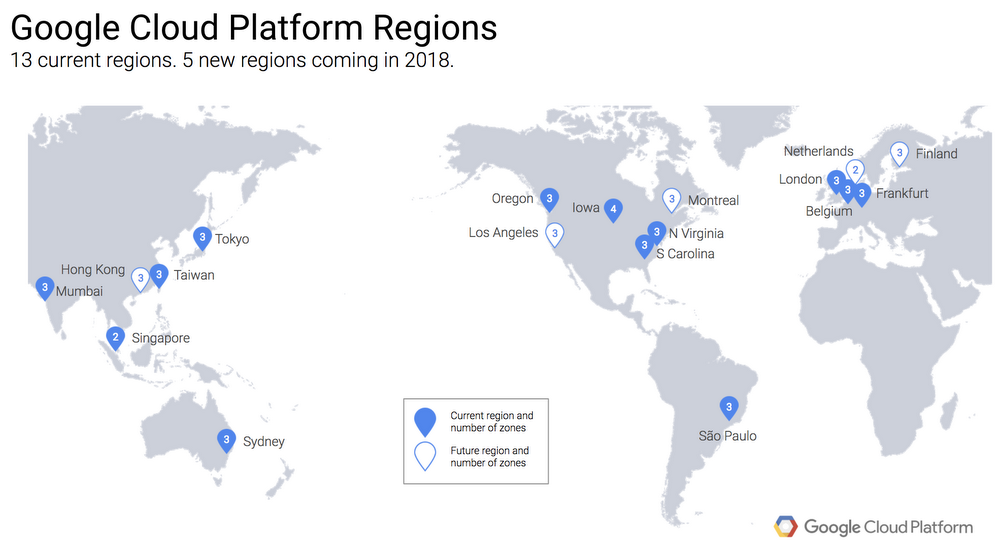

Late last year, Google also revealed plans to open a Google Cloud Platform region in Hong Kong in 2018 to join its recently launched Mumbai, Sydney, and Singapore regions, as well as Taiwan and Tokyo.

Of the five new Google Cloud regions, Netherlands and Montreal will be online in the first quarter of 2018. Three others in Los Angeles, Finland, and Hong Kong will come online later this year. The Hong Kong region will be designed for high availability, launching with three zones to protect against service disruptions. The HK-G cable will provide improved network capacity for the cloud region. Google promises they are not done yet and there will be additional announcements of other regions.

In an earlier announcement last week, Google revealed that it has implemented a compile-time patch for its Google Cloud Platform infrastructure to address the major CPU security flaw disclosed by Google’s Project Zero zero-day vulnerability unit at the beginning of this year.

Diane Greene, who heads up Google’s cloud unit, often marvels at how much her company invests in Google Cloud infrastructure. It’s with good reason. Over the past three years since Greene came on board, the company has spent a whopping $30 billion beefing up the infrastructure.

Google has direct investment in 11 cables, including those planned or under construction. The three cables highlighted in yellow are being announced in this blog post. (In addition to these 11 cables where Google has direct ownership, the company also leases capacity on numerous additional submarine cables.)

In the referenced Google blog post, Mr Treynor Sloss wrote:

At Google, we’ve spent $30 billion improving our infrastructure over three years, and we’re not done yet. From data centers to subsea cables, Google is committed to connecting the world and serving our Cloud customers, and today we’re excited to announce that we’re adding three new submarine cables, and five new regions.

We’ll open our Netherlands and Montreal regions in the first quarter of 2018, followed by Los Angeles, Finland, and Hong Kong – with more to come. Then, in 2019 we’ll commission three subsea cables: Curie, a private cable connecting Chile to Los Angeles; Havfrue, a consortium cable connecting the U.S. to Denmark and Ireland; and the Hong Kong-Guam Cable system (HK-G), a consortium cable interconnecting major subsea communication hubs in Asia.

Together, these investments further improve our network—the world’s largest—which by some accounts delivers 25% of worldwide internet traffic……………….l.l….

Simply put, it wouldn’t be possible to deliver products like Machine Learning Engine, Spanner, BigQuery and other Google Cloud Platform and G Suite services at the quality of service users expect without the Google network. Our cable systems provide the speed, capacity and reliability Google is known for worldwide, and at Google Cloud, our customers are able to to make use of the same network infrastructure that powers Google’s own services.

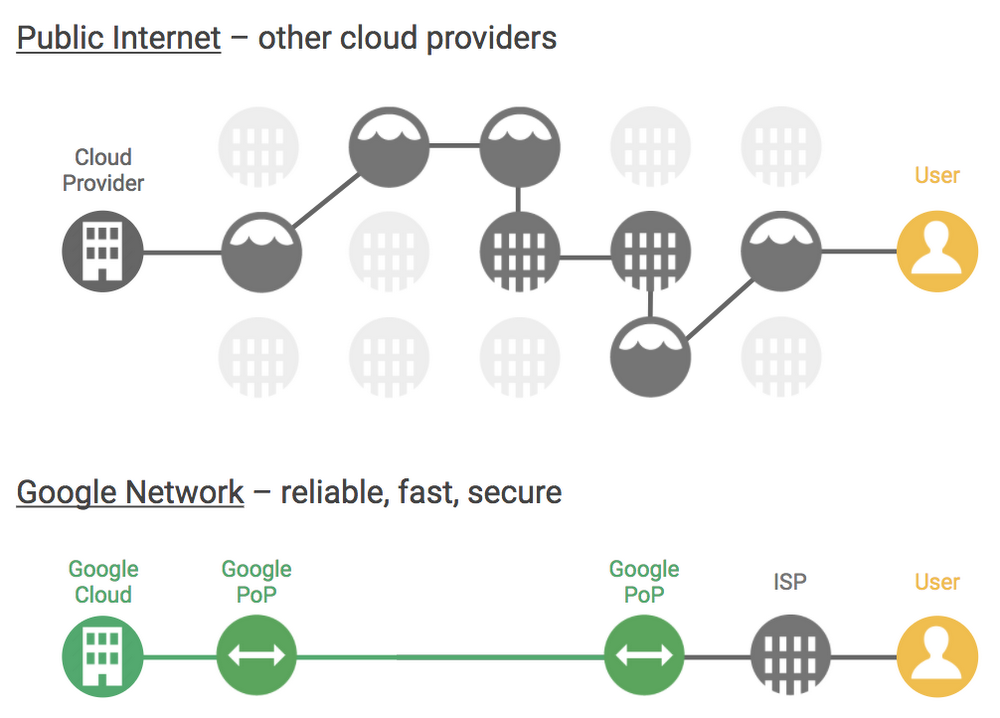

While we haven’t hastened the speed of light, we have built a superior cloud network as a result of the well-provisioned direct paths between our cloud and end-users, as shown in the figure below.

According to Ben: “The Google network offers better reliability, speed and security performance as compared with the nondeterministic performance of the public internet, or other cloud networks. The Google network consists of fiber optic links and subsea cables between 100+ points of presence, 7500+ edge node locations, 90+ Cloud CDN locations, 47 dedicated interconnect locations and 15 GCP regions.”

……………………………………………………………………………………………………………………………………………………………………………………………

Reference:

China’s 5 Year Optical Component Plan to aid domestic parts makers

In December 2017, China’s Ministry of Industry and Information Technology (MIIT) released a five-year plan outlining a road map for commercial and technological progress in a broad set of optical technologies.

China has optical component makers, but they have generally produce lower-speed devices that lag U.S. companies by a product generation. China’s efforts to develop a domestic optical industry aims to support optical network equipment makers, such as Huawei and ZTE, according to Jefferies analyst Rex Wu.

The 63-page MIIT document is written in Chinese (Mandarin), but Cignal AI commissioned a professional English translation which summarizes the section of the plan about the Chinese optical components industry.

The goals and objectives outlined in the plan are exceptionally ambitious and should gravely concern incumbent component vendors. This document outlines strategic rather than rational economic objectives to catalyze market progress in Chinese component companies. Our interpretation is that this will increase the number of non-rational economic actors participating in the component market.

If executed, this plan will greatly increase the level of competition in an already fractured industry. It will also reduce or in some cases eliminate access for western component vendors to the largest market for optical communications components in the world – China.

……………………………………………………………………………………………………………

NeoPhotonics, Oclaro, Acacia, Lumentum, and Finisar sell the most optical components to China, says a UBS report. Those optical parts makers took a hit in 2017 as demand weakened from China’s telecom service providers. Analysts have been expecting a rebound in 2018 spurred by spending on fiber-optic networks, 5G wireless backhaul and data centers designed for cloud computing services.

China’s domestic optical component makers include O-Net, Accelink and Innolight.

“The government aims to have two to three Chinese optics companies in global top 10 in 2020, and one company in global top 3 in 2022,” Mr. Wu wrote in a Jefferies report to clients. “The market share of Chinese optics companies will reach over 30% worldwide in 2022,” according to the government’s plan, he added.

References:

https://cignal.ai/2018/01/chinas-5-year-optical-component-plan/

2017 Top Telecom Stories and Well Deserved Tribute to Nikola Tesla

One unpublicized 2017 telecom story was that the U.S. telecom industry didn’t grow. Revenues were flat (despite continued exponential traffic growth), profits, CAPEX and stock prices were all down. Indeed, telecom was the worst performing S&P 500 sector in 2017 with a -6% loss (vs +37% gain for Information Technology sector). The most obvious top story of the year was the FCC’s vote to end neutrality, which we chronicled in this blog post.

Instead of a review of other telecom stories for 2017, we offer a tribute to radio and wireless transmission pioneer Nikola Tesla. Readers are invited to review the IEEE ComSoc Techblog archives and/or contact this author if you’d like to discuss the past year’s top telecom news and mega trends.

Tesla, whose name Elon Musk chose for his electric car company, was on the cover of Time magazine in 1931 for his achievements. Unfortunately, he died a poor man in 1943 after years devoted to projects that did not receive adequate financing. Although the main Tesla lab building on Long Island, New York is being restored by a nonprofit foundation — the Tesla Science Center at Wardenclyffe — the World System broadcast tower he built there was torn down for scrap to pay his hotel bill at the Waldorf Astoria in 1917. Yet Tesla’s most significant inventions resonate today.

Tesla’s ambitions outstripped his financing. He didn’t focus on radio as a stand-alone technology. Instead, he conceived of entire wireless transmission systems, even if they were decades ahead of the time and not financially feasible. Tesla envisioned a system that could transmit not only radio but also electricity across the globe. After successful experiments in Colorado Springs in 1899, Tesla began building what he called a global “World System” near Shoreham on Long Island, hoping to power vehicles, boats and aircraft wirelessly. Ultimately, he expected that anything that needed electricity would get it from the air much as we receive transmitted data, sound and images on smartphones. But he ran out of money, and J. P. Morgan Jr., who had provided financing, turned off the spigot.

“He proved that you could send power a short distance (without wires),” said Jane Alcorn, president of the Tesla Center. “But sending power a long distance is still proving to be a hurdle. It would be monumental if it could be done.”

Tesla’s wireless house lighting scheme was the first step towards a practical wireless transmission of energy system. The most striking result obtained was two vacuum tubes lighted in an alternating electrostatic field while held in the hand of the experimenter. The wireless energy transmission effect involved the creation of an electric field between two metal plates, each being connected to one terminal of the induction coil’s secondary winding. A light-producing device was used as a means of detecting the presence of the transmitted energy.

- Two high voltage AC plates fill the room with a fairly uniform electric field.

- The bulbs are vertically oriented to align with the electric field.

Tesla recognized that electrical energy could be projected outward into space and detected by a receiving instrument in the general vicinity of the source without a requirement for any interconnecting wires. He went on to develop two theories related to these observations

1. By using two type-one sources positioned at distant points on the earth’s surface, it is possible to induce a flow of electrical current between them.

2. By incorporating a portion of the earth as part of a powerful type-two oscillator the disturbance can be impressed upon the earth and detected “at great distance, or even all over the surface of the globe.”

Tesla also made an assumption that Earth is a charged body floating in space.

“A point of great importance would be first to know what is the capacity of the earth? and what charge does it contain if electrified? Though we have no positive evidence of a charged body existing in space without other oppositely electrified bodies being near, there is a fair probability that the earth is such a body, for by whatever process it was separated from other bodies—and this is the accepted view of its origin—it must have retained a charge, as occurs in all processes of mechanical separation.”

Tesla was familiar with demonstrations that involved the charging of Leiden jar capacitors and isolated metal spheres with electrostatic influence machines. By bringing these elements into close proximity with each other, and also by making direct contact followed by their separation the charge can be manipulated. He surely had this in mind in the creation of his mental image, not being able to know that the model of Earth’s origin was inaccurate. The presently accepted model of planetary origin is one of accretion and collision.

“If it be a charged body insulated in space its capacity should be extremely small, less than one-thousandth of a farad.”

We now know that the earth is, in fact, a charged body, made so by processes—at least in part—related to an interaction of the continuous stream of charged particles called the solar wind that flows outward from the center of our solar system and Earth’s magnetosphere.

“But the upper strata of the air are conducting, and so, perhaps, is the medium in free space beyond the atmosphere, and these may contain an opposite charge. Then the capacity might be incomparably greater”.

We also know one of the upper strata of Earth’s atmosphere, the ionosphere, is conducting.

“In any case it is of the greatest importance to get an idea of what quantity of electricity the earth contains”.

An additional condition of which we are now aware is that the earth possesses a naturally existing negative charge with respect to the conducting region of the atmosphere beginning at an elevation of about 50 Km. The potential difference between the earth and this region is on the order of 400,000 volts. Near the earth’s surface there is a ubiquitous downward directed E-field of about 100 V/m. Tesla referred to this charge as the “electric niveau” or electric level (As noted by James Corum, et al in the paper “Concerning Cavity Q,” PROCEEDINGS OF THE 1988 INTERNATIONAL TESLA SYMPOSIUM, and others).

“It is difficult to say whether we shall ever acquire this necessary knowledge, but there is hope that we may, and that is, by means of electrical resonance. If ever we can ascertain at what period the earth’s charge, when disturbed, oscillates with respect to an oppositely electrified system or known circuit, we shall know a fact possibly of the greatest importance to the welfare of the human race. I propose to seek for the period by means of an electrical oscillator, or a source of alternating electric currents”.

………………………………………………………………………………………………………………………………………………….

Another Tesla invention combined radio with a remote-control device. We’d now call it a robotic drone. Shortly after filing a patent application in 1897 for radio circuitry, Tesla built and demonstrated a wireless, robotic boat at the old Madison Square Garden in 1898 and, again, in Chicago at the Auditorium Theater the next year. These were the first public demonstrations of a remote-controlled drone.

An innovation in the boat’s circuitry — his “logic gate” — became an essential steppingstone to semiconductors. Tesla’s tub-shaped, radio-controlled craft heralded the birth of what he called a “teleautomaton”; later, the world would settle on the word robot. We can see his influence in devices ranging from “smart” speakers like Amazon’s Echo to missile-firing drone aircraft.

Tesla’s achievements were awesome but incomplete. He created the A.C. energy system and the basics of radio communication and robotics but wasn’t able to bring them all to fruition. His life shows that even for a brilliant inventor, innovation doesn’t happen in a vacuum. It requires a broad spectrum of talents, skills and lots of investment capital.

References:

https://teslaresearch.jimdo.com/wireless-transmission-of-energy-1/

IHS Markit: Telecom Revenue +1.1%; CAPEX -1.8% in 2017

Despite unabated exponential growth in network usage, global telecom revenue is on track to grow just 1.1 percent in 2017 over the prior year, according to a new report [1] by business information provider IHS Markit.

Global economic growth prospects, meanwhile, are looking up. IHS Markit macroeconomic indicators point to moderate global economic growth of 3.2 percent for 2017, up from 2.5 percent in 2016, and world real gross domestic product (GDP) is projected to increase 3.2 percent in 2018 and 3.1 percent in 2019.

“Although the telecom sector has been resilient, revenue growth in developed and developing economies has slowed dramatically due to saturation and fierce competition,” said Stéphane Téral, executive director of research and analysis and advisor at IHS Markit. “At this point, every region is showing revenue growth in the low single digits when not declining, and there is no direct positive correlation between slow economic expansion and anemic telecom revenue growth or decline as seen year after year in Europe, for instance.”

China alone is tamping down global telecom capex in 2017:

IHS Markit forecasts a 1.8 percent year-over-year decline in global telecom capital expenditures (capex) in 2017, mainly a result of a 13 percent year-over-year falloff in Chinese telecom capex. Asia Pacific outspends every other region in the world on telecom equipment.

“Call it precision investment, strategically focused investment or tactical investment, but all three of China’s service providers — China Mobile, China Unicom and China Telecom — scaled back their 2017 spending plans, and the end result is another double-digit drop in China’s telecom capex bucket, with mobile infrastructure hit the hardest,” Téral said. “Bringing down capital intensity to reasonable levels of 15 to 20 percent is the chief goal of these operators.”

The virtualization trend:

A transformation is underway in service provider networks, epitomized by software-defined networking (SDN) and network functions virtualization (NFV), which involve the automation of processes such as customer interaction, as well as the addition of more telemetry and analytics with feedback loops into network operations, operations and business support systems, and service assurance.

“Many service providers have deployed new architectural options — including content delivery networks, distributed broadband network gateways, distributed mini data centers in smart central offices, and video optimization,” said Michael Howard, executive director of research and analysis for carrier networks at IHS Markit. “Nearly all operators are madly learning how to use SDN and NFV, and the growing deployments today bring us to declare 2017 as The Year of SDN and NFV.”

Data is the new oil, and AI is the engine:

Big data is becoming more manageable, and operators are leveraging subscriber and network intelligence to support the automation and optimization of their networks using SDN, NFV and initial forays into using analytics, including artificial intelligence (AI) and machine learning (ML).

“Forward-thinking operators are experimenting with how to use anonymized subscriber data and analytics to create targeted services and broker this information to third parties such as retailers and internet content providers like Google,” Téral said. “No matter their size, market or current level of digitization, service providers need to rethink their roles in the new age of information and reset the strategies needed to capitalize on this opportunity.”

……………………………………………………………………………………………….

Note 1. The Telecom Trends & Drivers Market Report is published twice annually by IHS-Markit to provide analysis of global and regional market trends and conditions affecting service providers, subscribers, and the global economy. These roughly 40- page reports assess the state of the telecom industry, telling the story of what’s going on now and what we expect in the near and long term, illustrated with charts, graphs, tables, and written analysis. These critical analysis reports are a foundation piece for all market forecasts.

The reports include top takeaways on the economic health of the global telecom/datacom space; regional and global trends, drivers, and analysis for the service provider network sector in the context of the overall economy; financial analysis of the world’s top 10 service providers (revenue growth, capital intensities, free cash flow, debt level); regional enterprise and carrier spending trends; top-level service provider and subscriber forecasts; macroeconomic drivers; and key economic statistics (e.g., unemployment, OECD indicators, GDP growth). The reports are informed by all of IHS Technology research, from market share and forecasts to surveys with telecom service providers and small, medium, and large businesses.

……………………………………………………………………………………………………………….

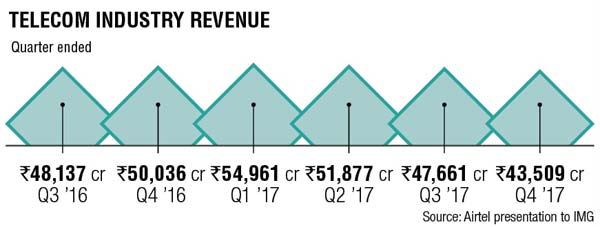

The chart below from Bharti Airtel (India’s largest telecom company) shows that telecom industry revenue has declined in 2017 Q2, Q3, and Q4 with only Q1 showing positive growth.

…………………………………………………………………………………………………………………..

Optical Network Equipment Vendors:

In a service provider survey report on Optical Networking and equipment vendors, IHS-Markit found Ciena, Huawei and Nokia as the three most popular optical networking equipment vendors. The report also highlighted Data Center Interconnection (DCI) is a huge growth opportunity.

IHS-Markit predicts DCI will be a significant driver for the optical equipment market, surging from 19 percent of overall equipment sales at mid-2017 to nearly 30 percent by 2021.

Ciena was deemed the top DCI vendor by 39 percent of those surveyed by IHS-Markit. Cisco, Coriant, and Infinera each garnered 36 percent of the votes.Last year Ciena reportedly won a DCI deal from rival ADVA Optical, which had a negative impact on ADVA’s operational results.

Ciena also topped the list of top (optical) transport software-defined networking (SDN) vendors, with 46 percent of those surveyed citing the company as a leader in the segment. Adams noted that while this market was still in its early days, Ciena’s continued integration of its Blue Planet software platform with its optical equipment products was driving differentiation in the market.

Cisco attracted the second most votes in terms of transport SDN leadership, followed by Nokia and Infinera.

FCC Votes to Reverse Net Neutrality & No Longer Regulate Broadband Internet Services

Overview:

By a 3 to 2 vote along party lines, the Federal Communications Commission (FCC) voted on Thursday to dismantle landmark rules regulating the businesses that connect consumers to the internet, granting broadband ISPs the power to potentially reshape Americans’ online experiences. The agency scrapped the so-called net neutrality regulations that prohibited broadband providers from blocking websites or charging for higher-quality service or certain content. The federal government will also no longer regulate high-speed internet delivery as if it were a utility, like phone service. The upshot is that the “Restoring Internet Freedom” order passed today, removes the FCC as a regulator of the broadband industry and relegates rules that prevented blocking and throttling content to the honor system.

That means a consumer or business is helpless if they have a complaint against an ISP or broadband service provider although there’s lip service saying that “the FCC and FTC will securely share consumer complaints pertaining to the subject matter of the Internet Freedom Order’s requirements to the extent feasible…….” FTC enforcement action is mentioned, but from our experience the FTC does nothing when it receives a complaint! They don’t even contact the business you’re complaining about (like the BBB does).

From the FCC’s Memorandum of Understanding (bold font added– see other FCC.gov references below):

(1) Pursuant to the FCC’s authority under the Communications Act of 1934, as amended, on December 14, 2017, the FCC adopted a Declaratory Ruling, Report and Order, and Order in the proceeding Restoring Internet Freedom, WC Docket No. 17-108, Declaratory Ruling, Report and Order, Order, FCC 17-166 (Dec. 14, 2017) (“Internet Freedom Order”), which, in principal part, restores broadband Internet access service to its Title I information service classification,reinstates the private mobile service classification of mobile broadband Internet access service, and returns to the Transparency Rule the FCC adopted in 2010 with certain limited modifications to promote additional transparency. As authority for the Transparency Rule, the FCC relies on Section 257 of the Communications Act, among other provisions, which requires the FCC to identify and eliminate market entry barriers for entrepreneurs and other small businesses in the provision and ownership of telecommunications services and information services and to report to Congress on how such marketplace barriers have been addressed by regulation or could be addressed by recommended statutory changes; and

(2) Congress has directed the FTC to, among other things, prevent unfair methods of competition and unfair or deceptive acts or practices in or affecting commerce under Section 5 of the Federal Trade Commission Act, 15 U.S.C. § 45, and has charged the FTC with enforcing a number of other specific rules and statutes.

Therefore, it is agreed that:

1. Consistent with its jurisdiction and to fulfill its duties under Section 257 of the Communications Act, among other provisions, the FCC will monitor the broadband market and identify market entry barriers by, among other activities, reviewing informal complaints filed by consumers, and will investigate and take enforcement action as appropriate with respect to failures by an Internet service provider to comply, in whole or in part, with the Internet Freedom Order’s requirements to file with the FCC or display on a publicly available, easily accessible website the specified subjects of disclosure.

2. Consistent with its jurisdiction, the FTC will investigate and take enforcement action as appropriate against Internet service providers for unfair, deceptive, or otherwise unlawful acts or practices, including but not limited to, actions pertaining to the accuracy of the disclosures such providers make pursuant to the Internet Freedom Order’s requirements, as well as their marketing, advertising, and promotional activities.

3. Consistent with each agency’s jurisdiction and to maximize the resources of each agency, at the regular coordination meeting established by the Agencies’ 2015 Memorandum of Understanding, the Agencies will discuss potential investigations against Internet Service Providers that could arise under each agency’s jurisdiction, and coordinate such activities to promote consistency in law enforcement and to prevent duplicate or conflicting actions, to the extent appropriate and consistent with law.

4. To further support coordination and cooperation on these matters, the Agencies will continue to work together to protect consumers, including through:

• Consultation on investigations or enforcement actions that implicate the jurisdiction of the other agency;

• Sharing of relevant investigative techniques and tools, intelligence, technical and legal expertise, and best practices in response to reasonable requests for such assistance from either Agency; and

• Collaboration on consumer and industry outreach and education efforts, as appropriate.

5. The FCC and FTC will securely share consumer complaints pertaining to the subject matter of the Internet Freedom Order’s requirements to the extent feasible and subject to the Agencies’ requirements and policies governing, among other things, the protection of confidential, personally identifiable, or nonpublic information.

6. The Agencies may coordinate and cooperate to develop guidance to assist consumers’ understanding of Internet service provider practices.

7. In seeking to encourage and facilitate the enforcement of applicable law, the Agencies recognize that decisions by one agency to take or withhold action are not, except by operation of law, binding on or intended to restrict action by the other agency.

8. To ensure the effective exchange of information between the Agencies, the persons signing below and their successors shall be deemed Designated Liaison Officers to serve as the primary sources of contact for each agency. Formal meetings between appropriate senior officials of both Agencies to exchange views on matters of common interest and responsibility shall be held from time to time, as determined to be necessary by such liaison officers…..blah, blah, blah!

……………………………………………………………………………………………………………………………………………………………….

Analysis:

The action reversed the agency’s 2015 decision, during the Obama administration, to better protect Americans as they have migrated to the internet for most communications. It will take a couple of weeks for the changes go into effect, but groups opposed to the action have already announced plans to sue the agency to restore the net neutrality regulations. Those suits could take many months to be resolved.

FCC chairman Ajit Pai said the rollback of the rules would eventually help consumers because broadband providers like AT&T and Comcast could offer people a wider variety of service options. We are helping consumers and promoting competition,” Mr. Pai said in a speech before the vote. “Broadband providers will have more incentive to build networks, especially to under-served areas.” We think that’s disingenuous nonsense!

The discarding of net neutrality regulations is the most significant and controversial action by the F.C.C. under Mr. Pai. In his first 11 months as chairman, he has lifted media ownership limits, eased caps on how much broadband providers can charge business customers and cut back on a low-income broadband program that was slated to be expanded to nationwide carriers.

His plan for the net neutrality rules, first outlined early this year, set off a flurry of opposition. Critics of the changes say that consumers may have more difficulty finding content online and that start-ups will have to pay to reach consumers. In the past week, there have been hundreds of protests across the country, and many websites have encouraged users to speak up against the repeal. After the vote, numerous groups said they planned to file a lawsuit challenging the change.

As expected, the five FCC commissioners were fiercely divided along party lines. In front of a room packed with reporters and television cameras from the major TV networks, the two Democratic commissioners warned of consumer harms to come from the changes.

Mignon Clyburn, one of the Democratic commissioners, presented two accordion folders full of letters in protest to the changes, and accused the three Republican commissioners of defying the wishes of millions of Americans. “I dissent, because I am among the millions outraged,” said Ms. Clyburn. “Outraged, because the F.C.C. pulls its own teeth, abdicating responsibility to protect the nation’s broadband consumers.”

“I dissent from this rash decision to roll back net neutrality rules,” said FCC Commissioner Rosenworcel. “I dissent from the corrupt process that has brought us to this point. And I dissent from the contempt this agency has shown our citizens in pursuing this path today. This decision puts the Federal Communications Commission on the wrong side of history, the wrong side of the law, and the wrong side of the American public.”

On the other hand, Brendan Carr, a Republican FCC commissioner, said it was a “great day” and dismissed “apocalyptic” warnings. “I’m proud to end this two-year experiment with heavy-handed regulation,” Mr. Carr added.

During Mr. Pai’s speech before the vote, security guards entered the meeting room at the F.C.C. headquarters and told everyone to evacuate. Commissioners were ushered out a back door. The hearing restarted a short time later. That shows you how unpopular the repeal of Internet Neutrality really is!

Despite all the uproar, it is unclear how much will change for internet users. The rules were essentially a protective measure, largely meant to prevent telecom companies from favoring some sites over others. And major telecom companies have promised consumers that their experiences online would not change.

Mr. Pai and his Republican colleagues have echoed the comments of telecom companies, who have told regulators that they weren’t expanding and upgrading their networks as quickly as they wanted to since the creation of the rules in 2015.

“There is a lot of misinformation that this is the ‘end of the world as we know it’ for the internet,” Comcast’s senior executive vice president, David Cohen, wrote in a blog post this week. “Our internet service is not going to change.” We certainly hope so!

But with the F.C.C. making clear that it will no longer oversee the behavior of broadband providers, telecom experts say, the companies could feel freer to come up with new offerings, such as faster tiers of service for business partners such as HBO’s streaming service or Fox News. Such prioritization could stifle certain political voices or give the telecom conglomerates with media assets an edge over rivals.

Is this net neutrality repeal set in stone? Not necessarily. The repeal could be overturned in court or by Congress. A Democratic senator is already working on legislation. Net neutrality advocates are also saying they’ll push ahead with both options to fight the repeal. In order for the repeal to go into effect, it must be approved by the Office of Management and Budget — a process that could take several months.

Other Voices:

Consumer groups, start-ups and many small businesses say there are examples of net neutrality violations by companies, such as when AT&T blocked FaceTime on iPhones using its network.

These critics of Mr. Pai, who was nominated by President Trump, say there isn’t enough competition in the broadband market to trust that the companies will try to offer the best services for customers. The providers have the incentive to begin charging websites to reach consumers, a strong business model when there are few places for consumers to turn when they don’t like those practices.

“Let’s remember why we have these rules in the first place,” said Michael Beckerman, president of the Internet Association, a trade group that represents big tech firms such as Google and Facebook. “There is little competition in the broadband service market.”

Mr. Beckerman said his group was weighing legal action against the commission. Public interest groups including Public Knowledge and the National Hispanic Media Coalition said they planned to challenge Mr. Pai’s order in court. Eric T. Schneiderman, the New York attorney general, also said he would file a lawsuit.

Dozens of Democratic lawmakers, and some Republicans, have pushed for Congress to pass a law on the issue, if only to prevent it from flaring up every couple of years at the F.C.C. — and then leading to a court challenge.

One Republican commissioner, Mike O’Reilly, said he supported a federal law created by Congress for net neutrality. But he said any law should protect the ability of companies to charge for faster lanes, a practice known as “paid prioritization.” Any legislation action appears to be far off, however, and numerous online companies warned that the changes approved on Thursday should be taken seriously.

“If we don’t have net neutrality protections that enforce tenets of fairness online, you give internet service providers the ability to choose winners and losers,” Steve Huffman, chief executive of Reddit, said in an interview. “This is not hyperbole.”

Netflix, which has been relatively quiet in recent weeks about its opposition to the change, said that the decision “is the beginning of a longer legal battle.” Netflix via Twitter (tweet) at 10:26 AM – Dec 14, 2017:

“We’re disappointed in the decision to gut #NetNeutrality protections that ushered in an unprecedented era of innovation, creativity & civic engagement. This is the beginning of a longer legal battle. Netflix stands w/ innovators, large & small, to oppose this misguided FCC order.”

This author totally agrees with Netflix! Let us know how you feel by leaving a comment in the box below this post. It can be anonymous if you like and your email address won’t be published! Thanks, Alan

…………………………………………………………………………………………………………………………………………………………………………………………………………

References:

| FCC Acts To Restore Internet Freedom (from FCC.gov website): | |||

| Reverses Title II Framework, Increases Transparency to Protect Consumers, Spur Investment, Innovation, and Competition | |||

| Documents: | |||

| Word : DOC-348261A1.docx DOC-348261A2.docx DOC-348261A3.docx DOC-348261A4.docx DOC-348261A5.docx DOC-348261A6.docx | |||

| PDF : DOC-348261A1.pdf DOC-348261A2.pdf DOC-348261A3.pdf DOC-348261A4.pdf DOC-348261A5.pdf DOC-348261A6.pdf | |||

| Text : DOC-348261A1.txt DOC-348261A2.txt DOC-348261A3.txt DOC-348261A4.txt DOC-348261A5.txt DOC-348261A6.txt | |||

| 12/14/2017 | |||

| Restoring Internet Freedom FCC-FTC Memorandum Of Understanding | |||

| . | |||

| Documents: | |||

| PDF : DOC-348275A1.pdf | |||

| Text : DOC-348275A1.txt | |||

Greg Wyler- OneWeb Satellite-Internet CEO- Telecom Man of the Year + $500M more from Softbank

Greg Wyler, the entrepreneur and CEO of satellite internet company OneWeb, has won the Fierce Wireless “Most Powerful Person In Telecom” tournament for 2017, just edging past T-Mobile CEO John Legere during this weekend’s final matchup and beating other industry notables like Ericsson’s Borje Ekholm, Apple’s Tim Cook and Verizon’s Lowell McAdam.

This past Sunday afternoon, Legere urged his almost 5 million Twitter followers to vote for OneWeb’s Wyler instead of himself: