Fiber vs Copper Broadband

Frontier Communications fiber build-out boom continues: record number of fiber subscribers added in the 1st quarter of 2023

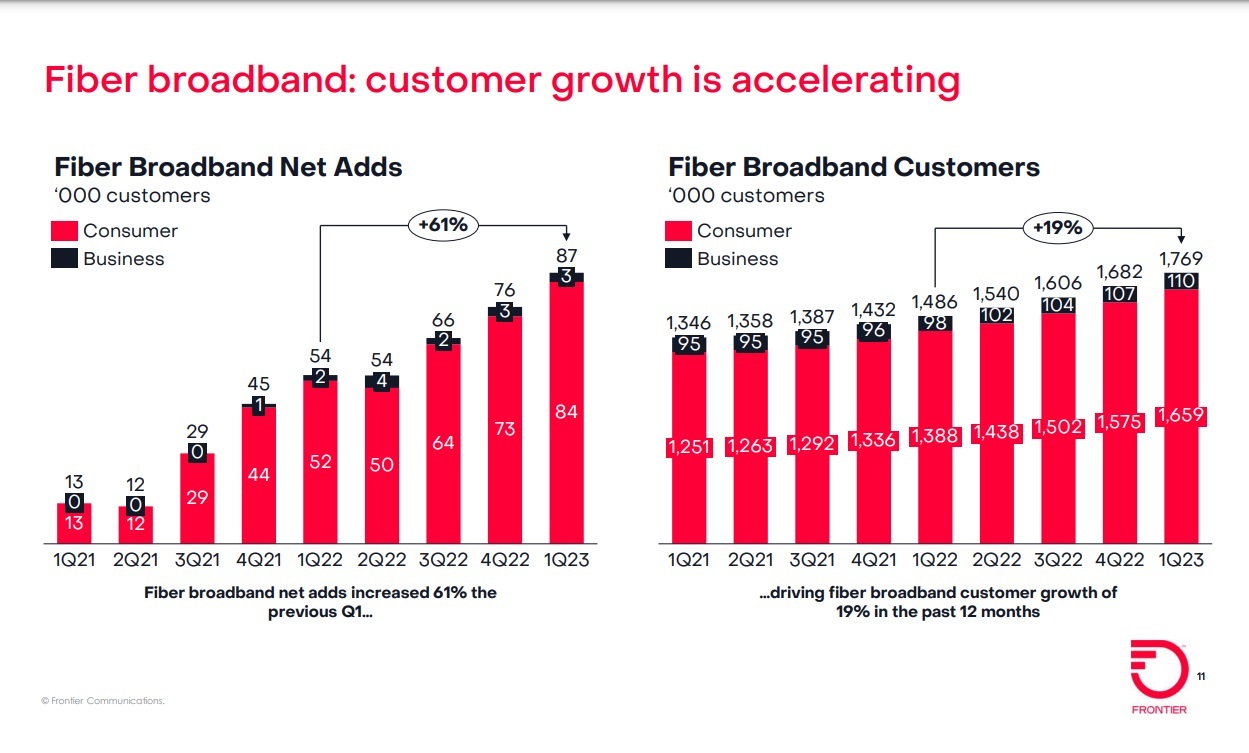

Frontier Communications added record number of fiber broadband customers in the 1st quarter of 2023. The fiber facility based network operator added 87,000 fiber subscribers (including 83,000 residential subs) in the first quarter of 2023, up from +54,000 in the year-ago quarter. Those results beat the 76,000 residential fiber subs Frontier was expected to add in the period. Frontier ended the quarter with 1.76 million fiber customers: 1.65 million residential subscribers and 110,000 business customers.

“We delivered another strong quarter and reached a critical milestone in our transformation. Thanks to our team’s consistent operational performance, we achieved EBITDA growth for the first time in five years,” said Nick Jeffery, President and Chief Executive Officer of Frontier.

“We are creating an internet company that people love. Over the last two years, we have rallied around our purpose of Building Gigabit America, invested in fiber, enhanced our product, put the customer at the center of everything we do and made it easier to do business with us. We are quickly becoming an agile, digital infrastructure company, and I’m confident we will return to growth this year.”

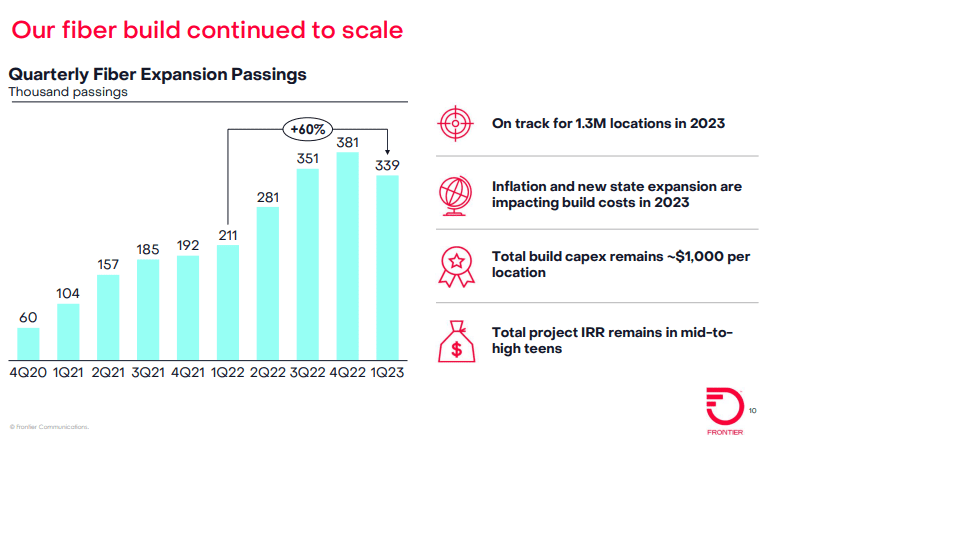

Frontier said it built fiber to an additional 339,000 locations in Q1 2023, up 60% from the 211,000 it built in the year-ago period. Frontier’s Q1 buildout was better than the 300,000 locations expected by the analysts at New Street Research. Frontier ended the quarter with 5.5 million fiber passings and 15.4 million total passings.

First-Quarter 2023 Consolidated Financial Results:

• Revenue of $1.44 billion decreased 0.5% from the first quarter of 2022 as growth in consumer, business and wholesale fiber was more than offset by declines in legacy copper

• Operating income was $143 million and net income was $3 million

• Adjusted EBITDA of $519 million increased 2.0% over the first quarter of 2022 as revenue declines were more than offset by lower content, selling, general and administrative expenses, and cost-saving initiatives

• Adjusted EBITDA margin of 36.0% increased from 35.2% in the first quarter of 2022

• Capital expenditures of $1.15 billion increased from $0.45 billion in the first quarter of 2022 as fiber expansion initiatives accelerated First-Quarter 2023

Consumer Results:

• Consumer revenue of $761 million decreased 1.9% from the first quarter of 2022 as strong growth in fiber broadband was more than offset by declines in legacy copper broadband and voice

• Consumer fiber revenue of $448 million increased 10.1% over the first quarter of 2022 as growth in consumer broadband, voice, and other more than offset declines in video

• Consumer fiber broadband revenue of $298 million increased 17.3% over the first quarter of 2022 driven by growth in fiber broadband customers

• Consumer fiber broadband customer net additions of 84,000 resulted in consumer fiber broadband customer growth of 19.5% from the first quarter of 2022

• Consumer fiber broadband customer churn of 1.20% was roughly flat with churn of 1.19% in the first quarter of 2022

• Consumer fiber broadband ARPU of $61.44 decreased 1.1% from the first quarter of 2022 driven primarily by the autopay and gift-card incentives introduced in the third quarter of 2021 First-Quarter 2023

Business and Wholesale Results:

• Business and wholesale revenue of $657 million decreased 1.4% from the first quarter of 2022 as growth in fiber was more than offset by declines in copper

• Business and wholesale fiber revenue of $281 million increased 6.0% over the first quarter of 2022 as growth in business was partly offset by modest declines in wholesale

• Business fiber broadband customer churn of 1.45% increased from 1.24% in the first quarter of 2022

• Business fiber broadband ARPU of $104.38 decreased 1.2% from the first quarter of 2022

………………………………………………………………………………………………………………………………..

While Frontier’s fiber growth engine continues to hum along, the company is dealing with higher costs related to its fiber initiative. The company raised its 2023 capex guidance to a range of $3 billion to $3.2 billion, up from an original outlook of $2.8 billion.

Frontier blamed the increase on a couple of factors – a decision to build inventory opportunistically where it saw supply chains ease a bit in the quarter and higher build costs as it scales its build into new geographies. Frontier is also seeing higher labor costs being driven by general inflation and higher rates as some of its multi-year labor contracts come up for renewal.

The anticipated increase in capex this year concerned investors. Frontier shares were down $2.33 (-10.94%) to $19.13 each in Friday morning trading.

Overall, Frontier expects fiber build costs in 2023 to be in the range of $1,000 to $1,100. But it’s confident that total project build costs will remain at about $1,000 per location as it mixes in lower-cost locations in some new-build states and benefits from aerial builds and an increased focus on multiple dwelling units (MDUs), Frontier CFO Scott Beasley said on Friday’s earnings call.

The current capex picture isn’t expected to impact Frontier’s overall fiber buildout/upgrade plan. “We’re confident that the 10 million locations is still attractive to build out,” Beasley said. Frontier is also continuing to explore an additional 1 million to 2 million additional fiber passings beyond the original 10 million target.

Frontier says it’s too early to tell how this year’s cost headwinds might impact future opportunities coming by way of the $42.5 billion Broadband Equity, Access and Deployment (BEAD) program. New Street Research estimates that there are 1.2 million BEAD-eligible locations in Frontier’s footprint. New Street Research expects ARPU pressure at Frontier to ease in the second quarter of the year and return to growth in the third quarter.

Frontier recently initiated several consumer pricing changes for value-added services that were previously free. Whole-home Wi-Fi, for example, now costs $10 per month, its Home Shield Elite product is now $6 per month extra and the company is now charging $50 for professional installs. Those actions are driving new fiber customer monthly ARPU to a range of $65 to $70, the company said.

Frontier is also speeding up its original cost savings target to $500 million by the end of 2024. Its prior target was $400 million by the end of 2024. Frontier is approaching that target through a range of streamlining and simplification initiatives, including improved field operations, self-service capabilities, the consolidation of call centers and an ongoing reduction in copper infrastructure.

Frontier’s guidance for the full year 2023:

• Adjusted EBITDA of $2.11 – $2.16 billion, unchanged from prior guidance

• Fiber build of 1.3 million new locations, unchanged from prior guidance

• Cash capital expenditures of $3.00 – $3.20 billion, an increase from prior guidance of $2.80 billion, reflecting higher inventory levels and fiber build costs

• Cash taxes of approximately $20 million, unchanged from prior guidance

• Net cash interest payments of approximately $655 million, an increase from prior guidance of $630 million, reflecting the $750 million of debt raised in March 2023

• Pension and OPEB expense of approximately $50 million (net of capitalization), unchanged from prior guidance

• Cash pension and OPEB contributions of approximately $125 million, unchanged from prior guidance

References:

Fiber builds propels Frontier Communication’s record 4th Quarter; unveils Fiber Innovation Labs

AT&T to use Frontier’s fiber infrastructure for 4G/5G backhaul in 25 states

Frontier Communications offers first network-wide symmetrical 5 Gig fiber internet service

Frontier Communications adds record fiber broadband customers in Q4 2022

Frontier’s Big Fiber Build-Out Continued in Q3-2022 with 351,000 fiber optic premises added

Frontier Communications sets another fiber buildout record; raises FTTP buildout target for 2022

“Fiber is the future” at Frontier, which added a record 54K fiber broadband customers in 1Q-2022

Frontier’s FTTP to reach 10M locations by 2025; +192,000 FTTP passings in 4Q-2021

Frontier Communications reports added 45,000 fiber broadband subscribers in 4Q-2021 – best in 5 years!

More KPN customers use fiber vs copper for broadband services in Nederlands

Dutch network operator KPN announced a new milestone on its fixed network: more customers are using fiber services than the old copper infrastructure for the first time. The disclosure was made in an internal announcement obtained by Telecompaper. KPN is seeing a steady increase in fiber orders in its consumer/residential market. The company said around 65% of orders are fiber and 35% for services on copper lines (DSL or POTs).

According to the Q1 Dutch Consumer Broadband report [1.], KPN had roughly the same number of residential DSL and fiber subscribers at the end of March, with just over 1.3 million lines each. While it has been adding fiber optic subscribers steadily each quarter, DSL losses remain slightly greater when including its second brand. The total consumer fixed broadband base has been flat (0% growth) over the past year.

Note 1. This Telecompaper report analyses developments in the first quarter of 2022 in the Dutch market for broadband internet access, focusing on consumer connections. The report further includes data on developments, fixed market revenues and broadband revenues. The findings are compared with results from previous periods. The analysis is based on Telecompaper’s continuous research into the development of the Dutch broadband communication services market. The focus is on cable network operators (Ziggo, Delta, Caiway), DSL providers (KPN, T-Mobile, Tele2, Online.nl, Budget Thuis) and FTTH providers (including KPN, T-Mobile, Caiway, Delta, Tele2, Online.nl, Budget Thuis).

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Babak Fouladi, KPN’s Chief Technology & Digital Officer and member of the Board of Management, spoke at the Telecom Insights 2022 conference in May. He said:

“Telecom networks are essential and vital, and we do not only literally ensure that the world remains connected to everything and everyone. Our networks also support massive digitization, essential in crisis situations since online access is often the only door to the outside world and contact with others. Our networks enable people to work from home, study online or continue doing business. In addition, the digital infrastructure contributes to the global economy and to keeping healthcare and education affordable. And our infrastructure makes a structural contribution to reducing CO2 emissions, the use of fossil fuels and cleaner air. Digitization is more and more important as accelerator for sustainability.”

He concluded his speech with an appeal to the Dutch telecom sector: “Let’s make the Netherlands the best connected country in the world! Let’s make it happen, together.”

References:

https://www.overons.kpn/nieuws/en/lets-make-the-netherlands-the-best-connected-country-in-the-world/

57% of European homes can now get FTTH/B internet access; >50% growth forecast over next 5 years

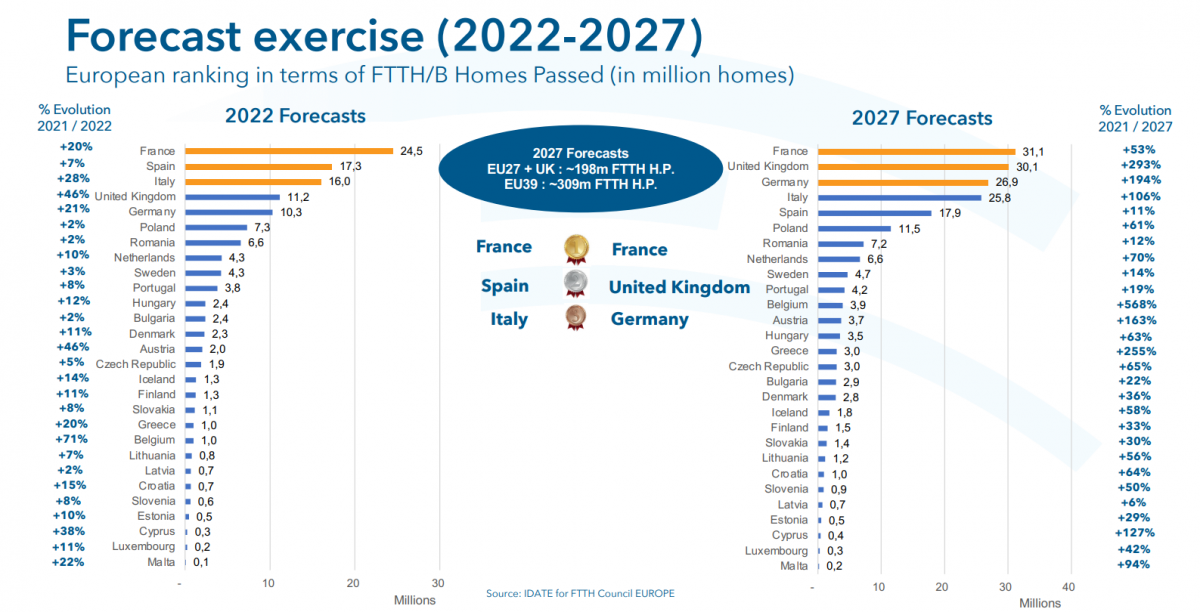

Europe has reached 200 million (M) homes that are now able to access FTTH/B services. That number is forecast to grow over 50 percent in the next five years, to more than 300 million homes passed, according to the latest research commissioned by the FTTH Council Europe. The new figures were released at its annual conference in Vienna, along with fiber subscriber numbers and research intro rural coverage.

The latest research by Idate for the council shows nearly 198.4 million homes were passed by FTTH or FTTB as of September 2021, up from 176.3 million a year earlier. The annual expansion was led by France (+4.3 M), the UK (+3.4 M), Germany (+2.4 M) and Italy (+1.5 M), all countries with a strong copper network footprint that previously held back fiber optic deployments.

The figures cover 39 countries across Europe and equal 57 percent of total households in the area, up by 4.5 percent points from a year earlier. In the 27 EU countries plus the UK, the coverage reached 48.5 percent of homes, up by 4.6 percent over the 12 months.

The number of subscribers on the fiber networks reached 96 million. The fastest growing markets in terms of new subscribers were France (+3.8 M), Spain (+1.2 M), Romania (+1 M), Italy (+820 K) and the UK (+765K). In total, 48.5 percent of households able to receive fibre services actually subscribed to the services, an increase of 3.6 percent in the network penetration rate. In the EU plus UK, take-up was at 52.4 percent, up 5.6 percent year-on-year.

Alternative operators still account for the majority of the FTTH/N coverage (57%), with incumbent operators taking 39 percent and 4 percent built by municipalities and utilities. Overall, there is a strong acceleration in fiber deployment, with a firm commitment to cover both urban and rural areas, the researchers said.

Idate also updated its five-year forecast for the FTTH/B market. It expects 199 million homes passed in 2027 in the EU+UK region and 309 million in the wider EU 39 region. Over the same period, the number of subscribers is expected to reach respectively 124 million and 190 million, equal to network penetration of over 62 percent in the EU and UK and more than 61 percent in the EU 39.

Further research shows that only 30 percent of rural inhabitants could enjoy fibre network access as of September 2021. Rural FTTH/B coverage is highest in Denmark (76%), Latvia (74%), Spain (66%), Romania (62%) and Luxembourg (55%). The report emphasized that immediate action should be oriented towards the rural regions, with increased public support through subsidies and partnerships to cover every European premise with high-speed broadband.

At the conference, the FTTH Council also announced several awards for contributions to the industry’s progress. UK wholesale operator CityFibre received the operator award; Jacek Wisniewski, CEO of Polish operator Nexera received the individual award; and Eurofiber CEO Alex Goldblum was winner of the Charles Kao award, named after the eponymous scientist who won a Nobel prize for physics for his research into fiber-optic communications.

References:

https://www.fibre-systems.com/news/europe-track-meet-connectivity-targets-rural-areas-gaining-focus

Swisscom achieves 50 Gbps on a fixed PON connection – a world first!

Swisscom has achieved transmission speeds of 50 Gbps in a real PON (Passive Optical Network) environment test – a world first, according to the company. Swisscom has upgraded existing OLT (Optical Line Termination) hardware with a 50 Gbps PON Line Card prototype to reach a download speed of 50 Gbps and an upload speed of 25 Gbps on a fixed network.

The PON technology can be ready to market and deployed in around two years, according to Swisscom. It can be an option for business customers initially. Progressive network virtualization will enable companies to use the bandwidth they need on a flexible basis in line with their requirements.

The 10 Gbps service is expected to be sufficient for the residential mass market for several years yet, the company said. The 50 Gbps option allows for flexible deployment using existing fibre-optic infrastructure.

Markus Reber, Head of Swisscom Networks, said: “There is no question that the bandwidth need will continue to increase over the coming years. That’s why, here at Swisscom, we are already considering how our technology needs to develop to ensure that Switzerland continues to be ready to take advantage of the latest digital services with the best possible experience in the future. The results of testing based on PON technology and architecture clearly demonstrate that we have some powerful options available.”

“In my opinion, PON with 50 Gbit/s will be an option for the business customer market initially. Progressive network virtualisation will enable companies to use the bandwidth they need on a flexible basis in line with their requirements, for instance. In contrast, the 10 Gbit/s already available in the residential mass market should be more than enough for several years to come. However, the 50 Gbit/s option offers even more opportunities, as it allows the existing fibre optic infrastructure to be deployed in a more versatile way. As an example, the technology will soon facilitate access to mobile communication masts, particularly for 5G, as the same network can be used as the one already built to connect households. With a transmission speed of 50 Gbit/s, there is ample bandwidth available.”

The technology also will support fiber optic access to mobile communication masts, particularly for 5G, since the same network can be used as the one already built to connect households.

Swisscom says that “over the coming years, the development of digital applications will result in a similar growth in bandwidth need as seen in recent years, when it increased more than tenfold within a decade. Swisscom is therefore investing in network expansion on an ongoing basis, deploying the latest innovative technologies to do so and safeguarding Switzerland’s high degree of digital competitiveness.”

…………………………………………………………………………………………………………………………………………………………………………………………………..

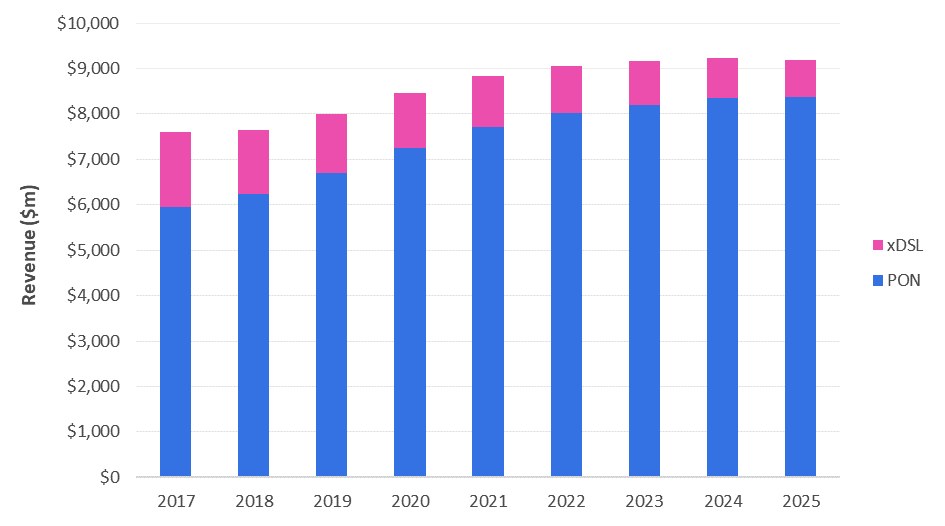

In April 2020, market research powerhouse Omdia (owned by Informa) forecast that In the 2018-2025 timeframe, the PON market will see a compound annual growth rate (CAGR) of 4.3% to be worth $8.4 billion by 2025. “This market remains in an upswing as operators continue to expand and upgrade their fiber-based access networks for both residential and non-residential subscribers and applications,” states the Omdia team in their report (published prior to the global impact of COVID-19, it should be noted).

Omdia: PON and xDSL/Gfast equipment market by major segment, 2017–2025

Growth in the PON market will be driven by increasing demand for next-generation PON equipment, including 10G GPON, 10G EPON, NG-PON2 and 25G/50G PON, according to Omdia: By 2021, most GPON OLT (optical line terminal) shipments are expected to be 10G.

Omdia expects demand for NG-PON2 equipment (which is expensive because it includes tunable lasers) is expected to be limited, with significant deployments anticipated only by one major operator, Verizon.

In Western Europe, PON investments are only just starting: That market is set for a CAGR of 16.5% to be worth $1.6 billion in 2025.

…………………………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.swisscom.ch/en/about/news/2020/10/08-weltpremiere.html

https://www.telecompaper.com/news/swisscom-reaches-50-gbps-in-real-network-environment–1357116

http://www.broadbandworldnews.com/document.asp?doc_id=758638

AT&T ends DSL sales while CWA criticizes AT&T’s broadband deployments

AT&T: DSL is Dead:

According to a message board post on DSL Reports, AT&T notified customers on billing statements in August that effective Oct. 1 it would no longer accept new orders for its copper-based DSL service. The notice also said that existing DSL subs will no longer be able to make speed changes to their respective DSL service.

The message board author wrote:

“On my August AT&T statement, traditional DSL is officially grandfathered effective October 1st. No new orders (moves, installs, speed change, etc.). Hopefully they will still allow promos….”

That’s no surprise to this author. AT&T’s DSL subscriber base has been eroding steadily – losing almost 350,000 subs over the past couple of years. In Q2 2020, AT&T shed 23,000 DSL subs, ending the period with just 463,000.

“We are focused on enhancing our network with more advanced, higher speed technologies like fiber and wireless, which consumers are demanding,” AT&T said in a statement. “We’re beginning to phase out outdated services like DSL and new orders for the service will no longer be supported after October 1. Current DSL customers will be able to continue their existing service or where possible upgrade to our 100% fiber network.”

……………………………………………………………………………………………………………………….

AT&T Fiber Update:

AT&T also announced three new price points for its AT&T Fiber tiers and said that all new and existing AT&T Fiber Internet 100, Internet 300 and Internet 1000 subscribers would enjoy unlimited data without additional charges. AT&T Fiber started offering the new deals as a standalone product with no annual contracts for new customers on Sunday.

As of Q2-2020, AT&T had 4.3 million AT&T Fiber customers with nearly two million of them on 1-gigabit speeds. Overall, AT&T has about 15.3 million broadband subscribers while Charter has 28 million and Comcast has over 29 million.

AT&T’s fiber tier announcement comes after AT&T CEO John Stankey told a Goldman Sachs investor conference in September that “priority number one” is investing in fiber for 5G and FTTP services.

The new prices are also an indication that AT&T intends to ramp up its drive on FTTP sales in the wake of a recent study showing that many of AT&T’s new subs were coming from existing customers upgrading to fiber rather than from gaining market share from cable Internet operators (MSOs).

………………………………………………………………………………………………….

CWA Calls Out AT&T’s broadband efforts:

Coincidently today, the Communications Workers of America (CWA) criticized AT&T’s lack of fiber deployments. The report, co-authored with the National Inclusion Alliance (NDIA) stated:

AT&T is making the digital divide worse and failing its customers and workers by not investing in crucial buildout of fiber-optic infrastructure that is the standard for broadband networks worldwide. The company’s recent job cuts — more than 40,000 since 2018 — are devastating communities and hobbling the company’s ability to meet the critical need for broadband infrastructure.

An in-depth analysis of AT&T’s network shows the company has made fiber available to fewer than a third of households in its footprint, halting most residential deployment after mid-2019. The analysis also shows that 28% of households in AT&T’s footprint do not have access to service that meets the FCC’s standard for high-speed internet, and in rural counties 72% of households lack this access. In some places, AT&T is decommissioning its outdated DSL networks and leaving customers with no option but wireless service, which is not a substitute for wireline service.

In all, AT&T has made fiber-to-the-home available for fewer than one-third of the households in its network. AT&T’s employees — many of whom are Communications Workers of America (CWA) members — know that the company could be doing much more to connect its customers to high-speed Internet if it invested in upgrading its wireline network with fiber. They know the company’s recent job cuts — more than 40,000 since 2018 — are devastating communities and hobbling the company’s ability to meet the critical need for broadband infrastructure.

CWA recommends that AT&T dedicate a substantial share of its free cash flow to investment in next-generation networks across rural and urban communities, make its low-income product offerings available widely, and stop laying off its skilled, unionized workers and outsourcing work to low-wage, irresponsible subcontractors.

Editor’s Note:

According to CWA, AT&T has deployed fiber-to-the-home (FTTH) to only 28% of the households in its fiber coverage area as of the end of June 30, 2019.

……………………………………………………………………………………………………………………………………………………………………………………………………..

The CWA/NDIA report said AT&T has targeted more affluent, non-rural areas for its fiber upgrades. Houses with fiber have a median income that’s 34% higher than those with DSL only. Across the rural counties in AT&T’s 21-state footprint, only a miniscule 5% have access to fiber, according to the report.

According to the report, 14.93 million—out of almost 53 million households—have access to AT&T’s fiber service. Among states, AT&T’s FTTH build out is the lowest in Michigan with 14% have access followed by Mississippi (15%) and Arkansas (16%).

“AT&T is also failing to make fiber available to the majority of its customer base in cities,” according to the report. “While most of AT&T’s fiber build has focused on urban areas—96 percent of households with access to fiber in AT&T’s footprint are in predominantly urban counties—the company hasn’t built enough fiber to reach the majority of urban residents. Seventy percent of households in urban counties still lack access to fiber from AT&T because the company has made fiber available to only 14.7 million households out of 48.4 million total households in these counties.”

The report also said there were many areas in AT&T’s footprint where it doesn’t offer the Federal Communications Commission’s “broadband” definition of 25 Mbps downstream and 3 Mbps upstream.

“For 28% of the households in its network footprint, AT&T’s internet service does not meet the FCC’s 25/3 Mbps benchmark to be considered broadband,” the report said. A key recommendation is that “AT&T must upgrade its network in rural communities to meet the FCC’s broadband definition, at least, and renew its efforts to deploy next-generation fiber.”

The report noted that in some areas where AT&T doesn’t provide faster speeds, cable operators, such as Comcast and Charter do.

“Even where that access is available from another provider—typically a cable provider—consumers are deprived of the benefits of competition in price, choice and service quality,” the report said.

…………………………………………………………………………………………………………

AT&T is counting on fiber for both residential and commercial services, including AT&T TV. In order to win over customers from cable operators, AT&T has paired its 1-Gig service with AT&T TV.

Regarding DSL, the report states: “AT&T’s poor maintenance of its DSL networks, with limited capacity for new connections, results in would-be new customers in some areas being denied service entirely or told they can only subscribe to fixed wireless service (a 4G wireless connection for home use, designed for rural areas).”

As expected, AT&T refuted the claims made in the CWA/NDIA report in a statement to FierceTelecom and Broadband World News on Monday afternoon.

“Our investment decisions are based on the capacity needs of our network and demand for our services. We do not ‘redline’ internet access and any suggestion that we do is wrong. We have invested more in the United States over the past 5 years (2015-2019) than any other public company. We have spent more than $125 billion in our U.S. wireless and wireline networks, including capital investments and acquisition of wireless spectrum and operations. Our 5G network provides high-speed internet access nationwide, our fiber network serves more 18 million customer locations and we continue to invest to expand both networks.”

……………………………………………………………………………………………………………………………………………………..

New Fiber Optics Market Report:

Finally, a new report by Technavio forecasts that the global fiber optics market size will grow by USD 2.44 billion during 2020-2024, progressing at a CAGR of almost 5% throughout the forecast period.

Image Credit: Technavio

The increase in the number of FTTH homes and subscribers is the key factor driving the market growth. A higher number of customers are opting for fiber optic connections to leverage broadband services. This reduces the requirements for customer premises equipment (CPE) and distribution point unit (DPU).

References:

https://cwa-union.org/sites/default/files/20201005attdigitalredlining.pdf

https://www.fiercetelecom.com/telecom/cwa-calls-out-at-t-s-lack-fiber-its-dsl-footprint

http://www.broadbandworldnews.com/document.asp?doc_id=764417

AT&T CEO: Fiber, Stories and (Video) Content to drive future revenues and growth

https://www.businesswire.com/news/home/20201005005444/en/

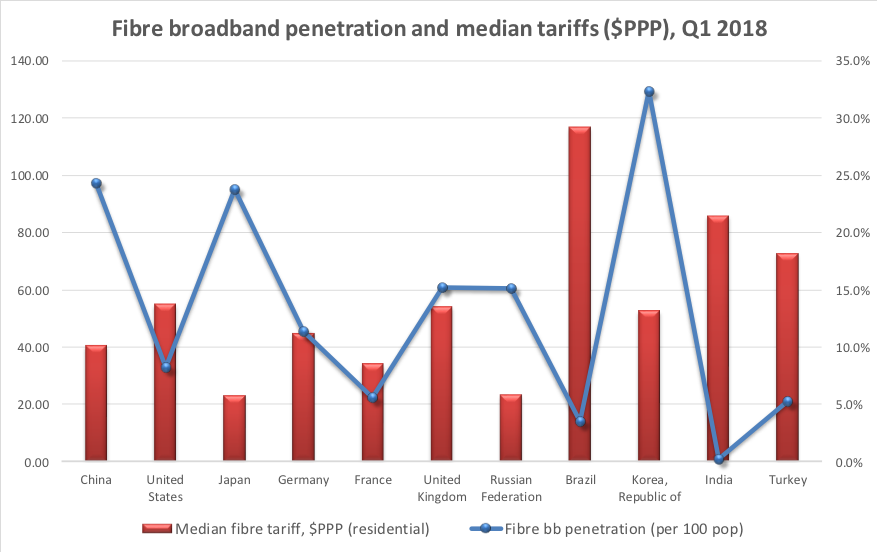

Point Topic: China leads FTTH adoption with 80% of net adds through 1Q-2018

|

|

|

Point Topic: 931.6M Fixed Broadband Connections at end of Q4-2017; VDSL Growth but Copper Connections Continue Decline

|

|

|

PointTopic: Fiber & cable make up 3/4 of global fixed broadband subscriptions

Fiber and cable networks are dominating the global broadband market, with the technologies now servicing 77% of fixed subscriptions, new figures from Point Topic have revealed.

According to the Global Broadband Statistics, which take into account subscriptions up to the end of 2017, more than 50% of people in more than 40 countries, including Singapore (97%), China (89%), United States (87%), and the UK (55%), are connected via full-fiber, fiber-fed copper or cable.

Point Topic Research Director Dr Jolanta Stanke told the Broadband Forum:

“We are finding that customers across most global regions increasingly prefer faster broadband services delivered over fiber and cable platforms, as opposed to ADSL. This trend will continue as more bandwidth-hungry young consumers become paying decision makers, even though superfast 4G LTE and 5G mobile broadband services will compete for their wallets.”

Fiber-fed subscriptions – including Fiber-to-the-Home (FTTH), Fiber-to-the-Building (FTTB), Fiber-to-the-Cabinet (FTTC), Very High Bitrate Digital Subscriber Line (VDSL), VDSL2 and G.fast – accounted for 57% of broadband subscriptions, with more than 530 million connections. Stanke agreed VDSL and Gfast were together largely responsible for the growth that fiber has seen, with more than 30 operators across all continents deploying or trialing G.fast.

“G.fast gives operators a more cost-effective variant of fiber that will be used by operators who want to upgrade their existing networks quicker and more easily,” she added. “This could enable them to serve more customers in less densely populated areas, where direct fiber investment is less economically feasible.”

In total, cable, including hybrid fiber-coaxial, accounted for 20% of all fixed broadband connections. According to the report, the latest standard of this technology is currently deployed across several markets, being especially popular in North America, and can deliver gigabit download speeds.

Broadband Forum CEO Robin Mersh said the figures reflect the fact that new technologies that let operators deploy fiber deep into the network without having to enter buildings themselves are quickly moving from trials to mass deployment.

“If operators want to deliver competitive broadband services, maximizing their investments through the use of technologies like G.fast is vital,” said Mersh. “Expanding the footprint of their existing fiber networks in this way is cost-effective and delivers the gigabit speeds consumers crave. The growing trend towards fiber, whether its fiber-fed copper or full fiber, and cable deployments highlighted by Point Topic’s report confirms that the Forum’s work on interoperability and management of ‘fiber-extending’ technologies is vitally important.”

The voracious demand for connectivity is evident in the increased demand for fiber, cable and coax despite the parallel growth of LTE and MAYBE (?) “5G.”

Though “5G” is in currently proprietary to each wireless network operator, huge investments in fiber, coax and copper are being made because strategic planners expect 5G to be mainstream in the next several years (we think NOT until late 2021 at the earliest when IMT 2020 recommendations are finalized and implemented in base stations and endpoint devices.

Last month, Broadbandtrends’ Global Service Provider G.fast Deployment Strategies surveyed 33 incumbent and competitive broadband operators from across the globe. The market research firm found that four in five service providers have G.fast plans for this year and that 27% are in active deployments. AT&T is a huge supporter of G.fast while Verizon is not.

About the Broadband Forum

Broadband Forum, a non-profit industry organization, is focused on engineering smarter and faster broadband networks. The Forum’s flagship TR-069 CPE WAN Management Protocol has now exceeded 800 million installations worldwide.

Vertical Systems Group: U.S. Business Fiber Availability Reaches 54.8%

The availability of optical fiber connectivity to large and medium size commercial buildings in the U.S. jumped to 54.8% in 2017, based on latest research from Vertical Systems Group. AT&T, Verizon and CenturyLink’s aggressive build-outs of fiber into commercial buildings have continued to increase the availability of fiber connectivity.

As a result, the U.S. Fiber Gap has dropped to less than fifty percent (45.2%) for the first time. This annual benchmark quantifies the scope of fiber lit buildings in the U.S. with twenty or more employees. Encompassing more than two million individual business establishments, this base of commercial buildings maps directly to the addressable market for higher speed Carrier Ethernet, Cloud, Data Center, Hybrid VPN and emerging SDN-enabled services.

“More commercial U.S. buildings were newly lit with fiber during 2017 than in any other year since we initiated this research in 2004…..

AT&T told investors that it reached 400,000 business buildings with its own lit fiber facilities. Due to AT&T’s aggressive build-out, the service provider now covers over 1.8 million U.S. business customer locations. The telco said it is “adding thousands more buildings each month.”

CenturyLink and Verizon took the M&A path to enhance their on-net fiber holdings.

In a huge M&A deal, CenturyLink’s purchase of Level 3 increased its on-net building reach by nearly 75% to approximately 100,000 buildings, including 10,000 buildings in EMEA and Latin America, which gives the #3 U.S. telco a larger footprint to deliver carrier Ethernet and software-defined network services.

Verizon’s purchase of XO Communications gave the telco additional metro fiber networks in 40 major U.S. markets with over 4,000 on-net buildings and 1.2 million fiber miles.

Consolidated Communications also enhanced its on-net fiber holdings via its acquisition of FairPoint. By acquiring FairPoint, Consolidated immediately established itself as the ninth largest fiber player with a presence in 24 states and 8,000 on-net buildings.

This greater density will enable Consolidated to pursue more dark fiber and lit Ethernet service opportunities with a larger mix of business and wholesale customers.

What was also notable about this year’s M&A on-net building rush was the presence of nontraditional players like Uniti Fiber, which acquired two regional fiber providers, Southern Light and Hunt Telecom. These two deals give the REIT more fiber to pursue a mix of wireless, E-Rate, military, enterprise and wholesale opportunities, including fiber-to-the-tower backhaul, small cell networks and dark fiber. The acquisition of Southern Light in particular gives Uniti access to an additional 4,500 on-net locations.

Fueling Ethernet, 5G deployments

Having more available on-net fiber is another factor that plays into service providers’ U.S. Ethernet service reach and 5G plans by creating pipes through which wireless operators can build small cell and distributed antenna systems (DAS) to improve wireless coverage in business buildings.

Encompassing more than 2 million individual business establishments, this base of commercial buildings maps directly to the addressable market for higher speed carrier Ethernet, cloud, data center, hybrid VPN and emerging SDN-enabled business services.

Several of the service providers that have high on-net fiber building counts represent some of the largest Ethernet providers in the U.S.

On the Ethernet end, AT&T, CenturyLink and Verizon continue to demand high spots in the Ethernet space. However, the effect of M&A clearly has altered the Ethernet landscape.

CenturyLink knocked AT&T from its nearly 13-year reign as the top domestic Ethernet provider in the U.S. by completing its acquisition of Level 3 Communications. The service provider’s move up the ranks of VSG’s year-end 2017 U.S. Ethernet Leaderboard was also a function of continued growth in Ethernet ports for both companies. Earlier, Level 3 ranked second to AT&T and CenturyLink ranked fifth on the Mid-2017 U.S. Ethernet Leaderboard.

But Ethernet is only one factor driving ongoing on-net fiber builds. Cochran noted in an e-mail to FierceTelecom that “larger providers larger providers are accelerating deployments” to position themselves for 5G.

Verizon, for example, acquired WideOpenWest’s fiber assets in Chicago, securing fiber to more than 500 macro-cell wireless sites and more than 500 small-cell wireless sites in the area.

Crown Castle advanced its fiber standing by acquiring Lightower—a deal that gave it greater fiber density to address businesses and its traditional wireless business customers deploying small cells in buildings. This acquisition gave Crown Castle rights to approximately 60,000 route miles of fiber, with a presence in all the top 10 and 23 of the top 25 metro markets.

As the expectations for higher speed Ethernet, cloud and in-building wireless coverages continues to ramp, service providers will continue to further narrow the fiber gap inside buildings. But unlike the speculative builds of the 1990s, these are focused on bandwidth hungry applications that are showing no signs of slowing.

Editor’s Note:

For this Vertical Systems Group analysis, a fiber lit building is defined as a commercial site or data center that has on-net optical fiber connectivity to a network provider’s infrastructure, plus active service termination equipment onsite. Excluded from this analysis are standalone cell towers, small cells not located in fiber lit buildings, near net buildings, buildings classified as coiled at curb or coiled in building, HFC-connected buildings, carrier central offices, residential buildings, and private or dark fiber installations.

References:

C Spire – Entergy Mississippi Partnership to Build Fiber Network along 5 routes

U.S. service provider C Spire today announced a partnership with electric utility Entergy Mississippi which aims to bring more than 300 miles of fiber to remote areas of Mississippi. C Spire will build and own the network, with Entergy contributing construction costs, according to C Spire Vice President of Government Relations Ben Moncrief in an interview with Telecompetitor.

Entergy will lease capacity on the network from C Spire to support its smart grid initiatives, he said. C Spire eventually expects to extend the middle-mile network to end user locations to support retail services, he added, although he emphasized that any such plans are not part of today’s news.

Details about the C Spire – Entergy partnership can be found in this press release. Clearly there were a lot of synergies for these companies to work together.

“This opens the door to offering service to residences and industrial parks,” Moncrief said. “But today is just about getting the (fiber optic) backbone in place.”

When Entergy Mississippi sought the Mississippi Public Service Commission’s approval to build a network to support its smart grid plans, one of the commissioners asked whether that network could also be “at least a foundation for broadband services,” Moncrief explained.

That idea led Entergy to a meeting with C Spire at which representatives of both companies had an “aha moment,” Moncrief recalled.

C Spire initially was a wireless carrier, as well as a provider of wireline business services, but in recent years has been quite aggressive in deploying fiber-to-the-home (FTTH) and other broadband network infrastructure in numerous rural markets in Mississippi. Meanwhile, Moncrief said, “Here’s an electric utility that for security reasons is keeping infrastructure away from population centers.”

The network will be installed with a minimum of 144-count fiber, “in some places more,” Moncrief noted. Each company will have its own fiber. The areas that the network will run through are “very rural” and might have been too costly for C Spire to build out to without the Entergy investment, Moncrief added.

C Spire also will gain connectivity from the rural areas to population centers, Moncrief said.

C Spire Entergy Fiber Network Map

……………………………………………………………………………………………………………………………….

The construction project will involve placing fiber optic cable along five separate routes as follows:

- Delta: a 92-mile route through Sunflower, Humphreys, Madison and Hinds counties and near the cities of Indianola, Inverness, Isola, Belzoni, Silver City, Yazoo City, Bentonia, Flora and Jackson.

- North: a 51-mile stretch in Attala, Leake and Madison counties, including near the towns of McAdams, Kosciusko and Canton.

- Central: a 33-mile route through Madison, Rankin and Scott counties and near the towns of Canton, Sand Hill and Morton.

- South: a 77-mile route passing through Simpson, Jefferson Davis, Lawrence and Walthall counties and near the towns of Magee, Prentiss, Silver Creek, Monticello and Tylertown.

- Southwest: a 49-mile stretch in Franklin and Adams counties that’s near the communities of Bude, Meadville, Roxie, Natchez and Eddiceton.

“We’re excited about partnering with C Spire to modernize our electrical grid and expand rural broadband access in some hard-to-reach areas across the state,” said Haley Fisackerly, president and CEO of Entergy Mississippi. “We have about 30,000 customers within five miles of the proposed routes who could potentially have access to broadband service when the project is complete. In addition, all of our customers will benefit from the enhancements to our communication systems that connect our facilities, substations, offices and radio sites.” The company provides electric service to an estimated 445,000 customers in 45 counties across the state.

“A robust broadband infrastructure is critical to the success of our efforts to move Mississippi forward by growing the economy, fostering innovation, creating job opportunities and improving the quality of life for all our residents,” said Hu Meena, CEO of C Spire, a Mississippi-based diversified telecommunications and technology services company.