Wireless LAN market

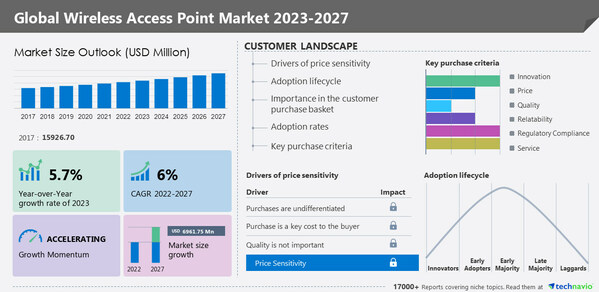

Technavio: Wireless access point market to grow at a CAGR of 6% 2022-2027

According to Technavio, the global wireless access point market size is estimated to grow by USD 6,961.75 million from 2022 to 2027. The market is estimated to grow at a CAGR of 6% during the forecast period. Moreover, the growth momentum will accelerate. North America will account for 32% of the growth of the global market during the forecast period. The report includes historic market data from 2017 to 2021.

The report also provides a comprehensive analysis of growth opportunities at regional levels, new product launches, the latest trends, and the post-pandemic recovery of the global market.

Market Definition:

- A wireless access point is a computer networking device that connects a wireless device and a wired network using a wireless standard such as Wi-Fi or Bluetooth.

- As a standalone device, a wireless access point is often linked to a router through a cable

- An access point is a networking hardware device that delivers and receives data on a wireless network

- An access point links users to other users on the network and acts as the point of connection between the WLAN and a fixed wire network

- Within a given network region, each access point can serve numerous users

- When a person goes outside the range of one access point, they are unavoidably handed over to the next access point

- A single access point is needed for a tiny WLAN

- The number required grows in direct proportion to the number of network users and the structural size of the network.

Key factor driving market growth:

- The increase in the development of smart cities is driving the growth of the global wireless access point market.

- Governments of various countries are investing large amounts in the construction of smart cities.

- These cities require public Wi-Fi networks to provide services such as safety and security, access to education, waste and water management, traffic management, infrastructure management, and healthcare.

- As a result, there will be a high demand for wireless access points in smart cities.

- Hence, the development of smart cities is expected to fuel the growth of the market during the forecast period.

The report provides actionable insights and estimates the contribution of all regions to the growth of the global wireless access point e growth of the global market during the forecast period. This growth is attributed to factors such as the increase in the use of the Internet and smartphones. The demand for bring-your-own-device (BYOD) solutions is also increasing in the region. In addition, the rising demand for 5G network acceleration has enabled firms and telecom component providers to develop advanced telecom infrastructure and related components. These factors will fuel the growth of the wireless access point market in the region during the forecast period.

Leading trends influencing the market:

1. The increase in the development of smart cities is driving the growth of the global wireless access point market.

- Governments of various countries are investing large amounts in the construction of smart cities.

- These cities require public Wi-Fi networks to provide services such as safety and security, access to education, waste and water management, traffic management, infrastructure management, and healthcare.

- As a result, there will be a high demand for wireless access points in smart cities.

- Hence, the development of smart cities is expected to fuel the growth of the market during the forecast period

2. The increase in 5G investments is a key trend in the global wireless access point market.

- The rise in these investments in 5G is creating a demand for 5G network infrastructure.

- Telecom service providers and network equipment providers will have to offer routers that will enable carriers to provide 5G services.

- Thus, an increase in investments in 5G will increase the adoption of devices such as wireless routers, which, in turn, will support the growth of the market during the forecast period.

The increase in the development of smart cities is a key factor driving the growth of the global wireless access point market. Across the world, governments are investing billions of dollars in the construction of smart cities or linked cities. This necessitates the use of public Wi-Fi networks to provide customers with services such as safety and security, access to education, waste and water management, traffic management, infrastructure management, and healthcare. It also offers LBS to city planners in order to obtain insight into how its residents live and how a smart city operates in order to deliver better services to people living in smart cities. As a result, there will be a high demand for wireless access points to be deployed in smart cities.

The government of China is focusing more on urbanization and the development of smart cities in its five-year plan. The development of a smart city includes identifying an urban area and facilitating economic growth and improved quality of life with technologies such as Wi-Fi connectivity. The databases and network systems here are connected to cameras, sensors, and control systems, where technology would be used for allocating services, managing traffic, and inventory, and managing and transferring information. Hence, with the development of smart cities, the market is expected to witness growth during the forecast period

The increase in 5G investments is the primary trend in the global wireless access point market growth. 5G is the next generation of communication technology, following 4G, and on commercialization, 5G will support data download speeds of 10,000 Mbps. There have been numerous investments in 5G across the world. The increasing investments in 5G are creating demand for 5G network infrastructure.

This is expected to accelerate the growth of the market during the forecast period. Such product launches enable telecom service providers and network equipment providers to offer routers, enabling carriers to provide 5G services. Thus, an increase in investments in 5G will propel the adoption of devices, including wireless routers, which will result in the growth of the market during the forecast period.

Major challenges hindering market growth:

- Latency issues are challenging the growth of the global wireless access point market.

- In remote areas, the quality of networks is low. Hence, mobile network operators need to build solutions to offer connectivity to IoT devices.

- This can impact the consumer segment, as individual consumers do not have access to high-speed Internet everywhere.

- Moreover, in countries with low internet speeds, such as Yemen, Cuba, and Sudan, the adoption of wireless APs is slow.

- Hence, low internet speeds and latency issues are negatively impacting the adoption of routers and APs.

- These factors will impede the market growth during the forecast period.

The latency issues are a major challenge for the growth of the global wireless access point market. The Internet is the backbone of the IoT devices market. IoT devices require reliable, high-speed internet connectivity to function effectively. Although many countries have advanced internet infrastructure, but in suburban areas and highways, where the quality of the network is usually poor, mobile network operators need to build solutions to offer connectivity to IoT devices in these areas. This challenge has the highest impact on the consumer segment, as individual consumers cannot have access to high-speed Internet everywhere.

Low internet speeds and latency (time taken by the data packet to travel between devices in a network) are affecting the adoption of routers and APs among consumers. Singapore has the fastest average download rate at 256 Mbps, followed by Hong Kong at 254 Mbps and Romania at 232 Mbps. Hence, the adoption of wireless APs is expected to be high in these countries. However, in countries with lower internet speeds, such as Yemen, Cuba, and Sudan, the adoption of wireless APs is slow, which creates latency issues and is expected to hinder the growth of the market during the forecast period.

Key Wireless Access Point Market Customer Landscape:

The report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

………………………………………………………………………………………………………………………………………

Methodology:

Technavio categorizes the global wireless access point market as a part of the global communications equipment market within the overall global information technology sector. The parent global communications equipment market covers manufacturers of enterprise networking products, including LANs, WANs, routers, telephones, switchboards, and exchanges. Technavio also includes communications infrastructure or telecom equipment market within the scope of the communications equipment market. Our research report has extensively covered external factors influencing the parent market growth during the forecast period.

……………………………………………………………………………………………………………………………………….

References:

Dell’Oro Worldwide Wireless LAN market at new high in 2Q-2022; IDC reports 20.4% annual growth for enterprise segment

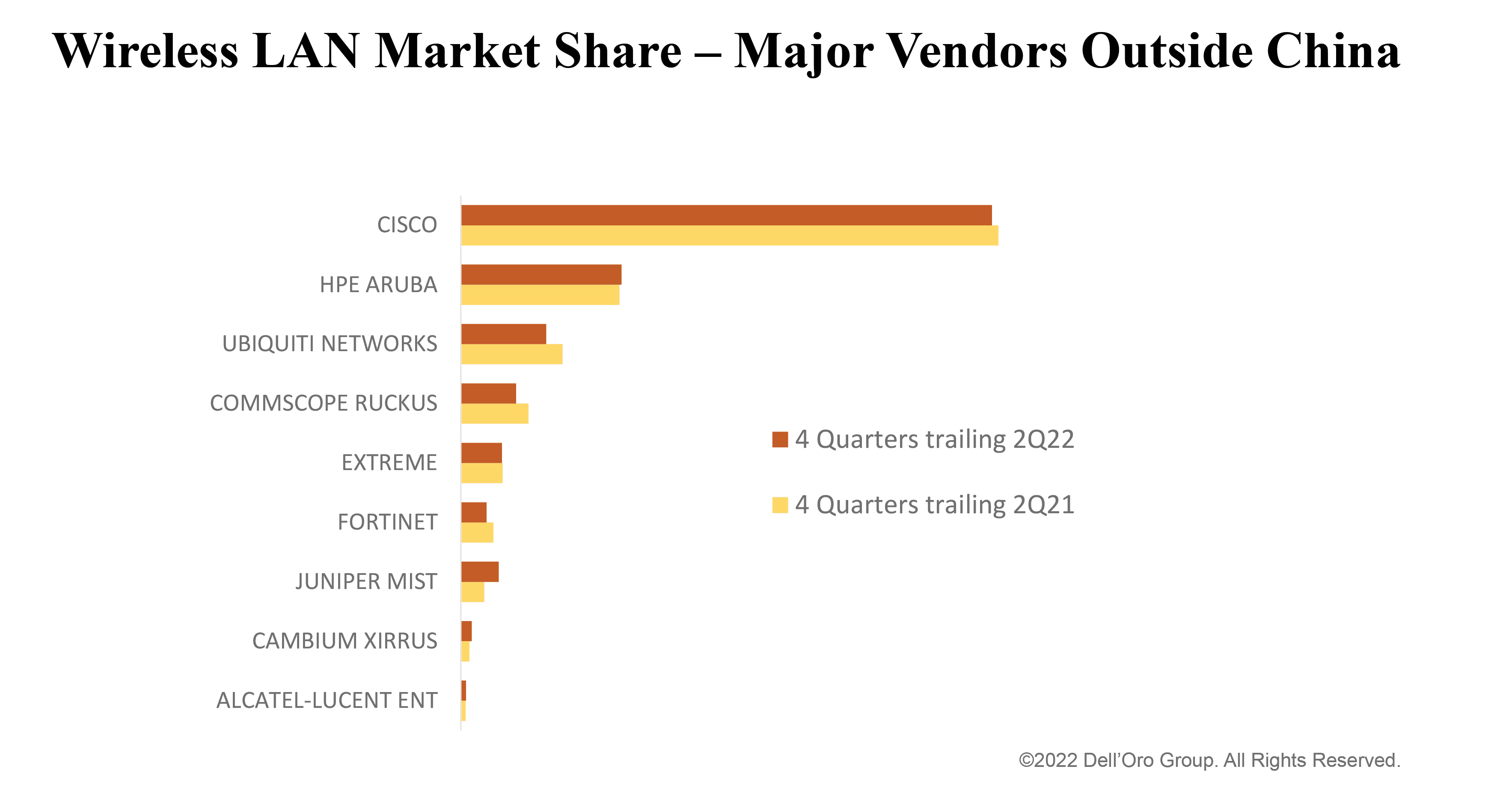

1. According to Dell’Oro Group’s Wireless LAN Quarterly Report, the Wireless LAN market reached a new high in the second quarter, eclipsing $2 Billion, with HPE Aruba and Juniper Mist overcoming supply constraints to contribute over two thirds of the shipment growth outside China. Enterprises saw a 10 percent increase in average prices compared to last year, boosting manufacturers’ revenues and helping to defray additional costs.

“HPE and Juniper really pulled rabbits out of their hats this quarter ̶ Aruba and Mist represent the majority of the growth in units shipped outside China,” says Siân Morgan, Wireless LAN Research Director at Dell’Oro Group. “It’s like a game of whack-a-mole for the manufacturers. They’ll get their hands on one particular access point component and then another shortage will pop up. We’re expecting shipments to be lumpy through the next few quarters.”

Cisco has promised shipments ‘en masse’ for enterprises, and all of the manufacturers are busy finding creative solutions: redesigning products, using brokerage firms, or bypassing component distributors.

“Wireless LAN solutions have also become more expensive for enterprises. It’s very rare to see such a long stretch of quarters with year-over-year price increases. It’s a combination of higher-end products being available, including the new Wi-Fi 6E technology, as well as a general move by the manufacturers to cover their escalating costs. Looking ahead we have to ask ourselves how long the market will bear these higher prices,” added Morgan.

Additional highlights from the 2Q 2022 Wireless LAN Quarterly Report:

- The Wireless LAN market saw two distinct phenomena driving the growth: one in China, and another one in the markets outside China.

- In light of the China lockdowns, the Wireless LAN market in China showed surprising strength with both Huawei and H3C pulling in strong quarters.

- Wi-Fi 6E shipments accelerated this quarter, as another half dozen vendors started shipping products supporting the new 6 GHz band. However, now in its fourth quarter of product availability, Wi-Fi 6E is lagging the adoption rate of the prior two generations of Wi-Fi.

- Revenue from public cloud-managed APs has outpaced the market. The cloud-managed AP business is still dominated by Cisco – although this quarter, Juniper grabbed an outsized market share in cloud-managed Wireless LAN.

Sian wrote in an email to this author, “It is difficult to judge changes in market share based on one or two quarters, given that supply constraints are making shipment volumes choppy. To understand how the market is unfolding it is useful to look at market share based on trailing four-quarter averages, which are shown in the chart below.

Dell’Oro note earlier this year that supply chain issues increased vendor backlogs by up to 15-times normal levels. “Many enterprises have planned network upgrades and the popular connection is Wi-Fi. The trouble is getting it. Several manufacturers announced that components from second and third-tier suppliers became the bottleneck in 1Q22,” said Tam Dell’Oro, Founder, CEO and Wireless LAN Analyst. “Supply constraints have resulted in highly volatile quarterly performance vendor-to-vendor depending on whether or not they have all the components. For example, sales may be up 20 percent in one quarter and down 20 percent the next. Another item, which could potentially cause delays, that we are keeping our eye on are the contract negotiations between the west coast dockworkers union and the Maritime Association,” added Dell’Oro.

The Dell’Oro Group Wireless LAN Quarterly Report offers complete, in-depth coverage of the Enterprise Outdoor and Indoor markets, Wireless LAN Controllers with tables containing manufacturers’ revenue, average selling prices, and unit shipments by the following wireless standards: 802.11ax (Wi-Fi 6 and 6E [6 GHz]), 802.11ac (Wi-Fi 5) Wave 1 vs. Wave 2, and historic IEEE 802.11 standards. The Enterprise market is portrayed by Public Cloud vs. Premises and Private Cloud deployments, as well as by ten Vertical markets and by Customer Size. To purchase these reports, please contact us by email at [email protected].

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

2. IDC reports that the enterprise segment of the worldwide wireless local area network (WLAN) market continued its strong growth in the second quarter of 2022 (2Q22), increasing 20.4% year over year to $2.1 billion. That’s according to the IDC report: “Worldwide Quarterly Wireless LAN Tracker.”

The 20.4% annualized growth builds on the enterprise WLAN market growing 17.1% year over year in the first quarter of 2022. In the first half of 2022, the enterprise WLAN market has grown 18.4% compared to the first half of 2021. Growth in the enterprise WLAN market continues to be driven by the latest Wi-Fi standard, known as Wi-Fi 6 or 802.11ax. Wi-Fi 6 access points (AP) made up 76.5% of the revenues in the Dependent AP segment and accounted for 62.7% of unit shipments within the segment. Wi-Fi 5 products, also known as 802.11ac, made up the remaining balance of Dependent AP sales.

The consumer segment of the WLAN market declined 3.5% year over year in 2Q22, with the quarter’s unit shipments remaining relatively flat at 0.6% growth compared to the first quarter of 2022. Adoption of Wi-Fi 6 continues in the consumer segment of the WLAN market too: In 2Q22, Wi-Fi 6 made up 33.5% of the market’s revenues.

“The enterprise WLAN market continues to grow at a rapid clip, emphasizing the importance of wireless technology in the network and digital transformation goals of organizations across the globe,” said Brandon Butler, research manager, Enterprise Networks at IDC. “The enterprise WLAN market is not immune to challenges however, with the supply chain disruptions and component shortages being notable examples. But strong demand for wireless refreshes to Wi-Fi 6 – and increasingly to Wi-Fi 6E – is buoying the market and leading to strong growth rates.”

The enterprise WLAN market had mixed results across the globe. In the United States, the market increased 15.7% annually, while in Latin America the market grew 47.7% from a year earlier. In Canada the market declined 1.6%. In Western Europe, the market increased 45.4%, but in Central and Eastern Europe, the market declined 20.6%. Within Central and Eastern Europe, Russia’s market declined 73.2% as the Russia-Ukraine war rages on. In the Middle East & Africa, the market rose 23.2%. In the Asia/Pacific region, excluding Japan and China, the market rose 26.5%, while in the People’s Republic of China the market increased 8.7% year over year. In Japan the market rose 6.2%.

Vendor highlights (note that Juniper Mist is NOT mentioned by IDC as a leading wireless LAN vendor):

- Cisco’s enterprise WLAN revenues increased 19.3% year over year in 2Q22 to $792.0 million, giving the company market share of 37.7%, compared to market share of 41.5% in the previous quarter, 1Q22.

- HPE-Aruba revenues rose 48.6% year over year in 2Q22, giving the company market share of 14.9%, down from 16.5% in the first quarter.

- Ubiquiti enterprise WLAN revenues increased 10.5% year over year in 2Q22, giving the company 7.9% market share in the quarter, up from 7.1% in 1Q22.

- Huawei enterprise WLAN revenues rose 20.0% year over year in 2Q22, giving the company 8.5% market share, up from 4.6% market share in the previous quarter.

- H3C revenues increased 16.4% year over year in 2Q22, giving the company market share of 4.6%, up from 4.3% in 1Q22.

The IDC Worldwide Quarterly Wireless LAN Tracker provides total market size and vendor share data in an easy-to-use Excel Pivot Table format. The geographic coverage includes nine major regions (USA, Canada, Latin America, People’s Republic of China, Asia/Pacific (excluding Japan & China), Japan, Western Europe, Central and Eastern Europe, and Middle East and Africa) and 60 countries. The WLAN market is further segmented by product class, product type, product, standard, and location. Measurement for the WLAN market is provided in vendor revenue, value, and unit shipments.

About IDC Trackers:

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly Excel deliverables and on-line query tools.

References:

HPE Aruba and Juniper Mist Navigate Component Shortages to Gain Share, According to Dell’Oro Group

https://www.idc.com/getdoc.jsp?containerId=prUS49663322

https://www.idc.com/getdoc.jsp?containerId=IDC_P23464