ZTE completes 3rd phase of CMIIT IMT-2020 5G core network tests

ZTE has announced it has completed the third phase of China’s Ministry of Industry and Information Technology’s (CMIIT) “IMT-2020 core network tests.” Those tests include: evaluating the performance of the network function virtualization infrastructure (NFVI) platform, the service performance of the 5G core network element, as well as system capacity and stability. The security function test focuses on the device identity management and registration, as well as the security service procedure in mobility.

ZTE said it has passed all test cases and met the requirements for service model and specification indicators with its test results, verifying the maturity of its 5G core network solution.

ZTE general manager for telecom cloud and core network products Liu Jianhua said the completion of the testing represents another significant milestone following the vendor’s completion of 5G standalone architecture functionality testing in September last year.

“ZTE will actively support and cooperate with (China) Ministry of Industry and Information Technology to help the 5G industry grow mature and embrace the arrival of the 5G era,” he said.

In addition to the completion of IMT-2020 third phase 5G core network test, ZTE also completed the world’s first end-to-end connection between 5G device and system, based on 3.5 GHz NSA networking, by virtue of ZTE’s 5G prototype smartphones. In collaboration with China Telecom, ZTE recently completed the first 4G and 5G network interoperability test using standalone (non LTE) architecture. In collaboration with Tianjin Unicom and Port of Tianjin, ZTE released 5G&MEC smart port industry applications.

…………………………………………………………………………………………………………………………………………………………………..

China’s IMT-2020 (5G) promotion group was jointly established in 2013 by the Chinese Ministry of Industry and Information Technology, the National Development and Reform Commission, and the Ministry of Science and Technology, based on the original IMT-Advanced Promotion Group. In China, it is the primary platform through which 5G research and international exchange and cooperation is conducted. Operators participating in the IMT-2020 Promotion Group include China Mobile, China Telecom, China Unicom and Japanese telecoms operator NTT DoCoMo. Vendors which are part of the initiative are Huawei, ZTE, Ericsson, Nokia, Datang and Samsung. A number of chipset and test measurement vendors, including Qualcomm, Intel, Mediatek, Ctec, Keysight Technologies and Rohde & Schwartz are also part of the initiative.

Under the guidance of China’s Ministry of Industry and Information Technology, IMT-2020 (5G) Promotion Group initiated the third phase of 5G R&D tests in November 2017, aiming at continuously improving the 5G technological R&D capability and promoting the maturity of the 5G industry. Under this initiative, China state-run telcos are in the process of deploying 5G networks in 16 cities to trial the pre-IMT 2020 standard wireless technology.

China has previously announced plans to commercialize 5G mobile networks as early as 2020. China Mobile, the world’s largest mobile operator, previously said it aims to deploy 10,000 5G base stations across China in 2020.

https://www.telecomasia.net/content/zte-completes-third-phase-imt-2020-core-network-tests

AT&T Communications CEO John Donovan on 4GE, 5G enterprise use cases, and partners

AT&T Communications CEO John Donovan and MediaLink Chairman and CEO Michael Kassan explored 5G and its potential opportunity for robotic manufacturing, AR/VR and mixed reality, sporting experiences, public safety and beyond.

Evidently, John Donovan isn’t concerned about the criticism that his company has faced for updating some 4G-LTE phones to display the 5G E label, a move that competitors are calling misleading for customers. Nor is he concerned that AT&T’s description of their so called mobile 5G deployed in 12 U.S. cities last month is: “standards based,” when it really is not. A video stated:”AT&T is the first to deliver standards based mobile 5G.” In fact, it is neither standards based or 5G as per ITU-R WP5D or 3GPP (which is NOT a standards organization).

“If I occupy beachfront real estate in my competitors’ heads, that makes me smile,” Donovan on Wednesday told CES attendees during a keynote in Las Vegas. HIs comments came one day after some customers discovered that their phones had changed from reading LTE to 5G E, which stands for 5G Evolution. The move, which caused some confusion, was meant to indicate that the phones were now accessing a network twice as fast as 4G LTE, Donovan said, and one that would pave the way for 5G.

Competitors slammed AT&T over the move. T-Mobile poked fun at the marketing ploy on Twitter. Verizon took out a full-ad in The New York Times, The Washington Post, The Wall Street Journal and USA Today to tell customers that it wouldn’t make the same move. And Sprint’s CTO told Engadget that “AT&T is blatantly misleading consumers.”

The 5G Evolution network is currently available in hundreds of markets for certain phones. Donovan said it is a stepping stone to the fifth generation of wireless technology and is twice as fast as the 4G LTE network that most mobile phones connect to, though still not as fast as 5G will be.

Donovan wrote off the criticism as frustration from competitors over AT&T’s “5G” advancements. In the fall, the company announced that it would make a mobile 5G network and mobile 5G devices available to consumers by the end of the year. In December, its pre standard mobile 5G network went live in 12 cities. Even with AT&T’s 5G work, it could be years before most Americans connect to 5G on their mobile phones. Donovan said, “the (5G) network wont be as broad geographically as to be a consumer benefit.” Therefore AT&T will concentrate on industrial users such as enterprise campus and in building wireless networks.

While Donovan did note that “media will be most transformed” by 5G technology, he shared a number of different industrial use cases. The AT&T executive said that 5G could be used to update billboards in real time and make them personalized based on the interests of drivers. 5G will also be instrumental in making mixed-VR headsets like Magic Leap, which AT&T has invested in, usable in mobile environments. He also referred to a new partnership with the Dallas Cowboys, but did not elaborate. Rush Hospital in Chicago was another 5G partner Donovan noted. “Those are front burners, rather than downloading a movie faster,” he said.

As AT&T prepares for 5G, Donovan said he is rethinking the retail experience. “What’s the WOW experience in our store? The WOW stands for ‘walk out and watch,'” he said, explaining that he wants customers to know about the content coming from Warner Media, which AT&T recently acquired. “It’s providing a whole new set of opportunities for the media business.”

Verizon CEO Hans Vestberg CES Keynote: a Magic Show of 5G Hype

At yesterday’s long winded CES keynote, Verizon CEO Hans Vestberg promised that 5G technology will dramatically impact all aspects of the economy. As others before him have said, “5G will usher in a 4th industrial revolution.” It will also be “a quantum leap compared to 4G” and “5G changes everything,” he said.

Yet none of those claims can be proven, because standardized 5G (based on IMT 2020) won’t be deployed till late 2020 or early 2021. Verizon’s version of 5G is based on the carrier’s proprietary V5GTF spec. Moreover, residential fixed wireless broadband (which Verizon has deployed in several U.S. cities with many more coming in 2019) isn’t even a use case for IMT 2020!

During the keynote, Vestberg introduced the eight “currencies” of 5G that will unleash highly connective technologies and blend physical and digital realms like never before – from AR and VR to IoT, AI, autonomous vehicles, advanced robotics, 3D printing, wearable tech and more.

The eight currencies are:

- Speed and Throughput: Peak data rates of 10 gigabits per second and mobile data volumes of 10 terabits per second per square kilometer

- Mobility, Connected Devices and Internet of Things: Mobile devices traveling at up to 500 kilometers per hour can potentially stay connected on a 5G network, and up to one million devices can be supported by 5G in a square kilometer

- Energy Efficiency and Service Deployment: 5G network equipment and devices will consume only 10% of the energy consumed by 4G network equipment and devices, and specialized services that will operate on the 5G network will take much less time to implement

- Latency and Reliability: Five millisecond end-to-end travel time of data from the mobile device to the edge of the 5G network – faster than the blink of an eye, and 5G will be more than 99.999% reliable

Vestberg added that Verizon’s ability to deliver all eight currencies of 5G is dependent on its fiber, spectrum, network density, and real estate – and that companies lacking these assets are underestimating what it will take to provide true 5G service. “Anyone who thinks 5G is just for the mobile handset is thinking too small.”

Verizon CEO Hans Vestberg discusses 5G at the 2019 CES. Image Credit: Jeremy Horwitz/VentureBeat

…………………………………………………………………………………………………………………………………………………………………………………………………….

To add credibility to his claims, Vestberg shared the CES stage with a diverse set of industry partners, including the New York Times, Walt Disney Studios, a doctor from the medical technology company Medivis and Verizon-owned drone operation company Skyward. There was also a carnival style basket shoot by a member of the L.A. Lakers using Virtual Reality goggles with the image provided by Verizon’s version of 5G.

Each partner spoke of how 5G will transform their business. For instance, the New York Times is opening a “5G journalism lab” with Verizon. NY Times CEO Mark Thompson (a Brit) expects that it will transform the way the publication’s journalists gather news, as well as how it distributes the news — notably including more VR and AR content.

Verizon is separately partnering with Walt Disney’s StudioLab to explore how next-generation connectivity can improve Disney’s content production and transmission. Walt Disney Studios CTO Jamie Voris took the stage to say that his company will be working with Verizon to give Marvel, Pixar, Disney, and LucasArts filmmakers early access to 5G innovations. Six months ago, Disney’s StudioLab was created in Burbank to figure out how to do things like improve rendering speeds for digital effects and use drones to advance cinematography. Now Verizon has joined StudioLab as a core innovation partner and will help Disney work on 5G cloud-based production workflows, 5G-connected movie standees and posters, and volumetric performance capture.

Skyward President Mariah Scott said that Verizon is committed to being the first to connect 1 million drone flights on its 5G network. Vestberg used a tablet in the keynote venue at the Venetian to pilot a drone in Los Angeles through a 5G connection. Ms. Scott mentioned the promise of using 5G-powered drones for industrial uses. “The ability to gather data and analyze it in real time is what will change things,” Scott said.

Dr. Christopher Morley (MD) of Medivis spoke about the impact of 5G on medical science, including how 5G could help the medical community rethink the connections between patients and caregivers — bringing people together and changing the way doctors provide care. He also offered a powerful tangible example of how 5G and AR will work together in medical procedures. However, there was no mention of 5G being able to deliver the low latency and high quality imaging that AR requires.

……………………………………………………………………………………………………………………………………………………………………………………………….

To expand its network of partners, Vestberg announced Verizon is launching a 5G innovation challenge, offering up to $1 million in seed money for the best applications of the technology. It’s called the Verizon “5G Challenge.”

Verizon last October said it launched “the world’s first commercial 5G service” with 5G Home, a fixed wireless service for residential customers. It offers theoretical peak throughput speeds of 1Gbps. During the keynote, Vestberg made a video call to Clayton Harris of Houston, Texas, the first 5G Home customer. Harris ran a speed test from his home, reaching 690 Mbps. He said he normally sees between 600 Mbps and 1 Gbps, with speeds at times reaching as high as 1.3 Gbps.

Vestberg said he ultimately wants to see an easier installation process for its 5G Home service– one that you can install yourself. That will be a very difficult endeavor indeed. For example, there is an outdoor antenna (RF transmitter/receiver) that has to be mounted outside, possibly run wires through walls, floors or ceilings, configure 5G router settings, and (if needed) Wi-Fi extenders will be installed in the home, at no charge, to ensure adequate Wi-Fi coverage for the entire house. Here’s the complete 5G Home installation procedure:

The Asurion technician will complete the following installation process for your 5G Home service and connect your devices:

-

- Verify and explain the areas in your home where the 5G signal is received.

-

- Conduct a test to determine whether the 5G receiver can be installed inside or outside your home. The strength of the 5G signal can vary inside and outside your home.

-

- Conduct a test of the Wi-Fi signal strength of each device throughout the house that is connected to the 5G Home Router. A Wi-Fi extender may also be installed at no charge to strengthen the Wi-Fi signal throughout your house or for devices that have a weak Wi-Fi signal.

-

- Install the receiver, with your approval, either inside or outside on the side of your house.

-

- Depending on the locations of the receiver and the router, the technician may need to run wires through walls, floors or ceilings.

-

- Ensure that all your previously Wi-Fi connected devices are now connected to your Verizon 5G Home Router.

-

- Demonstrate how you can use the My Verizon app to manage your router, such as how to restart it when you are away from home, and check the signal strength of the devices connected to the router.

–>Do you really think a non technical person can do such a self install?

Cignal AI: 2018 Cloud and Colo Spending Will Exceed $1.4 Billion

|

|

|

NTT Com expands North American operations with PoP in Toronto, Canada

Japan’s NTT Communications has expanded its North American footprint with the establishment of a new point of presence (P0P) in Toronto, Canada.

NTT Com Group has more than 30 companies in the Asia-Pacific region, Europe and the Americas.

………………………………………………………………………………………………….

NTT Com will use the new PoP to scale its offerings to ISPs, content providers and cloud, hosting and CDN providers in the Canadian market.

The expansion of its global IP network footprint will also help the operator meet growing demand for IP services from global companies and organizations with a Canadian presence.

Michael Wheeler, executive vice president of the NTT Communications Global IP Network at NTT America, said the company plans to particularly target the nation’s financial services, commercial, distribution, media and industrial sectors.

“We are thrilled to extend our footprint into one of North America’s fastest growing technology hubs,” he said.

“Internet-centric businesses and organizations operating in the area will have direct access to our tier-1 global backbone and the high-performance IP solutions they need for their content, online video, hosting, gaming and other bandwidth-intensive applications,” he added.

About NTT Communications

NTT Communications solves the world’s technology challenges by helping enterprises overcome complexity and risk in their ICT environments with managed IT infrastructure solutions. These solutions are backed by our worldwide infrastructure, including industry leading, global tier-1 public and private networks reaching over 190 countries/regions, and more than 400,000m2 of the world’s most advanced data center facilities. Our global professional services teams provide consultation and architecture for the resiliency and security required for your business success, and our scale and global capabilities are unsurpassed. Combined with NTT Data, NTT Security, NTT DOCOMO and Dimension Data, we are NTT Group.

www.ntt.com | Twitter@NTT Com | Facebook@NTT Com | LinkedIn@NTT Com

About NTT Communications Global IP Network

Consistently ranked among the top networks worldwide, NTT Com’s Tier-1 Global IP Network covers North and South America, Asia, Europe and Oceania, and provides the best possible environment for content, data and video transport through a single autonomous system number (AS 2914).

NTT Com was recently named Best North American Wholesale Carrier at the Global Carrier Awards 2018 for the fifth consecutive year. The company has also won the Best Global Wholesale Carrier (Data) award twice in the last five years.

Sprint to offer 5G Samsung Smartphone in Summer 2019

Sprint today confirmed plans for an innovative, pre-standard 5G smartphone expected to launch in summer 2019 from Samsung. The company says that Sprint customers will be among the first in the world to experience the incredible speed, reliability and mobility of 5G on this feature-rich handset. Note that AT&T and Verizon have also announced smartphone from Samsung for the 2nd half of 2019.

“We are proud that our longstanding relationship with Samsung has delivered some of the most innovative mobile technologies to our customers over the years – and this tradition continues with 5G,” said Dr. John Saw, Sprint chief technology officer. “Samsung is one of our key 5G network infrastructure Massive MIMO providers, so we are delighted that they will also deliver one of our first 5G smartphones, putting blazing fast connectivity right into our customers’ hands.”

This Samsung device will offer dual-mode connectivity to Sprint’s LTE and 5G network. For 5G and LTE, it will support Sprint’s 2.5 GHz spectrum. In addition, it will support Sprint’s 1.9 GHz spectrum (band 25), 800 MHz spectrum (band 26) and other LTE spectrum bands for roaming. Additional device specifications and exact timing will be announced later.

That’s in contrast to the mmWave frequency technology that’s favored by AT&T and Verizon (defined as being between 30GHz and 300GHz). In December, both AT&T and Verizon announced that they would be carrying upcoming 5G smartphones. Verizon was first, and it announced that it would be selling one of the phones in the first half of 2019. AT&T responded by saying that not only would it have that same phone early in the year, but it would also offer a second 5G phone from Samsung in the second half of the year.

5G promises new levels of innovation and progress to connect people, places and the billions of things Sprint customers do with super-fast speed and ultra-reliable wireless connectivity. Customers should experience a shift from 4G to 5G with full-length HD movie downloads in seconds instead of minutes. Graphic-heavy videos and high speed games should play without delays, hiccups or lag-time.

Sprint is building its 5G product ecosystem to give customers choice in how they connect to Sprint’s 5G network. This is the third device announced for Sprint’s 5G network to date. In August, Sprint was the first U.S. carrier to announce timing for a network-integrated 5G smartphone, and it followed in November with news of a 5G mobile smart hub.

In the first half of 2019 Sprint plans to launch its mobile 5G network in nine of some of the largest cities in the U.S.–Atlanta, Chicago, Dallas, Houston, Kansas City, Los Angeles, New York City, Phoenix and Washington, D.C., with additional markets to be announced. Massive MIMO technology is a key part of Sprint’s 5G strategy and network build. This breakthrough technology dramatically increases the capacity of Sprint’s LTE Advanced network today and is software upgradable to 5G. With Massive MIMO at the foundation of its mobile 5G service, Sprint can meet its customers’ demand for unlimited data and high-bandwidth applications, such as television in high definition and virtual reality.

To follow Sprint’s Next-Gen Network build out and its road to 5G, visit http://newsroom.sprint.com/network/.

…………………………………………………………………………………………………………………………………………………………………………..

Samsung is reportedly working on at least two variants of its upcoming Galaxy S10 smartphone: one with a Qualcomm modem and the other with a Samsung-made equivalent. One of these is also rumored to be a “Beyond X” version of the phone with a 6.7-inch screen. None of the three carriers have confirmed exactly which model of Samsung phone they’ll be carrying. Sprint stopped short of confirming that Samsung’s device would be the first 5G phone on its network, saying only that it would be “one of” the first after. The US carrier previously announced that it would carry a 5G phone from LG earlier in the year, and it also said it was working with HTC to develop a 5G “smart hub.”

D-Link announces 5G NR Gateway, but not which “5G” networks it’s compatible with

D-Link’s DWR-2010 “5G NR” Enhanced Gateway is one of the first gateway available for pre standard 5G broadband networks. D-Link claims it delivers speeds up to 40x faster than typical fixed broadband speed in the U.S. The average U.S. fixed-line broadband speed is around 70Mbps, the company claimed, citing a Forbes report.

Editor’s Note:

D-Link has not revealed which pre-standard 5G network this device will be compatible with. One would assume it would be for fixed broadband wireless access, which Verizon already offers but that service is based on their V5GTF proprietary spec. Verizon has said it would transition its (fake) 5G fixed service to 5G NR (3GPP Release 15)in the near future but has not said when that might be. C-Spire also offers a proprieatary fixed 5G service, but again it’s not compatible with 5G NR. Hence, we wonder where this D-Link device could actually be used.

……………………………………………………………………………………………………………………………………………………………………………..

“With expanded spectrum and new applications, 5G is going to bring more competition to the broadband market within the coming years,” said Raman Bridwell, vice president of product and services, D-Link Systems, Inc. “This gateway will help more people access that network in more places with the same wireline experience we have today.”

As “fake 5G” adoption accelerates within the coming year, more people may be turning to wireless carriers as their home internet provider. D-Link’s 5G gateway will help them take full advantage of the new wireless capability.

The DWR-2010 also offers customization options for service providers, making it suitable for deployment on a range of network configurations. The gateway features an embedded 5G NR (New Radio) NSA module and can operate on the sub-6 GHz or mmWave frequencies in 200 MHz (2 x 100 MHz) or 800 MHz (8 x 100 MHz) configurations. Complete with remote management (TR-069) and FOTA, the DWR-2010 provides hassle-free operation and a better customer experience.

Device Overview:

Embedded 5GNR NSA module (3GPP Rel.15)

◼ Qualcomm SDX55 Chipset

◼ Sub-6 GHz or mmWave frequency compatible

◼ 5 Ethernet Ports

• 1x 2.5Gbps LAN

• 1Gbps LAN

• 1x 1Gbps WAN/LAN

◼ AC2600 Dual Band Wi-Fi (800 + 1732 Mbps) with MU-MIMO

◼ 4 external antennas for LTE/5G NR

◼ Whole home coverage with D-Link Wi-Fi Mesh

◼ Auto Firmware Upgrade

◼ Supports VoLTE

◼ Supports Remote Management (TR-069)

Availability and Pricing

The 5G NR Enhanced Gateway will be available in the second half of 2019. Pricing will vary depending on preferred service providers (?).

About D-Link

D-Link designs, develops, and manufactures award-winning solutions for homes, businesses, and service providers. The global leader in connectivity implements and supports unified network solutions that integrate switching, wireless, broadband, IP Surveillance, and cloud-based network management. For more, visit us.dlink.com, or connect with D-Link on Facebook, Twitter, and D-Link’s Blog.

Sri Lanka’s Dialog Axiata completes South Asia’s first 5G pilot transmission

Sri Lanka network operator Dialog Axiata announced the successful completion of what it calls South Asia’s first fully functional 5G pilot transmission over commercial grade base stations and end-user devices. The pre-commercial 5G trial was conducted in collaboration with the Telecommunications Regulatory Commission of Sri Lanka (TRCSL), using spectrum in the 3.5-GHz band that has been assigned by the regulator for 5G trials.

During the trial, Dialog achieved pilot speeds of over 2 Gbps in a real-world setting using commercial-grade 5G home gateway routers.

Dialog Axiata enables South Asia’s First Fully functional 5G Pilot transmission.

………………………………………………………………………………………………………………………………………………………….

The Director General, TRCSL, Mr. P.R.S.P. Jayatilake in congratulating Dialog on embarking on the bold initiative of setting up a pre-commercial 5G transmission said, “Sri Lanka has consistently led the South Asia region in technology introduction. The TRCSL is very proud to note the achievements of the mobile sector in delivering broadband services to Sri Lankan consumers on a very affordable basis – this along with wider availability has driven broadband penetration in Sri Lanka”.

Supun Weerasinghe, Group Chief Executive, Dialog Axiata PLC said, “Reaching the milestone of enabling a fully functional pre-commercial 5G transmission as well as our investments in making a major part of our expansive island-wide 4G network fully 5G compliant, demonstrate our commitment to deliver to our customers, network capability and digital enablement on par with the most developed markets in the world. The progressive policies of the TRCSL have enabled Sri Lanka to lead the region in this respect and we greatly appreciate the foresight of the TRCSL to allocate spectrum for pre-commercial transmission of 5G services. Dialog will build on the learning from the pilot transmission and will work in partnership with the Telecommunications Regulatory Commission of Sri Lanka and the Ministry of Digital Infrastructure in leveraging the unique capabilities of 5G technology towards empowering Sri Lanka’s socio-economic transformation, enhancing productivity, efficiency and advancement of the country as a regional technology hub.”

………………………………………………………………………………………………………………………………………………………………………………………………

In August 2017, Dialog Axiata conducted South Asia’s first 5G demonstration in a laboratory environment, in conjunction with Huawei and Ericsson. The company said 20% of its base stations are now 5G ready due to the deployment of Massive MIMO technology. Since then Dialog has upgraded over 20% of its expansive base station network to ‘5G Ready Status’ by deploying Massive MIMO (Multiple Input Multiple Output) technology. Dialog’s Massive MIMO network today transmits speeds in excess of 720 MBps enabling superlative upload and download speeds on the company’s widely available 4G services. The same infrastructure will transmit 5G speeds upon the licensing of commercial 5G services in Sri Lanka.

References:

https://www.dialog.lk/south-asia-first-5g-pilot-transmission-goes-live/

https://www.facebook.com/dialog.lk/videos/10153877048811203/?permPage=1

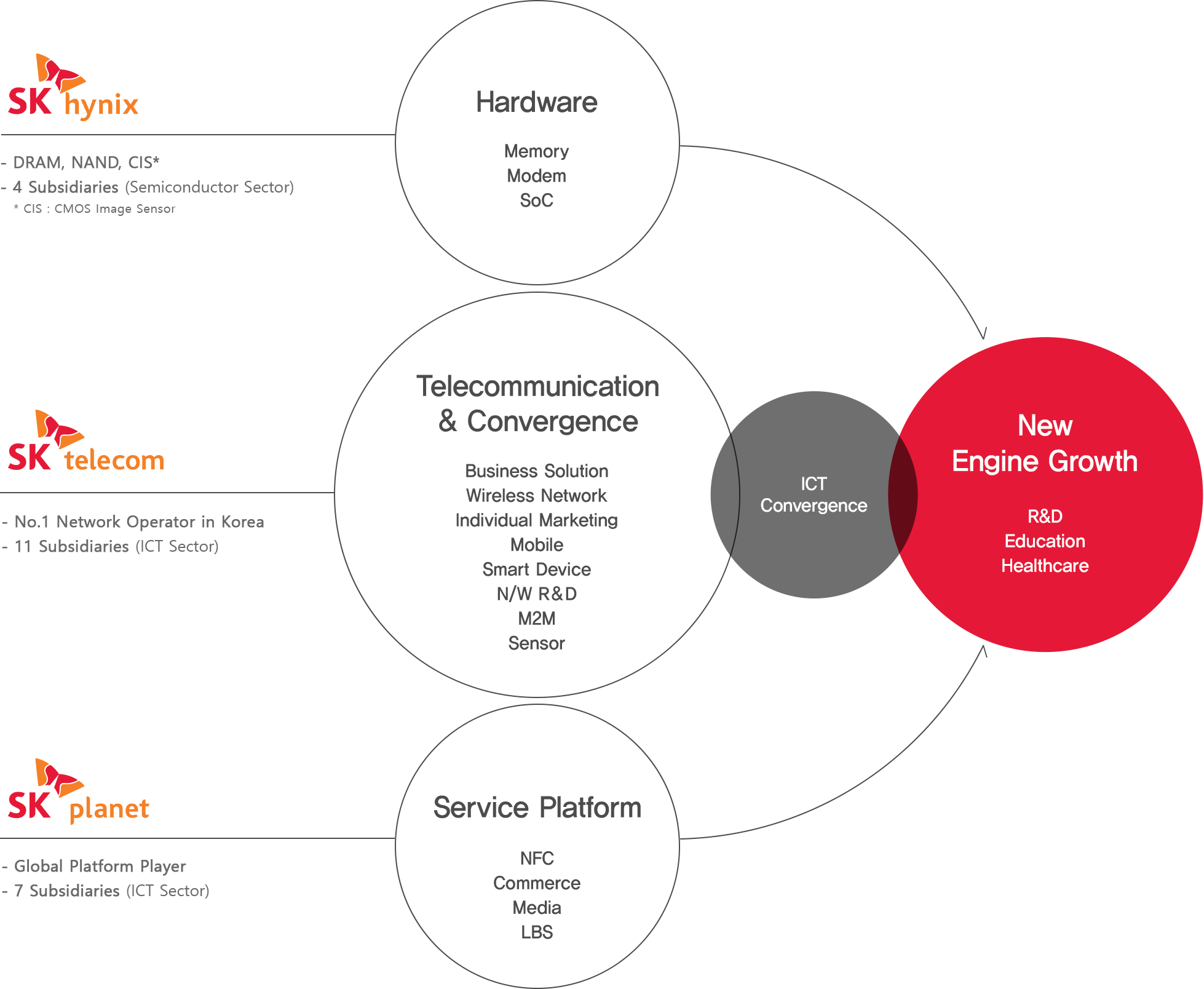

SK Telecom completes live TV broadcast over its 5G network

As a follow on to yesterday’s IEEE techblog on Korea 5G and ideal content, SK Telecom has completed the first live TV broadcast over its commercial 5G network and live broadcasting solution.

The operator ushered in 2019 with a live broadcast of Korea’s largest New Year’s event at the Bosingak pavilion in Seoul from around 11 minutes starting at midnight Korea Standard Time.

The live broadcast used SK Telecom’s T Live Caster live broadcasting solution, which the network operator has developed over a four year period. T Live Caster is designed to enable live broadcasting of video taken by smartphones over channels including TV and personal broadcasting over 5G anThe video taken by smartphone cameras installed with the T Live Caster app and connected to connected to a 5G mobile router was transmitted through 5G stations and entertainment channel XtvN’s transmission system for cable and IPTV viewers of the channel.

The video was taken by smartphone cameras installed with the T Live Caster app and connected to 5G mobile routers and transmitted through 5G base stations and XtvN’s transmission system to cable and IPTV viewers of XtvN.

Despite the highly congested data environment, the video was transmitted at a latency of less than one second, comparable to that of existing wired broadcasting systems.

“With today’s successful live TV broadcasting over commercial 5G network, SK Telecom ushers in a new era of 5G-based media services,” SK Telecom SVP and head of 5GX IoT/Data Group Choi Nak-hoon said.

“In this new era, individual creators will be able to provide high-quality live broadcast anytime, anywhere, via 5G smartphones.”

South Korea has successfully switched on commercial 5G network on the first day of December, officially marking the era of high-speed network. The country’s No.1 mobile carrier has become the first to make a commercial 5G video call, using a prototype Samsung smartphone.

SK Telecom’s 5G network currently covers main areas of 13 cities and counties nationwide, including Seoul, four cities in Gyeonggi-do (Seongnam, An-san, Hwaseong, Siheung), six metropolitan cities, Seogwipo in Jeju Island, and Ullengdo and Dokdo Islands in Ulleng county.

………………………………………………………………………………………..

SK said it plans to continue to enhance the quality of T Live Caster to UHD and interconnect the solution to personal broadcasting platforms within the year.

Plans also call for tapping into the drone broadcasting market. Last June, SK Telecom struck a partnership with drone manufacturer DJI to jointly develop a drone video surveillance solution.

SK’s blog about the event didn’t identify the suppliers of the 5G network infrastructure.

………………………………………………………………………..

References:

https://www.globalskt.com/home/info/2482

Korea’s telecom/media partnerships forming in 2019 for 5G & ideal content

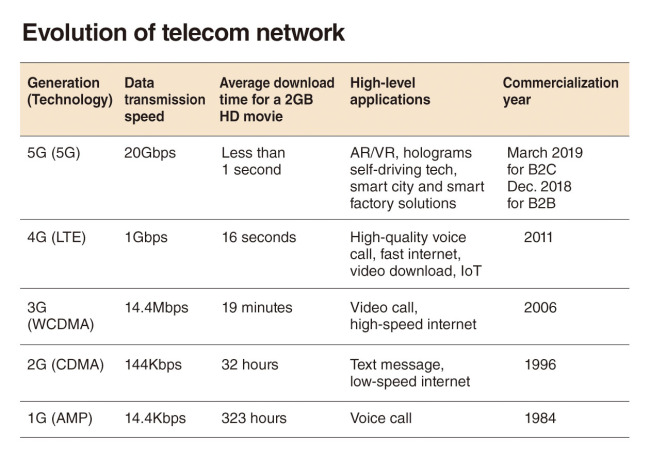

The Korea Herald reports that 2019 will be a cutthroat yet exciting year for South Korea’s telecommunications industry as the introduction of faster fifth-generation telecom networks in March will bring on upheavals in their own and other industries.

The Korean mobile operators at the forefront of the 5G commercialization are widely expected to escape their traditional areas of business, mainly centering on providing high-speed internet and high-quality calls, stretching out to the media industry by providing new services enabled by the 5G network.

Compared to the current 4G Long Term Evolution (LTE) mobile network, the 5G network provides 20 times faster speed for data transmission, allowing users to download a 2-gigabyte high-definition movie in less than a second.

Korea’s three mobile carriers — SK Telecom (SKT), KT and LG Uplus –in order of sales — are preparing to acquire or seek partnerships with small and mid-size broadcasters or media content startups to provide content for their respective 5G networks

SKT is forging ties with over-the-top mobile video content provider Pooq, run by the country’s three terrestrial broadcasters, in order to strengthen its own platform Oksusu that aims to rival Netflix.

SKT’s bigger plan is to spin off the Oksusu platform as one of four major subsidiaries along with the mobile network operator, and security and commerce arms.

This is also part of SKT CEO Park Jung-ho’s plan to establish an intermediary financial holding company – dubbed “ICT holding company of SK Group — that take control of the current four business areas of SKT.

KT is closely monitoring archrival SKT’s moves to start the new OTT business in a bid to lose out in the 5G content market.

KT’s New Media Business Group will be led by Kim Hoon-bae, former CEO of Genie Music — the mobile carrier’s music streaming platform — this year, which will focus on developing creative 5G content for its customers.

“KT is making efforts internally to develop content for 5G, for example the GiGA Live VR service on its IPTV platform,” said a KT official.

KT is also expanding Olleh TV subscribers’ access to TV content further to their mobile devices by launching Olleh TV Mobile application.

LG Uplus is gearing up for acquisition of CJ HelloVision, a cable TV channel provider under CJ Group, in order to enhance its cable TV business.

If LG acquires the CJ channel, it would become the second-largest cable TV service provider, beating out SKT’s Broadband with a total of 24.43 percent market share. KT is currently the market leader with a 30.86 percent share.

Taking a larger share of the pay TV market is becoming more important for the mobile carriers, because their internet protocol TV service subscribers are key customers for the home media business that would further develop into the future content business.

“Securing ideal content for the 5G network is the key to success in the new network market,” said an LG Uplus official. “We are seeking to enlarge the size of the home media business by securing more content provided by competitive third-party content providers with an ultimate goal of offering video content for 5G mobile customers, because the home media and mobile users prefer combined service plans.”

In an effort to attract around 300,000 Netflix users in Korea, LG Uplus has partnered with the US OTT business to offer access to Netflix content via its IPTV platform.

According to a report by KT Economics and Management Research Institute, the media industry is predicted to gain 3.6 trillion won in socioeconomic value by 2030 with the commercial use of 5G technology.

The report also mentioned the 5G technology will bring augmented reality and virtual reality content to end users, creating a new category in the media market.

By Song Su-hyun ([email protected]) and edited by Alan J Weissberger

……………………………………………………………………………………………

References:

http://www.koreaherald.com/view.php?ud=20190101000072

South Korean Mobile Operators to Launch 5G Simultaneously on Korea 5G Day