6G Spectrum

GSMA Vision 2040 study identifies spectrum needs during the peak 6G era of 2035–2040

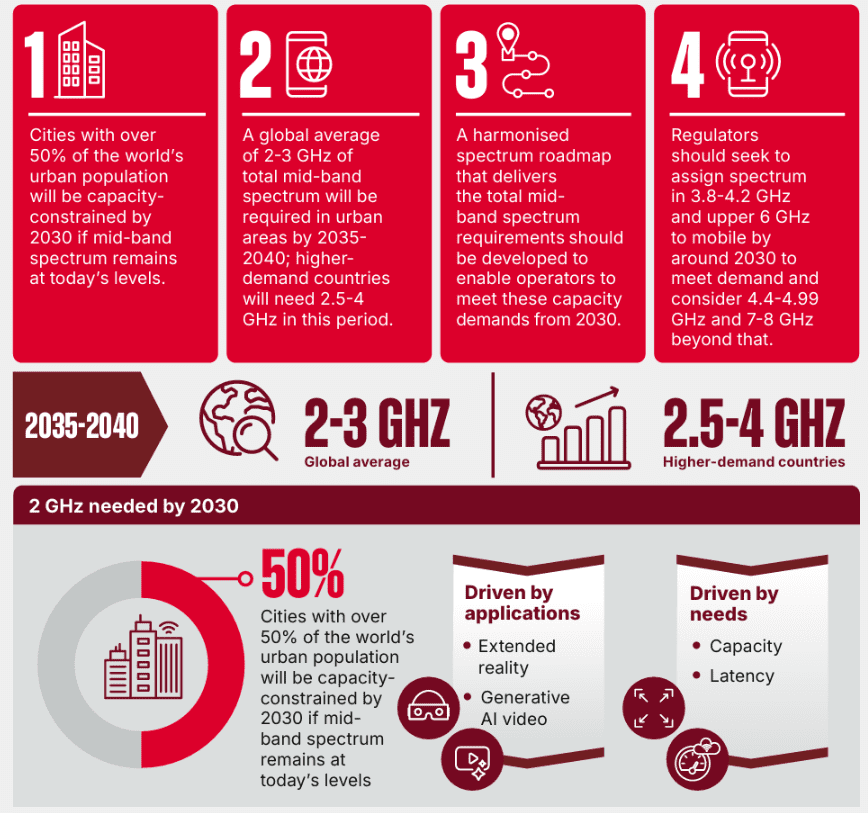

According to a recent GSMA Vision 2040 study, many cities worldwide could face capacity limitations by 2030 if mid-band spectrum availability does not increase, impacting over half of the global urban population. Strategic long-term planning for future wireless generations like 6G is necessary, as device and equipment development can take over a decade, with 6G expected to account for roughly 5 billion connections by 2040 while 4G and 5G remain prevalent. The GSMA’s modeling forecasts a significant rise in traffic, potentially reaching 4,000 EB/month by 2040 in a high-growth scenario driven by AI-enabled applications. The report’s analysis shows that countries must act now to secure enough spectrum for 6G, or risk slower speeds, rising congestion and lost economic opportunity in the 2030s.The GSMA cautions that without early government planning, consumers could face poorer connectivity, businesses may struggle to adopt new technologies, and national digital economies could lose competitiveness in the global transition to 6G.

“Next-generation 6G networks will require up to three times more mid-band spectrum than is typically available today to keep pace with surging demand for data, AI-powered services and advanced digital applications, according to new analysis published today by the GSMA, which represents the mobile ecosystem worldwide.”

John Giusti, Chief Regulatory Officer, GSMA:

“This study shows that the 6G era will require three times more mid-band spectrum than is available today. Satisfying these spectrum requirements will support robust and sustainable connectivity, deliver digital ambitions and help economies grow. I hope this report provides useful insights to governments as they strive to meet the connectivity needs of their citizens in the coming decade.”

Long-Term Spectrum Planning Underpins Enterprise Strategy:

Planning for 6G requires a substantial lead time; the report highlights that device ecosystem readiness and equipment development cycles often span a decade or more. Telecom operators must finalize decisions regarding fiber backhaul, Radio Access Network (RAN) upgrades, and site acquisitions years before new services go live. Enterprises developing AI-driven products or advanced mobility services rely heavily on this network predictability.

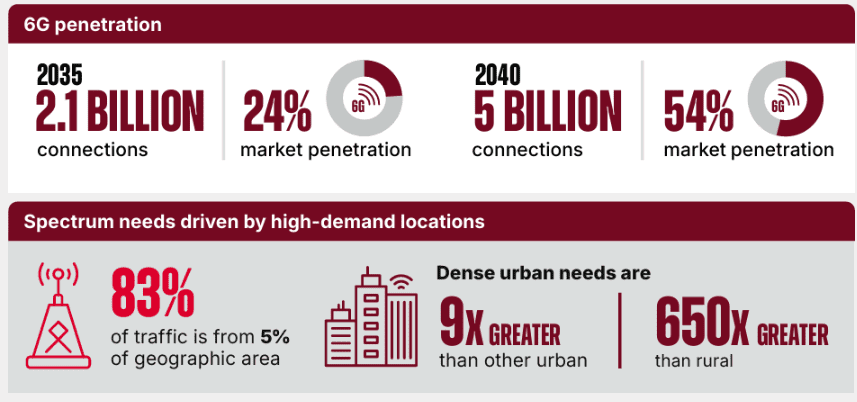

The report’s modeling suggests 6G will account for roughly 5 billion connections by 2040—approximately half of all global mobile connections. However, 4G and 5G will remain heavily utilized, particularly in emerging markets, making immediate spectrum re-farming impractical. Operators will increasingly rely on multi-RAT spectrum sharing (MRSS) to manage parallel generations of mobile technology. While MRSS offers improved efficiency over current dynamic spectrum sharing methods, coexistence introduces inherent operational complexity.

AI, Sensing, and the Power User Dynamic:

Demand is shifting toward intelligence-driven workloads, resulting in projected traffic growth across all GSMA scenarios. Even the most conservative projection forecasts 10% annual growth between 2030 and 2040, reaching 1,700 EB/month. The high-growth scenario predicts 4,000 EB/month, driven largely by AI-enabled applications.

The report identifies four primary channels through which Artificial Intelligence will impact traffic:

- New applications: including multimodal assistants.

- Performance demands: higher requirements for existing experiences like personalized video.

- Increased time online.

- Efficiency gains: some optimization through compression.

Enterprises implementing AI assistants, high-definition video, or hybrid cloud-edge processing will contribute significantly to this shift, requiring a focus on increased uplink demand.

A key behavioral finding is that 10% of users currently generate 60-70% of mobile traffic. As digitally-native generations mature, these usage patterns will become mainstream. Enterprise solutions for mobility, frontline workers, and customer engagement must be architected to handle these higher sustained uplink and downlink loads.

Geospatial analysis shows that 83% of traffic is concentrated in 5% of geographic areas. Dense-urban traffic can be nearly 700x higher per square kilometer than in rural areas. For enterprises operating in high-demand zones (e.g., logistics hubs, retail corridors, public venues), the localized performance of RAN deployments will determine service reliability and efficacy.

Mid-Band Spectrum as 6G’s Anchor Capability:

The GSMA study asserts that dense-urban areas will require 2-3 GHz of mid-band spectrum globally by 2035-2040, increasing to 2.5-4 GHz in higher-demand markets. Many regions currently provide only around 1 GHz, necessitating an additional 1-3 GHz allocation. The report stresses that at least 2 GHz must be operational by 2030 to prevent early 6G rollouts from facing immediate congestion.

This additional spectrum capacity enables several critical 6G capabilities:

- Low latency: Wide channels required for sub-10 ms latency supporting digital twins and real-time sensors.

- Balanced performance: Symmetrical uplink/downlink performance for real-time bi-directionality.

- Efficiency: Efficient reuse of existing bands via MRSS.

- Optimized deployment: Reduced reliance on mmWave, which is not economical for wide-area traffic coverage.

Operational Constraints to Manage:

- Densification Limits: Most urban networks operate optimally within inter-site distances of 200-800m. Further densification introduces rapidly escalating costs, making spectrum acquisition a more scalable solution.

- mmWave Role: Millimeter wave (mmWave) remains a supplementary technology, suitable for localized capacity but limited to carrying 5-10% of dense-urban traffic; it does not replace mid-band for wide-area coverage.

- Wi-Fi Offload: Due to its unmanaged nature, Wi-Fi offload cannot deliver the predictable performance guarantees required for mission-critical 6G-era applications.

- Gradual Re-farming: With 4G and 5G still prevalent through 2040, MRSS is essential for balancing capacity across generations of radio technology.

Recommendations for Telecoms Companies:

Telecom operators should develop a long-term spectrum roadmap informed by these findings, prioritizing 2-3 GHz globally, with targets up to 4 GHz in high-demand markets. Key actions include:

- Prioritize 6 GHz: Focus on the upper 6 GHz band, which offers approximately 700 MHz of new capacity between 6.425-7.125 GHz.

- Integrate MRSS: Build multi-RAT spectrum sharing into core network design to balance 4G, 5G, and 6G operations.

- Model Uplink Demands: Plan for greater asymmetric demands driven by future uplink-heavy workloads (e.g., enterprise AI, sensing).

- Address Vertical Needs: Prepare specific service level agreements (SLAs) for verticals such as manufacturing, transport, and retail that require guaranteed latency and reliability.

- Evaluate Densification: Utilize densification strategically in high-value, targeted areas rather than as a broad replacement for acquiring additional spectrum.

Conclusions:

Spectrum policy directly translates to concrete operational outcomes. A city or nation’s ability to deliver reliable 6G performance will be a key determinant of future economic growth and service innovation. For both telecom operators and enterprise technology leaders, aligning current investment strategies with critical spectrum decisions is essential for defining next-generation connectivity infrastructure. The full study is available on the GSMA Intelligence website.

Editor’s Note:

ITU-R is the SDO (Standards Development Organization) that defines the framework, requirements, and evaluation criteria for IMT-2030 (6G) systems, which includes identifying the necessary spectrum. The WRC-23 identified key frequency ranges (e.g., 4400-4800 MHz, 7125-8400 MHz, and 14.8-15.35 GHz) for further study for IMT-2030 under a WRC-27 agenda item.

After WRC determines the IMT 2030 frequencies, ITU-R WP 5D will develop a recommendation for IMT 2030 Frequency Arrangements, just as it did for IMT 2020, but it was delayed due to bickering and only was finalized after the ITU-R M.2150 recommendation (IMT 2020 RIT/SRITs) was approved. Specifically, ITU-R M.1036-7 provides harmonized frequency bands to facilitate global roaming and economies of scale, while acknowledging that specific national band plans may vary due to existing services.

References:

https://www.telecomstechnews.com/news/the-spectrum-decisions-shaping-gsma-6g-era-report/

Big 5G Conference: 6G spectrum sharing should learn from CBRS experiences

India’s TRAI releases Recommendations on use of Tera Hertz Spectrum for 6G

WRC-23 concludes with decisions on low-band/mid-band spectrum and 6G (?)

https://www.itu.int/en/ITU-R/study-groups/rsg5/rwp5d/imt-2030/pages/default.aspx