Canalys

Canalys: Global cloud infrastructure services spending up 16% in Q3-2023

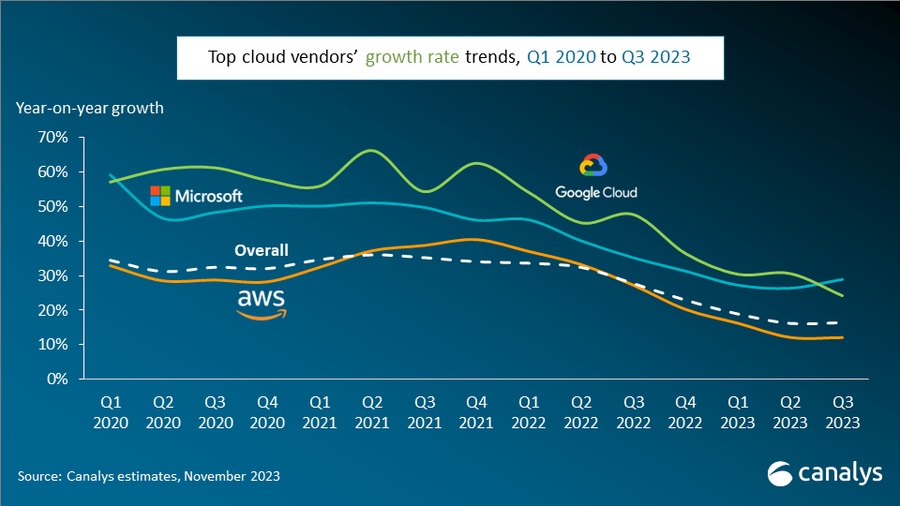

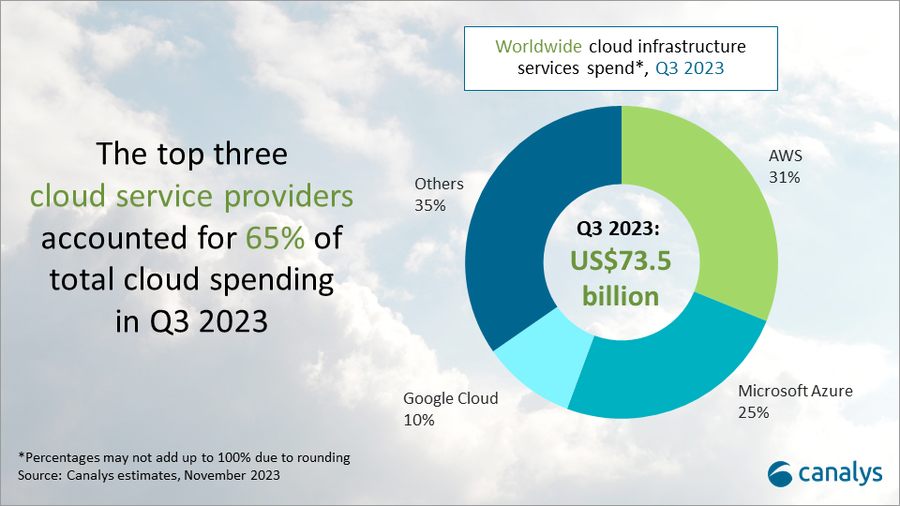

Global spending on cloud infrastructure services reached US$73.5 billion in Q3 2023, a 16% year-on-year increase. Q3 growth remained consistent with the previous quarter, showing we are entering a stable phase. The impact of enterprise IT spending cuts on the cloud services market is slowly easing. In Q3 2023, the top three cloud providers – AWS, Microsoft Azure and Google Cloud – jointly grew by 20%, slightly outpacing the overall market and accounting for 65% of total spending. AWS mirrored its performance in the previous quarter, while Microsoft saw an uptick in its growth rate. Google Cloud, however, saw a drop in its rate in Q3 2023.

In August, Canalys said that AI would be a major driver of cloud service provider investments.

Cloud market showing signs of resilience – helped by growing interest in AI

Despite enterprises continuing to optimize overall IT spending, the cloud market is beginning to show signs of resilience, helped in part by a growing interest in AI. While the broader market continues to grapple with the repercussions of cost-cutting behavior, the performance of the leading cloud vendors hints at a shift in the market dynamic. Growing demand for AI solutions is gradually offsetting the impact of reduced IT spending as enterprises begin to invest in cloud computing to support AI strategies.

Top three vendors launch AI-focused partner programs

Microsoft’s efforts to commercialize its AI products are gaining momentum, with the recent introduction of Copilot driving significant customer and partner interest. Looking ahead to next year and beyond, discussions around GenAI will take center stage, and it will become a key growth driver for the channel. Following AWS’ and Microsoft’s recent AI-focused partner program launches, Google Cloud introduced the Generative AI Partner Initiative in Q3, as it seeks to work with partners to drive enterprise adoption of its AI solutions, including Duet AI.

“Generative AI unlocks a wealth of opportunities for channel partners to venture into new areas of business growth,” said Alex Smith, VP at Canalys. “The big cloud players and their partners can seize this exponential growth opportunity by identifying customers with an appetite for AI solutions, while simultaneously strengthening their AI capabilities and offering comprehensive portfolios of AI-related products and services to address these evolving needs.”

“Apart from capitalizing on new business opportunities arising from GenAI, channel partners can incorporate GenAI internally to boost productivity,” said Yi Zhang, Analyst at Canalys. “To succeed in this rapidly evolving landscape, channel partners must stay ahead of the game by establishing robust AI strategies and investing in strategic AI partnerships.”

AWS continues to reign supreme with 31% market share

Amazon Web Services (AWS) continued to dominate the cloud infrastructure services market in Q3 2023, with a stable market share of 31%. Year-on-year growth of 12% was in line with the previous quarter but still below the overall market’s growth rate. The company’s efforts to cut costs and enhance efficiency resulted in substantial profit improvements in Q3 2023. AWS unveiled plans to open new data centers in South Korea and Malaysia, responding to the increasing demand for cloud computing in these regions. It also enhanced its cloud marketplace, as growing numbers of ISVs are seeing transactions accelerate via AWS Marketplace. AWS has committed to improving the AWS Marketplace and Partner Central in the coming months, aiming to empower partners to use AWS Marketplace to accelerate sales.

Microsoft Azure bounces back with 25% market share and rising growth rate

Microsoft Azure held second place in the cloud infrastructure services market in Q3 with a 25% market share. Following seven consecutive quarters of slowing year-on-year growth, it saw an uptick in its growth rate, which was up 29% compared with Q3 last year. The impact of the AI surge is palpable – marked by increased demand for cloud following the launch of Microsoft Copilot for Windows in September. Business performance is expected to remain steady, given the 18% increase in its cloud order backlog, which reached US$212 billion in Q3 2023. Since August, partners have had access to the new Microsoft AI Cloud Partner Program, designed to support partners in harnessing the advantages of incorporating AI capabilities into their organizations and capitalizing on the business opportunities presented by Microsoft AI-related products and Microsoft Azure.

Google Cloud takes 10% market share with growth below expectations

Google Cloud reached a market share of 10% in Q3 2023 after growing 24% year on year, securing third place in the cloud infrastructure services market. Growth was below expectations, and this was the first time that Google Cloud’s growth rate dipped below that of Microsoft Azure’s in the last three years. The dip was primarily due to the delayed impact of enterprises’ IT cost-cutting measures. Emphasizing its partner-first vision, Google Cloud is highlighting the Google Cloud partner ecosystem, particularly in the context of AI. It also committed to an open approach to GenAI development, facilitating the integration of partner-developed AI models into the Google Cloud Platform.

Canalys defines cloud infrastructure services as those services that provide infrastructure-as-a-service and platform-as-a-service, either on dedicated hosted private infrastructure or shared public infrastructure. This excludes software-as-a-service expenditure directly but includes revenue generated from the infrastructure services being consumed to host and operate them.

…………………………………………………………………………………………………………………………………..

According to Nick Wood at telecoms.com, the overall cloud infrastructure services market – which for Canalys encompasses infrastructure-as-a-service (IaaS) and platform-as-a-service (IaaS) – is on course to fall short of Canalys’ full-year expectations. In February, Canalys predicted that cloud spending in 2023 would grow 23% on last year, when it reached $247.1 billion. That makes for a projected total of around $304 billion.

However, since then, macroeconomic conditions have taken their toll on spending, tempering expectations for this year. The year to date total for 2023 is $212.3 billion, which means there is $91.7 billion worth of ground to make up in Q4 if spending is going to meet that target.

Achieving this looks like a tall order, because it would mean the year-on-year growth rate in Q4 would need to be 39.7%. Given the market grew by 19% in Q1, and 16% in both Q2 and Q3, a sudden surge in spending is unlikely.

References:

https://canalys.com/newsroom/global-cloud-services-q3-2023

https://telecoms.com/524974/cloud-spending-set-to-miss-full-year-forecast-despite-solid-q3-growth/

Cloud infrastructure services market grows; AI will be a major driver of future cloud service provider investments

Canalys: Cloud marketplace sales to be > $45 billion by 2025

Canalys: Global cloud services spending +33% in Q2 2022 to $62.3B

Gartner Forecast: Worldwide Public Cloud End-User Spending ~$679 Billion in 2024; GenAI to Support Industry Cloud Platforms

IDC: Public Cloud services spending to hit $1.35 trillion in 2027

Canalys: Global cloud services spending +33% in Q2 2022 to $62.3B

Synergy: Q3 Cloud Spending Up Over $11 Billion YoY; Google Cloud gained market share in 3Q-2022

AWS, Microsoft Azure, Google Cloud account for 62% – 66% of cloud spending in 1Q-2022

Cloud infrastructure services market grows; AI will be a major driver of future cloud service provider investments

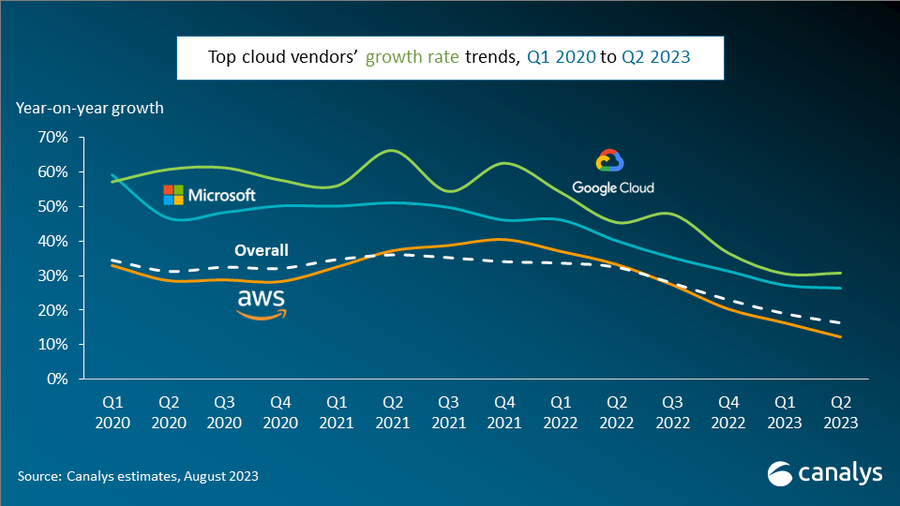

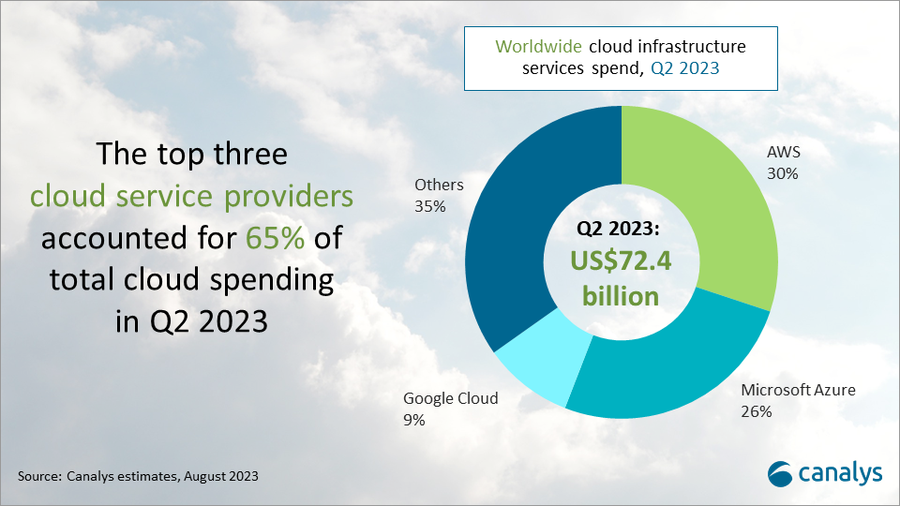

According to Canalys, worldwide cloud infrastructure services spending increased 16% to $72.4 billion in Q2 2023. This growth rate represents a decline against the previous quarter’s 19%, as the market feels the effect of spending pressures, though slower growth is also a consequence of the market’s greater size. In Q2 2023, the top three vendors, AWS, Microsoft Azure and Google Cloud, collectively grew 20% – down from 22% in Q1 – to account for 65% of total spending. While AWS and Microsoft both saw a deceleration in growth, Google Cloud’s growth rate remained stable compared with the previous quarter, at 31%.

The cloud infrastructure services market is feeling the impact of pressure on customer spending, the analyst firm noted, but pointed out that the slower growth is also a result of the increased size of the market.

Although AI hasn’t yet had a meaningful impact on revenues, there is plenty of cause for optimism. Canalys says AI represents a major driver of cloud investment in the future, and all the major cloud vendors continue to invest heavily in AI technologies. However, cloud service providers will have to be selective when deciding who to partner with in this market.

In the current business landscape, where emphasis is placed on cost control, cloud vendors must secure a significant influx of new customers and workloads to drive revenue growth. The emergence of AI technology is introducing new cloud workloads and is set to fuel massive demand for computing capacity, creating new opportunities for cloud growth. Notably in this quarter, both AWS and Microsoft launched new AI-oriented partner programs, recognizing the importance of collaborating with partners to drive customers’ use of their AI products.

“The most common collaboration model involves partners contributing their industry expertise, business process knowledge and data analytics experience within relationships,” said Yi Zhang, Research Analyst at Canalys. “Cloud providers, in turn, offer partners early exposure to their emerging technologies and provide technical support.”

“In the meantime, vendors need to separate the wheat from the chaff when it comes to driving their AI strategies through partners,” said Alex Smith, VP at Canalys. “That means focusing on partners that are building service practices around AI, engaging in sales and marketing initiatives that focus on AI, producing original thought leadership and compelling case studies around AI applications, and selling solutions that are embedded with AI capabilities. It’s these partners that will assume a leading role in steering companies toward being leaders in this field.”

Amazon Web Services (AWS) continued to lead the cloud infrastructure services market in Q2 2023, accounting for 30% of total spend, an increase of 12% year on year. AWS’s growth has more than halved since the same period last year. In the face of subdued revenue growth, AWS is actively increasing its investments in AI. It invested US$100 million in a new generative AI program, which was launched in June 2023. As part of the program, the AWS Generative AI Innovation Center will serve as a hub for free workshops and training and is expected to help enterprises accelerate the development of generative AI-based applications while connecting AWS’ technology with customers and partners. Recent announcements from AWS reveal that thousands of customers are engaging with its new AI service and, concurrently, AWS has established new partnerships with Omnicom and 3M Health Information Systems.

Microsoft Azure accounted for 26% of the market after growing 26% annually, positioning it as the second-largest cloud service provider in Q2 2023. Business performance is expected to remain steady, given the 19% increase in its cloud order backlog, which reached US$224 billion in Q2 2023. It has seen significant momentum in its Azure OpenAI Service, winning noteworthy clients including Ikea, Volvo Group and Zurich Insurance. In light of the projected surge in AI demand, it introduced the Microsoft AI Cloud Partner Program during its global partner event, Microsoft Inspire 2023. This aims to encourage Microsoft’s partner ecosystem to develop solutions that use Microsoft’s AI technology. Microsoft aims to ensure a smooth transition for its existing partners, automatically enrolling them in the new program while retaining their previous benefits and designations.

Google Cloud grew 31% year on year in Q2 2023, the strongest growth of the top three hyperscalers, to capture 9% of the cloud market. Its approach to extending the depreciation period for servers and network equipment helped control operating costs and bolstered Google Cloud’s profitability. Google Cloud’s partner ecosystem continues to provide support in the development of its generative AI applications. Hundreds of ISVs and SaaS providers, including Box, Salesforce and Snorkel, along with GSIs, have committed to training over 150,000 individuals on Google Cloud’s Generative AI. Google Cloud claims to command the allegiance of over 70% of burgeoning tech startups that specialize in generative AI. This roster features standout names such as Cohere, Jasper and Typeface, exemplifying the trust startups place in Google Cloud’s AI capabilities.

Canalys defines cloud infrastructure services as those services that provide infrastructure-as-a-service and platform-as-a-service, either on dedicated hosted private infrastructure or shared public infrastructure. This excludes software-as-a-service expenditure directly but includes revenue generated from the infrastructure services being consumed to host and operate them.

For more information, please contact:

Alex Smith: [email protected]

Yi Zhang: [email protected]

References:

https://canalys.com/newsroom/global-cloud-services-q2-2023

Canalys: Cloud marketplace sales to be > $45 billion by 2025

Global Cloud VPN Market Report: Rising Demand for Cloud-based Security Services

Synergy & IDC: Hosted and Cloud Services are driving the Unified Communications & Collaboration Markets

Forbes: Cloud is a huge challenge for enterprise networks; AI adds complexity

IDC: Cloud Infrastructure Spending +13.5% YoY in 4Q-2021 to $21.1 billion; Forecast CAGR of 12.6% from 2021-2026

Strong growth for global cloud infrastructure spending by hyperscalers and enterprise customers

Canalys: Cloud marketplace sales to be > $45 billion by 2025

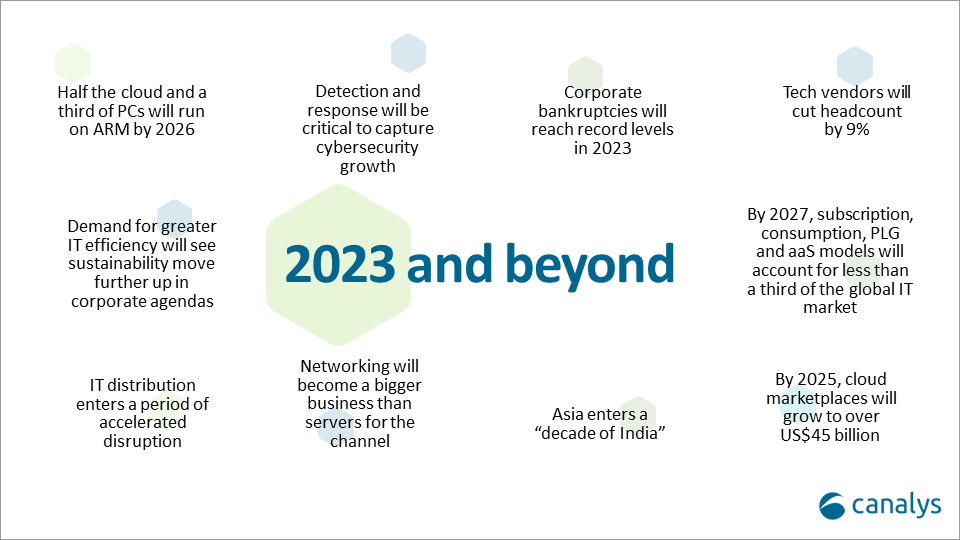

Canalys now expects that by 2025, cloud marketplaces will grow to more than $45 billion, representing an 84% CAGR. That was one of the market research firm’s predictions for 2023 and beyond (see chart below).

Cloud marketplaces [1.] are accelerating as a route to market for technology, led by hyperscale cloud vendors such as Alibaba, Amazon Web Services, Microsoft, Google and Salesforce, which are pouring billions of development dollars into the sector.

Note 1. A cloud marketplace is an online storefront operated by a cloud service provider. A cloud marketplace provides customers with access to software applications and services that are built on, integrate with or complement the cloud service provider’s offerings. A marketplace typically provides customers with native cloud applications and approved apps created by third-party developers. Applications from third-party developers not only help the cloud provider fill niche gaps in its portfolio and meet the needs of more customers, but they also provide the customer with peace of mind by knowing that all purchases from the vendor’s marketplace will integrate with each other smoothly.

…………………………………………………………………………………………………………………………………………………………………….

“The marketplace route to market is on fire and cannot be ignored by any channel leader,” said Canalys Chief Analyst, Jay McBain. “Marketplaces grew more in the first three months of the pandemic than in the previous decade and have just kept growing,” he added.

“We under-called it,” explained Steven Kiernan, vice president at Canalys. “Cloud marketplaces are accelerating at such a dizzying speed that we’ve doubled our pre-pandemic forecast.

Some software vendors that are active on marketplaces, in particular cybersecurity vendors, are publicly reporting as much as 600% year-on-year growth via this channel, according to McBain.

In addition, the hyperscalers are now reporting growing numbers of billion-dollar customer commitments through enterprise cloud consumption credits, which cover more than just software.

The large cloud marketplaces have lowered fees from upwards of 20% down to 3%, enabling vendors to fund multi-partner offers inside the transaction.

Private equity is funding billions more into marketplace development firms such as AppDirect, Mirakl, Vendasta and CloudBlue to enable hundreds of niche marketplaces across different buyers, industries, geographies, customer segments, product areas and business models.

Canalys Chief Analyst, Alastair Edwards:

“The rise of this route to market represents a threat to both resellers and two-tier distribution. But as more complex technologies are consumed via marketplaces, end customers are also turning to trusted partners to help them discover, procure and manage marketplace purchases. The hyperscalers are increasingly recognizing the value of channel partners, allowing them to create customized vendor offers for end-customers, and supporting the flow of channel margins through their marketplaces. Hyperscalers’ cloud marketplaces are becoming a growing force in global IT distribution as a result.”

By 2025, Canalys conservatively forecasts that almost a third of marketplace procurement will be done via channel partners on behalf of their end customers.

Canalys key predictions for 2023 and beyond:

About Canalys:

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

References:

https://canalys.com/newsroom/cloud-marketplace-forecast-2023

https://www.canalys.com/resources/Canalys-outlook-2023-predictions-for-the-technology-industry

https://www.techtarget.com/searchitchannel/definition/cloud-marketplace

Canalys: Global cloud services spending +33% in Q2 2022 to $62.3B

AWS, Microsoft Azure, Google Cloud account for 62% – 66% of cloud spending in 1Q-2022

IDC: Cloud Infrastructure Spending +13.5% YoY in 4Q-2021 to $21.1 billion; Forecast CAGR of 12.6% from 2021-2026

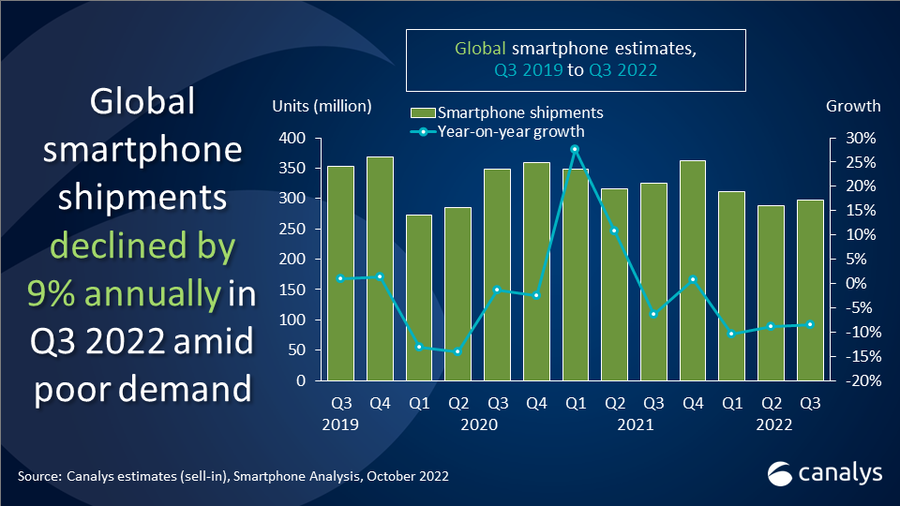

Canalysis & Counterpoint: Global Smartphone shipments plunge 9% YoY in 3Q-2022

Canalys smartphone analysis indicates weak demand in 3Q-2022 caused worldwide smartphone shipments to decline by 9% year-on-year to 297.8 million units. Samsung defended its first place in the market despite an 8% decline, shipping 64.1 million units. Apple, the only leading vendor to increase year-on-year driven by robust demand, grew 8% and shipped 53.0 million units. Following two quarters of double-digit declines, Xiaomi leveraged its global scale to find opportunities helping it strengthen its position to only decline 8%, shipping 40.5 million units. OPPO and Vivo took fourth and fifth place despite having over 20% declines, shipping 28.5 million and 27.4 million units respectively in Q3 2022.

“Performance of the high-end segment was the only highlight this quarter,” said Canalys Research Analyst Runar Bjørhovde. “Apple reached its highest Q3 market share yet, driven by both the iPhone 13 and newly launched iPhone 14 series. The popularity of the iPhone 14 Pro and Pro Max, in particular, will contribute to a higher ASP and stable revenue for Apple. On the Android side, Samsung refreshed its foldable portfolio and increased its marketing initiatives significantly to generate interest and demand for its new flagships. Mid-to-low-end demand has been hit making it challenging for vendors to navigate in a competitive segment. Xiaomi managed to leverage its global scale with a refreshed product line to offset declines in its home market. OPPO and vivo are still significantly impacted by the drop in the China market but have both shown small signs of recovery.”

“Europe and Asia Pacific outperformed the rest of the world in Q3,” said Canalys Analyst Sanyam Chaurasia. “Europe avoided a significant drop helped by a spike in shipments to Russia. Here, Chinese vendors leveraged short-term opportunities to stock up the channel in a market that has been undersupplied during previous quarters. APAC had a huge variation between different markets, but sequentially improving demand in India, Indonesia and the Philippines helped the region stabilize its performance. Carrier dominated markets such as North America and Latin America presented increasingly cautious sentiments on managing inventory before heading into big holiday seasons, contrasting a much more optimistic view in Q3 last year.”

“Moving into Q4, ongoing global disruptions are hampering the performance of entire ecosystem portfolios for vendors,” said Canalys Analyst Toby Zhu. “The upstream supply chain is entering a long winter sooner than expected where OEMs’ order targets are slashed heavily. Also, slow inventory turnover and poor economic figures have affected the channel’s confidence, falling back to major brands with iconic devices to generate traffic for the most important revenue quarter. Vendors are entering Q4 with cautious strategies to handle the persisting difficulties. Managing the gloomiest Q4 outlook in over a decade will show which vendors are well-positioned for the long-term.”

|

Worldwide smartphone shipments and annual growth Canalys Smartphone Market Pulse: Q3 2022 |

|||||||

|

Vendor |

Q3 2022 shipments (million) |

Q3 2022 |

Q3 2021 |

Q3 2021 |

Annual |

||

|

Samsung |

64.1 |

22% |

69.4 |

22% |

-8% |

||

|

Apple |

53.0 |

18% |

49.2 |

16% |

8% |

||

|

Xiaomi |

40.5 |

14% |

44.0 |

14% |

-8% |

||

|

OPPO |

28.5 |

10% |

36.7 |

12% |

-22% |

||

|

Vivo |

27.4 |

9% |

34.2 |

11% |

-20% |

||

|

Others |

84.3 |

27% |

92.1 |

25% |

-6% |

||

|

Total |

297.8 |

100% |

325.6 |

100% |

-9% |

||

|

Note: percentages may not add up to 100% due to rounding |

|||||||

Source: Canalys

…………………………………………………………………………………………………………………………………

Counterpoint: Global Smartphone Market at Lowest Q3 Level Since 2014

- The global smartphone market declined by 12% YoY even as it grew by 2% QoQ to reach 301 million units in Q3 2022.

- While quarterly growth in Apple and Samsung pushed the global smartphone market above 300 million units, a level it failed to reach last quarter, political and economic instability drove negative consumer sentiment.

- Apple was the only top-five smartphone brand to grow YoY, with shipments increasing 2% YoY, growing market share by two percentage points to 16%.

- Samsung’s shipments declined by 8% YoY but grew 5% QoQ to 64 million.

- Xiaomi, OPPO* and vivo, recovered slightly after receiving heavy beatings due to lockdowns in China in Q2, and as they captured more of the market ceded by Apple and Samsung’s exit from Russia.

Senior Analyst Harmeet Singh Walia said, “Most major vendors continued experiencing annual shipment declines in the third quarter of 2022. Russia’s escalating war in Ukraine, ongoing China-US political distrust and tensions, growing inflationary pressures across regions, a growing fear of recession, and weakening national currencies all caused a further dent in consumer sentiment, hitting already weakened demand. This is also adding to a slow but sustained lengthening of smartphone replacement cycles with smartphones becoming more durable and as technology advancement slows. This is accompanying, and to a smaller degree advancing, a fall in the shipments of mid- and lower-end smartphones, even as the premium segment weathers the economic storm better. Consequently, and thanks to an earlier launch of the latest iPhone series this year, Apple emerged as the only top-five smartphone vendor to manage annual shipment growth in the quarter.”

While Samsung grew QoQ in Q3 2022 thanks to record presales of its premium fold and flip smartphones, compared with the same quarter last year, however, its shipments fell by 8% YoY. This is primarily down to dampening consumer sentiment in several of its key markets. This also affected top Chinese brands, whose shipments remained low compared with last year as they were getting rid of excess inventory and at the same time managing a slowdown in the home market, China. However, they were able to capitalise on Apple and Samsung’s exit from the Russian market, in which their share increased substantially.

Associate Director Jan Stryjak noted, “With the full force of the latest iPhone launch being felt in Q4, we expect further quarterly improvement in the coming quarter, although central banks’ attempts to control inflation will further reduce consumer demand. The channel inventory is still higher, and the OEMs will focus on getting rid of excess inventory in Q4 as well. Hence, shipments are unlikely to reach last year’s levels, let alone pre-pandemic Q4 levels of over 400 million units. Looking further ahead into 2023, we expect sluggish demand with lengthening replacement rates, especially in the first half of the year.”

*OPPO includes OnePlus from Q3 2021

References:

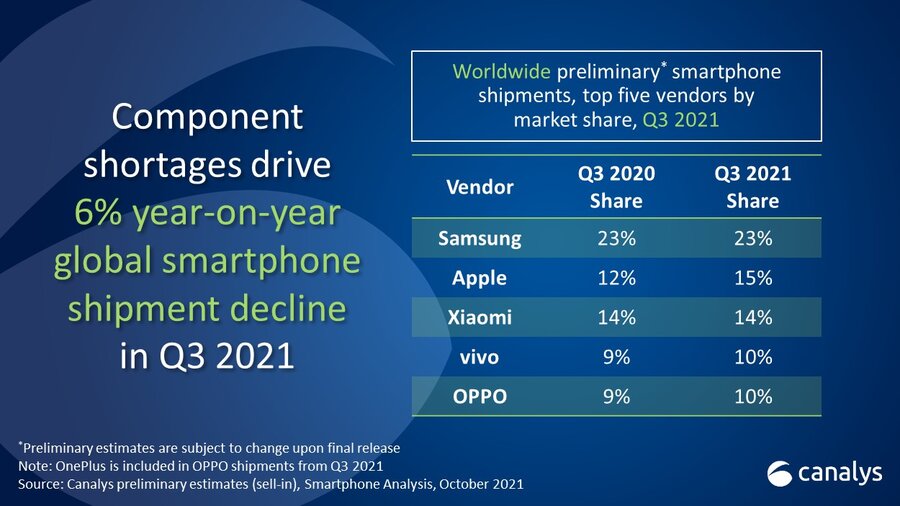

Canalys: Global Smartphone Shipments Fell 6% in 3Q-2021; Samsung Still #1

According to a new report by market tracker Canalys, global smartphone shipments fell 6 per cent in the third quarter (July-September period) this year, as vendors struggled to meet demand for devices amid component shortages. That decline comes after shipments increased by 12% in the second quarter of 2021.

- Samsung was the leading smartphone player with 23 per cent share.

- Apple regained second place in the global smartphone market with 15 per cent share in the third quarter (Q3) this year, thanks to strong early demand for iPhone 13.

- Xiaomi took 14 per cent share for the third place, while Vivo and Oppo completed the top five with 10 per cent share each.

“The chipset famine has truly arrived,” said Canalys Principal Analyst, Ben Stanton. “The smartphone industry is striving to maximize production of devices as best it can. On the supply side, chipset manufacturers are increasing prices to disincentivize over-ordering, in an attempt to close the gap between demand and supply. But despite this, shortages will not ease until well into 2022. As a result of this, as well as high costs of global freight, smartphone brands have reluctantly pushed up device retail pricing.”

“At the local level, smartphone vendors are also having to implement last-minute changes in device specification and order quantities. It is critical for them to do this and maximize volume capacity, but unfortunately it does lead to confusion and inefficiency when communicating with retail and distributor channels,” continued Stanton. “Many channels are nervous heading into important sales holidays, such as Singles’ Day in China, and Black Friday in the west. Channel inventories of smartphones are already running low, and as more customers start to anticipate these sales cycles, the impending wave of demand will be impossible to fulfill. Customers should expect smartphone discounting this year to be less aggressive. But to avoid customer disappointment, smartphone brands which are constrained on margin should look to bundle other devices, such as wearables and IoT, to create good incentives for customers.”

References:

https://www.canalys.com/newsroom/canalys-global-smartphone-market-Q3-2021

Canalys 2Q-2021 smartphone rankings show big gains for Xiaomi and OPPO

Canalys 2Q-2021 smartphone rankings show big gains for Xiaomi and OPPO

Telecom, IT and cloud market research firm Canalys, said that global smartphone shipments increased by 12% in the second quarter of 2021. Samsung still maintains its position as the world’s number one with a market share of 19%. Xiaomi’s mobile phone sales surpassed Apple’s and rose to the second place in the world for the first time, with a share of 17%. Apple ranked third with 14%. OPPO and Vivo ranked fourth and fifth in the world, with a market share of 10%.

Xiaomi’s growth rate is as high as 83%, making it the top five mobile phone brand with the fastest growth rate in market share. Lei Jun, the founder and CEO of Xiaomi, sent three consecutive Weibo messages to express his congratulations to Xiaomi, and at the same time released the “Open Letter to Xiaomi Students.” Lei Jun said that Xiaomi’s becoming the second ranked global smartphone vendor is a major milestone in the history of Xiaomi’s development.

In the third quarter of 2014, Xiaomi entered the top three in the world for the first time, and then encountered huge difficulties, and soon fell out of the top five in the world. In 2020, the launch of Xiaomi Mi 10 series will fully launch the development of Xiaomi mobile phones. In the high-end journey, in the third quarter of the same year, Xiaomi returned to the third place in the world. Only two quarters later, Xiaomi was promoted to the second place in the world.

Lei Jun also said that “the second in the world” is a major victory for Xiaomi’s strategy. In August last year, Xiaomi established its core strategy for the next ten years-mobile phone X AIoT, once again clarifying the core position of the smartphone business, progressing to promote intelligent interconnection, and the AIoT business will build a smart life around the core business of mobile phones. At the same time, it has established the “three iron laws” that will never change: technology-oriented, cost-effectiveness-oriented, and making the coolest products.

About Xiaomi:

Xiaomi is an electronics company based in Beijing, China. It was founded by Lei Jun in April 2010, and in 2014, Xiaomi was the largest smartphone company in China. Today, Xiaomi is one of the top five smartphone vendors in the world.

The “MI” in their logo stands for “Mobile Internet.” It also has other meanings, including “Mission Impossible”, because Xiaomi faced many challenges that had seemed impossible to defy in our early days.

…………………………………………………………………………………………………………………………………………

Meanwhile, Canalys said that OPPO ranked first among Android smartphone manufacturers. In addition to launching 5G phones in the full price range to meet the different needs of consumers, OPPO has been actively taking the lead in applying new technologies to its latest models.

Canalys wrote that in Middle East and Africa, OPPO has climbed to fourth place in market share with a 106% year-on-year growth. The United Arab Emirates and Saudi Arabia have been at the forefront of this rise, witnessing a 196% and a 218% year-on-year growth respectively which was attributed to OPPO’s innovative product offering and strong customer service. In addition, OPPO saw a year-on-year growth of 79% in Egypt.

Ethan Xue, President of OPPO MEA said, “We are proud to see our innovative products and customer-centric approach being well received and reflected in these promising figures. Our growth in the MENA region is phenomenal and illustrates the strong customer base we have that support us and understand our brand mission, technology for mankind, kindness for the world. At OPPO, we continue to push the boundaries and our growth only serves to motivate us even more to offer our customers the best possible products at competitive prices.”

The main proponent of the brands growth is strong product launches that closely align with the evolving demands of smartphone users. Earlier this month, OPPO launched the anticipated Reno6 series, comprising of three variations, the Reno6 Pro 5G, Reno6 5G, and the Reno6 Z 5G that have all been masterfully designed for trendsetting individuals, game enthusiasts and the young at heart. From stunning design details to powerful features, the Reno6 series is already proving to be popular in the region, with a 300% pre-order increase compared to its predecessor, solidifying the demand for the technology brand in MENA.

About OPPO:

OPPO is headquartered in Dongguan, China an has been a leading global technology brand since 2004, dedicated to providing products that seamlessly combines art and innovative technology.

OPPO says they’re on a mission to building a multiple-access smart device ecosystem for the era of intelligent connectivity. The smartphone devices have simply been a gateway for OPPO to deliver a diverse portfolio of smart and frontier technologies in hardware, software and system. In 2019, OPPO launched a $7 Billion US Dollar three-year investment plan in R&D to develop core technologies furthering design through technology.

For the last 10 years, OPPO has focused on manufacturing smartphones with camera capabilities that are second to none. OPPO launched the first mobile phone, the Smile Phone, in 2008, which marked the launch of the brand’s epic journey in exploring and pioneering extraordinary technology. Over the years, OPPO has built a tradition of being number one, which became a reality through inventing the world’s first rotating camera smartphone way back in 2013, launching the world’s then thinnest smartphone in 2014, being the first to introduce 5X Zoom ‘Periscope’ camera technology and developing the first 5G commercial smartphone in Europe.

OPPO is currently ranked as the number four smartphone brand globally. OPPO brings the aesthetics of technology of global consumers through the ColorOS system Experience, and Internet service like OPPO Cloud and OPPO+.

OPPO’s business covers 40 countries with over six research institutes and five R&D centers across the world, from San Francisco to Shenzhen. OPPO also opened an International Design Centre headquartered in London, driving cutting edge technology that will shape the future not only for smartphones but for intelligent connectivity.

References:

https://min.news/en/tech/5f2410bda155bbec25c819b98c454623.html

NEW for 3Q2021 Rankings: