Cloud Marketplace

Does AI change the business case for cloud networking?

For several years now, the big cloud service providers – Amazon Web Services (AWS), Microsoft Azure, and Google Cloud – have tried to get wireless network operators to run their 5G SA core network, edge computing and various distributed applications on their cloud platforms. For example, Amazon’s AWS public cloud, Microsoft’s Azure for Operators, and Google’s Anthos for Telecom were intended to get network operators to run their core network functions into a hyperscaler cloud.

AWS had early success with Dish Network’s 5G SA core network which has all its functions running in Amazon’s cloud with fully automated network deployment and operations.

Conversely, AT&T has yet to commercially deploy its 5G SA Core network on the Microsoft Azure public cloud. Also, users on AT&T’s network have experienced difficulties accessing Microsoft 365 and Azure services. Those incidents were often traced to changes within the network’s managed environment. As a result, Microsoft has drastically reduced its early telecom ambitions.

Several pundits now say that AI will significantly strengthen the business case for cloud networking by enabling more efficient resource management, advanced predictive analytics, improved security, and automation, ultimately leading to cost savings, better performance, and faster innovation for businesses utilizing cloud infrastructure.

“AI is already a significant traffic driver, and AI traffic growth is accelerating,” wrote analyst Brian Washburn in a market research report for Omdia (owned by Informa). “As AI traffic adds to and substitutes conventional applications, conventional traffic year-over-year growth slows. Omdia forecasts that in 2026–30, global conventional (non-AI) traffic will be about 18% CAGR [compound annual growth rate].”

Omdia forecasts 2031 as “the crossover point where global AI network traffic exceeds conventional traffic.”

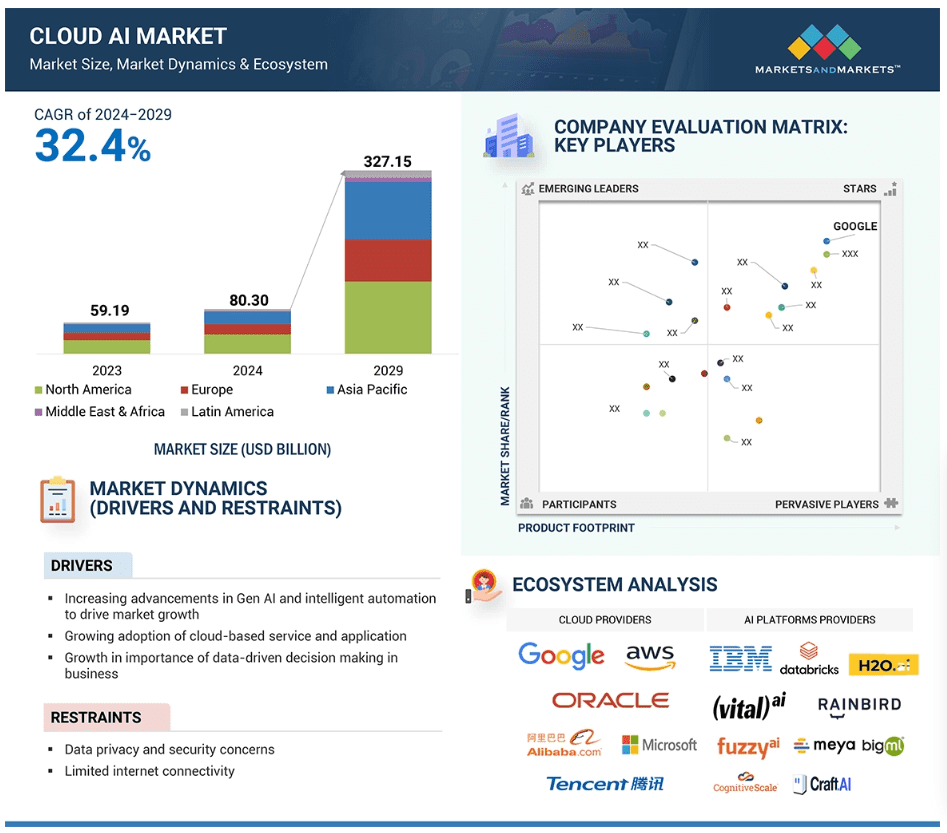

Markets & Markets forecasts the global cloud AI market (which includes cloud AI networking) will grow at a CAGR of 32.4% from 2024 to 2029.

AI is said to enhance cloud networking in these ways:

- Optimized resource allocation:

AI algorithms can analyze real-time data to dynamically adjust cloud resources like compute power and storage based on demand, minimizing unnecessary costs. - Predictive maintenance:

By analyzing network patterns, AI can identify potential issues before they occur, allowing for proactive maintenance and preventing downtime. - Enhanced security:

AI can detect and respond to cyber threats in real-time through anomaly detection and behavioral analysis, improving overall network security. - Intelligent routing:

AI can optimize network traffic flow by dynamically routing data packets to the most efficient paths, improving network performance. - Automated network management:

AI can automate routine network management tasks, freeing up IT staff to focus on more strategic initiatives.

The pitch is that AI will enable businesses to leverage the full potential of cloud networking by providing a more intelligent, adaptable, and cost-effective solution. Well, that remains to be seen. Google’s new global industry lead for telecom, Angelo Libertucci, told Light Reading:

“Now enter AI,” he continued. “With AI … I really have a power to do some amazing things, like enrich customer experiences, automate my network, feed the network data into my customer experience virtual agents. There’s a lot I can do with AI. It changes the business case that we’ve been running.”

“Before AI, the business case was maybe based on certain criteria. With AI, it changes the criteria. And it helps accelerate that move [to the cloud and to the edge],” he explained. “So, I think that work is ongoing, and with AI it’ll actually be accelerated. But we still have work to do with both the carriers and, especially, the network equipment manufacturers.”

Google Cloud last week announced several new AI-focused agreements with companies such as Amdocs, Bell Canada, Deutsche Telekom, Telus and Vodafone Italy.

As IEEE Techblog reported here last week, Deutsche Telekom is using Google Cloud’s Gemini 2.0 in Vertex AI to develop a network AI agent called RAN Guardian. That AI agent can “analyze network behavior, detect performance issues, and implement corrective actions to improve network reliability and customer experience,” according to the companies.

And, of course, there’s all the buzz over AI RAN and we plan to cover expected MWC 2025 announcements in that space next week.

https://www.lightreading.com/cloud/google-cloud-doubles-down-on-mwc

Nvidia AI-RAN survey results; AI inferencing as a reinvention of edge computing?

The case for and against AI-RAN technology using Nvidia or AMD GPUs

Generative AI in telecom; ChatGPT as a manager? ChatGPT vs Google Search

IDC: Public Cloud services spending to hit $1.35 trillion in 2027

Global spending on public cloud services is projected to reach $1.35 trillion in 2027, according to IT market research firm IDC. Although annual cloud spending growth is expected to slow slightly over the 2023-2027 forecast period, the market is forecast to achieve a five-year compound annual growth rate (CAGR) of 19.9%.

IDC forecasts that the U.S. will be the largest geographic public cloud market and will reach $697 billion in 2027. Western Europe is predicted to be in second place with $273 billion, followed by China at $117 billion in 2027.

Eileen Smith, program VP for data & analytics at IDC, said cloud is dominating spending in the tech sector across infrastructure, platforms and applications. She wrote:

“Cloud now dominates tech spending across infrastructure, platforms, and applications. Most organizations have adopted the public cloud as a cost-effective platform for hosting enterprise applications and for developing and deploying customer-facing solutions. Looking forward, the cloud model remains incredibly well positioned to serve customer needs for innovation in application development and deployment, including as data, artificial intelligence/machine learning (AI/ML), and edge needs continue to define the forefront of innovation.”

Of the 28 industries* covered in the IDC Spending Guide, the three largest in 2027 – Banking, Software and Information Services, and Telecommunications – will together represent $326 billion in public cloud services spending.

IDC forecasts that software-as-a-service (SaaS) applications to be the largest cloud computing category, garnering about 40% of all public cloud spending. Next largest is infrastructure as a service (IaaS) with a CAGR of 23.5%, followed by platform as a service (PaaS) with a five-year CAGR of 27.2%. SaaS – system infrastructure software (SIS) is forecast to be the smallest category of cloud spending, cornering about 15% of the market.

…………………………………………………………………………………………………………………….

References:

https://www.idc.com/getdoc.jsp?containerId=prUS51179523

https://www.idc.com/getdoc.jsp?containerId=IDC_P33214

IDC: Public Cloud software at 2/3 of all enterprise applications revenue in 2026; SaaS is essential!

https://techblog.comsoc.org/2022/02/09/gartner-accelerated-move-to-public-cloud-to-overtake-traditional-it-spending-in-2025/

IDC: Worldwide Public Cloud Services Revenues Grew 29% to $408.6 Billion in 2021 with Microsoft #1?

Cloud infrastructure services market grows; AI will be a major driver of future cloud service provider investments

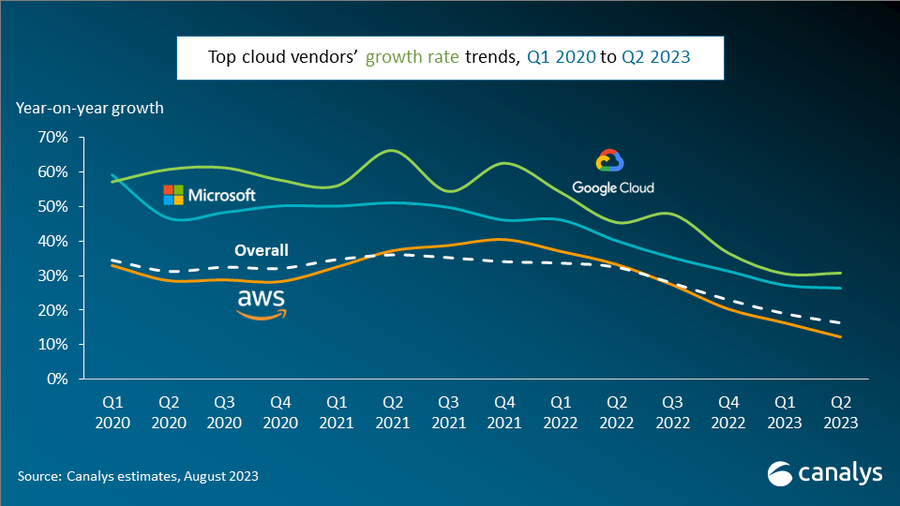

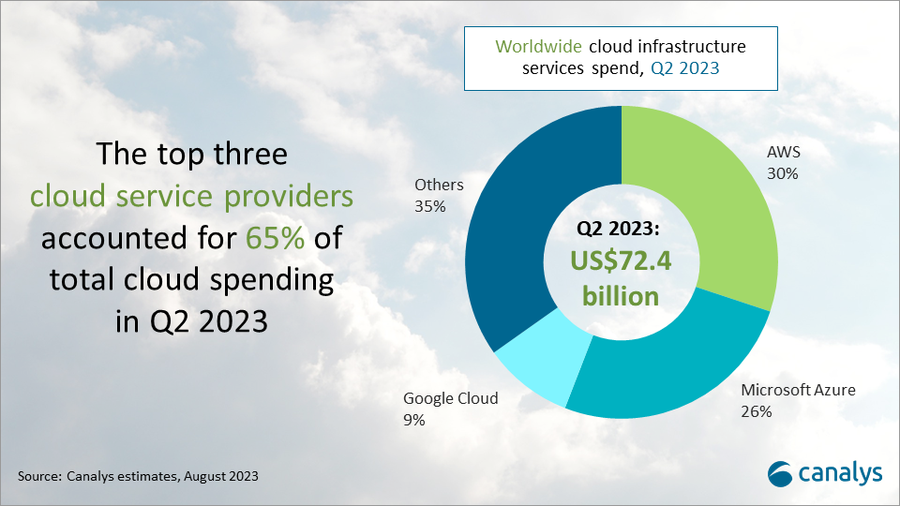

According to Canalys, worldwide cloud infrastructure services spending increased 16% to $72.4 billion in Q2 2023. This growth rate represents a decline against the previous quarter’s 19%, as the market feels the effect of spending pressures, though slower growth is also a consequence of the market’s greater size. In Q2 2023, the top three vendors, AWS, Microsoft Azure and Google Cloud, collectively grew 20% – down from 22% in Q1 – to account for 65% of total spending. While AWS and Microsoft both saw a deceleration in growth, Google Cloud’s growth rate remained stable compared with the previous quarter, at 31%.

The cloud infrastructure services market is feeling the impact of pressure on customer spending, the analyst firm noted, but pointed out that the slower growth is also a result of the increased size of the market.

Although AI hasn’t yet had a meaningful impact on revenues, there is plenty of cause for optimism. Canalys says AI represents a major driver of cloud investment in the future, and all the major cloud vendors continue to invest heavily in AI technologies. However, cloud service providers will have to be selective when deciding who to partner with in this market.

In the current business landscape, where emphasis is placed on cost control, cloud vendors must secure a significant influx of new customers and workloads to drive revenue growth. The emergence of AI technology is introducing new cloud workloads and is set to fuel massive demand for computing capacity, creating new opportunities for cloud growth. Notably in this quarter, both AWS and Microsoft launched new AI-oriented partner programs, recognizing the importance of collaborating with partners to drive customers’ use of their AI products.

“The most common collaboration model involves partners contributing their industry expertise, business process knowledge and data analytics experience within relationships,” said Yi Zhang, Research Analyst at Canalys. “Cloud providers, in turn, offer partners early exposure to their emerging technologies and provide technical support.”

“In the meantime, vendors need to separate the wheat from the chaff when it comes to driving their AI strategies through partners,” said Alex Smith, VP at Canalys. “That means focusing on partners that are building service practices around AI, engaging in sales and marketing initiatives that focus on AI, producing original thought leadership and compelling case studies around AI applications, and selling solutions that are embedded with AI capabilities. It’s these partners that will assume a leading role in steering companies toward being leaders in this field.”

Amazon Web Services (AWS) continued to lead the cloud infrastructure services market in Q2 2023, accounting for 30% of total spend, an increase of 12% year on year. AWS’s growth has more than halved since the same period last year. In the face of subdued revenue growth, AWS is actively increasing its investments in AI. It invested US$100 million in a new generative AI program, which was launched in June 2023. As part of the program, the AWS Generative AI Innovation Center will serve as a hub for free workshops and training and is expected to help enterprises accelerate the development of generative AI-based applications while connecting AWS’ technology with customers and partners. Recent announcements from AWS reveal that thousands of customers are engaging with its new AI service and, concurrently, AWS has established new partnerships with Omnicom and 3M Health Information Systems.

Microsoft Azure accounted for 26% of the market after growing 26% annually, positioning it as the second-largest cloud service provider in Q2 2023. Business performance is expected to remain steady, given the 19% increase in its cloud order backlog, which reached US$224 billion in Q2 2023. It has seen significant momentum in its Azure OpenAI Service, winning noteworthy clients including Ikea, Volvo Group and Zurich Insurance. In light of the projected surge in AI demand, it introduced the Microsoft AI Cloud Partner Program during its global partner event, Microsoft Inspire 2023. This aims to encourage Microsoft’s partner ecosystem to develop solutions that use Microsoft’s AI technology. Microsoft aims to ensure a smooth transition for its existing partners, automatically enrolling them in the new program while retaining their previous benefits and designations.

Google Cloud grew 31% year on year in Q2 2023, the strongest growth of the top three hyperscalers, to capture 9% of the cloud market. Its approach to extending the depreciation period for servers and network equipment helped control operating costs and bolstered Google Cloud’s profitability. Google Cloud’s partner ecosystem continues to provide support in the development of its generative AI applications. Hundreds of ISVs and SaaS providers, including Box, Salesforce and Snorkel, along with GSIs, have committed to training over 150,000 individuals on Google Cloud’s Generative AI. Google Cloud claims to command the allegiance of over 70% of burgeoning tech startups that specialize in generative AI. This roster features standout names such as Cohere, Jasper and Typeface, exemplifying the trust startups place in Google Cloud’s AI capabilities.

Canalys defines cloud infrastructure services as those services that provide infrastructure-as-a-service and platform-as-a-service, either on dedicated hosted private infrastructure or shared public infrastructure. This excludes software-as-a-service expenditure directly but includes revenue generated from the infrastructure services being consumed to host and operate them.

For more information, please contact:

Alex Smith: [email protected]

Yi Zhang: [email protected]

References:

https://canalys.com/newsroom/global-cloud-services-q2-2023

Canalys: Cloud marketplace sales to be > $45 billion by 2025

Global Cloud VPN Market Report: Rising Demand for Cloud-based Security Services

Synergy & IDC: Hosted and Cloud Services are driving the Unified Communications & Collaboration Markets

Forbes: Cloud is a huge challenge for enterprise networks; AI adds complexity

IDC: Cloud Infrastructure Spending +13.5% YoY in 4Q-2021 to $21.1 billion; Forecast CAGR of 12.6% from 2021-2026

Strong growth for global cloud infrastructure spending by hyperscalers and enterprise customers

Forbes: Cloud is a huge challenge for enterprise networks; AI adds complexity

Survey data and discussions with enterprise networking professionals reveal they are still grappling with many networking issues spawned by the expansion of the cloud – the most common of which include securing connections for remote work, implementing zero-trust security strategies, and integrating myriad cloud and wide-area networks (WANs).

For example, in Futuriom’s latest survey of 196 enterprise IT and networking professionals, more than 80% said the complexity of connecting the wide variety of networks was a large challenge. At nearly 70% of responses, expertise and knowledge was the second-largest challenge (multiple responses were allowed), and cost was cited by 60%. Please refer to survey highlights below.

Contributing to that complexity is the ephemeral nature of both cloud connectivity and hybrid work. Workers are now moving around more than ever, and cloud services can change and scale nearly every day (or minute).

Survey Highlights:

- Survey respondents indicate strong demand for SD-WAN and SASE managed services. Our survey data and discussions with end users indicate that SD-WAN/SASE technology helps professionals with network and security challenges, including the growing complexity created by distributed applications, cloud connectivity, and sprawling security risks.

- Managing network complexity is the largest challenge driving managed services demand. When asked about the largest challenges in managing WANs, 85% of respondents identified complexity, followed by expertise and knowledge (68%). Rounding out the responses were cost (60%) and time (47%). (Multiple responses were allowed.)

- Hybrid work and the need for zero-trust network access (ZTNA) are key drivers of SD-WAN/SASE technology. In the survey, 98% of respondents said that hybrid work has increased demand for SASE and ZTNA. When we asked respondents if ZTNA is a crucial component of SASE and SD-WAN offerings, 92% said yes.

- Hybrid (cloud/edge deployment) and single-pass architectures will be important components of SASE/SD-WAN services going forward. When respondents were asked if they wanted a hybrid solution that can accommodate networking and security both on premises and using cloud points of presence (PoPs), 98% said yes. In addition, 94% of respondents said they prefer a single-pass architecture.

- There will continue to be a diversity of SD-WAN/SASE deployment models. The two most popular models for deployment are best-of-breed combination (34%) and single-vendor (23%), but survey results show a wide diversity of deployment models.

AI increases complexity as enterprises need to figure out how to store, connect, and move their data in hybrid clouds that will leverage AI.

This complexity, along with the rapid shift to hybrid work spurred by COVID, has triggered a wave of innovation in networking – perhaps more innovation than we have seen in decades. Startups are drawing large funding rounds. Best-of-breed established networking players such as Arista Networks, Extreme Networks, Juniper Networks, and HPE are building new networking and security products and chipping away at the market share of market leader Cisco. Cisco is responding in kind. Sources tell me they think Cisco’s acquisition of Valtix may be the most interesting in years.

All of this sets the stage for the most dynamic networking environment I’ve seen in decades. And it’s only going to get more interesting, as the AI and hybrid work wave makes networking more crucial.

The melding of security and networking remains hot. In the software-defined networking (SD-WAN) and Secure Access Service Edge market, potential Initial Public Offering (IPO) companies such as Aryaka Networks, Cato Networks, and Versa Networks are building our product suites to help secure remote workers and cloud connectivity. These companies will also help enterprises connect to cloud on-ramps and consolidate security functions with a SASE approach. Versa last October tanked up with $120 in funding in what it called a “pre-IPO round.”

Many of the cloud networking startups that are included in the Futuriom 50 list of promising cloud innovators are using this chaotic moment to shore up strategies, raise money — or both.

For example, just this week, cloud-native networking start-up Arrcus announced that Hitachi Ventures would invest additional capital, raising its Series D to $65 million before it closes. Arrcus says its Arrcus Connected Edge (ACE) platform will be more economical for cloud providers and service providers deploying services such as 5G and AI. It claims it is growing revenue 100% year-over-year.

Other cloud networking startups are also going after AI. DriveNets recently announced that its Network Cloud-AI solution, which uses cloud-based Ethernet-based networking to boost the performance of AI clouds, is in trials with major hyperscalers.

Cost optimization, one of the strongest themes of the year in cloud technology, is another focus for cloud networking players. Cloud networking pioneer Aviatrix has beefed up security and cost-optimization features and launched a distributed firewall to help enterprises reduce the costs of cloud networking infrastructure. Prosimo last week made an interesting play to get its application-layer cloud networking suite in the hands of more users by launching a free, introductory-level version of its product called MCN Foundation.

Yes, there is a trend to all these announcements. They are focused on return on investment (ROI) and cost savings. This is the right message for the era we are in. Enterprise tech planners not only want to shift to more flexible cloud-based services, they need to do so to save money.

For example, in its new product release, Prosimo said customers can achieve a 30%-50% reduction in total cost of ownership (TCO) by optimizing cloud network connectivity. With its distributed firewall, Aviatrix says network pros will save money by reducing the expense of additional firewall instances, which many enterprises must buy to support additional cloud connectivity and scaling. (But they may not want to stack firewall upon firewall into the cloud, which after all can function as a firewall itself.) DriveNets says its trials have reduced the idle time of AI clouds by as much as 30%.

Integrating all of this stuff isn’t easy either. That’s the value proposition of Itential, a plucky Georgia-based startup with a set of low-code automation tools that streamline networking for integrations in hybrid networking and cloud environments.

It’s no coincidence that the marketing messages have all shifted toward ROI, which is the mother’s milk of technology. It’s the reason we all use cloud-based software-as-a-service and iPhones instead of minicomputers and rotary dial phones. Innovation is about efficiency.

This makes me very optimistic about cloud networking – and the networking market in general. After decades of stagnation, the cloud has woken up the industry. In addition to innovation, there is also a surge in competition — which will put more efficient and affordable technology into the hands of the users.

References:

Networking Startups Jump On Cloud Costs And AI (forbes.com)

https://www.futuriom.com/articles/news/results-from-our-sd-wan-sase-managed-services-survey/2023/06

Generative AI in telecom; ChatGPT as a manager? ChatGPT vs Google Search

Generative AI could put telecom jobs in jeopardy; compelling AI in telecom use cases

Allied Market Research: Global AI in telecom market forecast to reach $38.8 by 2031 with CAGR of 41.4% (from 2022 to 2031)

Canalys: Cloud marketplace sales to be > $45 billion by 2025

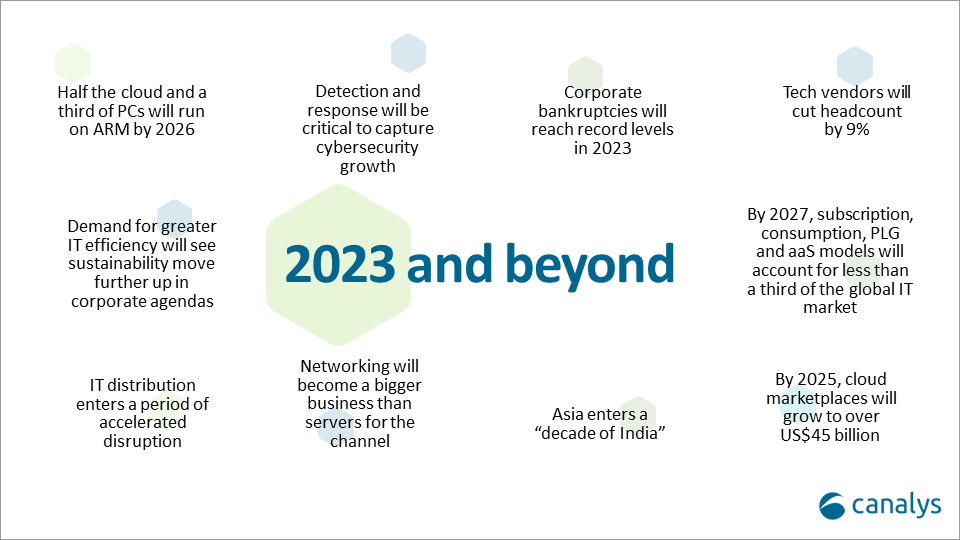

Canalys now expects that by 2025, cloud marketplaces will grow to more than $45 billion, representing an 84% CAGR. That was one of the market research firm’s predictions for 2023 and beyond (see chart below).

Cloud marketplaces [1.] are accelerating as a route to market for technology, led by hyperscale cloud vendors such as Alibaba, Amazon Web Services, Microsoft, Google and Salesforce, which are pouring billions of development dollars into the sector.

Note 1. A cloud marketplace is an online storefront operated by a cloud service provider. A cloud marketplace provides customers with access to software applications and services that are built on, integrate with or complement the cloud service provider’s offerings. A marketplace typically provides customers with native cloud applications and approved apps created by third-party developers. Applications from third-party developers not only help the cloud provider fill niche gaps in its portfolio and meet the needs of more customers, but they also provide the customer with peace of mind by knowing that all purchases from the vendor’s marketplace will integrate with each other smoothly.

…………………………………………………………………………………………………………………………………………………………………….

“The marketplace route to market is on fire and cannot be ignored by any channel leader,” said Canalys Chief Analyst, Jay McBain. “Marketplaces grew more in the first three months of the pandemic than in the previous decade and have just kept growing,” he added.

“We under-called it,” explained Steven Kiernan, vice president at Canalys. “Cloud marketplaces are accelerating at such a dizzying speed that we’ve doubled our pre-pandemic forecast.

Some software vendors that are active on marketplaces, in particular cybersecurity vendors, are publicly reporting as much as 600% year-on-year growth via this channel, according to McBain.

In addition, the hyperscalers are now reporting growing numbers of billion-dollar customer commitments through enterprise cloud consumption credits, which cover more than just software.

The large cloud marketplaces have lowered fees from upwards of 20% down to 3%, enabling vendors to fund multi-partner offers inside the transaction.

Private equity is funding billions more into marketplace development firms such as AppDirect, Mirakl, Vendasta and CloudBlue to enable hundreds of niche marketplaces across different buyers, industries, geographies, customer segments, product areas and business models.

Canalys Chief Analyst, Alastair Edwards:

“The rise of this route to market represents a threat to both resellers and two-tier distribution. But as more complex technologies are consumed via marketplaces, end customers are also turning to trusted partners to help them discover, procure and manage marketplace purchases. The hyperscalers are increasingly recognizing the value of channel partners, allowing them to create customized vendor offers for end-customers, and supporting the flow of channel margins through their marketplaces. Hyperscalers’ cloud marketplaces are becoming a growing force in global IT distribution as a result.”

By 2025, Canalys conservatively forecasts that almost a third of marketplace procurement will be done via channel partners on behalf of their end customers.

Canalys key predictions for 2023 and beyond:

About Canalys:

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

References:

https://canalys.com/newsroom/cloud-marketplace-forecast-2023

https://www.canalys.com/resources/Canalys-outlook-2023-predictions-for-the-technology-industry

https://www.techtarget.com/searchitchannel/definition/cloud-marketplace

Canalys: Global cloud services spending +33% in Q2 2022 to $62.3B

AWS, Microsoft Azure, Google Cloud account for 62% – 66% of cloud spending in 1Q-2022

IDC: Cloud Infrastructure Spending +13.5% YoY in 4Q-2021 to $21.1 billion; Forecast CAGR of 12.6% from 2021-2026