Cloud Native

Telco and IT vendors pursue AI integrated cloud native solutions, while Nokia sells point products

The move to AI and cloud native is accelerating amongst network equipment and IT vendors which have announced highly integrated smart cloud solutions designed to migrate their telco customers into a new and profitable cloud future. The Cloud Native Computing Foundation (CNCF), as the name suggests, is a vendor-neutral consortium dedicated to making cloud native ubiquitous. The group defines cloud native as a collection of “technologies [that] empower organizations to build and run scalable applications in modern, dynamic environments such as public, private and hybrid clouds. Containers, service meshes, microservices, immutable infrastructure and declarative APIs exemplify this approach.”

CNCF writes that the cloud native approach “enable[s] loosely coupled systems that are resilient, manageable and observable. Combined with robust automation, they allow engineers to make high-impact changes frequently and predictably with minimal toll.”

In particular, Ericsson, HPE/Juniper, Cisco, Huawei, ZTE, IBM, and Dell have all announced telco end to end solutions that provide a platform for new services and applications by integrating AI, automation, orchestration and APIs over cloud-native based infrastructure. Let’s look at each of those capabilities:

- AI (Artificial Intelligence): Leveraging AI capabilities allows telcos to automate processes, optimize network performance, and enhance customer experiences. By analyzing vast amounts of data, AI-driven insights enable better decision-making and predictive maintenance.

- Automation: Automation streamlines operations, reduces manual intervention, and accelerates service delivery. Whether it’s provisioning new network resources, managing security protocols, or handling routine tasks, automation plays a pivotal role in modern telco infrastructure.

- Orchestration: Orchestration refers to coordinating and managing various network functions and services. It ensures seamless interactions between different components, such as virtualized network functions (VNFs) and physical infrastructure. By orchestrating these elements, telcos achieve agility and flexibility.

- APIs (Application Programming Interfaces): APIs facilitate communication between different software components. In the telco context, APIs enable interoperability, allowing third-party applications to interact with telco services. This openness encourages innovation and the development of new applications.

- Cloud-Native Infrastructure: Moving away from traditional monolithic architectures, cloud-native infrastructure embraces microservices, containerization, and scalability. Telcos are adopting cloud-native principles to build resilient, efficient, and adaptable networks.

While each company has its unique approach, the overarching goal is to empower telcos to deliver cutting-edge services, enhance network performance, and stay competitive in an ever-evolving industry. These advancements pave the way for exciting possibilities in the telecommunications landscape. When fully integrated, these technologies will enable the creation of smart cloud networks that can run themselves without human involvement and do so less expensively — but also more efficiently, responsively and securely than anything that exists today.

Our esteemed UK colleague Stephen M Saunders, MBE (Member of the Order of the British Empire– more below) notes that Nokia is not embracing smart cloud telco solutions, but is instead focusing on individual products. Last October, the company announced strategic and operational changes to its business model and divided the company into four business units. At that time, Nokia’s President and CEO Pekka Lundmark said:

“We continue to believe in the mid to long term attractiveness of our markets. Cloud Computing and AI revolutions will not materialize without significant investments in networks that have vastly improved capabilities. However, while the timing of the market recovery is uncertain, we are not standing still but taking decisive action on three levels: strategic, operational and cost. First, we are accelerating our strategy execution by giving business groups more operational autonomy. Second, we are streamlining our operating model by embedding sales teams into the business groups and third, we are resetting our cost-base to protect profitability. I believe these actions will make us stronger and deliver significant value for our shareholders.”

Steve says Nokia’s new divide-and-conquer strategy is being reinforced at its sales meetings, according to an attendee at one such gathering this year, with sales reps being urged to laser-focus on selling point products.

“The telco capex situation at the moment means Nokia — and others — have no choice but to examine every aspect of their business to work out how to adjust for a future CSP market that is itself going through dramatic change,” said Jeremiah Caron, global head of research and analysis at market research firm GlobalData Technology.

Most telcos are increasingly adopting cloud-native technologies to meet the demands of 5G SA core networks and to better automate their services.. However, some telcos are hesitant to fully embrace cloud-native due to concerns about complexity, cost, and reliability. Other challenges of cloud native are: changing the software development life cycle, privacy and security, guaranteeing end to end latency, and cloud vendor lock-in due to a lack of standards (every cloud vendor has their own proprietary APIs and network access configurations.

References:

https://www.silverliningsinfo.com/multi-cloud/report-smart-cloud-and-coming-paradigm-shift

https://www.fiercewireless.com/5g/op-ed-whither-nokia

Building and Operating a Cloud Native 5G SA Core Network

Omdia and Ericsson on telco transitioning to cloud native network functions (CNFs) and 5G SA core networks

https://www.ericsson.com/en/ran/intelligent-ran-automation/intelligent-automation-platform

https://www.huaweicloud.com/intl/en-us/solution/telecom/cloud-native-development-platform.html

https://sdnfv.zte.com.cn/en/solutions/VNF/5G-core-network/cloud-native

https://www.ibm.com/products/cloud-pak-for-network-automation

https://www.dell.com/en-us/dt/industry/telecom/index.htm#tab0=0

Steve Saunders (a.k.a. Silverlinings‘ Sky Captain), is a British-born communications analyst, investor, and digital media entrepreneur. In 2018 he was awarded an MBE in the Queen’s Birthday Honours List for services to the telecommunications industry and business.

Forbes: Cloud is a huge challenge for enterprise networks; AI adds complexity

Survey data and discussions with enterprise networking professionals reveal they are still grappling with many networking issues spawned by the expansion of the cloud – the most common of which include securing connections for remote work, implementing zero-trust security strategies, and integrating myriad cloud and wide-area networks (WANs).

For example, in Futuriom’s latest survey of 196 enterprise IT and networking professionals, more than 80% said the complexity of connecting the wide variety of networks was a large challenge. At nearly 70% of responses, expertise and knowledge was the second-largest challenge (multiple responses were allowed), and cost was cited by 60%. Please refer to survey highlights below.

Contributing to that complexity is the ephemeral nature of both cloud connectivity and hybrid work. Workers are now moving around more than ever, and cloud services can change and scale nearly every day (or minute).

Survey Highlights:

- Survey respondents indicate strong demand for SD-WAN and SASE managed services. Our survey data and discussions with end users indicate that SD-WAN/SASE technology helps professionals with network and security challenges, including the growing complexity created by distributed applications, cloud connectivity, and sprawling security risks.

- Managing network complexity is the largest challenge driving managed services demand. When asked about the largest challenges in managing WANs, 85% of respondents identified complexity, followed by expertise and knowledge (68%). Rounding out the responses were cost (60%) and time (47%). (Multiple responses were allowed.)

- Hybrid work and the need for zero-trust network access (ZTNA) are key drivers of SD-WAN/SASE technology. In the survey, 98% of respondents said that hybrid work has increased demand for SASE and ZTNA. When we asked respondents if ZTNA is a crucial component of SASE and SD-WAN offerings, 92% said yes.

- Hybrid (cloud/edge deployment) and single-pass architectures will be important components of SASE/SD-WAN services going forward. When respondents were asked if they wanted a hybrid solution that can accommodate networking and security both on premises and using cloud points of presence (PoPs), 98% said yes. In addition, 94% of respondents said they prefer a single-pass architecture.

- There will continue to be a diversity of SD-WAN/SASE deployment models. The two most popular models for deployment are best-of-breed combination (34%) and single-vendor (23%), but survey results show a wide diversity of deployment models.

AI increases complexity as enterprises need to figure out how to store, connect, and move their data in hybrid clouds that will leverage AI.

This complexity, along with the rapid shift to hybrid work spurred by COVID, has triggered a wave of innovation in networking – perhaps more innovation than we have seen in decades. Startups are drawing large funding rounds. Best-of-breed established networking players such as Arista Networks, Extreme Networks, Juniper Networks, and HPE are building new networking and security products and chipping away at the market share of market leader Cisco. Cisco is responding in kind. Sources tell me they think Cisco’s acquisition of Valtix may be the most interesting in years.

All of this sets the stage for the most dynamic networking environment I’ve seen in decades. And it’s only going to get more interesting, as the AI and hybrid work wave makes networking more crucial.

The melding of security and networking remains hot. In the software-defined networking (SD-WAN) and Secure Access Service Edge market, potential Initial Public Offering (IPO) companies such as Aryaka Networks, Cato Networks, and Versa Networks are building our product suites to help secure remote workers and cloud connectivity. These companies will also help enterprises connect to cloud on-ramps and consolidate security functions with a SASE approach. Versa last October tanked up with $120 in funding in what it called a “pre-IPO round.”

Many of the cloud networking startups that are included in the Futuriom 50 list of promising cloud innovators are using this chaotic moment to shore up strategies, raise money — or both.

For example, just this week, cloud-native networking start-up Arrcus announced that Hitachi Ventures would invest additional capital, raising its Series D to $65 million before it closes. Arrcus says its Arrcus Connected Edge (ACE) platform will be more economical for cloud providers and service providers deploying services such as 5G and AI. It claims it is growing revenue 100% year-over-year.

Other cloud networking startups are also going after AI. DriveNets recently announced that its Network Cloud-AI solution, which uses cloud-based Ethernet-based networking to boost the performance of AI clouds, is in trials with major hyperscalers.

Cost optimization, one of the strongest themes of the year in cloud technology, is another focus for cloud networking players. Cloud networking pioneer Aviatrix has beefed up security and cost-optimization features and launched a distributed firewall to help enterprises reduce the costs of cloud networking infrastructure. Prosimo last week made an interesting play to get its application-layer cloud networking suite in the hands of more users by launching a free, introductory-level version of its product called MCN Foundation.

Yes, there is a trend to all these announcements. They are focused on return on investment (ROI) and cost savings. This is the right message for the era we are in. Enterprise tech planners not only want to shift to more flexible cloud-based services, they need to do so to save money.

For example, in its new product release, Prosimo said customers can achieve a 30%-50% reduction in total cost of ownership (TCO) by optimizing cloud network connectivity. With its distributed firewall, Aviatrix says network pros will save money by reducing the expense of additional firewall instances, which many enterprises must buy to support additional cloud connectivity and scaling. (But they may not want to stack firewall upon firewall into the cloud, which after all can function as a firewall itself.) DriveNets says its trials have reduced the idle time of AI clouds by as much as 30%.

Integrating all of this stuff isn’t easy either. That’s the value proposition of Itential, a plucky Georgia-based startup with a set of low-code automation tools that streamline networking for integrations in hybrid networking and cloud environments.

It’s no coincidence that the marketing messages have all shifted toward ROI, which is the mother’s milk of technology. It’s the reason we all use cloud-based software-as-a-service and iPhones instead of minicomputers and rotary dial phones. Innovation is about efficiency.

This makes me very optimistic about cloud networking – and the networking market in general. After decades of stagnation, the cloud has woken up the industry. In addition to innovation, there is also a surge in competition — which will put more efficient and affordable technology into the hands of the users.

References:

Networking Startups Jump On Cloud Costs And AI (forbes.com)

https://www.futuriom.com/articles/news/results-from-our-sd-wan-sase-managed-services-survey/2023/06

Generative AI in telecom; ChatGPT as a manager? ChatGPT vs Google Search

Generative AI could put telecom jobs in jeopardy; compelling AI in telecom use cases

Allied Market Research: Global AI in telecom market forecast to reach $38.8 by 2031 with CAGR of 41.4% (from 2022 to 2031)

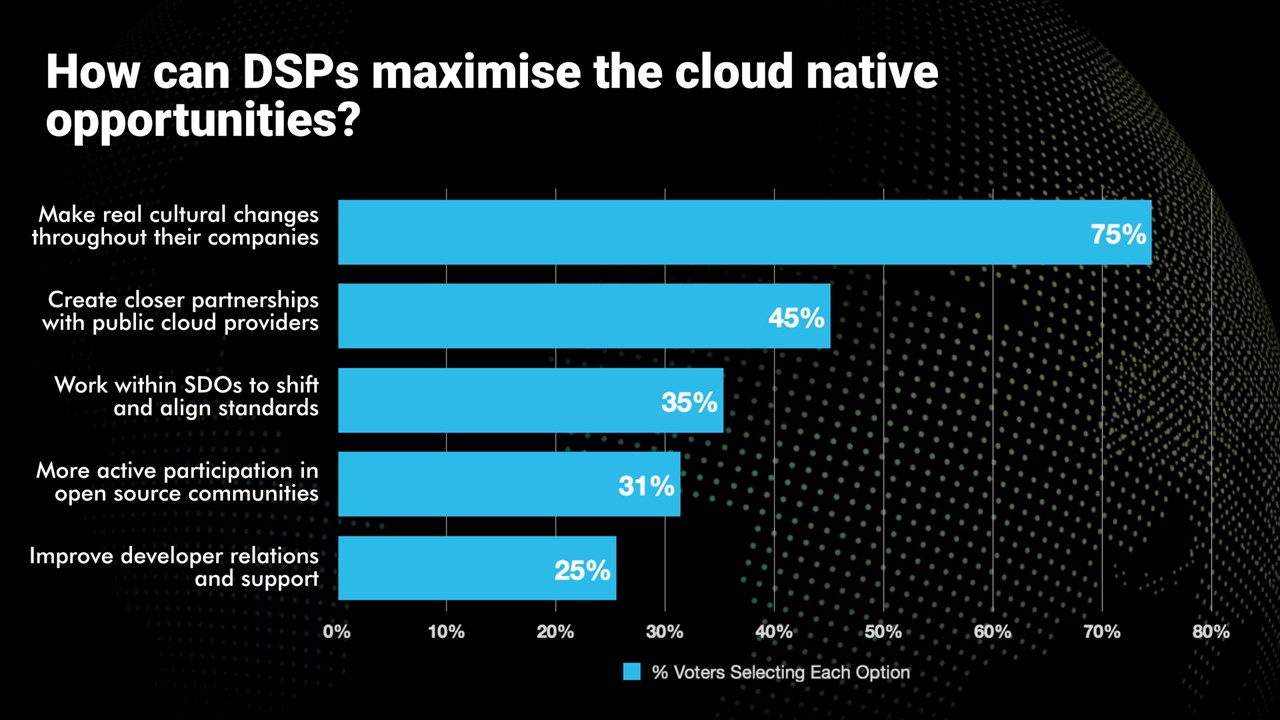

Telecom TV Poll: How to maximize cloud-native opportunities?

The adoption of cloud-native methodologies, processes and tools has been a challenge for communications service providers (CSPs), aka telcos or network operators.

- Telcos are embracing cloud-native processes and tools

- It’s part of their evolution towards being digital service providers

- But the cloud-native journey is still in its early stages

- Real cultural change is needed if telcos are to capitalise fully on the cloud-native opportunities

Alongside a a session, Why cloud native is essential to delivering the automation, agility and innovation needed to support new services, at Telco TV’s DSP Leaders World Forum event in Windsor, UK, a poll was taken. The following question was asked, “How can Digital Service Providers maximize the cloud-native opportunities?” Respondents were able to select all the options they deemed relevant. Here are the results:

Please check out the upcoming Cloud Native Telco Summit session on cloud-native application development to see what the industry experts have to say.

Omdia and Ericsson on telco transitioning to cloud native network functions (CNFs) and 5G SA core networks

Huawei Connect 2022: It’s Cloud Native everything!

Cloud RAN with Google Distributed Cloud Edge; Strategy: host network functions of other vendors on Google Cloud

At MWC 2023 Barcelona, Google Cloud announced that they can now run the radio access network (RAN) functions as software on Google Distributed Cloud Edge, providing communications service providers (CSPs- AKA telcos) with a common and agile operating model that extends from the core of the network to the edge, for a high degree of programmability, flexibility, and low operating expenses. CSPs have already embraced open architecture, open-source software, disaggregation, automation, cloud, AI and machine learning, and new operational models, to name a few. The journey started in the last decade with Network Functions Virtualization, primarily with value added services and then deeper with core network applications, and in the past few years, that evolved into a push towards cloud-native. With significant progress in the core, the time for Cloud RAN is now, according to Google. However, whether for industry or region-specific compliance reasons, data sovereignty needs, or latency or local data-processing requirements, most of the network functions deployed in a mobile or wireline network may have to follow a hybrid deployment model where network functions are placed flexibly in a combination of both on-premises and cloud regions. RAN, which is traditionally implemented with proprietary hardware, falls into that camp as well.

In 2021,the company launched Google Distributed Cloud Edge (GDC Edge), an on-premises offering that extends a consistent operating model from our public Google Cloud regions to the customer’s premises. For CSPs, this hybrid approach makes it possible to modernize the network, while enabling easy development, fast innovation, efficient scale and operational efficiency; all while simultaneously helping to reduce technology risk and operational costs. GDC Edge became generally available in 2022.

Google Cloud does not plan to develop its own private wireless networking services to sell to enterprise customers, nor does the company plan to develop its own networking software functions, according to Gabriele Di Piazza, an executive with Google Cloud who spoke at MWC 2023 in Barcelona. Instead, Google Cloud would like to host the networking software functions of other vendors like Ericsson and Mavenir in its cloud. It would also like to resell private networking services from operators and others.

Rather than develop its own cloud native 5G SA core network or other cloud networking software (like Microsoft and AWS are doing), Google Cloud wants to “avoid partner conflict,” Di Piazza said. Google has been building its telecom cloud story around its Anthos platform. That platform is directly competing against the likes of AWS and Microsoft for telecom customers. According to a number of analysts, AWS appears to enjoy an early lead in the telecom industry – but its rivals, like Google, are looking for ways to gain a competitive advantage. One of Google’s competitive arguments is that it doesn’t have aspirations to sell network functions. Therefore, according to Di Piazza, the company can remain a trusted, unbiased partner.

Image Credit: Google Cloud

Last year, the executive said that moving to a cloud-native architecture is mandatory, not optional for telcos, adding that telecom operators are facing lots of challenges right now due to declining revenue growth, exploding data consumption and increasing capital requirements for 5G. Cloud-native networks have significant challenges. For example, there is a lack of standardization among the various open-source groups and there’s fragmentation among parts of the cloud-native ecosystem, particularly among OSS vendors, cloud providers and startups.

In recent years, Google, Microsoft, Amazon, Oracle and other cloud computing service providers have been working to develop products and services that are specifically designed to allow telecom network operator’s to run their network functions inside a third-party cloud environment. For example, AT&T and Dish Network are running their 5G SA core networks on Microsoft Azure and AWS, respectively.

Matt Beal, a senior VP of software development for Oracle Communications, said his company offers both a substantial cloud computing service as well as a lengthy list of network functions. He maintains that Oracle is a better partner for telecom network operators because of it. Beal said Oracle has long offered a wide range of networking functions, from policy control to network slice management, that can be run inside its cloud or inside the cloud of other companies. He said that, because Oracle developed those functions itself, the company has more experience in running them in a cloud environment compared with a company that hasn’t done that kind of work. Beal’s inference is that network operators ought to partner with the best and most experienced companies in the market. That position runs directly counter to Google’s competitive stance on the topic. “When you know how these things work in real life … you can optimize your cloud to run these workloads,” he said.

While a number of other telecom network operators have put things like customer support or IT into the cloud, they have been reluctant to release critical network functions like policy control to a cloud service provider.

References:

https://cloud.google.com/solutions/telecommunications

https://cloud.google.com/blog/topics/telecommunications

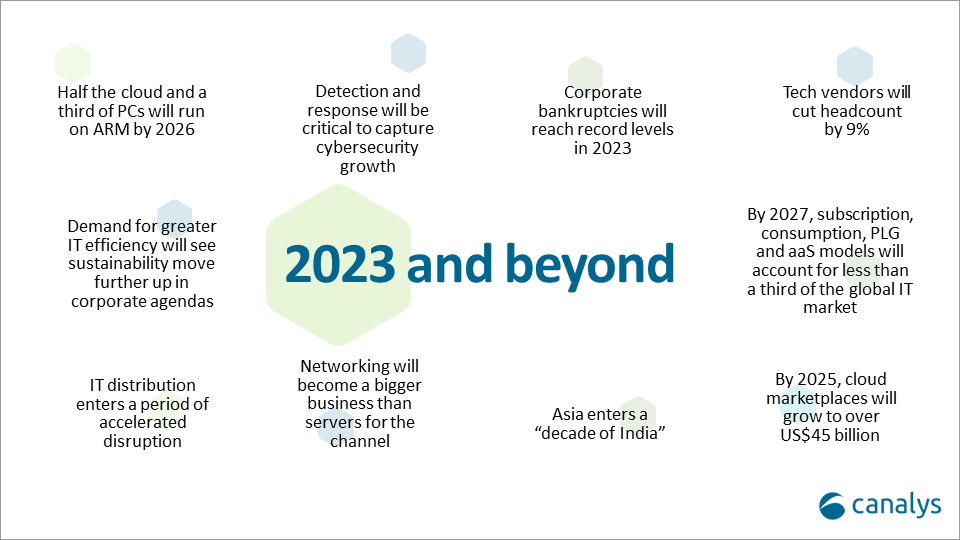

Canalys: Cloud marketplace sales to be > $45 billion by 2025

Canalys now expects that by 2025, cloud marketplaces will grow to more than $45 billion, representing an 84% CAGR. That was one of the market research firm’s predictions for 2023 and beyond (see chart below).

Cloud marketplaces [1.] are accelerating as a route to market for technology, led by hyperscale cloud vendors such as Alibaba, Amazon Web Services, Microsoft, Google and Salesforce, which are pouring billions of development dollars into the sector.

Note 1. A cloud marketplace is an online storefront operated by a cloud service provider. A cloud marketplace provides customers with access to software applications and services that are built on, integrate with or complement the cloud service provider’s offerings. A marketplace typically provides customers with native cloud applications and approved apps created by third-party developers. Applications from third-party developers not only help the cloud provider fill niche gaps in its portfolio and meet the needs of more customers, but they also provide the customer with peace of mind by knowing that all purchases from the vendor’s marketplace will integrate with each other smoothly.

…………………………………………………………………………………………………………………………………………………………………….

“The marketplace route to market is on fire and cannot be ignored by any channel leader,” said Canalys Chief Analyst, Jay McBain. “Marketplaces grew more in the first three months of the pandemic than in the previous decade and have just kept growing,” he added.

“We under-called it,” explained Steven Kiernan, vice president at Canalys. “Cloud marketplaces are accelerating at such a dizzying speed that we’ve doubled our pre-pandemic forecast.

Some software vendors that are active on marketplaces, in particular cybersecurity vendors, are publicly reporting as much as 600% year-on-year growth via this channel, according to McBain.

In addition, the hyperscalers are now reporting growing numbers of billion-dollar customer commitments through enterprise cloud consumption credits, which cover more than just software.

The large cloud marketplaces have lowered fees from upwards of 20% down to 3%, enabling vendors to fund multi-partner offers inside the transaction.

Private equity is funding billions more into marketplace development firms such as AppDirect, Mirakl, Vendasta and CloudBlue to enable hundreds of niche marketplaces across different buyers, industries, geographies, customer segments, product areas and business models.

Canalys Chief Analyst, Alastair Edwards:

“The rise of this route to market represents a threat to both resellers and two-tier distribution. But as more complex technologies are consumed via marketplaces, end customers are also turning to trusted partners to help them discover, procure and manage marketplace purchases. The hyperscalers are increasingly recognizing the value of channel partners, allowing them to create customized vendor offers for end-customers, and supporting the flow of channel margins through their marketplaces. Hyperscalers’ cloud marketplaces are becoming a growing force in global IT distribution as a result.”

By 2025, Canalys conservatively forecasts that almost a third of marketplace procurement will be done via channel partners on behalf of their end customers.

Canalys key predictions for 2023 and beyond:

About Canalys:

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

References:

https://canalys.com/newsroom/cloud-marketplace-forecast-2023

https://www.canalys.com/resources/Canalys-outlook-2023-predictions-for-the-technology-industry

https://www.techtarget.com/searchitchannel/definition/cloud-marketplace

Canalys: Global cloud services spending +33% in Q2 2022 to $62.3B

AWS, Microsoft Azure, Google Cloud account for 62% – 66% of cloud spending in 1Q-2022

IDC: Cloud Infrastructure Spending +13.5% YoY in 4Q-2021 to $21.1 billion; Forecast CAGR of 12.6% from 2021-2026

Omdia and Ericsson on telco transitioning to cloud native network functions (CNFs) and 5G SA core networks

Introduction:

Telco cloud has evolved from the much hyped (but commercially failed) NFV/Virtual Network Functions or VNFs and classical SDN architectures, to today’s more robust platforms for managing virtualized and cloud-native network functions that are tailored to the needs of telecom network workloads. This shift is bringing many new participants to the rapidly evolving telco cloud [1.] landscape.

Note 1. In this instance, “telco cloud” means running telco network functions, including 5G SA Core network on a public, private, or hybrid cloud platform. It does NOT imply that telcos are going to be cloud service providers (CSPs) and compete with Amazon AWS, Microsoft Azure, Google Cloud, Oracle Cloud, IBM, Alibaba and other established CSPs. Telcos gave up on that years ago and sold most of their own data centers which they intended to make cloud resident.

………………………………………………………………………………………………………………………………………………………………………………..

In its recent Telco Cloud Evolution Survey 2022, Omdia (owned by Informa) found that both public and private cloud technology specialists are shaping this evolution. In July 2022, Omdia surveyed 49 senior operations and IT decision makers among telecom operator. Their report reveals their top-of-mind priorities, optimism, and strategies for migrating network workloads to private and public cloud.

Transitioning from VNFs to CNFs:

The existing implementations of telco cloud mostly take the virtualization technologies used in datacenter environments and apply them to telco networks. Because telcos always demand “telco-grade” network infrastructure, this virtualization of network functions is supported through a standard reference architecture for management and network orchestration (MANO) defined by ETSI. The traditional framework was defined for virtual machines (VMs) and network functions which were to be packaged as software equivalents (called network appliances) to run as instances of VMs. Therefore, a network function can be visualized as a vertically integrated stack consisting of proprietary virtualization infrastructure management (often based on OpenStack) and software packages for network functions delivered as monolithic applications on top. No one likes to admit, but the reality is that NFV has been a colossal commercial failure.

The VNFs were “lift & shift” so were hard to configure, update, test, and scale. Despite AT&T’s much publicized work, VNFs did not help telcos to completely decouple applications from specific hardware requirements. The presence of highly specific infrastructure components makes resource pooling quite difficult. In essence, the efficiencies telcos expected from virtualization have not yet been delivered.

The move to cloud native network functions (CNFs) aims to solve this problem. The softwardized network functions are delivered as modern software applications that adhere to cloud native principles. What this means is applications are designed independent of the underlying hardware and platforms. Secondly, each functionality within an application is delivered as a separate microservice that can be patched independently. Kubernetes manages the deployment, scaling, and operations of these microservices that are hosted in containers.

5G Core leads telcos’ network workload containerization efforts:

The benefits of cloud-native are driving telcos to implement network functions as containerized workloads. This has been realized in cloud native 5G SA core networks (5G Core), the architecture of which is specified in 3GPP Release 16. A key finding from the Telco Cloud Evolution Survey 2022, was that over 60% of the survey respondents picked 5G core to be run as containerized workloads. The vendor ecosystem is maturing fast to support the expectations of telecom operators. Most leading network equipment providers (NEPs) have built 5G core as cloud-native applications.

Which network functions do/will you require to be packaged in containers? (Select all that apply):

This overwhelming response from the Omnia survey respondents is indicative of their growing interest in hosting network functions in cloud environments. However, there remain several important issues and questions telcos need to think about which we now examine:

The most challenging and frequent question is whether telcos should run 5G core functions and workloads in public cloud (Dish Network and AT&T) or in their own private cloud infrastructure (T-Mobile)? The choice is influenced by multiple factors including understanding the total cost of running network functions in public vs private cloud, complying with data regulatory requirements, resilience and scalability of infrastructure, maturity of cloud platforms and tools, as well as ease of management and orchestration of resources across distributed environments.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Ericsson says the adoption of cloud-native technology and the new 5G SA Core network architecture will impact six strategic domains of a telco network, each of which must be addressed and resolved during the telco’s cloud native transformation journey: Cloud infrastructure, 5G Core, 5G voice, automation and orchestration, operations and life cycle management, and security.

In the latest version of Ericsson’s cloud-native 5G Core network guide (published December 6, 2022), the vendor has identified five key insights for service providers transitioning to a cloud native 5G SA core network:

- Cloud-native transformation is a catalyst for business transformation. Leading service providers make it clear they view the transformation to cloud-native as a driver for the modernization of the rest of their business. The company’s ability to bring new products and solutions to market faster should be regarded as being of equal importance to the network investment.

- Clear strategy and planning for cloud-native transformation is paramount. Each individual service provider’s cloud-native transformation journey is different and should be planned accordingly. The common theme is that the complexity of transforming at this scale needs to be recognized, and must not be underestimated. For maximum short-and-long-term impact tailored, effective migration strategies need to be in place in advance. This ensures that investment and execution in this area forms a valuable element of an overall transformation strategy and plan.

- Frontrunners will establish first-mover advantage. Time should be a key factor in driving the plans and strategies for change. Those who start this journey early will be leading the field when they’re able to deploy new functionalities and services. A common frontrunner approach is to start with a greenfield 5G Core deployment to try out ideas and concepts without disrupting the existing network. Additionally, evolving the network will be a dynamic process, and it is crucial to bring application developers and solution vendors into the ecosystem as early as possible to start seeing faster, smoother innovation.

- Major potential for architecture simplifications. The standardization of 5G Core has been based on architecture and learnings from IT. The telecom stack should be simplified by incorporating cloud native principles into it – for example separating the lifecycle management of the network functions from that of the underlying Kubernetes infrastructure. While any transformation needs to balance both new and legacy technologies, there are clear opportunities to simplify the network and operations further by smart investment decisions in three major areas. These are: simplified core application architecture (through dual-mode 5G Core architecture); simplified cloud-native infrastructure stack (through Kubernetes over bare-metal cloud infrastructure architecture); and Automation stack.

- Readiness to automate, operate and lifecycle manage the new platform must be accelerated. Processes requiring manual intervention will not be sufficient for the levels of service expected of cloud-native 5G Core. Network automation and continuous integration and deployment (CI/CD) of software will be crucial to launch services with agility or to add new networks capabilities in line with advancing business needs. Ericsson’s customer project experience repeatedly shows us another important aspect of this area of change, telling us that the evolution to cloud-native is more than a knowledge jump or a technological upgrade – it is also a mindset change. The best platform components will not deliver their full potential if teams are not ready to use them.

Monica Zethzon, Head of Solution Area Core Networks, Ericsson said: “The time is now. Service providers need to get ready for the cloud-native transformation that will enable them to reach the full potential of 5G and drive innovation, shaping the future of industries and society. We are proud to be at the forefront of this transformation together with our leading 5G service providers partners. With this guide series we want to share our knowledge and experiences with every service provider in the world to help them preparing for their successful journeys into 5G.”

Ericsson concludes, “The real winners of the 5G era will be the service providers who can transform their core networks to take full advantage of what 5G Standalone (SA) and cloud-native technologies can offer.”

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Omdia says another big challenge telcos need to manage is the fragmentation in cloud-native tools and approaches adopted by various technology providers. Again, this is nothing new as telcos have faced and lived through similar situations while evolving to the NFV era. However, the scale and complexity are much bigger as network functions will be distributed, multi-vendor, and deployed across multiple clouds. The need for addressing these gaps by adopting clearly defined specifications (there are no standards for cloud native 5G core) and open-source projects is of utmost importance.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

Overcoming the challenges telcos face on their journey to containerized network functions

https://omdia.tech.informa.com/OM023495/Telco-Cloud-Evolution-Survey–2022

https://www.ericsson.com/en/news/2022/10/ericsson-publishes-the-cloud-native

https://www.t-mobile.com/news/network/t-mobile-lights-up-standalone-ultra-capacity-5g-nationwide

Dell partners with Wind River on modular cloud-native telecommunications infrastructure

Dell Technologies, together with Wind River (owned by Intel and Delphi Automotive), is introducing a new telecom cloud infrastructure solution to help communications service providers (CSPs) reduce complexity and accelerate their “cloud-native” network deployments.

To facilitate these solutions, Dell’s telecom partner certification program simplifies the process for technology partners to validate and integrate their products within a rapidly growing open technology ecosystem.

Dell Telecom Infrastructure Blocks help accelerate open, cloud-native network deployments. Dell is taking an entirely new approach to solve the complexities of cloud-native network deployments with Dell Telecom Infrastructure Blocks. The fully engineered, cloud-native infrastructure blocks simplify telecom cloud network deployment and management, while accelerating the introduction of new technologies and lowering operational expenses (OpEX).

As the fastest way to deploy the Dell Telecom Multicloud Foundation, launched earlier this year, these blocks include Dell PowerEdge servers, Dell Bare Metal Orchestrator management software, and a CSP’s choice of integrated telecom cloud software platforms, beginning with Wind River Studio.

Dell is the first company to launch a co-engineered system with Wind River, designed and factory integrated to host telecom workloads that can be scaled easily with automation, with streamlined support from Dell for the entire infrastructure stack3. The validated and pre-packaged blocks of hardware and software are designed to meet specific telecom workload requirements and use cases, spanning the network core to Open RAN Distributed Units (DU) and Centralized Units (CU).

Wind River delivers mature production-ready offerings based on proven Wind River Studio technology, live in deployments with leading operators. Wind River Studio provides the Containers-as-a-Service layer for a distributed cloud and the tools to automate and optimize “Day 2” operations at scale.

Holger Mueller of Constellation Research Inc. said today’s partnership with Wind River is all about making it easier for telecommunications firms to go live on Dell’s hardware and services. “What’s really of note is the new partner self-certification program,” the analyst said. “Partner certification can be slow and is normally always very expensive. So unleashing a self-service process for partners can be a huge accelerator, as long as the quality of the certification is not compromised.

Dennis Hoffman, senior vice president and general manager, Dell Technologies Telecom Systems Business:

As the telecom network disaggregates, network operators are challenged to effectively acquire, deploy, test and operate a myriad of open, cloud-native solutions. With our portfolio of software, solutions, development labs and partner programs, including our first open, telecom cloud engineered system with Wind River, a leader in Open RAN deployments, we can partner with communications service providers globally to simplify their transition to cloud-native technologies.

Kevin Dallas, president and chief executive officer, Wind River:

Our collaboration with Dell will help address complex CSP challenges in deploying and managing a physically distributed, ultra-low-latency cloud-native infrastructure for intelligent edge networks. As the de facto infrastructure for OpenRAN and 5G vRAN and only 5G solution that is commercially deployed at scale, Wind River Studio enables flexible networks and offers validated architectures to help service providers quickly and reliably deploy new services with industry-leading total cost of ownership for a cloud native future.

References:

Huawei Connect 2022: It’s Cloud Native everything!

Huawei’s annual flagship event, Huawei Connect 2022 –“Unleash Digital” opened in Bangkok, Thailand today.

- Ken Hu, the Rotating Chairman of Huawei, spoke about the importance of cloud adoption for enterprises to achieve leap-forward development.

- Zhang Ping’an, CEO of Huawei Cloud, announced the launch of two new Huawei Cloud regions in Indonesia and Ireland, as well as the “Go Cloud, Go Global” program for enterprises to access expertise and experience from Huawei Cloud’s global ecosystem partners.

- By the end of this year, Zhang said that Huawei Cloud will be deployed in 29 regions and 75 availability zones, covering 170 countries and regions worldwide. At the core of its offering is Everything as a Service built on a cloud-native foundation to enable enterprises to innovate faster and accelerate digital transformation.

Zhang Ping’an, CEO of Huawei Cloud

Editor’s Note: The top four Cloud service providers in China are Alibaba Cloud, Huawei Cloud, Tencent Cloud and Baidu. That’s very different from the U.S. where the leaders are Amazon AWS, Microsoft Azure, and Google Cloud.

Huawei Cloud has already set up 13 localized service centers in the Asia Pacific, with more than 1,000 certified engineers to provide tailored services. In addition, ecosystem development has been fruitful, with more than 2,500 local partners generating more than 50% of the revenue of Huawei Cloud. Huawei Cloud is also forging ahead with industry-government-academia collaboration in the Asia Pacific. Investment in the Huawei ASEAN Academy and the Seeds for the Future Program will be used to cultivate more than 1 million digital experts over the next five years.

Huawei Cloud serves 80% of the 50 biggest Internet companies in China and more than 200 major Internet companies in the Asia Pacific. In Sarawak, Malaysia, Huawei Cloud, together with its partners, has built cloud native infrastructure to support the collaboration of more than 30 government departments in five fields, and provided more than 80 digital government and smart city services to ensure more efficient and better-informed decision-making. In Indonesia, Huawei Cloud has provided a unified data foundation to help CT Corp migrate its media, retail, and finance services to the cloud, enabling precise recommendations for 200 million Internet users. The cloud native technologies of Huawei Cloud have helped Siam Commercial Bank (SCB) in Thailand quickly roll out its digital loan service. Loan approval and issuance, which used to take one month of work, is now fully automated and can be completed in just five minutes.

…………………………………………………………………………………………………………………………………………… …..

To address this pain point and unleash digital productivity for thousands of industries, Zeng Xingyun, President of Huawei Cloud, APAC, shared a three-pronged approach: to act with strategic resolve, embrace cloud-native and cultivate digital talent.

Zeng Xingyun, President of Huawei Cloud, APAC

Zeng emphasized long-term planning and a top-down approach to drive collaboration between IT and business departments to modernize blueprints and architecture based on cloud-native technologies. With 90% of enterprises in developed countries already using cloud technologies and 80% of all applications to be cloud-native by 2023, Zeng noted that cloud-native delivers efficient use of resources, agile applications, intelligent services and a secured system that helps government and enterprises stay compliant and grow sustainably.

In his speech, Zeng noted that Huawei Cloud has served more than 200 top Internet enterprises in Asia Pacific and 80% of the top 50 Internet enterprises in China. Huawei Cloud has 13 service centers in Asia Pacific, but more notably, Huawei Cloud is the first public cloud vendor to build local nodes in Thailand, with three availability zone data centers serving the local market.

He spoke about how cloud-native drives digital transformation in public and private sector, elaborating on how Huawei Cloud supports Siam Commercial Bank’s (SCB) automated processes to approve large volumes of loan requests within minutes, helping SCB attract 45,000 digital users and a credit limit worth THB 204 million within a quarter.

He also highlighted the importance of a talent ecosystem to address a digital talent shortage amounting to 47 million by 2030 in Asia Pacific. Through industry-academia cooperation such as the ASEAN Academy and the Seeds for the Future Program, more than 1 million digital talents will be cultivated in the next five years. Meanwhile, the Huawei Cloud Startup Program, aimed to help regional startups adopt cloud agilely, has already attracted more than 120 Asian enterprises since its recent launch. One such enterprise is ReverseAds, a Phuket-founded startup that has successfully secured US$24 million in funding to expand beyond Thailand.

The summit also saw the joint launch of Cloud Native Elite Club (CNEC) APAC by Huawei Cloud and Cloud Native Computing Foundation (CNCF). First established in China two years ago, CNEC gathers over 200 members working collaboratively to develop industry standards and promote cloud-native technologies in China. Likewise, the APAC branch will look to further cloud-native technologies.

Cloud-Native 2.0 for Industry Enablement:

An important driving force for service innovation, cloud-native technologies such as container, microservice, and dynamic orchestration empower enterprises to build and run scalable applications in modern, dynamic environments.

As cloud-native enters a new developmental stage, Fang Guowei, Chief Product Officer of Huawei Cloud, shared that Cloud Native 2.0 is a new phase for the intelligent upgrade of enterprises, focused on delivering Everything as a Service incorporating Infrastructure as a Service, Technology as a Service and Expertise as a Service to yield breakthroughs in digital transformation for government and enterprises.

An advocate of cloud-native innovations with open source, Huawei Cloud has contributed to the CNCF with open source projects including KubeEdge, Volcano and Karmada, hence growing the CNCF community from 1 Kubernetes project in 2015 to more than 20 categories and over 1,100 projects today.

Huawei Cloud delivers cost-effective cloud services with the innovative full-stack QingTian Architecture, featuring ultra-fast I/O engine, end-to-end security and enhanced operations and maintenance.

Adding to its offerings are more than 15 cloud-native products and services introduced to the global market for the first time. Elaborating on two core cloud-native innovations, Fang introduced the Cloud Container Engine (CCE) Turbo as a new cloud-contained engine that yields increased resource utilization, reduced access latency by up to 40%, and scale out 3,000 pods per minute to cope with traffic surges.

He also featured the Ubiquitous Cloud-Native Service (UCS), a distributed cloud-native service that allows enterprises to connect thousands of Kubernetes clusters to deliver a consistent experience through multi-cloud, cross-region applications.

Introductions were made to new services based on four pipelines: ModelArts to help AI developers effectively achieve one-stop data-tagging/model training; DataArts for an efficient and intelligent data governance pipeline; DevCloud for a secure and productive software development pipeline; and MetaStudio to provide better media experience. Other upcoming offerings include MacroVerse aPaaS such as KooMessage, KooSearch and KooGallery.

Fang also took the opportunity to release the Cloud-Native 2.0 Architecture White Paper to help enterprises embark on digital transformation.

Articulating the impact of Huawei Cloud’s innovations on industries, Hu cited AI adoption in the Pangu Drug Molecule Model to yield faster drug discovery for the First Affiliated Hospital of Xi’an Jiaotong University – successfully reducing R&D costs by 70% and development to approval time from a decade to a month for the world’s first broad-spectrum antimicrobial drug.

As one global network, Huawei Cloud has launched more than 240 cloud services, aggregating more than 38,000 partners and 3 million developers to release more than 7,400 applications in the cloud market.

With cloud-native technologies becoming a key engine to unleash digital productivity, Huawei Cloud demonstrates a commitment to harness cloud-native, Everything as a Service to spur economies.

References:

Casa Systems and Google Cloud strengthen partnership to progress cloud-native 5G SA core, MEC, and mobile private networks

Andover, MA based Casa Systems [1.] today announced a strategic technology and distribution partnership with Google Cloud to further advance and differentiate Casa Systems and Google Cloud’s integrated cloud native software and service offerings. The partnership provides for formalized and coordinated global sales, marketing, and support engagement, whereby Casa Systems and Google Cloud will offer Communication Service Providers (CSPs) and major enterprises integrated Google Cloud-Casa Systems solutions for cloud-native 5G core, 5G SA multi-access edge computing (MEC), and enterprise mobile private network use cases. It’s yet another partnership between a telecom company and a cloud service provider (e.g. AWS, Azure are the other two) to produce cloud native services and software.

This new partnership enables Google Cloud and Casa Systems’ technical teams to engage deeply with one another to enable the seamless integration of Casa Systems’ cloud-native software solutions and network functions with Google Cloud, for best-in-class solution offerings with optimized ease-of-use and support for telecom and enterprise customers. Furthermore, Casa Systems and Google Cloud will also collaborate on the development of unique, new features and capabilities to provide competitive differentiation for the combined Google Cloud – Casa Systems solution offering. Additionally, this partnership provides the companies with a foundation on which to build more tightly coordinated and integrated sales efforts between Casa Systems and Google Cloud sales teams globally.

“We are delighted to formalize our partnership with Google Cloud and more quickly drive the adoption of our cloud-native 5G Core and 5G SA MEC solutions, as well as our other software solutions,” said Jerry Guo, Chief Executive Officer at Casa Systems. “This partnership provides the foundation for Casa Systems and Google Cloud’s continued collaboration, ensuring we remain at the cutting edge with our cloud-native, differentiated software solutions, and that the products and services we offer our customers are best-in-class and can be efficiently brought to market globally. We look forward to working with Google Cloud to develop and deliver the solutions customers need to succeed in the cloud, and to a long and mutually beneficial partnership.”

“We are pleased to formalize our relationship with Casa Systems with the announcement of this multifaceted strategic partnership,” said Amol Phadke, managing director and general manager, Global Telecom Industry, Google Cloud. “We have been working with Casa Systems for over two years and believe that they have a great cloud-native 5G software technology platform and team, and that they are a new leader in the cloud-native 5G market segment. The partnership will enable a much wider availability of premium solutions and services for our mutual telecommunications and enterprise customers and prospects.”

Casa also partnered with Google Cloud last year to integrate its 5G SA core with a hyperscaler public cloud, in order to deliver ultra-low latency applications.

Note 1. Casa Systems, Inc. delivers the core-to-customer building blocks to speed 5G transformation with future-proof solutions and cutting-edge bandwidth for all access types. In today’s increasingly personalized world, Casa Systems creates disruptive architectures built specifically to meet the needs of service provider networks. Our suite of open, cloud-native network solutions unlocks new ways for service providers to build networks without boundaries and maximizes revenue-generating capabilities. Commercially deployed in more than 70 countries, Casa Systems serves over 475 Tier 1 and regional service providers worldwide. For more information, please visit http://www.casa-systems.com.

Image Courtesy of Casa Systems

…………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.fiercetelecom.com/cloud/casa-systems-google-cloud-tout-combined-cloud-native-offering

Dish Network & Nokia: world’s first 5G SA core network deployed on public cloud (AWS)

Dish Network is just a month into the commercial launch of its cloud native based 5G core network, but is already planning how it will expand that architecture to take advantage of multicloud and hybrid cloud environments.

During a Dish-Nokia fireside chat this Tuesday (sponsored by Nokia) on LinkedIn, Jitin Bhandari – CTO and VP, Cloud and Network Services, Nokia interviewed Sidd Chenumolu, VP of technology development and network services at Dish Wireless, provided some insight into the carrier’s current use of Amazon Web Services (AWS) public cloud resources.

Chenumolu said Dish’s 5G core was currently using three of AWS’ four public regions, was deployed in “multiple availability zones and almost all the local zones, but most were deployed with Nokia applications across AWS around the country.”

[AWS Outposts GM Joshua Burgin had previously explained to SDxCentral that Dish would be using a mixture of AWS Regions, Local Zones, and Outposts, specifically the smaller form factor AWS Outposts servers, to power its network. This includes the deployment of single 1U Outpost servers, some with an accelerator card, to run network functions in single-digit milliseconds at cell sites, he said in a phone interview.]

AWS Local Zones, which are built on Outpost racks and span 15 locations around the U.S., some of which were deployed to meet Dish’s demands, run Dish’s less latency-sensitive functions, Burgin explained. Dish’s operations and business support systems will run on AWS Regions.

“How to we deploy 5G SA core network on multi-cloud,” Sidd asked but did not answer. He then started to turn the tables and interview Jitin via a series of questions.

Chenumolu did not provide an update on Dish’s use of AWS’ Wavelength platform, which the cloud giant initially launched in partnership with Verizon to marry the network operators’ 5G networks with AWS’ edge compute service. Burgin had previously stated that support “could come down the line.”

The usual hype and back slapping/praise with glib expressions like “disintegrated disruptor, uncharted territory, automate learning with AI, cloud RAN,” etc. characterized the session.

References:

https://www.linkedin.com/video/event/urn:li:ugcPost:6945794807772438528/

https://www.sdxcentral.com/articles/news/dish-eyes-5g-multicloud-hybrid-cloud-expansion/2022/07/