China Telecom

China’s big 3 mobile operators have 9 Million 5G subscribers in advance of the service; Barron’s: China to lead in 5G deployments

According to Beijing News, the three major (state owned) China mobile network operators have already signed up 9 million advance orders for their yet to be launched 5G service. As of October 5th, China Mobile’s 5G subscribers have reached 5.32 million, China Unicom has 1.75 million, China Telecom has 1.76 million, and the total number of committed 5G users is nearly 9 million.

The three China network operators haven’t set a date for the start of service, but will reportedly commence simultaneously, most likely later this month of October. However, there are not many 5G smartphones (only two or three models) and no other endpoints (none announced yet) available from the three major China network operators. The preferential price is between 150 yuan and 550 yuan.

On September 20, Xu Ximing, deputy general manager of the marketing department of China Mobile Group Corporation, said at the China Mobile 5G+ Innovation Cooperation Conference that China Mobile is accelerating the pace of 5G commercialization. The 5G package will be officially released in October, including basic packages and CPE packages. And upgrade plans for old users. Customers will enjoy the “three different fast” login to the 5G network, that is, the 5G terminal does not need to change the card, does not need to change the number, does not need to register, and multi-channel fast order 5G network service.

- The China Unicom prices web page shows that the current campaign supports two mobile phones, Samsung Note 10+5G version offers 500 yuan, and vivo’s iQOO Pro 5G version offers 400 yuan. Telecom’s purchase discounts are 150 yuan for iQOO Pro, 300 yuan for ZTE Axon 10 Pro, and 550 yuan for Samsung Note 10+.

- For China Mobile’s preferential prices, Xiaomi 9 Pro 5G version is offered for 300 yuan, China Mobile’s pioneer X1, Samsung Note 10+ 5G version offer is 500 yuan. China Mobile told the Beijing News that more 5G models will be added in the future.

China Mobile Pioneer X1 is powered by a Qualcomm Snapdragon 855 chipset, a 6.47-inch AMOLED display with a waterdrop notch. The display supports FHD+ resolution and also houses an on-screen fingerprint scanner. Housed inside the waterdrop notch is a powerful 20MP camera.

…………………………………………………………………………………………………………………………………………………………………………………………………………………

Note: Although Samsung continues phone sales in China, last week the handset maker ceased its mobile phone production operations in China as it closed its last factory in the country, according to Reuters.

………………………………………………………………………………………………………………………………………………………………………………………………..

China’s 5G network coverage is progressing rapidly and the 5G network is increasingly equipped with a formal commercial foundation. Recently, the official statistics of the Beijing Municipal Bureau of Economics and Information Technology state that the three major network operators have completed more than 8,800 5G base stations in Beijing, covering areas along Chang’an Avenue, the World Expo, CCTV Broadcasting Center, and Shougang Park.

According to a message released by the Beijing Communications Administration, it is expected that by the end of 2019, Beijing will build more than 10,000 5G base stations. According to the current construction progress, the number of 5G base stations in Beijing is expected to reach 12,000 by the end of the year. Among the other three first-tier cities, Shanghai plans to build 10,000 5G base stations in 2019 and 20,000 5G base stations in 2020; Guangzhou proposes to complete no less than 20,000 5G base stations in 2019, and 5G will be built in 2021. The base station is 65,000; the plan for Shenzhen is to build 15,000 5G base stations by the end of 2019.

With the spread of 5G networks, innovative applications in various 5G environments are emerging and even landing. On September 25, Daxing International Airport was officially opened. Eastern Airlines, Beijing Unicom and Huawei jointly released a 5G-based smart travel integrated service system at Daxing International Airport. Under the system, the user does not need to present the ID card and the QR code as usual, and only needs face recognition to complete the travel process such as ticket purchase, check-in, check-in, security check, and boarding.

China’s government is partially subsidizing 5G deployments as we note in several paragraphs below:

- The Shenzhen city government is offering to pay operators RMB10,000 ($1,398) for every standalone 5G base station deployed, with a maximum payout of RMB150 million ($20.9 million). Its 5G plan issued last month promises support for site acquisition and subsidies for base station electricity costs. The tech-dominated Chinese city, home to Huawei, ZTE and Tencent, plans to install 15,000 5G base stations by the end of 2019 and 45,000 by next August (more on this below).

- Almost every Chinese city or provincial government has a 5G development plan. While many are light on specifics, some reveal big ambitions. For example, the government of Zhejiang, the wealthy province near Shanghai, expects to have 30,000 base stations next year. It plans to complete its 5G rollout by 2022, by which time its coverage will “lead the country.”

- The north-west province of Shanxi — not known for its advanced tech industries — has also made 5G a top priority. It has bench marked its 5G rollout against other provinces and, like Zhejiang, has set a target of 30,000 base stations by 2022. And the city is also offering subsidies for base station power costs and help in site selection.

………………………………………………………………………………………………………………………………………………………………………………………………..

From an article titled, “The Real 5G Winner Could Be China,” in the October 7, 2019 print edition of Barron’s:

Multiple Wall Street analysts are getting more optimistic about China’s 5G build out. For instance, Rosenblatt Securities notes that local governments in the Asian country are providing subsidies to “speed up 5G network deployments.” As a result, Rosenblatt says, more than 300 cities in China will have 5G networks by the end of next year. Even Hall, the Goldman Sachs 5G skeptic, expects 120 million 5G smartphones to ship next year, largely because of China’s aggressive build out.

In a report this past week, Piper Jaffray analyst Harsh Kumar cited a Chinese think tank that sees China-based companies spending $411 billion on 5G networks from 2020 to 2030. Of the 600,000 5G base stations expected to be rolled out worldwide next year, Kumar says half will be deployed in China: “We expect 2020 global [5G] deployments to largely be driven by the Chinese market.”

5G may come together slowly in the U.S. market, but China is serious about winning the race.

………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://tech.sina.com.cn/t/2019-10-06/doc-iicezzrr0343842.shtml

https://www.lightreading.com/asia-pacific/china-telcos-rack-up-9m-5g-advance-subs/d/d-id/754643?

https://www.barrons.com/articles/the-real-5g-winner-could-be-china-51570228459

https://www.wsj.com/articles/in-the-race-to-dominate-5g-china-has-an-edge-11567828888

China Mobile reveals 5G network expansion plans; China Telecom and China Unicom agreement on 5G network sharing

Lu Lu, a senior researcher at the China Mobile Research Institute, said in an industry speech last week that China’s largest wireless network operator expects its 5G network to reach 50 cities by the end of 2019 and 300 major cities by the end of 2020. Ms. Lu said that China Mobile aimed to reach commercial scale in 5G by June next year and that 5G private networking will be a major new enterprise network service. Edge computing, which was not used for 4G-LTE, was seen as essential for delivering customizable private networks, she said. The flexible architecture of the new 5G network was the critical factor, allowing for much more granular services and applications.

In addition, China Mobile is planning to offer network slicing services by the middle of next year when its standalone 5G network achieves commercial scale. That despite no standards for network slicing interoperability between different vendors.

“At present, China Mobile has reserved hundreds of nodes in edge computing rooms. Based on these nodes and 5G networks we will carry out trials of relevant edge computing services,” Lu said. China Mobile and its partners hoped to provide “full-stack edge-computing capabilities to industry customers,” she added.

The Chinese telco is building a “one-stop cloud-network convergence platform” that can provide customized service capabilities in both centralized data centers and data centers at the edge of cities around the country, Lu said. The operator has issued network slicing templates for six industry verticals — power grid, autonomous driving, gaming, entertainment, banking and medical. In partnership with Ericsson, China Mobile exhibited a network slicing-based autonomous vehicle application at MWC2019 in Barcelona earlier this year.

Earlier this year, Ms. Lu delivered a speech to introduce the achievements of the cooperation between China Mobile, Huawei, and Baidu, and elaborated on the concept of “5G network as a service”. She also invited partners to jointly build the 5G ecosystem and continuously promote the maturity of 5G technologies and industry development.

China Mobile Executive Vice-President Li Zhengmao has said he believes private networking and network slicing offered some of the best prospects among new 5G services.

“Operators can create a network-slicing-as-a-service business model, providing high-reliability, high-performance and easy deployment for the vertical industry through a centralized network slicing service platform,” he said in an interview with state news service Xinhua.

But he acknowledged that the lack of clear business models in industry partnerships was one of the biggest problems.

China Mobile has set up a 5G Joint Innovation Center to drive application development, with more than 500 industry partners and more than 400 vertical industry partners, Li said.

…………………………………………………………………………………………………………………………………………………………………………………………….

Separately, China Telecom and China Unicom, agreed to share the efforts to build and maintain 5G radio access networks across the country. The purpose is to accelerate deployment and slash associated infrastructure costs.

Each wireless carrier will be responsible for operating their own core networks, but will share spectrum resources and a single RAN network (which typically accounts for around 80 per cent of an operator’s capex). Under the agreement, the two companies will be individually responsible for construction and maintenance in specific regions.

In a statement China Telecom said: “The commencement of the co-build and co-share cooperation is beneficial to the efficient construction of [the] 5G network and will rapidly create 5G service capability to enhance network quality and business experience.”

It added the reduced costs would reinforce market competitiveness and achieve a win-win for both parties.

Both operators will continue to handle core networks and branding completely independently, with the collaboration only applying to the construction and ongoing maintenance of physical infrastructure assets. The network will use the companies’ combined spectrum.

In 2016, the operators collaborated on 4G network construction, a move which reportedly saved China Unicom millions in capex within the first year and helped the two better compete with the country’s largest operator, China Mobile.

References:

https://www.huawei.com/en/press-events/news/2019/4/huawei-china-mobile-baidu-5g-vertical-lan

China Wireless Carriers Consider 5G Partnership Amidst 5G Budget Constraints in 2019

Chinese mobile operators may be soon working together to build 5G networks in order to limit the costs, the Nikkei Asian Review reports. And why not- all three are state owned!

China’s second- and third-ranked mobile carriers, China Telecom and China Unicom area already close to an agreement. Number one China Mobile hasn’t commented yet. Please see China Mobile chairman’s statement in the last paragraph below.

China Telecom Chairman and CEO Ke Ruiwen said that his company is in “deep consideration” to jointly build a 5G network with China Unicom. He confirmed that top management on both sides have already reached a “high level of consensus” on the matter and “substantial progress” has been made toward a final deal.

“Co-building and co-sharing would bring great savings in capital expenditure, operating expenditure, as well as improve resource utilization,” Ke said, without revealing any numbers that might quantify the cost savings.

The 5G partnership was hinted at by China Unicom Chairman and CEO Wang Xiaochu earlier. During the company’s first-half earnings briefing, Wang floated the idea of a “co-built, co-shared” 5G infrastructure. Wang left the door open to cooperating with China Mobile and China Broadcasting Network, which were granted 5G licenses in June, but said China Unicom was “mutually complementary” with China Telecom, noting their strengths in different regions of the country.

The Chinese government hopes that developing a 5G network will help buoy the economy, but the three major mobile carriers are concerned about expenses and profits. © AP ………………………………………………………………………………………………………..

China Telecom’s Ke also mentioned these advantages at the operator’s first-half results presentation. Although Ke dodged questions from reporters in Hong Kong about the savings on investment and when an official agreement would be signed, he confirmed that top management on both sides have already reached a “high level of consensus” on the matter and “substantial progress” has been made toward a final deal.

Both mobile carriers are limiting their 5G investment budgets this year. China Telecom is keeping its budget unchanged from the beginning of the year at 9 billion yuan ($1.27 billion), while China Unicom is holding within the previously committed range of 8 billion yuan.

……………………………………………………………………………………………………..

The chief uncertainty about such a 5G mobile carrier partnership is about exactly what facilities the operators would share? Making use of the same cell towers, poles and other “passive” infrastructure would be no great leap. Through China Tower-a jointly owned telecom infrastructure business- all three mobile network operators have already pooled mobile towers to reduce costs.

China Tower is a joint venture of the three major Chinese mobile carriers. Chairman Tong Jilu told reporters on Aug. 7 that the cell-tower builder has not changed its annual capital expenditure budget of 30 billion yuan since the beginning of the year. Tong stressed that his company’s investment “is up to the telecom operators,” adding the annual investment “would not likely exceed the budget.”

China Tower said earlier this month that it had received client demands to install 65,000 5G base stations to date, a number that it expects to rise to 100,000 by the end of the year.

…………………………………………………………………………………………………………

Market leader China Mobile has pledged to allocate CNY 24 billion to 5G this year, above the CNY 17 billion suggested in March. Chairman Yang Jie said that its total capital expenditure for 2019 will be under CNY 166 billion, below last year’s CNY 167.1 billion. The company’s 5G investment this year is much smaller than the 38.7 billion yuan reported by Chinese media when 5G licenses were granted in early June. The government aims to spur job creation and support embattled equipment suppliers like Huawei and ZTE as the trade conflict with the U.S. drags on, but the carriers seem to have their own agenda.

Despite the government’s push for swift deployment of a network, Yang said “the peak period of 5G investment will be between 2020 and 2022.” This author completing agrees with that comment with the real investment not starting till 2021 after IMT 2020 RIT/SRIT standard has been completed by ITU-R.

………………………………………………………………………………………

References:

https://www.telecompaper.com/news/china-telecom-unicom-consider-5g-network-partnership–1305741

https://www.lightreading.com/mobile/5g/chinas-5g-market-has-teething-trouble/d/d-id/753657

Huawei and China Telecom Jointly Release 5G Super Uplink Innovation Solution

As a large number of new pre-standard 5G services emerge, they are posing higher requirements on the uplink rate and latency. During MWC2019 in Shanghai, China Telecom and Huawei jointly released the 5G Super Uplink Joint Technology Innovation solution to accommodate those applications.

The 5G Super Uplink solution proposes the innovative networking technology featuring TDD/FDD coordination, high-band/low-band complementation, and time/frequency domain aggregation, which achieves an unprecedented uplink rate of 5G networks and reduces latency over the air interface. This solution truly redefined 5G networks based on industry requirements.

At the “Hello 5G Encouraging the Future” 5G Innovation Cooperation Conference held in April this year, China Telecom formulated the networking strategy that depends on the standalone (SA) networking and applies three SA features of URLLC, eMBB, and eMTC to meet 2B/2C requirements. China Telecom has extensively explored 5G applications in vertical industries such as government affairs, transportation, ecosystem, party building, healthcare, tourism, policing, Internet of Vehicles (IoV), education, and manufacturing. In the future 2B/2C ecosystem, large bandwidth and low latency are the focus of services. For example, the 4K HD video backhaul will give rise to the boom of new media, Internet celebrity live broadcast, and other services, bringing immersive experience to the audience. Drone services, unmanned driving, and telemedicine have higher requirements on the uplink rate and network latency.

The 5G Super Uplink solution proposed by China Telecom and Huawei implements the time-frequency domain aggregation of TDD and FDD in the uplink frequency band. Therefore, the solution can increase uplink spectrum resources of NR, boost the uplink capability of the 5G network, reduce latency, and improve the utilization rate of the uplink spectrum of 2.1 GHz/1.8 GHz. At the launch event, the Proof of Concept (PoC) of “Super Uplink” was demonstrated. The test results showed that the experienced uplink rate of 5G UEs in the cell center was increased by 20% to 60%, the experienced uplink rate of 5G UEs at the cell edge was increased to 2 to 4 times, the air interface latency was reduced by about 30%, and the URLLC services were enabled. Huawei Balong 5000 chipset, customer-premises equipment (CPE), and Mate 20 X were also displayed at the event. Super Uplink is supported from end to end by Huawei 5G technologies.

Liu Guiqing, executive vice president of China Telecom Group Co., Ltd., said: “The five ecosystems extend to 5G and become the important engine for China Telecom’s continuous growth. China Telecom adheres to the philosophy of “Customer First, Attentive Service”, insists on formulating standards first and leading technology development, and pioneers the practice of 5G network innovation. To provide better 5G experience, optimize customers’ service awareness, and enhance differentiated competitiveness in the market, China Telecom cooperates with Huawei to propose the innovative 5G networking technology featuring TDD/FDD coordination, high-band/low-band complementation, and time/frequency domain aggregation. This solution aims to further improve the uplink data capability and reduce latency, providing better development space for vertical industry applications. China Telecom will work with industry partners to seek the optimal network experience solution and promote the prosperity of the industry.”

Ryan Ding, executive director, CEO of the Carrier BG of Huawei Technologies Co., Ltd., commented: “5G not only changes everyday life but also revolutionizes human society. Service requirements are driving the development of 5G technologies. 5G industry innovation represents uplink ultra-large bandwidth, ultra-low latency, end-to-end slicing, and mobile edge computing (MEC). Based on the digital requirements of the industry, Huawei and China Telecom proposed the 5G Super Uplink Joint Technology Innovation solution. It is another breakthrough after Huawei CloudAIR solution.”

Yang Chaobin, president of 5G Product Line, Huawei Technologies Co., Ltd., noted: “The Super Uplink solution can meet the service requirements of large bandwidth and low latency at the same time. We are honored to work with China Telecom to implement the test and verification of 5G Super Uplink. Huawei 5G supports end-to-end Super Uplink and co-deployment of NSA and SA. Huawei will help industry partners continuously innovate to create the optimal 5G experience.”

China Telecom and Huawei continue to cooperate closely in technological innovation, promote 5G innovation, and contribute to 5G industry development. Huawei will support the strategic goal of China Telecom’s 5G development as always, and deepen cooperation on Super Uplink to help China Telecom take the lead in the new era of a 5G intelligent world.

Contact:

Nash Chong

[email protected]

Reference:

……………………………………………………………………………………………………………………………………………………………………………………

China Telecom to accelerate 5G deployment; 100% Fiber network coverage; Gigabit fiber broadband deployment

According to its latest financial report published today, China Telecom has big plans for 5G. The report states in part:

New technologies represented by 5G and AI are integrating and evolving, enabling them to support supply-side structural reform, which will lead to a rapid expansion of potential value for digital economy. As the next generation infrastructure, 5G network will become ever more intertwined with applications and telecom operators will play an increasingly pivotal role in the information communications industry. The Company (China Telecom) will actively explore commercial applications of various new technologies, accelerate the development of operation mechanisms that are adapted for 5G, and capitalize on its advantages to promote ecological services ahead

of time.Recently, China Telecom was awarded the 3.5GHz band to conduct nationwide 5G network trials. Leveraging the advantages of the 5G mainstream frequency band and insisting on open cooperation, the Company will accelerate 5G deployment proactively and pragmatically. Persisting in a market-oriented and demand-driven approach, the Company will appropriately manage the momentum, propel the development of non-standalone (NSA) and standalone (SA) concurrently, and progressively expand the scale of network trials and the pilot project of 2B/2C applications.

In a presentation on its 2018 financial results, China Telecom noted these 5G milestones:

1. Technology:

• Published industry’s first 5G Technology White Paper

• Launched industry’s first 5G+AI handset standard

• Pioneered to accomplish 4G-5G interoperability on SA network architecture

• Pioneered to interoperate 5G SA (Stand Alone) on equipment from different vendors

2. Extensive Application Trials:

• Internet of Vehicles (IoV): 5G-based remote-controlled driving in Xiong’an and passed test

• Media convergence: Ultra-high definition 5G 4K, VR live broadcasting of gala show

• Smart city: 5G full coverage along a 28km road in city area, performing data traffic management for ultra-high definition 5G+, cloud VR and 5G smart transport

• Energy Internet: Trial on IoT electricity distribution leveraging 5G network slicing (?), performing 5G precision control on electricity distribution and usage

3. Network Capability- Prepare for flexible and agile 5G deployment with:

• Prompt assessment and modification of existing network

• Acceleration of network cloudification and intelligent upgrade

• 100MHz spectrum at 3.5GHz band, which has the world’s most developed industry chain for 5G trial

……………………………………………………………………………………………………………………………………………………….

China Telecom plans to accelerate 5G development pragmatically:

• Persistence in SA as the goal and direction, to expediate industry chain maturity and conduct scale trials in SA/NSA which is concurrently in a very early stage

• Adjust investment plan and expand trial subject to technology maturity, licensing, market competition and results of scale trial

• Actively explore network co-building and co-sharing to reduce network construction and maintenance cost

Open co-operation initiatives include:

• Promote key 5G technology researches, actively participate in formulating 5G international standards and foster end-to-end development of industry supply chains

• Collaborate with customers and business partners for innovations, enrich products and applications

• Work with industry to commence trials on smart city, autonomous driving, industrial Internet, entertainment, medical service, education, etc.

The Company has modified its R&D system to enhance the R&D capability of key technologies of strategic, pioneering and fundamental importance, such as 5G, network capability, AI, etc.

……………………………………………………………………………………………………………………………………………………………………………………………………………………

In its SEC Form 6-K the company wrote:

- Focusing on user experience, business scale expansion and value management, the Company pushed forward the construction and intelligent upgrade of its network to build up comprehensive network advantages.

- Leveraging big data analysis, we deployed dynamic capacity expansion of 4G network with precision, and further optimized in-depth coverage at key locations.

- The number of 4G base stations reached 1.38 million, effectively supporting the upgrade to VoLTE high definition voice, as well as the continuous growth of large data traffic business.

- Our fiber network now fully covers all cities and towns in the service area of the Company, enabling a leading customer experience. By leading the deployment of Gigabit fiber broadband, we established a new edge in broadband network.

- We continued to enhance our NB-IoT network, and built a whole-range speed rate IoT structure, which combines high, medium and low speeds, supporting further expansion in vertical industries.

- By pushing forward cloud-network integration at full throttle, we continued to optimize our nationwide deployment of cloud resources and backbone network coverage, resulting in the establishment of a cloud-led network.

- By introducing new technologies such as Software-Defined Networking (SDN) and Network Functions Virtualization (NFV), the Company accelerated the re-constitution of its networks, and rolled out scale promotion of intelligent self-selecting bandwidth network products for government and enterprise customers as well as home gateway products based on SDN technology, which allows our network products to be activated within minutes.

- We also launched a VoLTE virtual IP Multimedia Subsystem (vIMS) core network with software and hardware decoupling, facilitating the progress of cloudification and virtualization. This significantly strengthened our competitiveness and differentiation in the cloud market, while laying a foundation for 5G network cloudification in the future.

- The Company proactively contributed to the formulation of international standards for 5G technologies and conducted large-scale 5G network trial runs in a number of locations.

- We achieved some preliminary progress in areas such as 5G voice call, 4G/5G interoperability, and interoperability between (pre-standard 5G) equipment, among others.

- By supporting the Ultra HD Live broadcast for CCTV’s 2019 Spring Festival Evening Gala with “5G+4K” and “5G+VR” solutions, we took an important step towards the successful accomplishment of enhanced mobile broadband (eMBB) application scenarios.

- The Company also actively explored applications for other vertical industries, such as 5G autonomous driving bus, smart water treatment and mobile remote medical service.

………………………………………………………………………………………………………………………………………………………………………………

China Telecom’s CAPEX is expected to increase 4% this year, to roughly RMB78 billion ($11.6 billion), after dropping 7.9% in 2018. That will include a 21% increase in spending on “information and application services,” to about RMB10.5 billion ($1.56 billion), as China Telecom prepares for its 5G future.

…………………………………………………………………………………………………………………………………………………………………………………….

In a paper published last August, consulting company Deloitte said China had outspent the US on 5G-supporting infrastructure by around $24 billion since 2015. Last year, the 1.9 million mobile sites across China worked out at 14.1 for every 10,000 people. With just 200,000 sites, the US had an equivalent ratio of just 4.7, according to Deloitte. Catching up with China in 5G may be “near impossible” for the Americans, Deloitte said in its report which we summarized for the IEEE Techblog.

In a recent Lightreading.com blog post, Iain Morris wrote:

With its huge population and model of state capitalism, China could be a fertile testing ground for new 5G applications. China Telecom alone had a staggering 303 million mobile customers at the end of last year — an increase of 53 million on the number in 2017 — including 242 million on 4G networks. Revenues were up 3%, to RMB377.1 billion ($56.2 billion), thanks to customer growth, and net profit rose 14%, to RMB21.2 billion ($3.16 billion).

Seeking advantage in AI, China’s government will undoubtedly look for support to a such a large, financially stable organization, with its vast reserves of customer data and stake in 5G. Demographics and democracy make the task much harder for US authorities worried about falling behind in the new technology arms race. Amid recent political talk of building a nationalized 5G network, the US operators may be under government pressure on a generation of mobile technology like never before.

Editor’s Note: Mr. Morris strongly asserts that China Telecom said it will be a leader in delivering 5G low latency (which will be specified in 3GPP release 16- due to be completed in 2020 and later in ITU-R IMT 2020 for ultra low latency.high reliability use case). He wrote, “China Telecom said it will be “industry leading” in latency, a signaling delay that could become a new battleground for 5G competitive advantage.” However, we have NOT found that reference to latency in any of China Telecom’s reports (see highlights above) and presentation made today (March 19, 2019).

The 5G-IMT2020 radio access network latency objectives, which Ericsson and others often say will faciliate many new applications, are specified in ITU-R M.2410-0: https://www.itu.int/dms_pub/itu-r/opb/rep/R-REP-M.2410-2017-PDF-E.pdf

The minimum requirements for user plane latency are: 4 ms for eMBB and 1 ms for URLLC assuming unloaded conditions (i.e. a single user) for small IP packets (e.g. 0 byte payload + IP header), for both downlink and uplink.

………………………………………………………………………………………………………..

There is no spec or even target for cloud network latency related to carrying 5G packets. In fact, the cloud network might not be used at all for real time control of 5G applications such as V2V or IoT

Huawei’s “All Bands Go to 5G” Strategy Explained; Partnership with China Telecom Described

Huawei unveiled its “All Bands Go to 5G” strategy for the evolution towards a 5G wireless network at its Global Mobile Broadband Forum 2018 in London last week. This strategy provides suggestions for future development of the wireless network in three key aspects: simplified site, simplified network, and automation.

Huawei Launches the Evolution Strategy for 5G-oriented Wireless Target Network

……………………………………………………………………………………………………………………………………………………………………………

I. Global commercial use of 5G networks has now entered the fast lane.

Massive wireless connectivity has become an inevitable trend. Data traffic on global mobile broadband (MBB) networks has increased rapidly. By 1st half of 2018, the data of usage (DOU) for a number of global operators has exceeded 10 GB, and that in certain Middle East regions has even reached 70 GB. Releasing data traffic helps to promote a positive MBB business cycle in the global wireless industry and ushers in a new era of traffic operation.

By October 2018, new fixed wireless access (FWA) services have been put into commercial use on about 230 networks. About 75 million families can now enjoy the benefits of FWA-based home broadband (HBB) services. In the future, the larger bandwidth capability of 5G will provide fiber-like HBB user experience and enable diverse home entertainment applications such as 4K/8K UHD video and AR/VR. At the same time, new IoT connections are becoming a new source of potential growth for operators. LTE NB-IoT is undergoing rapid development and has seen 58 commercial networks around the world, with industry applications providing millions of connections such as smart gas, water, white goods, firefighting, and electric vehicle tracking. 5G technologies will offer more reliable connection capabilities with shorter latency. Massive wireless connectivity has become an inevitable trend.

The development of the global 5G industry is accelerating in 2018. According to the 5G spectrum report published by GSA in November 2018, the UK, Spain, Latvia, Korea, and Ireland have officially released spectrum resources dedicated for 5G by August 2018. In addition, 35 countries have scheduled related plans. The 5G industry supply chain is steadily growing more and more mature.

Huawei claims to have released 5G commercial CPEs in 2018 (???), and multiple 5G smartphones will be launched in 2019. According to the report released by GSMA, 182 global operators are conducting tests on 5G technologies and 74 operators have announced plans for 5G commercial deployment. Global commercial use of 5G networks has now entered the fast lane, according to Huawei (but not this author).

5G development will enable more commercial application scenarios and promote the continuous development of a digital society. Under such circumstances, Huawei has proposed a new eMBB (enhanced Mobile Broad Band) industry vision for Cloud X featuring smart terminals, broad pipes, and cloud applications. For example, Huawei has shifted the most complex processes of rendering, real-time computing, and service content to the cloud. Thanks to transmission data streams using large bandwidth and ultra-low latency on the 5G network, as well as encoding and decoding technologies that match the cloud and terminals, applications such as Cloud AR/VR can be deployed anywhere anytime, according to the company.

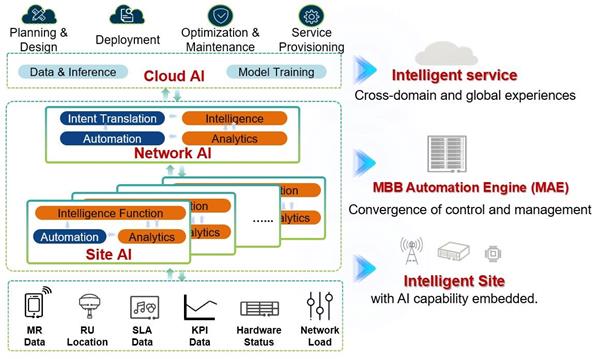

Huawei believes that AI technologies can be adopted in the communication industry. AI-based automation of network planning, deployment, optimization, and service provisioning will enable network O&M to be simplified, unleash network potential, and make networks more intelligent.

II. “LTE Evolution+5G NR” is gaining industry’s consensus for 5G wireless networks.

In the 5G era, wireless spectrum evolution is divided into two phases:

Phase 1: Sub-3 GHz spectrum resources evolve to LTE and 5G non stand alone (based on 3GPP release 15 NR) high frequency bands are introduced.

Phase 2: Sub-3 GHz spectrum resources evolve to 5G NR. “LTE Evo+NR” is realized on the target network.

Therefore, target network evolution in the 5G era can be summarized as “LTE Evolution+5G NR.” In the process of achieving this goal, the global wireless network faces the following challenges:

1. OPEX increases year by year. From 2005 to 2017, global operators’ OPEX/revenue percentage is increased from 62% to 75%. In the future, the coexistence of 2G, 3G, 4G, and 5G will increase the complexity of network O&M. In particular, site TCO is high. Site deployment still faces several issues such as difficult site acquisition, high engineering costs, and high site rentals.

2. 4G-LTE basic services fall back to 2G or 3G. Generally, insufficient 4G network coverage causes VoLTE services to fall back to 2G or 3G, deteriorating voice experience. NB-IoT/eMTC services also require better 4G network coverage. As a result, it is difficult for operators to shut down 2G and 3G networks.

–>The coexistence of four RAN technologies leads to more complex network operation and presents difficulties in reducing OPEX.

III. 5G-oriented simplified networks are built to effectively meet challenges and promote 5G business success.

Peter Zhou, CMO of Huawei Wireless Network Product Line, illustrated the evolution strategy for 5G-oriented wireless target network. This strategy aims to help operators resolve the preceding challenges and commercialize 5G. The evolution strategy includes three key aspects: simplified site, simplified network, and automation.

Simplified site enables full outdoor base stations and facilitates site acquisition, deployment, and TCO saving.

Along with the development of Moore’s Law, the 7 nm technology has enjoyed widespread commercial adoption throughout the chip manufacturing industry, and BBUs are becoming more and more integrated. In recent years, lithium battery technology has seen rapid development, and the energy density of lithium batteries is far more superior to that of lead-acid batteries. The development of new technologies makes full outdoor wireless base stations a reality. Peter Zhou pointed out, “Using componentized outdoor BBUs, blade power modules, and blade batteries, full outdoor macro base stations can be deployed on poles without shelters or cabinets. This greatly reduces the upgrade cost of existing sites, decreases the difficulty and cost of obtaining new sites, and helps operators reduce TCO by 30% and above.”

Antenna reconstruction is required for 5G deployment on the C-band. Currently, 70% urban sites cannot deploy new antennas due to insufficient antenna space. In order to resolve this problem, Huawei proposes the “1+1” antenna solution. That is, one multi-band antenna is used to support all sub-3 GHz bands, and one Massive MIMO AAU is used to support C-band NR. In total, two antennas are able to support all operator’s frequency bands. This solution greatly simplifies site space, reduces site OPEX, and realizes 5G NR deployment with insufficient antenna space.

Simplified network realizes the construction of an LTE full-service foundation network and ensures “Zero Fallback” for three basic services.

In the 5G era, the coexistence of multiple RAN technologies (2G/3G/4G/5G) results in complex networks and high O&M costs. Therefore, basic voice, IoT, and data services need to be migrated to the LTE network so that the LTE network becomes the bearer network for basic services and 2G and 3G networks enter the life cycle development phase. Huawei’s Peter Zhou emphasized that, “The LTE network needs to be built as a full-service foundation network to achieve ‘Zero Fallback’ for basic services such as voice, IoT, and data. Therefore, LTE must be planned based on the coverage of basic services rather than the traditional population coverage.”

“Simplified site, simplified network, and automation help operators reduce TCO, simplify the network architecture, reduce operation costs, and fully unleash the network potential. This lays a solid foundation for the successful commercial use of 5G networks and helps the industry to identify the goal and direction for future network evolution. Huawei also wishes to work more closely with industry partners to innovate continuously, build a 5G business ecosystem, and finally achieve a better connected digital society.”

……………………………………………………………………………………………………………………………………………….

Separately, China Telecom announced it had partnered with Huawei for investment in 5G innovation and has begun researching how to commercialize 5G technology. Both parties intend to leverage their advantages to develop the 5G service innovation base, build an industry ecosystem alliance, and research the usage scenarios and business models of 5G services. Huawei Wireless X Labs in Shenzhen, simulates 5G technologies and usage scenarios, and works with upstream and downstream industry partners to jointly develop industry standards and plans. China Telecom leverages the resources of 5G trial networks and existing industry customers to develop new 5G applications, driving the development of the entire 5G industry and improving China Telecom’s influence in the 5G field.

Application Models

Based on the first of six 5G trial network, China Telecom Shenzhen is exploring 5G application models. During the 5G Unmanned Aerial Vehicle (UAV) flight test and inspection demonstration, remote control personnel experienced VR capabilities and remote HD video transmission over a low-latency 5G network. Both the maiden test flight and inspection were completed successfully, demonstrating the ability of 5G to support UAV applications. This means that aerial photography, unattended inspection, logistics transportation, security identification, and other industrial applications will be driven by the rapid development of 5G in the telecom sector, creating a strong foundation for China Telecom to explore new vertical industries. In tests on Gbps-level experience buses, 5G provided an average speed of more than 1 Gbps and a peak rate of 3 Gbps, allowing passengers to experience mobile 4K IPTV, 16-channel HD video streams, and VR applications while traveling. This paves the way for China Telecom’s plans of 5G and IPTV convergence.

To achieve its goal of connecting 50 5G sites by the end of 2018 while constructing its transport network, China Telecom Shenzhen upgraded its existing IP RAN to deploy and verify 5G technologies, enabling the co-existence of both 4G and 5G. In addition, the operator gained valuable engineering experience and developed scenario-based solutions for subsequent 5G construction.

Addressing 5G challenges for the smooth evolution of live networks

While bringing a wide variety of services, 5G also brings challenges in terms of bandwidth, latency, connections, and the slicing of transport networks. GNodeBs, however, deliver five to ten times more bandwidth than eNodeBs. 5G services such as Internet of Vehicles (IoV) require the latency to be one-tenth of what they are with 4G. In terms of connections, the cloudification of wireless and core networks brings full-mesh connections, requiring flexible scheduling on the transport network. In addition, 5G’s differentiated services require network slicing, with a focus on isolation and the automated management of network slices on transport networks. To cope with these challenges, China Telecom Shenzhen assessed the existing IP RAN, opting to upgrade and expand core and aggregation devices and replace specific access devices for 5G transport. To quickly deploy 5G services and fully reuse the existing network, China Telecom Shenzhen implemented the smooth evolution solution for the transport network in pilot areas.

Network upgrade for co-existence of 4G and 5G

The co-deployment of eNodeB and gNodeB is the optimal choice for transport networks, and China Telecom Shenzhen verified different co-existence solutions. Access ring devices can be upgraded and expanded to satisfy the requirements of 50GE ring networking and allow 4G and 5G services to share the same access ring. When access devices need to be replaced, China Telecom Shenzhen can establish a new 5G access ring, which can share the core and aggregation layer to achieve unified service bearing.

E2E large capacity to meet HD video transmission requirements

As China Telecom continues to explore 5G services, the convergence of 5G and IPTV has become its focus. To meet the requirements of 4K IPTV video transmission using 5G, the transport network must have large bandwidth transmission capabilities. China Telecom Shenzhen upgraded the access layer from an eNodeB GE ring to a 50GE ring, and upgraded the core and aggregation layer from a 10GE network to a 100GE network, allowing high-bandwidth connections between base stations and the core network.

References:

https://techblog.comsoc.org/2018/11/06/gsma-5g-spectrum-guide-vs-wrc-2019/

Oracle Confirms Research: China Telecom Misdirected U.S. Internet traffic thru China

China Telecom is the largest fixed line operator in China, state owned, and bidding to become the third telecommunications network operator in the Philippines. Two weeks ago, researchers found that the company has been hacking into internet networks in the United States and hijacking data from countless users, a study has found.

The research, conducted jointly by scholars from the US Naval War College and Tel Aviv University, discovered that the China government, acting through China Telecom, has been engaged in data hacking even though it had entered into a pact with the U.S. in 2015 to stop cyber operations aimed at intellectual property theft.

Oracle’s Internet Intelligence division has just confirmed the findings of the academic paper published two weeks ago that accused China of “hijacking the vital internet backbone of western countries.”

Doug Madory, Director of Oracle’s Internet Analysis division (formerly Dyn), confirmed that China Telecom has, indeed, engaged in internet traffic “misdirection.” “I don’t intend to address the paper’s claims around the motivations of these actions,” said Madori. “However, there is truth to the assertion that China Telecom (whether intentionally or not) has misdirected internet traffic (including out of the United States) in recent years. I know because I expended a great deal of effort to stop it in 2017,” Madori said.

Image Courtesy of Oracle

……………………………………………………………………………………………………………….

Madori then goes on to detail several of China Telecom’s BGP (Border Gateway Protocol) route “misdirections,” most of which have involved hijacking US-to-US traffic and sending it via mainland China before returning it to the U.S.

Verizon APAC errors had a knock-on effect, Madori explained: “Verizon APAC … were announcing [routes] to the internet on behalf of their customers. A couple of AS hops away, China Telecom was mishandling them – announcing them in a manner that would cause internet traffic destined for those IP address ranges to flow back through China Telecom’s network.”

………………………………………………………………………………………………………………………………..

Indeed, the researchers found that China Telecom uses BGPs in order to carry out their data intrusions. Created in the early 1980s, BGP protocols do not feature any security controls, often resulting in misdirected traffic through “bad BGPs”. The majority of these cases are attributed to configuration mistakes.

However, researchers found that China Telecom has been deliberately hijacking BGP routes to send legitimate traffic through malicious servers.

They described the state-owned telco as “one of the most determined BGP hijackers in the international community.”

In order to validate their findings, the researchers built a route tracing system to monitor BGP announcements, allowing them to distinguish between normal, accidental patterns and deliberate ones.

They concluded that China Telecom was responsible for patterns of BGP behavior that “suggest malicious intent, precisely because of their unusual transit characteristics -namely the lengthened routes and the abnormal durations.”

“[China Telecom] has already relatively seamlessly hijacked the domestic US and cross-US traffic and redirected it to China over days, weeks, and months,” the researchers said.

“The prevalence of and demonstrated ease with which one can simply redirect and copy data by controlling key transit nodes buried in a nation’s infrastructure requires an urgent policy response,” they warned.

………………………………………………………………………………………………………………………………………….

The routing snafu involving domestic US Internet traffic coincided with a larger misdirection that started in late 2015 and lasted for about two and a half years, Oracle’s Madory said in a blog post published Monday. The misdirection was the result of AS4134, the autonomous system belonging to China Telecom, incorrectly handling the routing announcements of AS703, Verizon’s Asia-Pacific AS. The mishandled routing announcements caused several international carriers—including Telia’s AS1299, Tata’s AS6453, GTT’s AS3257, and Vodafone’s AS1273—to send data destined for Verizon Asia-Pacific through China Telecom, rather than using the normal multinational telecoms.

………………………………………………………………………………………………………………………………………….

Ahead of the third telco player’s selection Wednesday (November 7), Senators Grace Poe and Francis Escudero already voiced concerns about the possible threats to national security and data privacy in case China Telecom becomes the winner of the bidding.

………………………………………………………………………………………………………………………………………….

References:

https://internetintel.oracle.com/blog-single.html?id=China+Telecom%27s+Internet+Traffic+Misdirection

https://www.zdnet.com/article/oracle-confirms-china-telecom-internet-traffic-misdirections/

China Telecom: IoT partnerships with 3 network operators; Huawei NB-IoT award from GSMA

China Telecom’s 3 New IoT Partnerships:

China Telecom has entered three new partnership agreements aimed at accelerating the development of services based on an Internet of Things (IoT) open platform.

The operator has announced an expanded partnership with HKT to cover the development of a common IoT open platform to serve the operators’ customers in the combined geographical footprints of mainland China and Hong Kong.

With the arrangement, each network operator’s customers will be able to deploy IoT and M2M services on the other’s network.

The joint offering will allow seamless switching of IoT subscription between networks by integrating the two commonly-deployed embedded universal integrated circuit card platforms. The multi-domestic service is supported by the Ericsson Device Connection Platform (DCP).

China Telecom also announced a similar strategic partnership with Norway-based Telenor Group. That partnership will allow customers from China Telecom and Telenor Connexion to deploy IoT and Machine-to-Machine (M2M) services in each other’s network. It enables China Telecom’s multi-national enterprise customers with outbound IoT business to deploy their assets and offerings under Telenor Connexion’s networks in the European and other Asian Markets.

Similarly, Telenor Connexion’s global customers can enjoy the benefits of the rapidly growing Chinese market by leveraging on China Telecom’s IoT network resources and business capabilities. The seamless switching of IoT subscription between networks is achieved by the integration of the two commonly deployed eUICC platforms which are the key component of IoT collaboration across borders.

To recap, China Telecom’s multi-national enterprise customers will gain access to Telenor Connexion’s IoT networks in Europe and Asian markets, and will serve as Telenor Connexion’s preferred partner for connectivity in China.

…………………………………………………………………………..

A separate agreement with Orange Business Services will enable both companies to serve their respective enterprise customers through a combined footprint across three continents – Asia, Europe and Africa.

The network operators have also agreed to collaborate on the development of new service models supporting global IoT opportunities and to explore the potential of enhancing existing IoT capabilities and applying emerging technologies such as mobile IoT.

GSMA functions to connect participants throughout the global mobile communications ecosystem, including almost 800 operators and over 300 enterprises. The association lays significant emphasis on addressing common concerns to best serve the interests of mobile operators worldwide. GSMA’s “Best IoT Innovation for Mobile Networks” award identifies and rewards Internet of Things (IoT) products, solutions, services, and new business models to highlight innovative breakthroughs based on new technological developments and standards of mobile networks.

Huawei’s NB-IoT solution comprises an NB-IoT terminal chipset, terminal operation system LiteOS, NB-IoT RAN and EPC, OceanConnect (a cloud platform for IoT management), and OpenLab that helps related enterprises develop IoT services and applications. The goal of the Huawei NB-IoT solution is to jointly build a better connected IoT solution and ecosystem with operators and partners from a diverse range of vertical industries. Huawei was the first to launch associated products after 3GPP released standards formulated for NB-IoT – one of multiple competing “standards” for Low Power WANs (LPWANs) targeted at the (non LAN) IoT market.

In 2016, Huawei began conducting NB-IoT trial applications in conjunction with mainstream network operators and partners. In early 2017, Huawei launched Boudica120, the world’s first commercial NB-IoT chip.

http://www.huawei.com/en/news/2017/6/GSMA-Best-IoT-Innovation-Mobile-Networks-Award

Highlights of IoT Developers Conference, April 26-27, 2017 in Santa Clara, CA