Cloud Service Providers

Barracuda CloudGen SD-WAN runs on Microsoft Azure Virtual WAN Hubs; 5G Next Target for CSPs?

In the new world of cloud service providers (CSPs) taking over every aspect of communications, Microsoft Azure will now be used as the basis of what Barracuda calls “the first SD-WAN service built natively inside Azure Virtual WAN Hubs.” Those so called “hubs” are interconnected through Microsoft’s Global Network.

The new Barracuda CloudGen SD-WAN is a SaaS deployed directly from the Azure Marketplace for as many regions as needed and administered centrally in the CloudGen WAN portal for all office locations and remote endpoints. Since the Microsoft Global Network is automatically provisioned as the backbone for anywhere, anytime application access, service providers can create a pragmatic SASE platform in the public cloud tailored to their specific needs.

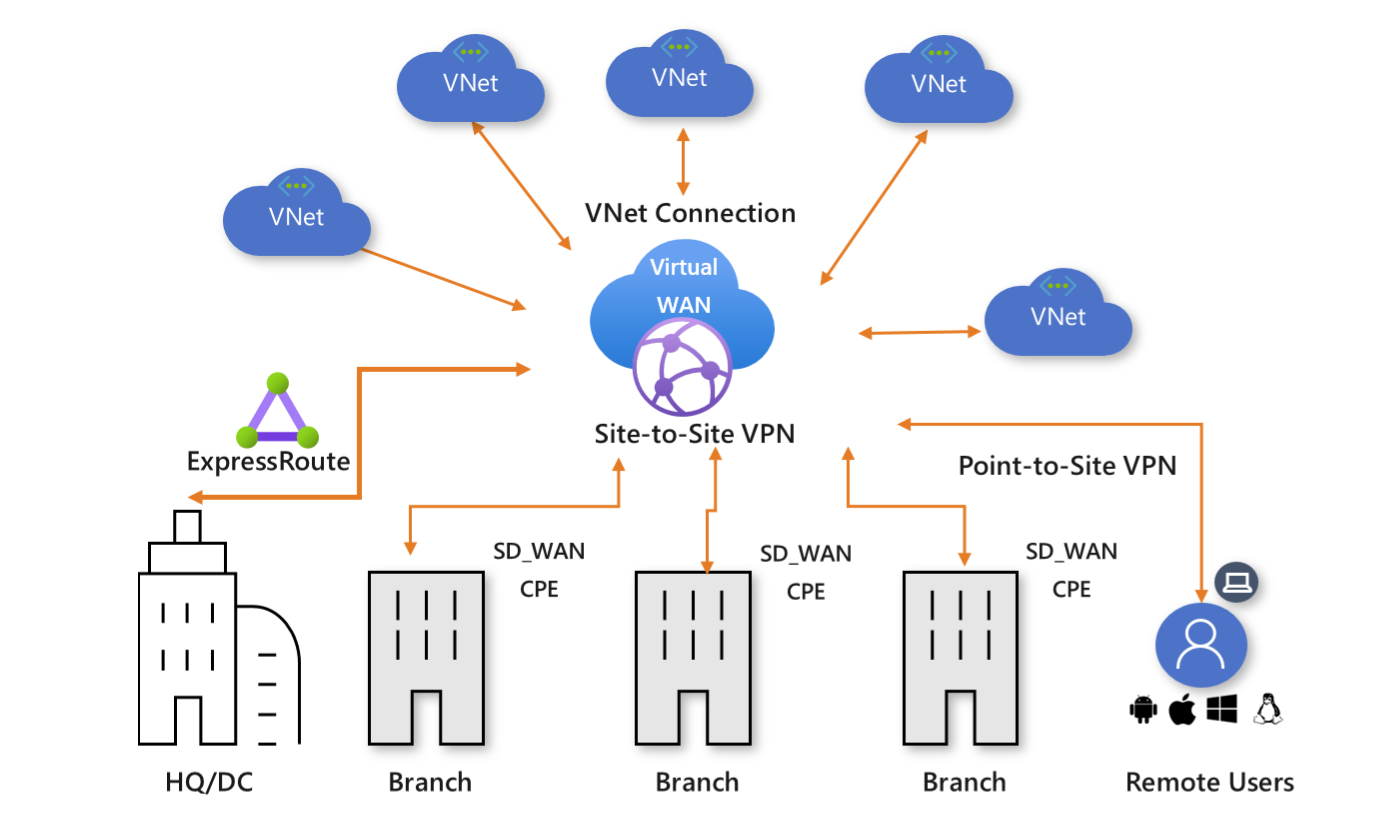

Illustration of Azure Virtual WAN from Microsoft (see reference below)

Microsoft says its Virtual WAN offers the following advantages:

- Integrated connectivity solutions in hub and spoke: Automate site-to-site configuration and connectivity between on-premises sites and an Azure hub.

- Automated spoke setup and configuration: Connect your virtual networks and workloads to the Azure hub seamlessly.

- Intuitive troubleshooting: You can see the end-to-end flow within Azure, and then use this information to take required actions.

………………………………………………………………………………………………………………………………………………………….

Barracuda said that their CloudGen WAN architecture can replace costly, inflexible network connectivity circuits, and the entire network can be dynamically sized to match current traffic workload, which can optimize network performance and minimize cost.

“A cloud-first strategy asks for a different approach on connectivity,” said Leon Sevriens, program manager, IT at Humankind, a large organization in the Netherlands that offers daycare and after-school care, with over 3,000 employees and over 450 locations. “We have invested heavily in Microsoft Office 365 adoption across the organization, and traditional connectivity doesn’t fit the bill anymore. We need a solution that is focused on delivering application performance, not just ‘plain’ connectivity. That’s why we’re moving forward with Barracuda CloudGen WAN,” he added.

In the recent report “Secure SD-WAN: The Launch Pad into Cloud,” Barracuda found that SD-WAN is being used by more than half of those who have added security to their public cloud. As the report explains, “SD-WAN can help overcome the top two security challenges organizations are facing when it comes to public cloud: lack of access control and backhauling traffic.”

Cloud-native, secure SD-WAN:

The perimeter is changing, and organizations need to be ready to adapt. According to Gartner, “The enterprise perimeter is no longer a location; it is a set of dynamic edge capabilities delivered when needed as a service from the cloud.”1

Secure SD-WAN services built natively on the cloud combine ease of use, full security, and cloud-scalable SD-WAN connectivity to use the Microsoft Global Network as the WAN backbone instead of leased lines. The new Barracuda CloudGen WAN is a SaaS service deployed directly from the Azure Marketplace for as many regions as needed and administered centrally in the CloudGen WAN portal for all office locations and remote endpoints. Since the Microsoft Global Network is automatically provisioned as the backbone for anywhere, anytime application access, service providers can create a pragmatic SASE solution in the public cloud tailored to their specific needs.

“With an all-in-one, secure SD-WAN solution natively built on the public cloud network, enterprises can finally make the shift to more public cloud deployments, both faster and more securely,” said Hatem Naguib, COO at Barracuda. “We appreciate the relationship we have developed with Microsoft over the years and the close collaboration over many months to integrate Barracuda SD-WAN technology natively on Microsoft Azure Virtual WAN Hubs. We know this is the future of networking in the public cloud, and we’re excited to be on this forefront with Microsoft.”

Yousef Khalidi, Corporate Vice President, Azure Networking at Microsoft said, “Cloud-native, secure SD-WAN technology, like the new CloudGen WAN service from Barracuda, provides a fast, reliable, and direct path to Microsoft Azure. We’re pleased to collaborate with Barracuda for this new wave of faster public cloud adoption to help our joint customers optimize network performance.”

Opinion: The huge implication here is that the major cloud service providers (Amazon AWS, Microsoft Azure and Google Cloud) will be replacing traditional telco networks. In this case, it’s SD-WAN access and Microsoft’s WAN backbone, but in the future it will likely be 5G network access built mostly from software building blocks. Why else did Microsoft acquire Affirmed Networks and Metaswitch?

For an Amazon AWS executive’s take on this topic (“we’re partners with telco’s”) read this Light Reading piece.

………………………………………………………………………………………………………………………………………………………………….

References:

https://docs.microsoft.com/en-us/azure/virtual-wan/virtual-wan-about

Will Hyperscale Cloud Companies (e.g. Google) Control the Internet’s Backbone?

Resources from Barracuda:

For more information about Barracuda CloudGen WAN, visit https://www.barracuda.com/products/cloudgenwan

Read the Barracuda blog post: http://cuda.co/40855

Read the Microsoft blog post from Yousef Khalidi: https://aka.ms/vwan-sdwan

Watch Reshmi Yandapalli’s session on “Use Azure networking services to accelerate, scale or re-architect your customer’s global network” for Microsoft Inspire: https://aka.ms/T4D193

Read the market report: https://www.barracuda.com/sdwan-report-2020

Find out Barracuda was recognized as a finalist for Commercial Marketplace 2020 Microsoft Partner of the Year: http://cuda.co/40853

1 Gartner, “The Future of Network Security Is in the Cloud”, Neil MacDonald, Lawrence Orans, Joe Skorupa, 30 August 2019.

……………………………………………………………………………………………………………………………………………………………………………

Synergy Research: Cloud Service Provider Rankings (See Comments for Details)

………………………………………………………………………………………………………………………………………………………………………

According to Larry Dignan of ZDNET, “the cloud computing market in 2019 will have a decidedly multi-cloud spin, as the hybrid shift by players such as IBM, which is acquiring Red Hat, could change the landscape. This year’s edition of the top cloud computing providers also features software-as-a-service giants that will increasingly run more of your enterprise’s operations via expansion.

One thing to note about the cloud in 2019 is that the market isn’t zero sum. Cloud computing is driving IT spending overall. For instance, Gartner predicts that 2019 global IT spending will increase 3.2 percent to $3.76 trillion with as-a-service models fueling everything from data center spending to enterprise software. In fact, it’s quite possible that a large enterprise will consume cloud computing services from every vendor in this guide. The real cloud innovation may be from customers that mix and match the following public cloud vendors in unique ways. ”

Key 2019 themes to watch among the top cloud providers include:

- Pricing power. Google recently raised prices of G Suite and the cloud space is a technology where add-ons exist for most new technologies. While compute and storage services are often a race to the bottom, tools for machine learning, artificial intelligence and serverless functions can add up. There’s a good reason that cost management is such a big theme for cloud computing customers–it’s arguably the biggest challenge. Look for cost management and concerns about lock-in to be big themes.

- Multi-cloud. A recent survey from Kentik highlights how public cloud customers are increasingly using more than one vendor. AWS and Microsoft Azure are most often paired up. Google Cloud Platform is also in the mix. And naturally these public cloud service providers are often tied into existing data center and private cloud assets. Add it up and there’s a healthy hybrid and private cloud race underway and that’s reordered the pecking order. The multi-cloud approach is being enabled by virtual machines and containers.

- Artificial intelligence, Internet of things and analytics are the upsell technologies for cloud vendors. Microsoft Azure, Amazon Web Services and Google Cloud Platform all have similar strategies to land customers with compute, cloud storage, serverless functions and then upsell you to the AI that’ll differentiate them. Companies like IBM are looking to manage AI and cloud services across multiple clouds.

- The cloud computing landscape is maturing rapidly yet financial transparency backslides. It’s telling when Gartner’s Magic Quadrant for cloud infrastructure goes to 6 players from more than a dozen. In addition, transparency has become worse among cloud computing providers. For instance, Oracle used to break out infrastructure-, platform- and software-as-a-service in its financial reports. Today, Oracle’s cloud business is lumped together. Microsoft has a “commercial cloud” that is very successful, but also hard to parse. IBM has cloud revenue and “as-a-service” revenue. Google doesn’t break out cloud revenue at all. Aside from AWS, parsing cloud sales has become more difficult.

IBM is more private cloud and hybrid with hooks into IBM Cloud as well as other cloud environments. Oracle Cloud is primarily a software- and database-as-a-service provider. Salesforce has become about way more than CRM.

………………………………………………………………………