Vertical Systems Group

AT&T tops VSG’s U.S. Carrier Managed SD-WAN Leaderboard for 4th year

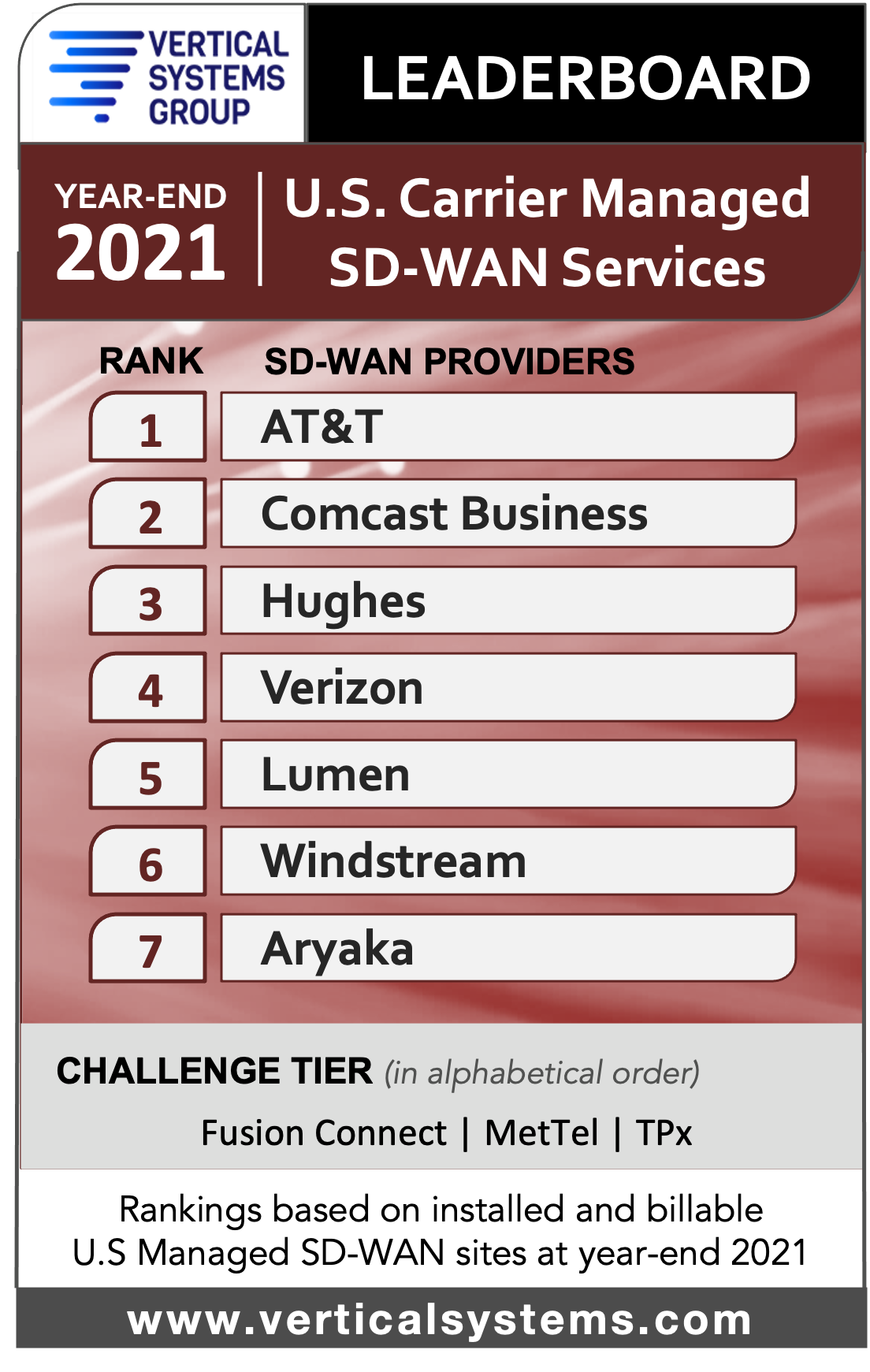

AT&T continues as the #1 U.S. Carrier Managed SD-WAN provider in 2021 for the fourth consecutive year, as per Vertical Systems Group’s annual SD-WAN Leaderboard. Seven service providers each have 2% or more of the installed and billable Carrier Managed SD-WAN customer sites in the U.S. as of December 31, 2021.

“The U.S. Managed SD-WAN services market emerged from the pandemic in 2021 with solid growth in new site installations, driven by accelerated network transformations and more flexible solutions for customers,” said Rick Malone, principal of Vertical Systems Group. “Competition is heating up as evidenced by the shake up in top provider rankings on our year-end 2021 U.S. LEADERBOARD benchmark.”

Comcast Business rose two places to the No. 2 position on the Leaderboard, bumping down Hughes and Verizon to third and fourth place, respectively. Vertical Systems Group (VSG) says that Comcast Business’s rise on the Leaderboard is due to “organic growth” plus sites added from the acquisition of Masergy.

Three companies attained a Challenge Tier citation for 2021 (in alphabetical order): Fusion Connect, MetTel and TPx. This tier includes service providers with between one percent 1% and 2% share of U.S. Carrier Managed SD-WAN sites.

Research Highlights:

- Rankings changed for five of the seven market leading providers on Vertical’s 2021 U.S. Carrier Managed SD-WAN LEADERBOARD based on latest site share results as compared to the previous year.

- AT&T retains first position overall for the fourth consecutive year.

- Comcast Business rises to second position, up from fourth in 2020 based on site share that includes organic growth plus sites added from its Masergy acquisition.

- Hughes moves to third position, from second overall in 2020. Verizon moves into fourth position, a change from third in the previous year.

- Lumen advances to rank fifth, up from sixth position. Windstream drops to sixth position from fifth in 2020. Aryaka retains seventh position and rounds out the roster of top providers for 2021.

- Additionally, TPx drops into the 2021 Challenge Tier from the Leaderboard.

- MEF 3.0 SD-WAN Service Certification has been attained by five of the 2021 U.S. LEADERBOARD companies: AT&T, Comcast Business, Verizon, Lumen and Windstream. Each of these providers also has employees with MEF SD-WAN Certified Professional training certification.

- Primary technology suppliers to the service providers ranked on the 2021 Carrier Managed SD-WAN LEADERBOARD include Cisco, Fortinet, Versa and VMware. Additionally, SD-WAN providers Aryaka and Hughes utilize internally developed technologies.

Market Players include providers selling Carrier Managed SD-WAN services in the U.S. with site share below 1%, including global network providers that manage U.S. customer sites. For 2021, the Market Player tier includes the following companies (in alphabetical order):

AireSpring, American Telesis, Arelion, Astound Business, Bigleaf, bSimplify, BT Global Services, C Spire Business, CentraCom, Cincinnati Bell, Cogent, Colt, Consolidated Communications, Cox, Crown Castle, DQE Communications, FirstLight, Frontier, Great Plains Communication, GTT, InfoStructure, Intelsat, Lightpath, Logix Fiber Networks, Meriplex, NTT, Orange Business, PCCW Global, PS Lightwave, SDN Communications, Segra, SES, SingTel, Sparklight Business, Spectrum Enterprise, Syringa, T-Mobile, T-Systems, Tata, Telefonica, Telstra, Transtelco, Unite Private Networks, Uniti, Veracity Networks, Virgin Media Business, Vodafone, Zayo and others.

Vertical’s Definition – Carrier Managed SD-WAN Service:

Vertical Systems Group defines a Carrier Managed SD-WAN Service for segment analysis and share calculations as a carrier-grade offering for business customers that is managed by a network operator. Required components and functionality for these offerings include an SDN service architecture that provides dynamic optimization of traffic flows, a purpose-built SD-WAN appliance or CPE-hosted SD-WAN VNF at each customer edge site, support for multiple active underlay connectivity services, automated failover fast enough to maintain active sessions, and centralized network orchestration with traffic and application visibility end-to-end. Security capabilities may be supplied by a managed SD-WAN service provider based on customer requirements.

VSG Global SD-WAN Leaderboard Rankings and Results

Orange Business Services (France), AT&T (U.S.), and Verizon (U.S.) topped Vertical Systems Group’s (VSG) latest leaderboard for global carrier-managed SD-WAN. They were followed in the rankings by NTT (Japan), BT (UK), Telefonica Global Solutions (Spain), and Vodafone (UK). [The rank order is based on site share outside of the provider’s home country, as of June 30, 2021.]

Rosemary Cochran, principal analyst and co-founder of Vertical Systems Group said that global networks are far more complex to manage and administer compared to domestic SD-WAN offerings. They often require service providers to negotiate contracts with multiple countries, meet diverse regulatory requirements, and support numerous network technologies.

This industry benchmark for multinational SD-WAN market presence ranks companies that hold a 5% or higher share of billable retail sites outside of their respective home countries.

Twelve companies qualify for the Mid-2021 Global Provider Managed SD-WAN Challenge Tier (in alphabetical order):

Aryaka (U.S.), Colt (U.K.), Deutsche Telekom (Germany), Global Cloud Xchange (India), GTT (U.S.), Hughes (U.S.), Lumen (U.S.), PCCW Global (Hong Kong), Singtel (Singapore), Tata (India), Telia (Sweden) and Telstra (Australia).

The Challenge Tier includes companies with site share between 1% and 5% of this defined SD-WAN segment.

“We’re pleased to release the first benchmark that measures Global Provider market presence based on multinational managed SD-WAN customer sites,” said Rick Malone, principal of Vertical Systems Group. “Enterprises with business-essential applications that span multiple regions of the world are choosing SD-WAN solutions from network operators with the global infrastructures, experience, partnerships and technical expertise necessary to deliver world-class services.”

Research Highlights for Global Provider SD-WAN Services:

- Orange Business Services gained the top share rank on the Mid-2021 Global Provider Managed SD-WAN LEADERBOARD with the largest number of customer sites installed.

- Vertical’s SD-WAN Coverage Analysis for five regional markets – North America, Latin America, Europe, Africa/Middle East, Asia/Pacific – shows that all seven companies ranked on the Mid-2021 Global Provider SD-WAN LEADERBOARD have good to strong coverage in at least three of these regions.

- COVID-19 continues to appreciably impact every region of the world. Just being able to get the SD-WAN equipment and support the services has been a disruptive experience for service providers and their customers.

- Challenges cited by Global SD-WAN operators include: workforce health protection, tracking the shift back from remote to office environments, service disconnects due to business closures, and supply chain disruptions.

- Most multinational Managed SD-WAN customer implementations are hybrid network configurations that incorporate MPLS, IP VPN, Cloud connectivity or other services, plus multiple security capabilities that are integral or supplied by technology partners.

- SD-WAN customers with MPLS connections are migrating to more cloud-suitable broadband services that provide bandwidth flexibility and lower pricing.

- Ethernet DIA (Dedicated Internet Access) is the preferred choice for SD-WAN customers that require dedicated, symmetrical connectivity.

Fictitious image of a global mesh connected SD-WAN

…………………………………………………………………………………………..

Five of the seven companies on the Mid-2021 Global Provider SD-WAN LEADERBOARD are ranked on the 2020 Global Provider Ethernet LEADERBOARD (in rank order): AT&T, Orange Business Services, Verizon, BT Global Services and NTT.

- Two companies ranked on the Mid-2021 Global Provider SD-WAN LEADERBOARD – AT&T and Verizon – have attained MEF 3.0 SD-WAN Services Certification to date. Additionally, three companies cited in the Challenge Tier – Colt, PCCW Global and Telia – have MEF 3.0 SD-WAN Services certification.

- The primary technology suppliers to the nineteen Mid-2021 Carrier Managed SD-WAN LEADERBOARD and Challenge Tier companies are as follows (in alphabetical order): Cisco, Fortinet, HPE Aruba, Nuage Networks (Nokia), Versa and VMware.

The Market Player tier includes providers with site share below 1%. Companies in the Mid-2021 Market Player tier are as follows (in alphabetical order):

Batelco (Bahrain), China Telecom (China), Claro Enterprise Solutions (Mexico), CMC Networks (South Africa), Cogent (U.S.), Epsilon (Singapore), Etisalat (Abu Dhabi), Expereo (Netherlands), HGC Global (Hong Kong), Intelsat (U.S.), KDDI (Japan), Masergy (U.S.), Meriplex (U.S.), PLDT Enterprise (Philippines), SES (Luxembourg), Sparkle (Italy), StarHub (Singapore), Syringa Networks (U.S.), T-Mobile (U.S.), Telenor (Norway), Telin(Singapore), Transtelco (U.S.), Virgin Media (U.K.), Zayo (U.S.) as well as other providers (unnamed) selling SD-WAN services outside their home country.

Closing Comment:

This VSG report highlights the disparate implementations of global SD-WANs. “…implementations are hybrid network configurations that incorporate MPLS, IP VPN, Cloud connectivity or other services, plus multiple security capabilities that are integral or supplied by technology partners.”

That is because there is no clear definition of functionality (yeah we know about MEF’s definition) and no specification of any exposed interfaces, e.g. UNI, network node to network node, or NNI between two SD-WAN networks.

As such, global SD-WANs are really a concept, not a set of required networking technologies with defined reference points and standardized interfaces/APIs. As a result, it’s a serious challenge for the global SD-WAN operator to ensure interoperability between each of the different subnetwork interfaces so that end to end connectivity is achieved.

…………………………………………………………………………………………….

References:

Shift from SDN to SD-WANs to SASE Explained; Network Virtualization’s important role