Month: June 2017

AT&T to Test “5G” via DIRECTV Now in Austin, TX

In the continuing saga of pre-standard “5G” trials, AT&T has begun field trials of its “5G” based fixed wireless system in Austin, TX using its DIRECTV Now streaming-video service. That’s the mega telco’s second commercial trial of gigabit millimeter-wave spectrum technology. Its first “5G” millimeter-wave trial in 2016 was also in Austin.

Earlier this year, AT&T and Nokia combined on a lab test of 5G fixed-wireless streaming of DirecTV Now over a 39-GHz system that was conducted at the AT&T Labs facility in Middletown, NJ.

………………………………………………………………………………………

AT&T is using Ericsson’s “5G” RAN and Intel’s “5G” Mobile Trial Platform and says it plans to incorporate software-defined networks in other “5G” efforts this year.

AT&T said it expects the trial in Austin will deliver speeds up to 1 Gbps using mmWave spectrum.

The latest Austin trial represents a “major step on our journey to deliver state-of-the-art 5G wireless speeds as early as late 2018,” according to an AT&T press release, which also stated:

“We expect 5G to take people and businesses places they’ve never been with all new experiences thanks to the advantages of enhanced mobile broadband, critical IoT solutions and low latency applications.

Lower latency will play a powerful role in the connected experience. It impacts things like the time between clicking a web link and seeing a webpage begin to load on your device. Through this trial, participants will be able to see the real-life, daily benefits that fixed wireless 5G offers them directly or to their customers.”

…………………………………………………………………………………………

“The technology behind 5G is important. But it’s also about advancing social trends like mobile video streaming,” said Marachel Knight, AT&T senior vice president, wireless network architecture and design.

“In Austin, we’re testing DirecTV NOW over ultra-fast internet speeds at a variety of locations,” Knight said. “The network of the future will help redefine what connectivity means to both consumers and businesses. This trial helps show that the new reality is coming fast.”

http://www.multichannel.com/news/content/att-kicks-5g-powered-directv-now-trial/413707

Deloitte: $150B U.S. Fiber Infrastructure Investment for 5G

The U.S. needs $130 billion to $150 billion in fiber network expansion to be fully ready for 5G-based networks and to ensure that the digital economy’s benefits reach all Americans, according to a Deloitte report.

The suggested $130 billion to $150 billion fiber infrastructure investment is required in the U.S. to unleash innovation, close the digital divide, and fully prepare the country for 5G, according to a report from management consulting firm Deloitte. The report says the investment is needed over the next five to seven years to enable ‘deep fiber,’ or fiber infrastructure closer to the end user.

Much of the premise behind the report focuses on 5G, which requires a dense fiber network for backhaul and fronthaul. But it also stresses the discrepancy between rural and urban broadband options. Deloitte is calling on regulators and the broadband carrier community to address this issue, or risk losing leadership for the global digital economy opportunity.

Key Points:

– Future of connectivity remains uncertain in the U.S.; investment needed to ensure U.S. is 5G ready

– Vast discrepancies in choice, affordability and performance exist between rural, underserved and urban geographies

– Deep fiber paramount to unleashing wireless innovation, internet of things (IoT) functionality and immersive entertainment.

…………………………………………………………………………………………..

“Network infrastructure is among the key factors in a nation’s economic growth potential and status as an innovator, and ultimately in propelling our economy’s gross domestic product and job growth,” said Craig Wigginton, vice chairman and telecommunications sector leader, Deloitte & Touche LLP in a press release announcing the report.

“We see a 5G ready U.S. infrastructure as critical to enabling a range of other adjacent industries to compete globally and safeguard our digital economy.”

The report says the U.S. currently lacks the fiber infrastructure necessary to take advantage of 5G. Many tier one carriers, including Verizon, have expressed their plans to ramp up fiber investments. Deloitte seems to suggest it’s not enough.

The report notes that FTTP reaches less than one-third of U.S. homes, with only 39% of U.S. consumers having access to more than one provider who offers a 25 Mbps speed tier or higher. The situation is worse in rural communities, where 10 million rural homes do not have broadband of at least 25 Mbps. The FCC definition for broadband includes a minimum speed of 25 Mbps. Well sort of. It depends on where you live and whether your carrier receives Connect America Fund (CAF) support.

“It is essential that fiber gets deployed closer to the customer to enable next generation wireless and to ensure affordable high speed connectivity across urban, suburban and rural geographies,” said Dan Littmann, principal, Deloitte Consulting LLP in the press release.

The report calls for $35B to $40B for rural fiber infrastructure and $60B to $100B for what Deloitte calls ‘broadband competition.’ I assume broadband competition means enabling multiple broadband providers who offer speeds of 25 Mbps or more.

Deloitte suggests carriers consider “shared infrastructure” models, a play on open access perhaps. IoT presents integration and security opportunities, that Deloitte says carriers need to get better at exploiting. They also suggest, carriers partner with OTT players, inviting them to fund and own their own fiber optic networks. This author believes that’s highly unlikely!

The report suggests that IP migration and regulatory reforms, while important, will not be enough to create the case for fiber deployment. Wireless, wireline and cable require creative new ways to monetize “last mile” access as an incentive for massive fiber deployment. The report contemplates three potential models:

- Synergies between deep fiber and adjacent services in an “unlimited” world: Gartner predicts that affluent households will have up to 500 connected devices by 2022. In some cases, IoT services offer the prospect of new revenue. However, most connected devices will require low bandwidth or be WiFi enabled and, therefore, may not provide carriers with incremental revenue. In such cases, carriers have an opportunity to increase revenue by offering integration, network security, and traffic management services within the increasingly complex mix of IoT devices and ecosystems.

- Partnership between carriers and OTT players to fund deep fiber: As limited fiber availability constrains increased wireless densification and fiber broadband, over the top players may choose to fund fiber deployment, including owning assets or forming partnerships with carriers.

- Deep fiber as a financial investment: Insufficient supply of deep fiber and overwhelming demand growth are strong fundamentals for fiber investment. As interest grows from nontraditional fiber investors, we expect shared infrastructure models to emerge for last mile fiber access. Fiber as leased real estate could allow carriers to maximize asset utilization.

Communications Infrastructure Upgrade – The Need for Deep Fiber (Source: PRNewsfoto/Deloitte)

………………………………………………………………………………….

For regulators, Deloitte offers these suggestions, which on the surface are pretty light on the details:

- Eliminating regulatory barriers that prevent carriers from operating a single IP network, impede deployment of additional fiber assets, or restrict the types of services that may be offered.

- Avoiding regulation that limits carrier innovation in creating new monetization mechanisms.

- Reforming the Universal Services Administrative Company internal operations to meet broader goals of expanding fiber infrastructure and addressing rural internet access to close the digital divide.

References:

http://www.prnewswire.com/news-releases/deloitte-us-investment-of-130b-to-150b-in-deep-fiber-infrastructure-required-to-lead-global-digital-economy-opportunity-300480135.html

Timeline for IMT 2020 (5G) Radio Access Recommendations + Evaluation Methodology

Introduction:

This article was written based on the ITU-R WP5D Niagara Falls, Canada meeting that concluded last week. We attempt to present the true picture for standardizing IMT 2020 (5G) Radio Interface Technologies (RITs – aka Radio Access Networks or Radio Access Interfaces).

We don’t mention 3GPP release 15 (“5G” features over a LTE network) or 16 (pure 5G- no LTE) which will provide different levels of “5G” support. Those specs might be submitted to ITU-R WP 5D for their consideration, based on the IMT 2020 RIT Evaluation methodology described in item 2. below.

Global carriers that have announced 5G specs and trials will likely have to do a major upgrade to their “5G” base stations to support the ITU-R IMT 2020 RIT specifications to be completed at the end of 2020 as per item 1. below. It’s a mystery (to me and other IEEE members on the ComSocSCV email discussion group) as to what companies will provide the pre-standard “5G” handsets and other mobile/fixed end point devices that will have to be upgraded or replaced completely when standardized 5G is finalized in late 2020.

Note: SK Telecom said that’s not a problem as mobile device refresh/replace time is 18 months, so pre-standard 5G handsets will be obsolete when standardized 5G is finally deployed.

1. Development of IMT 2020 (5G) radio access recommendation(s) by ITU-R WP 5D

Critical milestones in IMT 2020 radio interface development process:

(0): Issue an invitation to propose Radio Interface Technologies (RITs) -March 2016

(1): ITU proposed cut off for submission – July 2019

(2): Cut off for evaluation report to ITU – February 2020

(3): WP 5D decides framework and key characteristics of IMT-2020 RIT and SRIT -June 2020

(4): WP 5D completes development of radio interface specification recommendations- October 2020

Terminology:

RIT= Radio Interface Technologies

SRIT= Set of Radio Interface technologies, each meeting the evaluation criteria

…………………………………………………………………………………………………………………………………….

2. Key Sections of Evaluation of IMT 2020 Radio Interfaces (from new ITU-R WP5D draft report):

Scope:

This Report provides guidelines for the procedure, methodology and the criteria (technical, spectrum and service) to be used in evaluating the candidate IMT-2020 radio interface technologies (RITs) or Set of RITs (SRITs) for a number of test environments. These test environments are chosen to simulate closely the more stringent radio operating environments. The evaluation procedure is designed in such a way that the overall performance of the candidate RITs/SRITs may be fairly and equally assessed on a technical basis. It ensures that the overall IMT‑2020 objectives are met.

This Report provides, for proponents, developers of candidate RITs/SRITs and independent evaluation groups, the common evaluation methodology and evaluation configurations to evaluate the candidate RITs/SRITs and system aspects impacting the radio performance. This Report allows a degree of freedom so as to encompass new technologies. The actual selection of the candidate RITs/SRITs for IMT-2020 is outside the scope of this Report.

The candidate RITs/SRITs will be assessed based on those evaluation guidelines. If necessary, additional evaluation methodologies may be developed by each independent evaluation group to complement the evaluation guidelines. Any such additional methodology should be shared between independent evaluation groups and sent to the Radiocommunication Bureau as information in the consideration of the evaluation results by ITU-R and for posting under additional information relevant to the independent evaluation group section of the ITU-R IMT-2020 web page (http://www.itu.int/en/ITU-R/study-groups/rsg5/rwp5d/imt-2020/Pages/submission-eval.aspx)

Evaluation guidelines:

IMT-2020 can be considered from multiple perspectives: users, manufacturers, application developers, network operators, service and content providers, and, finally, the usage scenarios – which are extensive. Therefore candidate RITs/SRITs for IMT-2020 must be capable of being applied in a much broader variety of usage scenarios and supporting a much broader range of environments, significantly more diverse service capabilities as well as technology options. Consideration of every variation to encompass all situations is, however, not possible; nonetheless the work of the ITU-R has been to determine a representative view of IMT‑2020 consistent with the process defined in Resolution ITU-R 65, Principles for the process of future development of IMT‑2020 and beyond, and the key technical performance requirements defined in Report ITU-R M.[IMT-2020.TECH PERF REQ] – Minimum requirements related to technical performance for IMT-2020 radio interface(s).

The parameters presented in this Report are for the purpose of consistent definition, specification, and evaluation of the candidate RITs/SRITs for IMT-2020 in ITU-R in conjunction with the development of Recommendations and Reports such as the framework and key characteristics and the detailed specifications of IMT-2020. These parameters have been chosen to be representative of a global view of IMT-2020 but are not intended to be specific to any particular implementation of an IMT-2020 technology. They should not be considered as the values that must be used in any deployment of any IMT-2020 system nor should they be taken as the default values for any other or subsequent study in ITU or elsewhere.Further consideration has been given in the choice of parameters to balancing the assessment of the technology with the complexity of the simulations while respecting the workload of an evaluator or technology proponent.

This procedure deals only with evaluating radio interface aspects. It is not intended for evaluating system aspects (including those for satellit system aspects).

The following principles are to be followed when evaluating radio interface technologies for IMT‑2020:

− Evaluations of proposals can be through simulation, analytical and inspection procedures.

− The evaluation shall be performed based on the submitted technology proposals, and should follow the evaluation guidelines, using the evaluation methodology and the evaluation configurations defined in this Report.

− Evaluations through simulations contain both system-level and link-level simulations. Independent evaluation groups may use their own simulation tools for the evaluation.

− In case of evaluation through analysis, the evaluation is to be based on calculations which use the technical information provided by the proponent.

− In case of evaluation through inspection the evaluation is to be based on statements in the proposal.

The following options are foreseen for proponents and independent external evaluation groups doing the evaluations:

− Self-evaluation must be a complete evaluation (to provide a fully complete compliance template) of the technology proposal.

− An external evaluation group may perform complete or partial evaluation of one or several technology proposals to assess the compliance of the technologies with the minimum requirements of IMT-2020.

− Evaluations covering several technology proposals are encouraged.

6. Overview of characteristics for evaluation

The characteristics chosen for evaluation are explained in detail in Report ITU-R M.[IMT‑2020.SUBMISSION −Requirements, evaluation criteria and submission templates for the development of IMT‑2020], § 3, including service aspect requirements, spectrum aspect requirements, and technical performance requirements , the last of which are based on Report ITU‑R M.[IMT-2020.TECH PERF REQ]. These are summarized in Table 6-1, together with their high level assessment method:

− Simulation (including system-level and link-level simulations, according to the principles of the simulation procedure given in § 7.1).

− Analytical (via calculation or mathematical analysis).

Inspection (by reviewing the functionality and parameterization of the proposal).

…………………………………………………………………………………………………………………………………….

Summary of evaluation methodologies:

- Characteristic for evaluation

- High-level assessment method

- Evaluation methodology in this report

Related IMT-2020 Reports:

ITU-R M.[IMT-2020.TECH PERF REQ] and ITU-R M.[IMT‑2020.SUBMISSION]

7. Evaluation methodology

The submission and evaluation process is defined in Document IMT-2020/2 − Submission, evaluation process and consensus building for IMT-2020.

Evaluation should be performed in compliance with the technical parameters provided by the proponents and the evaluation configurations specified for the test environments in § 8.2 of this Report. Each requirement should be evaluated independently, except for the average spectral efficiency and 5th percentile user spectral efficiency – both of which criteria shall be assessed jointly using the same simulation; consequently, the candidate RITs/SRITs shall fulfil the corresponding minimum requirements jointly.

Furthermore, the evaluation parameters used for the system-level simulation used in the mobility evaluation should be the same as the parameters used for system-level simulation for average spectral efficiency and 5th percentile user spectral efficiency.

The evaluation methodology should include the following elements:

1 Candidate RITs/SRITs should be evaluated using reproducible methods including computer simulation, analytical approaches and inspection of the proposal.

2 Technical evaluation of the candidate RITs/SRITs should be made against each evaluation criterion for the required test environments.

3 Candidate RITs/SRITs should be evaluated based on technical descriptions that are submitted using a technologies description template

In order for the ITU to be in a position to assess the evaluation results of each candidate RIT/SRIT, the following points should be taken into account:

− Use of unified methodology, software, and data sets by the evaluation groups wherever possible, e.g. in the area of channel modelling, link-level simulation, and link-to-system-level interface.

− Evaluation of multiple proposals using a single simulation tool by each evaluation group.

Evaluations of average spectral efficiency, 5th percentile user spectral efficiency, peak spectral efficiency, user experienced data rate, area traffic capacity, peak data rate, mobility, reliability, and connection density of candidate RITs/SRITs should take into account the Layer 1 and Layer 2 overhead information provided by the proponents.

……………………………………………………………………………………………………………

Sprint Merger with T-Mobile Gets Closer; Incompatible 2G/3G Technologies is an Issue

German newspaper Handelsblatt yesterday reported that T-Mobile US Inc.’s parent company (Deutsche Telekom AG) favors a merger with Sprint. Deutsche Telekom AG, which controls T-Mobile, aims to maintain control of the combined company after an all-stock deal with Sprint, according to Handelsblatt, which cited sources close to the German company’s management committee and board.

Bloomberg reported two weeks ago that Sprint and T-Mobile were considering an all-stock deal. Sprint and T-Mobile were also talking to other potential merger partners, Bloomberg reported then, citing people familiar with the matter. Executives of both companies have said a merger would produce billions of dollars in cost savings and help them compete against larger rivals AT&T Inc. and Verizon Communications Inc.

When the merger was rumored months ago, SoftBank — Sprint’s parent company — reportedly had not pushed the subject due to strict U.S. Federal Communications Commission rules prohibiting rival carriers from conspiring during airwave auctions.

Now, the report claims that final measures are being put in place to complete the merger and the all-stock agreement would eliminate transaction costs with a deal like this because both companies would be exchanging stock rather than actual money.

This news also comes right after Sprint introduced its new promotion to encourage customers to ditch their current carriers. Those who switched to Sprint would receive unlimited data for up to five lines for free — making it clear that the carrier might be in trouble.

Sprint has consistently been playing catch-up with its rival carriers — AT&T, Verizon, and T-Mobile. Last year OpenSignal reported the carrier took last place in all categories ranging from speed to latency. On the other hand, T-Mobile had an increase in 4G coverage at 81.2 percent — which was neck and neck with AT&T at 82.6 percent — trailing closely behind Verizon. Sprint came in last, yet again, at 70 percent.

T-Mobile has been making efforts to improve its service across the board after having rolled out LTE on the 700MHZ spectrum. The OpenSignal report also measured LTE speeds in 11 of the biggest metro areas where T-Mobile won in four cities — placing it ahead of Verizon’s three — but the two carriers tied in Atlanta, San Francisco, and Washington, D.C.

A merger would likely see T-Mobile and Sprint’s networks also unified, although that would take much longer than many pundits expect. That’s because Sprint uses CDMA technology to power its 2G and 3G networks, while T-Mobile uses GSM (like all of Europe). The two wireless digital transmission technologies are not compatible, and CDMA would likely have to be phased out (along with some customer devices) before the two networks could truly unify. In the short term, internetworking units would be needed for seamless connectivity between wireless endpoints.

Also, T-Mobile has announced a nationwide 5G network, while Sprint has not, although it’s working with several companies (including Intel) on 5G software technologies.

Verizon still remains champion when it comes to coverage nationwide and reliability. AT&T is a close number 2. T-Mobile, which this year passed Sprint as the #3 U.S. wireless carrier, has been very aggressive and is clearly working to toward getting ahead. Sprint has lagged behind, most likely because it had to jettison its WiMAX network and replace it with LTE.

……………………………………………………………………………………………………………………………………………….

Update: Sprint CEO interviewed on CNBC, June 22, 2017:

A combined T-Mobile–Sprint could pose a “powerful” threat to telecom giant AT&T, Sprint CEO Marcelo Claure told CNBC on Thursday, June 22, 2017.

“We have looked at every other alternative to make sure we are making the right decision,” Claure said on “Halftime Report.” “If the government works to allow us to combine, we’ll be No. 3, but we’ll be a formidable competitor and we’ll continue to disrupt the industry.”

The Sprint chief spoke after a meeting at the White House with President Donald Trump and other tech leaders to discuss the potential impact of emerging technologies on U.S. industrial workers, among other topics. Representatives from Verizon, AT&T and T-Mobile were also at the meeting, Claure said.

On Tuesday, German business newspaper Handelsblatt reported that Deutsche Telekom, T-Mobile’s parent, was prepping documents for a potential merger with Sprint. T-Mobile declined to comment but sources said the company is sounding out if there are any government objections to a deal, the newspaper reported.

T-Mobile did not immediately respond to a request for comment from CNBC.

Wall Street has frequently speculated about a possible merger of the two companies.

On the regulatory issues of such a deal, Claure said with more companies in the telecom market, like Comcast and Google, it is less likely to raise an eyebrow from the government. “You’re talking seven or eight formidable competitors today,” he said.

More importantly, “we’re going to need to make some serious investments in order to bring 5G to the United States,” he added. “And that’s going to require to the tune of $40 to $50 billion of investments.”

More at:

Colt plans to enter U.S. Metro Fiber Market in 2018 after Asia Metro Network Investments in 2017

UK based Colt, an alternative telco leader in software defined and virtualized WANs (see sections below for examples), is plotting an assault on the US metro fiber market next year (i.e. in 2018). According to the Financial Times (on line subscription required), Colt wants to become world’s largest metro fiber company within three years. That’s a truly optimistic goal considering all the legacy fiber facilities based network operators, including Century Link which now owns Level One’s fiber assets.

Colt remains one of the most substantial “alt-nets”(alternative or competitive facilities based wireline network operators) still in operation and this year has been investing in its networks in Singapore, Tokyo and Osaka as part of its expansion plan (see section below for more on this).

The telco hopes to build or buy networks in several large US cities that also says the provider might lease some facilities from other vendors. CEO Carl Grivner cited the expected fiber boom from cloud services and the internet of things (IoT) as Colt’s basis for optimism. The company will also look to expand its networks in the UK outside of London in Manchester and Birmingham in the UK.

………………………………………………………………………………………………………………………………………………………………………………………………………………….

On January 12, 2017, Colt announced it was investing in Asia metro area networks. In particular, it will expand and enhance the Colt IQ Network™ in Singapore and Hong Kong in 2017 as part of its plans to invest significantly into Asia over the next three years. In Singapore, these investments will revolve around a series of initiatives that include a large-scale expansion of existing coverage, provisioning of high-bandwidth capacity, and new digging projects for Colt’s next-generation fiber optics.

The Colt network expansion, comprising both Optical and Ethernet architectures, will provide high-bandwidth services to major buildings and data centers across Asia. The investment underlines the growing bandwidth demands of global organizations, particularly in digital, data-intensive industries.

……………………………………………………………………………………………………………………………………………………………………………………………………………………..

The move to target US fiber investment reminds us of the ill-fated strategy of Cable & Wireless in 2000-2001, when that UK network operator pumped billions of pounds into US acquisitions months before the market collapsed.

CEO Grivner, who worked at Cable & Wireless along with XO (now owned by Verizon), said that, with cloud computing and technology relating to the “internet of things” only growing, the bet on expansion looked safer than it did at the turn of the century. “I don’t think it is going to take a pause. The growth has caught up to the hype,” he said.

…………………………………………………………………………………………………………………………………………………………………………………………………………….

Other Voices:

Fierce Telecom wrote on June 19, 2017:

Colt’s plans to build a mixed network in the U.S. should not be a great surprise. In November 2016, Colt said it was expanding its North American sales and support teams. While the focus was to leverage type 2 facilities from other carriers, Colt’s initial foray into the United States could challenge AT&T and Verizon, attracting more multinational customers that need local and international connectivity services.

As a Pan-European provider, Colt operates in 20 countries across Europe and Asia. One of its first moves was to open two regional offices: one in Chicago and another in Jersey City, New Jersey.

………………………………………………………………………………………………………………………………………………………………………………………………………………

At the 2017 Open Network Summit, this author attended an impressive presentation by Colt’s experience in deploying SDN and NFV solutions in production both for Ethernet and IP services, the learning associated as well as their future plans. In particular, Javier Benitez covered Colt developments around Ethernet and IP on Demand, SD VPN, SDN controlled MPLS packet core and SDN/NFV NNI standardization. His presentation is available on reader request. Other 2017 Open Network Summit presentations can be downloaded for free here.

……………………………………………………………………………………………………………………………………………………………………………………………………………….

SDx Central wrote last November:

AT&T is working with Colt Technology Services to provision network services using a programmatic API-to-API interface between separate software-defined networking (SDN) architectures.

The test occurred between two networks — one in the U.S. and one in Europe — and demonstrated that enterprises can provision on-demand, scalable network services across multiple locations and multiple networks, even networks from different service providers. The trial took place between the East Coast of the U.S. and various locations in Europe, and it combined AT&T and Colt’s on-demand network capabilities. AT&T and Colt plan to share the network-to-network interface and open API code with standards bodies and industry forums.

This is an important finding for service providers that want to sell services to enterprises. With this capability, enterprises will be able to reserve ports, order a point-to-point Ethernet service, or adjust their bandwidth requirements on demand.

……………………………………………………………………………………………………………………………………………………………………………

About Colt:

Colt, formerly known as City of London Telecom, is owned by fund manager Fidelity which was an original investor in the business when it was founded 25 years ago. The company was briefly a rising star of the UK telecoms sector, achieving a valuation of £4bn and entering the FTSE 100. However, it struggled to fulfill its growth potential, as moves into IT services and data centers in the past decade failed to pay off. Fidelity de-listed the business in 2015.

Mr Grivner said it was easier to invest in the telecom business (as a network operator) outside the glare of the public markets. Therefore, there were no plans to relist the company’s shares.

AT&T and KT to work together on 5G, NFV & SDN; Consortium of 5G Carriers Forming?

Executive Summary:

According to Business Korea, AT&T Chief Strategy Officer John Donovan met with Lee Dong-myeon, director of the KT (Korea Telecom) Technology Convergence Center to discuss plans for the well respected telcos to share AT&T’s NFV and SDN work and KT’s efforts around 5G. AT&T is expected to cooperate with KT in many new technologies, especially their own version of SDN/NFV and 5G. KT is leading the 5G technology development (along with SK Telecom) and is prepared to share that with AT&T.

“We expect that cooperation through AT&T’s SDN/NFV leadership and KT’s 5G leadership will create synergies to solve challenges of the telecom industry in the future,” said Mr. Lee.

Lee Dong-myeon director of the KT Technology Convergence Center and John Donovan, AT&T Chief Strategy Officer. Photo courtesy of Business Korea

……………………………………………………………………………………………………………………………………………………………..

KT and AT&T Working with Other Companies on 5G Development & Deployment:

Verizon’s Huge Increase in Fiber Investments for “5G” Small Cell Backhaul & FTTP

Verizon Communications’ recent surge in buying fiber assets has little to do with its FiOS video and broadband Internet access. Yet the company expects to benefit from the investments, Senior Vice President Kyle Malady said at the Fiber Connect conference this week. He said Verizon is doubling down on fiber to fuel 5G network builds. His presentation can be viewed here.

“All the cards are lining up for us to double down on fiber again,” Malady said during his June 13th keynote address at the conference. Malady said balancing CAPEX requirements in a world of 4G, pending 5G, and other key network initiatives may have given the appearance that Verizon was scaling back on fiber investments. But that has now changed and you can thank wireless backhaul for it.

“Fiber is basically the nervous system of the networks of the future,” Malady said and Verizon is making big investments in it. He cited recent announcements with Corning and other fiber suppliers that Malady said has the carrier buying enough fiber to string to “Mars and back.”

This doubling-down in fiber is not driven by expanding FiOS. It’s driven by the need to densify Verizon’s network for 5G. FTTP applications will be a benefit of this densification. Because of 5G, Verizon will need to backhaul wireless traffic from small cells located at approximately 1,000-foot intervals in urban applications.

Those small cells will require gigabit capable backhaul, which is best delivered through a deep fiber network, says Malady. As a result, Verizon is changing their approach to fiber. They are adding many more strands as they lay this fiber, leading to the ability to offer FTTP services as they accommodate their small cell-heavy 5G network. “All applications can be served out of one fiber sheath,” said Malady.

Verizon’s “One Fiber” in Boston, MA. is their first market for this approach. It’s an approach that Verizon CEO Lowell McAdam stressed at a recent industry conference, suggesting Verizon will have the largest national fiber footprint as a result of their 5G intentions. Verizon is also partnering with the city of Sacramento, CA. The theme is: “Designing and Constructing an Integrated Fiber Solution with our Municipality Partners,” according to Malady.

“[5G] leads to a whole new architecture and will require massive bandwidth, deep fiber and flexible access at the edge,” said Malady. This 5G-driven architecture is one reason Verizon is moving to NG-PON2 for their next generation fiber platform.

“We’re going to skip XG-PON and move on to NG-PON2,” Malady said, citing mid-2018 as their commercial launch time frame. NG-PON2 is better suited for 5G because of its wavelength flexibility and capability to eventually scale up to 80 Gbps in capacity.

Malady hinted this new outlook on fiber could lead to Verizon entering markets outside of their traditional territory. He cited ongoing discussions with Sacramento, Calif. for a fiber broadband-based public-private partnership.

New network architecture, according to Verizon:

• Massive bandwidth – deep fiber, flexible access

• Edge Computing

• Dense 5G Wireless

• Unlicensed and shared spectrum

• Software defined infrastructure

• Open source and automation, open RAN

References:

http://www.telecompetitor.com/verizon-were-doubling-down-on-fiber-broadband-just-dont-call-it-fios/

https://static.coreapps.net/fiber2017/handouts/106c1f9a-833d-4387-8afa-3b83ace7ea26_1.pdf

https://www.fiberconnect.org/page/education-program

https://app.core-apps.com/fiber2017/event/a041198839018a16ba6025fbe8eca53d

NFV Open Source (OPNFV) Reaches Critical Juncture at Beijing Summit

The OPNFV Summit – June 12-15th in Beijing, China – marks a critical moment in the development and acceptance of the open-source network functions virtualization technology by telecoms and others, said Heather Kirksey, Director of the Open Platform for NFV (OPNFV) project within the Linux Foundation. Ms. Kirksey told Light Reading that network operators “are engaging in open source in the right way now.”

Instead of showing up in large numbers with lists of demands or problems that need solving, “they are at the table working, contributing code and addressing problems.” Kirksey cites AT&T’s “Nirvana stack” (presented by AT&T’s Paul Carver at the 2017 Open Networking Summit) as an example of how open source is becoming a critical element of AT&T’s future networking protocol work.

Having initially used Juniper Network’s Contrail SDN controllers in its AT&T Integrated Cloud, the network operator is now looking at an open source ODL-based controller running on top of OPNFV software/firmware (see chart below).

AT&T’s “Nirvana” SDN Stack, as presented by Paul Carver at the 2017 Open Networking Summit

…………………………………………………………………………………………………………

“Within OPNFV itself, and working with other open source groups, we’ve had a big focus for us on what it means to have a healthy open source culture, what it means to be effective,” Kirksey said. “In terms of what TIP (Facebook’s Telecom Infrastructure Project) does, it’s their people and processes group. I think it is really interesting, it never would have dawned on me to take that on as a task within an open source group. But we focus on it a lot when we are building our own culture, hoping that will create seeds,” she added.

OPNFV has, from its outset, worked in collaboration with other groups and upstream code whenever possible, Kirksey said next week’s summit reflects some of that cooperation.

This week’s four-day event in Beijing kicks off with OPNFV Project‘s Design Summit, for the developer community to push forward on Euphrates, the next OPNFV release. But those first two days also include mini-summits for the Open Network Automation Platform (ONAP), OpenDaylight, DPDK, FD.io and the Cloud Native Computing Foundation, as well as its own mini-summit on data plane and VNF acceleration.

The event comes at an interesting time in the open source world, as debate rages on a few issues, including the commercial viability of open source and how it goes to market, and the way in which open source is being embraced by the carrier community. There is also much more discussion about how open source groups work together, versus duplicating work or working at cross purposes.

…………………………………………………………………………………………………..

OPNFV is under the Linux Foundation, which has become the dominant open source organization for open networking/software defined networking. Next week’s event will be the third OPNFV Summit and the first held in China. Many Chinese companies will attend, including: China Mobile, China Telecom, Huawei and ZTE. Didi Chuxing , the Chinese version of Uber, will also be present.

HPE’s Pradeep Sen (formerly with Verizon) will present a keynote at the OPNFV Beijing Summit. He will talk about “Cloudification and Disaggregation stages of the telco journey to the cloud, and what we in the industry, and open source and OPNFV in particular, need to pay attention to.”

Representatives from Orange and NTT DOCOMO will also present keynotes.

References:

http://events.linuxfoundation.org/events/opnfv-summit

Open Network Summit: ONAP Steals the Show with Broad Support

Cisco: Online video to account for 82% of all Internet traffic by 2021!

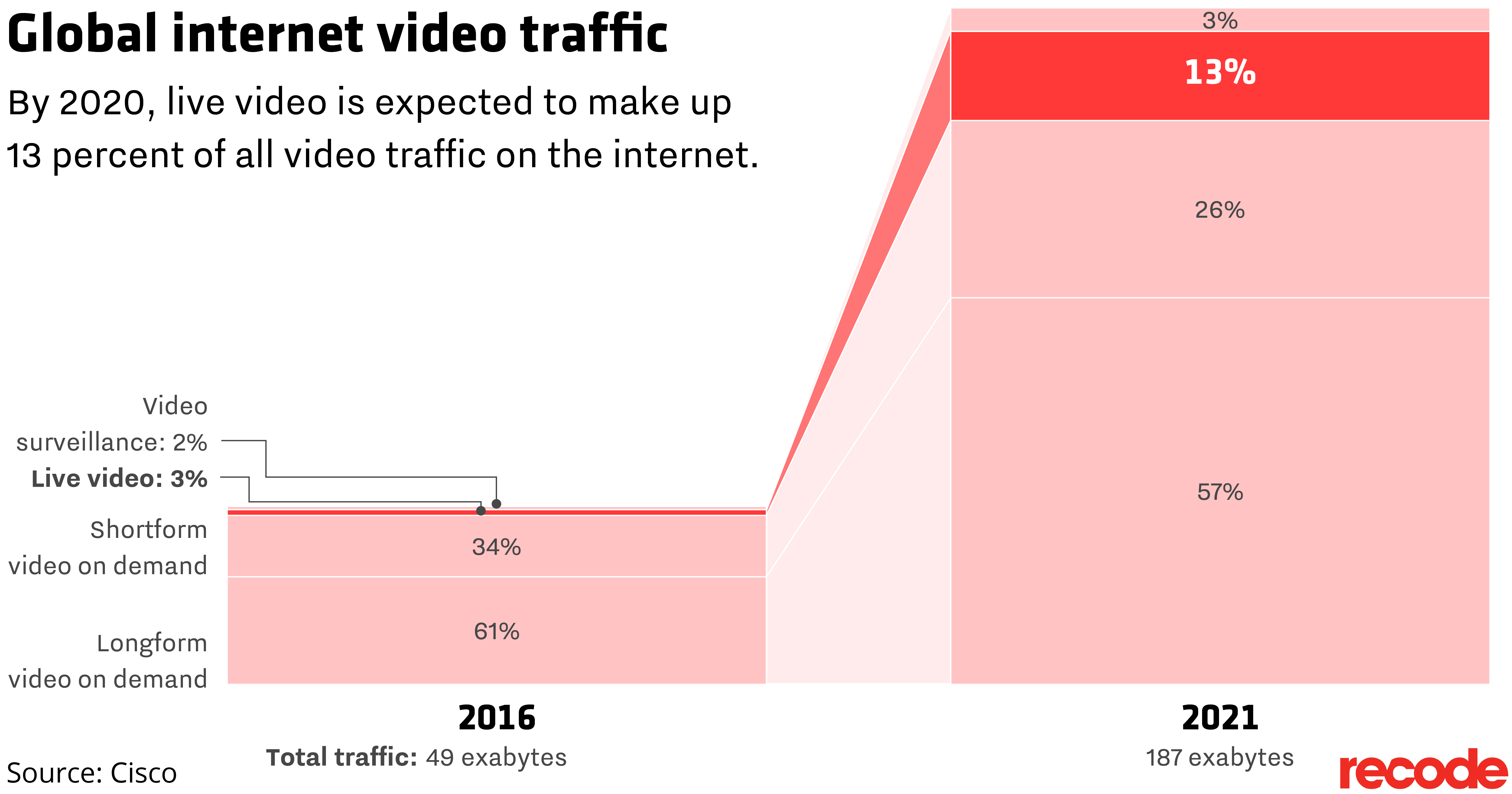

Online video will make up 82% of internet traffic in 2021, according to a Cisco forecast released this week. The amount of bandwidth consumed will grow as more video is consumed and higher-quality videos are watched. Live (real time or linear) video is expected to see the fastest rate of growth over the next four years. Video accounted for 73% of traffic in 2016.

Cord cutters generate twice as much internet traffic as those who still pay for regular TV, according to Cisco. The video bandwidth demand is coming from all types of internet video, including on-demand content like Netflix, web cam viewing and traditional TV options available over the internet (IP VoD).

/cdn.vox-cdn.com/uploads/chorus_asset/file/8650935/Cisco_global_ip_traffic_01.png)

Chart Courtesy of Recode: https://www.recode.net/2017/6/8/15757594/future-internet-traffic-watch-live-video-facebook-google-netflix

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

44% in 2016 –>58% by 2021

2.3 in 2016 –>3.5 by 2021

27.5 Mbps in 2016–>53.0Mbps by 2021

4. Average Traffic per Capita per Month

12.9 GB in 2016–>35.5GB by 2021

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Live video is set to be the fastest growing segment of internet video traffic thanks to new video offerings like Facebook Live, Twitter’s broadcast of live sports and live over-the-top bundles from companies like AT&T, YouTube and Hulu. It’s expected to grow to nearly 25 exabytes (25 billion gigabytes), about 13 percent of internet video traffic, by 2021, up from 1.6 exabytes, or 3 percent of video traffic last year.

2021 Forecast IP Traffic Highlights:

- Globally, IP traffic will grow 3-fold from 2016 to 2021, a compound annual growth rate of 24%.

- Globally, IP traffic will reach 278.1 Exabytes per month in 2021, up from 96.1 Exabytes per month in 2016.

- Global IP networks will carry 9.1 Exabytes per day in 2021, up from 3.2 Exabytes per day in 2016.

- Globally, IP traffic will reach an annual run rate of 3.3 Zettabytes in 2021, up from an annual run rate of 1.2 Zettabytes in 2016.

- Globally, IP traffic will reach 35 Gigabytes per capita in 2021, up from 13 Gigabytes per capita in 2016.

- Globally, average IP traffic will reach 847 Tbps in 2021, and busy hour traffic will reach 5.0 Pbps.

- In 2021, the gigabyte equivalent of all movies ever made will cross Global IP networks every 1 minutes.

Source: Cisco http://www.cisco.com/c/m/en_us/solutions/service-provider/vni-forecast-highlights.html

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Rreal-world impact of IoT:

Cisco anticipate the balance of power shifting from mobile phones/tablets to IoT connected devices. By 2019, IoT connections will account for more mobile additions than smartphones, tablets, and PCs. And by 2021, 638 million IoT modules will be added, while smartphone, tablet and PC additions will reach 381 million.

From a 5G perspective, there will be a slight impact over the next five years. The end of 2020 has been earmarked as the 5G finish line for a number of operators, though no-one should forget about 4G too quickly. Cisco predicts that by 2021, 5G will account for roughly 0.2% of mobile connections, though each connection will generate nearly 30 gigabytes per month, almost five times higher than the average 4G connection. These estimates would see 5G take 1.5% of the total traffic despite the modest number of connections.

“There are several issues that remain to be addressed before significant commercial 5G deployments commence (starting in 2020),” said Shruti Jain, one of Cisco’s analysts. “Can you imagine the impact of 5G on today’s data cap structures? Currently, top 1% of mobile users consume 30 GB of monthly data. When 5G is introduced, 30GB will be the average.”

As you can probably imagine, a lot of this traffic will be video, in fact 80% of it will be. Video will dominate IP traffic and overall Internet traffic growth representing 80% of all Internet traffic by 2021, up from 67% in 2016. This means there will be 1.9 billion Internet video users by 2021, as well as three trillion internet video minutes per month, about one million video minutes every second.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Chart Courtesy of Recode: https://www.recode.net/2017/6/8/15757594/future-internet-traffic-watch-live-video-facebook-google-netflix

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

References:

http://www.cisco.com/c/en/us/solutions/service-provider/visual-networking-index-vni/index.html

Akamai: U.S. Internet speeds increased 22% YoY; IPv6 adoption is a conundrum

http://telecoms.com/482612/the-age-of-face-to-face-conversation-is-pretty-much-over/

LPWAN race for cellular IoT heats up with Vodafone’s successful test of NB-IoT

Vodafone said it has successfully carried out NB-IoT (Narrow Band – Internet of Things) interoperability tests, paving the way for a global rollout of NB-IoT services in the near future. The U.K.-based global wireless telco said it has tested modules made by Neul and Qualcomm with network equipment from Ericsson, Huawei and Nokia in multiple regions.

“All of these vendors’ NB-IoT radio access network (RAN) technology has been successfully interconnected with Vodafone’s IoT core network,” said Luke Ibbetson, head of R&D and technology strategy at Vodafone. “As a company committed to a multi-vendor strategy, we understand the importance of a healthy device and network ecosystem in delivering the best service to customers at a competitive price,” he said.

Vodafone deployed its first NB-IoT network in Spain in January 2017. It had previously announced plans to switch on networks in Germany, Ireland, and the Netherlands during the first quarter of this year, but as yet, no such launches have taken place.

Vodafone is a vocal proponent of NB-IoT, a low-power, wide-area network (LPWAN) technology that uses licensed spectrum to provide two-way communication over long distances and in hard-to-reach locations. It can support huge numbers of cheap, low throughput devices that consume very little power. It was standardized by the 3GPP in June 2016 as part of its work on LTE Release 13 (see reference below).

Vodafone prefers it to competing standards like ITU-R’s LTE CatM (or M1) and consortium generated LPWAN specifications like LoRaWAN (long range wide area networking). Promoted by the LoRa Alliance, it claims to offer similar performance to NB-IoT, but using unlicensed spectrum, opening the door to any company that wants to operate an IoT network, not just licensed spectrum holders.

And let’s not forget the leader in LPWANs- Sigfox, which claims to be “the only global operated LPWAN IoT network to provide high capacity and high service level while operating in the unlicensed ISM frequency bands.” 32 countries covered, low energy consumption, low cost, and compatible wireless technology (compatible with Bluetooth, GPS 2G/3G/4G and WiFi) are its touted advantages over other LPWANs

Author’s Note: We’ve written for well over a year on the many competing LPWAN specs and still believe there are way too many of them!

References:

https://www.totaltele.com//497213/Vodafone-hails-successful-NB-IoT-interoperability-tests

http://www.3gpp.org/news-events/3gpp-news/1785-nb_iot_complete