Cignal AI: Japan’s Optical Hardware Growth Soars in 1Q2019; North America Remains Weak

by Scott Wilkinson and Andrew Schmitt of Cignal AI (edited by Alan J Weissberger)

Metro Bandwidth Growth Outpaces Long Haul; North America Remains Weak

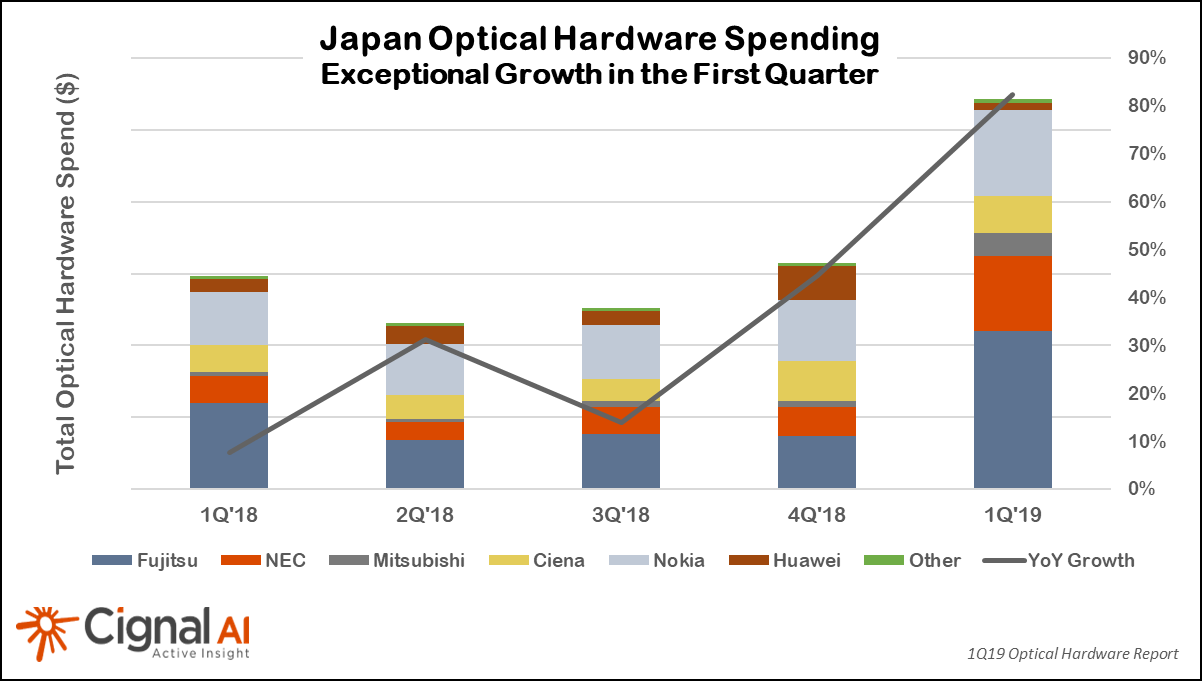

Japan continued its recent hot streak as 1Q2019 marked the fourth quarter in a row of growth with an extraordinary 82% increase, according to the most recent (1Q2019) Optical Hardware Report from research firm Cignal AI. Japan registered an extraordinary 82% year-over-year increase in optical networking hardware sales in the first quarter of 2019. Prime beneficiaries were domestic suppliers NEC, Mitsubishi and Fujitsu along with Ciena and Nokia, all of which posted significant gains during the quarter.

“The exceptional optical market growth in Japan is the story to watch for 2019,” said Scott Wilkinson, Lead Analyst for Optical Hardware at Cignal AI. “Network operators have begun significant network rebuilds and expansions, and domestic as well as non-Japanese vendors continue to grow sales in the region at remarkable rates.”

North American growth continued to disappoint as slow optical hardware spending among traditional telco operators obscured growth in sales to cloud and colo operators (e.g. multi-tenant data centers).

Additional key findings in the 1Q19 Optical Hardware Report:

- Metro Bandwidth Outpaces Long Haul – While long haul spending grew at a higher rate than metro, analysis reveals that metro bandwidth is growing more rapidly.

- Growth in China Decelerates – Growth in China moderated into the single-digits during 1Q19, as 2018’s high spending by Chinese carriers could not continue indefinitely.

- EMEA Posted Solid Gains – Both metro and long haul spending grew during the quarter, with growth led by both traditional and cloud & colo operators.

- CALA Continues Lackluster Performance –Q1 showed no improvement for the region. Relief may be coming, as vendors believe major carriers in the region will return to spending later this year.

Cignal AI’s Optical Hardware Report is issued each quarter and examines optical equipment revenue across all regions and equipment types. The analysis is based on financial results, independent research, and guidance from individual equipment companies. Forecasts are based on overall spending trends for equipment types within the regions.

……………………………………………………………………………………………………………………………………………………………………………………………………..

Cignal AI’s interactive Optical Hardware Superdashboard is available to clients of the Optical Hardware Report and provides up-to-date market data for real-time visibility on individual vendors’ results. Users can manipulate data online and see information in a variety of useful ways.

The Cignal AI Optical Hardware Report is published quarterly and includes market share and forecasts for optical transport hardware used in optical networks worldwide. In addition to the interactive tracker, the analysis includes an Excel database as well as PDF and PowerPoint summaries. Subscribers to the Optical Hardware Report also have access to Active Insight, Cignal AI’s real-time news service on current market events.

The report examines revenue for metro WDM, long-haul WDM and submarine (SLTE) equipment in six global regions and includes detailed port shipments by speed. Vendors in the report include Adtran, ADVA, Ciena, Cisco, ECI, Ekinops, Fiberhome, Fujitsu, Huawei, Infinera, Mitsubishi Electric, NEC, Nokia, Padtec, Tejas, Xtera, and ZTE.

Full report details, as well as articles and presentations, are available on the Cignal AI website.

About Cignal AI

Cignal AI provides active and insightful market research for the networking component and equipment market and the market’s end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications.

Cignal AI: Record Spending on Cloud Operator Optical Networks Drives Growth in 2018

2 thoughts on “Cignal AI: Japan’s Optical Hardware Growth Soars in 1Q2019; North America Remains Weak”

Comments are closed.

“The Optical Network Hardware Market is expected to have a highly positive outlook for the next five years 2019-2024 according to a recently released Optical Network Hardware market research report. Garner Insights research report titled, ‘Optical Network Hardware Market Professional Survey Report 2019’ examines and evaluates the market for‘ Optical Network Hardware’ at a and regional scale.

The major takeaways in the report are product segment analysis, application segment analysis, regional segment analysis and data of the major Optical Network Hardware Market players from around the world. The report details information and statistics about the market share of major players –Huawei, Infinera, Alcatel-Lucent, Ciena, Cisco, ADTRAN, ADVA Optical Networking, Ericsson, NEC, Nokia Solutions and Networks, Padtec, TE Connectivity, ZTE, , as well as key regions of the Optical Network Hardware Market.

This analysis is followed by the supply chain analysis wherein users will get information about the supply chain, the raw materials market, manufacturing activities, production processes and cost and end user market analysis.

The Optical Network Hardware is segmented mainly on the basis of: type and applications. Depending upon the type the Optical Network Hardware can be segmented as WDM, SONET or SDH. Based on the application the market is split into Telecom, Data Center, Enterprise.

Important Optical Network Hardware Market Data Available In This Report:

-Strategic recommendations forecast growth areas of the Optical Network Hardware Market.

-Emerging opportunities, competitive landscape, the revenue share of main manufacturers.

-This report discusses the Market summary; Market scope gives a brief outline of the Market

-Key performing regions (APAC, EMEA, Americas) along with their major countries are detailed in this report.

-Company profiles, product analysis, Marketing strategies, emerging Market segments and comprehensive analysis of Market

-Challenges for the new entrants, trends Market drivers.

-The market share year-over-year growth of key players in promising regions

https://www.garnerinsights.com/Global-Optical-Network-Hardware-Market-2018-by-Manufacturers-Regions-Type-and-Application-Forecast-to-2023#discount

Verizon CTO Malady: Fiber build-out continues at fast clip

Speaking at the Wells Fargo Telecom 5G Forum 2019 on Thursday, Malady said Verizon is continuing its quest of adding a thousand route miles of fiber per month across 60 cities.

While Verizon continues to build up its fiber war chest, AT&T Communications CEO John Donovan said earlier this month that his company would take a more incremental approach to deploying fiber starting next month. As part of its 2015 merger with DirecTV, the Federal Communications Commission required that AT&T expand its deployment of its high-speed, fiber-optic broadband internet service to 12.5 million customer locations, as well as to E-rate eligible schools and libraries, by July of this year, which AT&T built out to 14.5 million customer locations.

Verizon saw the fiber writing on the wall two years ago when it signed a $1.1 billion, three-year fiber and hardware purchase agreement with Corning to build a next-generation fiber platform to support 4G LTE, 5G, gigabit backhaul for 5G networks and fiber-to-the premise deployments to residential and business customers. Also in 2017, Verizon also announced a $300 million fiber deal with Prsymian Group to provide additional fiber for its wireline and wireless broadband services.

“We wanted owners’ economics,” Malady said at yesterday’s conference. “We wanted to kind of be masters of our own destiny as we are deploying our wireless network.

“It made sense to us because we’re going to be densifying 4G. We saw 5G coming and we see a host of other uses for fiber and that’s why we’ve been down what we call the One Fiber path the last few years.”

Verizon’s One Fiber project, which has been ongoing for several years, combined all of the telco’s fiber needs and planning into one project. It also allows Verizon to plot out its fiber uses cases and purchasing plans across all of its sectors.

In addition to densification of the wireless network and enabling wireline access, having fiber deep is key for supporting radio access networks (RAN) as well as provisioning an increasing number of small cells.

Verizon plans to have 5G in up to 30 cities this year, which means it’s continuing to build out its fiber assets in those areas.

“I feel we’re going a lot faster than when we first started,” Malady said. “I feel we can go a little bit faster, but as anybody that does this knows, this is frankly construction.

https://www.fiercetelecom.com/telecom/verizon-cto-malady-fiber-deployments-continue-at-a-fast-clip

https://www.fiercetelecom.com/telecom/verizon-s-hicks-one-fiber-to-rule-them-all