Reports and Data: Telecom Cloud Market to grow at CAGR of 19.7% through 2026

The global Telecom Cloud Market is projected to grow at a CAGR of 19.7% in terms of value, from 2019 to reach USD 59.25 Billion by 2026, according to a new report by Reports and Data. OTT (Over-the-top) consumers demand more flexibility in scheduling, arranging videos, live events, and recording of favorite shows, thereby pushing the service providers to opt for more resources, infrastructure scalability, and computing resources to cater demands. By adopting a cloud-based workflow, video service providers can efficiently hand off duty for the infrastructure and networking supporting their OTT services. Telecom cloud can be instrumental in meeting the needs of OTT service providers, thus resulting in the growth of the market.

The telecom cloud market Modernization of IT platforms is estimated to fuel the growth of the market in the forecast period. As some of the largest communication service providers across the globe modernize their networks, they facilitate large enterprises to transform the way they involve with a progressively digital world. By leveraging IP-based technology, UCaaS (Unified Communications-as-a-Service), embedded communications (such as voice, chat, and video built into web and business applications) and other novelties on an IP network, communication service providers and the organizations they cater to can provide enhanced service to their customers and reap higher margins by reducing their expenses along with the lower total cost of ownership delivered by software-defined real-time communications (RTC).

Increasing demand for over-the-top cloud services is one of the significant factors influencing market growth. The telecom cloud leads to low operational costs, which is expected to drive the market growth in the forecast period. By deploying cloud computing, service providers can host services and software at a considerably lower cost. Provisioning and virtualization software allows organizations to efficiently assign computing resources, thus lowering the cost of hardware. Service providers can locate facilities at low-cost locations, provisioning, which cannot be replicated by most enterprises, resulting in low up-front costs.

Additionally, the proliferation of the internet, especially in developing nations, is expected to propel the growth of the telecom cloud market in the upcoming years.

Key participants include AT&T Inc., Verizon Communications Inc., Ericsson, Deutsche Telekom, BT Group PLC, CenturyLink Inc., Orange Business Services, NTT Communication Services, Singapore Telecommunications Limited, and Telstra Corporation Limited, among others.

Key findings from the report:

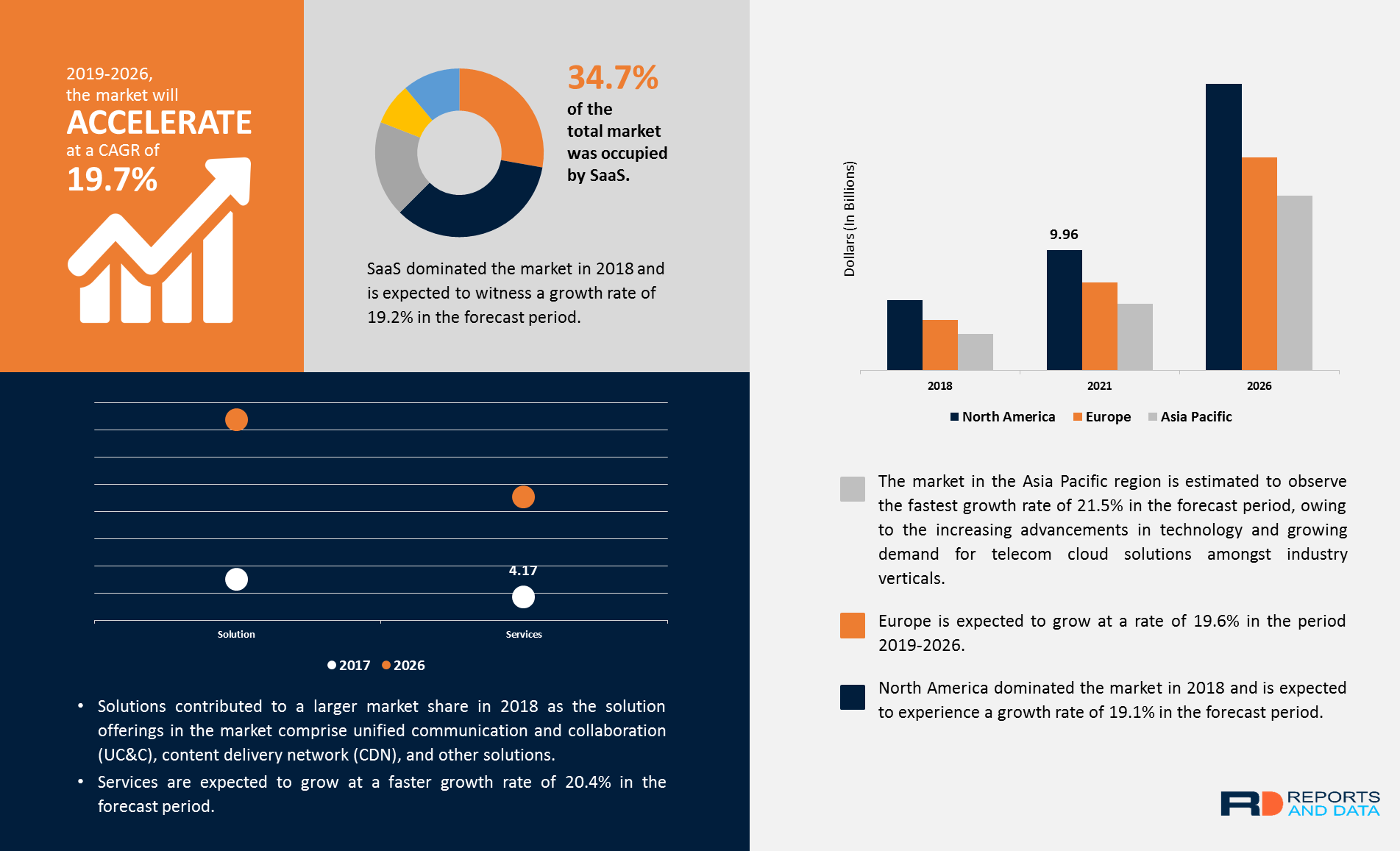

• By offering, solutions contributed to a larger market share in 2018 as the solution offerings in the market comprise unified communication and collaboration (UC&C), content delivery network (CDN), and other solutions.

• By service type, SaaS dominated the market in 2018 and is expected to witness a growth rate of 19.2% in the forecast period. The swift growth of on-demand services among consumers has resulted in a high demand for this service type in the telecom cloud market.

• By organization size, small & medium-sized enterprises are expected to witness a higher CAGR of 20.5% in the period 2019-2026 as services and solutions have the potential to produce enhanced efficiency, quality, and business productivity.

• By industry verticals, BFSI (Banking, financial services and insurance) held the largest market share in 2018 and is expected to grow at a rate of 19.6% in the forecast period.

• North America dominated the market in 2018 and is expected to experience a growth rate of 19.1% in the forecast period. The market dominance of North America is attributed to the presence of leading telecom companies mainly in the U.S. and Canada

The growing concerns pertaining to spectrum crunch in the developing nations are driving the market for telecom cloud as it helps telecom companies to increase their profitability in the telecom market. In countries with a high population, especially Countries in the Asia Pacific region, the telecom cloud plays an instrumental role in enabling telecom market players to gain a competitive edge in the market.

Incorporating cloud computing platforms into telecommunication allows Network functions virtualization (NFV) to virtualize servers, networks, and storage augments the utilization of available system resources and lowers infrastructure cost. Besides, network virtualization offers the implementation of numerous applications and features an open environment. Thus, telecom cloud virtualization is linked to many significant advantages, including enhanced scalability, flexibility of deployment, and a reduction in cost of the equipment, which permits reiteration of application software, better support for resolving faults, and enhanced security, among others.

References:

https://www.reportsanddata.com/report-detail/telecom-cloud-market

3 thoughts on “Reports and Data: Telecom Cloud Market to grow at CAGR of 19.7% through 2026”

Comments are closed.

The title of this report is an oxymoron because telcos have failed miserably in the cloud computing and storage market which is dominated by AWS, Azure and Google Cloud. Telcos have even abdicated deploying their own 5G SA core network and MEC to the big 3 cloud providers.

“The goal here is to work with the carriers,” explained Sunay Tripathi, Google’s new director and head of products for telecom and the “distributed cloud edge.”

Tripathi, who spoke at a 5G Future Forum event here, typified the new trend: He cut his teeth at Sun Microsystems before helping to found software-defined networking company Pluribus Networks. For the past three years, he was the CTO of Deutsche Telekom’s MobiledgeX. According to his LinkedIn profile, he joined Google in July. “We are rearchitecting a lot of the underlying network, and that creates a lot of opportunity,” Tripathi explained.

Google, Microsoft and Amazon have long played in the telecom industry as software, IT and cloud suppliers. And like most modern enterprises across all industries, mobile network operators have increasingly pushed their IT operations into the public cloud.

But during the past two years, Google, Microsoft and Amazon have all begun developing cloud computing products specifically designed to host wireless providers’ network functions. Whether it’s Microsoft’s Azure for Operators or Google’s Anthos for Telecom, it’s intended to get network operators to put their crown jewels – their core network functions – into a hyperscale cloud.

And it’s something all three cloud companies are serious about, judging from their telecom hiring sprees or their acquisitions in the space. Microsoft, for example, last year spent an estimated $1.8 billion buying longtime telecom vendors Affirmed Networks and Metaswitch Networks.

New ideas and new disruption

According to analysts, the entry of the public cloud hyperscalers represents a major new strategic turn in the industry, considering network operators have historically retained tight control over their networking systems. And though most have been moving toward cloud technologies they own and operate, few have agreed to run their networking software in a public cloud operated by a hyperscaler.

“In outsourcing the infrastructure to cloud providers, telcos risk losing control of different aspects of their network and technology roadmap over the long term,” warned analyst Frank Rayal of Xona Partners in a post to his website titled “How telcos outsourced their brains.”

Nonetheless, there are increasing indications that operators around the world are more than open to the idea. “The technologies that we will build [with the cloud] will let others consume our network,” explained Luciano Ramos, SVP of network development, planning and engineering for Rogers Comunications in Canada.

Indeed, AT&T recently announced it would transition its 5G core network operations into Microsoft’s cloud over the next three years. And Dish Network plans to run all of its network operations in the Amazon Web Services cloud.

According to Rakuten’s outspoken mobile chief, Tareq Amin, it’s ultimately necessary. He said he designed Rakuten’s mobile network in Japan to natively run in the cloud, and that it required a major shift in his team’s thinking. “I wanted to pick the right mentality” when staffing up Rakuten Mobile, he said. “It was easier to deploy cloud because the Rakuten people wanted to be open to new ideas,” he said. “They were open to new ideas and new disruption.”

Amin made his comments during a keynote address at the MWC LA show here. He made sure to point out that Rakuten Mobile in Japan now counts around 5 million customers, and boasts leading network metrics. It was essentially Amin’s victory lap after announcing his plan to build such a network just a few years ago, at the MWC Barcelona show in 2019.

https://www.lightreading.com/service-provider-cloud/that-time-public-cloud-hyperscalers-invaded-mwc-la/a/d-id/773111?

Amazon Web Services beat expectations (by $651 million) with revenues of $16.11 billion. Its operating income, $4.88 billion, was up almost 40% from a year ago.

Put differently, Amazon’s cloud unit, leading the cloudy sector with a 41% market share, had more operating income than the company as a whole. It makes up 15% of the company’s total revenue, with its operating margin widening to 30.3% from 28.3% in the previous quarter.

“A lot of customers accelerated their journey to the cloud based on the pandemic,” said Amazon’s chief financial officer, Brian Olsavsky, on a conference call.

https://www.lightreading.com/service-provider-cloud/aws-one-sparkle-in-amazons-cloudy-earnings/d/d-id/773133?