Telecom Cloud Market

Future Market Insights: Telecom Cloud Market CAGR at 15.2% from 2022-2032

The Telecom Cloud Market revenues were estimated at US$ 19.8 Bn in 2021 and are anticipated to grow at a CAGR of 15.2% from 2022-2032, according to a recently published Future Market Insights (FMI) report. By the end of 2032, the market is expected to reach a valuation of US$ 24 Bn. Globally, the cloud services market is expected to reach a valuation of 2.5 Bn by 2030, as per a new study by FMI.

During the pandemic, as individuals lived at home during the shutdown and businesses opted to work remotely, massive data consumption led to a spike in demand for telecom cloud installations, which significantly contributed to the market growth. Cloud has been one of the key themes of conversation in the telecom business in 2021 with the development of cloud-native 5G technology.

The public cloud solution provides on-demand infrastructure, lowering capital expenditure as well as continuous operational and life-cycle control. The public cloud may be a terrific incubator environment for not just developing new apps and services, but also bringing them to market and scaling them quickly.

Many corporate firms rely on the public cloud as their base. Telecom companies are increasingly looking to collaborate using public cloud services to use their computational capacity and use their strong network skills on the back end.

Hyperscalers such as Amazon, Google, Microsoft, and Oracle often establish and manage a uniform tech environment with public cloud platforms. CSPs, on the other hand, buy solutions from a variety of vendors who compete and advance in different directions, sometimes marginally, sometimes significantly.

Also, The BFSI sector outsources non-core functions to save money and enhance efficiency. As a consequence, targeted content views and precise financial data are required, which may be merged via a telecommunications cloud service.

Competitive Landscape:

The market is fiercely competitive, where key players are increasingly focused to obtain a competitive advantage. The key companies in the Telecom Cloud Market are focused on R&D to produce innovative technological solutions.

- In April 2021, Momentum Telecom, a global provider of managed network and clouds voice, revealed that it had accomplished its purchase of Atlus Technology, a Tennessee-based leader in the development of cloud-based unified communications solutions.

- In December 2020, Cisco announced the purchase of IMImobile, a cloud telecommunications software and service provider, allowing Cisco to provide its customers with an end-to-end client engagement management solution.

Multi Cloud Management Market Trend: Multi cloud management is similar to the use of best-of-breed applications from multiple developers on a personal computer, rather than the defaults offered by the operating system vendor.

Cloud Business Email Market Demand: The global cloud business email market is expected to acquire a market value of nearly USD 2.15 Bn, proliferating at a CAGR of 10.4% during the forecast period from 2017 to 2027.

More Insights Available

Future Market Insights, in its new offering, presents an unbiased analysis of the Telecom Cloud Market, presenting historical market data (2015-2021) and forecast statistics for the period of 2022-2032.

ABOUT FUTURE MARKET INSIGHTS, INC:

Future Market Insights, Inc. is an ESOMAR-certified business consulting & market research firm, a member of the Greater New York Chamber of Commerce and is headquartered in Delaware, USA. A recipient of Clutch Leaders Award 2022 on account of high client score (4.9/5), we have been collaborating with global enterprises in their business transformation journey and helping them deliver on their business ambitions. 80% of the largest Forbes 1000 enterprises are our clients. We serve global clients across all leading & niche market segments across all major industries.

………………………………………………………………………………………………………………………………………………….

References:

Public Cloud Based Telecom Cloud Market to Register a CAGR (globenewswire.com)

https://www.futuremarketinsights.com/reports/telecom-cloud-market

Telecom Cloud Market Size, Share, Sales & Trends – 2032 | FMI (futuremarketinsights.com)

Request a Sample Copy of Report:

https://www.futuremarketinsights.com/reports/sample/rep-gb-3353

IDC Directions 2022: Telecom Renaissance, by Daryl Schooler

MTN Consulting: Network Infrastructure market grew 5.1% YoY; Telco revenues surge 12.2% YoY

Telecom network infrastructure (NI) vendors had a 5.1% year-over-year (YoY) increase in revenue during the second quarter 2021, reflecting a significant pullback from a 10% gain in the previous quarter, according to MTN Consulting.

The market share leaders in the global telco NI market remain Huawei, Ericsson, Nokia, and ZTE, who are also the top providers of 5G infrastructure. After these top four, China Comservice took the fifth spot in 2Q21 due to services sales with domestic telcos. Cisco and Intel followed in the sixth and seventh spots, leveraging strength in the router market, and data centers and virtualization, respectively. CommScope, NEC, and Fiberhome round out the top 10.

- CommScope is a key provider in the connectivity market, both fixed and mobile, and for broadband CPE.

- NEC is becoming an important player in the emerging open RAN market.

- Fiberhome has a significant market share for network equipment in the Chinese telco market, across optical transport and mobile networks.

- Samsung, ranked 11 in 2Q21, is also a notable player in telco NI, as it is rising in the US due to success at Verizon, and has strong potential in Europe.

MTN Consulting’s telco network infrastructure market share study includes a wide range of vendor types and cuts across hardware, software, and services. That’s in contrast to other market research firms that only count telecom equipment vendors.

If one considers only hardware and software revenues from network equipment providers (NEPs), total revenues were $121.6 billion for the 2Q2021 annualized. The top ten providers for this market are Huawei, Nokia, Ericsson, ZTE, Intel, NEC, Cisco, Fiberhome, Samsung, and Fujitsu. The top four of these suppliers account for 64% of market revenues. This category (NEP hardware & software) most directly maps into what is sometimes reported as the “telecom equipment” market.

Vendors collectively received $110.4 billion in revenue during the first half of 2021, up 7.4% from the first half of 2020. Some of that growth can be attributed to a weak first half of 2020 when the initial spread of COVID-19 clobbered network infrastructure spending plans, Matt Walker, chief analyst at MTN Consulting, explained.

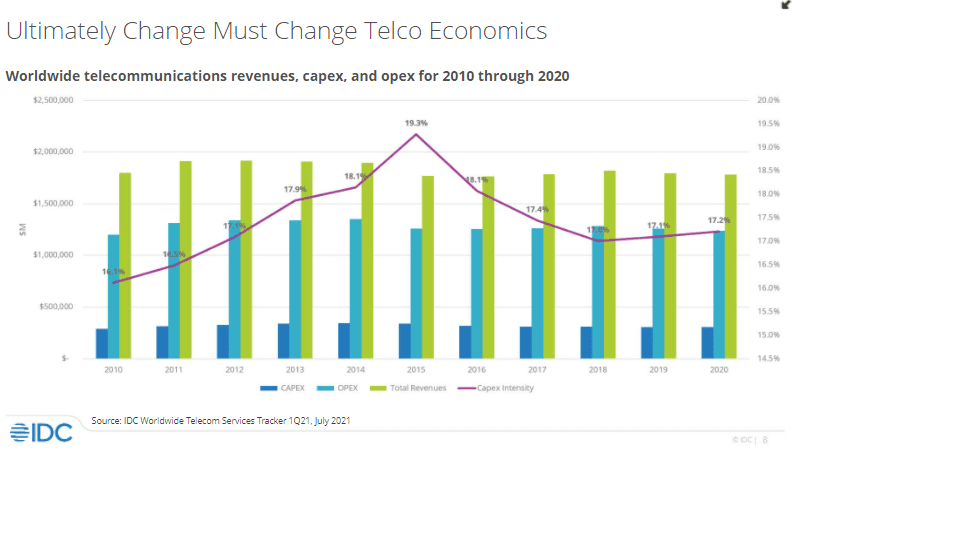

“Labor costs are a big part of telco opex (and rising), and automation is a key area of investment in 2021 for nearly all major telcos,” Walker wrote. “Numerous telcos are reporting that network operations are taking up a larger portion of the opex pie. This is important because vendors are increasingly selling into opex budgets within their telco customers, not just capex budgets. That’s especially true on the services and software sides.”

Total telco capex for the first half of 2021 jumped 9.8% year over year to $151.1 billion, he said, noting that the analyst firm added Airspan, Google Cloud, Amazon Web Services (AWS), and Microsoft Azure to its telco market coverage at the beginning of 2021. Telco capex grew 15% year over year in the second quarter of 2021 while telco opex climbed 14% during the same period.

The biggest YoY Telco NI sales jumps in 1H21 were easily recorded by Ericsson and Nokia, up $1.46 and $1.01B respectively. Cisco, Samsung, and Dell Technologies (VMWare) also saw sizable growth in the telco vertical, as did several vendors riding China’s 5G boom: China Comservice, ZTE, and Fiberhome. On the downside, Huawei’s $1.48B YoY decline in Telco NI sales in 1H2021 was far worse than any other supplier (due to being banned by the U.S. and other countries for political reasons).

Huawei market share decreased the most YoY, when comparing its annualized share in 2Q2021 with that of 2Q2020. As predicted, the company’s share of telco NI has now fallen below 20% (19.01% in 2Q2021, annualized).

For other NI vendors, most changes are due to one of three factors: M&A, telco spending cycles, and technology dislocations.

- Recent M&A deals of note include Capgemini-Altran, CommScope-ARRIS, ECI-Ribbon, Hengtong-Huawei Marine, Casa-Netcomm, and Amdocs-Openet.

- A number of vendors have been impacted by telcos’ 5G infrastructure push, including the recent shift towards core network spending.

- Several large countries are seeing growth in fiber access deployment spending.

- Telcos’ increased adoption of the cloud in a variety of forms cuts across a large number of the changes seen in the below charts. AWS, Azure and GCP have all seen dramatic growth in their telco vertical revenues in the last few quarters, as has Dell Technologies (VMWare) and Arista.

Regarding declines in NI market share, Samsung’s annualized share change reflects a dropoff in Korean 5G spend as it still awaits a pickup in the US, India and/or Europe.

Nokia’s share has stabilized, after falling due to a perception of falling behind in mobile RAN radio technology, as well as its backing away from China. Huawei’s share decline is due to political and supply chain obstacles.

Webscalers/Cloud Service Providers Penetrate Telco Market:

Nearly a decade ago, as cloud services began gaining popularity, many telcos hoped to be direct beneficiaries on the revenue side. The cloud market went a much different direction, though, with large internet-based providers (aka webscalers) proving to have the global scale and deep pockets able to develop the market effectively. From 2011-2020 webscale operators invested over $700 billion in capex, a big portion of it devoted to building out their cloud infrastructure.

The cloud sector has geared its offerings to businesses of all stripes and sizes. Serving telecom operators was not an initial focus for many reasons. Telcos have unique network requirements and stringent reliability criteria, and tend to make purchasing decisions slowly. Many telcos also viewed cloud providers with trepidation, as potential competitors on the enterprise side. Yet the telecom market is also one of the biggest around, viewed as a prize worth fighting for. Nearly $300 billion in annual capex and $1.2 trillion in opex (excluding depreciation) are figures that are hard to ignore. Amazon Web Services (AWS) made the earliest strides in telecom, in 2015 (with Verizon), but Azure and GCP were serious about the market by 2017. Last year, Microsoft bolstered its 5G and cloud-based telecoms offerings with the big-ticket acquisitions of Affirmed Networks and Metaswitch Networks.

This telco-webscale collaboration activity has picked up in the last 12-18 months. Webscale operators help telcos with service and application development, shifting of workloads, and developing, enabling and marketing cloud-based services. Collaborations can involve delivery of a portfolio of 5G edge computing solutions that leverage the telco’s 5G network and the webscale operator’s global cloud coverage, as well as its expertise in areas like Kubernetes, AI/ML, and data analytics. Managing costs is a central purpose of telcos’ willingness to partner with webscale providers. Increasingly, the webscale operators who deliver cloud services are competing alongside traditional telco-facing vendors like Amdocs, Citrix, CSG and Nokia.

For the four quarters ended 2Q2021, MTN Consulting estimates that AWS, Azure and GCP had aggregate revenues to the telco sector of $1.92 billion, up 78% from the 1Q2020 annualized period. These cloud providers will sometimes be valuable partners for telco-focused vendors, but in many cases they will be competitors, and are important to track.

Telco spending outlook for remainder of 2021:

Telco industry capex is likely to come in around $300B for 2021, only slightly up from $295B in 2019. Telco opex budgets are a bit more appealing for vendors. Opex (excluding depreciation & amortization) is roughly 4x capex, and the network operations-related (“netops”) piece of opex is growing for many telcos. For 2021, MTN Consulting projects netops opex of about $297B, from $282B in 2020, and telco outsourcing of netops tasks are widespread and growing. Cloud providers are taking advantage of some of this growth, but a large number of traditional Telco NI vendors sell into telco opex budgets.

…………………………………………………………………………………………………………………………….

In a related report, MTN says that telco revenues surged to 12.2% (for the first time in at least a decade on a YoY basis) coming in at $478.4 billion (B). But this unusually high growth is due to a weak base in 2Q20, when revenues totaled $426.5B, the lowest ever during the 1Q2011-2Q2021 period. Also, as witnessed in 1Q2021, the trend of currency appreciation against the US dollar in several key markets continued to play out in the latest quarter.

Annualized telco revenues also grew for the second straight quarter, posting $1.88 trillion with a YoY growth rate of 5.5% in 2Q21. At the network operator level, five of the top 20 best performing telcos by topline in 2Q21 posted double-digit growth on an annualized basis. These include Deutsche Telekom (30.6% YoY vs. annualized 2Q20), China Telecom (17.6%), China Mobile (17.3%), and China Unicom (14.1%). By the same criteria, the worst telco growth came from Softbank (-13.9%) during the same period. America Movil and Telefonica were only the two other operators among the top 20 to post a decline in revenues. While the big swings at Deutsche Telekom and Softbank are due to the former closing its acquisition of Sprint from Softbank in April 2020, growth witnessed by other operators was mostly an outcome of low base effect. Another factor for some operators is non-service revenues, as these have grown with 5G device sales in many markets.

The biggest capex spender in 2Q21 on a single quarter and annualized basis was China Mobile. This was despite the company’s YoY drops of 6.4% and 15.3% in the single quarter and annualized 2Q21 periods, respectively, enabled by CM’s network partnership with CBN. Nine out of the top 20 operators by annualized capex spend posted double-digit growth rates in the period ended 2Q21. Some of these include: Deutsche Telekom (52.1% YoY vs. annualized 2Q20), Vodafone (24.2%), Orange (17.6%), and BT (25.6%). On an annualized capital intensity basis, Rakuten beats all other telcos handily with a roughly 183% capex/revenue ratio for the quarter; its greenfield network rollout is reaching its peak. Other capital intensity standouts include: Globe Telecom (49.9%), PLDT (43.1%), Oi (41%), Telecom Egypt (34.1%), CK Hutchison (32.7%), True Corp (31.3%), and Digi Communications (31.2%).

To improve operational efficiency, telcos are resorting to several initiatives specifically aimed at digitizing the sales and marketing function. Amid the pandemic last year, telcos were forced to operate with minimal human intervention, and automation efforts have only accelerated since then. As telco execs aim for more automated networks to sustain and grow profitability, automation will be a key selling point for vendor solutions.

Telco industry headcount continues to decline, falling to 4.838 million in 2Q21, down from 4.944 million a year ago. Telco spending on digital transformation, software-defined networks (SDN) and AI tools have facilitated a smaller workforce. MTN Consulting expects headcount reductions to continue via attrition and voluntary retirement schemes, heading towards 4.5 million by 2025. However, we also expect telcos to invest heavily in their workforce: retraining existing employees on digital platforms, and hiring highly skilled software savvy employees. The average telco employee salary will rise as a result, an outlook consistent with 2Q21 results – annualized labor costs per employee increased to $61.5K in 2Q21 from $57.8K in 2Q20.

All four major geographical regions experienced double-digit growth in revenues from 2Q2020. But in capex terms, Europe was a standout as it managed to grow by 29.9% on a YoY basis in 2Q2021. The region also recorded not just an uptick but also the highest annualized capital intensity of 18.4% in 2Q2021, while all other regions witnessed a fall when compared to the same period last year. Europe’s capex growth story is courtesy of a late start to 5G spending due to delayed spectrum auctions, coupled with increased efforts in FTTH deployments and government-supported rural rollouts.

References:

https://www.mtnconsulting.biz/product/telecoms-biggest-vendors-2q21-edition/

https://www.mtnconsulting.biz/product/telecommunications-network-operators-2q21-market-review/

Dell’Oro: Worldwide Telecom Equipment Revenue +10% Year over Year

Reports and Data: Telecom Cloud Market to grow at CAGR of 19.7% through 2026

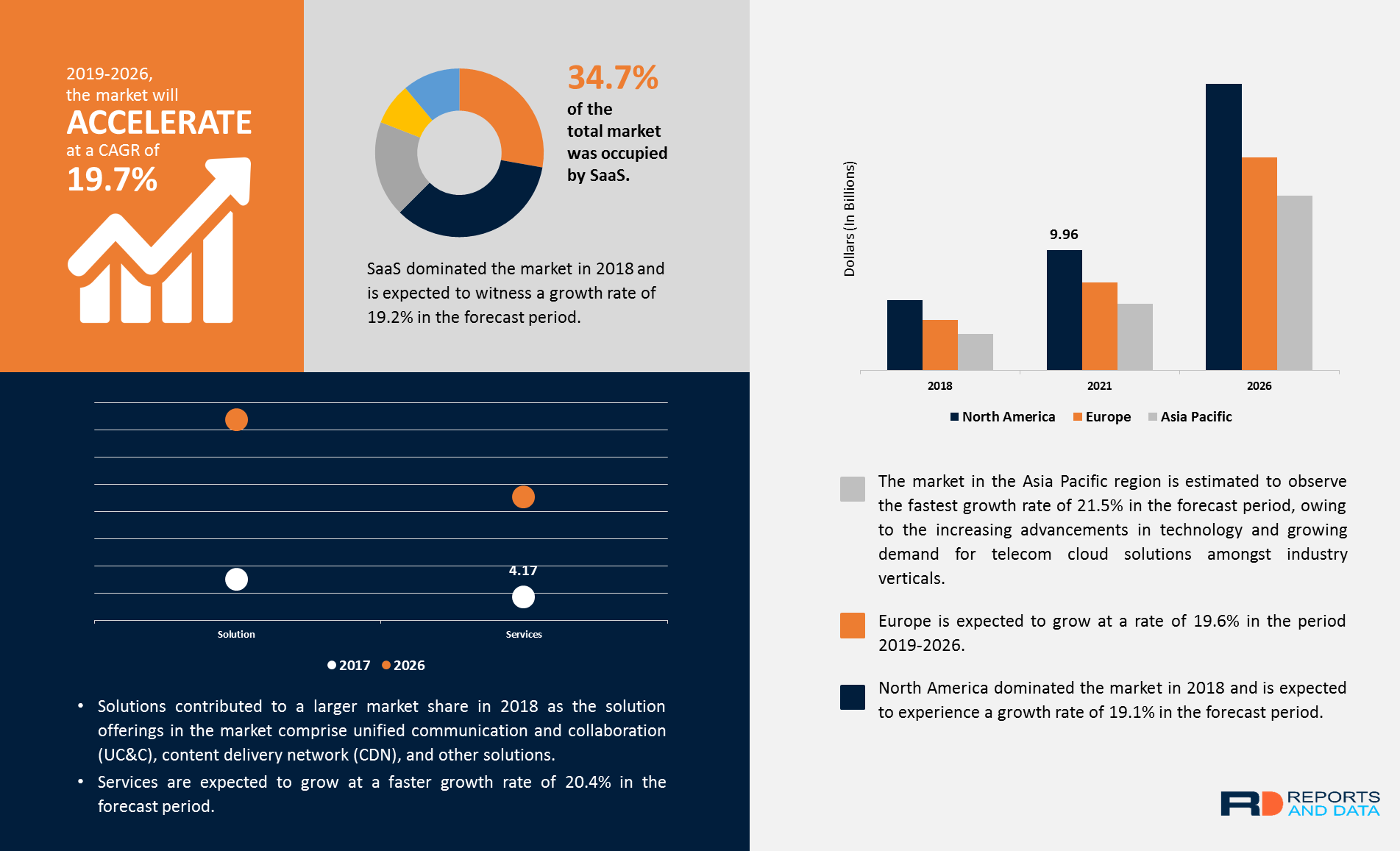

Reports and Data: Telecom Cloud Market to grow at CAGR of 19.7% through 2026

The global Telecom Cloud Market is projected to grow at a CAGR of 19.7% in terms of value, from 2019 to reach USD 59.25 Billion by 2026, according to a new report by Reports and Data. OTT (Over-the-top) consumers demand more flexibility in scheduling, arranging videos, live events, and recording of favorite shows, thereby pushing the service providers to opt for more resources, infrastructure scalability, and computing resources to cater demands. By adopting a cloud-based workflow, video service providers can efficiently hand off duty for the infrastructure and networking supporting their OTT services. Telecom cloud can be instrumental in meeting the needs of OTT service providers, thus resulting in the growth of the market.

The telecom cloud market Modernization of IT platforms is estimated to fuel the growth of the market in the forecast period. As some of the largest communication service providers across the globe modernize their networks, they facilitate large enterprises to transform the way they involve with a progressively digital world. By leveraging IP-based technology, UCaaS (Unified Communications-as-a-Service), embedded communications (such as voice, chat, and video built into web and business applications) and other novelties on an IP network, communication service providers and the organizations they cater to can provide enhanced service to their customers and reap higher margins by reducing their expenses along with the lower total cost of ownership delivered by software-defined real-time communications (RTC).

Increasing demand for over-the-top cloud services is one of the significant factors influencing market growth. The telecom cloud leads to low operational costs, which is expected to drive the market growth in the forecast period. By deploying cloud computing, service providers can host services and software at a considerably lower cost. Provisioning and virtualization software allows organizations to efficiently assign computing resources, thus lowering the cost of hardware. Service providers can locate facilities at low-cost locations, provisioning, which cannot be replicated by most enterprises, resulting in low up-front costs.

Additionally, the proliferation of the internet, especially in developing nations, is expected to propel the growth of the telecom cloud market in the upcoming years.

Key participants include AT&T Inc., Verizon Communications Inc., Ericsson, Deutsche Telekom, BT Group PLC, CenturyLink Inc., Orange Business Services, NTT Communication Services, Singapore Telecommunications Limited, and Telstra Corporation Limited, among others.

Key findings from the report:

• By offering, solutions contributed to a larger market share in 2018 as the solution offerings in the market comprise unified communication and collaboration (UC&C), content delivery network (CDN), and other solutions.

• By service type, SaaS dominated the market in 2018 and is expected to witness a growth rate of 19.2% in the forecast period. The swift growth of on-demand services among consumers has resulted in a high demand for this service type in the telecom cloud market.

• By organization size, small & medium-sized enterprises are expected to witness a higher CAGR of 20.5% in the period 2019-2026 as services and solutions have the potential to produce enhanced efficiency, quality, and business productivity.

• By industry verticals, BFSI (Banking, financial services and insurance) held the largest market share in 2018 and is expected to grow at a rate of 19.6% in the forecast period.

• North America dominated the market in 2018 and is expected to experience a growth rate of 19.1% in the forecast period. The market dominance of North America is attributed to the presence of leading telecom companies mainly in the U.S. and Canada

The growing concerns pertaining to spectrum crunch in the developing nations are driving the market for telecom cloud as it helps telecom companies to increase their profitability in the telecom market. In countries with a high population, especially Countries in the Asia Pacific region, the telecom cloud plays an instrumental role in enabling telecom market players to gain a competitive edge in the market.

Incorporating cloud computing platforms into telecommunication allows Network functions virtualization (NFV) to virtualize servers, networks, and storage augments the utilization of available system resources and lowers infrastructure cost. Besides, network virtualization offers the implementation of numerous applications and features an open environment. Thus, telecom cloud virtualization is linked to many significant advantages, including enhanced scalability, flexibility of deployment, and a reduction in cost of the equipment, which permits reiteration of application software, better support for resolving faults, and enhanced security, among others.

References:

https://www.reportsanddata.com/report-detail/telecom-cloud-market