Dell’Oro: 5G SA Core network launches accelerate; 14 deployed

According to a recently published report from Dell’Oro Group, revenues for the Mobile Core Network (MCN) market are poised for growth in 2022. The outlook has turned positive, starting in 4Q 2021, as 5G Standalone (SA) commercial launches begin to accelerate.

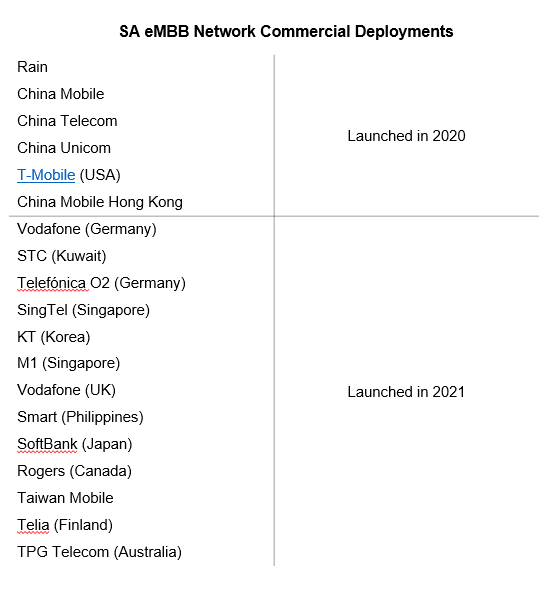

“The expected growth rate for 2022 is more optimistic than reported last quarter with the commercial deployments of more 5G SA enhanced Mobile Broadband (eMBB) networks,” stated Dave Bolan, Research Director at Dell’Oro Group. “We count 14 commercial 5G SA networks deployed by Communication Service Providers for eMBB services. Five of the 14 5G SA networks went commercial after the close of 3Q 2021 quarter. Europe had a surprising uptick in 3Q 2021 with 5G SA network commercial launches primarily in Germany,” Bolan added.

Additional highlights from the 3Q 2021 Mobile Core Network Report:

- MCN market revenues declined into negative growth year-over-year and quarter-over-quarter.

- The slowdown is attributed to a slowing of the 5G SA network buildouts in China.

- 5G Packet Core revenues for the quarter were spread across only six vendors: Ericsson, Huawei, Mavenir, NEC, Nokia, and ZTE.

13 January 2022 Update (SA=Stand Alone; eMBB=Enhanced Mobile Broadband 5G use case):

The Dell’Oro Group Mobile Core Network Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, shipments, and average selling prices for Evolved Packet Core, 5G Packet Core, Policy, Subscriber Data Management, and IMS Core including licenses by Non-NFV and NFV, and by geographic regions. To purchase this report, please contact us at [email protected].

Opinion:

It’s this author’s belief that the 5G SA core network market will be dominated by the hyperscale cloud service providers. In particular, Amazon AWS, Microsoft AZURE, Google Cloud, Oracle Cloud. 5G SA core network enables many hyped capabilities, such as network slicing, MEC, VoNR, automation, virtualization and others.

Addendum:

Please refer to Dave Bolan’s COMMENT in the box below this article. You can download a free whitepaper from the link there.

References:

5G Standalone Commercial Launches Accelerate Mobile Core Market, According to Dell’Oro Group

The Sorry State of 5G SA Core Networks- Smart Communications in Phillipines

Telcos Loss: Private 5G & MEC/5G SA Core Network – Cloud Giants Take Market Share

2 thoughts on “Dell’Oro: 5G SA Core network launches accelerate; 14 deployed”

Comments are closed.

Challenges Moving The 5G Core to The Public Cloud

Dell’Oro Group has counted 15 Communication Service Providers (CSPs) that have commercially deployed 5G Standalone (5G SA) networks for eMBB (enhanced Mobile Broadband) services, which requires 5G Core. None of these CSPs used the Public Cloud for their 5G Core. Rather, they went the traditional route, building their own private telecom networks, or, as known in the 5G world, the Telco Cloud.

With nearly a thousand CSPs in the world, we are obviously in the embryonic stage of the lifecycle of the 5G SA market. A lot is at stake, as billions of dollars will be invested in 5G Core. So which way should a CSP go, Public Cloud or Telco Cloud? Part of the answer depends on the target market of particular CSPs: eMBB, FWA (Fixed Wireless Access), Private Wireless Networks, or IIOT (Industrial Internet-of-Things). The rest of the answer depends on the management and engineering expertise a CSP may or may not have. One size will not fit all CSPs.

Since no CSP is yet up and running an eMBB 5G Core in the Public Cloud, what questions need to be answered before they decide to move to the Public Cloud? What are the challenges and considerations? In this white paper, we will give CSPs the information they need to make the move or not, while also informing Public Cloud SPs of the questions they need to respond to.

About the Author

Dave Bolan joined Dell’Oro Group in 2017 and is currently responsible for the Mobile Core Network market research, as well as our Advanced Research report for Multi-Access Edge Computing market research programs. He previously covered the Carrier IP Telephony, and Wireless Packet Core markets for Dell’Oro Group. Mr. Bolan has written articles in industry media such as RCR Wireless. Mr. Bolan’s research and analysis has been widely cited in leading trade and business publications. Mr. Bolan is a frequent speaker at industry conferences and events, including CTIA Wireless conference, NetEvents Global Summit, and SDN NFV World Congress.

https://www.delloro.com/knowledge-center/white-papers/challenges-moving-the-5g-core-to-the-public-cloud/

Dave Bolan of Dell’Oro Group:

The 2021 5G MCN market came in 10% below our expectations from 2020, and this is due to the lack of more aggressive 5G Standalone (SA) network buildout than anticipated. We count 13 CSPs that commercially deployed 5G SA networks for enhanced Mobile Broadband (eMBB) in 2021, and they were nowhere close to the aggressiveness in breadth and depth of the buildouts that we saw by the Chines SPs in 2020, or for that matter in 2021. We thought all three CSPs in Korea would have launched by now, but so far only KT has launched. And we expected AT&T and Verizon in the US, and the CSPs in Switzerland to have launched 5G SA in 2021. In spite of these disappointments, the projected growth rate for 2021 is 61% Y/Y for 2021 and lowering to 18% Y/Y for 2022 due to the expected decline in growth rate by the Chinese CSPs.

The outlook is still positive for the overall MCN market growth rate with a 6% Y/Y for 2021 and 8% for 2022 being driven by the expansion of existing 5G SA networks and new 5G SA networks poised to launch for the 5G MCN and IMS Core markets.

https://www.delloro.com/predictions-2022-mobile-core-network-market/