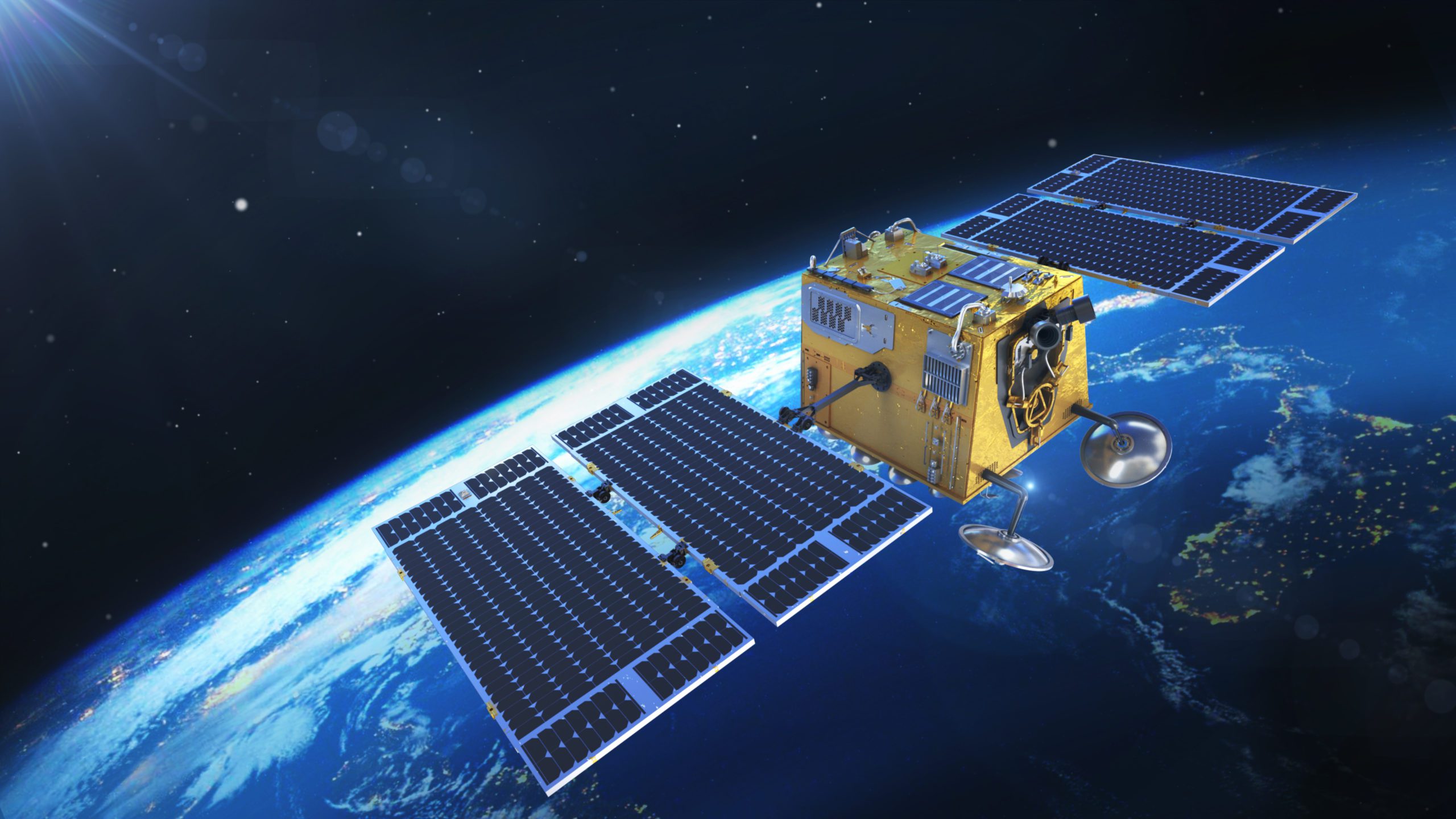

China’s answer to Starlink: GalaxySpace planning to launch 1,000 LEO satellites & deliver 5G from space?

Chinese state media is reporting that start-up satellite Internet firm GalaxySpace is planning to launch 1,000 low-Earth orbit (LEO) satellites, ultimately aiming to compete with SpaceX’s high-profile Starlink constellation.

GalaxySpace was founded in 2016. The company says it’s “committed to mass produce low-cost, high-performance small satellite through agile and fast-iterative development mode, and build the world’s leading LEO broadband satellite constellation and a global coverage with 5G communication network. Our mission is to improve the network connection condition of all regions and individuals, and to provide cost-effective, efficient and convenient broadband networks and services.Providing more accessible knowledge, more equal and extensive information, simpler and convenient communication and more development opportunities for everyone. The mission of GalaxySpace is to Creating global converged 5G communication network.”

Image Credit: GalaxySpace

According to the South China Morning Post (via Yahoo), the first batch of six satellites have already been produced, tested, and delivered to an undisclosed launch site. Beijing-based start-up GalaxySpace, has said it wants to extend China’s 5G coverage around the world and compete with Starlink, owned by Elon Musk’s firm SpaceX, in the market for high-speed internet services in remote areas. Of course, GalaxySpace’s new constellation of satellites will have quite a bit of catching up with Starlink, which has already launched around 2,000 LEO “birds,” with plans to increase the constellation size to 42,000. Starlink says they offer speeds of up to 110Mbps for consumer use.

According to Chinese media reports, GalaxySpace’s differentiating factor is that it will be the first constellation to deliver 5G connectivity to consumers, potentially offering download speeds of over 500Mbps. That’s an interesting claim, as there are no standards or implementation specs for 5G from anywhere in space. ITU-R M.2150 (formerly IMT 2020.specs) only covers terrestrial 5G services.

Naturally, like all satellite connectivity services, the quality of service will potentially be reduced significantly by poor weather. However, GalaxySpace claims that they will be able to deliver at least 80Mbps second even in the worst possible weather, according to their research.

5G is already prolific throughout China, according to the CCP (if you believe them). Recent figures suggest that by the end of 2021 there were 730 million 5G subscribers in China, over half the total population. As a result, GalaxySpace’s 5G services will likely be offered primarily to overseas companies as well as Chinese government and military activities.

But GalaxySpace is not China’s only growing broadband constellation. Both the Hongyan and Hongyun projects – owned by the state-owned China Aerospace Science and Technology Corporation and China Aerospace Science and Industry Corporation, respectively – have been launching test satellites since as early as 2018.

Hongyan is aiming for 324 total satellites in its constellation, while Hongyun will have 157, with the two constellations operating at different altitudes and with different frequencies.

In 2021, with Starlink’s rise to prominence, Chinese authorities were reportedly considering making “major changes” to both the Hongyan and Hongyun projects. What these changes might be is unclear, but it seems likely to be some sort of acceleration in deployment and perhaps scale; China has said repeatedly in recent month that it fears Starlink’s dominance of this emerging industry could represent a threat to national security, especially if these devices are being used clandestinely by the US military.

Last year, Zhu Kaiding, a space engineer from the China Academy of Space Technology, which is working with GalaxySpace on the project, wrote in an academic article that the rise of Starlink had caused a Chinese satellite production line to increase its productivity by more than a third.

In addition to commercial LEO satellite Internet service rivalry, China has identified Starlink, which has signed multimillion dollar contracts with the U.S. military, as a threat to China’s national security. In 2020, researchers with the Chinese National University of Defense Technology estimated that it could increase the average global satellite communication bandwidth available to the U.S. military from 5Mbps to 500Mbps. The researchers also warned that existing anti-satellite weapons technology would find it virtually impossible to destroy a constellation the size of Starlink.

Zhu Kaiding, a space engineer from the China Academy of Space Technology, which is working with GalaxySpace on the project, said the Chinese project was struggling to keep pace with Starlink, which according to Musk is producing six satellites a day.

Zhu did not disclose how quickly China was producing satellites, but in a paper published in domestic journal Aerospace Industry Management in October last year, he said the Starlink program had forced a satellite assembly line in China to increase its productivity by more than a third. Zhu and colleagues have said that more than half the routine checks carried out at the launch site of high-frequency operations have been cancelled to save time.

The new satellites also use many components produced by private companies that have not previously been involved in Chinese space projects – a move that helped reduce the total hardware price of a high-speed internet satellite by more than 80 per cent.

Zhu said that the race against Starlink had put enormous pressure on China’s space industry, because “the technology is complex, the competition fierce, the deadlines tight and the workloads heavy.”

It is likely that the number of civilian users of satellite internet service in China will be limited – most urban residents can access 5G through their phone and broadband services are available in most rural areas – so the most likely customers are overseas companies or the Chinese government and military.

……………………………………………………………………………………………………………………………………………………………………………………………………….

Stepping away from the geopolitical dimension of the satellite broadband space race, it is worth noting that the potential negatives for introducing such an enormous number of satellites into LEO could have for society, from Kessler syndrome caused by the build-up of space debris to the obstruction of terrestrial observatories. In fact, just this week there was a new study, published in The Astrophysical Journal Letters, suggests that Starlink satellites are hindering the detection of near-Earth asteroids.

“There is a growing concern about an impact of low-Earth-orbit (LEO) satellite constellations on ground-based astronomical observations, in particular, on wide-field surveys in the optical and infrared,” explained the study.

In 2020, SpaceX had responded to astronomers initial concerns about Starlink disrupting their imagine technology by attaching visors to their new satellites to dampen their brightness. This new study, however, would suggest that this problem is only going to be further exacerbated as the various players continue to launch devices into orbit throughout this year.

References:

https://www.totaltele.com/512227/Is-GalaxySpace-Chinas-answer-to-Starlink

https://www.yahoo.com/now/china-start-building-5g-satellite-093000905.html

http://www.yinhe.ht/aboutusEn.html

Starlink’s huge ambition and deployment plan may clash with reality

Ookla: Starlink’s Satellite Internet service vs competitors around the world

Starlink Internet could be a game changer with 100 megabytes per second download speed

PCMag Study: Starlink speed and latency top satellite Internet from Hughes and Viasat’s Exede

Starlink to explore collaboration with Indian telcos for broadband internet services

4 thoughts on “China’s answer to Starlink: GalaxySpace planning to launch 1,000 LEO satellites & deliver 5G from space?”

Comments are closed.

Thanks for the thorough review of this big development. It is unfortunate that one of the motivations for these massive satellite projects is the militarization of space.

Don’t believe anything the CCP says. Given that 5G is a hoax in China, how can China Academy of Space Technology & GalaxySpace build a 5G satellite network? They have lied thousands of times in the past.

I recall China said someone invented the world’s first Quantum Communications 10 years ago, even launched a Quantum Communications satellite. All of the news at that time said China could beat the U.S. in telecommunications with their Quantum Communications technology.

Xi Jinping’s CCP congress report in 2012 included China’s breakthrough of Quantum Communications.

Many people asked me various technical questions on Quantum Communications in the past 10 years. I simply replied that it is a joke and lie.

Now many Quantum Communications start-up companies in China are bankrupt. As a result, no one in China mentions Quantum Communications any more. That’s despite fake articles like https://thequantuminsider.com/2021/04/20/9-companies-leading-the-quantum-technologies-race-in-china/

The 5G satellite network for sure is another joke, just to fool the Chinese people.

Bloomberg: Musk’s Starlink Brings Internet to Ukraine, and Attention to a New Space Race

SpaceX enabled its Starlink satellite broadband service in Ukraine and began shipping additional dishes. Those dishes are especially valuable now that Russia’s military is targeting Ukrainian infrastructure. “Received the second shipment of Starlink stations!” Mykhailo Fedorov, Ukraine’s minister of digital transformation, tweeted on March 9. “@elonmusk keeps his word!”

The dishes Starlink’s Elon Musk has provided to Ukraine and to Tonga following its January tsunami have cast a spotlight on low-Earth-orbit (LEO) satellites, a new generation of spacecraft that can circle the globe in just 90 minutes and connect users to the internet. They’re small and inexpensive: A Starlink satellite weighs 260 kilograms (573 pounds) and costs from $250,000 to $500,000, while an Inmarsat Group Holdings Ltd. geostationary satellite can clock in at 4 metric tons and sell for $130 million.

The satellite networks will be able to provide broadband access to tens of millions of people in places such as rural India that otherwise lack access to more traditional mobile and fixed-line networks. “There is a large opportunity to bridge the digital divide in remote areas where the cost of terrestrial communication is high, and hence both voice and broadband communication have not been set up,” says Anil Bhatt, director general of the Indian Space Association.

On March 9, Musk boasted that SpaceX had sent 48 more satellites into orbit, adding to its over 2,000 already circling the Earth. But Musk has rivals with their own LEO satellite ambitions. They include fellow space billionaire Jeff Bezos. Amazon.com Inc.’s Kuiper Systems wants to launch more than 7,000 satellites. On March 5 a Chinese rocket launched six LEO satellites for Beijing-based GalaxySpace, which plans a constellation with as many as 1,000. The European Union in February announced a plan for a constellation that would cost about €6 billion ($6.6 billion). And Indian billionaire Sunil Mittal’s Bharti Global, along with the British government, is an investor in OneWeb Ltd., which plans to begin operating its LEO constellation of 648 satellites this year. It intended to launch its latest group of satellites on March 5 aboard a Russian rocket, but canceled after the Kremlin’s space agency demanded that the U.K. sell its stake. OneWeb is looking for alternative services for six future launches.

Unlike more established operators, which have a relatively small number of satellites in fixed locations about 36,000 kilometers (22,369 miles) above sea level, companies launching LEO satellites place them at heights of 550 to 1,200 km. That makes it easier for the satellites to provide speedy services than those higher in space, says Marco Caceres, an analyst with Teal Group, an aerospace and defense market analysis firm. “They’re going to make a lot of these traditional systems dinosaurs overnight,” he says, adding that Starlink alone is likely to have 4,500 satellites in operation by the middle of the decade. “They’re moving at lightning speed.”

SpaceX began signing up customers in India in 2021 even though it didn’t have a license to offer Starlink service there. India’s government in January demanded the company return money from would-be customers. As SpaceX works out its entry strategy for India, Reliance Jio Infocomm Ltd.—the telecommunications operator controlled by Mukesh Ambani, India’s richest person—in February formed a joint venture with Luxembourg-based satellite operator SES SA to provide internet access via satellites in geostationary and medium-Earth orbits.

While the new satellite companies boast of their ability to reach underserved communities, many will struggle to make their equipment affordable for some target markets, says Bloomberg Intelligence analyst Matthew Bloxham. According to BI, a standard Starlink plan costs $499 for the hardware, plus a monthly fee of $99. But there are other reasons governments are likely to provide financial support for internet via satellite, Bloxham says: “It provides resilience in case of a cyberattack that takes out the regular internet that we know today.”

Still, critics say Musk and others aren’t considering the risks of having too many satellites in a relatively narrow band above Earth. “What’s going on now is there’s a race to put up as many as possible for the rights that are implied by having those satellites, even if it’s not economically justified, or safe, or sustainable,” says Mark Dankberg, chairman of Viasat Inc., a California-based satellite operator of geostationary satellites, which in November agreed to buy rival Inmarsat for $4 billion. As operators attempted to bulk up in response to the challenge from newcomers, M&A deal volume for the satellite industry in 2021 reached its highest level since 2007, according to data compiled by Bloomberg, with companies signing 60 deals worth $18 billion.

China in December said two of Starlink’s satellites came dangerously close to its space station. The U.S. said there had been no “significant probability” of a Starlink collision with the Chinese station, but some experts worry that the situation was a sign of what’s to come. International agreements governing space date to the 1960s and ’70s, when billionaires didn’t have their own space programs. “We have so many of these new actors coming on board, and we don’t have sufficiently strong international law,” says Maria Pozza, a director at Gravity Lawyers in Christchurch, New Zealand, who advises clients on space law and regulation. “We’ve got a little bit of a mess.”

https://www.bloomberg.com/news/articles/2022-03-16/musk-bezos-satellite-companies-target-low-orbit-networks