KDDI claims world’s first 5G Standalone (SA) Open RAN site using Samsung vRAN and Fujitsu radio units

Japan’s KDDI is claiming to have turned on the world’s first commercial 5G Standalone (SA) Open Radio Access Network (Open RAN) site, using equipment and software from Samsung Electronics and Fujitsu. KDDI used O-RAN Alliance compliant [1.] technology, including Samsung’s 5G virtualized CU (vCU) and virtualized DU (vDU) as well as Fujitsu’s radio units (MMU: Massive MIMO Units).

Note 1. O-RAN Alliance specifications are being used for RAN module interfaces that support interoperation between different Open RAN vendors’ equipment.

The first network site went live in Kawasaki, Kanagawa today. KDDI, together with its two partners, will deploy this Open RAN network in some parts of Japan and continue its deployment and development, embracing openness and virtualization in KDDI’s commercial network. Note that both Rakuten-Japan and Dish Network/Amazon AWS have promised 5G SA Open RAN but neither company seems close to deploying it.

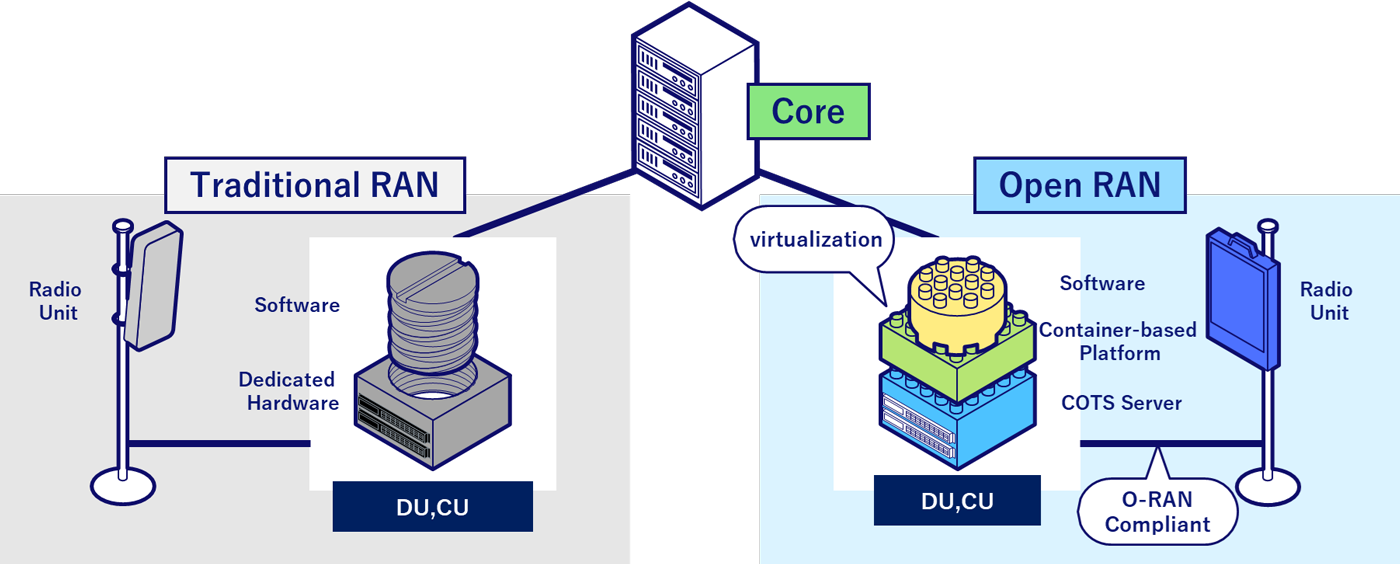

Virtualization and O-RAN technology replaces dedicated hardware with software elements that can run on commercial off-the-shelf (COTS) servers. This brings flexibility and agility to KDDI’s network, allowing the operator to offer enhanced mobile services to its users. KDDI says this architecture will deliver reliability, while accelerating deployment of Open RAN throughout Japan, including in rural areas. Meanwhile, 5G SA will deliver superior performance, higher speeds and lower latency and make possible advanced services/applications, such as network slicing, automation, service chaining and Multi-access Edge Computing (MEC).

Traditional RAN vs. Open RAN Configuration. Source: KDDI

Characteristics of this site:

This Open RAN site leverages fully-virtualized RAN software, provided by Samsung, that runs on commercial off-the-shelf (COTS) servers. Furthermore, by pursuing an open network approach between radio units and baseband unit, KDDI used Samsung’s baseband and Fujitsu’s Massive MIMO Units, which are connected with an open interface.

- Fully-virtualized 5G RAN software can be swiftly deployed using existing hardware infrastructure, which brings greater flexibility in deployment. New 5G SA technologies―such as network slicing, Multi-access Edge Computing (MEC) and others―powered by 5G vRAN, will deliver superior performance, higher speeds and lower latency, allowing KDDI users to experience a range of new next-generation services and immersive applications.

- Using an open interface between radio units and baseband unit, Open RAN not only ensures security and reliability but also enables operators to implement best-of-breed solutions from different partners and build an optimal network infrastructure for maximized performance.

- The virtualized network allows the use of general-purpose hardware (COTS servers) across the country, which will greatly increase deployment efficiencies. Additionally, by leveraging system automation, fully-virtualized RAN software can reduce deployment time, enabling swift nationwide expansion, including rural areas.

Comments from Kazuyuki Yoshimura, Chief Technology Officer, KDDI Corporation:

“Together with Samsung and Fujitsu, we are excited to successfully develop and turn on the world’s first commercial 5G SA Open RAN site powered by vRAN. Taking a big step, we look forward to continue leading network innovation and advancing our network capabilities, towards our vision of delivering cutting-edge 5G services to our customers.”

Comments from Woojune Kim, Executive Vice President, Head of Global Sales & Marketing, Networks Business at Samsung Electronics:

“Leveraging our industry-leading 5G capabilities, we are excited to mark another milestone with KDDI and Fujitsu. Samsung stands out for its leadership in 5G vRAN and Open RAN with wide-scale commercial deployment experiences across the globe. While KDDI and Samsung are at the forefront of network innovation, we look forward to expanding our collaboration towards 5G SA, to bring compelling 5G services to users.”

Note: Samsung released its first 5G vRAN portfolio in early 2021 following its blockbuster RAN deal with Verizon, which was the first operator to commercially deploy the new equipment. Samsung also gained a foothold in Vodafone’s plan to deploy 2,500 open RAN sites in the southwest of England and most of Wales. Samsung’s open RAN compliant vRAN hardware and software were previously deployed in 5G NSA commercial networks in Japan and Britain, but this is the first 5G SA deployment. We wonder if it is “cloud native?” Hah, hah, hah!

Comments from Shingo Mizuno, Corporate Executive Officer and Vice Head of System Platform Business (In charge of Network Business), Fujitsu Limited:

“The Open RAN-based ecosystem offers many exciting possibilities and this latest milestone with KDDI and Samsung demonstrates the innovative potential of next-generation mobile services with Massive MIMO Units. Fujitsu will continue to enhance this ecosystem, with the goal of providing advanced mobile services and contributing to the sustainable growth of our society.”

The companies will continue to strengthen virtualized and Open RAN leadership in this space, bringing additional value to customers and enterprises with 5G SA.

……………………………………………………………………………………………………………………………………………………………………………………………………………..

Addendum: As of December 31, 2021 there were only 21 known 5G SA eMBB networks commercially deployed.

|

5G SA eMBB Network Commercial Deployments |

|

|

Rain (South Africa) |

Launched in 2020 |

|

China Mobile |

|

|

China Telecom |

|

|

China Unicom |

|

|

T-Mobile (USA) AIS (Thailand) True (Thailand) |

|

|

China Mobile Hong Kong |

|

|

Vodafone (Germany) |

Launched in 2021 |

|

STC (Kuwait) |

|

|

Telefónica O2 (Germany) |

|

|

SingTel (Singapore) |

|

|

KT (Korea) |

|

|

M1 (Singapore) |

|

|

Vodafone (UK) |

|

|

Smart (Philippines) |

|

|

SoftBank (Japan) |

|

|

Rogers (Canada) |

|

|

Taiwan Mobile |

|

|

Telia (Finland) |

|

|

TPG Telecom (Australia) |

|

SOURCE: Dave Bolan, Dell’Oro Group.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://news.kddi.com/kddi/corporate/english/newsrelease/2022/02/18/5896.html

Samsung Electronics wins $6.6B wireless network equipment order from Verizon; Galaxy Book Flex 5G

Mobile Core Network (MCN) growth to slow due to slow roll-out of 5G SA networks

One thought on “KDDI claims world’s first 5G Standalone (SA) Open RAN site using Samsung vRAN and Fujitsu radio units”

Comments are closed.

Feb 10, 2023 Update:

KDDI has selected Samsung to provide the kit for its 5G standalone core network, and its pretty excited about the potential for furthering the 5G experience in Japan.

The news will hardly raise any eyebrows; the South Korean operator and vendor have been working together for years. But the announcement is noteworthy because, amongst other things, it demonstrates the growing desire amongst Japanese players to push the 5G ecosystem on.

According to Samsung, its cloud-native, 5G SA core solution will afford KDDI the usual benefits we are used to hearing in connection with 5G: lower latency and high reliability, as well as 5G-enhanced capabilities. It supports both 4G and 5G networks, thereby offering seamless migration from one to the other, which is important at this stage in proceedings, and comes with a range of features, such as an overload control feature designed to counteract sudden traffic spikes.

The vendor also highlighted the fact that Samsung and KDDI are operating multiple cores in various locations for the sake of redundancy. Each core is capable of picking up loads should one active core become unavailable due to a traffic burst or a natural disaster.

“With Samsung’s 5G SA Core, we will offer unprecedented speed, instantaneous connectivity and high reliability which could bring numerous new experience value for consumers and enterprises,” said Toshikazu Yokai, Managing Executive Officer, General Manager of Mobile Network Technical Development Division at KDDI. “We look forward to continue advancing 5G networks to stay ahead of our customers’ needs.”

What he didn’t say, but probably didn’t need to, was that by advancing its 5G capabilities, KDDI also hopes to keep itself in a competitive position with its market rivals.

It sits squarely in the middle of the market in terms of customer numbers, claiming a 32 percent market share as of the end of September, according to the latest figures from Japan’s Telecommunications Carriers Association. NTT DoCoMo is bigger, Softbank smaller. It’s worth noting that the TCA does not include fourth network operator Rakuten Mobile in its data, presumably because it has yet to rack up a meaningful number of customers.

The launch of Rakuten Mobile as an MNO almost three years ago gave competition something of a shot in the arm in the Japanese mobile market, and of course it coincided with the early days of 5G in the country, another competitive battleground. The country’s operators are still in something of a landgrab phase, so getting its 5G SA core sorted is a step forward for KDDI.

The telco is behind DoCoMo in the 5G customer race, with just over 15 million at the end of last year to its rival’s 18.22 million. Softbank didn’t share numbers. Nonetheless, it’s clearly a close call at present, making the Japanese market one to watch going forward.

Spectrum allocation, for 5G services and beyond, is also likely to focus the attention of the broader industry on Japan in the coming months and years.

The government is planning to introduce an auction system for the allocation of spectrum, according to a report by Nikkei last month. While spectrum auctions are the norm in most telecoms markets, Japan has historically doled out airwaves to its mobile operators at no cost and with no competitive element, the thinking doubtless being that operators need their cash to roll out networks.

However, the news agency claims that Japan’s Ministry of Internal Affairs and Communications will introduce the auction concept by the end of fiscal 2025, or end-March of that year, although it notes that the winners will not be determined solely by bid price, but also by technology roadmaps and business plans.

It’s a proposal that has been in the works for some time and has both supporters and detractors. As the Japan Times reported last summer, DoCoMo has come out in favour of the idea, while newcomer Rakuten fears for its competitive position. KDDI and Softbank have less strong views, by all accounts.

It will be interesting to see how that one plays out, and ultimately what, if any, effect it has on the market.

In the meantime, the telcos are focusing on their own 5G rollouts. For KDDI that means leveraging the Samsung 5G SA core to facilitate higher-performance use cases like smart factories, automated vehicles, cloud-based online gaming and multi-camera live streaming at sporting events. It is also keen to push on with network slicing, something that will help it to attract enterprise customers and the revenue potential they offer.

But that’s not a position unique to KDDI, of course, or even to Japan. Mobile operators the world over have the same goals.

https://telecoms.com/519855/kddi-does-5g-sa-core-deal-with-samsung/