ABI Research: Expansion of 5G SA Core Networks key to 5G subscription growth

The number of 5G subscriptions will surge from 934 million in 2022 to 3.1 billion in 2027 -a Compound Annual Growth Rate (CAGR) of 27% – according to a study from ABI Research. Further, 5G traffic is forecast to increase from 293 Exabytes (EB) in 2022 to 2,515 EB in 2027, at a CAGR of 54%.

ABI’s forecast is largely based on an increase in 5G Core (5GC) networks. To date, more than 35 5GC networks are operating in 5G standalone (SA) mode. 5GC is expected to lead to a growth in devices connected to the network and the traffic routed through it.

“5GC holds potential for operators to monetize further existing cellular connectivity for traditional mobile broadband (MBB) use cases but also offers scope for operators to expand cellular capabilities in new domains. Additionally, 5GC also offers innovation potential for committed telcos to establish new operating models for growth outside of the consumer domain,” explains Don Alusha, Senior Analyst, 5G Core and Edge Networks, at ABI Research.

5GC presents Communications Service Providers (CSPs) with a fluid and dynamic landscape. In this landscape, there is no static offering (requirements constantly change), no uniform offering (one shoe does not fit all), and no singular endpoint (one terminal with multiple applications). 5GC guides the industry into edge deployments and topologies. CSPs step out of the four walls of either their virtual Data Center (DC) or physical DC to place network functionality and compute as close to their customers as possible. This constitutes decentralization, a horizontal spread of network assets and technology estate that calls for a ‘spread’ in the operating model.

The shift from a centralized business (e.g. with 4G EPC) to a decentralized business (5G SA core network) stands to be a significant trend in the coming years for the telecoms industry. Against that backdrop, the market will demand that CSPs learn to drive value bottom-up. “What customers need” is the starting point for companies like AT&T, BT, Deutsche Telekom, Orange, and Vodafone. In other words, in this emerging landscape, there will be enterprise-specific, value-based, and niche engagements where the business strategy sets the technology agenda. So, it is rational to conclude that a “bottom-up” approach may be required to deliver unique value and expand business scope. That said, CSPs may be better equipped to drive sustained value creation if they learn to build their value proposition, starting from enterprise and industrial edge and extending to core networks.

“A 5G cloud packet core can potentially unlock new transactions that supplement existing volume-centered modus operandi with a local, bottom-up value play for discrete engagements. But the power of a bottom-up model is not enough. To monetize a 5G cloud packet core at scale, some of the existing top-down intelligence is needed too. Learning how to operate in this hybrid top-down and the emerging bottom-up, horizontally stratified ecosystem is a journey for NTT Docomo, Rakuten Mobile, Singtel, Softbank, and Telstra, among other CSPs. In the impending cellular market, an effective and efficient operating model must contain both control and lack of control, both centralization and decentralization and a hybrid of bottom-up plus some of the ‘standard’ top-down intelligence. The idea is that CSPs’ operating model should flexibly fit and change in line with new growing market requirements, or new growth forays may hit a roadblock,” Alusha concludes.

Editor’s Note:

It’s critically important to understand that the 3GPP defined 5G core network protocols and network interfaces enable the entire mobile system. Those include call and session control, mobility management, service provisioning, etc. Moreover, the 3GPP defined 5G features can ONLY be realized with a 5G SA core network. Those include: Network Automation, Network Function Virtualization, 5G Security, Network Slicing, Edge Computing (MEC), Policy Control, Network Data Analytics, etc

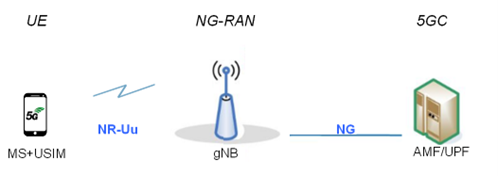

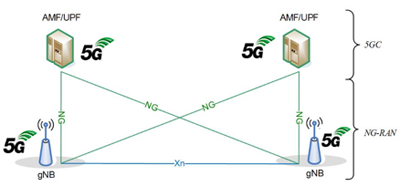

Figure 1: Overview of the 5G system

The 5GC architecture relies on a “Service-Based Architecture” (SBA) framework, where the architecture elements are defined in terms of “Network Functions” (NFs) rather than by “traditional” Network Entities. Via interfaces of a common framework, any given NF offers its services to all the other authorized NFs and/or to any “consumers” that are permitted to make use of these provided services. Such an SBA approach offers modularity and reusability.

Figure 2: 5G SA Core Network Architecture

The 5G SA architecture can be seen as the “full 5G deployment,” not needing any part of a 4G network to operate.

Finally, 3GPP has not liased their 5G system architecture specifications to ITU-T so there are no ITU-T standards for 5G SA Core Network or any other 5G non-radio specification. Instead, 3GPP sends their specs to ETSI which rubber stamps them as “ETSI standards.”

……………………………………………………………………………………………………………………………………………………….

These findings are from ABI Research’s 5G Core Market Status and Migration Analysis report. This report is part of the company’s 5G Core & Edge Networks research service, which includes research, data, and analyst insights. Based on extensive primary interviews, Application Analysis reports present an in-depth analysis of key market trends and factors for a specific technology.

About ABI Research

ABI Research is a global technology intelligence firm delivering actionable research and strategic guidance to technology leaders, innovators, and decision makers around the world. Our research focuses on the transformative technologies that are dramatically reshaping industries, economies, and workforces today.

References:

https://www.3gpp.org/technologies/5g-system-overview#

https://www.nokia.com/networks/core/5g-core/

A few key 3GPP Technical Specifications (TSs) are listed here:

- TS 22.261, “Service requirements for the 5G system”.

- TS 23.501, “System architecture for the 5G System (5GS)”

- TS 23.502 “Procedures for the 5G System (5GS)

- TS 32.240 “Charging management; Charging architecture and principles”.

- TS 24.501 “Non-Access-Stratum (NAS) protocol for 5G System (5GS); Stage 3”

- TS 38.300 “NR; NR and NG-RAN Overall description; Stage-2”

One thought on “ABI Research: Expansion of 5G SA Core Networks key to 5G subscription growth”

Comments are closed.

5G Fixed Wireless Access (FWA) subscriptions are forecast to reach 72 million by 2027, representing 35% of the total FWA market, according to a recent report by ABI Research.

Although LTE FWA services have already been widely deployed worldwide, they often cannot provide the speed needed to compete with wired broadband connections, ABI noted. 5G FWA is set to offer data rates rivaling the range of fiber, making it a “competitive alternative to wired broadband solutions,” the company said.

ABI also highlighted that North America, Western Europe and the Asia Pacific region are driving 5G FWA deployments. In North America and Western Europe, MNOs are using 5G FWA to compete with DSL broadband services. According to the research firm, major U.S. operators, like T-Mobile US, see a huge opportunity with 5G FWA because two-thirds of its residential customers living in urban and suburban areas are dissatisfied cable customers, making up a significant amount of potential 5G FWA customers.

https://www.rcrwireless.com/20230526/5g/global-5g-subscribers-reach-3-billion-2027-abi-research