U.S. Network Operators and Equipment Companies Agree: 5G CAPEX slowing more than expected

We noted in a recent IEEE Techblog post that the 5G spending slowdown in the U.S. is broader than many analysts and executives expected. Well, it’s worse than that! The previously referenced negative comments from the CEO of Crown Castle, were corroborated by American Tower last week:

“The recent pullback was more abrupt than our initial expectations,” said Rod Smith, the CFO for cell tower firm American Tower, during his company’s quarterly conference call last week, according to Seeking Alpha. Smith was discussing the reduction in US operator spending on 5G, a situation that is now cutting $40 million out of American Tower’s margin expectations. “The initial burst of 5G activity has slowed down,” agreed the financial analysts at Raymond James in a note to investors following the release of American Tower’s earnings.

Cell tower giant SBA Communications said it too is seeing the broad pullback in spending that has affected its cell tower competitors (i.e. American Tower and Crown Castle). But the company’s management sought to reassure investors with promises of continued growth over the long term. During their earnings call, SBA executives said they expect activity to increase next year as T-Mobile looks to add 3.45GHz and C-band spectrum to its network, and as Dish Network restarts its network buildout.

The two largest 5G network equipment vendors that sell gear in the U.S. are seeing similar CAPEX cutbacks. “We see some recovery in the second half of the year but it will be slower than previously expected,” Nokia CEO Pekka Lundmark said earlier this month during his company’s quarterly conference call, in response to a question about the company’s sales in North America. His comments were transcribed by Seeking Alpha. Ericsson’s CEO, Borje Ekholm, is experiencing similar trends: “We see the buildout pace being moderated,” he said of the North American market, according to a Seeking Alpha transcript

AT&T’s CFO Pascal Desroches confirmed the #1 U.S. network operator is slowing its network spending. “We expect to move past peak capital investment levels as we exit the year,” he said during AT&T’s quarterly conference call, as per a Seeking Alpha transcript. AT&T’s overall CAPEX would be $1 billion lower in the second half of 2023 when compared with the first half of this year due to greatly reduced 5G network build-outs.

“This implies full year capex of ~$23.7 billion, which management believes is consistent with their prior full year 2023 capex guidance of ‘~$24 billion, near consistent with 2022 levels’ and includes vendor financing payments,” wrote the financial analysts at Raymond James in their assessment of AT&T’s second quarter results, citing prior AT&T guidance.

“Although management declined to guide its 2024 outlook, it has suggested that it expects capital investments to come down as it progresses past the peak of its 5G investment and deployments. We believe the trends present largely known CY23 [calendar year 2023] headwinds for direct 5G plays CommScope, Ericsson and Nokia. Opportunities from FWA [fixed wireless access] might provide modest offsets and validate Cambium’s business. AT&T’s focus on meeting its FCF [free cash flow] targets challenge all of its exposed suppliers, which also include Ciena, Infinera and Juniper,” the financial services firm added.

Verizon CEO Hans Vestberg told a Citi investor conference in January that CAPEX would drop to about $17bn in 2024, down from $22bn in 2022″ “We continue to expect 2023 capital spending to be within our guidance of $18.25 billion to $19.25 billion. Our peak capital spend is behind us, and we are now at a business-as-usual run rate for capex, which we expect will continue into 2024,” explained Verizon CFO Tony Skiadas during his company’s quarterly conference call last week, according to Seeking Alpha.

“After years of underperformance, perhaps the best argument for Verizon equity is that expectations are very low. They are coming into a phase where capex will fall now that they’ve largely completed their 5G network augmentation. Higher free cash flow will flatter valuations, but it will also, more importantly, lead to de-levering first, and potentially even to share repurchases down the road,” speculated the analysts at MoffettNathanson in a research note to investors following the release of Verizon’s earnings.

T-Mobile USA had previously said its expansive 5G build-out had achieved a high degree of scale and it would reduce its capex sharply starting in 2023.”We expect capex to taper in Q3 and then further in Q4,” said T-Mobile USA’s CFO Peter Osvaldik during his company’s quarterly conference call last week, according to Seeking Alpha. He said T-Mobile’s capex for 2023 would total just under $10 billion. T-Mobile hopes to cover around 300 million people with its 2.5GHz midband network by the end of this year. Afterward, it plans to invest in its network only in locations where such investments are necessary.

Similarly, Verizon and AT&T are completing deployments of their midband C-band 5G networks, and will slow spending after doing so. That’s even though neither telco has deployed a 5G SA core network which involves major expenses to build, operate and maintain.

Dish Network managed to meet a federal deadline to cover 70% of the U.S. population with it’s 5G OpenRAN in June. As a result, the company said it would pause its spending until next year at the earliest.

American Tower was a bit more hopeful that CAPEX would pick up in the future:

- “Moderation in carrier spend following the recent historic levels of activity we’ve seen in the industry isn’t unexpected and is consistent with past network generation investment cycles,” explained CFO Rod Smith.

- “The cycles typically progress as there’s a coverage cycle. It’s what we’ve seen in past cycles, including 3G and 4G. It’s an initial multiyear period of elevated coverage capex, and it’s tied to new G spectrum aimed at upgrading the existing infrastructure,” said American Tower’s CEO Tom Bartlett. “And then later in the cycle, it will fill back into a capacity stage where we’ll start to see more densification going on. So I’m hopeful that our investor base doesn’t get spooked by the fact that this is a pullback. It’s very consistent. The cadence is really spot on with what we’ve seen with other technologies.”

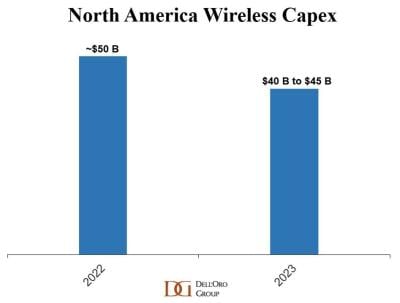

In April, Dell’Oro Group analyst Stefan Pongratz forecast global telecom capex is projected to decline at a 2% to 3% CAGR over the next 3 years, as positive growth in India will not be enough to offset sharp capex cuts in North America. He also predicted that wireless CAPEX in the North America (NA) region would decline 10% to 20% in 2023 as per this chart:

Now, that NA CAPEX decline seems more like 30% this year!

……………………………………………………………………………………………………………………………………………

References:

U.S. 5G spending slowdown continues; RAN revenues set to decline for years!

USA’s 5G capex bubble will burst this year as three main operators cut back

GSM 5G-Market Snapshot Highlights – July 2023 (includes 5G SA status)

Worldwide Telecom Capex to Decline in 2023, According to Dell’Oro Group

https://www.fiercewireless.com/wireless/wireless-capex-north-america-expected-decline-10-20-2023

Dell’Oro: Telecom Capex Growth to Slow in calendar years 2022-2024

One thought on “U.S. Network Operators and Equipment Companies Agree: 5G CAPEX slowing more than expected”

Comments are closed.

This TelecomTV article provides further evidence of a slow-down as it indicates that Ericsson is laying off 750 field service workers. There has been a shortage of people with these types of skills, so this recent layoff is a significant announcement of how much the 5G market has softened.

https://www.telecomtv.com/content/5g/what-s-up-with-ericsson-vodafone-and-nokia-tpg-48136/