T-Mobile

U.S. Network Operators and Equipment Companies Agree: 5G CAPEX slowing more than expected

We noted in a recent IEEE Techblog post that the 5G spending slowdown in the U.S. is broader than many analysts and executives expected. Well, it’s worse than that! The previously referenced negative comments from the CEO of Crown Castle, were corroborated by American Tower last week:

“The recent pullback was more abrupt than our initial expectations,” said Rod Smith, the CFO for cell tower firm American Tower, during his company’s quarterly conference call last week, according to Seeking Alpha. Smith was discussing the reduction in US operator spending on 5G, a situation that is now cutting $40 million out of American Tower’s margin expectations. “The initial burst of 5G activity has slowed down,” agreed the financial analysts at Raymond James in a note to investors following the release of American Tower’s earnings.

Cell tower giant SBA Communications said it too is seeing the broad pullback in spending that has affected its cell tower competitors (i.e. American Tower and Crown Castle). But the company’s management sought to reassure investors with promises of continued growth over the long term. During their earnings call, SBA executives said they expect activity to increase next year as T-Mobile looks to add 3.45GHz and C-band spectrum to its network, and as Dish Network restarts its network buildout.

The two largest 5G network equipment vendors that sell gear in the U.S. are seeing similar CAPEX cutbacks. “We see some recovery in the second half of the year but it will be slower than previously expected,” Nokia CEO Pekka Lundmark said earlier this month during his company’s quarterly conference call, in response to a question about the company’s sales in North America. His comments were transcribed by Seeking Alpha. Ericsson’s CEO, Borje Ekholm, is experiencing similar trends: “We see the buildout pace being moderated,” he said of the North American market, according to a Seeking Alpha transcript

AT&T’s CFO Pascal Desroches confirmed the #1 U.S. network operator is slowing its network spending. “We expect to move past peak capital investment levels as we exit the year,” he said during AT&T’s quarterly conference call, as per a Seeking Alpha transcript. AT&T’s overall CAPEX would be $1 billion lower in the second half of 2023 when compared with the first half of this year due to greatly reduced 5G network build-outs.

“This implies full year capex of ~$23.7 billion, which management believes is consistent with their prior full year 2023 capex guidance of ‘~$24 billion, near consistent with 2022 levels’ and includes vendor financing payments,” wrote the financial analysts at Raymond James in their assessment of AT&T’s second quarter results, citing prior AT&T guidance.

“Although management declined to guide its 2024 outlook, it has suggested that it expects capital investments to come down as it progresses past the peak of its 5G investment and deployments. We believe the trends present largely known CY23 [calendar year 2023] headwinds for direct 5G plays CommScope, Ericsson and Nokia. Opportunities from FWA [fixed wireless access] might provide modest offsets and validate Cambium’s business. AT&T’s focus on meeting its FCF [free cash flow] targets challenge all of its exposed suppliers, which also include Ciena, Infinera and Juniper,” the financial services firm added.

Verizon CEO Hans Vestberg told a Citi investor conference in January that CAPEX would drop to about $17bn in 2024, down from $22bn in 2022″ “We continue to expect 2023 capital spending to be within our guidance of $18.25 billion to $19.25 billion. Our peak capital spend is behind us, and we are now at a business-as-usual run rate for capex, which we expect will continue into 2024,” explained Verizon CFO Tony Skiadas during his company’s quarterly conference call last week, according to Seeking Alpha.

“After years of underperformance, perhaps the best argument for Verizon equity is that expectations are very low. They are coming into a phase where capex will fall now that they’ve largely completed their 5G network augmentation. Higher free cash flow will flatter valuations, but it will also, more importantly, lead to de-levering first, and potentially even to share repurchases down the road,” speculated the analysts at MoffettNathanson in a research note to investors following the release of Verizon’s earnings.

T-Mobile USA had previously said its expansive 5G build-out had achieved a high degree of scale and it would reduce its capex sharply starting in 2023.”We expect capex to taper in Q3 and then further in Q4,” said T-Mobile USA’s CFO Peter Osvaldik during his company’s quarterly conference call last week, according to Seeking Alpha. He said T-Mobile’s capex for 2023 would total just under $10 billion. T-Mobile hopes to cover around 300 million people with its 2.5GHz midband network by the end of this year. Afterward, it plans to invest in its network only in locations where such investments are necessary.

Similarly, Verizon and AT&T are completing deployments of their midband C-band 5G networks, and will slow spending after doing so. That’s even though neither telco has deployed a 5G SA core network which involves major expenses to build, operate and maintain.

Dish Network managed to meet a federal deadline to cover 70% of the U.S. population with it’s 5G OpenRAN in June. As a result, the company said it would pause its spending until next year at the earliest.

American Tower was a bit more hopeful that CAPEX would pick up in the future:

- “Moderation in carrier spend following the recent historic levels of activity we’ve seen in the industry isn’t unexpected and is consistent with past network generation investment cycles,” explained CFO Rod Smith.

- “The cycles typically progress as there’s a coverage cycle. It’s what we’ve seen in past cycles, including 3G and 4G. It’s an initial multiyear period of elevated coverage capex, and it’s tied to new G spectrum aimed at upgrading the existing infrastructure,” said American Tower’s CEO Tom Bartlett. “And then later in the cycle, it will fill back into a capacity stage where we’ll start to see more densification going on. So I’m hopeful that our investor base doesn’t get spooked by the fact that this is a pullback. It’s very consistent. The cadence is really spot on with what we’ve seen with other technologies.”

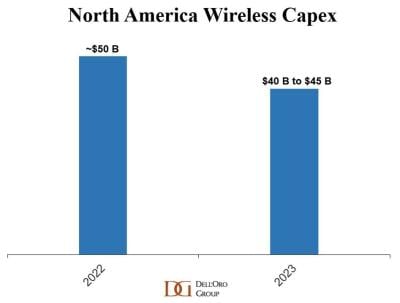

In April, Dell’Oro Group analyst Stefan Pongratz forecast global telecom capex is projected to decline at a 2% to 3% CAGR over the next 3 years, as positive growth in India will not be enough to offset sharp capex cuts in North America. He also predicted that wireless CAPEX in the North America (NA) region would decline 10% to 20% in 2023 as per this chart:

Now, that NA CAPEX decline seems more like 30% this year!

……………………………………………………………………………………………………………………………………………

References:

U.S. 5G spending slowdown continues; RAN revenues set to decline for years!

USA’s 5G capex bubble will burst this year as three main operators cut back

GSM 5G-Market Snapshot Highlights – July 2023 (includes 5G SA status)

Worldwide Telecom Capex to Decline in 2023, According to Dell’Oro Group

https://www.fiercewireless.com/wireless/wireless-capex-north-america-expected-decline-10-20-2023

Dell’Oro: Telecom Capex Growth to Slow in calendar years 2022-2024

T-Mobile Launches Voice Over 5G NR using 5G SA Core Network

T-Mobile has deployed commercial Voice over 5G (VoNR, or Voice Over (5G) New Radio) service in limited areas of Portland, Oregon and Salt Lake City, Utah. The Un-carrier plans to expand VoNR to many more areas this year. Now that Standalone 5G (5G SA) is beginning to carry voice traffic with the launch of VoNR, other real 5G services, such as network slicing and security are likely to be deployed. T-Mobile customers with Samsung Galaxy S21 5G smartphones can take advantage of VoNR today in select areas.

“We don’t just have the leading 5G network in the country. T-Mobile is setting the pace for providers around the globe as we push the industry forward – now starting to roll out another critical service over 5G,” said Neville Ray, President of Technology at T-Mobile. “5G is already driving new levels of engagement, transforming how our customers use their smartphones and bringing unprecedented connectivity to areas that desperately need it. And it’s just going to get better thanks to the incredible T-Mobile team and our partners who are tirelessly innovating and advancing the capabilities of 5G every day.”

Standalone 5G removes the need for an underlying 4G LTE network and 4G core, so 5G can reach its true potential. In other words, it’s “pure 5G”, and T-Mobile was the first in the world to deliver it nationwide nearly two years ago.

The addition of VoNR takes T-Mobile’s standalone 5G network to the next level by enabling it to carry voice calls, keeping customers seamlessly connected to 5G. In the near-term, customers connected to VoNR will notice slightly faster call set-up times, meaning less delay between the time they dial a number and when the phone starts ringing. But VoNR is not just about a better calling experience. Most importantly, VoNR brings T-Mobile one step closer to truly unleashing its standalone 5G network because it enables advanced capabilities like network slicing that rely on a continuous connection to a 5G core.

“VoNR represents the next step in the 5G maturity journey-an application that exists and operates in a complete end-to-end 5G environment,” says Jason Leigh, research manager, 5G & Mobility at IDC. “Migrating to VoNR will be a key factor in developing new immersive app experiences that need to tap into the full bandwidth, latency and density benefits offered by a 5G standalone network.”

“The commercial launch of the VoNR service is another important step in T-Mobile’s successful 5G deployment,” said Fredrik Jejdling, Executive Vice President and Head of Business Area Networks at Ericsson. “It demonstrates how we as partners can introduce 5G voice based on the Ericsson solution.”

“We are proud of our partnership with T-Mobile to bring the full capabilities of 5G to customers in the United States,” said Tommi Uitto, President, Nokia Mobile Networks. “Nokia’s radio and core solutions power T-Mobile’s 5G standalone network – and this VoNR deployment is a critical step forward for the new 5G voice ecosystem.”

“At Samsung, we want to give our users the best possible 5G experience on every device – and today’s announcement represents a big step forward,” said Jude Buckley, Executive Vice President, Mobile eXperience at Samsung Electronics America. “By supporting extensive integration and testing, and working alongside an industry leader like T-Mobile, we’re bringing to life all the benefits of 5G technology with the help of our Samsung Galaxy devices.”

VoNR is available for customers in parts of Portland, Ore. and Salt Lake City with the Samsung Galaxy S21 5G and is expected to expand to more areas and more 5G smartphones this year including the Galaxy S22.

T-Mobile is the U.S. leader in 5G with the country’s largest, fastest and most reliable 5G network. The Un-carrier’s Extended Range 5G covers nearly everyone in the country – 315 million people across 1.8 million square miles. 225 million people nationwide are covered with super-fast Ultra Capacity 5G, and T-Mobile expects to cover 260 million in 2022 and 300 million next year.

………………………………………………………………………………………………………………………………………………………

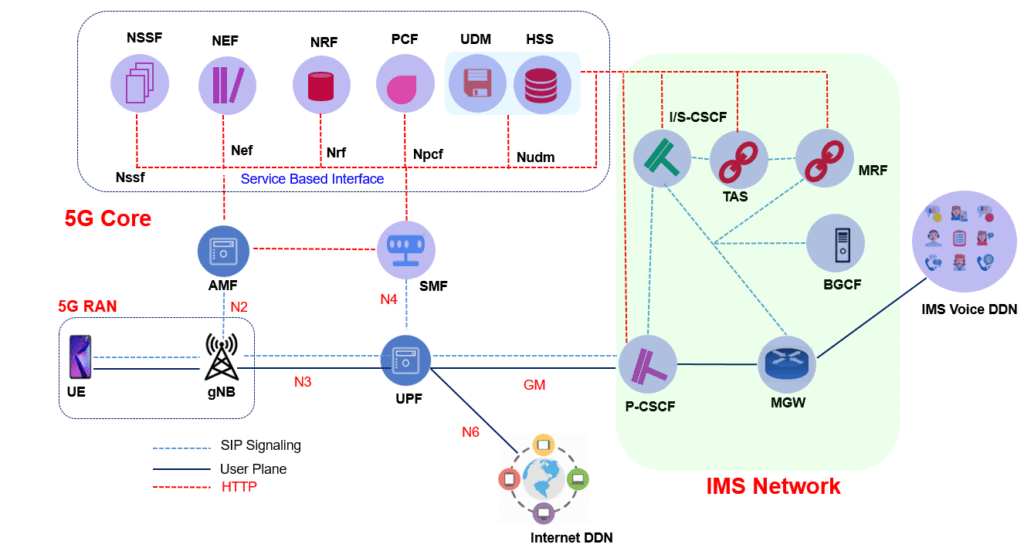

Voice Over NR Network Architecture:

Voice Over NR network Architecture is consist of 5G RAN, 5G Core and IMS network. A high level architecture is shown below. (Only major network functions are included). This network architecture supports Service based interface using HTPP protocol.

VoNR Key Pointers:

- VoNR rely upon IP Multimedia Subsystem (IMS) to manage the setup, maintenance and release or voice call connections.

- UE PDCP should support RTP and RTCP, RoHC compression and MAC layer should support DRX

- SIP is used for signaling procedures between the UE and IMS.

- VoNR uses a QoS Flow with 5QI= 5 for SIP signaling messages and QoS Flow with 5QI= 1

- QoS Flows with 5QI= 5 is non-GBR but should be treated with high priority to ensure that SIP signaling procedures are completed with minimal latency and high reliability.

- QoS Flow with 5QI= 1 is GBR. This QoS Flow is used to transfer the speech packets after connection establishment

- gNB uses RLC-AM mode DRB for SIP signaling and RLC-UM mode for Voice Traffic (RTP) DRBs

- 3GPP has recommended ‘Enhanced Voice Services’ (EVS) codecs for 5G

- EVS codec supports a range of sampling frequencies to capture a range of audio bandwidths.

- These sampling frequencies are categorized as Narrowband, Wideband, Super Wideband and Full band.

- VoNR UE provides capability information during the NAS: Registration procedure with IE ‘ UE’s Usage Setting’ indicates that the higher layers of the UE support the IMS Voice service.

- The AMF can use the UE Capability Request to get UE’s support for IMS Voice services. gNB can get UE Capability with RRC: UE Capability Enquiry and UE Capability response to the UE. The UE indicates its support for IMS voice service with following IEs

-

- ims-VoiceOverNR-FR1-r15: This field indicates whether the UE supports IMS voice over NR FR1

- ims-VoiceOverNR-FR2-r15: This field indicates whether the UE supports IMS voice over NR FR2

- within feature set support IE ims-Parameters: ims-ParametersFRX-Diff, voiceOverNR : supported

-

References:

https://www.techplayon.com/voice-over-nr-vonr-call-flow/

Samsung’s Voice over 5G NR (VoNR) Now Available on M1’s 5G SA Network

Will 2022 be the year for 5G Fixed Wireless Access (FWA) or a conundrum for telcos?

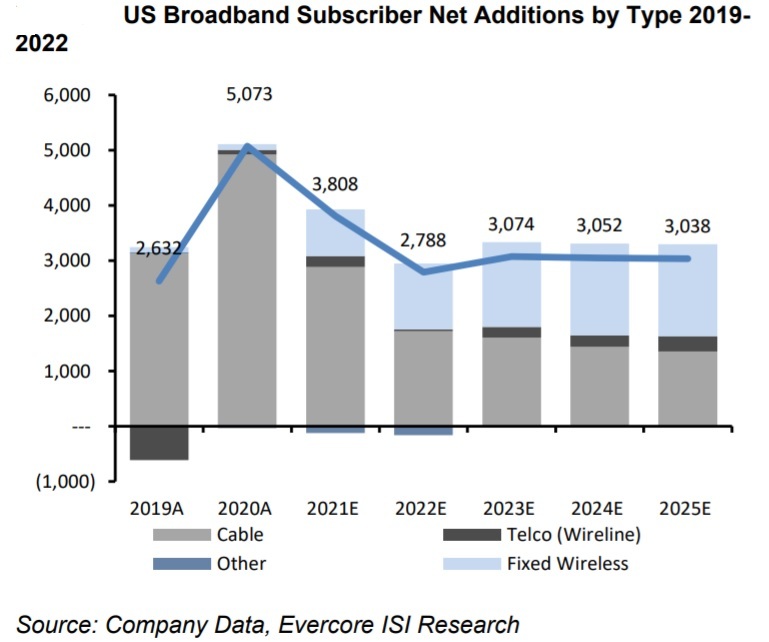

Lightshed Partners says absolutely! “This is the year for 5G Wireless Home Broadband,” as it emerges as a viable competitor to cable based Internet access.

The market research firm believes that the recent deployment of large blocks of spectrum by wireless operators will enable them to offer viable home broadband service to a notable segment of the market.

T-Mobile is already adding more than 200k home broadband subs per quarter, and Verizon is about to unleash rate plans that drop as low as $25/month. Verizon is also layering additional commission opportunities for their sales group. The vast majority of cell phone upgrades in the U.S. are still done in a cellular operator’s store. That provides wireless network operators with a familiar opportunity to sell home broadband and they are incenting their salesforce to do so.

Fixed wireless access (FWA) services into homes and offices, have approximately 7 million users around the U.S. The new efforts by Verizon and T-Mobile appear poised to push the technology into the cable industry’s core domain.

“We forecast that Verizon and T-Mobile will add 1.8 million wireless home broadband customers in 2022, more than doubling the 750,000 added in 2021,” the LightShed analysts forecast. “To put that growth in context, Comcast, Charter and Altice combined added 2.4 million broadband subscribers in 2021 and 2.7 million in 2019. Investors expect these three cable companies to add more than 2 million broadband subs in 2022, but even that reduced level of growth from recent years may prove to be too aggressive.”

5G fixed wireless access (FWA) services could serve 8.4 million rural households—nearly half the rural homes in the U.S.—with a “future-proof”, rapidly deployable, and cost-effective high-speed broadband option, according to a new Accenture study commissioned by CTIA, the wireless industry association.

Other analysts agree. “Fixed wireless probably cost Comcast and Charter, in aggregate, about 180,000 subscribers in the second half of 2021,” wrote the financial analysts at Sanford C. Bernstein & Co. in a recent note to investors.

“The great risk seems to lie in late 2022 and 2023. As Verizon, T-Mobile and AT&T deploy initial and subsequent blocks of C-band spectrum and as T-Mobile expands its 2.5GHz coverage to the last 1/3rd of US households, the availability of fixed wireless should expand,” Bernstein analysts wrote.

The financial analysts at Evercore predict that FWA services will gain a growing share of U.S. broadband new subscribe additions. Light Reading’s Mike Dano wrote the reasons are as follows:

- Verizon and T-Mobile are in the midst of deploying significant amounts of new spectrum into their networks. The addition of C-band spectrum (for Verizon) and 2.5GHz spectrum (for T-Mobile) will give them far more network capacity. And that’s important considering the average Internet household chews through almost 500 GB per month, according to OpenVault. The average smartphone user, meanwhile, consumes just 12 GB per month, according to Ericsson.

- Verizon and T-Mobile have finally shifted their FWA offerings from the test phase into the deployment phase. Although Verizon has been discussing FWA services for years, it finally started reporting actual customer numbers late last year (it ended the third quarter of 2021 with a total of 150,000 customers). Similarly, T-Mobile first outlined its FWA strategy in 2018, but officially launched its 5G FWA service in April – the company ended 2021 with 646,000 in-home Internet customers, well above its goal of 500,000. And both companies have recently cut FWA prices.

- The cable industry appears to be in the early stages of what MoffettNathanson analyst firm described as the “great deceleration.” According to the principal analyst Craig Moffett, this cable industry slowdown stems from such factors as a decrease in the rate of new household formation, increased competition from fiber providers – and FWA. He described the situation as a “concerning issue for cable investors, particularly if it appears that this is just a taste of what lies ahead.”

However, Craig is not convinced that FWA from telcos will mount a serious threat to cablecos Internet, partly because of capacity challenges operators will face as they bring subscribers onto the platform. They also wonder if it makes sense for mobile operators to get too aggressive with FWA, considering the much higher value on a per-gigabit basis they get from their respective mobile bases.

MoffettNathanson does acknowledge that both Verizon and T-Mobile have ramped up their focus on FWA even as AT&T takes a more cautious, targeted approach. Last week at an investor conference, AT&T CEO John Stankey said:

I believe that having some fixed high bandwidth infrastructure is going to be essential to being an effective networking company moving forward… Is fixed wireless going to be the best way to get a lot of bandwidth out to less densely populated rural areas? Yes, it probably will be. So is there a segment of the market where fixed wireless will apply and be effective? Sure, it will, and we’ll be in a position to have the right product to address those places.

But I don’t want to just simply say, well, that is the single solution that’s going to deal with what I would call the 70% of the business community, the 70% of the consumer population that are going to be pretty intensive users in some location, indeed, to have fixed infrastructure to support that over the long haul, given all the innovation that’s going to come……I see an opportunity for us to be very targeted and very disciplined around what we do (in FWA) and what used to be I hate using the term but traditional out of region markets, where good fiber deployment that supplements the strength of our wireless network.

Moffett wrote in a note to clients today:

There’s been a sea change in the rhetoric about fixed wireless broadband. We’re admittedly still struggling to understand it.

Until recently, Verizon and T-Mobile had, by turns, swung between aggressiveness and reticence. Investors will recall that in 2018, Verizon made bold claims about millimeter wave-based FWA. T-Mobile was rather skeptical at the time, not just about mmWave but even about FWA-over-mid-band. By 2019, Verizon had pulled in their horns, just as T-Mobile was first committing to bring FWA to rural Americans in a bid to sell their Sprint merger to regulators. At the start of last year, when all three of Verizon, AT&T, and T-Mobile held analyst days, T-Mobile upped the ante, forecasting 7-8M FWA customers by 2025. But Verizon was by then more cautious, committing only to a paltry $1B in revenue by 2024 (equating to perhaps 1.7M customers) and warning that their participation would be back end loaded. And AT&T was more cautious still, arguing that the capacity utilization implications made FWA unattractive.

Now, for the first time, Verizon and T-Mobile are pounding the table at the same time. What has changed? And what does it mean for the many plans for fiber overbuilds?

First, it’s important to consider the network capacity implications of fixed wireless. Most investors understand that the burden of serving homes with a wired broadband replacement is far greater than that of serving individual phones for mobility. But investors will also understand that network utilization isn’t uniform across all cell sites; there are cell sites with more excess capacity and there are cell sites with less.

The challenge for operators is to ensure that their FWA subscriptions fit as neatly as possible into the cell sites, or sectors of cell sites, with the most available capacity (a cell site will typically be divided into three sectors, each covering a 120 degree arc).

No operator wants to risk their high-value mobile service experience for the benefit of a few incremental low-value fixed subscriptions (as we’ll see shortly, the revenue per bit from a mobile customer is 30 to 50x higher than that for fixed).

Still, both T-Mobile and Verizon see FWA as promising. T-Mobile expects to have between 7 million to 8 million FWA subs by 2025, and views an addressable market of about 30 million homes that are suitable from a signal quality and capacity standpoint. T-Mobile has already noted that their 664K FWA customers include a mix of customers from relatively rural areas with limited or no wired broadband availability and those from suburbia who were previously cable subscribers.

Verizon, meanwhile, is committing to about $1 billion in FWA revenues by 2024, which MoffettNathanson equates to roughly 1.7 million customers (Verizon ended Q3 2021 with about 150,000 FWA subscribers).

Craig questions whether there’s enough bandwidth to go around to fulfill subscriber targets, and if getting aggressive with FWA makes business sense. He indicates that 5G telcos are getting desperate to find revenues after spending billions of dollars for licensed spectrum and 5G RAN buildouts.

With tens of billions of dollars of investment in spectrum already sunk, and with tens of billions more to come for network densification, one might imagine that carriers are desperate to find a more tangible revenue opportunity than one that depends on beating Amazon AWS at what is essentially just a next iteration of cloud services.

And when all is said and done, Craig is as puzzled as this author:

As we said at the outset… we’re struggling to understand. We’re struggling to understand why Verizon and T-Mobile suddenly see this (FWA) relatively low value use of network resources as attractive. We’re struggling to understand how, after an initial burst of growth, they will sustain that growth as sectors “fill up.” We’re struggling to understand why they have set such ambitious targets so publicly. And we’re struggling to understand why cable investors have come to expect that deployments of FWA and fiber should be treated as independent, or additive, risks. It doesn’t seem, to us, that it all adds up.

Opinion: We think an undisclosed reason for telco interest in FWA is that 5G mobile offers few, if any advantages over 4G and there is no roaming. Therefore, the 5G enhanced mobile broadband use case will continue to fail to gain market traction. 5G FWA can work well with a proprietary telco/cloud native 5G SA core network which could be shared by both 5G mobile and FWA subscribers (perhaps using the over hyped “network slicing”). So even though FWA was NOT an ITU IMT 2020 use case, it still has a lot of room to grow into a revenue generating service for wireless telcos.

References:

MoffettNathanson research note (only available to the firm’s clients)

Complete and Comprehensive Highlights of AT&T CEO’s Remarks at Citi Conference

T-Mobile opens new Test Lab optimized for 5G, but also includes 4G LTE, 3G, LAA, NB-IoT, etc

T-Mobile US just opened a brand-new device lab designed to analyze performance and pressure test devices across the Un-carrier’s range of current and future 5G spectrum, as well as all current technologies. The new, 20,000 square foot facility will test 5G devices as well as devices which enable License Assisted Access, narrowband IoT, LTE and 3G. The new T-Mo test facility, known as the Launch Pad, also houses the carrier’s 5G Tech Experience showcase for 4G and 5G, in addition to T-Mobile US’ network lab.

Why it matters: New technology requires new and innovative approaches to testing, and the new lab will help T-Mobile ensure customers have the best experience possible with their new 5G devices.

The Un-carrier said in a press release that the new lab consists of more than a dozen testing areas, ranging from radio frequency signal testing to voice call/sound quality, video optimization and data throughput testing; “in-depth testing” of software, applications and services; and durability testing including drop-testing, water testing and sensitivity to heat. Further, the lab has equipment to test devices across a range of frequencies from low-band and mid-band to millimeter wave — in both its “current and planned” 5G spectrum, which is expected to expand considerably, if its proposed merger with Sprint is finalized.

T-Mo said the new device lab “is equipped with new, rigorous tests to ensure smartphones, IoT devices and any other connected devices take full advantage of the high-, mid- and low-band spectrum from New T-Mobile 5G, if the merger is approved.”

T-Mobile US said that the Launch Pad is designed to bring device and network quality engineers together to innovate and refine technologies from end-to-end before delivering them to customers” — which it said it critical for 5G, which is a combination of new tech in both devices and the network itself.

“5G will unlock SO MANY new capabilities and opportunities for innovation. And with that comes new complexities in delivering the technology to customers,” said Neville Ray, Chief Technology Officer at T-Mobile. “We’ve evolved in this new era of wireless to deliver continuous innovation and the best 5G experience possible — from the network to the devices in their hands — which is why I’m So. Damn. Proud. of this amazing team and cutting-edge lab,” he emphatically added.

The lab includes:

–Sub-6 GHz 5G Radio Performance Chamber: A test chamber for sub-6 GHz 5G testing, which has more than 50 antennas at different angles in order to assess signal quality transmission and reception.

–5G Millimeter Wave Antenna Range: A mmWave test chamber, complete with magenta “T” logo.

–Multi-band 5G SmartLab Chambers: A series of what the Un-carrier calls “5G SmartLab Chambers,” which support all of its current and planned 5G spectrum. T-Mo said that within those chambers, engineers can test devices across different combinations of spectrum and technologies.

–Software Performance Lab: A device software testing area, which contains machines that the carrier said are capable of “simulating a week’s worth of customer usage in just 24 hours,” including testing the device keyboard, battery life, and applications from voice calls and music to gaming, videos, texting, email and more. Devices have to run continuously for 24 hours and perform hundreds of tasks without any glitches or freezes, T-Mobile US added.

–Hardware Pressure Testing Room: A room for testing the durability of device hardware, where devices are put in machines which tumble and drop them, or that subject them to a wide range of temperatures to ensure that they continue to operate.

Reference:

https://www.t-mobile.com/news/5g-device-lab

T-Mobile Claim: 1st Standalone 5G Data Session on a Multi-Vendor Radio and Core Network

T-Mobile and Ericsson have conducted the first standalone 5G data session in the United States.

“This major 5G breakthrough is another example of how the T-Mobile engineering team continues to innovate and drive the entire industry forward. I could not be more proud of them,” said Neville Ray, Chief Technology Officer at T-Mobile. “5G brings a new era in wireless, and if our merger with Sprint is approved, the New T-Mobile will bring together the resources and vision necessary to ensure America has a network that’s second to none,” he added.

Existing 5G networks are non standalone (NSA) and require a simultaneous connection to an LTE network. While a non-standalone architecture still offers better speeds and performance than just LTE, a standalone architecture makes sense for some new enterprise 5G services such as smart cities.

T-Mobile used Ericsson’s AIR 6488 radio and Baseband 6630. These products, from Ericsson’s Radio System portfolio, can become standalone with just a software update Ericsson says (we have our doubts).

According to Ericsson, Standalone New Radio (SA NR) – coupled with cloud-native 5G Core – will help to power exciting new applications such as mobile VR, cloud gaming, and connected cars. Such applications require almost real-time responses and reliable connectivity.

3GPP Release 15 “5G New Radio (NR)” is an OFDM-based global wireless spec for pre-standard 5G mobile networks.

It has two versions: Non-Standalone (NSA) 5G NR (widely deployed) and Standalone 5G NR (not deployed yet).

…………………………………………………………………………………………………….

Accomplishing this standalone 5G milestone on a multi-vendor 5G next generation network was no small feat. To complete the successful data session in its Bellevue, Washington lab, T-Mobile enlisted the help of industry leaders Ericsson, Nokia, Cisco and MediaTek.

Standalone New Radio (SA NR) – coupled with cloud-native 5G Core – will provide better support for all use cases and unlock the power of next-generation mobile technology. It will supercharge applications that require real-time responses and massive connectivity such as mobile augmented and virtual reality (AR/VR), cloud gaming, smart factories and meters, and connected vehicles.

Ericsson has been providing T-Mobile with equipment for multi-band 5G networks since 2018.

T-Mobile has not specified what spectrum it used for the standalone 5G data session, but a spokesperson has confirmed it was sub-6GHz.

As part of concessions to win the Department of Justice’s approval for the proposed T-Mobile-Sprint merger, Sprint will divest its prepaid business to Dish. Dish will have access to T-Mobile’s network through an MVNO arrangement for seven years while Dish builds out its own 5G standalone network.

T-Mobile says it plans to introduce standalone 5G in 2020, but that will NOT be compatible with IMT 2020 which won’t be completed till the end of that year!

All of today’s 5G networks in the US are currently non standalone (NSA), based on 3GPP Release 15 5G NR in the data plane. 3GPP Release 16, together with parts of Release 15, will be 3GPP’s final IMT 2020 RIT submission to ITU-R WP5D.

3GPP has agreed revised completion dates for Release 16 – schedule shifted out by 3 months:

- Release 16 RAN-1 Freeze RAN # 86 December 2019

- Release 16 RAN Stage 3 Freeze RAN # 87 March 2020

- Release 16 ASN.1 Freeze RAN # 88 June 2020

- Release 16 RAN-4 Freeze RAN # 89 September 2020

References:

https://www.ericsson.com/en/news/2019/7/t-mobile-5g-data-session

https://www.t-mobile.com/news/t-mobile-achieves-a-worlds-first-with-standalone-5g-data-session

T-Mobile’s “Record Breaking” 4th Quarter, Prospects for Sprint Acquisition; 5G Bragging Rights?

Controlled by Deutsche Telekom, T-Mobile USA said it added 1 million postpaid phone customers in the December quarter, accelerating its holiday period gains from 891,000 new subscribers a year ago. For fiscal 2019, T-Mobile said it expects to add 2.6 million to 3.6 million subscribers.

T-Mobile CEO John Legere sounded very optimistic on Thursday’s earnings call:

“We had the highest total customer net additions ever in Q4 and we followed that up with record breaking financials, which is a winning formula for our shareholders. T-Mobile led the industry in postpaid phone net adds for the fifth year in a row and we posted a Q4 record low branded postpaid phone churn. Both service and total revenues hit record highs in this quarter while adjusted EBITDA was our best Q4 ever. Our 2019 guidance shows our confidence for the standalone outlook for T-Mobile. We continue to meet the needs of wireless customers and translate that into incredible results. I feel good about the state of our business going into 2019.

I want to reiterate unequivocally that prices will go down and customers will get more for less. We’re entering the final stages of our regulatory review process and it’s an important time to document the commitments that we’ve made from day one. This is another example of T-Mobile putting its money where its mouth is and backing up what we said in our public interest statement.

In summary, I am very, very pleased with the progress we’ve made on our merger and the process so far and I continue to expect regulatory approval in the first half of this year. Okay, to wrap it up I also couldn’t be more excited about the performance in 2018 and our guidance shows continued momentum in 2019. The combination with Sprint means that we will be able to create a future that is even more exciting for American consumers.”

Legere also said that he expects the acquisition of Sprint to be approved in the first half of this year.

“We continue to work through the regulatory review process with humility and respect for all parties involved. A number of major milestones have been completed and we remain optimistic and confident that once regulators review all the facts they will recognize the significant pro consumer and pro competitive benefits of this combination. We continue to have a productive dialogue with both federal and state regulatory authorities.”

On Monday, T-Mobile told U.S. Federal Communications Commission it would not increase prices for three years, with few exceptions, if it gets approval to buy Sprint for $26 billion.

In sharp contrast, MoffettNathanson analyst Craig Moffett said in a report published on Thursday: “A series of developments over the past few weeks have forced investors to consider the possibility that T-Mobile’s merger with Sprint may be in more trouble than previously appreciated,”

……………………………………………………………………………………………………………………………………………………………………………………………………………….

T-Mobile has just a 10 percent market share of business customers, said Chief Operating Officer Mike Sievert during the call, giving the carrier opportunity for more growth. “Now that the network is there … we’re starting to see these kinds of customers come in, in historic numbers,” Sievert said. T-Mobile added network capacity in rural areas of the United States during the 4th quarter of 2018.

Legere summarized the wireless carrier’s progress and 5G and how the competition (mostly AT&T) responded:

“Our engineering team is hard at work furiously building out our 600 MHz and setting the stage for America’s first real nationwide 5G network next year. Our aggressive build out is on 5G ready equipment and we have made rapid progress in just one year since getting our hands on the spectrum. 2700 cities and towns in 43 states and Puerto Rico are live on 600 MHz and we already have 29 600 MHz capable devices in our lineup today including the new iPhones.

We have standards based 5G equipment deployed to six of the top 10 markets including New York and Los Angeles. We believe the 5G revolution should be for everyone, everywhere, and not just the few intense areas. While the other guys hyped 5G we continue to focus on real 5G using global standards based equipment, 5G NR that will light up and deliver for customers across the U.S.

How has the competition responded to our plans? Well, AT&T responded by trying to rebrand 4G as 5GE and we know the customers see right through their bullshit and Verizon by the way, their current standard pups, pre-standard 5G footprint covers what they even themselves call limited areas in four cities, while our 5G capable 600 MHz network already covers hundreds of thousands of square miles. Also we continue to expand our 4G LTE coverage and deliver industry leading network performance.

Our network now covers more than 325 million Americans with 4G LTE effectively matching Verizon’s population coverage. We now have 600 and 700 MHz low band spectrum deployed to 301 million people across the country and we continue to lead the industry in 4G LTE speeds. In Q4 our average download 4G LTE speed was 33.4 Mb per second once again ahead of all the competitors. We remain very confident in our outlook for 2019 and this is reflected in our guidance.”

T-Mo CTO Neville Ray, bragging about T-Mobile’s adding 600 MHz spectrum for both 5G NR and LTE, said that the uncarrier’s 600 MHz spectrum is deployed in more than 2,700 cities and is supported by 29 devices. It is “going to be the biggest and largest and most transformative piece as we move through ’19 and into ’20. We do not take our eye off the ball at all on capacity and performance…The 600 LTE rollout has been going incredibly strong. As we get our software matured and ready for primetime, we will light up 5G services on those same radios. The 5G story is coming on super strong.” If that wasn’t enough, Ray said:

“You can see an aggressive competitive response against 5G NR victory lap on the fastest LTE. AT&T especially trying to figure out how to not be second or third in that race for the coming couple of years. We’re going to be adding 600 MHz spectrum to the fight, both with LTE and with 5G NR and speeds and performance are going to continue to increase on this network into 2019 and materially more so in 2020 when we can reach our nationwide ambition on the 600 MHz 5G deployment……

Biggest focus right now is, as we’ve reference multiple times here is the 600 MHz build, that’s going to be the biggest and largest and most transformative piece as we move through ’19 and into ’20. I mean thousands upon thousands of new sites with 600 MHz capability coming on air, but we do not take our eye off the ball at all on capacity and performance. We’re at the best capacity performance in our company’s history right now, lowest congestion figures we’ve ever seen. We love to be that way.

The proxy for that in the marketplace is our fastest speed performance. And as I mentioned earlier, we continue to win on that front and look to maintain that lead. On the small cell piece, we are starting to see and introduce license assisted access, so LTE in the 5 gig space we’re seeing very positive results and returns from those investments and so a lot of opportunity to grow capacity in the urban calls. We’re not taking our eye off that ball, but big, big most major improvements coming on the 600 MHz side this year.”

On small cells: “(we have) just over 21,000 small cells in play today. We plan on continuing our march on small cells another 20,000 or so plan to come off as we exit ’19 and into ’20. And we continue to densify this network to prepare for obviously a tremendous capacity and performance future.”

T-Mo President Mike Sievert on incremental revenues and pricing:

“So, on pricing, the short answer would be, we have big aspirations for incremental revenues and growth from 5G, but not through pricing, through our current smartphone plans. So the incremental revenues come from more and more users picking wireless technologies instead of other technologies for their conductivity.

There is a big broadband business that we expect to build, there are big enterprise opportunities, there are IoT opportunities, there more devices per users, there are new capabilities being developed, all of which we can monetize with revenue growth. But we don’t have plans for the smartphone plans that you see today to charge differently for 5G enablement versus 4G LTE.”

Legere concluded his bragging about T-Mo’s (not yet deployed with paying customers) 5G network:

“Yes, so again, as I said from the very first day back in April going into the first week of May, I’ve been down here in Washington with the very same story that the 5G Network that’s going to be built with the $40 billion worth of investment and the breadth and the depth is going to be something that the country needs and has yet to see, it’s going to be super charging the uncarrier, capacity will go up precipitously and prices will go down and jobs will increase. And that’s been a dialogue that has gone from sound bite to tremendous modeling and conversation and depositions and hearings.”

References on T-Mo’s 5G at 600MHz:

https://www.t-mobile.com/news/first-600mhz-5g-test

https://www.digitaltrends.com/mobile/t-mobile-5g-rollout/

http://fortune.com/2019/02/07/t-mobile-5g-prices-sprint/

https://www.rcrwireless.com/20190207/carriers/t-mobile-us-600-mhz-update

………………………………………………………………………………………………………………………….

Related post:

The Future of 5G—and the Risks that Come With It

T-Mobile talks up 5G fixed Broadband Wireless Access (BWA) to FCC

In a prepared statement to the FCC intended to buttress the case for the T-Mobile merger with Sprint, current T-Mobile COO Mike Sievert laid out the company’s objectives for “5G” as a home broadband option.

The claim is that this new fixed BWA offers performance better than Verizon and AT&T while being able to realistically compete with cablecos/MSOs like Comcast and Charter (as well as other triple play service providers that offer download speeds in excess of 100Mbps).

Editor’s Note:

Sievert didn’t say what technology and spectrum would be used, or mention that there are no standards for “5G” BWA and that fixed wireless is not even a use case for ITU-R IMT 2020 (real 5G) standard. IEEE decided not to submit 802.11ax or 802.11ay to ITU-R as proposed 5G BWA standards to complement IMT 2020.

In the absence of a standard, T-Mobile didn’t say what specification they are using for their “5G” BWA and really haven’t said much till now about their roll out plans for that offering. In August, T-Mobile said it would start deploying mobile 5G in 2019 with 30 cities named.

………………………………………………………………………………………………………

Sievert explained that most people in the U.S. have few options when it comes to in-home internet and that their choices often include high prices and slow internet speeds. With T-Mobile’s 5G fixed BWA, millions of U.S. households would be offered high speed internet and create a competitive environment that lowers prices.

T-Mobile’s in-home 5G BWA plans include 100Mbps download speeds out of the gate, but would increase those speeds to between 300Mbps and 500Mbps for 200+ million people by 2024. Sievert wrote in his FCC post:

New T-Mobile’s (merged with Sprint) 5G network will change this competitive dynamic by closing the speed differential between mobile and wired broadband. By combining the resources of TMobile and Sprint, the combined company will create the capacity and coverage to provide in home broadband services. Our business planning has confirmed that there is a large market for New T-Mobile’s in-home broadband offering at the anticipated pricing and service levels. New T-Mobile’s entry into the in-home broadband marketplace will cause incumbent providers to lower their prices and invest in their networks—benefitting all in-home broadband customers.

………………………………………………………………………………..

T-Mobile says that its 5G BWA will only be available in areas where network “capacity exceeds mobile requirements and is sufficient to support the in-home services.” That should mean coverage in at least 52% of US zip codes. T-Mobile says they could have 1.9 million 5G home internet customers by 2021 and 9.5 million by 2024.

T-Mobile also wants to make 5G home internet available without the need for installation of devices by a professional, which would mean eliminating expensive setup costs. Their goal is to allow customers the option to “self-provision the necessary in-home equipment.” That’s the opposite of how Verizon’s new 5G home service works.

T-Mobile 5G home internet will also be available without contracts or strict monthly data caps, according to Sievert.

T-Mobile will cover 64 percent of Charter’s territory and 68 percent of Comcast’s territory with its in-home broadband services by 2024. In addition, New T-Mobile expects to utilize caching and other network optimization techniques to increase the number of households that can be served. In sum, New T-Mobile will have the depth and breadth of network to deliver broadband speeds and capacity to consumers across the country.

New T-Mobile’s in-home wireless broadband offering will provide consumers across the country with average download speeds of 100 Mbps. By 2024, New T-Mobile will be able to cover more than 250 million people with data rates greater than 300 Mbps and more than 200 million people at greater than 500 Mbps.

………………………………………………………………………………………

5G hotspot as an in-home option: Sievert also talked about allowing customers to simply use their mobile 5G plan as their only home internet solution. He explained that “New T-Mobile will also enable consumers to use their mobile services as a substitute for in-home broadband.” My guess is that T-Mobile could have an option within their wireless plans that opens up data caps for higher usage.

Currently,, T-Mobile offers 4G wireless plans that can throttle users after 50GB of data use in a month and also limits hotspot usage in many cases. For a customer to be able to use their mobile 5G plans for home internet, they’d have to remove those caps or offer some sort of tier that expands them.

Summing up, Sievert stated:

The planned service area of New T-Mobile’s broadband services will also dwarf the limited service areas of wired broadband providers. These speeds and coverage areas will be offered at a significant discount to the prices of traditional broadband providers, with monthly prices planned to be generally lower than traditional services

……………………………………………………………………………………………………………………………………………………….

Chris Milla wrote in a related blog post:

T-Mobile knows that rural broadband and broadband competition are two hot-button issues within the FCC right now, so it’s positioning the merger as a magical solution to those problems, without showing how its new claims match up with statements it was making less than a year ago. It’s the same thing that the company has been doing with 5G, and with prepaid wireless during this merger process — saying whatever the FCC wants to hear, with the reality a distant second.

What do you think of this gambit? Please comment in the box below this article.

References:

https://ecfsapi.fcc.gov/file/109171182702890/Appendices%20A-K%20(Public).pdf

T-Mobile in $3.5B deal with Ericsson for “5G” Equipment; Offers extended range LTE in U.S. and Puerto Rico

Ericsson has signed a $3.5 billion multi-year deal with T-Mobile to provide the “un-carrier” with “5G” network equipment. It’s the biggest 5G order that Ericsson has announced to date. That is in addition to the $3.5 billion “5G” agreement that T-Mobile inked with Nokia back in July.

As it moves from LTE Advanced (true 4G) to whatever it envisions as 5G, T-Mobile will use the Ericsson portfolio of products. Ericsson will be providing T-Mobile with 5G New Radio (NR) hardware and 3GPP-compatible software. Ericsson’s digital services like dynamic orchestration, business support systems and Ericsson cloud core will be used to help T-Mobile roll out “5G” services to its customers.

“We have recently decided to increase our investments in the U.S. to be closer to our leading customers and better support them with their accelerated 5G deployments; thereby bringing 5G to life for consumers and enterprises across the country,” Niklas Heuveldop, President of Ericsson North America, said in a statement. “This agreement marks a major milestone for both companies. We are excited about our partnership with T-Mobile, supporting them to strengthen, expand and speed up the deployment of their nationwide 5G network.”

The partnership with Ericsson implies that T-Mobile’s installed base of Ericsson Radio Systems will be able to run 3GPP release 15 spec. 5G NR with a remote software installation.

Ericsson increased its market share of the mobile networks market in the second quarter, partly due to faster network upgrades in the North American, where it ranks as the biggest supplier ahead of Nokia.

T-Mobile, the third biggest U.S. mobile carrier, said in February it was working with Ericsson and rival network vendor Nokia of Finland to build out 5G networks in 30 U.S. cities during 2018.

“While the other guys just make promises, we’re putting our money where our mouth is. With this new Ericsson agreement we’re laying the groundwork for 5G – and with Sprint we can supercharge the 5G revolution,” said Neville Ray, T-Mobile’s Chief Technology Officer. (Note that the FCC says it needs more time to review the T-Mobile-Sprint merger).

………………………………………………………………………………………………………………………………………………………

In an earlier announcement, T-Mobile says it has deployed 600 MHz (Band 71) Extended Range LTE in 1,254 cities and towns in 36 states, including the island of Puerto Rico. The Un-carrier’s furiously paced deployment of 600 MHz LTE is expanding network coverage and capacity, particularly in rural areas, and lays the foundation for nationwide 5G in 2020 with 5G-ready equipment.

T-Mobile’s Extended Range LTE signals travel twice as far from the tower and are four times better in buildings than mid-band LTE, providing increased coverage and capacity. The Un-carrier has already deployed Extended Range LTE to more than 80 percent of Americans with 700 MHz (Band 12), and rapidly began deploying it with 600 MHz (Band 71) last year to expand coverage and capacity even further.

In April 2017, T-Mobile made its largest network investment ever, tripling its low-band spectrum holdings by purchasing spectrum sold in the US government’s 600 MHz auction. Those licenses cover 100% of the US, including Puerto Rico. Immediately after receiving the licenses, T-Mobile began its rapid 600 MHz Extended Range LTE rollout. To accelerate the process of freeing up the spectrum for LTE, T-Mobile is working with broadcasters occupying 600 MHz spectrum to assist them in moving to new frequencies.

T-Mobile, Sprint Combo Bypasses Dish; With spectrum plus linear and OTT subscribers, satellite provider was seen as a logical partner

By Michael Farrell of Multichannel News

The announced merger of T-Mobile and Sprint, the third- and fourth-largest wireless carriers in the nation, answers many of the scale questions that have dogged the two companies over the past several years. But in creating a carrier with about 100 million customers and valued at a combined $146 billion, the deal bypasses what many had considered to be T-Mobile’s more perfect match: Dish Network.

With a large swath of wireless spectrum, 11 million satellite TV subscribers and 2.2 million customers for its over-the-top video service Sling TV, Dish was seen by many to be a logical target for T-Mobile. Combining the No. 3 wireless carrier, which has obvious video aspirations through its January purchase of Layer3 TV, with Dish would in many minds have created a strong competitor in the ongoing wireless-OTT-traditional video wars.

Investors apparently believed so too. Shares in Dish fell 3% ($1.19 each) to $33.55 per share on April 30, the first trading day after T-Mobile and Sprint announced their deal. The stock has continued to slip in subsequent trading, closing at $33.09 on May 3.

Video Plans ‘Ratchet Up’

On a conference call to discuss first-quarter results shortly after the Sprint deal was announced, T-Mobile chief financial officer Braxton Carter said the transaction “ratchets up” the wireless provider’s video plans by allowing the combined company to provide customers with an IPTV service via wireline and wireless broadband.

“So T-Mobile’s in the position as a new T-Mobile to be able to offer a quad play, if that’s what the market wants,” Carter said on the call.

The combined company will be controlled by T-Mobile management: CEO John Legere will continue that role in the new entity, as will T-Mobile chief operating officer Mike Sievert. T-Mobile parent Deutsche Telekom will own 42% of the combined company, with Sprint parent Softbank owning 27% and the remaining 31% held by the public. The deal is expected to close in the first half of next year.

This is the two companies’ third time on the merger dance floor together. They scrapped talks in 2014 over regulatory concerns and in 2017 over control issues. While the two have managed to work out their control issues, some analysts are skeptical that the current deal will sail easily through the regulatory process.

BTIG telecom analyst Walt Piecyk gave the merger a less than 40% chance of passing regulatory muster, primarily because he didn’t believe the deal, which will reduce the number of wireless competitors to three from four, will pass the antitrust smell test.

“It doesn’t look like a competitive market right now, and that’s what the regulator may focus on,” Piecyk told CNBC.

Columbia Law professor Tim Wu wrote an op-ed piece for The New York Times urging regulators to block the deal, adding that having four separate competitors has been most beneficial to wireless customers, leading to free unlimited data plans and lower prices. Transforming the wireless business into a “triopoly” like the airline business will only serve to raise prices and lower service.

“Competition has actually worked the way economists say it is supposed to, forcing firms to improve quality or face elimination,” Wu wrote in the Times. “But it takes competitors to compete, which is where blocking mergers comes in.”

Pivotal Research Group CEO and senior media & communications analyst Jeff Wlodarczak has said in research notes over the past year that pairing Dish and T-Mobile would “immediately vault the most disruptive U.S. wireless player into the leading U.S. spectrum position,” and at worst would force rival wireless company Verizon Communications to pay more for the satellite asset. For now, though, it looks like Dish will remain on its own. Other scenarios see the satellite company being acquired either by another wireless service provider, like Verizon, or even by the new T-Mobile. The latter scenario wouldn’t take place for at least another year. Dish has struggled over the past several quarters as the satellite business has dwindled. In the fourth quarter the company lost more than 100,000 satellite-TV subscribers and added 160,000 Sling TV customers.

Dish Misses Out on Buildout Relief

For Dish, a purchase by a wireless carrier would mean relief from its obligation to build its own wireless network. As a result of its success in bidding on spectrum in several of the government’s wireless auctions, Dish faces a March 2020 deadline to build out wireless service in 70% of the market territories it won.

Dish chair Charlie Ergen has said the company will spend about $1 billion on that initial phase, which will be more geared toward IoT services.

For T-Mobile, a Dish purchase would give it an instant video base through the satellite-TV offering, programming contracts with cable networks and the largest OTT service in the country, Sling TV.

But not all analysts believe that a T-Mobile-Dish deal is more palpable. In a research note in November, after T-Mobile and Sprint ended merger talks, MoffettNathanson principal and senior analyst Craig Moffett wrote that he never saw any synergies in combining those companies, other than as a source of additional spectrum.

The argument that the dissolution of the merger was bad news for Dish is equally compelling in that, if Dish does build its wireless network, it would become the fifth player in an already-crowded market, he added.

“However bad one might have imagined the ROI (Return on Investment) for network building, it has to be worse if the industry is more fragmented than expected,” Moffett wrote in November.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Dish’s Spectrum Yet to be Deployed:

Dish has quietly worked to cobble together a significant amount of spectrum via spectrum auctions and secondary-market transactions. The company’s first spectrum purchase was made through EchoStar’s relatively minor purchase of E Block licenses for $700 million in the FCC’s 700 MHz spectrum auction in 2008. But Dish in 2011 spent $2.77 billion to acquire 40 MHz of S-band satellite spectrum from bankrupt TerreStar and DBSD North America. Then, in 2014, Dish was the only bidder in the FCC’s H Block spectrum auction, essentially walking away uncontested with 10 MHz for around $1.6 billion. In 2015, Dish spent roughly $8 billion on AWS-3 spectrum licenses, and then just two years later it committed a whopping $6.2 billion to buy 486 licenses in the FCC’s 600 MHz incentive auction.

Dish recently outlined plans to build a NB-IoT network using its spectrum to provide connectivity to a wide range of devices other than traditional tablets and smartphones. Some analysts remain skeptical, though, believing that Dish plans to either sell or lease its spectrum, or partner with an existing service provider to join the wireless market.

Dish has to comply with Federal Communications Commission requirements that a network using the spectrum it owns be deployed by 2020, Josh Yatskowitz, an analyst at Bloomberg Intelligence, said last November.