Verizon’s 2023 broadband net additions led by FWA at 375K

At the end of 2023, Verizon’s total broadband base was 10.7 million, with fixed wireless access (FWA) customers making up the bulk of quarterly net additions. For all of 2023, Verizon posted 375,000 net FWA additions, bringing its total fixed wireless subscriber base to over 3 million.

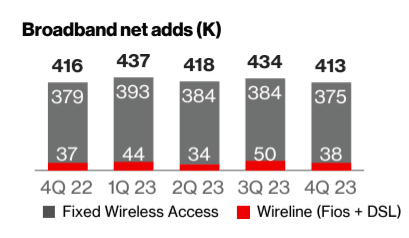

Total broadband net additions were 413,000, compared to 416,000 in Q4 2022. Although Verizon doesn’t post metrics for its DSL customers, overall wireline net adds were 38,000, implying the company lost 17,000 DSL subscribers in the quarter.

In the 4th quarter of 2023, Verizon added 55,000 Fios Internet customers, marking a year-on-year decline of 4,000. Consumer Fios revenue of $2.9 billion increased 1% from Q4 2022, but for the full year was relatively flat at $11.6 billion. Business Fios revenue for the quarter increased 2.6% to $312 million, while jumping 2.8% to $1.2 million for full-year 2023.

CEO Hans Vestberg noted on the earnings call broadband net adds for full-year 2023 totaled more than 1.7 million, “with more than one and a half million from fixed wireless access.” Fios net additions for the year came to 248,000.

Total Broadband:

- Total broadband net additions of 413,000, represented the fifth consecutive quarter that Verizon reported more than 400,000 broadband net additions. Total broadband net additions included 375,000 fixed wireless net additions, bringing the subscriber base to over 3 million. In fourth-quarter 2023, more than 80 percent of Consumer fixed wireless gross additions were in Verizon’s first 76 C-Band markets. Verizon is ahead of schedule to achieve its goal of 4 to 5 million subscribers by the end of 2025.

- 55,000 Fios Internet net additions, down 4,000 from the fourth-quarter 2022.

- 10.7 million total broadband subscribers as of the end of fourth-quarter 2023.

Total Wireless:

- Total wireless postpaid net additions for full-year 2023 increased 26 percent compared to 2022.

- Total wireless service revenue of $19.4 billion, a 3.2 percent increase year over year.

- Retail postpaid phone net additions of 449,000, and retail postpaid net additions of 1,460,000.

- Retail postpaid churn of 1.18 percent, and retail postpaid phone churn of 0.93 percent.

“After delivering continuous improvement throughout 2023, we ended the year strong and continue to pursue the right balance of growth and profitability,” CEO Hans Vestberg said in the 4th quarter earnings statement.

References:

https://www.verizon.com/about/investors/quarterly-reports/4q-2023-earnings-conference-call-webcast

Ookla: T-Mobile and Verizon lead in U.S. 5G FWA

Verizon once again delays 5G Standalone (SA) commercial service

2 thoughts on “Verizon’s 2023 broadband net additions led by FWA at 375K”

Comments are closed.

Verizon’s capital expenditures (capex) last year totalled $18.8bn, down significantly from the $23.1bn it spent in 2022. Verizon expects its 2024 capex spending to come in at between $17bn and $17.5bn – a year-on-year reduction of between 9.6% and 6.9%.

For telecom vendors such as Ericsson, which today reported that it isn’t sure when telco purse strings might open wider again following a brutal 2023, this is very bad news.

Verizon’s full year revenues in 2023 were down by 2.1% to $134bn, while its operating profit sunk by almost 25% to $22.9bn and its net profit declined by 44% to $12.1bn, impacted by the recently reported $5.8bn goodwill writedown associated with its business services division.

The operator’s earnings report is full of details about all its lines of business, but one worth noting is the continuing demand for the operator’s fixed wireless access (FWA) broadband service, which added 375,000 customers in the fourth quarter of last year alone and ended 2023 with more than 3 million users in total. Verizon says its “ahead of schedule to achieve its goal of 4 to 5 million [FWA] subscribers by the end of 2025.”

https://www.telecomtv.com/content/5g/verizon-finishes-2023-with-strong-cash-flow-and-wireless-customer-growth-49456/

ABI Research expects 5G fixed wireless access (FWA) CPE shipments to increase from 10.7 million in 2023 to 36.8 million by 2029 with a CAGR of 22.9 per cent, due in part to increased uptake by businesses.

Larbi Belkhi, an industry analyst at ABI Research, highlighted the US market as a success story for 5G FWA with Verizon, AT&T and T-Mobile US on track to hit their targets for connections.

He stated those connections are “achieved by serving customers with a multi-vendor portfolio of CPEs for their varying requirements.”

https://www.mobileworldlive.com/5g/abi-forecasts-surge-in-5g-fwa-cpe-shipments/

The company also noted enterprise FWA announcements have gained traction in 2024, especially in the US market where operators are diversifying their offerings.

ABI cited AT&T adding Askey and Cisco 5G FWA gear to its enterprise offerings as proof of the uptake this year while T-Mobile picked a Cradlepoint 5G router for its business customers.

Belkhi stated the business sector, particularly small-to-medium sized business (SMBs), “is a fast-growing opportunity for FWA, especially in the US”.

“The faster deployment and scalability it offers makes it particularly attractive for SMBs, but they have more nuanced requirements than simply just performance and price, so CPE vendors diversifying offerings to serve this market is key to success,” he explained.

Globally, ABI Research forecast 5G FWA subscriptions to hit 118 million by 2029, around 45 per cent of total users at that point.

https://www.mobileworldlive.com/5g/abi-forecasts-surge-in-5g-fwa-cpe-shipments/