Ookla: Uneven 5G deployment in Europe, 5G SA remains sluggish; Ofcom: 28% of UK connections on 5G with only 2% 5G SA

According to Ookla, Europe is a “two-speed” 5G competitiveness landscape,” with some countries surging ahead and others falling well behind, In Q2-2025, Nordic and southern Europe countries maintained a substantial lead in 5G availability, helped by recent 700MHz band deployments in countries such as Sweden and Italy. By contrast, 5G availability in central and western European laggard countries such as Belgium, the UK and Hungary remains less than half that of the 5G pacemakers, says the study. On average, mobile subscribers in the EU spent 44.5% of their time connected to 5G networks in Q2 2025, up from 32.8% a year earlier.

The deployment and adoption of 5G SA in Europe remain sluggish, increasing slowly from a very low base and further widening the region’s gap with North America and Asia. Spain stands out as a clear leader in 5G SA deployment, reaching an 8% Speedtest® sample share compared with the EU average of just 1.3% as of Q2 2025. This progress has been driven by Spain’s proactive use of EU recovery funds to subsidize 5G SA rollouts in underserved areas, with a particular focus on bridging the rural-urban digital divide. However, the U.S. and China are still far ahead, with 5G SA sample shares above 20% and 80% respectively, reflecting a much greater pace of coverage and adoption in those markets.

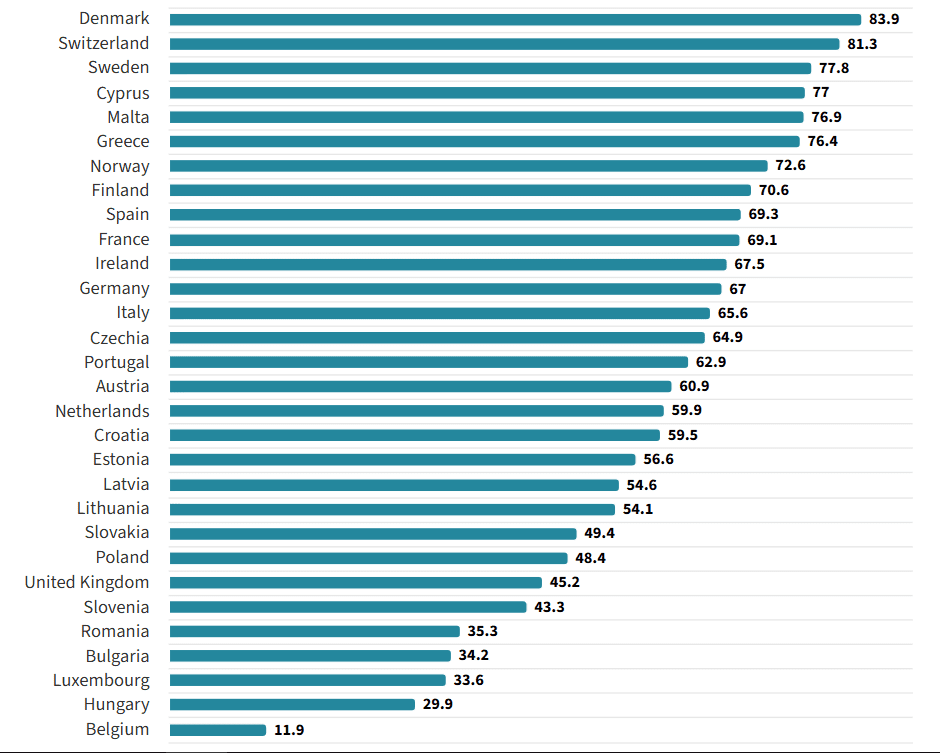

Northern Europe Maintains 5G Availability Lead – Speed Test Intelligence Q2-2025:

Fragmented 5G Availability across Europe is driven by a complex mix of national policies on spectrum assignment and broader economic factors, rather than by simple geographic or demographic differences. 5G Availability is more strongly correlated with policy-driven factors such as spectrum allocation timelines and costs, coverage obligations, subsidy mechanisms, and regulations for infrastructure sharing and permitting, than with structural factors like urbanization rates or the number of operators. This indicates that 5G competitiveness is shaped less by technology gaps or inherent market imbalances and more by effective policy execution.

Northern Europe Maintains 5G Availability Lead; Other Countries Lag:

Fragmentation remains a persistent theme, shaping stark 5G deployment asymmetries that cannot be explained by geography or demographics alone. Northern and Southern European countries such as Denmark (83.9%), Sweden (77.8%), and Greece (76.4%) are disproportionately represented among the countries with the highest 5G Availability in Q2 2025, with coverage rates up to twice as high as those in Western and Eastern countries like the United Kingdom (45.2%), Hungary (29.9%), and Belgium (11.9%).

Low-band deployment and DSS use continue to lift 5G availability in lagging countries:

Recent advances in 5G Availability have been driven by low-band deployments and the use of DSS, raising the average proportion of time spent on 5G networks in the EU from 32.8% in Q2 2024 to 44.5% in Q2 2025. The pace of coverage growth, and the corresponding increase in 5G usage, has primarily reflected each country’s starting point. Lagging countries like Latvia, Poland, and Slovenia have seen double-digit gains in 5G Availability from a low base. By contrast, leading countries such as Switzerland and Denmark, where 5G coverage is now nearly ubiquitous, have shifted their focus to targeted capacity upgrades through site densification and mid-band expansion.

About Ookla:

Ookla, a global leader in connectivity intelligence, brings together the trusted expertise of Speedtest®, Downdetector®, Ekahau®, and RootMetrics® to deliver unmatched network and connectivity insights. By combining multi-source data with industry-leading expertise, we transform network performance metrics into strategic, actionable insights. Solutions empower service providers, enterprises, and governments with the critical data and insights needed to optimize networks, enhance digital experiences, and help close the digital divide. At the same time, we amplify the real-world experiences of individuals and businesses that rely on connectivity to work, learn, and communicate. From measuring and analyzing connectivity to driving industry innovation, Ookla helps the world stay connected.

Ookla is a division of Ziff Davis, a vertically focused digital media and internet company whose portfolio includes leading brands in technology, entertainment, shopping, health, cybersecurity, and martech.

……………………………………………………………………………………………………………………………………………………………………………………

Mobile Matters report from communications regulator Ofcom discusses 5G’s share of network connections in UK. Ofcom’s analysis – based on crowdsourced data collected by Opensignal and covering the period October 2024 to March 2025 – showed that 28% of connections were on 5G, with 71% still on 4G, 0.7% on 3G and a holdout 0.2% on 2G. In terms of mobile network operators, BT-owned EE had the highest proportion of network connections on 5G, at 32%, while Vodafone had the lowest, at 24%. O2, which is now the mobile arm of Virgin Media, had the lowest share of 4G connections (68%) and the highest proportion on 3G (3%).

5G standalone vs 5G non-standalone performance:

• 5G standalone (SA) accounted for 2% of all 5G connection attempts in the six months to March 2025. UK MNOs have started to offer 5G SA but its use is currently low.

• Standalone 5G’s average response time (latency) was about 15% lower (better) than for 5G NSA. However, our analysis also indicated that 5G SA had a lower average connection success rate (95.9%) than 5G NSA (97.6%), although this was slightly higher than 4G’s.

• 5G SA provided significantly higher download speeds than 5G NSA. Seventy per cent of 5G SA download speeds measurements were at 100 Mbit/s or higher, compared to 46% for 5G NSA, and 2MB, 5MB and 10MB file download times, on average, were about 45% faster on 5G SA than over 5G NSA.

• The picture was more mixed for uploads. While 5G NSA had a higher proportion of low-speed connections (18% of 5G NSA upload speeds provided less than 2 Mbit/s compared to 10% on 5G SA) it also had a slightly higher share of higher-speed connections (30% of 5G NSA uploads were 20 Mbit/s or higher vs 28% on 5G SA).

References:

https://www.ookla.com/articles/europe-5g-q2-2025

Highlights of new Ookla report:

*European Union (EU) trails North America and Asia in 5G deployment and coverage because different member states pursue different strategies and goals.

*Report explicitly states that EU policy “acts as a barrier, not a catalyst, for 5G deployment in western and eastern European laggards.

*Regulatory policies have encouraged 5G investment in some European countries but “they have stifled it in others.”

*The net result is a “two-speed competitiveness landscape” in Europe.

https://www.telecomtv.com/content/5g/ookla-report-highlights-europe-s-5g-failings-53467/

5G Standalone (SA) deployment in Europe is lower than in other regions due to a combination of factors, including slower monetization of 5G, a more cautious approach to investment, and a lack of cohesive European policy. While 5G SA offers significant benefits, including lower latency and higher speeds, European operators have been slower to adopt it, partly due to concerns about return on investment and the disruptive nature of migrating from the initial Non-Standalone (NSA) architecture

From Heavy Reading:

5G standalone (SA) deployments are becoming more widespread, but identifying the services potential for 5G SA remains a challenge. While 5G SA provides the opportunity to access new or better 5G services, such as RedCap and network slicing, service providers continue to grapple with how best to package 5G SA services and communicate the value of 5G SA to consumers and enterprise customers.

Gabriel Brown of Heavy Reading likens the difference between 5G non-standalone and 5G SA to driving a 20-year-old car in good condition to a newer model vehicle. Or, using a five-year-old iPhone versus the iPhone 16. In both cases, the older model will do the job required but there’s a stark difference in the features of the latest model.

“You’re not going to notice a few milliseconds of difference on your phone but I think incrementally we’re going to see basically better service,” says Brown.

The big Chinese (state owned) network operators and T-Mobile have been running 5G SA at scale for years, he adds. In addition, Reliance Jio in India is running a huge 5G SA network and has ten network slice types available in commercial operations, and EE in the UK has reached 50% population coverage for 5G SA. There’s plenty of evidence that 5G SA deployments at scale are doable so that supports a forecast of broader adoption, Brown.

In Heavy Reading’s 2025 5G SA Core Operator Survey, 35% of respondents said 5G SA is already generally available nationwide in their company’s wide area network, and 20% said it would be generally available by the end of the year.

During the podcast, Brown also explains the difference between 5G SA and 5G Advanced.

https://www.lightreading.com/5g/5g-standalone-deployments-are-scaling-now-comes-the-hard-part