Highlights of Ericsson’s Mobility Report – November 2025

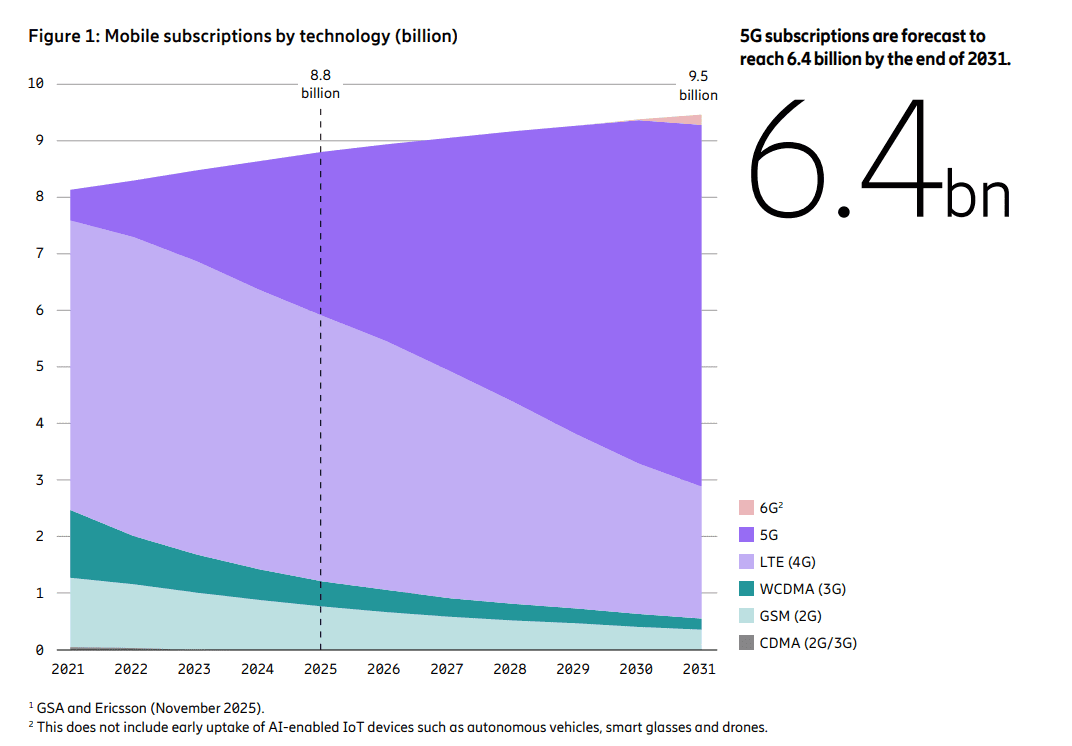

The latest issue of the Ericsson Mobility Report states that 5G subscriptions now account for one-third of total mobile subscriptions. Mobile network data traffic grew slightly more than expected – 20 percent between Q3 2024 and Q3 2025. As 5G evolves, service providers are increasingly exploring innovative use cases and new monetization opportunities such as offering differentiated connectivity services and modernizing enterprise IT with 5G.

After many years of hype, network slicing, which requires a 5G SA core network, is finally gaining market traction with 33 communications service providers now offering variations of the technology. Of the 118 network slicing cases discovered by Ericsson’s researchers, 65 have moved beyond proof of concept and into commercial services, either as standalone subscription services or as add-on packages for consumer or business customers. Ericsson attributes this growth spurt to more widespread deployment of 5G SA core networks.

Looking further ahead, the 6G RAN standardization process has begun in 3GPP and ITU-R WP5D, with the first commercial launches expected in front-runner markets.

–>However, there has been no work initiated on the 6G core network in either 3GPP or ItU-T.

Ericsson’s report says the U.S., Japan, South Korea, China, India and some Gulf Cooperation Council countries are the 6G leaders. Global 6G subscriptions are likely to reach 180 million by the end of 2031, the report predicts.

We think that forecast is highly unlikely as the IMT 2030 (6G) RIT/SRITs recommendation won’t be completed till the end of 2030 with initial deployments sometime in 2031.

…………………………………………………………………………………………………………….

Data from Omdia, a Light Reading sister company, shows Ericsson, Huawei and Nokia were even more dominant last year than they were in 2023, growing their combined market share by 2.3 percentage points over this period, to 77.4%. Besides China’s ZTE, the only other contender with more than a percentage point of market share was Samsung.

References:

https://www.ericsson.com/en/reports-and-papers/mobility-report/reports/november-2025

Dell’Oro: 4G and 5G FWA revenue grew 7% in 2024; MRFR: FWA worth $182.27B by 2032

Ericsson’s revenue drops, profits soar; deal with Vodafone and partnership with Export Development Canada look promising

Latest Ericsson Mobility Report talks up 5G SA networks and FWA

Ericsson Mobility Report touts “5G SA opportunities”

Ericsson Mobility Report: 5G monetization depends on network performance

Ericsson Mobility Report: 5G subscriptions in Q2 2022 are 690 million (vs. 8.3 billion total mobile users)