5G monetization

How 5G network operators can stay competitive and grow their business

By Shekar Ayyar (edited by Alan J Weissberger)

Introduction:

New services enabled by 5G and the cloud present a significant business opportunity, but upgrading existing network infrastructure to deliver these services can be a challenge amid the ongoing supply-chain disruptions and significant economic volatility.

But that’s exactly what communications service providers (CSPs) need to do to stay competitive and ensure that they have the right infrastructure for success in the future.

This article suggests how this can be accomplished. Let’s first look at 5G use cases as illustrated below:

Image Credit: https://www.rajarshipathak.com/2020/01/requirements-for-5g-network-monetization-solution.html

………………………………………………………………………………………………………………………………………………………

Discussion:

1. Introduce new services while being smart about infrastructure investments

5G requires an upgrade in network infrastructure to deliver more bandwidth, faster processing and lower latency. This transition impacts all parts of the network, from the access layer to the edge, across the transport layer and into the network core. And increasingly, it requires connectivity to multi-cloud environments, as several workloads are hosted there.

CSPs that are deploying 5G need to adopt agile, open, software-driven approaches and modern networks that are cost effective, efficient and programmable and allow them to deploy services at the edge all the way into the cloud. With the right technology, CSPs (and enterprises) are better positioned for new service creation to drive topline improvement, increase performance, enable quality of service and reduce costs to deliver bottom line improvement.

The right infrastructure can enable CSPs to launch new services like network slicing, multi-access edge computing (MEC) and multi-cloud networking (MCN), which can boost the top line in a world of declining average revenue per user (ARPU). Manufacturing automation is just one example of network slicing delivering benefits through dedicated bandwidth for IoT devices. And when network operators combine that with MEC in a low-latency environment, they can get much faster response rates to enable automation and machine learning in real time. In addition, MCN enables CSPs and co-location providers to offer secure multi-cloud connectivity to enterprises, on demand and as a service.

Software-based infrastructure that leverages compute resources delivers operational savings because it allows CSPs to use their infrastructure for many different use cases, which makes their networks much more efficient. This is akin to the efficiencies that virtual machines (VMs), which let multiple applications or instances run on a single server, brought to the data center.

2. Avoid doubling down on outdated tech, opt for next-gen programmable networks

Yet many network operators continue to rely on legacy networking equipment. That’s problematic because legacy networking technology is hardware-centric and tied to specific silicon choices, and does not deliver protection against supply-chain shortages and volatility. When CSPs and enterprises experience vendor lock-in, they become completely reliant and stake all aspects of their network on that one vendor: speed of innovation, pricing power and supply availability. This is risky, as evidenced by the recent chip shortages that all industries have witnessed.

But software-based networking can run on merchant silicon and purpose-built switch and router hardware, or on servers. It disaggregates the network stack, making it highly programmable for maximum agility; scales based on consumption; and works across the access network, edge and core. And it does all of the above using a single operating system, without requiring costly integration and in a way that lowers TCO and supply chain risk.

3. Disaggregated solutions break the stronghold that a single vendor can have on a CSP or enterprise.

By adopting this approach, CSPs and enterprises now have a broad choice of silicon as well as a wide range of off-the-shelf white-box platforms. Vendor diversification mitigates any supply-chain challenges. It also gives buyers greater pricing leverage.

And while CSPs and enterprises are controlling their costs and avoiding vendor lock-in, they get the modern networks that they need to move fast and effectively monetize 5G infrastructure.

CSPs and enterprises now have an important choice to make. Do they remain locked into legacy technology or attempt to integrate piecemeal open networking solutions? Or do they want to move into the future with minimal risk and maximum revenue potential and ease?

……………………………………………………………………………………………………………………………………………………………..

Shekar Ayyar is chairman and CEO of Arrcus, the hyperscale networking software company and a leader in core-to-edge network infrastructure.

MoffettNathanson: 5G use cases and revenue streams have not yet materialized

Status of 5G Use Cases:

- Multi-access Edge Compute (MEC) remains relatively intangible, and is likely to be fiercely competitive (hyper-scalers/cloud services, and even tower operators, likely better positioned).

- IoT similarly has not demonstrated material revenue upside potential for carriers.

- Private 5G networks may not include carriers at all; and when they do, it is unclear that carriers will achieve attractive revenue splits with the (many) other participants in the value chain (systems integrators, software providers, hardware providers, security providers, hyperscalers).

- Fixed wireless access has emerged as a “consolation prize,” with incremental revenue but at very low revenue/bit, potentially significantly taxing network resources in a way other 5G applications do not.

Editor’s Notes:

The URLLC use case envisioned by the ITU does not exist because the 3GPP Release 16 URLLC in the RAN spec has still n not been completed and the ITU-R M.2150 recommendation uses 3GPP Release 15 URLLC which does not meet the ITU-R M.2410 performance requirements.

Also, the true 5G features, such as network slicing, automation/virtualization and security, can only be realized via a 5G SA core network for which there are relatively few.

…………………………………………………………………………………………………………………….

Telco incumbents always believe the answer is to “move up the (protocol) stack”… but they face much better-equipped competitors in the cloud service providers (Amazon, Microsoft, Google etc.).

Summary and Conclusions:

In our view, the broadband slowdown appears to owe more to a broad market deceleration than to significant shifts in market share…

• Cable broadband churn is at all-time lows

• TelCo broadband gains have not accelerated

• A significant portion of FWA appears to be market expansion

…so pricing and capital intensity do not appear to be at significant risk.

Footprint expansion initiatives are likely sufficient to keep broadband net add growth at least narrowly positive.

Wireless is now Cable’s Act III

Reference:

Moffett Nathanson Oct 2022 Slide Deck (subscribers only)

Viavi’s State of 5G report finds 1,947 5G cities (635 new) -mostly NSA- at end of 2021

As of end-December, the number of cities worldwide with 5G networks was 1,947 , with 635 new cities added in 2021, according to the latest Viavi Solutions report ‘The State of 5G.’

By the end of January 2022, 72 countries had 5G networks, with Argentina, Bhutan, Kenya, Kazakhstan, Malaysia, Malta and Mauritius coming online in the second half of 2021.

Europe, Middle East & Africa (EMEA) passed Asia Pacific including Greater China (APAC), to become the region with the most 5G cities, at 839. APAC has 689 5G cities and the Americas has 419.

China has the most 5G cities (356), ahead of the US (296) and the Philippines (98). However, more than half of China’s so called 5G subscribers are on 4G networks. Robert Clark of Light Reading wrote: “China has tried to kick-start 5G with low prices, with the result that it has a huge population of 5G subscribers on 4G networks. Less than half of China Mobile’s 467 million 5G subs are actually using 5G – a ratio that has remained constant for the past year.”

Most 5G networks deployed are Non-Standalone (NSA) networks. There are only 24 5G Standalone (SA) networks. It is widely considered that many of the next-generation use cases and monetization models associated with 5G, beyond enhanced Mobile Broadband (eMBB) will only be possible when Standalone 5G networks built on new 5G core networks are in place.

![]()

The State of 5G also highlights the growing Open RAN ecosystem, combining mobile operators as well as software and infrastructure vendors, seeking to develop an open, virtualized Radio Access Network (RAN) with embedded Artificial Intelligence (AI) control. As of March 2022, 64 operators have publicly announced their participation in the development of Open RAN networks. This breaks down to 23 live deployments of Open RAN networks, 34 in the trial phase with a further seven operators that have publicly announced they are in the pre-trial phase.

As of March 2022, 64 operators publicly announced their participation in the development of Open RAN networks, of which 23 were live deployments, 34 in the trial phase and another 7 operators in the pre-trial phase.

“5G continued to expand, despite the headwinds of a global pandemic,” said Sameh Yamany, CTO, VIAVI Solutions. “What comes next in 5G is the reinforcement of networks. This will take a couple of forms. Firstly, we expect to see more Standalone 5G networks, which will deliver on much of the promise of 5G, both for the operator and for the wider ecosystem of users. And secondly, we expect to see Open RAN continue its rapid development and start to become a de facto standard. VIAVI will continue to play a central role in testing those new networks as they are built and expanded.”

References:

https://www.viavisolutions.com/en-us/literature/state-5g-may-2022-posters-en.pdf

https://www.lightreading.com/asia/consumers-still-seeking-reason-to-buy-5g/d/d-id/777250?

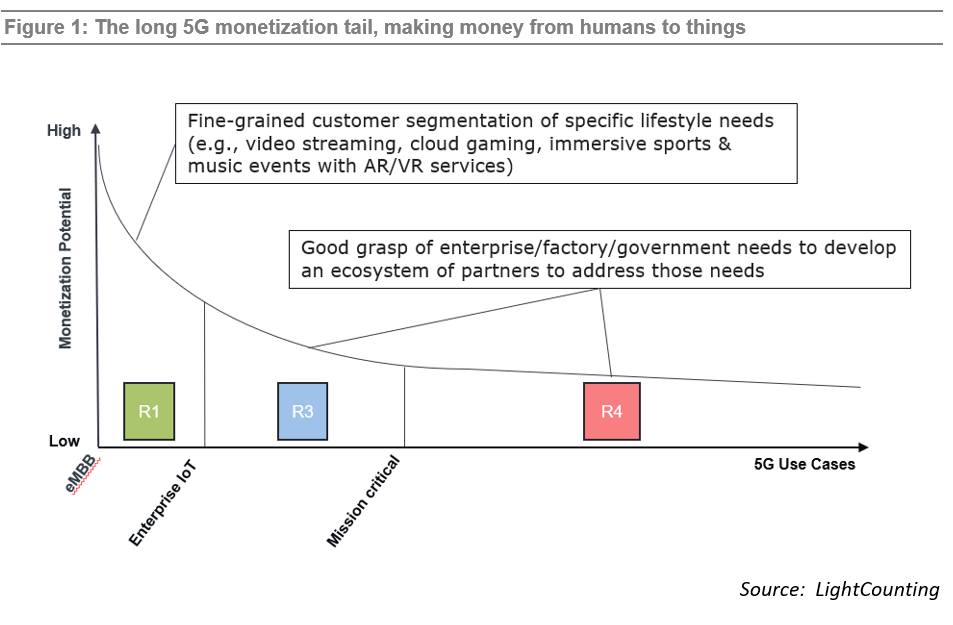

Moody’s skeptical on 5G monetization; Heavy Reading: hyperscalers role in MEC and telecom infrastructure

In a recent “Top of Mind” series report, Moody’s said, “The adoption of 5G is gaining momentum. Yet we question how fast companies can roll out 5G and the ability to generate revenue from applications based on 5G technology.”

“We do not expect material revenue increases in the global telecom sector from 5G in the 2022-2025 period. This is because 5G will mainly evolve around enhanced mobile broadband, which will be broadly similar to 4G.”

Wireless network operators have invested heavily in 5G spectrum, network infrastructure upgrades and the credit rating and financial research firm concludes global carriers’ capex will continue to rise through 2025. That’s despite more tepid carrier capex forecasts from Dell’Oro Group and others.

“Global capex growth is expected to moderate from 9 percent in 2021 to 3 percent in 2022, before tapering off in 2023 and 2024,” wrote Stefan Pongratz of Dell’Oro.

Wireless carriers’ capex as a share of revenue leveled off at 16% globally in 2019 and 2020, inched up to 17% in 2021, and is expected to hit 18% for the next four years, according to Moody’s.

Wireless telcos have cumulatively spent $200 billion globally on 5G spectrum to date, according to Moody’s, and GSMA predicts operators will invest about $510 billion on 5G-related infrastructure and services from 2022 to 2025.

…………………………………………………………………………………………………………………..

On the income side of the ledger, wireless carriers have experienced a prolonged period of flat to declining revenue. Rising costs and flat revenue portends a rough four-year stretch for operators, and there’s little to suggest that dynamic will change by 2026. One analyst said the only real revenue generator for wireless telcos in the last few years has been selling their cell towers!

The largely unmet promise of 5G, with no real “killer apps,” follows previous disappointments for carriers in the 3G and 4G time periods. Indeed, they did not make any money of mobile apps, cloud computing/storage, interactive gaming, edge computing or really any value added services.

“This phase carries the greatest uncertainty about companies’ capital spending. As a result, we remain cautious when projecting revenue growth derived from 5G until there is clarity on the business case, especially given the lessons of limited monetization of 4G and 3G,” Moody’s analysts wrote.

Specialized services for enterprises continue to be the most compelling use cases for 5G, and additional IoT applications could drive incremental revenue gains after 2025 but those are unlikely to justify carriers’ significant 5G investments, the financial research firm said.

While ultra low latency might be important (assuming 3GPP release 16 “URLLC in the RAN” spec is completed, performance tested and deployed), the resulting “almost immediate network response time is only relevant in specialized use cases, Indeed, it has become apparent that the most compelling use cases for 5G revolve around businesses rather than residential consumers,” the Moody’s analysts wrote.

“The wide array of potential applications — such as autonomous vehicles, robotics, and smart homes — places different demands on networks in terms of speed and latency, in contrast to previous generations that focused on one major advance, such as broadband mobile video with 4G or web browsing with 3G,” the analysts wrote.

………………………………………………………………………………………………………………..

Moody’s missed a very crucial point related to 5G revenues: that the hyperscalers (Amazon, Microsoft, Google) will get an increasing share of 5G SA core network services and MEC revenues. That’s because of the partnerships wireless carriers have made with the big cloud service providers.

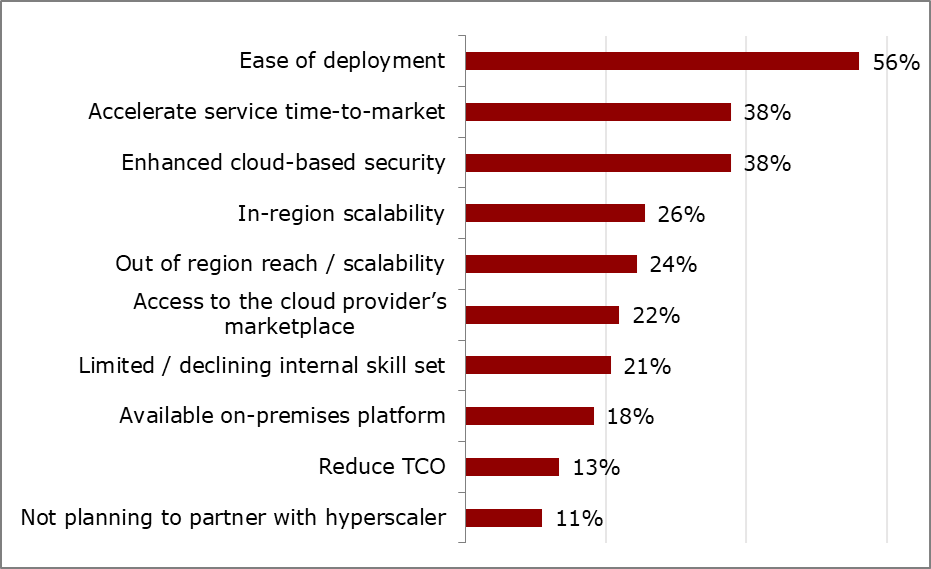

Heavy Reading noted that in a recent blog post. Heavy Reading conducted a survey in collaboration with Accedian, Kontron and Red Hat. The survey questioned 82 communications service providers (CSPs) that have launched edge computing solutions or are planning to do so within 24 months. One of the objectives of the survey was to examine the go-to-market strategies of the CSP and the role the hyperscalers have assumed in those strategies.

Hyperscalers have introduced dedicated edge products and embedded their software stack into operator infrastructure, including Internet of Things (IoT) devices and network gateways. They have introduced products dedicated to the telco market, such as Wavelength from Amazon Web Services (AWS), Azure Edge Zones from Microsoft and Anthos for Telecom from Google Cloud. According to Heavy Reading’s survey results, their efforts have paid off, as CSPs have unquestionably decided to partner with hyperscalers in their multi-access edge computing (MEC) services.

Q: Why do you plan to partner with a hyperscaler to deliver your edge computing? Select up to three. (n=82)

Source: Heavy Reading

…………………………………………………………………………………………………………..

Heavy Reading’s most recent edge computing survey determined that the pivot to improved customer experience is the key goal of edge network deployments and that CSPs must clear new paths to achieve this goal. They must do so by:

- Leaning into automation, particularly in overall lifecycle management.

- Building in comprehensive security protections from the design phase forward.

- Enhancing performance control through automation and AI. CSPs’ growing collaborations with hyperscalers are key to achieving these goals and improving ease of deployment, accelerating time-to-market and enhancing cloud-based security.

Heavy Reading’s survey results show that carriers have committed to edge computing and are progressing rapidly with implementations. The deployment of edge computing brings with it issues of scale and complexity. CSPs are most concerned with overall network performance and security. In fact, those companies that have already deployed the edge have a heightened concern about these issues. They are looking for help from their traditional vendor and integrator partners, from their network monitoring and assurance tools and from the hyperscalers.

References:

Nokia survey finds CSPs are not monetizing 5G services- BSS must be improved

A Nokia-commissioned survey of 100 communication service providers (CSPs) around the world found only 11% have sufficient Business Support Systems (BSS) in place for effective 5G monetization. Yet this author believes such BSS are not the key issue in monetizing 5G. The IEEE Techblog which has repeatedly stated there are currently no compelling 5G use cases without URLLC in the RAN/core and cloud native 5G SA Core networks deployed. Also, a cloud-native software architecture is key to achieving a 5G-ready monetization system, with many benefits that include limitless scalability, and an ideal platform for AI, analytics, and edge computing capabilities for ultra-low latency use cases.

An overwhelming number of survey respondents, at 98%, indicated they would have to alter their BSS in the coming years in order to put proper, up-to-date monetization tools in place.

The survey also found that nearly 70% of CSPs are now considering deploying cloud-based monetization solutions. In addition, two-thirds of respondents indicated they believe that real-time charging is essential for 5G monetization, in part because of its ability to help CSPs respond quickly to customer demands.

More details on the research can be found here.

John Abraham, Principal Analyst at Analysys Mason, said: “Most Service Providers are ill-prepared to effectively engage and monetize emerging 5G-enabled use cases and need to urgently transform their BSS. With Service Providers looking to get that ROI on 5G, now is the time for them to invest in flexible monetization systems especially as 5G brings to the forefront the importance of real-time charging capabilities. Given Nokia’s portfolio and expertise, they are well placed to support CSPs on this journey.”

Hamdy Farid, Senior Vice President, Business Applications at Nokia, said: “To unlock 5G revenues and move beyond the traditional data plan model, a major shift among CSPs is needed toward adaptable monetization systems that utilize cloud-native, scalable and flexible infrastructure and open APIs for easy integration and deployment; and I think this survey highlights the work still to be done.”

…………………………………………………………………………………………………………………………………………………………………….

Nokia’s Head of Digital Business within CNS Jonah Pransky shared with RCR Wireless News that moving to cloud-native BSS “is becoming increasingly important to ensure greater business agility.”

“This is particularly true when it comes to efficiently monetizing 5G and capturing new revenue streams that 5G makes possible, including differentiated pricing, network slicing, and flexible product offerings, such as IoT and B2B2X. The 5G Standalone [SA] network is built on cloud-native network functions that provide the flexibility and agility to define, create and launch new services faster than ever before. 5G monetization systems, starting with the 5G charging function, need to be based on the same agile technology, or risk becoming a bottleneck in the release of new offers to the market, and ultimately slow the ROI that service providers must see sooner rather than later.”

Pransky also indicated that real-time charging is important for 5G-ready monetization systems, but provided a longer view of what capabilities are necessary, including support for open APIs, the enablement of new network-sliced based services easily and efficiently, meeting the CX demands of digital users for simple, transparent digital first commerce and finally, and being designed with no-code configurability.

While CSPs are still behind in their 5G monetization journeys, Pransky said that because the industry is moving away from large software monoliths and towards modular microservices-based applications, there is an opportunity for service providers to take a phased approach to transforming their monetization systems for 5G.

“That means they can begin with the most urgent need, which in this case is the 5G Converged Charging system,” he continued. “There is definitely still time with the roll out of 5G SA accelerating in some regions, but with many still only beginning to prepare for this. The advice [Nokia] would give would be to look for a monetization partner that has actual experience implementing 5G Charging in 5G SA networks in order to avoid potential pitfalls and hit the ground running, prepared for what will be necessary for effective monetization.”

…………………………………………………………………………………………………………………………………………………..

References:

CSPs are behind in 5G monetization, according to Nokia survey

https://www.rajarshipathak.com/2020/01/requirements-for-5g-network-monetization-solution.html