5G private networks

Draft new ITU-R report: Applications of IMT (4G, 5G) for Specific Societal, Industrial and Enterprise Usages

Introduction and Call for Contributions:

A preliminary new ITU-R draft report M.[imt.industry] addresses the usage, technical and operational aspects and capabilities of IMT for meeting specific needs of societal, industrial and enterprise usages. ITU-R WP 5D invites the views of External Organizations (Including 3GPP TSG SA WG 6 (SA6)) involved in standardization and development of applications of IMT to provide industrial and enterprise usages and applications, required capabilities, technical and operational aspects and any other related material that would facilitate in completion of this Report.

External organizations may wish to provide information on the relevant work as indicated in Question ITU-R 262/5. External Organizations are invited to submit material preferably to the 40th meeting of WP 5D but no later than 41st meeting of WP 5D which is planned for 13-24 June 2022.

ITU-R WP 5D looks forward to collaborating with External Organizations on this matter.

Backgrounder:

ITU-R Report M.2441, published in 2018, provided an initial compilation of usage of IMT in specific applications. Further, it introduces potential new emerging applications of IMT in areas beyond traditional voice, data and entertainment type communications as envisaged in the vision for IMT-2020. PPDR, one of the specific applications of IMT is addressed in Report ITU-R M.2291.

This report has been developed in response to Question ITU-R 262/5 which calls upon ITU-R to study specific industrial and enterprise applications, their emerging usages, and their functionalities, that may be supported by IMT.

Today’s industrial automation is powered by ICT technology and this trend will increase manifold with advent of new broadband mobile technologies such as IMT-2020 (5G), leading to increased business efficiencies, improved safety, and enhanced market agility. Industry 4.0 enables industries to fuse physical with digital processes by connecting all sensors and actuators, machines and workers in the most flexible way available. Tethering them to a wired network infrastructure is expensive and, ultimately, it will limit the possible applications of Industry 4.0. Industrial grade private wireless will unleash its real potential by providing the most flexible and cost-effective way to implement a wide range of Industry 4.0 applications.

Current IT based automation solutions are well adapted for day-to-day business communications but are limited in reliability, security, predictable performance, multiuser capacity and mobility, all features which are required for operational applications that are business or mission critical. Similarly, applications in mines, port terminals or airports require large coverage area, low latency and challenging environments, which so far only two-way mission critical radios could meet. In both mining and port terminals, remotely operated, autonomous vehicles, such as trucks, cranes and straddle carriers are used requiring highly reliable mission critical mobile communications.

Take manufacturing, with thousands of factories with more than 100 employees, as an example, typical business cases revolve around controlling the production process, improving material management, improving safety, and introducing new tools. Research has shown that manufacturers can expect to see a tenfold increase in their returns on investment (ROIs) with IMT-2020, while warehouse owners can expect a staggering fourteenfold increase in ROI. Fortunately, IMT-2020 is available in configurations perfectly suited to building industrial-strength private wireless networks to support Industry 4.0. They bring the best features of wireless and cable connectivity and have proven their capabilities both in large consumer mobile networks area as well as in many industrial segments. The time is ripe for many industries to leverage private and captive IMT-2020 to increase efficiencies and automation. In simple terms –

(i) A private network is a dedicated network of the enterprise involving connections of the people, systems and processes of the enterprise.

(ii) A private network is a dedicated network by the enterprise setup internally in the enterprise by internal IT teams or outsourced.

(iii) A private network is a dedicated network for the enterprise to enable communication infrastructure for the systems and people associated with the enterprise.

The emergence of ultrafast IMT-2020 technology in higher (mmWave) frequency bands as well provides manufacturers with the much-needed reliable connectivity solutions, enabling critical communications for wireless control of machines and manufacturing robots, and this will unlock the full potential of Industry 4.0.

Apart from manufacturing, many other industries are also looking at IMT-2020 as the backbone for their equivalent of the Fourth Industrial Revolution. The opportunity to address industrial connectivity needs of a range of industries include diverse segments with diverse needs, such as those in the mining, port, energy and utilities, automotive and transport, public safety, media and entertainment, healthcare, agriculture and education industries, among others.

Some recent trial of IMT in port operations demonstrated the “5G New Radio (5G NR)” capabilities for critical communications enablers such as ultra-reliable low-latency communication (URLLC), enhanced mobile broadband (eMBB) to support traffic control, AR/VR headsets and IoT sensors mounted on mobile barges and provides countless possibilities to improve efficiency and sustainability in seaports and other complex and changing industrial environments. In response to the impact of COVID-19 pandemic some ports are increasing/accelerating their adoption of digital processes, automation and other technologies to enhance efficiency and resiliency to crises such as a global pandemic.

Similarly, in mining exploration sites, the drilling productivity could be substantially increased through automation of its drills alone. Additional savings from increased usage of equipment could also lead to lower capital expenditures for mines (CapEx) as well as a better safety and working environments for their personnel.

Even the most advanced factories of today still largely depend on inexpensive unlicensed wireless networks that have several drawbacks, such as lack of protection and potential interference in dense settings and complex fixed connections that are difficult to manage in large industrial settings. While the unlicensed spectrum is freely available, it is severely limited in quality of service (QoS) and support for mobility. In smart manufacturing, such networks cannot support the mobile requirements of automated guided vehicles (AGVs) or the even some of the faster moving arms of robots. It also does not support low power requirements of sensors and other IoT devices. Further, it cannot support the high density of sensors, devices, robots, workers and vehicles that are operating in a typical manufacturing plant.

An example of an application in health care that need critical communications that is supported by new capabilities of IMT is remote robotic surgery. A latency of 1 millisecond is critical in providing haptic feedback to a surgeon that is connected through a mobile connection to a surgical robot. A high data rate is needed to transfer high-definition image streams. As an ongoing surgery cannot be interrupted an ultra-reliable communication is needed to keep connection down-time and packet loss very low.

A new generation of private IMT networks is emerging to address critical wireless communication requirements in public safety, manufacturing industries, and critical infrastructure. These private IMT networks are physical or virtual cellular systems that have been deployed for private use by a government, company or group of companies. A number of administrations took the lead to enable locally licensed or geographically shared IMT spectrum available for enterprise use and have begun to recognize spectrum sharing and localised broadband networks in providing flexibility and meeting the needs of critical communications by vertical industries and enterprises. Some administrations have decided to partition the IMT spectrum between commercial carriers and private broadband and others enabled opportunistic use and dynamic access to IMT spectrum that is licensed to commercial carriers.

Industrial and enterprise usages and applications supported by IMT:

- IMT applications in mining sector

- IMT applications in oil and gas sector

- IMT applications in distribution and logistics

- IMT applications in construction and similar usages

- IMT applications in enterprises and retail sector

- IMT applications in healthcare

- IMT applications in utilities

- IMT applications community and education sector

- IMT applications in manufacturing

- IMT applications in airports and ports

- IMT applications in the agriculture sector

- IMT applications for in-flight passengers’ broadband communication

Required capabilities of Industrial and Enterprise usages supported by IMT:

[Editor notes: This section, when completed, will include categories of applications/usages and corresponding requirements supported by IMT]

Technical and operational aspect of industrial and enterprise usages supported by IMT:

TBD

Case studies:

TBD

Spectrum aspects:

[Editor’s note: Frequency bands, if any, can be added later from contributions]

Private IMT broadband networks need to operate in frequency bands identified for IMT in order to benefit from the economies of scale of the global IMT ecosystem. The choice of which frequency band(s) to use for local area networks is determined at the national level.

IMT frequency bands in which local area private networks have been deployed or are being planned include: TBD

Editor’s Note: ITU-R M.1036 recommendation titled, ‘Frequency arrangements for implementation of the terrestrial component of International Mobile Telecommunications (IMT) in the bands identified for IMT in the Radio Regulations,” is used for public terrestrial IMT networks.

Courtesy of WSJ: Here’s a yacht equipped with the Meridian 5G Dome Router, for 5G connectivity offshore. PHOTO: MOTORYACHT MUSASHI

Regulatory aspects:

Increased use of local (small cell) private network deployments can expand wireless capacity within existing spectrum resources.

Alternative spectrum allocation mechanisms may be needed to grant spectrum access to local area private networks to enable spectrum sharing by multiple networks operating in a portion of a frequency band or share spectrum with incumbent networks.

National Table of Frequency Allocations (NTFAs) primarily specify the radio services authorized by a national administration in frequency bands and the entities which have access to them. Frequency bands may be allocated to certain services or application on an “exclusive” or “shared” basis. The Licensed Shared Access (LSA) concept has been originally introduced as an enabler to unlock access to additional frequency bands for mobile broadband under individual licensed regime while maintaining incumbent uses. It was also developed with the aim of making a dynamic use of spectrum possible, whenever and wherever it is unused by incumbent users.[5]

LSA offers a regulatory tool to make available additional spectrum resource for use by mobile broadband when spectrum re-farming is not feasible or desirable. It is however defined as a general concept which does not specify the nature of the incumbents and LSA users. LSA licensees and incumbents operate different applications and are subject to different regulatory constraints. They would each have exclusive individual access to a portion of spectrum at a given location and time.[5]

Spectrum access mechanisms to enable spectrum sharing and deployment of local area private networks include: TBD

Dynamic spectrum access:

In the context of ITU-R Report SM.2405, dynamic spectrum access (DSA) stands for the possibility of a radio system implementing cognitive radio systems (CRS) capabilities to operate on a temporary unused/unoccupied spectrum and to adapt or cease the use of such spectrum in response to other users of the band. Cognitive Radio System (CRS) is defined as a radio system employing technology that allows the system to obtain knowledge of its operational and geographical environment, established policies and its internal state; to dynamically and autonomously adjust its operational parameters and protocols according to its obtained knowledge in order to achieve predefined objectives; and to learn from the results obtained.

In USA, the FCC established the Citizens Broadband Radio Service (CBRS) in April of 2015 and created a three-tiered access and authorization framework to accommodate shared use of the band 3550-3700 MHz between private organizations and incumbent military radar and fixed satellite stations. Access and operations are managed through the use of an automated frequency coordination system, called Spectrum Access System (SAS).

Related ITU-R documents:

[1] Question ITU-R 262/5 – Usage of the terrestrial component of IMT systems for specific applications. (Copy reproduced in Attachment 2).

[2] Recommendation ITU-R M.2083 – Framework and overall objectives of the future development of IMT for 2020 and beyond.

[3] Report ITU-R M.2440 – The use of the terrestrial component of International Mobile Telecommunications (IMT) for Narrowband and Broadband Machine-Type Communications.

[4] Report ITU-R M.2441 – Emerging usage of the terrestrial component of International Mobile Telecommunication (IMT).

[5] Report ITU-R SM.2404 – Regulatory tools to support enhanced shared use of the spectrum

[6] Report ITU-R SM.2405 – Spectrum management principles, challenges and issues related to dynamic access to frequency bands by means of radio systems employing cognitive capabilities

Rethink Research: Private 5G deployment will be faster than public 5G; WiFi 6E will also be successful

Introduction:

RAN Research, a division of Rethink Technology Research, says in a new report that private 5G network deployments will surge over the next few years faster than public 5G, reaching a peak in 2027 when they will generate $19.3 billion in equipment sales, before subsiding after that as saturation approaches.

There will be a similar boom in deployment of enterprise WiFi networks around the WiFi 6E standard (IEEE 802.11ax endpoints that are capable of operating at 6 GHz, as well as in the 2.4 GHz and 5 GHz spectra already used by Wi-Fi 6). They will offer greater capacity and performance than the current WiFi generation (IEEE 802.11ac, 802.11n, etc).

WiFi growth will be confined largely to North America and Europe, and will peak earlier in 2024, after which an increasing number of sites will swing to 5G for more demanding use cases.

Private 5G networks will generate annual revenues of US$19.3 billion worldwide in 2027, up from $1.5 billion this year, according to a new report written by Rethink analyst Caroline Gabriel. Growth will be at its fastest in the 2022-2025 period, peaking in 2027 and then declining towards the end of the decade as market saturation approaches, she notes.

By 2028 there will be 26.6 million private 5G networks deployed globally, a significant increase on the 1.1 million expected to be rolled out this year.

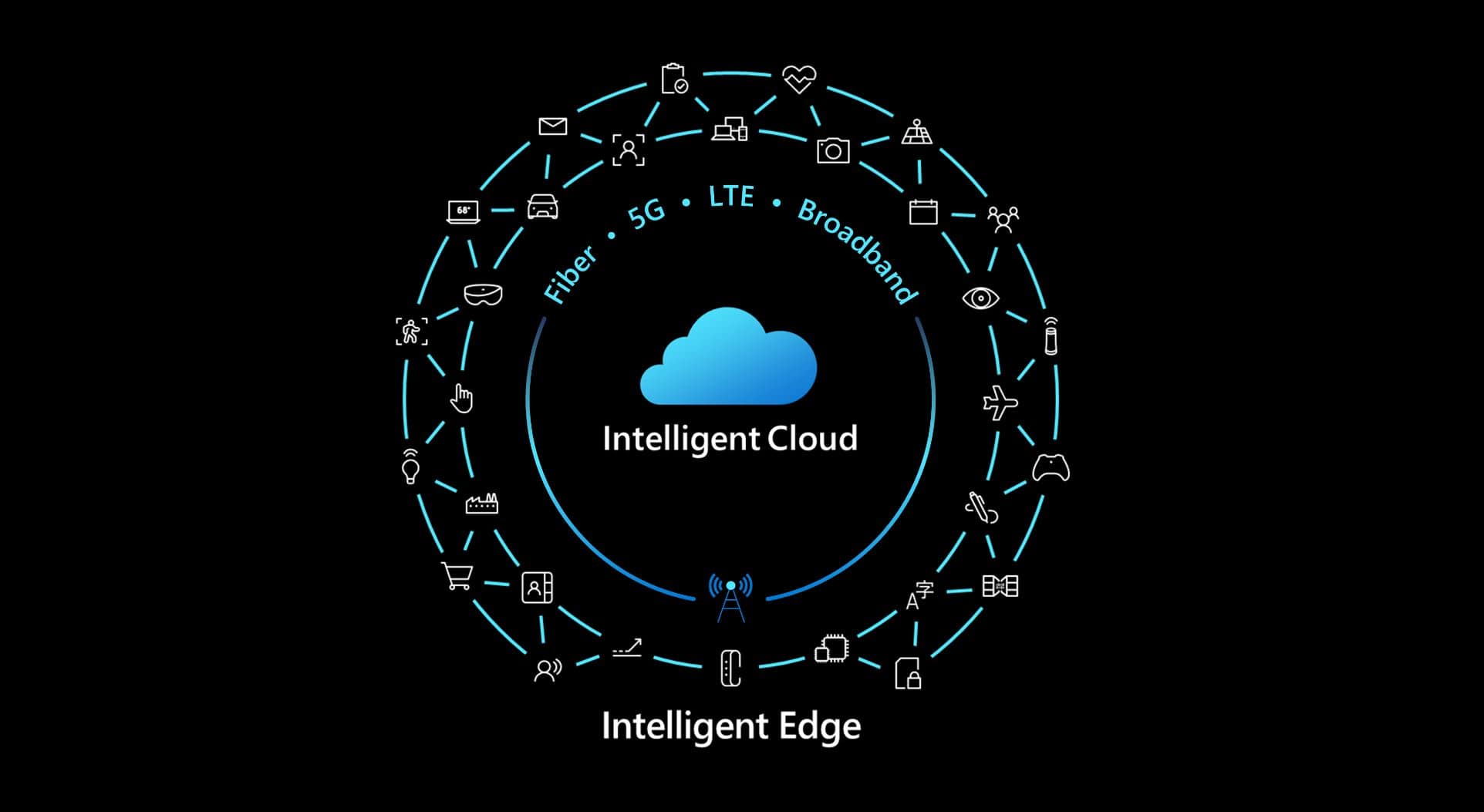

Image Courtesy of Qualcomm

These are key findings of the latest report, “Private Networks Driving Opportunities in 5G and WiFi” from RAN Research, the wireless forecasting arm of Rethink Technology Research. The forecast drills down into regions and vertical industry sectors, identifying manufacturing as a major driver for private enterprise 5G in line with the industry 4.0 revolution, but with strong growth across the board. Healthcare, transportation, energy and government stand out as other industry vertical where deployments of private 5G and WiFi 6E will flourish.

Executive Summary:

Private 5G networks are on the verge of rapid take off to generate a surge in annual revenues for network equipment from $1.5 billion in 2021 to $19.3 billion in 2027. Growth will be fastest in most markets from 2022 to 2025 before tailing off and declining towards the end of the period after 2027 as saturation approaches.

By 2028 there will be 26.6 million private 5G networks deployed around the world, up from 1.1 million in 2021. This growth will occur in all regions but will be most striking in the four countries leading the private 5G field now, the U.S., Germany, China and Japan. Of these four, China stands out for facing stronger regulatory resistance to private 5G where roll out is dominated by the three great stateowned monopolies, China Mobile, China Telecom and China Unicom. But strong upsurge from enterprises, including government agencies as well as manufacturers, looks like opening up the country ’ enterprise 5G field to rapid growth.

Image Courtesy of Qualcomm

Private wireless networks will be deployed at a faster rate than 5G as a whole in most markets, as mobile networks combined with edge compute become capable of meeting more use cases and enabling new applications in manufacturing process, UAVs, remote healthcare, advanced transportation and others.

WiFi 6E is on course for a similar growth trajectory as private 5G, tailing off later in the forecast period. It is true though that only the next generation WiFi 7 that will start being deployed after 2024 will close the gap on 5G in peak performance, capacity and low latency. Our forecast numbers for WiFi 6E also include early deployments of WiFi 7 without making any distinction. Certainly, until that 7th generation comes along, WiFi will lack the deterministic behavior required for the most demanding ultra low latency real time applications, such as control of UAVs. In these scenarios 5G will be preferred but WiFi will continue to coexist for applications where best effort performance is adequate. This will include some of those use cases touted for 5G under the eMBB category concerned mostly with high capacity, although WiFi 6E itself still has to justify investment in the upgrade from WiFi 5. 5G will emerge in some cases as an immediate alternative to WiFi 6E. There are also common factors affecting both private 5G and WiFi 6E roll out, such as chip shortages and other continuing impacts of the global Covid19 pandemic. All these will impede deployments in the short and medium term, with both service providers and their equipment suppliers reporting a slowdown resulting from changed working practices during the pandemic and disruptions within the supply chain.

For some enterprises where blanket indoor coverage is established there will be more concerted migration from WiFi to cellular for private wireless communications. But unless such 5G coverage is almost ubiquitous, users will continue with WiFi and indeed penetration will increase around new best effort use cases.

Copyright © 2021 Rethink Research, All rights reserved.

………………………………………………………………………………………………

References:

https://rethinkresearch.biz/reports-category/ran-research/

China to drive private 5G network growth despite regulatory headwind– research

O2 UK and Microsoft to test MEC in a Private 5G Network

UK mobile network operator O2 (Telefónica UK) has partnered with Microsoft to test the benefits of on-premise Mobile Edge Computing (MEC) within a Private 5G network, with a focus on low latency and security.

The MEC Proof of Concept (PoC) involves technology running on Microsoft Azure, which will be the first Azure deployment using a UK Private 5G network. It is designed to support secure data management, with all confidential data staying on premises at all times.

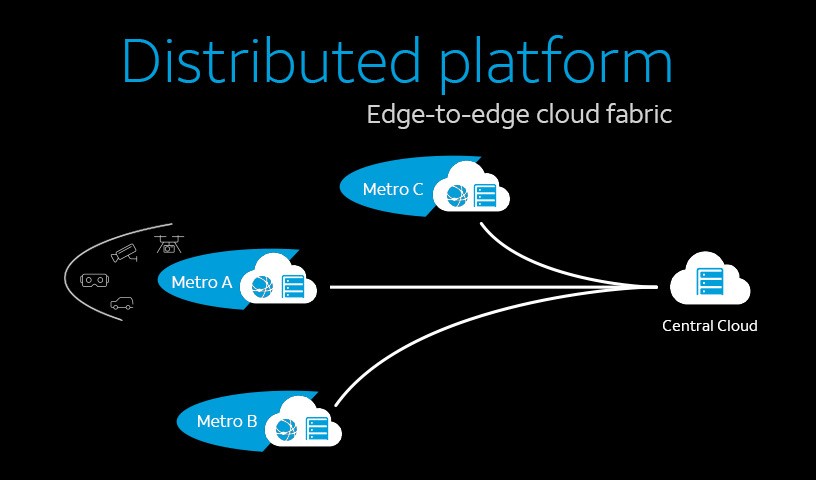

Image credit: Microsoft Azure for Operators

O2 (Telefónica UK) will provide Secure 5G Network capabilities and various Industry 4.0 applications. The computing service will be delivered via Azure Private Edge Zones, bringing compute, intelligence and storage to the edge where data is created. O2 and Microsoft will also support start-ups in developing new 5G solutions through the ‘Microsoft for Startups’ program.

O2 recently announced it had launched a Private 5G Network initiative with Leonardo, a global high technology company in the Aerospace, Defence & Security sector. This trial with Microsoft will be similar, however will involve MEC to broaden the use cases and benefits.

Jo Bertram, MD of Business at O2, said, “We’re incredibly proud of our track record of supporting business partners with innovative network solutions. This particular trial with the Microsoft Azure platform will provide secure and superfast capabilities that will maximise productivity and efficiency, as well as peace of mind. We pride ourselves on having a secure 5G network and being champions of coverage and reliability, as recognised in industry awards.”

Yousef Khalidi, corporate vice president, Azure for Operators at Microsoft, said: “Through our collaboration with O2, we will enable enterprises to leverage 5G to unlock new scenarios that accelerate digital transformation within their own private, on-premises environments. Combining Azure technology with O2 services is critical to bringing MEC to the enterprise edge, and we look forward to seeing customers leverage this platform to drive innovation across a broad range of information and operational technology applications.”

Key Deliverables:

- O2 partners with Microsoft to trial the benefits of on premise Mobile Edge Computing (MEC) within a Private 5G Network, focusing on security and low latency

- The Proof of Concept (PoC) aims to pave the way for secure data management, enabling confidential information to stay on premises at all times

- Technology will be run via the Microsoft Azure platform, its first deployment utilizing a UK Private 5G Network

References:

https://azure.microsoft.com/en-us/industries/telecommunications/

Verizon: Private 5G market at $8B in 4 years

Verizon distinguishes between a private wireless network product and mobile edge compute (MEC) offerings, he noted, but likes it when both come together. That’s when “the full power of 5G” can be exploited, he said, with features like low power usage and high device density. Verizon has ambitions for both public and private MEC, in partnerships with Microsoft and AWS.

Asked about moving beyond just providing connectivity and driving new revenue streams with private wireless, he pointed to recurring services such as security, managed services, and running custom applications or IoT.

“The private network piece, very few can do it as well as us, but it’s the layers of services on top that creates a pretty compelling revenue case for us,” Sowmyanarayan said. “But more importantly use-cases for the customer.”

He acknowledged that typically with large customers there’s also a significant upfront piece to get the private network up and running. The private network is essentially a scaled down version of the macro network consisting of core, radio, and other elements at a local location. But afterwards the recurring services are attractive for both Verizon and private wireless customers who can then keep attention on their main business functions.

“They are able to look to a large partner to offload some of the complex work so they can focus on what their core is,” Sowmyanarayan noted, pointing to mines as an example.

Verizon also has a private wireless offering for international customers, which uses Nokia network equipment. The carrier recently signed its first European 5G private wireless deal with Associated British Ports (ABP) for the Port of Southampton in the U.K. Sowmyanarayan said the carrier is very excited about the ABP deal and categorized it as “a sign for things to come” for Verizon.

In the 1st Quarter of 2021, Verizon posted a loss of 170,000 monthly wireless subscribers. Analysts had predicted 82,100 new customers. The top U.S. wireless carrier continues to see partnerships like its ones with Amazon.com Inc. and Corning Inc. as the best path to bring advanced 5G services from development to actual sales.

……………………………………………………………………………………………………………………………………..

References:

https://www.fiercewireless.com/private-wireless/verizon-chases-7-8b-private-wireless-market

https://www.fiercedigitaltechevents.com/private-wireless-networks-summit

AT&T Exec: 5G Private Networks are coming soon + 5G Security Conundrum?

Just two weeks after Verizon won a 5G Private Network contract in the UK, AT&T now says that Private 5G Networks are coming soon to your office or campus. AT&T’s Rita Marty wrote in a blog post that many companies want “5G in a private space.”

“We’ve done exactly that at AT&T Stadium in Dallas. Fans will get experiences like live stats projected over the field on their smartphone camera.”

“Some organizations want a truly private, standalone 5G system. They envision full control of a “local area network” similar to corporate Wi-Fi, but with the performance, reliability and security of cellular. Nellis Air Force Base in Nevada is testing one flavor: a 5G-powered command-and-control center on a trailer. It will form the hub of a moveable, private cellular network for local personnel in a conflict area.

Ms. Marty alluded to network slicing and edge computing in her blog post. Those are two ultra hyped technologies that have yet to be deployed at scale by any 5G network operator.

“Other organizations are enhancing their 5G coverage with the ability to control specific local traffic themselves. They can peel off (via network slicing) certain data flows for “edge computing.” This means alarms in a factory, for instance, could be processed right on the premises – and thus much more quickly. MxD, a manufacturing innovation center in Chicago, is showing how fractions of seconds can help solve quality, safety and inventory issues.

Network slicing allows 5G network operators to create different sub-networks (which can be private) networks with different properties. Each sub-network slices the resources from the physical network to create its own independent, no-compromised network for its preferred applications. It requires a 5G standalone core network, the implementation of which has not been standardized and AT&T has yet to deploy.

Most of AT&T’s activities in mobile edge computing and private 5G networks are in trials and testing. AT&T is working to bring enhanced capabilities to their edge computing solutions by testing AT&T Network Edge (ANE) with cloud providers. AT&T says ANE’s potential benefits include:

- Lower latency: Deliver low-latency connectivity to high performance compute

- Network routing optimization: Network integration with cloud providers

- Extended cloud ecosystem: AT&T intends to develop an extended ANE ecosystem, allowing customers to use cloud services like they do today.

Image Credit: AT&T

Private networks also need careful thought and consultation, Ms. Marty stated. “Considerations include design, spectrum, and who’s going to actually run it. Even a standalone network, and even 5G, must be set up properly to achieve the highest security against cyberattacks,” she added.

5G Security Conundrum:

As leader of AT&T’s 5G security team, Ms. Marty has her work cut out for her. Especially considering choosing which of the 3GPP 5G SA security specs to support. Many of them are not complete and targeted for 3GPP Release 17. Also, European network operators have taken different approaches to 5G security and this will likely be a global phenomenon.

The real work on 5G security is being done by 3GPP with technical specification (TS) 33.501 Security architecture and procedures for 5G system being the foundation 5G security document. That 3GPP spec was first published in Release 16, but the latest version dated 16 December 2020 is targeted at Release 17. You can see all versions of that spec here.

3GPP’s 5G security architecture is designed to integrate 4G equivalent security. In addition, the reassessment of other security threats such as attacks on radio interfaces, signaling plane, user plane, masquerading, privacy, replay, bidding down, man-in-the-middle and inter-operator security issues have also been taken in to account for 5G and will lead to further security enhancements.

Another important 3GPP Security spec is TS 33.51 Security Assurance Specification (SCAS) for the next generation Node B (gNodeB) network product class, which is part of Release 16. The latest version is dated Sept 25, 2020.

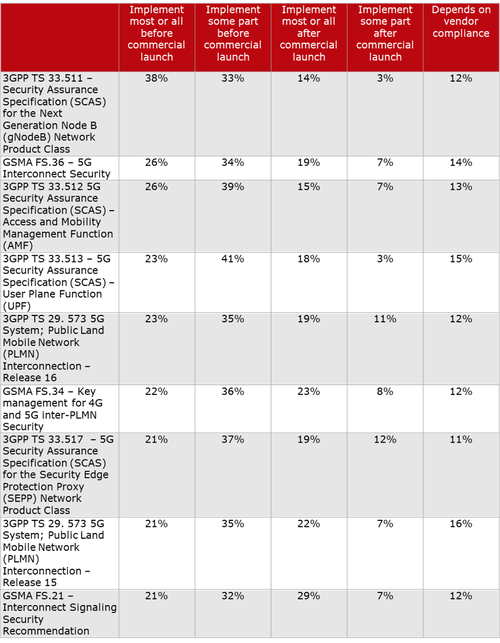

Here’s a chart on 3GPP and GSMA specs on 5G Security, courtesy of Heavy Reading:

Scott Poretsky, Ericsson’s Head of Security, wrote in an email:

“The reason for the inconsistent implementation of the 5G security requirements is the language in the 3GPP specs that make it mandatory for vendor support of the security features and optional for the operator to decide to use the feature. The requirements are defined in this manner because some countries did not want these security features implemented by their national telecoms due to these security features also providing privacy. The U.S. was not one of those countries.”

……………………………………………………………………………………………………………………….

References:

https://about.att.com/innovationblog/2021/private_5G_networks.html

https://www.business.att.com/learn/top-voices/att-continues-development-of-network-edge-compute.html

https://techblog.comsoc.org/2018/05/18/ieee-comsoc-papers-on-network-slicing-and-5g/

5G Security Issues Raise Mission Critical Questions & Issues

Verizon Business wins Private 5G contract in the UK

Verizon Communications Inc. won a contract to erect and operate a private 5G network in Southampton, England (United Kingdom), for Associated British Ports Holdings, its first industrial 5G award in Europe. The #1 U.S. wireless telco beat out local telecommunications companies and is jump starts a push to sell the wireless systems to global businesses.

- Verizon teams up with Nokia to offer private 5G capabilities to enterprises in Europe and Asia-Pacific

- Private 5G will enable organizations to deliver mission critical and real-time capabilities

- Announcement marks Verizon’s continued investment in 5G and network-as-a-service strategy

A private 5G network is a self-contained network whose components all reside in a single facility, consisting of micro towers and small cells and connects to an organization’s Local Area Network (LAN) and enterprise applications. It will utilize Nokia’s Digital Automation Cloud, a private wireless network solution with automation enablers that will allow for application deployment through a web-based interface.

New York-based Verizon opened a showroom in London last year and spoke about its hopes to muscle in on 5G enterprise deals beyond the U.S. It’s a sign competition is heating up in the segment, seen as a key way to fuel growth in the otherwise stagnant telecommunications sector for local carriers like Newbury, England-based Vodafone Group Plc.

“We chose Verizon simply just due to the track record within setting up private 5G networks,” said Henrik Pedersen, chief executive officer of ABP, in a video call with Bloomberg. “Regional or local, I don’t see it like this. I see 5G as a global thing.”

Southampton is a crucial British terminal which usually handles about 900,000 cars and sees millions of cruise ship passengers per year. It’s upgrading its network as the port adapts to its new status as a freeport, one of several low-tariff business zones on the British coast that U.K. chancellor Rishi Sunak unveiled last month as part of his plans to stimulate post-Brexit trade.

Verizon’s 5G network will remove dead spots and increase bandwidth at the port, ultimately enabling new systems, such as using drones that can transmit high-definition video for maintenance checks, and sending live shipping data, Pedersen said.

“There’ll be a lot of need for data transfer in the future in the freeport zone, and especially when you start to move goods in and out of the customs zones,” said Pedersen. He said he wants the system up and running by July, and added that more of ABP’s 21 ports are likely to get 5G networks in the future.

“Today, we’ve announced the next phase of Verizon’s global 5G vision with the launch of private 5G for our international customers,” said Tami Erwin, CEO, Verizon Business. “If the past few months have taught us anything, it’s that there’s never been a more critical time for mobility, broadband and cloud products and services. Private 5G networks will be a transformative technology that will drive the new era of disruption and innovation for enterprises around the world.”

“Private wireless connectivity has become central to many industries in realizing their long-term digital transformation goals. By delivering private 5G together with Verizon, we’re paving the way to accelerate digitalization for the most demanding industries who crave reliable wireless connectivity,” said Brian R. Fitzgerald, SVP Global Solutions at Nokia.

“We’re seeing international markets moving rapidly to deploy 5G Private Networks, which appears as a major use case for the uptake of 5G, particularly in order to capitalize on 5G investments in the enterprise market. With the ingredients of an early mover go-to-market 5G-know-how, foundational enterprise networking and innovative 5G enabled services Verizon’s go-to-market recipe with Nokia will be an attractive solution to the broader market,” said Martina Kurth, associate vice president of IDC’s European Telco Research practice.

Today’s announcement follows recent MEC partnership announcements with Microsoft, Cisco, IBM and AWS. In August, Verizon recently announced its successful completion of lab trials with Corning and Samsung on its new 5G mmWave in-building solutions.

………………………………………………………………………………………………………………………………

References:

https://www.verizon.com/about/news/verizon-business-takes-private-5g-global

https://www.bnnbloomberg.ca/verizon-beats-out-european-carriers-to-run-5g-at-u-k-freeport-1.1585233