Microsoft

Microsoft acquires Lumenisity – hollow core fiber high speed/low latency leader

Executive Summary:

Microsoft announced it has acquired Lumenisity® Limited, a leader in next-generation hollow core fiber (HCF) solutions. Lumenisity’s innovative and industry-leading HCF product can enable fast, reliable and secure networking for global, enterprise and large-scale organizations.

The acquisition will expand Microsoft’s ability to further optimize its global cloud infrastructure and serve Microsoft’s Cloud Platform and Services customers with strict latency and security requirements. The technology can provide benefits across a broad range of industries including healthcare, financial services, manufacturing, retail and government.

Organizations within these sectors could see significant benefit from HCF solutions as they rely on networks and datacenters that require high-speed transactions, enhanced security, increased bandwidth and high-capacity communications. For the public sector, HCF could provide enhanced security and intrusion detection for federal and local governments across the globe. In healthcare, because HCF can accommodate the size and volume of large data sets, it could help accelerate medical image retrieval, facilitating providers’ ability to ingest, persist and share medical imaging data in the cloud. And with the rise of the digital economy, HCF could help international financial institutions seeking fast, secure transactions across a broad geographic region.

Types of Hollow Core Fiber:

Various types of hollow-core photonic bandgap fibers:

(a) Photonic crystal fiber featuring small hollow core surrounded by a periodic array of large air holes.

(b) Microstructured fiber featuring medium-sized hollow core surrounded by several rings of small air holes separated by nano-size bridges.

(c) Bragg fiber featuring large hollow core surrounded by a periodic sequence of high and low refractive index layers

Lumenisity HCF benefits:

Lumenisity’s hollow core fiber technology replaces the standard glass core in a fiber cable with an air-filled chamber. According to Microsoft, light travels through air 47% faster than glass. Lumenisity’s next generation of HCF uses a proprietary design where light propagates in an air core, which has significant advantages over traditional cable built with a solid core of glass, including:

- Increased overall speed and lower latency as light travels through HCF 47% faster than standard silica glass.[1]

- Enhanced security and intrusion detection due to Lumenisity’s innovative inner structure.

- Lower costs, increased bandwidth and enhanced network quality due to elimination of fiber nonlinearities and broader spectrum.

- Potential for ultra-low signal loss enabling deployment over longer distances without repeaters.

Lumenisity was formed in 2017 as a spinoff from the world-renowned Optoelectronics Research Centre (ORC) at the University of Southampton to commercialize breakthroughs in the development of hollow core optical fiber. In 2021 and 2022, the company won the Best Fibre Component Product for their NANF® CoreSmart® HCF cable in the European Conference on Optical Communication (ECOC) Exhibition Industry Awards. As part of the Lumenisity acquisition, Microsoft plans to utilize the organization’s technology and team of industry-leading experts to accelerate innovations in networking and infrastructure.

Lumenisity said: “We are proud to be acquired by a company with a shared vision that will accelerate our progress in the hollow-core space. This is the end of the beginning, and we are excited to start our new chapter as part of Microsoft to fulfill this technology’s full potential and continue our pursuit of unlocking new capabilities in communication networks.”

………………………………………………………………………………………………………………………………………………………………..

Analysis:

The purchase is also noteworthy in light of Microsoft’s other recent acquisitions in the telecommunications sector, which include Affirmed Networks, Metaswitch Networks and AT&T’s core network operations (including 5G SA Core Network).

Microsoft isn’t the only company interested in HCF technology and Lumenisity. Both BT in the UK and Comcast in the US have tested Lumenisity’s offerings.

Comcast announced in April it was able to support speeds in the range of 10 Gbit/s to 400 Gbit/s over a 40km “hybrid” connection in Philadelphia that utilized legacy fiber and the new hollow core fiber. Comcast worked with Lumenisity.

“As we continue to develop and deploy technology to deliver 10G, multigigabit performance to tens of millions of homes, hollow core fiber will help to ensure that the network powering those experiences is among the most advanced and highest performing in the world,” said Comcast networking chief Elad Nafshi in the release issued in April.

References:

https://www.datacenterdynamics.com/en/news/microsoft-acquires-hollow-core-fiber-firm-lumenisity

Comcast Deploys Advanced Hollowcore Fiber With Faster Speed, Lower Latency

Google Cloud revenues up 54% YoY; Cloud native security is a top priority

Google Cloud revenues increased 54% year over year to $4.62 billion during the second quarter of 2021, parent company Alphabet reported today. Google Cloud’s operating loss shrunk 59%, from $1.42 billion a year ago to $591 million last quarter.

Google Cloud includes both Google Cloud Platform (GCP) and its Workspace (formerly G Suite) cloud computing services and collaboration tools.

Like previous quarters, “GCPs revenue growth was, again, above cloud overall, reflecting significant growth in both infrastructure and platform services,” the company said in a statement.

“As for Google Cloud, we remain focused on revenue growth, and are pleased with the trends we’re seeing across cloud,” Google CFO Ruth Porat said on the company’s 2Q-2021 earnings call today. Porat added that growth in its Google Cloud Platform segment again surpassed overall cloud gains “reflecting significant growth in both infrastructure and platform services.”

“We will continue to invest aggressively, including expanding our go-to-market organization, our channel expansion, our product offerings, and our compute capacity,” she said.

Also on today’s earnings call, Google CEO Sundar Pichai cited security as a competitive differentiator and “our strongest product portfolio.” Google will continue to invest in security and continue its work to integrate its various security products such as Beyond Corp and Chronicle, he added.

“Cyber threats increasingly are on the mind of not just CIOs but CEOs across our partners. So it’s definitely an area where we are seeing a lot of conversations, a lot of interest…so a definite source of strength and you’ll see us continue to invest here,” he said.

“We are cloud native, we pioneered … zero trust and built the architecture out from a security-first perspective. Particularly, over the course of the last couple of years, with the recent attacks, [companies] really started thinking deeply about vulnerabilities, supply chain security has been a major source of consensus, cyber threats are increasingly on the mind of, not just CIOs, but CEOs across our partners. So it’s definitely an area where we are seeing a lot of conversations, a lot of interest.”

Google Cloud, along with its other business units, boosted Alphabet’s revenue 62% year over year, to $61.9 billion. As usual, Google ad revenue represented the biggest piece of the pie. It grew 69% to $50.44 billion. Retail was the biggest contributor to advertising growth.

Google Cloud holds around 7% market share in the cloud services segment, according to a Canalys report released in April 2021. It trails Amazon Web Services (AWS) and Microsoft Azure, which hold 32% and 19% market share, respectively.

Microsoft posted financial results Tuesday, its Intelligent Cloud revenue increased 30% to $17.4 billion. The company stated Azure revenue grew of 51%, but did not break out a dollar figure. Amazon is set to report earnings on Thursday.

Along with their hyper-scale cloud competitors Google Cloud is partnering with telecom companies all over the world to help them drive transformation and accelerate 5G adoption and monetization.

Here are a few of their telco partners:

………………………………………………………………….

References:

https://abc.xyz/investor/static/pdf/2021Q2_alphabet_earnings_release.pdf?cache=4db52a1

https://www.fiercetelecom.com/financial/google-cloud-revenue-climbs-54-q2

https://www.sdxcentral.com/articles/news/google-cloud-losses-shrink-59-revenue-hits-4-6b/2021/07/

NEC and Microsoft in MAJOR multi-year strategic partnership based on cloud computing

Microsoft and NEC Corporation on Tuesday announced an expansion of their decades-long collaboration. Through a new multi-year strategic partnership, the companies will leverage Microsoft Azure, Microsoft 365, NEC’s network and IT expertise, including 5G technologies, and each other’s AI and IoT solutions to help enterprise customers and the public sector across multiple markets and industries further accelerate their cloud adoption and digital transformation initiatives. Microsoft and NEC have a history of strong collaboration spanning more than 40 years (since NEC introduced its PC running Microsoft software in 1979).

The partnership will have NEC adopt Microsoft Azure as its preferred cloud platform to deliver enhanced capabilities to drive sustained digitalization, help customers transform their business models, and build Digital Workplaces for the post-pandemic “new normal.”

To accelerate NEC’s Digital Workplace innovation and workforce transformation, the companies will work together to migrate NEC’s on-premises IT environment to Azure and deploy Azure Virtual Desktop and other Azure services among the NEC Group’s 110,000 employees worldwide. This modernization builds on NEC’s existing Microsoft 365 platform and will enable a highly sustainable environment that is more secure and robust, accelerating cloud migration for NEC and its customers throughout the commercial and public sector in Japan and around the world.

The companies will work together to help improve digital services for public sector and enterprise customers through workplace and workforce transformation. Greater speed and lower-latency data connections will provide high-performance network experiences to create more efficient workplaces and empower employees to realize more personalized work styles for public sector as well as private sector customers.

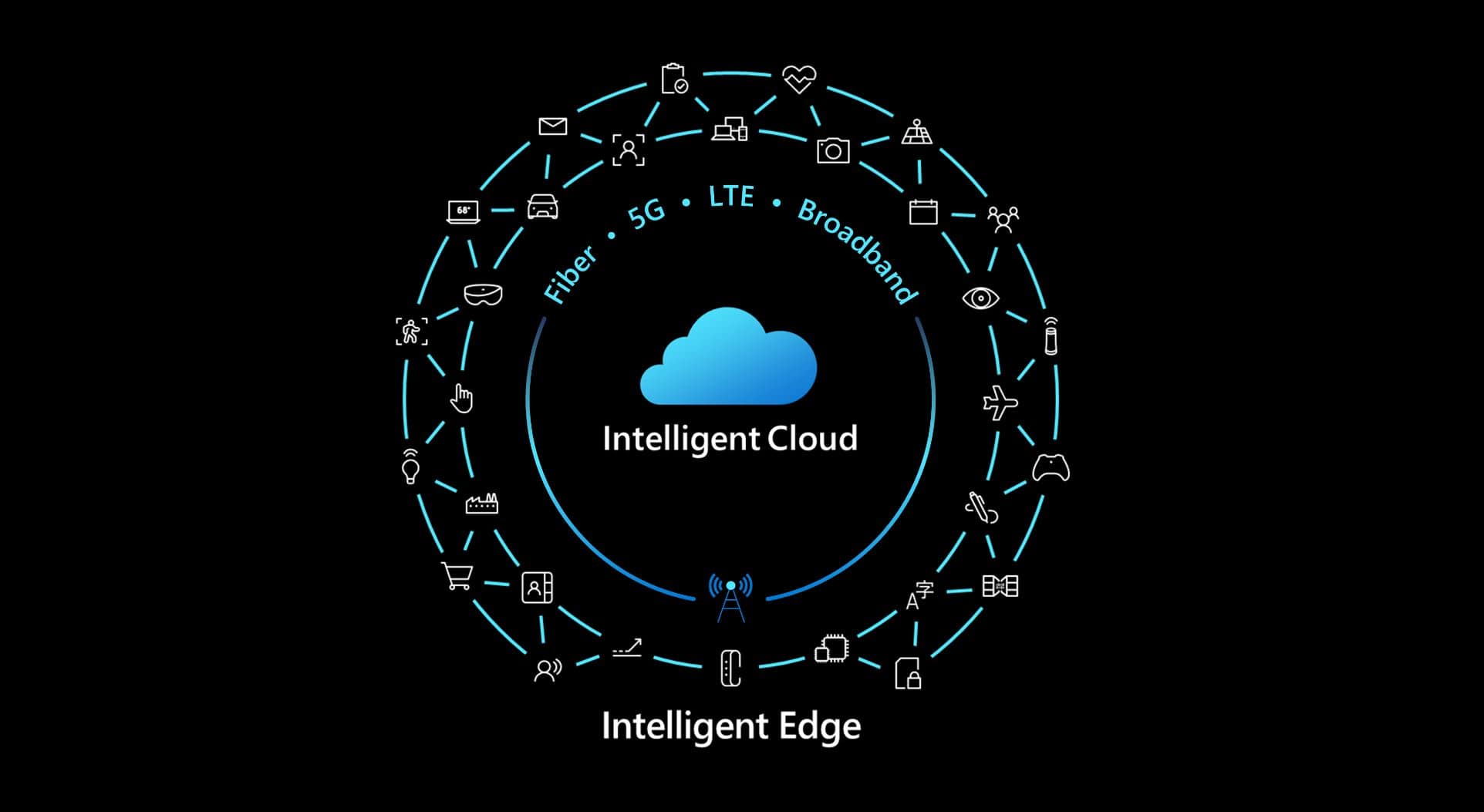

Leveraging the assets of both companies, including Microsoft’s Intelligent Edge solutions and NEC’s private 5G networking technologies (?), the companies will work together to help customers across industries transform. In retail, for example, the two companies will work together to analyze customer transaction data in real time using AI to better understand buying patterns, improve operational efficiency and identify new market opportunities.

The combination of Azure and both companies’ AI and IoT technologies and expertise will enhance NEC’s customer experience through advanced solutions and enable more secure maintenance and operation of stores. In addition, NEC and Microsoft plan to explore network innovation initiatives built on Microsoft Azure for enterprise domains and specific industries.

Through the partnership, the companies will work together to double the number of digital-focused engineers within the NEC Group who are specialized in Microsoft technologies. This investment in technical capabilities and the expertise of NEC’s employees will help ensure customers’ digital transformation success, benefiting the market and society.

“As we’ve seen over the past year, digital adoption curves are accelerating across every industry and business function,” said Satya Nadella, chairman and CEO, Microsoft. “Our strategic partnership with NEC brings together the power of Azure and Microsoft 365 with NEC’s services and infrastructure expertise to help public and private sector customers build resilience and transform during this era of rapid change.”

“NEC is pleased to enter into this strategic collaboration with Microsoft Corp.,” said Takayuki Morita, president and CEO of NEC Corporation. “With Microsoft’s trusted cloud and services, the experience that NEC has cultivated in its own systems, and both companies’ AI and IoT technologies, we will enable companies globally to use digital services that are safer and more secure than ever before as they progress with digital initiatives.”

“The need for sustainable transformation to ensure business resiliency and growth has never been more important in the world and especially Japan,” said Hitoshi Yoshida, president & CEO, Microsoft Japan. “Our partnership will help accelerate the industry’s cloud-based digital transformation and utilization of data migration and help Japan’s continued success globally, leading to greater economic and societal prosperity.”

…………………………………………………………………………………………………………………………………………………..

More on NEC:

NEC recently announced it had demonstrated its 4G and 5G Mobile Core Solution on Amazon Web Services for commercial offerings from “multiple” service providers in Japan. “Our core and its associated orchestration products allow us to provide sophisticated capabilities, such as end-to-end slicing, ultra-low latency and multi-cloud deployment options, which are key to realize the promises of 5G monetization,” claimed Patrick Lopez, NEC’s global VP of product management for 5G products.

Of course, NEC has partnered with Rakuten Mobile to develop the Rakuten Communications Platform (RCP) and related 5G SA Cloud Native Core network software.

References:

https://www.lightreading.com/5g/nec-sends-5g-to-cloud-with-microsoft/d/d-id/770831?

Rakuten Mobile, Inc. and NEC to jointly develop the containerized standalone (SA) 5G core network

Rakuten Communications Platform (RCP) defacto standard for 5G core and OpenRAN?

AT&T 5G SA Core Network to run on Microsoft Azure cloud platform

AT&T will run its 5G SA Core network on Microsoft’s Azure public cloud computing platform. Microsoft AZURE, which is the second largest cloud computing provider by revenue behind rival Amazon Web Services, has been building out specific cloud computing offering to attract carriers. AT&T is Microsoft’s first major deal in the 5G SA Core network space.

The two giant companies said that Microsoft will purchase software and intellectual property developed by AT&T to help build out its offerings for carriers. The companies did not disclose the terms of the deals, but said that Microsoft will make job offers to several hundred AT&T Network Cloud engineers.

Microsoft will use AT&T’s software and IP to grow its telecom flagship offering, Azure for Operators. Microsoft is acquiring AT&T’s carrier-grade Network Cloud platform technology, which AT&T’s 5G core network (when completed) will run on.

The companies disclosed a few key details about their new deal, but did not provide any firm numbers or any financial arrangements/guidance:

- Microsoft will “assume responsibility for both software development and deployment of AT&T’s Network Cloud immediately,” according to the companies, and will transition AT&T’s existing network cloud operations into Azure over the next three years. Eventually, all of AT&T’s mobile network traffic will run over Microsoft’s Azure.

- The effort will start with AT&T’s 5G core, but will eventually include virtually all of the company’s network operations, including its 4G core.

- Microsoft will be the company to certify all of AT&T’s software-powered network operations for inclusion in the AT&T network. That will include software from other vendors. AT&T has not yet named its 5G core network vendors.

- Microsoft will acquire AT&T’s Network Cloud technology – including its AT&T engineering and lifecycle management software – and its cloud-network operations team. The companies did not disclose exactly how many AT&T employees that transaction might cover, but an AT&T official suggested it will be in the “low hundreds.” Microsoft will then incorporate AT&T’s intellectual property into its Azure for Operators offering, which is for sale to other 5G network operators.

- Microsoft and AT&T did not provide the logistics of their deal, including exactly how many Azure computing locations might be necessary to power AT&T’s network. It’s an important issue considering AT&T’s cellular network spans an estimated 70,000 cell towers across the country, and the operation of the radios on top of those towers might eventually be handled by programs running inside of Microsoft’s cloud. A top Microsoft executive involved in the deal told Light Reading that Microsoft’s Azure software will be installed into some of AT&T’s existing computing locations. Several of those compute server locations are staffed by AT&T technicians.

- AT&T said the company plans to continue to run its network workloads inside of its own data centers and facilities. However, AT&T added that the deal today is focused on AT&T’s 5G core network and that the companies might explore additional elements of the network such as Open Radio Access Network (O-RAN) technology over the course of the agreement.

…………………………………………………………………………………………………………………………………………………

Sidebar: 5G SA Core networks to run on cloud service provider platforms:

- In late April, Dish Network made a similar deal to have Amazon run its 5G core network on AWS.

- In late May, Telefónica said it had validated AWS Outposts as option for 5G SA core deployment in Brazil.

- Earlier this week, TIM said it was building its 5G SA Core network on “Google’s cloud solutions” (whatever that means?)

Do you think the cloud service providers will essentially take over the implementation, operations, and maintenance of 5G SA Core networks, especially since they will likely all be “cloud native.” Please post a comment in the box below this article to express your opinion and why. Thanks!

………………………………………………………………………………………………………………………………………………………………………

“This deal is not exclusive, so I fully expect Azure will try to assert itself as the telecom cloud provider for many carriers around the world,” said Roger Entner of Recon Analytics LLC.

“It’s the first time a Tier One operator has trusted their existing consumer subscriber base to hyper-scaler technology,” Microsoft’s Shawn Hakl, VP of the company’s 5G strategy, told Light Reading. Before joining Microsoft in 2020, Hakl was a longtime Verizon executive.

The deal follows a $2 billion agreement in 2019 in which AT&T said it would start using Microsoft’s cloud for software development and other tasks. At that time, AT&T said it would continue to run its core networking functions in its own private data centers.

Andre Fuetsch, AT&T’s chief technology officer, said that shifting to a public cloud vendor will let AT&T take advantage of a larger ecosystem of software developers who are working on technologies such as wringing more use out of pricey 5G spectrum or creating new features for users. “That’s what we at AT&T want to do, and we think working with Microsoft gives us that advantage,” Fuetsch told Reuters in an interview.

“AT&T has one of the world’s most powerful global backbone networks serving hundreds of millions of subscribers. Our Network Cloud team has proved that running a network in the cloud drives speed, security, cost improvements and innovation. Microsoft’s decision to acquire these assets is a testament to AT&T’s leadership in network virtualization, culture of innovation, and realization of a telco-grade cloud stack,” said Andre Fuetsch, executive vice president and chief technology officer, AT&T. “The next step is making this capability accessible to operators around the world and ensuring it has the resources behind it to continue to evolve and improve. And do it securely. Microsoft’s cloud expertise and global reach make them the perfect fit for this next phase.”

Microsoft intends to use the newly acquired technology – plus the experience gained helping AT&T run the network – to build out a product it calls Azure for Operators, which it will use to pursue 5G core network business from telecommunications companies in the 60 regions of the world where it operates.

https://azure.microsoft.com/en-us/industries/telecommunications/

https://about.att.com/story/2021/att_microsoft_azure.html

https://www.reuters.com/business/media-telecom/att-run-core-5g-network-microsofts-cloud-2021-06-30/

https://www.lightreading.com/the-core/atandt-to-offload-5g-into-microsofts-cloud/d/d-id/770600?

O2 UK and Microsoft to test MEC in a Private 5G Network

UK mobile network operator O2 (Telefónica UK) has partnered with Microsoft to test the benefits of on-premise Mobile Edge Computing (MEC) within a Private 5G network, with a focus on low latency and security.

The MEC Proof of Concept (PoC) involves technology running on Microsoft Azure, which will be the first Azure deployment using a UK Private 5G network. It is designed to support secure data management, with all confidential data staying on premises at all times.

Image credit: Microsoft Azure for Operators

O2 (Telefónica UK) will provide Secure 5G Network capabilities and various Industry 4.0 applications. The computing service will be delivered via Azure Private Edge Zones, bringing compute, intelligence and storage to the edge where data is created. O2 and Microsoft will also support start-ups in developing new 5G solutions through the ‘Microsoft for Startups’ program.

O2 recently announced it had launched a Private 5G Network initiative with Leonardo, a global high technology company in the Aerospace, Defence & Security sector. This trial with Microsoft will be similar, however will involve MEC to broaden the use cases and benefits.

Jo Bertram, MD of Business at O2, said, “We’re incredibly proud of our track record of supporting business partners with innovative network solutions. This particular trial with the Microsoft Azure platform will provide secure and superfast capabilities that will maximise productivity and efficiency, as well as peace of mind. We pride ourselves on having a secure 5G network and being champions of coverage and reliability, as recognised in industry awards.”

Yousef Khalidi, corporate vice president, Azure for Operators at Microsoft, said: “Through our collaboration with O2, we will enable enterprises to leverage 5G to unlock new scenarios that accelerate digital transformation within their own private, on-premises environments. Combining Azure technology with O2 services is critical to bringing MEC to the enterprise edge, and we look forward to seeing customers leverage this platform to drive innovation across a broad range of information and operational technology applications.”

Key Deliverables:

- O2 partners with Microsoft to trial the benefits of on premise Mobile Edge Computing (MEC) within a Private 5G Network, focusing on security and low latency

- The Proof of Concept (PoC) aims to pave the way for secure data management, enabling confidential information to stay on premises at all times

- Technology will be run via the Microsoft Azure platform, its first deployment utilizing a UK Private 5G Network

References:

https://azure.microsoft.com/en-us/industries/telecommunications/

IHS Markit: Microsoft #1 for total cloud services revenue; AWS remains leader for IaaS; Multi-clouds continue to form

Following is information and insight from the IHS Markit Cloud & Colocation Services for IT Infrastructure and Applications Market Tracker.

Highlights:

· The global off-premises cloud service market is forecast to grow at a five-year compound annual growth rate (CAGR) of 16 percent, reaching $410 billion in 2023.

· We expect cloud as a service (CaaS) and platform as a service (PaaS) to be tied for the largest 2018 to 2023 CAGR of 22 percent. Infrastructure as a service (IaaS) and software as a service (SaaS) will have the second and third largest CAGRs of 14 percent and 13 percent, respectively.

IHS Markit analysis:

Microsoft in 2018 became the market share leader for total off-premises cloud service revenue with 13.8 percent share, bumping Amazon to the #2 spot with 13.2 percent; IBM was #3 with 8.8 percent revenue share. Microsoft’s success can be attributed to its comprehensive portfolio and the growth it is experiencing from its more advanced PaaS and CaaS offerings.

Although Amazon relinquished its lead in total off-premises cloud service revenue, it remains the top IaaS provider. In this very segmented market with a small number of large, well-established providers competing for market share:

• Amazon was #1 in IaaS in 2018 with 45 percent of IaaS revenue.

• Microsoft was #1 for CaaS with 22 percent of CaaS revenue and #1 in PaaS with 27 percent of PaaS revenue.

• IBM was #1 for SaaS with 17 percent of SaaS revenue.

…………………………………………………………………………………………………………………………………

“Multi-clouds [1] remain a very popular trend in the market; many enterprises are already using various services from different providers and this is continuing as more cloud service providers (CSPs) offer services that interoperate with services from their partners and their competitors,” said Devan Adams, principal analyst, IHS Markit. Expectations of increased multi-cloud adoption were displayed in our recent Cloud Service Strategies & Leadership North American Enterprise Survey – 2018, where respondents stated that in 2018 they were using 10 different CSPs for SaaS (growing to 14 by 2020) and 10 for IT infrastructure (growing to 13 by 2020).

Note 1. Multi-cloud (also multicloud or multi cloud) is the use of multiple cloud computing and storage services in a single network architecture. This refers to the distribution of cloud assets, software, applications, and more across several cloud environments.

There have recently been numerous multi-cloud related announcements highlighting its increased availability, including:

· Microsoft: Entered into a partnership with Adobe and SAP to create the Open Data Initiative, designed to provide customers with a complete view of their data across different platforms. The initiative allows customers to use several applications and platforms from the three companies including Adobe Experience Cloud and Experience Platform, Microsoft Dynamics 365 and Azure, and SAP C/4HANA and S/4HANA.

· IBM: Launched Multicloud Manager, designed to help companies manage, move, and integrate apps across several cloud environments. Multicloud Manager is run from IBM’s Cloud Private and enables customers to extend workloads from public to private clouds.

· Cisco: Introduced CloudCenter Suite, a set of software modules created to help businesses design and deploy applications on different cloud provider infrastructures. It is a Kubernetes-based multi-cloud management tool that provides workflow automation, application lifecycle management, cost optimization, governance and policy management across cloud provider data centers.

IHS Markit Cloud & Colocation Intelligence Service:

The bi-annual IHS Markit Cloud & Colocation Services Market Tracker covers worldwide and regional market size, share, five-year forecast analysis, and trends for IaaS, CaaS, PaaS, SaaS, and colocation. This tracker is a component of the IHS Markit Cloud & Colocation Intelligence Service which also includes the Cloud & Colocation Data Center Building Tracker and Cloud and Colocation Data Center CapEx Market Tracker. Cloud service providers tracked within this service include Amazon, Alibaba, Baidu, IBM, Microsoft, Salesforce, Google, Oracle, SAP, China Telecom, Deutsche Telekom Tencent, China Unicom and others. Colocation providers tracked include Equinix, Digital Realty, China Telecom, CyrusOne, NTT, Interion, China Unicom, Coresite, QTS, Switch, 21Vianet, Internap and others.

Microsoft & Packerland Broadband target 25/3 Mbps (DS/US) using TV White Spaces/WiFi

Microsoft’s Airband TV White Spaces initiative is a project that plans to bring broadband to 2 million rural Americans by 2022, beginning in Michigan and Wisconsin. Microsoft is partnering with Packerland Broadband (a division of CCI Systems). The companies are aiming for speeds of 25 Mbps downstream and 3 Mbps upstream for a fixed wireless deployment in rural Michigan and Wisconsin that will use TV white spaces and other technologies, said Cory Heigl, vice president for Packerland Broadband. The technology is “maturing pretty rapidly” and the companies hope manufacturers will support 25/3 Mbps speeds by year-end, Heigl said in a phone interview with Telecompetitor.

Packerland will use a mix of technologies to provide broadband to its customers in rural communities, including TV White Spaces and Wi-Fi hardware developed with support from Microsoft, to extend the reach of its existing hybrid fiber-coax and wireless delivery platforms. TV white spaces technology uses vacant TV broadcast spectrum and has excellent propagation, making it well suited to serve locations lacking a clear line of sight to the base station.

Packerland expects to cover approximately 33,750 people by the end of 2019, and approximately 82,000 people by 2022. As part of the Packerland-Microsoft project, Packerland will provide Windows devices, Office 365 and other cloud-based services to small businesses, consumers and students, as well as digital literacy skills training. Packerland will also leverage Microsoft Azure as part of its operations management.

When Microsoft announced Airband plans in July 2017, the company said TV white spaces will be the best approach to reaching communities with population densities between two and 200 people per square mile, while areas with lower population densities would be best served by satellite and those in areas with more than 200 people per square mile would be best served with fiber-to-the-home. Soon after Microsoft announced their initiative in July, AT&T and NetComm Wireless announced a plan to bring fixed-wireless broadband to 18 states.

Around 34 million Americans, including 19.4 million people living in rural parts of the US, don’t have adequate broadband, according to the release. About 43% of rural Wisconsin and 34% of rural Michigan lack proper internet access and thus miss out on the benefits it can offer, Microsoft said.

Quotes:

“Northern Wisconsin is nothing but forest,” making it challenging to use other wireless technologies, observed Heigl. Distances covered are expected to range from about one to four miles, Heigl added.

The Microsoft – Packerland service, which will also tap other fixed wireless and wired technologies, is targeted to be available to 33,750 people by the end of 2019 and approximately 82,000 people by 2022. This deployment is one of 12 projects planned as part of the Microsoft Airband TV White spaces initiative, which aims to bring broadband to 2 million people in rural America by 2022.

“This partnership with Packerland Broadband will help us address the rural broadband gap in northern Wisconsin and Michigan’s Upper Peninsula,” said Brad Smith, president of Microsoft. “Broadband has become the electricity of the 21st century, essential for education, business, agriculture and health care. Microsoft’s Airband Initiative is focused on bringing this necessity of life to 2 million people in rural counties by 2022.”

“Partnering with Microsoft allows us to bring new services and push our services further into the rural landscape in our region and beyond,” said Cory Heigl, vice president of Packerland Broadband. “We are the people we serve, and in this part of the world, we want to make an impact for the better. Our partnership with Microsoft will help us to influence lives by improving at-home education, enhancing economic opportunities, keeping up with health care advancements and furthering the agricultural innovation of our rural communities.”

“The mission of TechSpark Wisconsin is to bring new digital solutions to our region,” said Microsoft TechSpark Wisconsin Manager Michelle Schuler. “Packerland Broadband and Microsoft are making it possible for people living in rural Wisconsin to have the same opportunities to live, learn and work as people living in connected cities. That’s win-win for the people living here and the region’s economy.”

CCI Systems, Inc. CEO John Jamar said, “We have been focused on making life better by connecting people through innovative communications networks, and we are enthused to team up with our friends at Microsoft to accelerate that.”

“The time is right for the nation to set a clear and ambitious but achievable goal – to eliminate the rural broadband gap within the next five years by July 4, 2022, “said Brad Smith, president and chief legal officer at Microsoft in a blog post announcing the project. “We believe the nation can bring broadband coverage to rural America in this timeframe, based on a new strategic approach that combines private sector capital investments focused on expanding broadband coverage through new technologies, coupled with targeted and affordable public-sector support.”

References:

http://michiganradio.org/post/microsoft-and-michigan-company-partner-expand-broadband-wisconsin