Apple

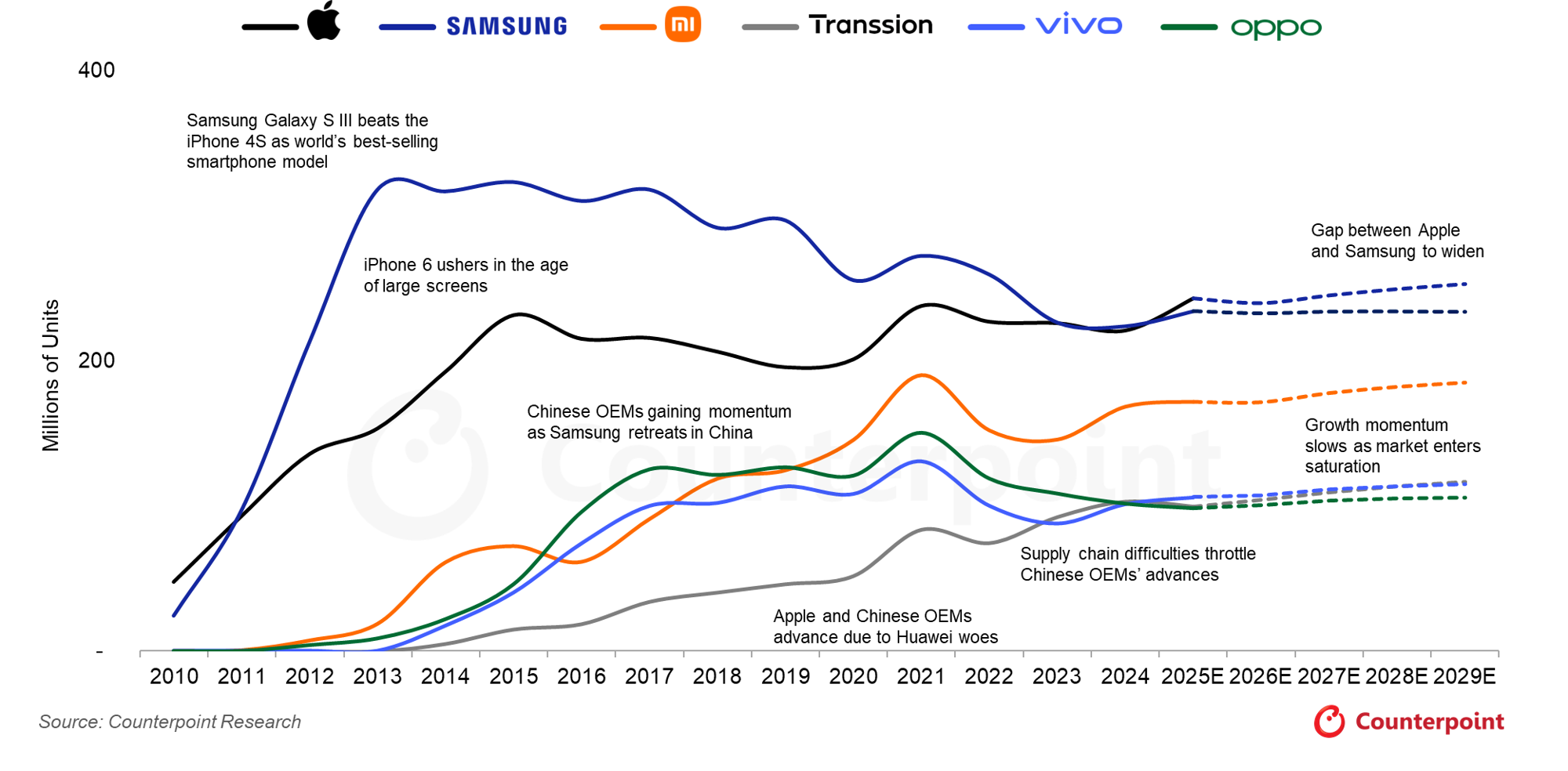

Apple leads 128+% YoY increase in foreign mobile phones shipped within China; Global market share leaders

In November 2025, the volume of foreign-branded mobile phones shipped within China experienced a substantial year-over-year increase of 128.4%. This surge was primarily due to increased sales of Apple iPhones, especially iPhone 17. According to data released by the government-affiliated China Academy of Information and Communications Technology (CAICT), 6.93 million units of international brands were shipped last month. This sharp rise occurred within the context of a broader market increase — total national mobile phone shipments for November reached 30.16 million units, representing a more modest overall year-on-year growth of 1.9%.

The exceptional increase in foreign branded phones is largely attributed to the robust reception of the new iPhone 17 series in the Chinese market. Reports indicate the iPhone 17 line accounted for a substantial portion of Apple’s sales during the period, successfully recapturing market share that had been lost to strong local competition, such as Huawei, throughout the year.

This marks a significant turnaround for Apple in China. In the first month after the iPhone 17 launch, sales reportedly jumped 22% compared to the iPhone 16 launch the previous year. The performance stands in stark contrast to previous periods in 2024 where Apple’s sales had faced challenges and decline due to intensified competition and market saturation. In October 2025, iPhones reportedly accounted for one in every four smartphones sold in China, their highest market share since 2022.

Meanwhile, domestic phone brands like Huawei and Xiaomi saw slower momentum as they delayed some new product launches. That gave Apple a wider sales window and helped foreign brands capture about 23% of the market, compared with roughly 10% in past months.

China brands account for eight of the top 10 global smartphone market share positions after Samsung and Apple.

………………………………………………………………………………………………………………………

https://counterpointresearch.com/en/insights/Global-Smartphone-Forecast-for-2025

IDC: Worldwide Smartphone Shipment +7.8% YoY; Samsung regains #1 position

Huawei forecast to increase mobile phone shipments despite Android ban

Ookla: Global performance of Apple’s in-house designed C1 modem in iPhone 16e

Apple designed the C1 modem entirely in-house [1.] as part of its Apple Silicon efforts, a significant move to reduce its reliance on external vendors like Qualcomm. The C1 modem is featured in the iPhone 16e and is manufactured by TSMC, which produces the chip on 4nm and 7nm process nodes. The C1 modem supports all the low and mid-band 5G spectrum but it doesn’t support 5G mmWave spectrum. It also supports Wi-Fi 6 with 2×2 MIMO and Bluetooth 5.3, but lacks Wi-Fi 7 support unlike the rest of the iPhone 16 series of devices.

Note 1. In 2019, Apple purchased Intel’s smartphone modem business for $1 billion with the explicit goal of eventually designing its own modems. The C1 modem is the first major outcome of this strategic shift, replacing Qualcomm’s modems in certain Apple devices, starting with the iPhone 16e. Historically, Apple relied upon Qualcomm to provide most of its iPhone modems so its decision to use the C1 modem in the iPhone 16e is considered a significant move.

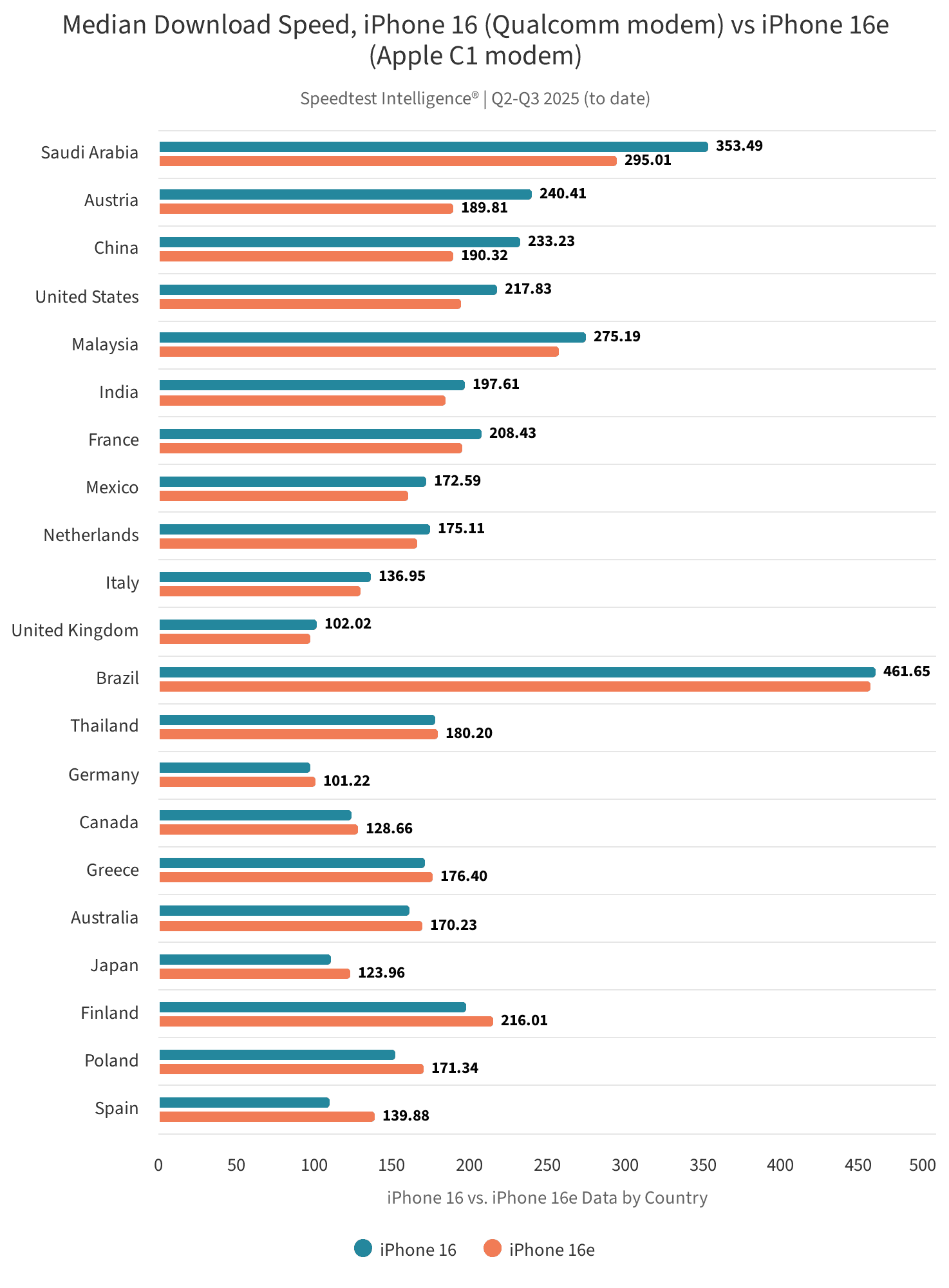

Ookla has just analyzed the performance of the iPhone 16e and compared it to the performance of the iPhone 16 on 5G, using Speedtest Intelligence data for Q2 and Q3 2025.

A few important takeaways include:

- The iPhone 16e with the Apple C1 modem performs similarly to the iPhone 16 with the Qualcomm modem in the vast majority of markets we examined.

- The iPhone 16 with Qualcomm modem performs better on more capable mobile networks that have a 5G standalone (SA) footprint supporting higher carrier aggregation combinations and uplink MIMO technology. The iPhone 16e with the C1 modem is not able to achieve the same frontier of performance in these markets due to its technical limitations. Key examples of networks facilitating stronger performance for the iPhone 16 include those in Saudi Arabia, China, India and the U.S.

- In the U.S., T-Mobile users experienced better performance on the iPhone 16, which supports four-carrier aggregation, than iPhone 16e users with the Apple C1 modem, which supports a maximum of three-carrier aggregation. Median download speed for the iPhone 16 on T-Mobile’s network was 317.64 Mbps, compared to 252.80 Mbps on the iPhone 16e.

- The iPhone 16e performs strongly on other key performance metrics. Across the markets analyzed, it tended to record better download speeds among the 10th percentile of users (those with the lowest overall download speeds), and across 10th, median and 90th percentiles for upload speeds. At the lower 10th percentile it’s likely that more users are connected solely to low-band spectrum (sub GHz) which offers better coverage but slower speeds.

Japan is the most popular market for the iPhone 16e, with 11.3% of samples from the 16 lineup, followed chiefly by European markets. Adoption of the iPhone 16e depends on a range of factors, including the level of subsidies within a market and to which devices they are directed, level of price sensitivity among consumers, as well as launch timing, and consumer preferences for different form factors and device features.

The combination of these factors likely explains the relatively higher 16e penetration observed in Japan. Beyond the historic appetite for lower-cost, compact iPhones like the SE (to which the 16e is a spiritual successor) and a subsidy structure that favors entry variants, the recent weakness of the yen has made the Pro and Pro Max models more expensive in local terms, prompting elastic buyers (like students and families) to shift down the line-up.

……………………………………………………………………………………………………………………………………………………………………………….

The iPhone 16e outperforms the iPhone 16 in median upload speed in 15 of the 21 markets we examined. Canada is perhaps the most dramatic example where iPhone 16e median upload speeds of 23.91 Mbps are more than double the iPhone 16’s median upload speed of 11.57 Mbps. However, once again we saw the iPhone 16 perform strongly in median upload speed in countries with advanced 5G networks such as Saudi Arabia and China. Although in the US market the iPhone 16e outperformed the iPhone 16 in upload speeds, when we drilled down further (see the US section of this report), we found that upload performance varied between the different operators.

…………………………………………………………………………………………………………………………………………………………………………….

In the U.S., the iPhone 16 performs better than the iPhone 16e in median download speed for T-Mobile and Verizon customers. This is a slight change from our March 2025 analysis when the iPhone 16e performed better for Verizon customers than the iPhone 16. Because the iPhone 16 supports mmWave spectrum and mmWave is part of Verizon’s 5G Ultra Wideband service, it’s likely that this is a contributing factor in the iPhone 16’s better performance on the Verizon network. Verizon users on the iPhone 16 only clocked a median download speed of 172.12 Mbps, which is significantly lower than iPhone 16 users on T-Mobile’s network that logged a median download speed of 317.64 Mbps.

When comparing the median upload speeds of the iPhone 16 and 16e across US providers there’s a much different story than when comparing median download speeds. On Verizon’s and AT&T’s networks the iPhone 16e outperforms the iPhone 16 in upload speeds. Verizon iPhone 16e users experienced median upload speeds of 11.51 Mbps compared to Verizon iPhone 16 users that logged median upload speeds of 9.67 Mbps. Likewise, AT&T iPhone 16e users experienced median upload speeds of 8.47 Mbps compared to iPhone 16 users with median upload speeds of 7.09 Mbps.

Instead of seeing the iPhone 16 outperform the iPhone 16e at T-Mobile, the two devices are nearly equal in median UL performance with 16e users seeing median upload speeds of 11.79 Mbps compared to iPhone 16 users with 11.70 Mbps. These results are very similar to what we uncovered in our March 2025 report where we saw clear differences in the iPhone 16e and the iPhone 16 performance for AT&T and Verizon users but nearly equal performance for T-Mobile users.

References:

https://www.ookla.com/articles/iphone-c1-modem-performance-q2-q3-2025

Apple in advanced talks to buy Intel’s 5G modem business for $1 billion

China’s mobile data consumption slumps; Apple’s market share shrinks-no longer among top 5 vendors

AST SpaceMobile completes 1st ever LEO satellite voice call using AT&T spectrum and unmodified Samsung and Apple smartphones

AI wave stimulates big tech spending and strong profits, but for how long?

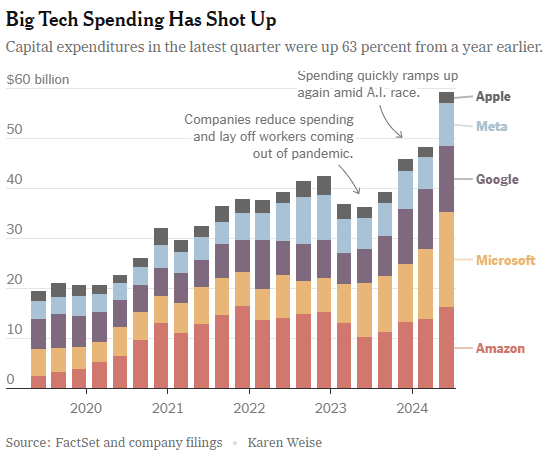

Big tech companies have made it clear over the last week that they have no intention of slowing down their stunning levels of spending on artificial intelligence (AI), even though investors are getting worried that a big payoff is further down the line than most believe.

In the last quarter, Apple, Amazon, Meta, Microsoft and Google’s parent company Alphabet spent a combined $59 billion on capital expenses, 63% more than a year earlier and 161 percent more than four years ago. A large part of that was funneled into building data centers and packing them with new computer systems to build artificial intelligence. Only Apple has not dramatically increased spending, because it does not build the most advanced AI systems and is not a cloud service provider like the others.

At the beginning of this year, Meta said it would spend more than $30 billion in 2024 on new tech infrastructure. In April, he raised that to $35 billion. On Wednesday, he increased it to at least $37 billion. CEO Mark Zuckerberg said Meta would spend even more next year. He said he’d rather build too fast “rather than too late,” and allow his competitors to get a big lead in the A.I. race. Meta gives away the advanced A.I. systems it develops, but Mr. Zuckerberg still said it was worth it. “Part of what’s important about A.I. is that it can be used to improve all of our products in almost every way,” he said.

………………………………………………………………………………………………………………………………………………………..

This new wave of Generative A.I. is incredibly expensive. The systems work with vast amounts of data and require sophisticated computer chips and new data centers to develop the technology and serve it to customers. The companies are seeing some sales from their A.I. work, but it is barely moving the needle financially.

In recent months, several high-profile tech industry watchers, including Goldman Sachs’s head of equity research and a partner at the venture firm Sequoia Capital, have questioned when or if A.I. will ever produce enough benefit to bring in the sales needed to cover its staggering costs. It is not clear that AI will come close to having the same impact as the internet or mobile phones, Goldman’s Jim Covello wrote in a June report.

“What $1 trillion problem will AI solve?” he wrote. “Replacing low wage jobs with tremendously costly technology is basically the polar opposite of the prior technology transitions I’ve witnessed in my 30 years of closely following the tech industry.” “The reality right now is that while we’re investing a significant amount in the AI.space and in infrastructure, we would like to have more capacity than we already have today,” said Andy Jassy, Amazon’s chief executive. “I mean, we have a lot of demand right now.”

That means buying land, building data centers and all the computers, chips and gear that go into them. Amazon executives put a positive spin on all that spending. “We use that to drive revenue and free cash flow for the next decade and beyond,” said Brian Olsavsky, the company’s finance chief.

There are plenty of signs the boom will persist. In mid-July, Taiwan Semiconductor Manufacturing Company, which makes most of the in-demand chips designed by Nvidia (the ONLY tech company that is now making money from AI – much more below) that are used in AI systems, said those chips would be in scarce supply until the end of 2025.

Mr. Zuckerberg said AI’s potential is super exciting. “It’s why there are all the jokes about how all the tech C.E.O.s get on these earnings calls and just talk about A.I. the whole time.”

……………………………………………………………………………………………………………………

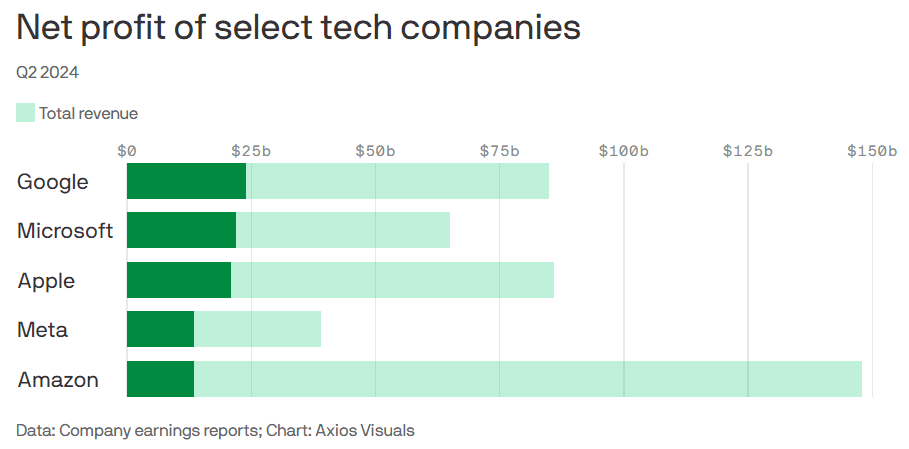

Big tech profits and revenue continue to grow, but will massive spending produce a good ROI?

Last week’s Q2-2024 results:

- Google parent Alphabet reported $24 billion net profit on $85 billion revenue.

- Microsoft reported $22 billion net profit on $65 billion revenue.

- Meta reported $13.5 billion net profit on $39 billion revenue.

- Apple reported $21 billion net profit on $86 billion revenue.

- Amazon reported $13.5 billion net profit on $148 billion revenue.

This chart sums it all up:

………………………………………………………………………………………………………………………………………………………..

References:

https://www.nytimes.com/2024/08/02/technology/tech-companies-ai-spending.html

https://www.axios.com/2024/08/02/google-microsoft-meta-ai-earnings

https://www.nvidia.com/en-us/data-center/grace-hopper-superchip/

AI Frenzy Backgrounder; Review of AI Products and Services from Nvidia, Microsoft, Amazon, Google and Meta; Conclusions

China’s mobile data consumption slumps; Apple’s market share shrinks-no longer among top 5 vendors

Mobile data demand is in a steep decline in China, the world’s largest 5G market by subscribers. China’s MIIT numbers released this week show per user data consumption (DOU) grew just 8.1% in the first half of the year. That compares to a 68% increase in 2019, the year that 5G licenses were issued. That fell to 13% in 2022 and 11% at end- 2023. Since then, there’s been a decrease in growth of nearly three percentage points in six months.

| Indicator name | unit | Cumulative from January to June | Year-on-year

Growth ( %) |

| Total volume of telecommunication business (at constant prices of the previous year) | 100 million yuan | 8992 | 11.1 |

| Operating income | 100 million yuan | 10712 | 2.8 |

| Including: Telecommunication business income | 100 million yuan | 8941 | 3.0 |

| Total call duration of fixed-line outgoing calls | 100 million minutes | 380 | -3.4 |

| Total mobile phone call duration | 100 million minutes | 10688 | -4.6 |

| Mobile SMS traffic | 100 million | 9407 | 0.5 |

| Mobile Internet access traffic | 100 million GB | 1604 | 12.6 |

| Average mobile Internet access traffic per household in the month (DOU) | GB/household · month | 18.15 | 8.1 |

| Note: 1. The duration of fixed-line outgoing calls and mobile phone calls includes the corresponding IP phone call duration.

2. Starting from February 2024, the 5G mobile Internet access traffic and the number of 5G mobile Internet users of China Radio and Television Network Group Co., Ltd. (hereinafter referred to as China Radio and Television) will be included in the industry summary data, and the data for the same period last year will be adjusted synchronously. |

|||

“While China has rapidly rolled out 5G and continues to perform well vs other markets, there is a limit to the number of people in the market that will engage in advanced data services; the slowdown in traffic growth is an indication that we could be reaching that limit,” according to GSMA.

Commercial 5G standalone (SA) networks, now present in seven APAC countries (Australia, India, Japan, the Philippines, Singapore, South Korea, and Thailand), will help fuel this growth, alongside 5G Advanced, RedCap and AI, creating opportunities to launch new 5G applications and kick start a fresh round in 5G investments for enterprises and consumers.

The authors of the report, GSMA Intelligence, expect 5G to add almost $130 billion to the Asia Pacific economy in 2030, with the manufacturing industry forecast to benefit the most, driven by new 5G-enabed applications including smart factories, smart-grids, and IoT-enabled products. Financial services and public administration are also expected to be big beneficiaries, as they turn to 5G to digitally transform services and operations. To help support this growth the GSMA today launched the GSMA APAC Fintech Forum, a new community programme to unite the connected fintech and commerce sectors with Asia Pacific’s mobile network operators through new technologies.

…………………………………………………………………………………………………………………………………………

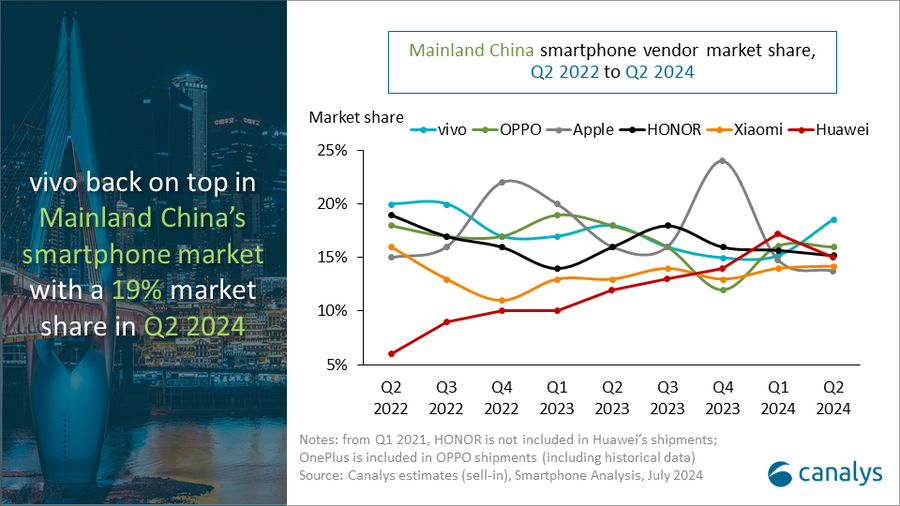

Meanwhile, Apple’s smartphone market share in China shrank by two percentage points in the second quarter of 2024 and the company is no longer one of the top vendors, according to data from market research firm Canalys. The decline underscores the difficulties the U.S. tech giant faces in its third-largest market.

Huawei’s smartphone shipments surged 41 per cent year on year in the the quarter, bolstered by the launch of its new Pura 70 series in April. Chinese smartphone vendors held the top five spots in the second quarter.

“It is the first quarter in history that domestic vendors dominate all the top five positions,” said Canalys Research Analyst Lucas Zhong. “Chinese vendors’ strategies for high-end products and their deep collaboration with local supply chains are starting to pay off in hardware and software features. HONOR’s latest Magic V3, which leverages GenAI, has significantly enhanced the user experience of foldable devices. Conversely, Apple is facing a bottleneck in mainland China. The vendor’s current channel strategy maintains a healthy inventory level and aims to stabilize retail prices and protect margins of channel partners. In the long term, the Chinese high-end market is ripe with opportunity. Local brands such as Huawei, HONOR, OPPO, and vivo are leading the way by incorporating technologies such as GenAI into products and services. Additionally, the localization of Apple’s Intelligence services in mainland China will be crucial in the next 12 months.”

People’s Republic of China (Mainland) smartphone shipments and annual growth

Canalys Smartphone Market Pulse: Q2 2024

|

Vendor |

Q2 2024 |

Q2 2024 |

Q2 2023 |

Q2 2023 |

Annual |

|

vivo |

13.1 |

19% |

11.4 |

18% |

15% |

|

OPPO |

11.3 |

16% |

11.4 |

18% |

-1% |

|

HONOR |

10.7 |

15% |

10.3 |

16% |

4% |

|

Huawei |

10.6 |

15% |

7.5 |

12% |

41% |

|

Xiaomi |

10.0 |

14% |

8.6 |

13% |

17% |

|

Others |

14.8 |

21% |

15.1 |

24% |

-2% |

|

Total |

70.5 |

100% |

64.3 |

100% |

10% |

|

Notes: from Q1 2021, HONOR is not included in Huawei’s shipments; OnePlus is included in OPPO shipments. |

|||||

References:

https://www.miit.gov.cn/gxsj/tjfx/txy/art/2024/art_e2f06366bb134479a40cf4cf86445b1e.html

https://canalys.com/newsroom/china-smartphone-market-Q2-2024

https://www.lightreading.com/5g/slowing-mobile-numbers-cast-doubt-on-gsma-s-buoyant-forecasts

GSMA: China’s 5G market set to top 1 billion this year

MIIT: China’s Big 3 telcos add 24.82M 5G “package subscribers” in December 2023